Key Insights

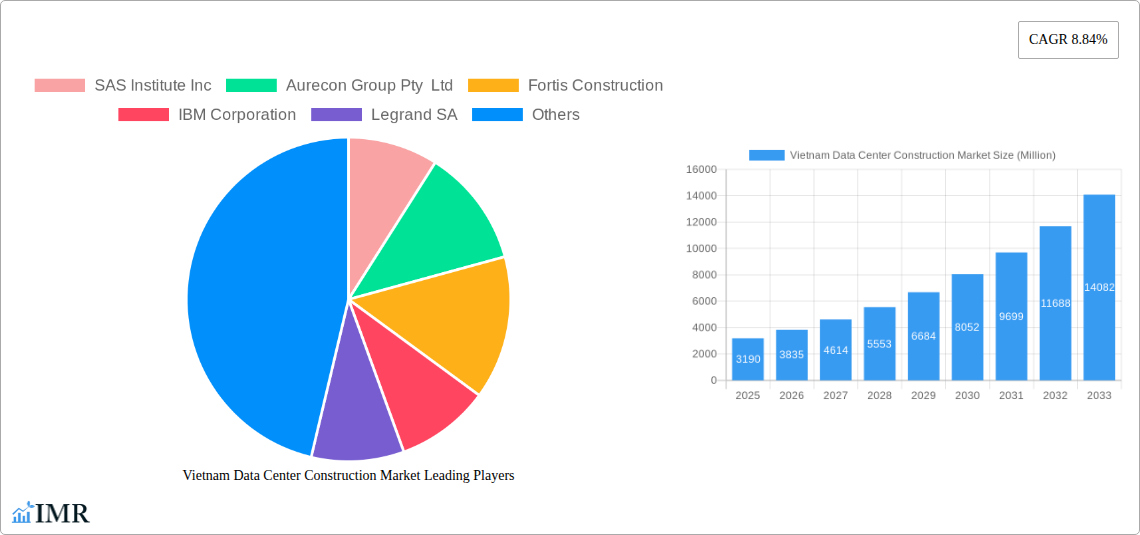

The Vietnam Data Center Construction Market is poised for significant expansion, with an estimated market size of USD 3.19 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 20.47%, indicating a rapidly accelerating demand for sophisticated data infrastructure. Key drivers for this surge include the escalating adoption of cloud computing services, the burgeoning digital economy in Vietnam, and increasing government initiatives to promote digitalization across various sectors. Furthermore, the growing adoption of advanced technologies like AI, IoT, and big data analytics necessitates more powerful and extensive data center facilities. The market is segmented by electrical infrastructure, including power distribution solutions like PDUs, transfer switches, and switchgear, as well as power backup solutions such as UPS and generators. Mechanical infrastructure, encompassing advanced cooling systems (immersion cooling, direct-to-chip cooling) and racks, also plays a crucial role. The IT and Telecommunications sector, along with Banking, Financial Services, and Insurance (BFSI), are projected to be major end-users, driving demand for high-density and secure data center environments.

Vietnam Data Center Construction Market Market Size (In Billion)

The projected growth trajectory highlights Vietnam's emergence as a strategic hub for data center development in Southeast Asia. The increasing demand for hyperscale and colocation data centers, driven by both domestic enterprises and international tech giants seeking to establish a regional presence, underpins the substantial CAGR. Investments in upgraded electrical infrastructure, including resilient power distribution and backup systems, are critical to meeting the evolving needs of modern data operations. Similarly, advancements in mechanical infrastructure, particularly in efficient cooling technologies, are essential for supporting the high-performance computing demands of new applications. The expansion of data center facilities will also be influenced by tier classifications, with a growing emphasis on Tier 3 and Tier 4 facilities to ensure high availability and reliability for critical business operations. The vibrant economic landscape and supportive government policies are expected to attract substantial investments, further propelling the market's development.

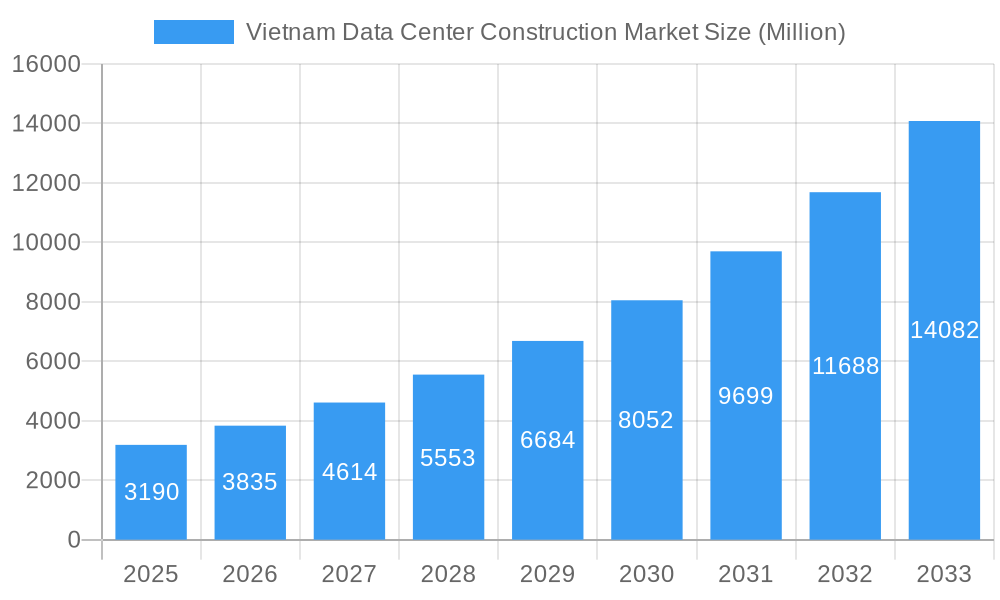

Vietnam Data Center Construction Market Company Market Share

Vietnam Data Center Construction Market: Navigating a Rapidly Evolving Digital Infrastructure Landscape

This comprehensive report delves into the dynamic Vietnam data center construction market, forecasting significant growth from 2019–2033. By 2025, the market is estimated to be valued at XX billion, with a projected CAGR of XX% during the forecast period (2025–2033). We provide in-depth analysis of critical market segments, including electrical infrastructure, with a deep dive into power distribution solutions (PDU - Ba, Transfer Switches - Static, Automatic (ATS), Switchgear - Low-voltage, Medium-voltage, Power Panels and Components) and power backup solutions (UPS, Generators), alongside mechanical infrastructure, focusing on cooling systems (Immersion Cooling, Direct-to-chip Cooling, Rear Door Heat Exchanger, In-row and In-rack Cooling) and racks. The report also examines general construction and various tier types (Tier 1 and 2, Tier 3, Tier 4) and end-user industries such as Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Government and Defense, and Healthcare.

The Vietnam data center construction market is witnessing an unprecedented surge, driven by escalating digital transformation initiatives, the burgeoning demand for cloud computing services, and the government's push towards a digital economy. This report provides a granular view of the market's trajectory, offering actionable insights for stakeholders.

Vietnam Data Center Construction Market Market Dynamics & Structure

The Vietnam data center construction market is characterized by increasing market concentration, driven by substantial capital investments and consolidation opportunities. Key technological innovation drivers include the rapid adoption of advanced cooling technologies, hyperscale data center designs, and the integration of AI for operational efficiency. Regulatory frameworks are evolving to support data localization and cloud infrastructure development, fostering a more secure investment environment. Competitive product substitutes are emerging in the form of edge data centers and private cloud solutions, albeit traditional colocation facilities remain dominant. End-user demographics show a strong preference from the IT and Telecommunications sector, followed by BFSI, as they expand their digital footprints. Merger and acquisition (M&A) trends are on the rise, with established players acquiring smaller entities to expand their regional presence and service offerings. For instance, the acquisition of smaller colocation providers by larger international firms is a notable trend, enhancing their market share and operational scale. Innovation barriers include the high cost of advanced infrastructure components and the need for skilled labor in specialized construction and maintenance.

Vietnam Data Center Construction Market Growth Trends & Insights

The Vietnam data center construction market is poised for exponential growth, fueled by a confluence of factors that are reshaping the nation's digital infrastructure. The market size is projected to expand from approximately XX billion in 2019 to an impressive XX billion by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period (2025–2033). This robust expansion is underpinned by the accelerated adoption of cloud computing, the proliferation of 5G networks, and the increasing demand for data processing and storage from emerging technologies like the Internet of Things (IoT) and artificial intelligence (AI). Technological disruptions, such as the development of liquid cooling solutions and modular data center designs, are significantly enhancing operational efficiency and scalability. Consumer behavior shifts, including a growing reliance on digital services for business and personal use, are directly translating into higher data consumption and, consequently, a greater need for sophisticated data center facilities. The market penetration of advanced data center technologies is steadily increasing, with enterprises increasingly investing in hyperscale and enterprise-grade facilities to support their digital transformation journeys. These insights are derived from extensive market analysis, including historical data, current trends, and future projections, all meticulously integrated to provide a holistic view of the market's evolution. The increasing digitalization of industries across Vietnam, from manufacturing to retail, further amplifies the demand for robust and reliable data center infrastructure.

Dominant Regions, Countries, or Segments in Vietnam Data Center Construction Market

The Vietnam data center construction market is experiencing significant growth across various segments, with IT and Telecommunications emerging as the dominant end-user segment, driving substantial investment and development. This dominance is attributable to the sector's inherent need for massive data processing and storage capabilities to support a wide array of digital services, including mobile networks, cloud platforms, and internet services. The increasing rollout of 5G technology by major telecommunication providers like Viettel and VNPT necessitates the construction of more numerous and geographically distributed data centers to handle the increased data traffic and reduced latency requirements. Coupled with this, the electrical infrastructure segment, particularly power distribution solutions and power backup solutions, is a critical growth driver. The demand for reliable and resilient power is paramount, leading to significant investments in advanced PDU solutions, automatic transfer switches (ATS), and high-capacity UPS and generator systems.

- IT and Telecommunications: This segment is leading market expansion due to its insatiable demand for cloud infrastructure, big data analytics, and network backbone upgrades.

- Electrical Infrastructure: This segment sees robust growth due to the essential requirement for uninterrupted power supply and efficient energy distribution in data centers.

- Power Distribution Solution: High-voltage switchgear, advanced PDU units, and reliable transfer switches are in high demand.

- Power Backup Solutions: Scalable UPS systems and high-capacity generators are critical for ensuring data center uptime.

- Mechanical Infrastructure: The increasing density of servers and the need for efficient heat dissipation are driving demand for advanced cooling systems, including In-row and In-rack Cooling and the exploration of Immersion Cooling technologies.

- General Construction: As the overall market expands, the demand for specialized data center construction services, including site selection, building design, and project management, is also on the rise.

- Tier 3 Data Centers: This tier type is experiencing significant growth as businesses seek a balance between reliability, availability, and cost-effectiveness for their critical operations.

The strategic importance of Vietnam as a digital hub in Southeast Asia, coupled with favorable government policies promoting digital economy growth, further solidifies the dominance of these segments.

Vietnam Data Center Construction Market Product Landscape

The Vietnam data center construction market is characterized by continuous product innovation aimed at enhancing efficiency, scalability, and sustainability. Leading companies are introducing advanced cooling systems, including more efficient In-row and In-rack Cooling solutions, alongside pioneering exploration into Immersion Cooling and Direct-to-chip Cooling technologies to manage the thermal demands of high-density computing. In electrical infrastructure, the focus is on intelligent Power Distribution Solutions (PDU), highly responsive Automatic Transfer Switches (ATS), and robust Switchgear for seamless power management. Power Backup Solutions are seeing advancements in modular and scalable UPS systems and more fuel-efficient generators. These product innovations are critical for supporting the performance metrics required by demanding applications like AI, big data, and 5G services, offering unique selling propositions such as reduced energy consumption, increased uptime, and a smaller environmental footprint.

Key Drivers, Barriers & Challenges in Vietnam Data Center Construction Market

Key Drivers:

- Digital Transformation: The widespread adoption of digital technologies across all industries in Vietnam is creating an unprecedented demand for data storage and processing capabilities, directly fueling data center construction.

- Government Initiatives: The Vietnamese government's strong push towards a digital economy and the development of smart cities provides a supportive regulatory and policy environment for data center investments.

- Foreign Direct Investment (FDI): Vietnam's attractive investment landscape is drawing significant FDI into the technology and infrastructure sectors, including data center development.

- Growth of Cloud Computing: The increasing reliance on cloud services by businesses of all sizes necessitates the expansion of hyperscale and enterprise data centers.

Barriers & Challenges:

- High Capital Expenditure: The substantial upfront investment required for land acquisition, construction, and advanced technology integration poses a significant financial barrier.

- Skilled Labor Shortage: A lack of adequately trained and experienced personnel for specialized data center construction, operation, and maintenance can impede project timelines and quality.

- Supply Chain Disruptions: Global and local supply chain vulnerabilities for critical components like specialized IT hardware and construction materials can lead to project delays and cost overruns.

- Regulatory Uncertainty: While generally supportive, evolving regulations around data privacy, cybersecurity, and environmental impact can introduce complexities and require continuous adaptation.

- Power Availability and Reliability: Ensuring a consistent and stable power supply, especially in rapidly developing areas, remains a critical challenge for data center operations.

Emerging Opportunities in Vietnam Data Center Construction Market

Emerging opportunities within the Vietnam data center construction market lie in the burgeoning demand for edge data centers to support low-latency applications like autonomous vehicles and real-time IoT analytics. The increasing adoption of sustainability-focused construction practices, including renewable energy integration and water-efficient cooling systems, presents a significant niche for environmentally conscious developers. Furthermore, the growth of specialized data centers for sectors like Healthcare and BFSI, requiring enhanced security and compliance, offers lucrative prospects. The development of advanced colocation services catering to hyperscalers and enterprises seeking flexible and scalable infrastructure solutions also presents a growing avenue for market expansion.

Growth Accelerators in the Vietnam Data Center Construction Market Industry

Several catalysts are accelerating the growth of the Vietnam data center construction market. The rapid expansion of 5G network deployment is a primary driver, demanding localized data processing and enhanced network infrastructure. Strategic partnerships between telecommunication providers and data center operators are fostering a symbiotic growth environment. Furthermore, the increasing adoption of AI and machine learning technologies by Vietnamese enterprises necessitates more powerful and sophisticated data processing capabilities, directly boosting demand for advanced data center facilities. Market expansion strategies, including the development of hyperscale data centers by international players and the creation of specialized data centers for specific industry needs, are also significant growth accelerators.

Key Players Shaping the Vietnam Data Center Construction Market Market

- SAS Institute Inc

- Aurecon Group Pty Ltd

- Fortis Construction

- IBM Corporation

- Legrand SA

- Archetype Group

- Delta Group

- NEC Vietnam Co Ltd

- Schneider Electric SE

- Turner Construction Co

- Dell Inc

- Cisco Systems Inc

- AECOM

- NTT Ltd

- Iris Global

Notable Milestones in Vietnam Data Center Construction Market Sector

- September 2021: Viettel jointly conducted trials with Samsung in Da Nang, showcasing advancements in 5G technology.

- September 2021: Viettel partnered with Ericsson and Qualcomm to test and achieve 5G data transmission speeds over 4.7 Gbps, highlighting the need for expanded data center infrastructure to support such high bandwidth.

- September 2021: VNPT upgraded its backbone and core networks, and developed 4G, 5G, and M2M/IoT platforms.

- September 2021: VNPT conducted commercial tests of 5G services and signed an agreement with Nokia to develop and apply new networking technologies, signaling increased demand for robust data center support.

In-Depth Vietnam Data Center Construction Market Market Outlook

The outlook for the Vietnam data center construction market remains exceptionally positive, with sustained growth driven by ongoing digital transformation and favorable economic conditions. The increasing investments in IT and Telecommunications, coupled with the expansion of cloud services, will continue to fuel demand for hyperscale and enterprise-grade facilities. Emerging trends such as the development of more energy-efficient cooling systems and the integration of renewable energy sources will shape future construction projects, aligning with global sustainability goals. Strategic partnerships and ongoing technological advancements will act as critical growth accelerators, ensuring Vietnam's position as a key digital hub in Southeast Asia. The market is poised for further expansion, with significant opportunities for both domestic and international players to contribute to the nation's evolving digital infrastructure.

Vietnam Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Market Segmentation - By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Ba

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-voltage

- 1.1.1.3.2. Medium-voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Panels and Components

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. Market Segmentation - By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-to-chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-row and In-rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. Market Segmentation - By Electrical Infrastructure

-

2. Electrical Infrastructure

-

2.1. Power Distribution Solution

- 2.1.1. PDU - Ba

-

2.1.2. Transfer Switches

- 2.1.2.1. Static

- 2.1.2.2. Automatic (ATS)

-

2.1.3. Switchgear

- 2.1.3.1. Low-voltage

- 2.1.3.2. Medium-voltage

- 2.1.4. Power Panels and Components

- 2.1.5. Other Power Panels and Components

-

2.2. Power Backup Solutions

- 2.2.1. UPS

- 2.2.2. Generators

- 2.3. Service

-

2.1. Power Distribution Solution

-

3. Power Distribution Solution

- 3.1. PDU - Ba

-

3.2. Transfer Switches

- 3.2.1. Static

- 3.2.2. Automatic (ATS)

-

3.3. Switchgear

- 3.3.1. Low-voltage

- 3.3.2. Medium-voltage

- 3.4. Power Panels and Components

- 3.5. Other Power Panels and Components

-

4. Power Backup Solutions

- 4.1. UPS

- 4.2. Generators

- 5. Service

-

6. Mechanical Infrastructure

-

6.1. Cooling Systems

- 6.1.1. Immersion Cooling

- 6.1.2. Direct-to-chip Cooling

- 6.1.3. Rear Door Heat Exchanger

- 6.1.4. In-row and In-rack Cooling

- 6.2. Racks

- 6.3. Other Mechanical Infrastructure

-

6.1. Cooling Systems

-

7. Cooling Systems

- 7.1. Immersion Cooling

- 7.2. Direct-to-chip Cooling

- 7.3. Rear Door Heat Exchanger

- 7.4. In-row and In-rack Cooling

- 8. Racks

- 9. Other Mechanical Infrastructure

- 10. General Construction

-

11. Tier Type

- 11.1. Tier 1 and 2

- 11.2. Tier 3

- 11.3. Tier 4

- 12. Tier 1 and 2

- 13. Tier 3

- 14. Tier 4

-

15. End User

- 15.1. Banking, Financial Services, and Insurance

- 15.2. IT and Telecommunications

- 15.3. Government and Defense

- 15.4. Healthcare

- 15.5. Other End Users

- 16. Banking, Financial Services, and Insurance

- 17. IT and Telecommunications

- 18. Government and Defense

- 19. Healthcare

- 20. Other End Users

Vietnam Data Center Construction Market Segmentation By Geography

- 1. Vietnam

Vietnam Data Center Construction Market Regional Market Share

Geographic Coverage of Vietnam Data Center Construction Market

Vietnam Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Migration to Cloud-based Business Operations; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers

- 3.3. Market Restrains

- 3.3.1. Higher Initial Investments and Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. Tier 3 is the Largest Tier Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Ba

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-voltage

- 5.1.1.1.3.2. Medium-voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Panels and Components

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. Market Segmentation - By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-to-chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-row and In-rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. Market Segmentation - By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Electrical Infrastructure

- 5.2.1. Power Distribution Solution

- 5.2.1.1. PDU - Ba

- 5.2.1.2. Transfer Switches

- 5.2.1.2.1. Static

- 5.2.1.2.2. Automatic (ATS)

- 5.2.1.3. Switchgear

- 5.2.1.3.1. Low-voltage

- 5.2.1.3.2. Medium-voltage

- 5.2.1.4. Power Panels and Components

- 5.2.1.5. Other Power Panels and Components

- 5.2.2. Power Backup Solutions

- 5.2.2.1. UPS

- 5.2.2.2. Generators

- 5.2.3. Service

- 5.2.1. Power Distribution Solution

- 5.3. Market Analysis, Insights and Forecast - by Power Distribution Solution

- 5.3.1. PDU - Ba

- 5.3.2. Transfer Switches

- 5.3.2.1. Static

- 5.3.2.2. Automatic (ATS)

- 5.3.3. Switchgear

- 5.3.3.1. Low-voltage

- 5.3.3.2. Medium-voltage

- 5.3.4. Power Panels and Components

- 5.3.5. Other Power Panels and Components

- 5.4. Market Analysis, Insights and Forecast - by Power Backup Solutions

- 5.4.1. UPS

- 5.4.2. Generators

- 5.5. Market Analysis, Insights and Forecast - by Service

- 5.6. Market Analysis, Insights and Forecast - by Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.6.1.1. Immersion Cooling

- 5.6.1.2. Direct-to-chip Cooling

- 5.6.1.3. Rear Door Heat Exchanger

- 5.6.1.4. In-row and In-rack Cooling

- 5.6.2. Racks

- 5.6.3. Other Mechanical Infrastructure

- 5.6.1. Cooling Systems

- 5.7. Market Analysis, Insights and Forecast - by Cooling Systems

- 5.7.1. Immersion Cooling

- 5.7.2. Direct-to-chip Cooling

- 5.7.3. Rear Door Heat Exchanger

- 5.7.4. In-row and In-rack Cooling

- 5.8. Market Analysis, Insights and Forecast - by Racks

- 5.9. Market Analysis, Insights and Forecast - by Other Mechanical Infrastructure

- 5.10. Market Analysis, Insights and Forecast - by General Construction

- 5.11. Market Analysis, Insights and Forecast - by Tier Type

- 5.11.1. Tier 1 and 2

- 5.11.2. Tier 3

- 5.11.3. Tier 4

- 5.12. Market Analysis, Insights and Forecast - by Tier 1 and 2

- 5.13. Market Analysis, Insights and Forecast - by Tier 3

- 5.14. Market Analysis, Insights and Forecast - by Tier 4

- 5.15. Market Analysis, Insights and Forecast - by End User

- 5.15.1. Banking, Financial Services, and Insurance

- 5.15.2. IT and Telecommunications

- 5.15.3. Government and Defense

- 5.15.4. Healthcare

- 5.15.5. Other End Users

- 5.16. Market Analysis, Insights and Forecast - by Banking, Financial Services, and Insurance

- 5.17. Market Analysis, Insights and Forecast - by IT and Telecommunications

- 5.18. Market Analysis, Insights and Forecast - by Government and Defense

- 5.19. Market Analysis, Insights and Forecast - by Healthcare

- 5.20. Market Analysis, Insights and Forecast - by Other End Users

- 5.21. Market Analysis, Insights and Forecast - by Region

- 5.21.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAS Institute Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aurecon Group Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fortis Construction

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Archetype Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Delta Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Vietnam Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Turner Construction Co

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dell Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cisco Systems Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AECOM

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NTT Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Iris Global

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 SAS Institute Inc

List of Figures

- Figure 1: Vietnam Data Center Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 2: Vietnam Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 3: Vietnam Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 4: Vietnam Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 5: Vietnam Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 6: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 7: Vietnam Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 8: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2020 & 2033

- Table 9: Vietnam Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 10: Vietnam Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 11: Vietnam Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 12: Vietnam Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 13: Vietnam Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 14: Vietnam Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 15: Vietnam Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 16: Vietnam Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 17: Vietnam Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 18: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 19: Vietnam Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 20: Vietnam Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 21: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 22: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 23: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 1 and 2 2020 & 2033

- Table 24: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2020 & 2033

- Table 25: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 26: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 3 2020 & 2033

- Table 27: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 28: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 4 2020 & 2033

- Table 29: Vietnam Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Vietnam Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 31: Vietnam Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 32: Vietnam Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 33: Vietnam Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 34: Vietnam Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 35: Vietnam Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 36: Vietnam Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 37: Vietnam Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 38: Vietnam Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 39: Vietnam Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 40: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 41: Vietnam Data Center Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 42: Vietnam Data Center Construction Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 43: Vietnam Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 44: Vietnam Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2020 & 2033

- Table 45: Vietnam Data Center Construction Market Revenue undefined Forecast, by Electrical Infrastructure 2020 & 2033

- Table 46: Vietnam Data Center Construction Market Volume K Unit Forecast, by Electrical Infrastructure 2020 & 2033

- Table 47: Vietnam Data Center Construction Market Revenue undefined Forecast, by Power Distribution Solution 2020 & 2033

- Table 48: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Distribution Solution 2020 & 2033

- Table 49: Vietnam Data Center Construction Market Revenue undefined Forecast, by Power Backup Solutions 2020 & 2033

- Table 50: Vietnam Data Center Construction Market Volume K Unit Forecast, by Power Backup Solutions 2020 & 2033

- Table 51: Vietnam Data Center Construction Market Revenue undefined Forecast, by Service 2020 & 2033

- Table 52: Vietnam Data Center Construction Market Volume K Unit Forecast, by Service 2020 & 2033

- Table 53: Vietnam Data Center Construction Market Revenue undefined Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 54: Vietnam Data Center Construction Market Volume K Unit Forecast, by Mechanical Infrastructure 2020 & 2033

- Table 55: Vietnam Data Center Construction Market Revenue undefined Forecast, by Cooling Systems 2020 & 2033

- Table 56: Vietnam Data Center Construction Market Volume K Unit Forecast, by Cooling Systems 2020 & 2033

- Table 57: Vietnam Data Center Construction Market Revenue undefined Forecast, by Racks 2020 & 2033

- Table 58: Vietnam Data Center Construction Market Volume K Unit Forecast, by Racks 2020 & 2033

- Table 59: Vietnam Data Center Construction Market Revenue undefined Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 60: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other Mechanical Infrastructure 2020 & 2033

- Table 61: Vietnam Data Center Construction Market Revenue undefined Forecast, by General Construction 2020 & 2033

- Table 62: Vietnam Data Center Construction Market Volume K Unit Forecast, by General Construction 2020 & 2033

- Table 63: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 64: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 65: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 1 and 2 2020 & 2033

- Table 66: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 1 and 2 2020 & 2033

- Table 67: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 3 2020 & 2033

- Table 68: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 3 2020 & 2033

- Table 69: Vietnam Data Center Construction Market Revenue undefined Forecast, by Tier 4 2020 & 2033

- Table 70: Vietnam Data Center Construction Market Volume K Unit Forecast, by Tier 4 2020 & 2033

- Table 71: Vietnam Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 72: Vietnam Data Center Construction Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 73: Vietnam Data Center Construction Market Revenue undefined Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 74: Vietnam Data Center Construction Market Volume K Unit Forecast, by Banking, Financial Services, and Insurance 2020 & 2033

- Table 75: Vietnam Data Center Construction Market Revenue undefined Forecast, by IT and Telecommunications 2020 & 2033

- Table 76: Vietnam Data Center Construction Market Volume K Unit Forecast, by IT and Telecommunications 2020 & 2033

- Table 77: Vietnam Data Center Construction Market Revenue undefined Forecast, by Government and Defense 2020 & 2033

- Table 78: Vietnam Data Center Construction Market Volume K Unit Forecast, by Government and Defense 2020 & 2033

- Table 79: Vietnam Data Center Construction Market Revenue undefined Forecast, by Healthcare 2020 & 2033

- Table 80: Vietnam Data Center Construction Market Volume K Unit Forecast, by Healthcare 2020 & 2033

- Table 81: Vietnam Data Center Construction Market Revenue undefined Forecast, by Other End Users 2020 & 2033

- Table 82: Vietnam Data Center Construction Market Volume K Unit Forecast, by Other End Users 2020 & 2033

- Table 83: Vietnam Data Center Construction Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Vietnam Data Center Construction Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Data Center Construction Market?

The projected CAGR is approximately 20.47%.

2. Which companies are prominent players in the Vietnam Data Center Construction Market?

Key companies in the market include SAS Institute Inc, Aurecon Group Pty Ltd, Fortis Construction, IBM Corporation, Legrand SA, Archetype Group, Delta Group, NEC Vietnam Co Ltd, Schneider Electric SE, Turner Construction Co, Dell Inc, Cisco Systems Inc, AECOM, NTT Ltd, Iris Global.

3. What are the main segments of the Vietnam Data Center Construction Market?

The market segments include Infrastructure, Electrical Infrastructure, Power Distribution Solution, Power Backup Solutions, Service , Mechanical Infrastructure, Cooling Systems, Racks, Other Mechanical Infrastructure, General Construction, Tier Type, Tier 1 and 2, Tier 3, Tier 4, End User, Banking, Financial Services, and Insurance, IT and Telecommunications, Government and Defense, Healthcare, Other End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Migration to Cloud-based Business Operations; Rise of Green Data Centers; Government Support in the Form of Tax Incentives for Development of Data Centers.

6. What are the notable trends driving market growth?

Tier 3 is the Largest Tier Type.

7. Are there any restraints impacting market growth?

Higher Initial Investments and Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

September 2021: Viettel jointly conducted trials with Samsung in Da Nang, in early September 2021. Viettel partnered with Ericsson and Qualcomm to test and achieve 5G data transmission speeds over 4.7 Gbps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Vietnam Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence