Key Insights

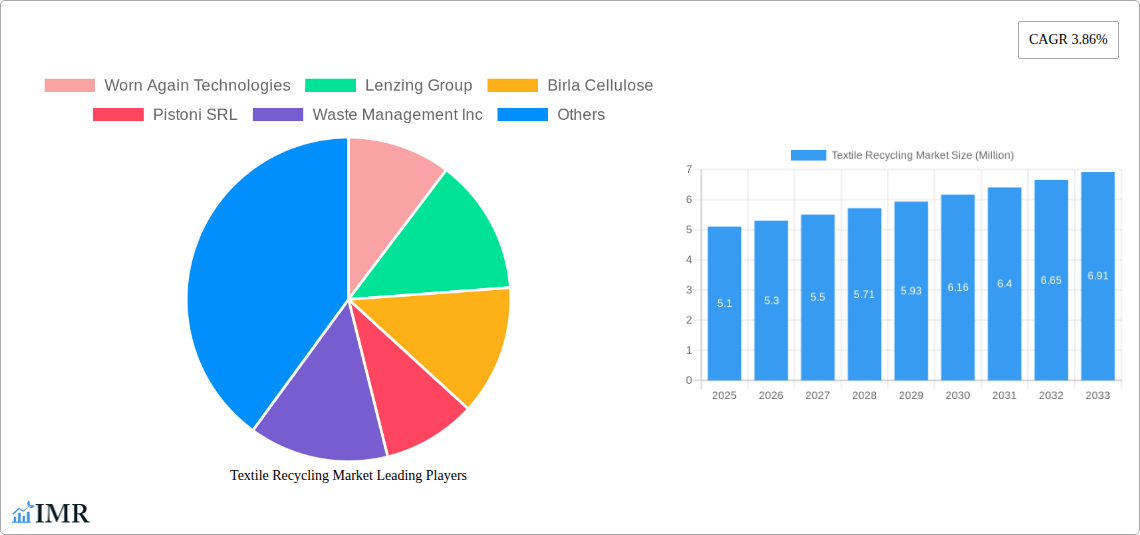

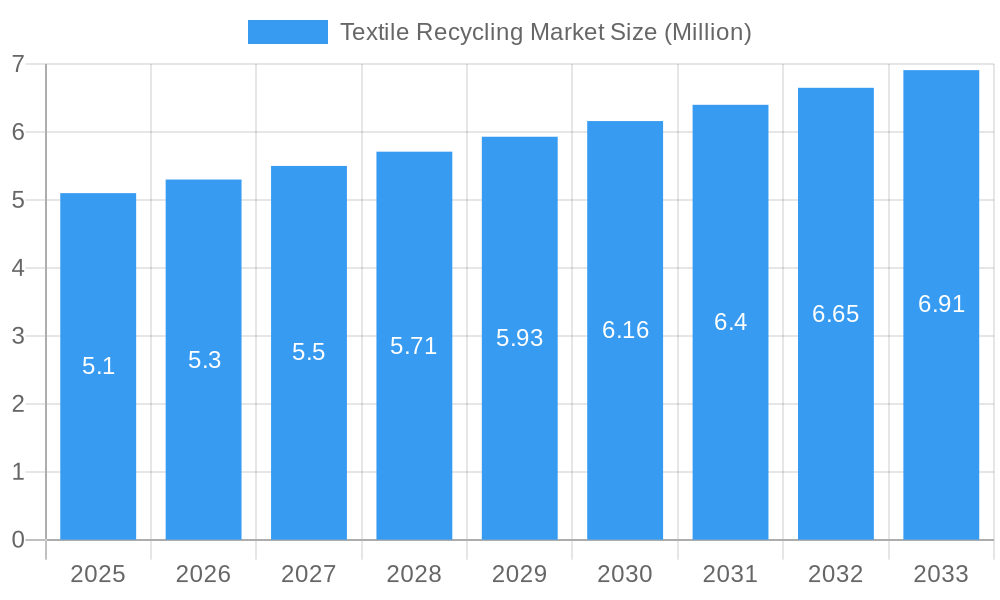

The global textile recycling market is poised for significant expansion, projected to reach $5.10 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 3.86% through 2033. This robust growth is primarily propelled by an increasing global awareness of the environmental impact of textile waste, coupled with stringent government regulations promoting circular economy principles. The apparel industry, in particular, is a major contributor to textile waste, making its recycling a critical focus. As consumers and brands alike prioritize sustainability, the demand for recycled textile materials for new garments and home furnishings is on the rise. Technological advancements in mechanical and chemical recycling processes are also a key driver, enabling more efficient and cost-effective methods for transforming post-consumer and post-industrial textile waste into valuable raw materials. This innovation is crucial for overcoming existing challenges in sorting and processing diverse textile compositions.

Textile Recycling Market Market Size (In Million)

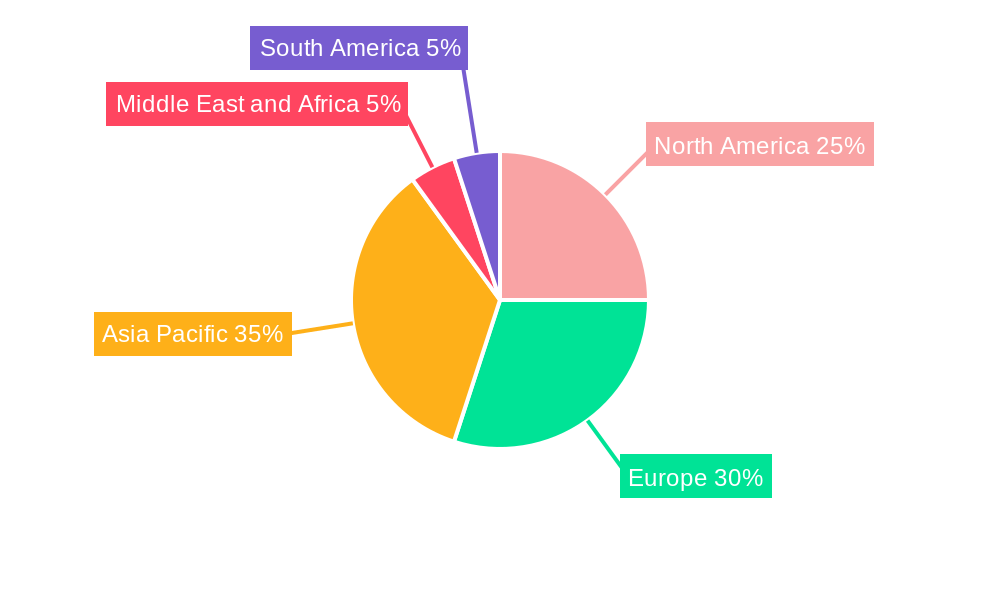

The market is segmented by material, with cotton and polyester leading due to their widespread use, and emerging interest in recycling wool and nylon fibers. The primary sources of textile waste are apparel and home furnishings, with significant potential also identified in automotive waste. Regionally, Asia Pacific is expected to dominate the market, driven by its large textile manufacturing base and growing consumer market, followed by North America and Europe, which are actively investing in advanced recycling infrastructure and policies. Key players like Lenzing Group and Birla Cellulose are at the forefront of developing innovative recycling solutions, while companies such as Worn Again Technologies are pioneering advanced chemical recycling. Despite the positive outlook, challenges remain, including the complexity of mixed fiber recycling, collection infrastructure limitations, and the need for greater consumer participation in textile collection programs. Addressing these restraints will be vital for unlocking the full potential of the textile recycling market.

Textile Recycling Market Company Market Share

Unlock critical insights into the burgeoning Textile Recycling Market, a vital sector poised for exponential growth as the world embraces circular economy principles. This in-depth report provides a detailed analysis of the market's trajectory from 2019 to 2033, with a base year of 2025 and an estimated 2025 market value of USD XX Million. Delve into the forecast period of 2025–2033 to understand the driving forces, challenges, and opportunities that will shape this transformative industry.

This report is meticulously crafted for industry professionals, policymakers, investors, and stakeholders seeking a profound understanding of the global textile waste management landscape, fiber-to-fiber recycling advancements, and the increasing demand for sustainable fashion solutions.

Textile Recycling Market Market Dynamics & Structure

The Textile Recycling Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and shifting consumer preferences towards sustainability. Market concentration varies across different recycling processes, with mechanical recycling currently dominating due to its established infrastructure, while chemical recycling, though nascent, shows significant promise for high-value material recovery. Technological innovation is a key driver, with companies investing heavily in advanced sorting technologies and chemical processes to handle complex fiber blends and improve the quality of recycled materials. Regulatory frameworks, such as extended producer responsibility (EPR) schemes and landfill bans for textiles, are increasingly incentivizing recycling efforts globally. Competitive product substitutes, primarily virgin materials, still hold a significant market share, but the rising cost of virgin resources and growing environmental consciousness are eroding their dominance. End-user demographics are increasingly skewed towards younger, environmentally aware consumers who actively seek out products made from recycled textiles. Mergers and acquisitions (M&A) trends indicate a consolidation of key players and strategic partnerships aimed at scaling up recycling capacities and securing feedstock. For instance, the acquisition of smaller collection and sorting companies by larger recycling firms is a common strategy to ensure a consistent supply of pre-consumer and post-consumer textile waste.

- Market Concentration: Moderate to High in mechanical recycling, Low to Moderate in chemical recycling, with strategic partnerships forming to increase concentration.

- Technological Innovation Drivers: Advancements in automated sorting, chemical dissolution for fiber recovery, and upcycling technologies are critical.

- Regulatory Frameworks: Growing adoption of EPR, landfill diversion targets, and eco-labeling standards are pushing market growth.

- Competitive Product Substitutes: Virgin polyester and cotton fibers remain key competitors, but their market share is being challenged by recycled alternatives.

- End-User Demographics: Younger, socially conscious consumers are driving demand for recycled textile products.

- M&A Trends: Strategic acquisitions and joint ventures aimed at expanding collection networks, enhancing processing capabilities, and developing new recycling technologies.

Textile Recycling Market Growth Trends & Insights

The global Textile Recycling Market is experiencing robust growth, projected to expand significantly over the forecast period. The increasing volume of textile waste generated annually, estimated at XX Million Tons, coupled with growing environmental awareness, is acting as a primary catalyst. Consumer demand for sustainable apparel and home furnishings, driven by a desire to reduce environmental impact, is a major factor influencing market penetration. Technological disruptions, particularly in chemical textile recycling, are enabling the recovery of higher-quality fibers from mixed-fiber textiles, previously considered difficult to recycle. This advancement is crucial for closing the loop in the circular fashion economy. Shifts in consumer behavior, such as a greater willingness to purchase second-hand clothing and products made from recycled materials, are directly contributing to the market's upward trajectory. The adoption of textile-to-textile recycling technologies is gaining momentum, moving away from downcycling applications. The market is witnessing an increasing integration of recycled materials into mainstream fashion and textile production. The Textile Recycling Market is poised for a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is underpinned by substantial investments in research and development and the scaling up of pilot projects into commercial operations.

- Market Size Evolution: Significant growth projected from USD XX Million in the base year 2025 to an estimated USD XX Million by 2033.

- Adoption Rates: Increasing adoption of recycled textiles by major fashion brands and textile manufacturers globally.

- Technological Disruptions: Breakthroughs in chemical recycling are enabling higher yields and better quality of recycled fibers, driving market adoption.

- Consumer Behavior Shifts: Growing preference for eco-friendly products, increased awareness of textile waste impact, and support for circular fashion initiatives.

- Market Penetration: Expected to rise as infrastructure and technology mature, making recycled textiles more accessible and competitive.

Dominant Regions, Countries, or Segments in Textile Recycling Market

In the Textile Recycling Market, Cotton and Polyester and Polyester Fiber segments are currently dominating due to their widespread use in apparel and home furnishings, and the established technologies for their recycling. The Apparel Waste source segment is the largest contributor, accounting for a substantial portion of the collected textile waste, followed by Home Furnishing Waste. Regionally, Europe is a leader in textile recycling, driven by stringent environmental regulations, advanced infrastructure, and strong consumer awareness. Countries like Germany, the Netherlands, and Sweden are at the forefront, with high collection rates and innovative recycling initiatives. North America, particularly the United States, is also showing significant growth, propelled by increasing corporate sustainability commitments and governmental support. Asia Pacific, while a major producer of textile waste, is rapidly developing its recycling capabilities, with countries like China and India investing heavily in modern recycling facilities. The Mechanical Recycling process currently holds a larger market share due to its cost-effectiveness and established infrastructure. However, Chemical Recycling is rapidly gaining traction, especially for mixed-fiber streams, and is expected to witness substantial growth. Economic policies, such as carbon taxes and subsidies for sustainable practices, are crucial drivers in these dominant regions and segments. Infrastructure development, including advanced sorting facilities and collection networks, plays a vital role in facilitating efficient recycling processes.

- Dominant Segments (Material): Cotton and Polyester and Polyester Fiber are leading due to high volume and established recycling methods.

- Dominant Segments (Source): Apparel Waste is the primary source, reflecting the fast fashion cycle.

- Dominant Regions: Europe leads due to supportive policies and infrastructure; North America and Asia Pacific are rapidly growing.

- Dominant Processes: Mechanical recycling is dominant, but chemical recycling is emerging as a key growth area.

- Key Drivers: Stringent regulations, consumer demand for sustainable products, corporate social responsibility (CSR) initiatives, and technological advancements.

Textile Recycling Market Product Landscape

The Textile Recycling Market product landscape is characterized by a growing array of innovative recycled textile materials and their applications. Companies are developing advanced processes to produce high-quality yarns and fibers from post-consumer and pre-consumer textile waste, suitable for use in new apparel, home textiles, and even technical applications. Key product innovations include recycled polyester staple fibers (rPSF) derived from PET bottles and textile waste, and recycled cotton fibers produced through mechanical and chemical methods, offering comparable quality to virgin cotton. The performance metrics of these recycled materials are continuously improving, with enhanced durability, color fastness, and texture. Unique selling propositions often revolve around the reduced environmental footprint, lower water and energy consumption during production, and the ability to offer traceable, circular solutions. Technological advancements are enabling the recycling of previously challenging mixed-fiber textiles into valuable raw materials.

Key Drivers, Barriers & Challenges in Textile Recycling Market

Key Drivers:

- Environmental Regulations & Policy Support: Government mandates, extended producer responsibility (EPR) schemes, and landfill diversion targets are significant drivers.

- Growing Consumer Demand for Sustainability: Increasing consumer awareness and preference for eco-friendly and ethically produced goods.

- Corporate Sustainability Goals: Major brands and manufacturers are setting ambitious sustainability targets, driving demand for recycled materials.

- Technological Advancements: Innovations in sorting, mechanical, and chemical recycling are making textile recycling more efficient and economically viable.

- Resource Scarcity & Volatility of Virgin Material Prices: The rising cost and limited availability of virgin raw materials make recycled alternatives more attractive.

Barriers & Challenges:

- Collection and Sorting Infrastructure: Inefficient collection systems and the complexity of sorting mixed textile waste pose significant hurdles.

- Technological Limitations for Mixed Fibers: Developing cost-effective and efficient methods for recycling blended fabrics remains a challenge.

- Quality Consistency and Performance: Ensuring consistent quality and performance of recycled fibers that match virgin materials.

- Economic Viability and Cost Competitiveness: The cost of collecting, sorting, and processing can sometimes be higher than using virgin materials.

- Consumer Perception and Acceptance: Overcoming potential consumer skepticism regarding the quality and aesthetics of recycled textile products.

- Supply Chain Complexity: Establishing robust and scalable supply chains for textile waste collection and recycling.

Emerging Opportunities in Textile Recycling Market

Emerging opportunities in the Textile Recycling Market lie in the development of advanced chemical recycling technologies capable of handling complex fiber blends, leading to higher-value material recovery. The expansion of textile-to-textile recycling systems for premium apparel and technical textiles presents a significant untapped market. Evolving consumer preferences towards conscious consumption and the demand for transparency in supply chains are creating opportunities for brands that can effectively integrate and communicate their use of recycled materials. Furthermore, the development of innovative business models, such as clothing rental and resale platforms, indirectly supports the recycling ecosystem by extending the life of garments and channeling them towards appropriate end-of-life solutions.

Growth Accelerators in the Textile Recycling Market Industry

The Textile Recycling Market is experiencing accelerated growth driven by several key factors. Technological breakthroughs in chemical recycling, such as depolymerization and dissolution processes, are enabling the transformation of textile waste into high-quality new fibers, creating a true closed-loop system. Strategic partnerships between fashion brands, chemical companies, and recycling innovators are crucial for scaling up these technologies and securing feedstock. Market expansion strategies are focusing on developing localized recycling infrastructure to reduce transportation costs and environmental impact. The increasing focus on a circular economy by governments and international bodies is also a significant accelerator, fostering innovation and investment in sustainable textile solutions.

Key Players Shaping the Textile Recycling Market Market

- Worn Again Technologies

- Lenzing Group

- Birla Cellulose

- Pistoni SRL

- Waste Management Inc

- The Woolmark Company

- American Textile Recycling

- Boer Group Recycling Solutions

- I:Collect

- Infinited Fiber Company

- 7 Other Companies

Notable Milestones in Textile Recycling Market Sector

- December 2023: The Accelerating Circularity Initiative was granted USD 1.5 million worth of funding from the Walmart Foundation to scale up the Building Circular Systems program, demonstrating early success in technical feasibility for textile-to-textile recycling systems.

- March 2023: Kelheim Fibres, a viscose manufacturer, collaborated with Recycling Atelier Augsburg to produce quality products from recycled materials, aiming to ensure fibers are manufactured from recycled wood, thus tightening the loop.

In-Depth Textile Recycling Market Market Outlook

The Textile Recycling Market outlook is exceptionally promising, fueled by accelerating growth catalysts. Continuous advancements in chemical recycling technologies will unlock the potential for highly efficient, fiber-to-fiber loops, significantly reducing reliance on virgin resources. Strategic collaborations between industry leaders are expected to streamline the supply chain, from waste collection to the production of high-quality recycled textiles. Market expansion will be driven by both regulatory push and consumer pull, creating a favorable environment for investment and innovation. The increasing integration of recycled materials into mainstream fashion will further normalize sustainable practices, solidifying the circular economy's role in the textile industry. This forward momentum positions the Textile Recycling Market for sustained and significant growth in the coming years.

Textile Recycling Market Segmentation

-

1. Material

- 1.1. Cotton

- 1.2. Polyester and Polyester Fiber

- 1.3. Wool

- 1.4. Nylon and Nylon Fiber

- 1.5. Others

-

2. Source

- 2.1. Apparel Waste

- 2.2. Home Furnishing Waste

- 2.3. Automotive Waste

- 2.4. Others

-

3. Process

- 3.1. Mechanical

- 3.2. Chemical

Textile Recycling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Bangladesh

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. South America

Textile Recycling Market Regional Market Share

Geographic Coverage of Textile Recycling Market

Textile Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Environmental Awareness; Regulatory Initiatives and Policies

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Awareness; Regulatory Initiatives and Policies

- 3.4. Market Trends

- 3.4.1. Europe is Set to Revamp Initiatives Focused on Reducing Waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Cotton

- 5.1.2. Polyester and Polyester Fiber

- 5.1.3. Wool

- 5.1.4. Nylon and Nylon Fiber

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Apparel Waste

- 5.2.2. Home Furnishing Waste

- 5.2.3. Automotive Waste

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Mechanical

- 5.3.2. Chemical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Cotton

- 6.1.2. Polyester and Polyester Fiber

- 6.1.3. Wool

- 6.1.4. Nylon and Nylon Fiber

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Apparel Waste

- 6.2.2. Home Furnishing Waste

- 6.2.3. Automotive Waste

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Process

- 6.3.1. Mechanical

- 6.3.2. Chemical

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Cotton

- 7.1.2. Polyester and Polyester Fiber

- 7.1.3. Wool

- 7.1.4. Nylon and Nylon Fiber

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Apparel Waste

- 7.2.2. Home Furnishing Waste

- 7.2.3. Automotive Waste

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Process

- 7.3.1. Mechanical

- 7.3.2. Chemical

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Cotton

- 8.1.2. Polyester and Polyester Fiber

- 8.1.3. Wool

- 8.1.4. Nylon and Nylon Fiber

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Apparel Waste

- 8.2.2. Home Furnishing Waste

- 8.2.3. Automotive Waste

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Process

- 8.3.1. Mechanical

- 8.3.2. Chemical

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East and Africa Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Cotton

- 9.1.2. Polyester and Polyester Fiber

- 9.1.3. Wool

- 9.1.4. Nylon and Nylon Fiber

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Apparel Waste

- 9.2.2. Home Furnishing Waste

- 9.2.3. Automotive Waste

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Process

- 9.3.1. Mechanical

- 9.3.2. Chemical

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. South America Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Cotton

- 10.1.2. Polyester and Polyester Fiber

- 10.1.3. Wool

- 10.1.4. Nylon and Nylon Fiber

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Apparel Waste

- 10.2.2. Home Furnishing Waste

- 10.2.3. Automotive Waste

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Process

- 10.3.1. Mechanical

- 10.3.2. Chemical

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Worn Again Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lenzing Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Birla Cellulose

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pistoni SRL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Management Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Woolmark Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 American Textile Recycling

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boer Group Recycling Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 I

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Worn Again Technologies

List of Figures

- Figure 1: Global Textile Recycling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Textile Recycling Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 4: North America Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 5: North America Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 7: North America Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 8: North America Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 9: North America Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 10: North America Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 11: North America Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 12: North America Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 13: North America Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 14: North America Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 15: North America Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 20: Europe Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 21: Europe Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 23: Europe Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 24: Europe Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 25: Europe Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 26: Europe Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 27: Europe Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 28: Europe Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 29: Europe Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 30: Europe Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 31: Europe Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 36: Asia Pacific Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 37: Asia Pacific Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 39: Asia Pacific Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 40: Asia Pacific Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 41: Asia Pacific Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 42: Asia Pacific Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 43: Asia Pacific Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 44: Asia Pacific Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 45: Asia Pacific Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 46: Asia Pacific Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 47: Asia Pacific Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 52: Middle East and Africa Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 53: Middle East and Africa Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 54: Middle East and Africa Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 55: Middle East and Africa Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 56: Middle East and Africa Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 57: Middle East and Africa Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 58: Middle East and Africa Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 59: Middle East and Africa Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 60: Middle East and Africa Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 61: Middle East and Africa Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 62: Middle East and Africa Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 63: Middle East and Africa Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East and Africa Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 68: South America Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 69: South America Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 70: South America Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 71: South America Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 72: South America Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 73: South America Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 74: South America Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 75: South America Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 76: South America Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 77: South America Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 78: South America Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 79: South America Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 81: South America Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Textile Recycling Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 7: Global Textile Recycling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Textile Recycling Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 15: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 23: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 24: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 25: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 26: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 27: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Russia Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Russia Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 42: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 43: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 44: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 45: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 46: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 47: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: China Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: India Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Indonesia Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Indonesia Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Bangladesh Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Bangladesh Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Asia Pacific Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 60: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 61: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 62: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 63: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 64: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 65: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 68: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 69: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 70: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 71: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 72: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 73: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Recycling Market?

The projected CAGR is approximately 3.86%.

2. Which companies are prominent players in the Textile Recycling Market?

Key companies in the market include Worn Again Technologies, Lenzing Group, Birla Cellulose, Pistoni SRL, Waste Management Inc, The Woolmark Company, American Textile Recycling, Boer Group Recycling Solutions, I: Collect, Infinited Fiber Company**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Textile Recycling Market?

The market segments include Material, Source, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Environmental Awareness; Regulatory Initiatives and Policies.

6. What are the notable trends driving market growth?

Europe is Set to Revamp Initiatives Focused on Reducing Waste.

7. Are there any restraints impacting market growth?

Growing Environmental Awareness; Regulatory Initiatives and Policies.

8. Can you provide examples of recent developments in the market?

December 2023: The Accelerating Circularity Initiative was granted USD 1.5 million worth of funding from the Walmart Foundation, which will be used to scale up the new Building Circular Systems program. The funds will contribute to the development of the early stages of the program, which have so far shown the technical feasibility of textile-to-textile recycling systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Recycling Market?

To stay informed about further developments, trends, and reports in the Textile Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence