Key Insights

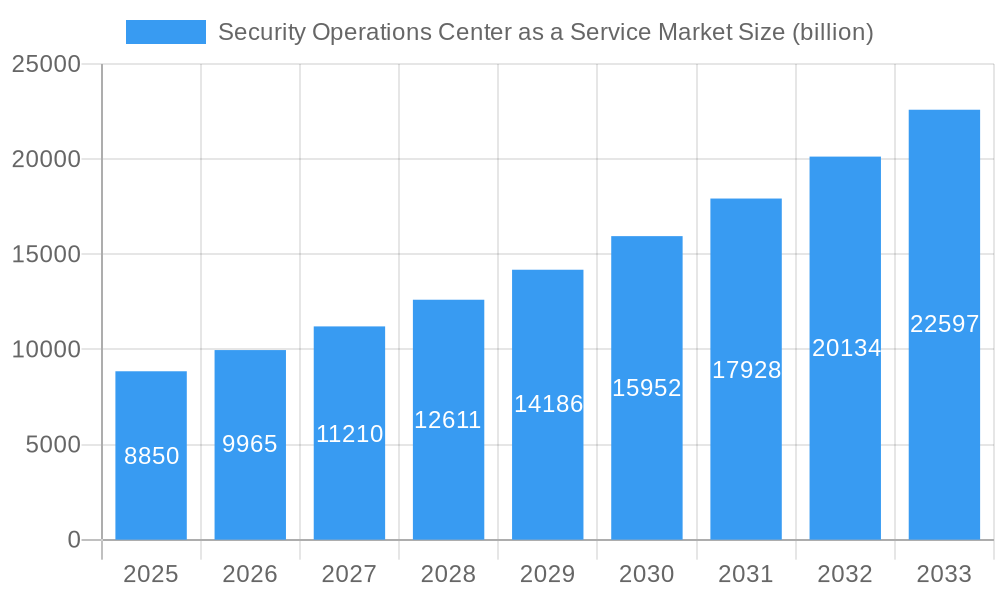

The Security Operations Center as a Service (SOCaaS) Market is poised for substantial growth, projected to reach $8.85 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 12.56%. This robust expansion is fueled by several key factors. The escalating sophistication and frequency of cyber threats, coupled with a persistent shortage of skilled cybersecurity professionals, are compelling organizations of all sizes to outsource their security monitoring and incident response capabilities. Furthermore, the increasing adoption of cloud computing and the proliferation of connected devices (IoT) have expanded the attack surface, necessitating advanced and continuous security oversight that SOCaaS providers are well-equipped to deliver. Regulatory compliance mandates across various industries are also a significant driver, pushing businesses to invest in comprehensive security solutions that SOCaaS offers.

Security Operations Center as a Service Market Market Size (In Billion)

The market is segmented by enterprise size, with both Small and Medium-sized Enterprises (SMEs) and Large Enterprises contributing to the growth, though SMEs represent a rapidly expanding segment due to their need for cost-effective, enterprise-grade security. Key end-user industries like IT and Telecom, BFSI, Pharmaceutical, Manufacturing, and the Public Sector are leading the adoption of SOCaaS, recognizing its critical role in protecting sensitive data and maintaining operational continuity. Emerging trends include the integration of Artificial Intelligence (AI) and Machine Learning (ML) for proactive threat detection and automation, as well as the demand for specialized SOCaaS solutions tailored to specific industry risks. While the market experiences strong tailwinds, potential restraints such as concerns over data privacy, vendor lock-in, and the complexity of integrating third-party SOCaaS solutions with existing IT infrastructure need to be carefully navigated by providers.

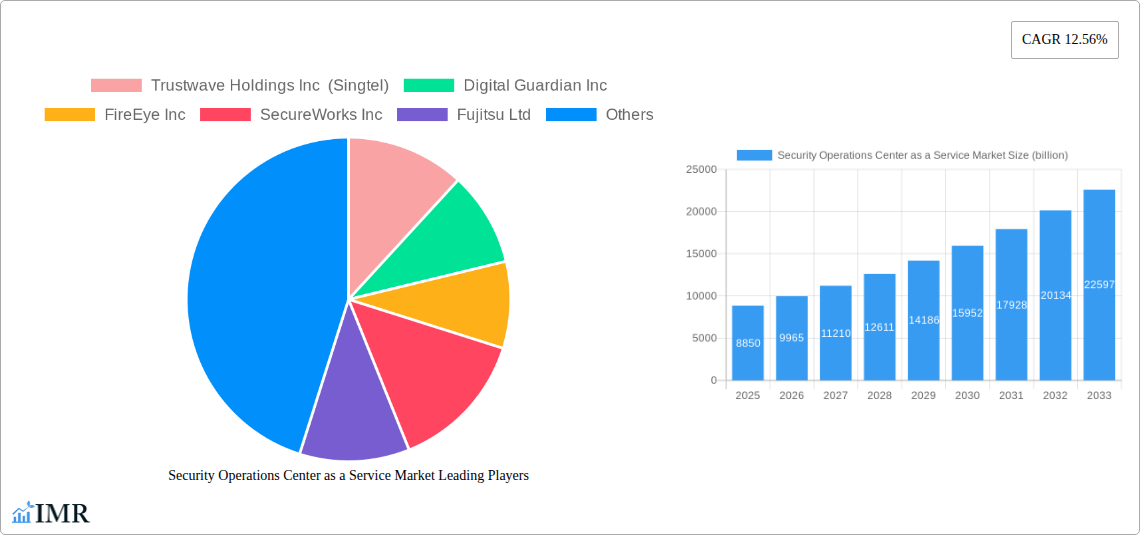

Security Operations Center as a Service Market Company Market Share

Here's a compelling, SEO-optimized report description for the Security Operations Center as a Service Market, designed to maximize visibility and engage industry professionals.

Report Title: Security Operations Center as a Service Market: Global Trends, Opportunities, and Forecast (2019-2033)

Report Description:

Gain unparalleled insights into the dynamic Security Operations Center as a Service (SOCaaS) market, a critical component of modern cybersecurity strategies. This comprehensive report, covering the study period 2019–2033 with a base year of 2025, delves into the intricate market dynamics, growth trajectories, and future outlook of SOCaaS solutions. Understand how evolving threats, increasing regulatory compliance, and the growing demand for expert cybersecurity management are shaping this rapidly expanding sector.

This in-depth analysis leverages high-traffic keywords such as Managed Security Services (MSS), Managed Detection and Response (MDR), cyber threat intelligence, incident response, and 24/7 security monitoring to ensure maximum search engine visibility. We provide a granular breakdown of the market by enterprise size (Small and Medium Enterprises, Large Enterprises) and end-user industry (IT and Telecom, BFSI, Pharmaceutical, Manufacturing, Public Sector, Other End-user Industries).

Explore the competitive landscape featuring key players like Trustwave Holdings Inc (Singtel), Digital Guardian Inc, FireEye Inc, SecureWorks Inc, Fujitsu Ltd, CenturyLink Inc, Capgemini SE, ESDS Software Solution Pvt Ltd, NTT Security Ltd, Thales Group, BlackStratus Inc, BAE Systems PLC, Cygilant Inc, AT & T Cybersecurity Inc, Atos SE, Symantec Corporation, Alert Logic Inc, NetMagic Solutions Pvt Ltd. This report also highlights significant industry developments and notable milestones, including Alert Logic's Partner Connect program launch in August 2020 and Accenture's acquisition of Symantec's Cyber Security Services business in January 2020, demonstrating the market's active M&A and partnership ecosystem.

For professionals seeking to understand market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, this report is an indispensable resource. It quantifies the market size, projected to reach XX billion units by 2033, with the base year 2025 estimated at XX billion units. The forecast period 2025–2033 reveals a robust Compound Annual Growth Rate (CAGR), driven by the increasing sophistication of cyberattacks and the need for cost-effective, advanced security solutions.

Key report sections include:

Security Operations Center as a Service Market Market Dynamics & Structure

The Security Operations Center as a Service (SOCaaS) market is characterized by a blend of intense competition and strategic consolidation, driven by escalating cyber threats and the demand for specialized expertise. Market concentration is influenced by large, established cybersecurity providers offering comprehensive SOCaaS suites, alongside nimble, specialized players focusing on niche segments like Managed Detection and Response (MDR). Technological innovation is a primary driver, with advancements in AI, machine learning, and automation continuously enhancing threat detection and response capabilities. Regulatory frameworks, such as GDPR and CCPA, compel organizations to adopt robust security measures, thereby fueling SOCaaS adoption. Competitive product substitutes include in-house SOCs, though the cost and complexity of maintaining them often favor outsourced solutions. End-user demographics are increasingly diverse, with Small and Medium Enterprises (SMEs) showing significant adoption due to resource constraints, complementing the established demand from Large Enterprises. Mergers and acquisitions (M&A) are prevalent, with larger entities acquiring specialized capabilities or expanding geographical reach.

- Market Concentration: Dominated by a mix of global giants and specialized MSSPs, with increasing M&A activity.

- Technological Innovation Drivers: AI/ML for advanced threat detection, automated response, cloud-native SOC platforms.

- Regulatory Frameworks: GDPR, CCPA, HIPAA driving demand for compliance-driven security services.

- Competitive Product Substitutes: In-house SOC teams, point solutions, but often less cost-effective and comprehensive.

- End-User Demographics: Growing adoption among SMEs and continued reliance from Large Enterprises across various sectors.

- M&A Trends: Strategic acquisitions to broaden service portfolios and market presence.

Security Operations Center as a Service Market Growth Trends & Insights

The Security Operations Center as a Service (SOCaaS) market is experiencing robust growth, propelled by an escalating threat landscape and the increasing complexity of managing enterprise-grade cybersecurity. The market size has seen a steady upward trajectory from XX billion units in 2019 to an estimated XX billion units in 2025, with projections indicating a significant expansion to XX billion units by 2033. This growth is underpinned by a growing adoption rate of outsourced security solutions, as organizations of all sizes recognize the limitations of in-house capabilities in the face of sophisticated cyberattacks. Technological disruptions, particularly in the realm of Artificial Intelligence (AI) and Machine Learning (ML), are revolutionizing SOCaaS by enabling faster, more accurate threat detection and response. These advancements are transforming consumer behavior, shifting preferences towards proactive, predictive security measures rather than reactive ones. The increasing adoption of cloud services also necessitates robust cloud security monitoring, further driving SOCaaS demand. The market penetration for SOCaaS is expanding, particularly among Small and Medium Enterprises (SMEs) that previously found dedicated SOC teams cost-prohibitive. The rise of Managed Detection and Response (MDR) services, a key component of the broader SOCaaS offering, is a significant growth accelerator, providing specialized capabilities for detecting and responding to advanced threats that often bypass traditional security measures. Furthermore, the continuous evolution of attack vectors, including ransomware, phishing, and zero-day exploits, necessitates constant vigilance and adaptation, which SOCaaS providers are uniquely positioned to offer. The increasing volume and velocity of data also necessitate advanced analytics and threat intelligence, areas where SOCaaS excels. The economic impact of cyber breaches, including financial losses, reputational damage, and regulatory fines, is a potent motivator for organizations to invest in comprehensive security solutions like SOCaaS, further fueling market growth. The shift towards remote work models has also expanded the attack surface, making continuous monitoring and rapid response capabilities offered by SOCaaS indispensable. The market is also benefiting from an increasing awareness among businesses of the need for continuous security posture improvement and threat hunting. The competitive landscape is intensifying, with providers differentiating themselves through specialized threat intelligence, compliance expertise, and service level agreements (SLAs) tailored to specific industry needs. The trend towards consolidated security platforms and integrated solutions is also shaping market dynamics, as clients seek end-to-end security management. The overall growth trajectory indicates that SOCaaS is no longer a niche service but a fundamental pillar of modern cybersecurity strategies for businesses worldwide.

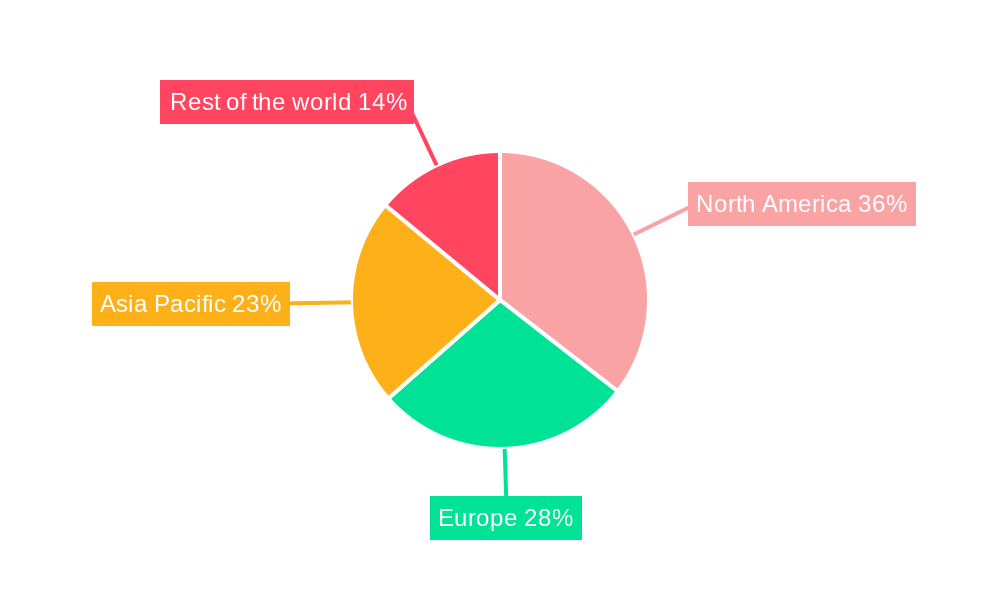

Dominant Regions, Countries, or Segments in Security Operations Center as a Service Market

The North America region consistently emerges as a dominant force in the Security Operations Center as a Service (SOCaaS) market. This dominance is attributable to a confluence of factors including a highly developed technological infrastructure, a strong regulatory environment that mandates robust cybersecurity practices, and a mature market for cybersecurity services. The United States, in particular, leads in this region due to the presence of a large number of technology-forward enterprises, a high concentration of cybersecurity talent, and significant investments in advanced security solutions. The BFSI (Banking, Financial Services, and Insurance) sector stands out as a primary end-user industry driving this dominance. Financial institutions are prime targets for cyberattacks due to the sensitive data they handle and the significant financial assets at stake. Consequently, they are early and aggressive adopters of sophisticated SOCaaS solutions to ensure compliance with stringent financial regulations, protect customer data, and maintain operational integrity.

- Dominant Region: North America, driven by the United States.

- Key Drivers: Advanced technological infrastructure, stringent regulatory compliance (e.g., SOX, GLBA), high cybersecurity spending, presence of major cybersecurity vendors and talent pool.

- Market Share Contribution: Estimated to hold over XX% of the global SOCaaS market by 2025.

- Growth Potential: Continued innovation in threat intelligence and managed detection and response (MDR) services.

- Dominant End-User Industry: BFSI (Banking, Financial Services, and Insurance).

- Key Drivers: High sensitivity of data, stringent regulatory compliance requirements (e.g., PCI DSS, GDPR), significant financial impact of breaches, need for 24/7 monitoring and rapid incident response.

- SOCaaS Adoption: BFSI organizations are increasingly leveraging SOCaaS for advanced threat detection, fraud prevention, and compliance management.

- Growth Potential: Increasing sophistication of financial cybercrime necessitates more advanced SOCaaS capabilities.

- Dominant Enterprise Size Segment: Large Enterprises.

- Key Drivers: Complex IT environments, vast amounts of sensitive data, significant resources allocated to cybersecurity, and the need for comprehensive, scalable SOCaaS solutions.

- Market Share Contribution: Large enterprises represent the largest segment, accounting for an estimated XX% of the market.

- Growth Potential: Expansion of cloud adoption and hybrid environments within large enterprises creates new SOCaaS opportunities.

While North America leads, the IT and Telecom sector also plays a crucial role, often acting as early adopters and influencers due to their inherent understanding of technology and security needs. The increasing reliance on digital services and the vast networks managed by these companies make them susceptible to a wide array of threats, driving a strong demand for continuous monitoring and rapid response capabilities. The Public Sector is also a significant growth area, fueled by national security concerns and the need to protect critical infrastructure. As governments increasingly digitize services, the demand for secure and resilient IT operations managed through SOCaaS solutions escalates. The Manufacturing sector is witnessing a surge in adoption due to the increasing integration of Industrial Control Systems (ICS) and the Internet of Things (IoT) into operational technology (OT) environments, creating new attack surfaces. The Pharmaceutical industry's focus on protecting sensitive research data and intellectual property also contributes to the growing demand for robust SOCaaS. The "Other End-user Industries" category, encompassing sectors like healthcare, retail, and energy, represents a rapidly expanding segment as awareness of cyber risks grows across the board. The global expansion of digital services, coupled with the increasing sophistication of cyber threats, ensures that the demand for SOCaaS will continue to diversify across all regions and industries.

Security Operations Center as a Service Market Product Landscape

The Security Operations Center as a Service (SOCaaS) product landscape is characterized by an evolution towards integrated, intelligent, and automated solutions. Providers are increasingly offering platform-based services that consolidate threat detection, incident response, vulnerability management, and threat intelligence into a unified offering. Key product innovations include the incorporation of advanced AI and machine learning algorithms for more accurate anomaly detection and faster threat identification, significantly reducing mean time to detect (MTTD) and mean time to respond (MTTR). Cloud-native SOCaaS platforms are gaining traction, offering scalability, flexibility, and ease of deployment for organizations leveraging cloud infrastructure. Unique selling propositions often revolve around specialized threat intelligence feeds, industry-specific compliance expertise, and tailored service level agreements (SLAs) that guarantee specific response times. Performance metrics like reduced incident dwell time, improved detection rates, and cost savings compared to in-house SOCs are crucial differentiators in this competitive market.

Key Drivers, Barriers & Challenges in Security Operations Center as a Service Market

The Security Operations Center as a Service (SOCaaS) market is propelled by several key drivers. The escalating sophistication and frequency of cyber threats, including ransomware and phishing attacks, necessitate advanced, 24/7 monitoring that many organizations cannot afford or manage internally. The growing adoption of cloud computing and hybrid environments expands the attack surface, creating a greater need for centralized security management. Furthermore, stringent regulatory compliance mandates across industries, such as GDPR and HIPAA, push organizations to invest in robust security solutions that SOCaaS providers offer.

- Key Drivers:

- Increasing volume and sophistication of cyber threats.

- Cloud adoption and expanded attack surfaces.

- Stringent regulatory compliance requirements.

- Shortage of skilled cybersecurity professionals.

- Cost-effectiveness compared to in-house SOCs.

Conversely, several barriers and challenges impede market growth. The perceived loss of control and data privacy concerns can deter some organizations from outsourcing their security operations. The complexity of integrating SOCaaS solutions with existing IT infrastructures can be a significant hurdle. Moreover, the intense competition among providers can lead to pricing pressures, impacting profitability for smaller players. Ensuring consistent service quality and maintaining trust in a provider's capabilities are paramount.

- Key Barriers & Challenges:

- Data privacy and control concerns.

- Integration complexity with existing IT systems.

- Intense market competition and pricing pressures.

- Need for continuous service quality assurance.

- Resistance to change and vendor lock-in fears.

Emerging Opportunities in Security Operations Center as a Service Market

Emerging opportunities in the SOCaaS market lie in the increasing demand for specialized services within niche sectors. The rise of Industrial IoT (IIoT) in manufacturing and critical infrastructure presents a significant untapped market for tailored OT security monitoring. Furthermore, the growing adoption of AI and machine learning by attackers necessitates equally advanced AI-driven defense mechanisms, creating opportunities for providers offering next-generation threat detection and predictive analytics. The "as-a-service" model is also expanding into areas like cloud security posture management (CSPM) and application security testing, offering integrated solutions that go beyond traditional network monitoring. The need for proactive threat hunting and continuous vulnerability assessment is also creating new service avenues.

Growth Accelerators in the Security Operations Center as a Service Market Industry

Several catalysts are accelerating the long-term growth of the SOCaaS industry. Technological breakthroughs, particularly in AI and automation, are enhancing the efficiency and effectiveness of security operations, making SOCaaS more appealing. Strategic partnerships between SOCaaS providers and cloud service providers, managed service providers (MSPs), and security technology vendors are expanding market reach and service offerings. Market expansion strategies, including geographic diversification and catering to specific industry verticals, are also driving growth. The increasing adoption of Security Orchestration, Automation, and Response (SOAR) platforms by SOCaaS providers further enhances their value proposition by streamlining incident response workflows.

Key Players Shaping the Security Operations Center as a Service Market Market

- Trustwave Holdings Inc (Singtel)

- Digital Guardian Inc

- FireEye Inc

- SecureWorks Inc

- Fujitsu Ltd

- CenturyLink Inc

- Capgemini SE

- ESDS Software Solution Pvt Ltd

- NTT Security Ltd

- Thales Group

- BlackStratus Inc

- BAE Systems PLC

- Cygilant Inc

- AT & T Cybersecurity Inc

- Atos SE

- Symantec Corporation

- Alert Logic Inc

- NetMagic Solutions Pvt Ltd

Notable Milestones in Security Operations Center as a Service Market Sector

- August 2020: Alert Logic launched a new tier of its Partner Connect program, specifically for Managed Service Providers (MSPs), enabling them to deliver advanced cybersecurity services. This initiative, featuring the industry's first managed detection and response (MDR) partner program, empowers MSPs to leverage Alert Logic's solutions for improved unit economics and scalable market expansion.

- January 2020: Accenture acquired Symantec's Cyber Security Services business from Broadcom, Inc. This strategic acquisition integrated Symantec's robust portfolio, including global threat monitoring, real-time threat intelligence, and incident response services delivered through a network of security operation centers, into Accenture's broader cybersecurity offerings.

In-Depth Security Operations Center as a Service Market Market Outlook

The Security Operations Center as a Service (SOCaaS) market is poised for continued significant expansion, driven by an ever-evolving threat landscape and the increasing complexity of digital environments. Growth accelerators such as AI-driven threat detection, automation in incident response, and strategic channel partnerships are bolstering market penetration across enterprise sizes and industries. The future outlook suggests a greater emphasis on integrated security platforms, proactive threat hunting, and specialized services for emerging technologies like IoT and cloud-native applications. Organizations will increasingly rely on SOCaaS for cost-effective, expert-led security, ensuring resilience and compliance in an increasingly digital and volatile world.

Security Operations Center as a Service Market Segmentation

-

1. Enterprise Size

- 1.1. Small and medium Enterprises

- 1.2. Large Enterprises

-

2. End-user Industry

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Pharmaceutical

- 2.4. Manufacturing

- 2.5. Public Sector

- 2.6. Other End-user Industries

Security Operations Center as a Service Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the world

Security Operations Center as a Service Market Regional Market Share

Geographic Coverage of Security Operations Center as a Service Market

Security Operations Center as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Rise in Security Breaches and Sophisticated Cyber Attacks Across Enterprises; Increasing Cloud Adoption and BYOD Trends

- 3.3. Market Restrains

- 3.3.1. Lack of Trust in Allowing Full Control of System Architecture to SOCaaS Providers

- 3.4. Market Trends

- 3.4.1. BFSI is Expected to have Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security Operations Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.1.1. Small and medium Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Pharmaceutical

- 5.2.4. Manufacturing

- 5.2.5. Public Sector

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the world

- 5.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6. North America Security Operations Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.1.1. Small and medium Enterprises

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT and Telecom

- 6.2.2. BFSI

- 6.2.3. Pharmaceutical

- 6.2.4. Manufacturing

- 6.2.5. Public Sector

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7. Europe Security Operations Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.1.1. Small and medium Enterprises

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT and Telecom

- 7.2.2. BFSI

- 7.2.3. Pharmaceutical

- 7.2.4. Manufacturing

- 7.2.5. Public Sector

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8. Asia Pacific Security Operations Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.1.1. Small and medium Enterprises

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT and Telecom

- 8.2.2. BFSI

- 8.2.3. Pharmaceutical

- 8.2.4. Manufacturing

- 8.2.5. Public Sector

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9. Rest of the world Security Operations Center as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.1.1. Small and medium Enterprises

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT and Telecom

- 9.2.2. BFSI

- 9.2.3. Pharmaceutical

- 9.2.4. Manufacturing

- 9.2.5. Public Sector

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Enterprise Size

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Trustwave Holdings Inc (Singtel)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Digital Guardian Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FireEye Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SecureWorks Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Fujitsu Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CenturyLink Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Capgemini SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ESDS Software Solution Pvt Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NTT Security Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Thales Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BlackStratus Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BAE Systems PLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Cygilant Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 AT & T Cybersecurity Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Atos SE

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Symantec Corporation

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Alert Logic Inc

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 NetMagic Solutions Pvt Ltd

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Trustwave Holdings Inc (Singtel)

List of Figures

- Figure 1: Global Security Operations Center as a Service Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Security Operations Center as a Service Market Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 3: North America Security Operations Center as a Service Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 4: North America Security Operations Center as a Service Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Security Operations Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Security Operations Center as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Security Operations Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Security Operations Center as a Service Market Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 9: Europe Security Operations Center as a Service Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 10: Europe Security Operations Center as a Service Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Security Operations Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Security Operations Center as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Security Operations Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Security Operations Center as a Service Market Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 15: Asia Pacific Security Operations Center as a Service Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 16: Asia Pacific Security Operations Center as a Service Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Security Operations Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Security Operations Center as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Security Operations Center as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the world Security Operations Center as a Service Market Revenue (billion), by Enterprise Size 2025 & 2033

- Figure 21: Rest of the world Security Operations Center as a Service Market Revenue Share (%), by Enterprise Size 2025 & 2033

- Figure 22: Rest of the world Security Operations Center as a Service Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Rest of the world Security Operations Center as a Service Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the world Security Operations Center as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the world Security Operations Center as a Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Security Operations Center as a Service Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 2: Global Security Operations Center as a Service Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Security Operations Center as a Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Security Operations Center as a Service Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 5: Global Security Operations Center as a Service Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Security Operations Center as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Security Operations Center as a Service Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 8: Global Security Operations Center as a Service Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Security Operations Center as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Security Operations Center as a Service Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 11: Global Security Operations Center as a Service Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Security Operations Center as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Security Operations Center as a Service Market Revenue billion Forecast, by Enterprise Size 2020 & 2033

- Table 14: Global Security Operations Center as a Service Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Security Operations Center as a Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security Operations Center as a Service Market?

The projected CAGR is approximately 12.56%.

2. Which companies are prominent players in the Security Operations Center as a Service Market?

Key companies in the market include Trustwave Holdings Inc (Singtel), Digital Guardian Inc, FireEye Inc, SecureWorks Inc, Fujitsu Ltd, CenturyLink Inc, Capgemini SE, ESDS Software Solution Pvt Ltd, NTT Security Ltd, Thales Group, BlackStratus Inc, BAE Systems PLC, Cygilant Inc, AT & T Cybersecurity Inc, Atos SE, Symantec Corporation, Alert Logic Inc, NetMagic Solutions Pvt Ltd.

3. What are the main segments of the Security Operations Center as a Service Market?

The market segments include Enterprise Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Rise in Security Breaches and Sophisticated Cyber Attacks Across Enterprises; Increasing Cloud Adoption and BYOD Trends.

6. What are the notable trends driving market growth?

BFSI is Expected to have Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Trust in Allowing Full Control of System Architecture to SOCaaS Providers.

8. Can you provide examples of recent developments in the market?

August 2020 - Alert Logic launached a new tier of its Partner Connect program purpose-built for managed service providers (MSPs) to seamlessly deliver advanced cybersecurity services to their customers. Through the industry's first managed detection and response (MDR) partner program, MSPs can leverage Alert Logic's best-in-class security solution and exclusive resources to improve unit economics and market expansion at scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security Operations Center as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security Operations Center as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security Operations Center as a Service Market?

To stay informed about further developments, trends, and reports in the Security Operations Center as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence