Key Insights

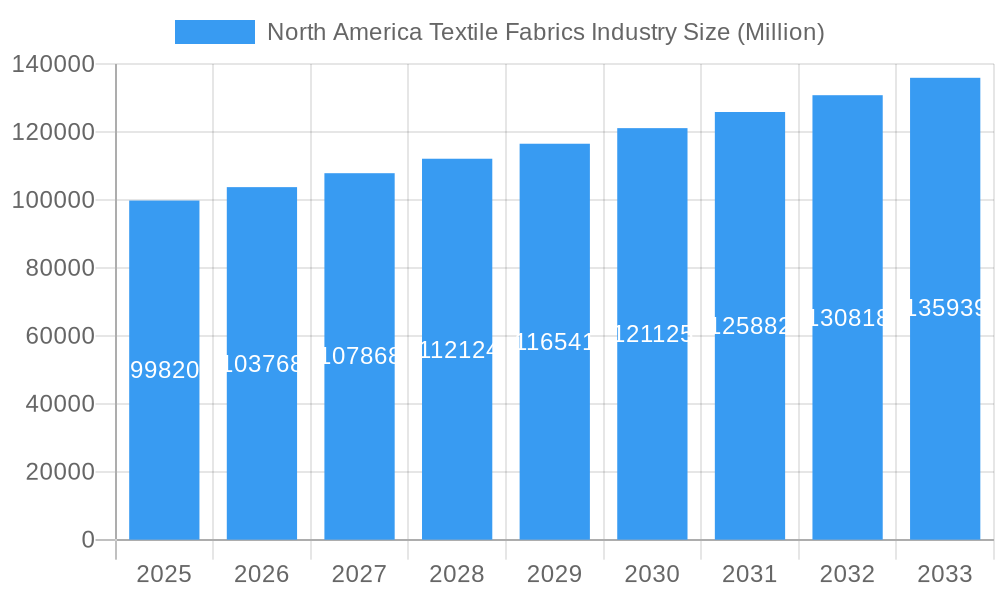

The North America textile fabrics industry, valued at $99.82 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing demand for comfortable and functional apparel, particularly athleisure and performance wear, fuels significant growth within the industry. Consumer preferences for sustainable and ethically sourced fabrics, coupled with advancements in textile technology leading to innovative materials with enhanced properties (e.g., moisture-wicking, antimicrobial), are also contributing to market expansion. The robust e-commerce sector further facilitates market access and growth, allowing brands to reach wider audiences and consumers to easily compare prices and explore options. While challenges exist, such as fluctuating raw material costs and global supply chain disruptions, the overall outlook remains positive, supported by consistent consumer spending on apparel and home furnishings.

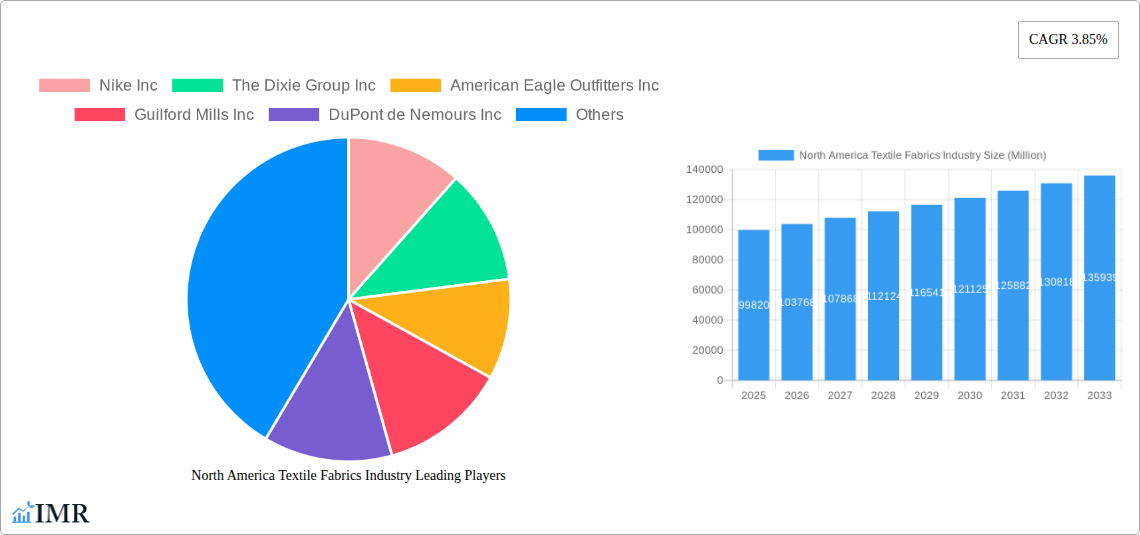

North America Textile Fabrics Industry Market Size (In Billion)

Growth is expected to be sustained by a projected Compound Annual Growth Rate (CAGR) of 3.85% from 2025 to 2033. This growth trajectory is further influenced by the increasing popularity of home renovation and improvement projects, boosting demand for upholstery fabrics and home textiles. However, potential restraints include increased competition from low-cost imports and the growing adoption of substitute materials in certain applications. Major players like Nike, Levi Strauss & Co., and Mohawk Industries are actively shaping the market through product innovation, strategic partnerships, and a focus on sustainable practices. Segment-specific growth will vary, with performance fabrics and sustainable textiles likely experiencing the highest growth rates. Regional variations within North America will be influenced by factors such as consumer spending patterns and manufacturing capacity in different regions. The long-term outlook points to a consistently expanding market, with opportunities for both established players and new entrants.

North America Textile Fabrics Industry Company Market Share

North America Textile Fabrics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America textile fabrics industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking a granular understanding of this dynamic sector. Market values are presented in millions of units.

North America Textile Fabrics Industry Market Dynamics & Structure

The North American textile fabrics industry is characterized by a moderately concentrated market structure, with a few large players dominating specific segments. Technological innovation, particularly in sustainable and high-performance fabrics, is a key driver. Regulatory frameworks, including environmental regulations and trade policies, significantly impact market dynamics. The industry faces competition from substitute materials like synthetics and innovative alternatives. End-user demographics, including shifting consumer preferences towards sustainable and ethically sourced products, are shaping demand. M&A activity has been notable, with several significant transactions reshaping the competitive landscape. The estimated market size in 2025 is xx Million.

- Market Concentration: High in certain segments (e.g., high-performance fabrics), moderate in others (e.g., cotton fabrics). Top 5 players hold approximately xx% market share.

- Technological Innovation: Focus on sustainable materials (recycled fibers, organic cotton), smart fabrics, and improved performance characteristics (water resistance, breathability).

- Regulatory Framework: Stringent environmental regulations (e.g., regarding water usage and waste disposal) drive innovation and compliance costs. Trade policies influence import/export dynamics.

- Competitive Substitutes: Synthetic fibers (polyester, nylon) offer cost advantages but face growing scrutiny regarding environmental impact. Bio-based alternatives are emerging.

- End-User Demographics: Growing demand for sustainable, ethical, and functional fabrics from environmentally conscious consumers.

- M&A Trends: Consolidation through acquisitions and mergers aims to gain market share, expand product portfolios, and achieve economies of scale. The past 5 years have seen xx M&A deals, with an average deal value of xx Million.

North America Textile Fabrics Industry Growth Trends & Insights

The North American textile fabrics market experienced a period of [Describe growth or decline and state the value in million] from 2019 to 2024. Growth is projected to accelerate during the forecast period (2025-2033), driven by factors such as increasing consumer spending on apparel and home furnishings, technological advancements in fabric production, and rising demand for sustainable and performance-oriented fabrics. The adoption rate of innovative textile technologies is steadily increasing, while consumer behavior shifts toward sustainable and functional products are driving demand. The compound annual growth rate (CAGR) is estimated to be xx% during 2025-2033. Market penetration of sustainable fabrics is projected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, such as advancements in 3D printing and digital textile printing, are enhancing design possibilities and production efficiency.

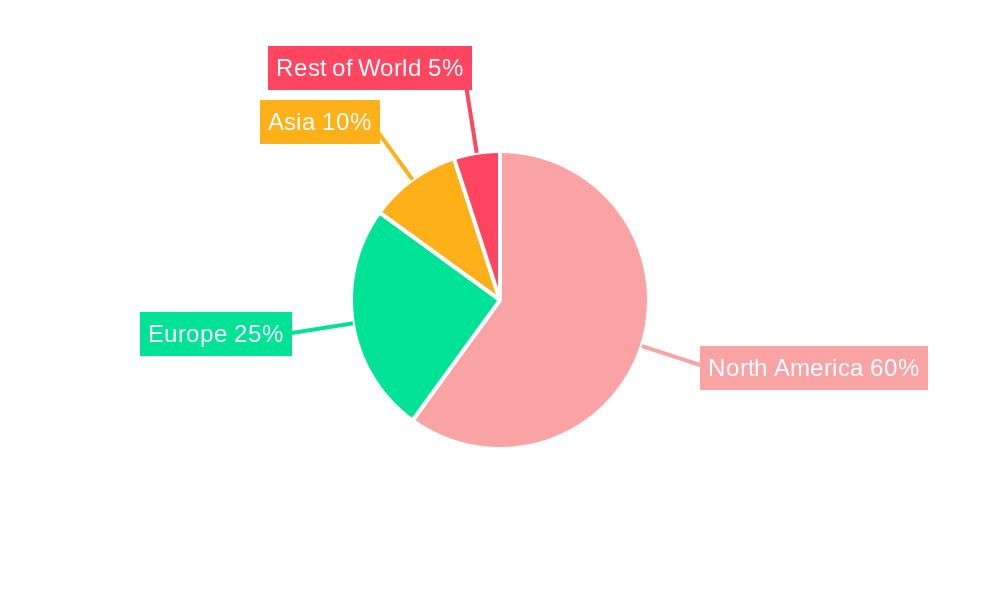

Dominant Regions, Countries, or Segments in North America Textile Fabrics Industry

The [Specific region/state e.g., Southeastern US] region dominates the North American textile fabrics market, accounting for xx% of total market value in 2025. Its dominance stems from a combination of factors: established textile manufacturing infrastructure, presence of key players, and favorable business environment. The apparel segment accounts for the largest share, followed by the home furnishings segment.

- Key Drivers:

- Established Manufacturing Base: Concentration of textile mills and factories with established supply chains.

- Favorable Business Environment: Access to skilled labor, supportive government policies, and proximity to key markets.

- Technological Advancements: Early adoption of advanced textile technologies, leading to increased productivity and efficiency.

- Dominance Factors:

- High Market Share: Accounts for a significant portion of total production and consumption.

- Growth Potential: Continued investment in infrastructure and technology enhances its competitive advantage.

North America Textile Fabrics Industry Product Landscape

The North American textile fabrics market offers a diverse range of products, catering to various applications and end-user needs. Innovation in sustainable materials, such as recycled polyester and organic cotton, is gaining traction, while performance fabrics with features like water resistance, breathability, and antimicrobial properties are increasingly popular. Technological advancements in digital printing and finishing techniques are enabling greater design flexibility and customization. Unique selling propositions include enhanced durability, comfort, and style, aligning with consumer preferences for high-quality, long-lasting products.

Key Drivers, Barriers & Challenges in North America Textile Fabrics Industry

Key Drivers: Growing consumer demand for apparel and home furnishings, increasing disposable incomes, technological advancements, and government initiatives promoting sustainable textiles are driving market expansion. A shift towards eco-friendly and functional fabrics further fuels growth.

Challenges & Restraints: Fluctuating raw material prices, rising labor costs, intense competition, stringent environmental regulations, and supply chain disruptions pose significant challenges. These factors can increase production costs and limit profitability. The impact of these challenges is estimated to reduce market growth by approximately xx% in the next 5 years.

Emerging Opportunities in North America Textile Fabrics Industry

Untapped markets include specialized applications like medical textiles and protective wear. Innovative applications like smart textiles with embedded sensors and conductive fabrics offer exciting opportunities. Evolving consumer preferences towards personalized and customized products create demand for tailored solutions. The development of circular economy models, focusing on textile recycling and reuse, presents a significant growth opportunity.

Growth Accelerators in the North America Textile Fabrics Industry

Technological breakthroughs in sustainable materials and production processes, strategic partnerships between textile manufacturers and brands, and market expansion strategies focusing on emerging markets and niche segments will be crucial for long-term growth. Investments in R&D and adoption of Industry 4.0 technologies will boost efficiency and competitiveness.

Key Players Shaping the North America Textile Fabrics Industry Market

- Nike Inc

- The Dixie Group Inc

- American Eagle Outfitters Inc

- Guilford Mills Inc

- DuPont de Nemours Inc

- Levi Strauss & Co

- Hennes & Mauritz AB

- WestPoint Home Inc

- Welspun India Ltd

- Standard Textile Co Inc

- Mohawk Industries Inc

- Elevate Textiles Inc

Notable Milestones in North America Textile Fabrics Industry Sector

- February 2023: Huntsman Corporation completes the sale of its Textile Effects division to Archroma for USD 593 million.

- December 2022: India and Canada negotiate a free trade agreement, potentially impacting textile trade.

- August 2022: Archroma enters into a definitive agreement to acquire Huntsman Corporation's Textile Effects business.

In-Depth North America Textile Fabrics Industry Market Outlook

The future of the North American textile fabrics industry is bright, driven by ongoing technological advancements, sustainable practices, and evolving consumer demands. Strategic partnerships, investments in R&D, and expansion into new markets will be key to capitalizing on future growth opportunities. The market is poised for substantial expansion, with significant potential for innovation and value creation.

North America Textile Fabrics Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

North America Textile Fabrics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Textile Fabrics Industry Regional Market Share

Geographic Coverage of North America Textile Fabrics Industry

North America Textile Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.3. Market Restrains

- 3.3.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.4. Market Trends

- 3.4.1. Increasing demand for North America's apparels driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Textile Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nike Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dixie Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 American Eagle Outfitters Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guilford Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont de Nemours Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Levi Strauss & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hennes & Mauritz AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WestPoint Home Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Welspun India Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Textile Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mohawk Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Elevate Textiles Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nike Inc

List of Figures

- Figure 1: North America Textile Fabrics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Textile Fabrics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: North America Textile Fabrics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Textile Fabrics Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: North America Textile Fabrics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Textile Fabrics Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Textile Fabrics Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the North America Textile Fabrics Industry?

Key companies in the market include Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, Elevate Textiles Inc **List Not Exhaustive.

3. What are the main segments of the North America Textile Fabrics Industry?

The market segments include Application, Material Type, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

6. What are the notable trends driving market growth?

Increasing demand for North America's apparels driving the market.

7. Are there any restraints impacting market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

8. Can you provide examples of recent developments in the market?

February 2023: Huntsman Corporation (NYSE: HUN) announced that it has completed the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The agreed purchase price was USD 593 million in cash plus assumed pension liabilities. Huntsman expects the net after-tax cash proceeds to be approximately USD 540 million before customary post-closing adjustments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Textile Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Textile Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Textile Fabrics Industry?

To stay informed about further developments, trends, and reports in the North America Textile Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence