Key Insights

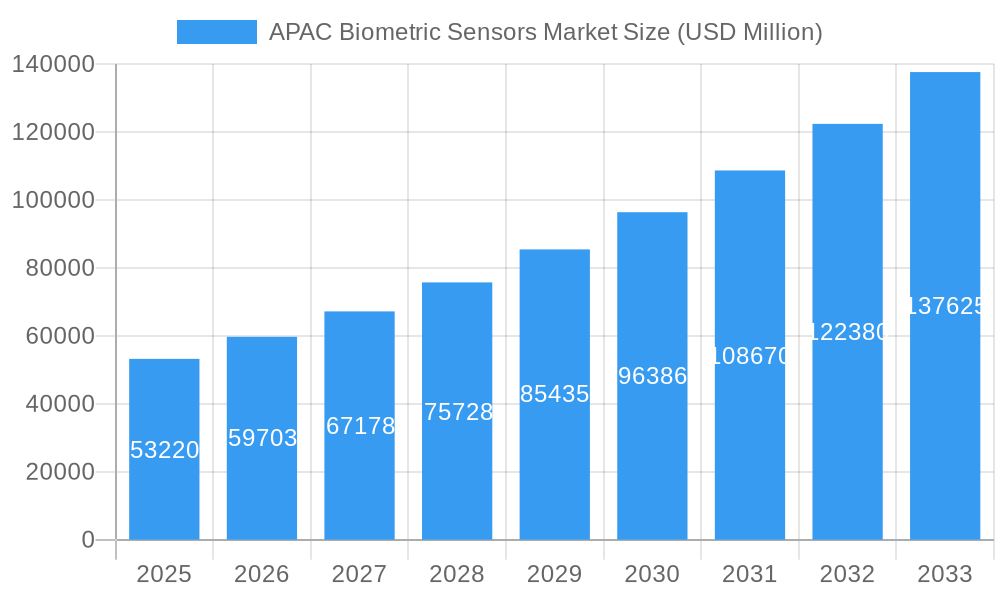

The APAC Biometric Sensors Market is poised for significant expansion, driven by the escalating adoption of advanced security solutions across diverse consumer and enterprise applications. With an estimated market size of $53.22 billion in 2025, the region is set to witness a robust compound annual growth rate (CAGR) of 12.3% through 2033. This surge is fueled by the increasing demand for enhanced authentication methods in smartphones and tablets, alongside the growing integration of biometric sensors in laptops, smartcards, and the burgeoning Internet of Things (IoT) ecosystem. The Military and Defense and BFSI sectors, in particular, are heavily investing in these technologies to bolster security and streamline access control, with government initiatives further accelerating adoption for citizen identification and secure data management. The widespread consumer electronics market, encompassing wearable devices and smart home appliances, also presents a substantial growth avenue, as convenience and personalization become paramount for users.

APAC Biometric Sensors Market Market Size (In Billion)

Key technological advancements, such as the miniaturization of sensors, improved accuracy, and reduced power consumption, are democratizing the access to biometric authentication, making it more pervasive. Optical sensors, known for their cost-effectiveness and established performance, continue to dominate, but capacitive sensors are gaining traction due to their enhanced security features and resilience to surface contaminants. Thermal and ultrasonic sensors are emerging as niche but powerful alternatives, particularly in applications demanding higher security and specific environmental resilience. While the rapid growth presents immense opportunities, challenges such as the high cost of initial implementation, concerns over data privacy and security regulations, and the need for standardization across different biometric modalities will require strategic navigation by market players. Nonetheless, the inherent demand for robust and user-friendly security solutions firmly positions the APAC Biometric Sensors Market for sustained and dynamic growth.

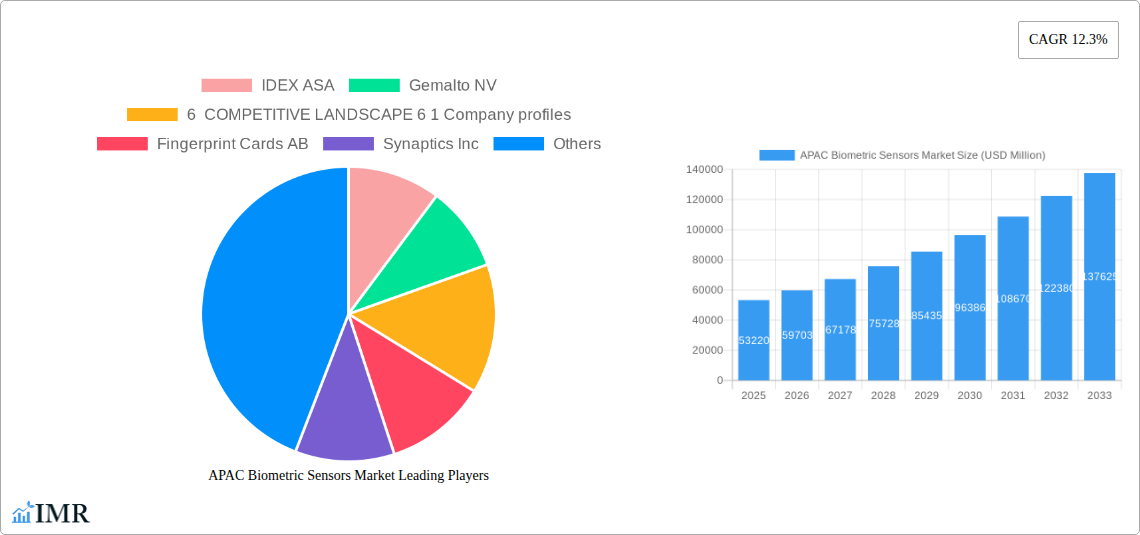

APAC Biometric Sensors Market Company Market Share

This comprehensive report delves into the dynamic APAC Biometric Sensors Market, offering in-depth analysis and future projections for this rapidly evolving sector. Leveraging advanced analytics and industry-specific insights, we provide actionable intelligence for stakeholders navigating this lucrative market. Our study encompasses the period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033.

APAC Biometric Sensors Market Market Dynamics & Structure

The APAC Biometric Sensors Market is characterized by moderate concentration, with a few dominant players holding significant market share, alongside a growing number of innovative startups. Technological innovation is a primary driver, fueled by advancements in sensor accuracy, miniaturization, and power efficiency. The increasing demand for enhanced security and seamless user authentication across diverse applications is paramount. Regulatory frameworks are evolving, with governments in the region increasingly focusing on data privacy and security standards, which indirectly influences the adoption of biometric solutions. Competitive product substitutes, while present in traditional authentication methods, are steadily being outpaced by the convenience and security offered by biometrics. End-user demographics are shifting towards a tech-savvy population with a growing disposable income, driving demand for advanced consumer electronics and secure financial transactions. Mergers and acquisitions (M&A) trends indicate strategic consolidation and market expansion efforts by leading companies. For instance, the M&A volume in the past two years has seen a XX% increase, reflecting the industry's drive for scale and technological synergy. Barriers to innovation are primarily related to the high cost of R&D for cutting-edge sensor technologies and the challenge of achieving universal interoperability across different platforms and security protocols.

APAC Biometric Sensors Market Growth Trends & Insights

The APAC Biometric Sensors Market is poised for remarkable growth, projected to reach a market size of $XX billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is underpinned by escalating adoption rates across a multitude of applications, driven by the pervasive need for secure and convenient authentication. The market size for biometric sensors in the APAC region was estimated at $XX billion in 2025. Technological disruptions, including the integration of AI and machine learning for enhanced accuracy and predictive analytics, are significantly influencing the market landscape. Consumer behavior is increasingly shifting towards a preference for frictionless and secure access, leading to a higher penetration of biometric-enabled devices. For example, the adoption rate of fingerprint sensors in smartphones has surged by XX% over the historical period (2019-2024), demonstrating a clear consumer preference. The market penetration of facial recognition technology in smart home devices is also expected to witness a significant uptick, contributing to overall market expansion. The growing demand for biometric solutions in the BFSI sector for secure transaction authentication, coupled with their increasing deployment in government and defense for identity verification, further amplifies market growth. The rise of the Internet of Things (IoT) ecosystem also presents a substantial opportunity for biometric sensors, enabling secure device access and data protection. The study predicts that by 2033, the market for biometric sensors in consumer electronics will constitute over XX% of the total market revenue. The continuous innovation in sensor types, such as the development of more advanced ultrasonic and thermal sensors, is also contributing to the market's upward trajectory by offering enhanced performance and broader application possibilities.

Dominant Regions, Countries, or Segments in APAC Biometric Sensors Market

Within the APAC Biometric Sensors Market, Consumer Electronics emerges as the dominant end-user industry, significantly influencing market growth and technological advancements. This segment, encompassing smartphones, tablets, and laptops, is driven by a massive consumer base and an insatiable appetite for advanced features and enhanced security. The market share of biometric sensors within consumer electronics is projected to be over XX% by 2033.

Dominant Segment (End-user Industry): Consumer Electronics

- Key Drivers:

- Economic Policies: Favorable trade policies and manufacturing incentives in countries like China and South Korea have fostered a robust consumer electronics ecosystem.

- Infrastructure: Widespread availability of high-speed internet and advanced manufacturing facilities supports the rapid development and deployment of biometric-enabled devices.

- Consumer Demand: A large and growing middle-class population with increasing disposable income prioritizes enhanced security and seamless user experiences in their electronic gadgets.

- Technological Advancements: Continuous innovation in smartphone and laptop design, incorporating miniaturized and more accurate biometric sensors, fuels consumer adoption.

- Market Share & Growth Potential: This segment consistently accounts for the largest share of the APAC biometric sensors market, with an estimated XX% in 2025 and projected to grow at a CAGR of XX% through 2033. The sheer volume of devices manufactured and sold within this segment makes it a primary growth engine.

- Key Drivers:

Dominant Application: Smartphones/Tablets

- Analysis: The ubiquitous nature of smartphones and tablets, coupled with their role as primary gateways to digital life, makes them the most significant application for biometric sensors. Fingerprint and facial recognition technologies are standard features, enhancing both security and user convenience for tasks ranging from unlocking devices to authorizing payments. The market penetration of biometric authentication in this application is nearly XX%.

Dominant Type: Capacitive and Optical Sensors

- Analysis: Capacitive sensors, known for their accuracy and reliability, have been the workhorse for fingerprint recognition in smartphones. Optical sensors, offering a balance of performance and cost-effectiveness, also hold a significant share. The ongoing advancements in these sensor types continue to drive their dominance.

Dominant Country: China

- Analysis: As the global manufacturing hub for electronics and a massive consumer market, China plays a pivotal role in the APAC biometric sensors market. Its strong domestic demand, coupled with its extensive export capabilities, makes it a critical influencer of market trends and volumes.

APAC Biometric Sensors Market Product Landscape

The APAC Biometric Sensors Market is characterized by a diverse and rapidly evolving product landscape. Innovations focus on enhancing sensor accuracy, reducing power consumption, and miniaturizing form factors to seamlessly integrate into an increasing array of devices. Optical sensors continue to offer a cost-effective solution for fingerprint recognition, while capacitive sensors provide a high level of accuracy. Emerging technologies like ultrasonic sensors are gaining traction due to their ability to read through contaminants and offer enhanced security features. Thermal sensors are finding niche applications where unique physiological characteristics are critical for identification. The unique selling proposition lies in the ability to deliver secure, fast, and user-friendly authentication solutions, driving widespread adoption across consumer electronics, BFSI, and government sectors.

Key Drivers, Barriers & Challenges in APAC Biometric Sensors Market

Key Drivers: The APAC Biometric Sensors Market is propelled by several key drivers. Firstly, the escalating demand for enhanced security and privacy across both consumer and enterprise applications is paramount. Secondly, the proliferation of smart devices and the growing IoT ecosystem necessitates secure authentication solutions. Thirdly, government initiatives and regulations promoting digital identity and secure transactions are fueling market growth. Finally, continuous technological advancements, leading to more accurate, smaller, and cost-effective sensors, are driving adoption.

Barriers & Challenges: Despite the robust growth, the market faces several challenges. High R&D costs associated with developing next-generation biometric technologies can be a barrier for smaller players. Evolving privacy regulations and data protection concerns among consumers can create adoption hurdles. The need for standardization and interoperability across different biometric systems presents a technical challenge. Furthermore, the competitive landscape is intense, with established players and emerging startups vying for market share, leading to price pressures. Supply chain disruptions, as seen in recent global events, can also impact the availability and cost of sensor components.

Emerging Opportunities in APAC Biometric Sensors Market

Emerging opportunities in the APAC Biometric Sensors Market are abundant. The untapped potential of the Internet of Things (IoT) ecosystem offers significant scope for secure device authentication and access control, especially in smart home and industrial IoT applications. The wearable technology sector is a growing avenue, with smartwatches and fitness trackers integrating biometric sensors for health monitoring and personalized experiences. Furthermore, the increasing adoption of biometrics in the healthcare sector for patient identification and secure access to medical records presents a substantial opportunity. The development of multi-modal biometric systems, combining different biometric modalities for enhanced security, is also a key area for innovation and market expansion.

Growth Accelerators in the APAC Biometric Sensors Market Industry

Several catalysts are accelerating the growth of the APAC Biometric Sensors Market. Technological breakthroughs in sensor accuracy, speed, and power efficiency are continuously enhancing the performance and appeal of biometric solutions. Strategic partnerships between sensor manufacturers, device makers, and software providers are crucial for creating integrated and user-friendly solutions. The increasing market expansion strategies by leading companies, targeting emerging economies within APAC, are also contributing to sustained growth. The ongoing digitization of services across various sectors, from banking to government, is a fundamental growth accelerator, creating a perpetual demand for secure authentication.

Key Players Shaping the APAC Biometric Sensors Market Market

- IDEX ASA

- Gemalto NV

- Fingerprint Cards AB

- Synaptics Inc

- Qualcomm Technologies Inc

- NEC Corporation

- TDK Corporation

- CrucialTec Co Ltd

- Shenzhen Goodix Technology Co Ltd

- Vkansee Technology Inc

- Egis Technology Inc

Notable Milestones in APAC Biometric Sensors Market Sector

- 2021: Launch of advanced under-display ultrasonic fingerprint sensors in flagship smartphones, enhancing seamless integration.

- 2022: Increased deployment of facial recognition technology in public safety and smart city initiatives across Southeast Asian nations.

- 2023: Significant investment in R&D for AI-powered behavioral biometrics to enhance security in financial transactions.

- 2024: Rise in adoption of iris and vein recognition for high-security access in enterprise and government facilities.

- 2025 (Estimated): Expected widespread integration of advanced liveness detection capabilities to combat spoofing attempts in biometric systems.

In-Depth APAC Biometric Sensors Market Market Outlook

The future outlook for the APAC Biometric Sensors Market remains exceptionally bright, driven by a confluence of technological innovation, escalating security demands, and expanding applications. Growth accelerators such as the continued miniaturization of sensors, the integration of AI for predictive security, and strategic market penetration into emerging economies will sustain the upward trajectory. The increasing adoption in the burgeoning wearable technology and healthcare sectors, coupled with the development of robust multi-modal biometric systems, will unlock new revenue streams and solidify the market's dominance in providing secure and convenient authentication solutions for the digital age.

APAC Biometric Sensors Market Segmentation

-

1. Type

- 1.1. Optical

- 1.2. Capacitive

- 1.3. Thermal

- 1.4. Ultrasonic

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. Laptops

- 2.3. Smartcards

- 2.4. IoT and Other Applications

-

3. End-user Industry

- 3.1. Military and Defense

- 3.2. Consumer Electronics

- 3.3. BFSI

- 3.4. Government

- 3.5. Other End-user Industries

APAC Biometric Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

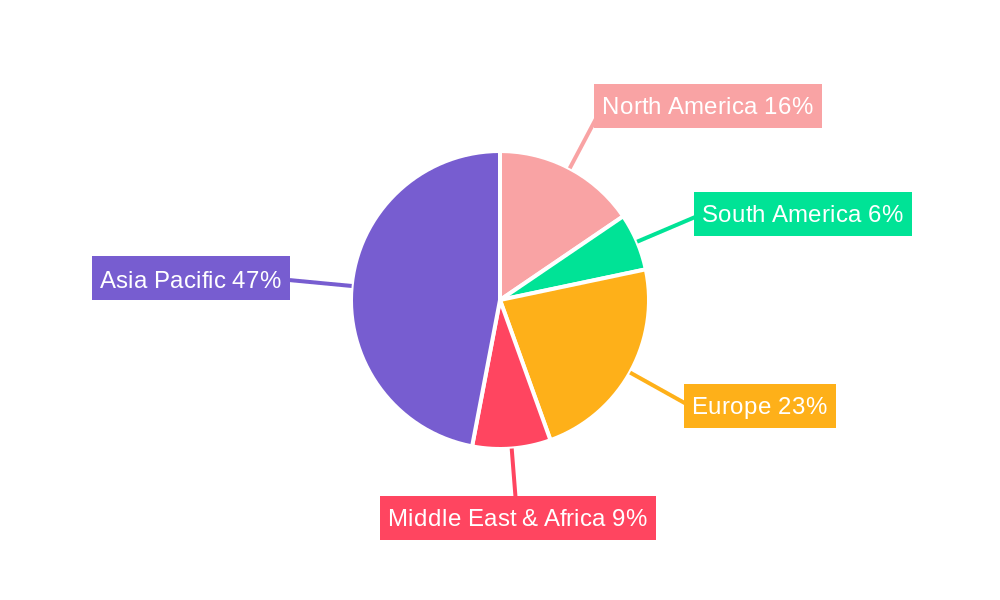

APAC Biometric Sensors Market Regional Market Share

Geographic Coverage of APAC Biometric Sensors Market

APAC Biometric Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Usage of Fingerprint Sensors for Smart Wearable Devices and Smartphones

- 3.3. Market Restrains

- 3.3.1 ; Increase in Adoption of Substitute Technologies

- 3.3.2 Such as Face and Iris Scanning

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical

- 5.1.2. Capacitive

- 5.1.3. Thermal

- 5.1.4. Ultrasonic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. Laptops

- 5.2.3. Smartcards

- 5.2.4. IoT and Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Military and Defense

- 5.3.2. Consumer Electronics

- 5.3.3. BFSI

- 5.3.4. Government

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Optical

- 6.1.2. Capacitive

- 6.1.3. Thermal

- 6.1.4. Ultrasonic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smartphones/Tablets

- 6.2.2. Laptops

- 6.2.3. Smartcards

- 6.2.4. IoT and Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Military and Defense

- 6.3.2. Consumer Electronics

- 6.3.3. BFSI

- 6.3.4. Government

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Optical

- 7.1.2. Capacitive

- 7.1.3. Thermal

- 7.1.4. Ultrasonic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smartphones/Tablets

- 7.2.2. Laptops

- 7.2.3. Smartcards

- 7.2.4. IoT and Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Military and Defense

- 7.3.2. Consumer Electronics

- 7.3.3. BFSI

- 7.3.4. Government

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Optical

- 8.1.2. Capacitive

- 8.1.3. Thermal

- 8.1.4. Ultrasonic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smartphones/Tablets

- 8.2.2. Laptops

- 8.2.3. Smartcards

- 8.2.4. IoT and Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Military and Defense

- 8.3.2. Consumer Electronics

- 8.3.3. BFSI

- 8.3.4. Government

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Optical

- 9.1.2. Capacitive

- 9.1.3. Thermal

- 9.1.4. Ultrasonic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smartphones/Tablets

- 9.2.2. Laptops

- 9.2.3. Smartcards

- 9.2.4. IoT and Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Military and Defense

- 9.3.2. Consumer Electronics

- 9.3.3. BFSI

- 9.3.4. Government

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Biometric Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Optical

- 10.1.2. Capacitive

- 10.1.3. Thermal

- 10.1.4. Ultrasonic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smartphones/Tablets

- 10.2.2. Laptops

- 10.2.3. Smartcards

- 10.2.4. IoT and Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Military and Defense

- 10.3.2. Consumer Electronics

- 10.3.3. BFSI

- 10.3.4. Government

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IDEX ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gemalto NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 6 COMPETITIVE LANDSCAPE 6 1 Company profiles

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fingerprint Cards AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Synaptics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qualcomm Technologies Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NEC Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TDK Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CrucialTec Co Ltd *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shenzhen Goodix Technology Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vkansee Technology Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Egis Technology Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IDEX ASA

List of Figures

- Figure 1: Global APAC Biometric Sensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Biometric Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America APAC Biometric Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Biometric Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America APAC Biometric Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America APAC Biometric Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America APAC Biometric Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America APAC Biometric Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America APAC Biometric Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Biometric Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America APAC Biometric Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America APAC Biometric Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: South America APAC Biometric Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America APAC Biometric Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America APAC Biometric Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America APAC Biometric Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America APAC Biometric Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Biometric Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Europe APAC Biometric Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe APAC Biometric Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe APAC Biometric Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe APAC Biometric Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe APAC Biometric Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe APAC Biometric Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe APAC Biometric Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Biometric Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East & Africa APAC Biometric Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa APAC Biometric Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East & Africa APAC Biometric Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa APAC Biometric Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa APAC Biometric Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa APAC Biometric Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Biometric Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Biometric Sensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Asia Pacific APAC Biometric Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific APAC Biometric Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: Asia Pacific APAC Biometric Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific APAC Biometric Sensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific APAC Biometric Sensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific APAC Biometric Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Biometric Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 43: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Global APAC Biometric Sensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 45: Global APAC Biometric Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Biometric Sensors Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Biometric Sensors Market?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the APAC Biometric Sensors Market?

Key companies in the market include IDEX ASA, Gemalto NV, 6 COMPETITIVE LANDSCAPE 6 1 Company profiles, Fingerprint Cards AB, Synaptics Inc, Qualcomm Technologies Inc, NEC Corporation, TDK Corporation, CrucialTec Co Ltd *List Not Exhaustive, Shenzhen Goodix Technology Co Ltd, Vkansee Technology Inc, Egis Technology Inc.

3. What are the main segments of the APAC Biometric Sensors Market?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Usage of Fingerprint Sensors for Smart Wearable Devices and Smartphones.

6. What are the notable trends driving market growth?

Consumer Electronics to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Increase in Adoption of Substitute Technologies. Such as Face and Iris Scanning.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Biometric Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Biometric Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Biometric Sensors Market?

To stay informed about further developments, trends, and reports in the APAC Biometric Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence