Key Insights

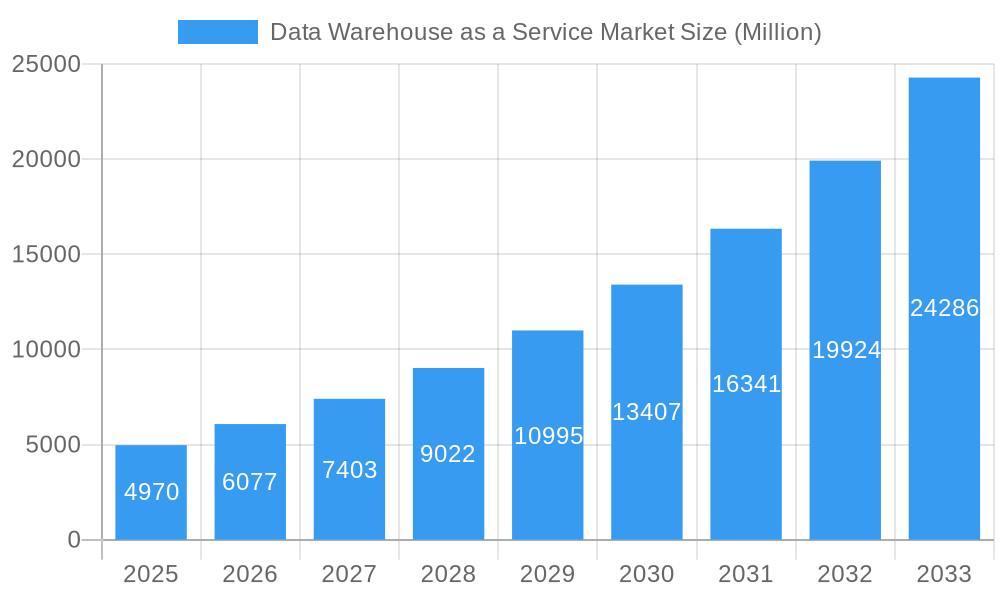

The Data Warehouse as a Service (DWaaS) market is experiencing explosive growth, projected to reach a substantial $4.97 Billion by 2025. This surge is fueled by a remarkable CAGR of 22.60%, indicating a rapid and sustained expansion of this critical cloud-based data management solution. The primary drivers behind this impressive trajectory include the escalating volume of data generated by businesses across all sectors, the increasing demand for advanced analytics and business intelligence for informed decision-making, and the compelling cost-effectiveness and scalability offered by cloud-native DWaaS solutions compared to traditional on-premise deployments. Small and Medium Enterprises (SMEs), in particular, are increasingly adopting DWaaS to democratize access to powerful data insights, previously exclusive to larger organizations.

Data Warehouse as a Service Market Market Size (In Billion)

The market's expansion is further propelled by key trends such as the growing adoption of hybrid and multi-cloud strategies, enabling organizations to leverage the best of different cloud environments for their data warehousing needs. The integration of AI and machine learning capabilities within DWaaS platforms is another significant trend, offering enhanced data processing, predictive analytics, and automated insights. Furthermore, the increasing emphasis on data governance and security in cloud environments is being addressed by advanced features within DWaaS offerings. While the market is robust, potential restraints could emerge from concerns regarding data privacy and security in the cloud, the complexity of data migration for some legacy systems, and the need for skilled personnel to manage and optimize cloud data warehouses. However, the overwhelming benefits of agility, cost savings, and accessibility are expected to outweigh these challenges, driving robust growth across all segments and regions.

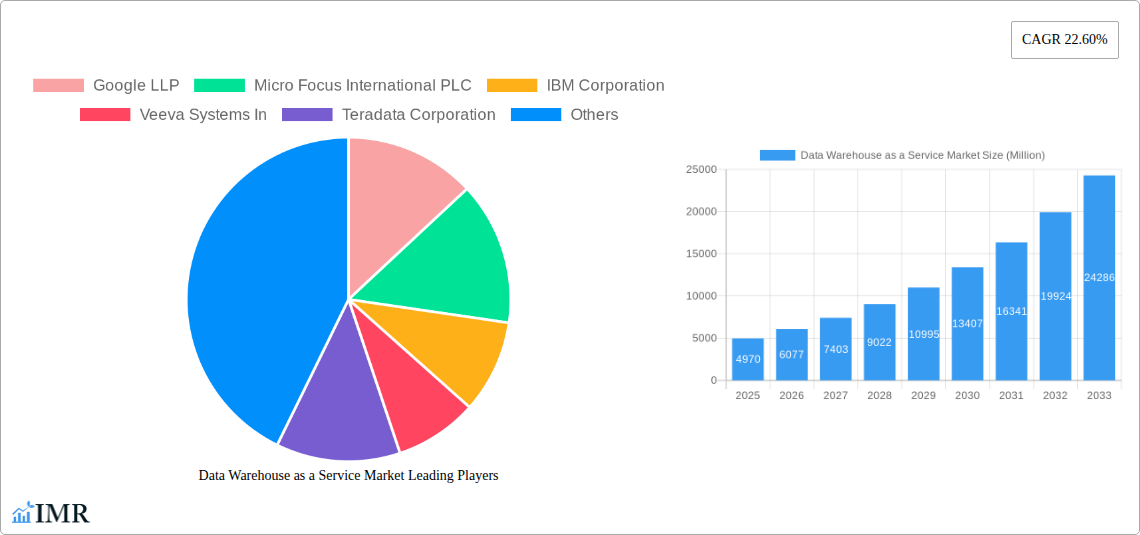

Data Warehouse as a Service Market Company Market Share

Unleash the Power of Cloud Data: Comprehensive Data Warehouse as a Service Market Report (2019-2033)

Dive deep into the dynamic world of Data Warehouse as a Service (DWaaS) with our definitive market report. Spanning 2019–2033, with a base year of 2025, this analysis provides critical insights into market size, growth trajectories, and key players shaping the future of cloud-based data warehousing. With a forecast period extending from 2025–2033, this report is your essential guide to navigating the evolving landscape of data management and analytics. Gain a competitive edge by understanding market drivers, barriers, opportunities, and the strategic moves of industry giants.

Report Focus: Data Warehouse as a Service (DWaaS) Market, Cloud Data Warehousing, Big Data Analytics, Business Intelligence (BI) Solutions, Data Management Platforms.

Key Segments Explored:

- Organization: Large Enterprises, Small and Medium Enterprises (SME)

- End-User Vertical: BFSI, Government, Healthcare, E-Commerce and Retail, Media and Entertainment, Other End-user Industries

Featured Companies: Google LLP, Micro Focus International PLC, IBM Corporation, Veeva Systems Inc, Teradata Corporation, Yellowbrick B.V., Cloudera Inc, Microsoft Corporation, Amazon Web Services Inc, Snowflake Computing Inc, Oracle Corporation, Pivotal Software Inc, SAP SE.

Data Warehouse as a Service Market Market Dynamics & Structure

The Data Warehouse as a Service (DWaaS) market is characterized by intense competition, rapid technological innovation, and evolving regulatory landscapes. Market concentration is high, with major cloud providers and established tech giants dominating the scene, vying for significant market share through strategic product development and aggressive go-to-market strategies. Technological innovation is the primary driver, with advancements in AI/ML, serverless computing, and data virtualization continuously enhancing DWaaS capabilities, enabling faster, more scalable, and cost-effective data analysis. Regulatory frameworks, particularly around data privacy (e.g., GDPR, CCPA), are increasingly influencing DWaaS adoption, pushing vendors to offer robust compliance features. Competitive product substitutes, including on-premises data warehouses and specialized analytics platforms, are present but are increasingly being outpaced by the agility and scalability of cloud-native DWaaS solutions. End-user demographics are shifting towards a greater demand for self-service analytics and democratized data access across organizations of all sizes. Mergers and Acquisitions (M&A) trends are prominent, with larger players acquiring innovative startups to expand their technological portfolios and market reach.

- Market Concentration: Dominated by a few key cloud hyperscalers and enterprise software vendors.

- Technological Innovation Drivers: AI/ML integration, serverless architectures, real-time data processing, enhanced security protocols.

- Regulatory Frameworks: Increasing importance of data privacy, compliance, and governance.

- Competitive Product Substitutes: On-premises solutions, data lakes, specialized analytical databases.

- End-User Demographics: Growing demand from SMEs and a surge in self-service analytics adoption.

- M&A Trends: Strategic acquisitions to enhance cloud capabilities and expand service offerings.

Data Warehouse as a Service Market Growth Trends & Insights

The Data Warehouse as a Service (DWaaS) market is poised for exceptional growth, driven by the pervasive digital transformation initiatives across industries. Market size evolution indicates a significant upward trajectory, propelled by the increasing volume, velocity, and variety of data generated globally. Adoption rates for DWaaS solutions are accelerating, as businesses recognize the inherent advantages of scalability, cost-efficiency, and reduced IT overhead compared to traditional on-premises data warehousing. Technological disruptions, such as the rise of cloud-native architectures, columnar storage, and in-memory computing, are continuously redefining the capabilities and performance of DWaaS platforms. These advancements enable organizations to perform complex analytics on massive datasets with unprecedented speed and agility. Consumer behavior shifts are also playing a pivotal role, with a growing expectation for real-time insights and data-driven decision-making becoming the norm. This necessitates robust and accessible data warehousing solutions that can cater to diverse analytical needs. The market is witnessing a strong CAGR, fueled by the increasing need for business intelligence (BI) and advanced analytics across various sectors. Market penetration is expected to rise significantly as more SMEs embrace cloud solutions and larger enterprises migrate their existing data infrastructure to the cloud for greater flexibility and innovation. The democratisation of data through user-friendly DWaaS platforms is further enhancing adoption and driving deeper insights across business functions. The shift from capital expenditure (CapEx) to operational expenditure (OpEx) models also makes DWaaS an attractive proposition for budget-conscious organizations. The continuous innovation in data integration, ETL/ELT processes, and data governance tools integrated within DWaaS offerings are further bolstering market growth and increasing the value proposition for end-users.

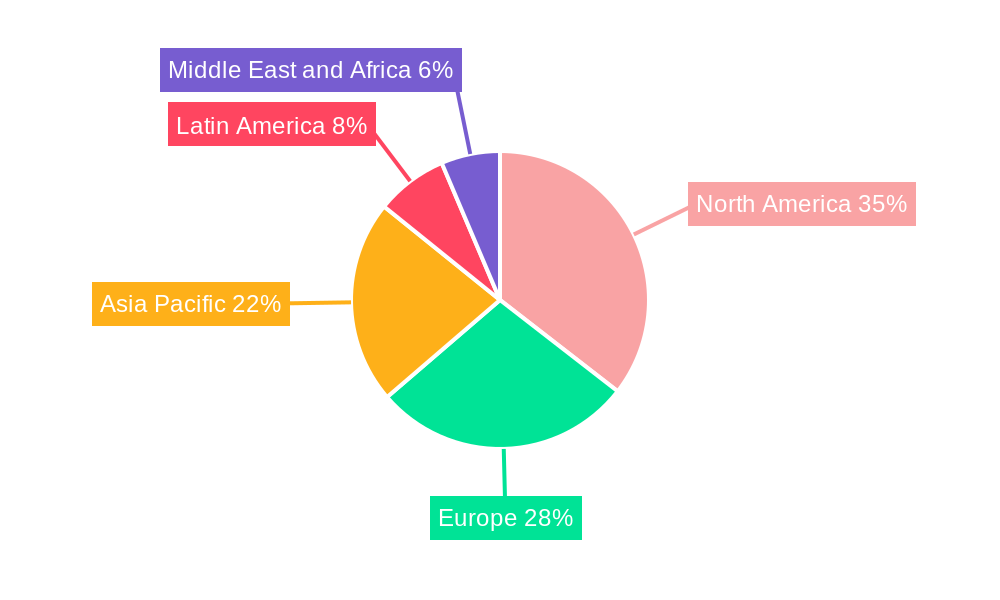

Dominant Regions, Countries, or Segments in Data Warehouse as a Service Market

The North America region stands as the dominant force in the Data Warehouse as a Service (DWaaS) market, driven by a confluence of technological adoption, economic strength, and a mature digital ecosystem. Within this region, the United States leads significantly due to its concentration of leading technology companies, robust venture capital funding for cloud innovations, and a high rate of digital transformation across all industry verticals. The BFSI sector is a prime example of a segment exhibiting exceptional growth within the DWaaS market, propelled by the critical need for real-time risk assessment, fraud detection, customer analytics, and personalized financial services. Financial institutions are increasingly leveraging DWaaS to consolidate vast amounts of transactional and customer data, enabling sophisticated analytics for competitive advantage. Furthermore, Large Enterprises represent a significant segment contributing to market dominance. These organizations possess the resources and the complex data requirements that make DWaaS an indispensable tool for managing and analyzing large-scale data operations, driving operational efficiency, and fostering innovation. The adoption of cloud-native DWaaS solutions allows these enterprises to scale their analytics capabilities rapidly without substantial upfront infrastructure investments. The presence of a highly developed IT infrastructure, coupled with strong government initiatives promoting digital adoption and innovation, further solidifies North America's leading position. The competitive landscape in this region is characterized by intense innovation and strategic partnerships, with companies continuously pushing the boundaries of what DWaaS can offer. The high adoption of cloud computing services, in general, sets a strong foundation for the rapid expansion of DWaaS.

- Dominant Region: North America, particularly the United States.

- Key Segment Drivers:

- Organization: Large Enterprises – requiring advanced scalability and complex analytics.

- End User Vertical: BFSI – demanding real-time insights for risk, fraud, and customer analytics.

- Factors Contributing to Dominance:

- Pioneering cloud technology adoption.

- Significant investment in R&D and innovation.

- High concentration of technology companies and startups.

- Favorable economic policies supporting digital transformation.

- Mature IT infrastructure and widespread internet penetration.

- Stringent regulatory environments driving advanced data security and compliance needs.

Data Warehouse as a Service Market Product Landscape

The DWaaS product landscape is defined by continuous innovation aimed at enhancing performance, usability, and integration capabilities. Key product developments focus on AI-driven automation for data management, real-time data ingestion and processing, and seamless integration with a wide array of data sources and analytical tools. Unique selling propositions often revolve around cost optimization through pay-as-you-go models, superior query performance, and robust security features. Technological advancements include the widespread adoption of serverless architectures, columnar storage formats, and in-memory processing, enabling unprecedented analytical speeds and scalability. Many platforms now offer specialized features for data governance, lineage tracking, and compliance, addressing critical enterprise needs. The integration of advanced machine learning algorithms directly within the DWaaS environment allows for sophisticated predictive analytics and automated insights generation, further empowering users.

Key Drivers, Barriers & Challenges in Data Warehouse as a Service Market

The Data Warehouse as a Service (DWaaS) market is propelled by several key drivers, including the escalating volume of data generated across industries, the growing need for advanced analytics to gain competitive advantages, and the cost-effectiveness and scalability offered by cloud-based solutions. Technological advancements in AI, machine learning, and Big Data processing further fuel adoption, enabling more sophisticated data analysis. The shift towards operational expenditure (OpEx) models also makes DWaaS an attractive option for businesses.

- Key Drivers:

- Explosion of big data.

- Demand for advanced analytics and business intelligence.

- Scalability and cost-effectiveness of cloud solutions.

- Technological innovation (AI/ML, serverless).

- Shift from CapEx to OpEx.

Conversely, the market faces significant barriers and challenges. Data security and privacy concerns remain paramount, with organizations apprehensive about entrusting sensitive data to third-party providers. Integration complexity with existing legacy systems can also pose a hurdle, requiring substantial effort and expertise. Vendor lock-in is another concern, as migrating data between DWaaS providers can be challenging and costly. Additionally, the shortage of skilled data professionals capable of managing and leveraging DWaaS effectively presents a restraint. The initial investment in migration and training, coupled with a lack of clear ROI understanding for some organizations, can slow down adoption.

- Key Barriers & Challenges:

- Data security and privacy concerns.

- Integration complexity with existing systems.

- Vendor lock-in.

- Shortage of skilled data professionals.

- Initial migration costs and training.

- Uncertainty in demonstrating clear ROI.

Emerging Opportunities in Data Warehouse as a Service Market

Emerging opportunities in the DWaaS market lie in the growing demand for real-time analytics and the expansion of AI/ML capabilities within these platforms. The increasing adoption of data virtualization and data fabric architectures presents avenues for more agile and unified data access. Untapped markets, particularly in developing economies and specific niche industries like IoT analytics and edge computing, offer significant growth potential. Evolving consumer preferences for personalized experiences are driving the need for more sophisticated customer data platforms, which DWaaS can powerfully support. The development of industry-specific DWaaS solutions tailored to the unique regulatory and analytical needs of sectors like manufacturing and logistics also represents a burgeoning opportunity. Furthermore, the integration of blockchain technology for enhanced data security and immutability within DWaaS is an emerging area with promising applications.

Growth Accelerators in the Data Warehouse as a Service Market Industry

Several key catalysts are accelerating long-term growth in the DWaaS industry. Technological breakthroughs, such as advancements in massively parallel processing (MPP) architectures and the proliferation of serverless computing, are significantly boosting performance and reducing latency. Strategic partnerships between cloud providers, data analytics firms, and independent software vendors (ISVs) are creating more integrated and comprehensive DWaaS ecosystems, offering end-to-end solutions. Market expansion strategies, including the development of specialized DWaaS offerings for specific industry verticals and the increasing penetration into the small and medium-sized enterprise (SME) segment, are broadenig the customer base. The continuous evolution of data governance and compliance tools within DWaaS platforms is also fostering greater trust and adoption among regulated industries. The increasing accessibility and ease of use of DWaaS platforms are democratizing data analytics, enabling a wider range of users to derive value from their data, thus driving sustained growth.

Key Players Shaping the Data Warehouse as a Service Market Market

- Google LLP

- Micro Focus International PLC

- IBM Corporation

- Veeva Systems Inc

- Teradata Corporation

- Yellowbrick B.V.

- Cloudera Inc

- Microsoft Corporation

- Amazon Web Services Inc

- Snowflake Computing Inc

- Oracle Corporation

- Pivotal Software Inc

- SAP SE

Notable Milestones in Data Warehouse as a Service Market Sector

- May 2022: Dell partnered with Snowflake Inc to ease access to on-premises data, integrating Snowflake Data Cloud's tools with on-premises object storage.

- January 2022: Firebolt, a data warehouse startup, raised USD100 million at a USD1.4 billion valuation, signaling strong investment interest in faster, cheaper analytics on massive datasets and enabling further technological development and market expansion.

In-Depth Data Warehouse as a Service Market Market Outlook

The outlook for the Data Warehouse as a Service (DWaaS) market remains exceptionally strong, driven by an ongoing digital transformation that necessitates robust and scalable data management. Growth accelerators such as the pervasive adoption of AI and machine learning for advanced analytics, coupled with the increasing demand for real-time data processing capabilities, will continue to propel market expansion. Strategic partnerships among key technology vendors and cloud providers are fostering a more integrated and sophisticated DWaaS ecosystem, offering comprehensive solutions to a wider array of businesses. The market's ability to cater to the evolving needs of both large enterprises and SMEs, through flexible pricing models and user-friendly interfaces, will further solidify its growth trajectory. The future holds immense potential for innovative applications, particularly in emerging fields like IoT and edge analytics, where DWaaS will play a critical role in deriving actionable insights from distributed data sources.

Data Warehouse as a Service Market Segmentation

-

1. Organization

- 1.1. Large Enterprises

- 1.2. Small and Medium Enterprises (SME)

-

2. End User Vertical

- 2.1. BFSI

- 2.2. Government

- 2.3. Healthcare

- 2.4. E-Commerce and Retail

- 2.5. Media and Entertainment

- 2.6. Other End-user Industries

Data Warehouse as a Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Data Warehouse as a Service Market Regional Market Share

Geographic Coverage of Data Warehouse as a Service Market

Data Warehouse as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption of Cloud-based Solutions and Focus on Real-time Data Analysis; Rising use of Data Warehouse services in BFSI sector to drive the market.; Data analytics and business intelligence are expected to play a major role in enterprise management.

- 3.3. Market Restrains

- 3.3.1. Data Security and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Rising use of Data Warehouse services in BFSI sector to drive the market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization

- 5.1.1. Large Enterprises

- 5.1.2. Small and Medium Enterprises (SME)

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. BFSI

- 5.2.2. Government

- 5.2.3. Healthcare

- 5.2.4. E-Commerce and Retail

- 5.2.5. Media and Entertainment

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Organization

- 6. North America Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization

- 6.1.1. Large Enterprises

- 6.1.2. Small and Medium Enterprises (SME)

- 6.2. Market Analysis, Insights and Forecast - by End User Vertical

- 6.2.1. BFSI

- 6.2.2. Government

- 6.2.3. Healthcare

- 6.2.4. E-Commerce and Retail

- 6.2.5. Media and Entertainment

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Organization

- 7. Europe Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization

- 7.1.1. Large Enterprises

- 7.1.2. Small and Medium Enterprises (SME)

- 7.2. Market Analysis, Insights and Forecast - by End User Vertical

- 7.2.1. BFSI

- 7.2.2. Government

- 7.2.3. Healthcare

- 7.2.4. E-Commerce and Retail

- 7.2.5. Media and Entertainment

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Organization

- 8. Asia Pacific Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization

- 8.1.1. Large Enterprises

- 8.1.2. Small and Medium Enterprises (SME)

- 8.2. Market Analysis, Insights and Forecast - by End User Vertical

- 8.2.1. BFSI

- 8.2.2. Government

- 8.2.3. Healthcare

- 8.2.4. E-Commerce and Retail

- 8.2.5. Media and Entertainment

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Organization

- 9. Latin America Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization

- 9.1.1. Large Enterprises

- 9.1.2. Small and Medium Enterprises (SME)

- 9.2. Market Analysis, Insights and Forecast - by End User Vertical

- 9.2.1. BFSI

- 9.2.2. Government

- 9.2.3. Healthcare

- 9.2.4. E-Commerce and Retail

- 9.2.5. Media and Entertainment

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Organization

- 10. Middle East and Africa Data Warehouse as a Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization

- 10.1.1. Large Enterprises

- 10.1.2. Small and Medium Enterprises (SME)

- 10.2. Market Analysis, Insights and Forecast - by End User Vertical

- 10.2.1. BFSI

- 10.2.2. Government

- 10.2.3. Healthcare

- 10.2.4. E-Commerce and Retail

- 10.2.5. Media and Entertainment

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Organization

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Google LLP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Micro Focus International PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Veeva Systems In

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teradata Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yellowbrick B V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cloudera Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microsoft Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amazon Web Services Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Snowflake Computing Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pivotal Software Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SAP SE

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Google LLP

List of Figures

- Figure 1: Global Data Warehouse as a Service Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Data Warehouse as a Service Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Data Warehouse as a Service Market Revenue (Million), by Organization 2025 & 2033

- Figure 4: North America Data Warehouse as a Service Market Volume (K Unit), by Organization 2025 & 2033

- Figure 5: North America Data Warehouse as a Service Market Revenue Share (%), by Organization 2025 & 2033

- Figure 6: North America Data Warehouse as a Service Market Volume Share (%), by Organization 2025 & 2033

- Figure 7: North America Data Warehouse as a Service Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 8: North America Data Warehouse as a Service Market Volume (K Unit), by End User Vertical 2025 & 2033

- Figure 9: North America Data Warehouse as a Service Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 10: North America Data Warehouse as a Service Market Volume Share (%), by End User Vertical 2025 & 2033

- Figure 11: North America Data Warehouse as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Data Warehouse as a Service Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Data Warehouse as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Data Warehouse as a Service Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Data Warehouse as a Service Market Revenue (Million), by Organization 2025 & 2033

- Figure 16: Europe Data Warehouse as a Service Market Volume (K Unit), by Organization 2025 & 2033

- Figure 17: Europe Data Warehouse as a Service Market Revenue Share (%), by Organization 2025 & 2033

- Figure 18: Europe Data Warehouse as a Service Market Volume Share (%), by Organization 2025 & 2033

- Figure 19: Europe Data Warehouse as a Service Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 20: Europe Data Warehouse as a Service Market Volume (K Unit), by End User Vertical 2025 & 2033

- Figure 21: Europe Data Warehouse as a Service Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 22: Europe Data Warehouse as a Service Market Volume Share (%), by End User Vertical 2025 & 2033

- Figure 23: Europe Data Warehouse as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Data Warehouse as a Service Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Data Warehouse as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Data Warehouse as a Service Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Data Warehouse as a Service Market Revenue (Million), by Organization 2025 & 2033

- Figure 28: Asia Pacific Data Warehouse as a Service Market Volume (K Unit), by Organization 2025 & 2033

- Figure 29: Asia Pacific Data Warehouse as a Service Market Revenue Share (%), by Organization 2025 & 2033

- Figure 30: Asia Pacific Data Warehouse as a Service Market Volume Share (%), by Organization 2025 & 2033

- Figure 31: Asia Pacific Data Warehouse as a Service Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 32: Asia Pacific Data Warehouse as a Service Market Volume (K Unit), by End User Vertical 2025 & 2033

- Figure 33: Asia Pacific Data Warehouse as a Service Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 34: Asia Pacific Data Warehouse as a Service Market Volume Share (%), by End User Vertical 2025 & 2033

- Figure 35: Asia Pacific Data Warehouse as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Data Warehouse as a Service Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Data Warehouse as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Data Warehouse as a Service Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Data Warehouse as a Service Market Revenue (Million), by Organization 2025 & 2033

- Figure 40: Latin America Data Warehouse as a Service Market Volume (K Unit), by Organization 2025 & 2033

- Figure 41: Latin America Data Warehouse as a Service Market Revenue Share (%), by Organization 2025 & 2033

- Figure 42: Latin America Data Warehouse as a Service Market Volume Share (%), by Organization 2025 & 2033

- Figure 43: Latin America Data Warehouse as a Service Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 44: Latin America Data Warehouse as a Service Market Volume (K Unit), by End User Vertical 2025 & 2033

- Figure 45: Latin America Data Warehouse as a Service Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 46: Latin America Data Warehouse as a Service Market Volume Share (%), by End User Vertical 2025 & 2033

- Figure 47: Latin America Data Warehouse as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Data Warehouse as a Service Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Data Warehouse as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Data Warehouse as a Service Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Data Warehouse as a Service Market Revenue (Million), by Organization 2025 & 2033

- Figure 52: Middle East and Africa Data Warehouse as a Service Market Volume (K Unit), by Organization 2025 & 2033

- Figure 53: Middle East and Africa Data Warehouse as a Service Market Revenue Share (%), by Organization 2025 & 2033

- Figure 54: Middle East and Africa Data Warehouse as a Service Market Volume Share (%), by Organization 2025 & 2033

- Figure 55: Middle East and Africa Data Warehouse as a Service Market Revenue (Million), by End User Vertical 2025 & 2033

- Figure 56: Middle East and Africa Data Warehouse as a Service Market Volume (K Unit), by End User Vertical 2025 & 2033

- Figure 57: Middle East and Africa Data Warehouse as a Service Market Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 58: Middle East and Africa Data Warehouse as a Service Market Volume Share (%), by End User Vertical 2025 & 2033

- Figure 59: Middle East and Africa Data Warehouse as a Service Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Data Warehouse as a Service Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Data Warehouse as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Data Warehouse as a Service Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 2: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 3: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 4: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 5: Global Data Warehouse as a Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 8: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 9: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 10: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 11: Global Data Warehouse as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 18: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 19: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 20: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 21: Global Data Warehouse as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: Germany Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: UK Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: UK Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Spain Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 34: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 35: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 36: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 37: Global Data Warehouse as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 39: China Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Japan Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: India Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Australia Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Australia Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 50: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 51: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 52: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 53: Global Data Warehouse as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 55: Brazil Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Mexico Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Mexico Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Argentina Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Latin America Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Latin America Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Data Warehouse as a Service Market Revenue Million Forecast, by Organization 2020 & 2033

- Table 64: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Organization 2020 & 2033

- Table 65: Global Data Warehouse as a Service Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 66: Global Data Warehouse as a Service Market Volume K Unit Forecast, by End User Vertical 2020 & 2033

- Table 67: Global Data Warehouse as a Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Data Warehouse as a Service Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 69: UAE Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: UAE Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Saudi Arabia Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Saudi Arabia Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Data Warehouse as a Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Data Warehouse as a Service Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Warehouse as a Service Market?

The projected CAGR is approximately 22.60%.

2. Which companies are prominent players in the Data Warehouse as a Service Market?

Key companies in the market include Google LLP, Micro Focus International PLC, IBM Corporation, Veeva Systems In, Teradata Corporation, Yellowbrick B V, Cloudera Inc, Microsoft Corporation, Amazon Web Services Inc, Snowflake Computing Inc, Oracle Corporation, Pivotal Software Inc, SAP SE.

3. What are the main segments of the Data Warehouse as a Service Market?

The market segments include Organization, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption of Cloud-based Solutions and Focus on Real-time Data Analysis; Rising use of Data Warehouse services in BFSI sector to drive the market.; Data analytics and business intelligence are expected to play a major role in enterprise management..

6. What are the notable trends driving market growth?

Rising use of Data Warehouse services in BFSI sector to drive the market..

7. Are there any restraints impacting market growth?

Data Security and Privacy Issues.

8. Can you provide examples of recent developments in the market?

May 2022 - Dell partnered with Snowflake Inc to ease access to on-premises data. The partnership between Snowflake Inc. and Dell Technologies brings Snowflake Data Cloud's tools to on-premises object storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Warehouse as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Warehouse as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Warehouse as a Service Market?

To stay informed about further developments, trends, and reports in the Data Warehouse as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence