Key Insights

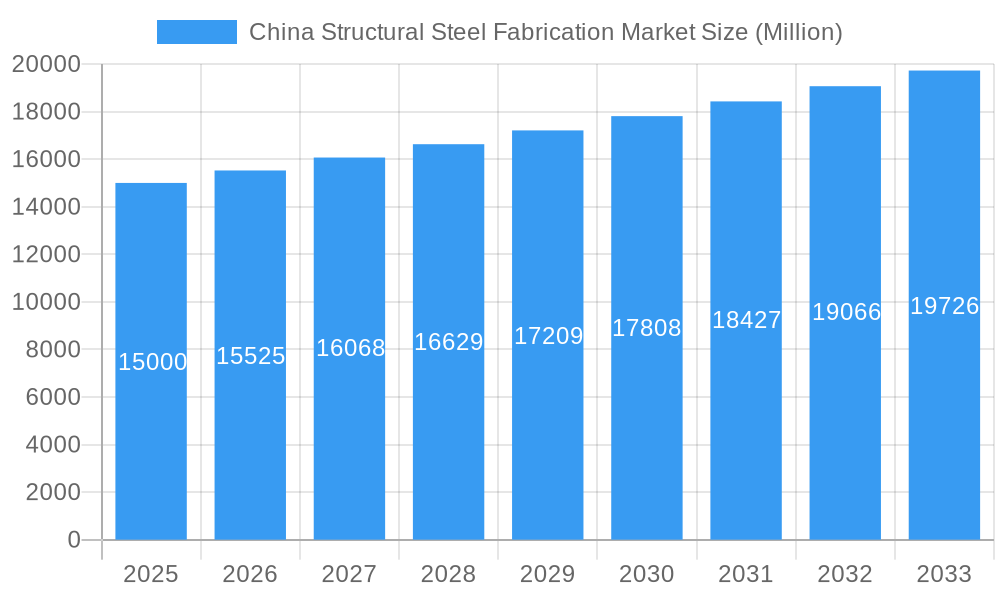

The China structural steel fabrication market is projected to experience significant expansion, driven by substantial infrastructure investments and ongoing urbanization. Anticipated to grow at a compound annual growth rate (CAGR) of 5.1%, the market was valued at $43.4 billion in the base year 2025. Key growth drivers include the development of high-speed rail networks, urban renewal projects, and the expansion of industrial zones. Advancements in fabrication technologies, such as automation and laser cutting, are enhancing efficiency and cost-effectiveness. Challenges include price volatility of raw materials and strict environmental mandates. The market is segmented by fabrication type (e.g., H-beams, I-beams, hollow sections), application (construction, manufacturing, energy), and region. Major industry participants, including China Steel Structure Co Ltd, Hebei Baofeng Steel Structure Co Ltd, and Qingdao Xinguangzheng Steel Structure Co Ltd, are focusing on technological innovation and capacity enhancement. Government support for infrastructure development is a key factor contributing to a positive long-term market outlook through 2033.

China Structural Steel Fabrication Market Market Size (In Billion)

The competitive environment features a blend of large-scale enterprises and niche providers. Industry consolidation is expected to continue through strategic acquisitions, enabling larger companies to broaden market presence. The growing demand for sustainable fabrication practices is spurring innovation, with a focus on eco-friendly production methods and the utilization of recycled steel. This emphasis on environmental responsibility will increasingly influence market dynamics and consumer preferences. The ongoing development of smart cities and the imperative for robust infrastructure will sustain demand for premium structural steel fabrication services in the foreseeable future.

China Structural Steel Fabrication Market Company Market Share

China Structural Steel Fabrication Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China structural steel fabrication market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The analysis is segmented by various factors, providing valuable insights for industry professionals, investors, and stakeholders. The parent market is the broader China Steel Market, while the child market is specifically focused on Structural Steel Fabrication. The total market size in 2025 is estimated to be xx Million units.

China Structural Steel Fabrication Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the China structural steel fabrication market. The market exhibits a moderately concentrated structure, with several large players holding significant market share. Technological innovation is primarily driven by improving efficiency and sustainability, including the adoption of advanced manufacturing techniques and eco-friendly materials. The regulatory framework plays a crucial role, particularly in safety standards and environmental regulations. The market also faces competition from alternative materials like concrete and composite structures. The end-user demographics encompass a diverse range of sectors, including construction, infrastructure, and manufacturing. Significant M&A activity has been observed in the sector, shaping the competitive landscape.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Focus on automation, advanced welding techniques, and sustainable steel production.

- Regulatory Framework: Stringent safety and environmental standards influence production and design practices.

- Competitive Substitutes: Concrete, composite materials pose challenges to steel's dominance.

- End-User Demographics: Construction (xx%), Infrastructure (xx%), Manufacturing (xx%), others (xx%).

- M&A Trends: A significant number of mergers and acquisitions, totaling xx deals in the past five years, with an average deal value of xx Million units.

China Structural Steel Fabrication Market Growth Trends & Insights

The China structural steel fabrication market has experienced consistent growth over the historical period (2019-2024), driven by robust infrastructure development, urbanization, and industrial expansion. The market size is projected to reach xx Million units by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the adoption of Building Information Modeling (BIM) and automated welding systems, are further driving market expansion. Shifting consumer preferences towards sustainable and high-performance building materials are also influencing market growth.

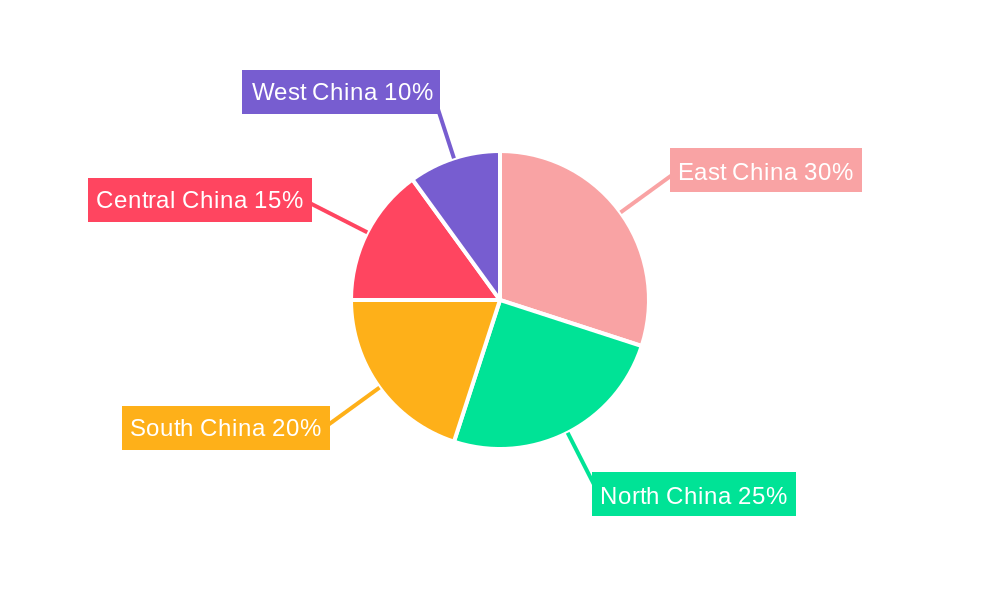

Dominant Regions, Countries, or Segments in China Structural Steel Fabrication Market

The coastal regions of China, particularly areas experiencing rapid urbanization and industrial growth, dominate the structural steel fabrication market. Provinces like Guangdong, Jiangsu, and Shandong are key contributors. This dominance is driven by several factors, including strong economic growth, robust infrastructure investments, and the concentration of major steel producers. The market is further segmented by product type (e.g., H-beams, I-beams, etc.) and application (e.g., high-rise buildings, bridges, industrial facilities).

- Key Drivers: Government investment in infrastructure projects, rapid urbanization, and industrial expansion.

- Dominance Factors: High concentration of steel mills and fabrication facilities in coastal provinces.

- Growth Potential: Significant opportunities exist in developing inland regions and specialized applications.

China Structural Steel Fabrication Market Product Landscape

The market offers a diverse range of products, encompassing various structural steel sections, including H-beams, I-beams, channels, angles, and other specialized profiles. Innovations focus on high-strength low-alloy steels, advanced coatings for corrosion resistance, and improved weldability. The emphasis is on enhancing structural integrity, durability, and sustainability.

Key Drivers, Barriers & Challenges in China Structural Steel Fabrication Market

Key Drivers:

- Robust infrastructure development and urbanization initiatives.

- Growing industrial sector and manufacturing expansion.

- Government support and investment in construction projects.

Key Challenges:

- Fluctuations in steel prices and raw material costs.

- Stringent environmental regulations and sustainability concerns.

- Intense competition and increasing pressure on pricing.

- Potential supply chain disruptions.

Emerging Opportunities in China Structural Steel Fabrication Market

Emerging opportunities lie in prefabricated modular construction, the adoption of advanced materials like high-strength steel, and expanding into specialized applications, such as offshore wind energy structures and high-speed rail projects. Demand for sustainable and eco-friendly steel fabrication solutions is also creating new growth avenues.

Growth Accelerators in the China Structural Steel Fabrication Market Industry

Technological advancements such as automation, robotic welding, and improved design software are pivotal growth catalysts. Strategic partnerships and collaborations between steel producers and fabricators are also driving market expansion.

Key Players Shaping the China Structural Steel Fabrication Market Market

- China Steel Structure Co Ltd

- Hebei Baofeng Steel Structure Co Ltd

- Qingdao Xinguangzheng Steel Structure Co Ltd

- United Steel Structures Ltd

- Qingdao Havit Steel Structure Co Ltd

- Huayin Group

- Qingdao Tailong Steel Structure Co Ltd

- Hongfeng Industrial Group

- Wuxi Chuxin Steel Structure Project Co Ltd

- Guangdong Dongji Intelligent Device Co Ltd

- Rizhao Steel Holding Group Co Ltd

- Dingli Steel Structure Co Ltd

Notable Milestones in China Structural Steel Fabrication Market Sector

- August 2022: China Baowu Steel Group acquired a 51% stake in XinSteel for CNY 4.26 billion (USD 630 million), consolidating its position in the steel industry.

- December 2022: China Baowu Steel Group approved to take over Sinosteel Group, further strengthening its market dominance and global reach.

In-Depth China Structural Steel Fabrication Market Market Outlook

The China structural steel fabrication market is poised for continued growth, driven by ongoing infrastructure development, industrialization, and the adoption of advanced technologies. Strategic investments in research and development, coupled with a focus on sustainability, will further enhance market potential. The market presents significant opportunities for companies to leverage technological advancements, optimize production processes, and expand their market share.

China Structural Steel Fabrication Market Segmentation

-

1. Service

- 1.1. Metal Welding

- 1.2. Metal Forming

- 1.3. Metal Cutting

- 1.4. Metal Shearing

- 1.5. Metal Stamping

- 1.6. Machining

- 1.7. Metal Rolling

- 1.8. Others

-

2. Application

- 2.1. Construction

- 2.2. Automotive

- 2.3. Manufacturing

- 2.4. Energy & Power

- 2.5. Electronics

- 2.6. Defense & Aerospace

- 2.7. Others

China Structural Steel Fabrication Market Segmentation By Geography

- 1. China

China Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of China Structural Steel Fabrication Market

China Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Prefabricated Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Metal Welding

- 5.1.2. Metal Forming

- 5.1.3. Metal Cutting

- 5.1.4. Metal Shearing

- 5.1.5. Metal Stamping

- 5.1.6. Machining

- 5.1.7. Metal Rolling

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Automotive

- 5.2.3. Manufacturing

- 5.2.4. Energy & Power

- 5.2.5. Electronics

- 5.2.6. Defense & Aerospace

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Steel Structure Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hebei Baofeng Steel Structure Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qingdao Xinguangzheng Steel Structure Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Steel Structures Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qingdao Havit Steel Structure Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huayin Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Tailong Steel Structure Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hongfeng Industrial Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wuxi Chuxin Steel Structure Project Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guangdong Dongji Intelligent Device Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rizhao Steel Holding Group Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dingli Steel Structure Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China Steel Structure Co Ltd

List of Figures

- Figure 1: China Structural Steel Fabrication Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Structural Steel Fabrication Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: China Structural Steel Fabrication Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Structural Steel Fabrication Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the China Structural Steel Fabrication Market?

Key companies in the market include China Steel Structure Co Ltd, Hebei Baofeng Steel Structure Co Ltd, Qingdao Xinguangzheng Steel Structure Co Ltd, United Steel Structures Ltd, Qingdao Havit Steel Structure Co Ltd, Huayin Group, Qingdao Tailong Steel Structure Co Ltd, Hongfeng Industrial Group, Wuxi Chuxin Steel Structure Project Co Ltd, Guangdong Dongji Intelligent Device Co Ltd, Rizhao Steel Holding Group Co Ltd, Dingli Steel Structure Co Ltd.

3. What are the main segments of the China Structural Steel Fabrication Market?

The market segments include Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Prefabricated Buildings.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022; The world's largest iron and steel company China Baowu Steel Group, a state-owned enterprise, acquired a 51% stake in XinSteel, the biggest steelmaker in Jiangxi province. JunHe and Clifford Chance advised this CNY 4.26 billion (USD 630 million) deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the China Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence