Key Insights

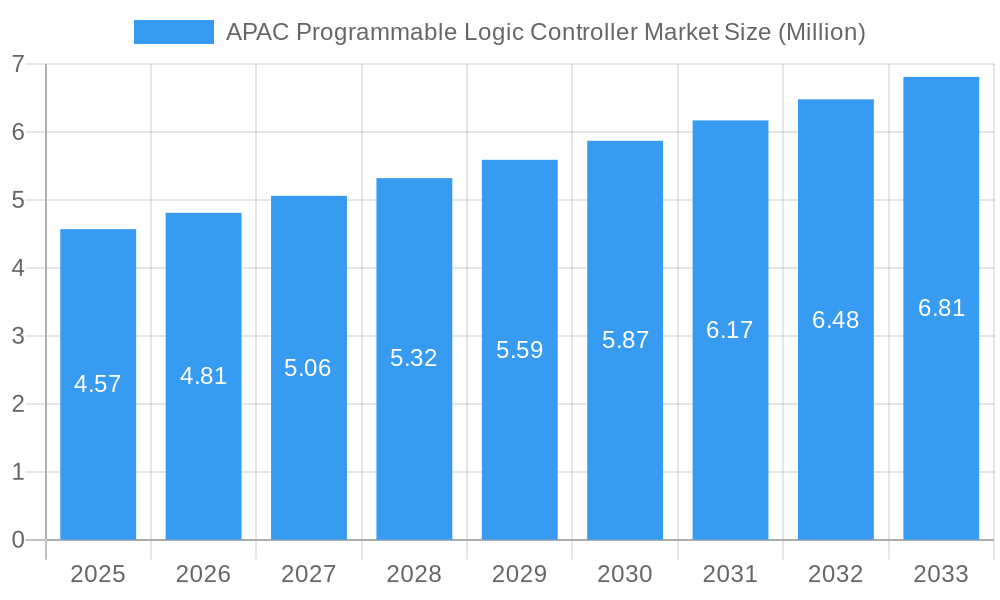

The Asia Pacific Programmable Logic Controller (PLC) market is poised for significant expansion, currently valued at USD 4.57 Million in 2025, and is projected to experience a robust Compound Annual Growth Rate (CAGR) of 5.20% throughout the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for automation across diverse end-use industries, including automotive, electronics, food processing, chemical processing, and pharmaceuticals. The increasing adoption of Industry 4.0 technologies, the need for enhanced operational efficiency and precision, and stringent government initiatives promoting manufacturing automation are key drivers propelling the market forward. Furthermore, the continuous innovation in PLC product types, such as the development of more compact, modular, and intelligent controllers, catering to the evolving needs of modern industrial environments, will further stimulate market growth. The region's burgeoning manufacturing sector and its strategic importance as a global production hub underscore the critical role of PLCs in modern industrial operations.

APAC Programmable Logic Controller Market Market Size (In Million)

The market is characterized by a dynamic competitive landscape, featuring major global players like Rockwell Automation, Siemens AG, ABB Ltd, and Mitsubishi Electric Corporation, alongside strong regional contenders. These companies are actively engaged in research and development to introduce advanced PLC solutions with enhanced connectivity, cybersecurity features, and energy efficiency. While the market presents a favorable growth trajectory, certain restraints such as the high initial investment costs for advanced PLC systems and the shortage of skilled workforce for their implementation and maintenance, could pose challenges. However, the growing emphasis on total cost of ownership, along with the development of more affordable and user-friendly PLC solutions, is expected to mitigate these concerns. The market is segmented across product types like Compact PLCs, Rack-Mounted PLCs, and Modular PLCs, with ongoing advancements in each category to meet specific application requirements. The APAC region's diverse industrial base and its commitment to technological advancement position it as a critical growth engine for the global PLC market.

APAC Programmable Logic Controller Market Company Market Share

APAC Programmable Logic Controller (PLC) Market Report: Industry Insights, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the APAC Programmable Logic Controller (PLC) market, a critical component of industrial automation. Covering the period from 2019 to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, key drivers, challenges, and the competitive landscape. Gain unparalleled insights into the evolution of industrial control systems across the Asia-Pacific region, with a particular focus on the parent and child market segments driving innovation and adoption.

APAC Programmable Logic Controller Market Market Dynamics & Structure

The APAC Programmable Logic Controller (PLC) market is characterized by a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration remains significant, with a few key global players dominating. However, the emergence of regional manufacturers and niche players is gradually increasing competition. Technological innovation acts as a primary driver, fueled by the relentless pursuit of enhanced efficiency, increased automation, and the integration of Industry 4.0 principles. Regulatory frameworks, particularly those promoting industrial modernization and safety standards, also play a crucial role in shaping market adoption. Competitive product substitutes, such as Distributed Control Systems (DCS) and other automation solutions, are present but PLCs maintain a strong foothold due to their versatility and cost-effectiveness. End-user demographics are shifting towards industries demanding higher levels of automation and smart manufacturing capabilities. Mergers & Acquisitions (M&A) trends are observable as larger entities seek to consolidate their market position and acquire innovative technologies or expand their geographical reach.

- Market Concentration: Dominated by global leaders, with increasing regional player influence.

- Technological Innovation: Driven by Industry 4.0, IoT integration, and edge computing.

- Regulatory Frameworks: Supportive of industrial automation and smart manufacturing initiatives.

- Competitive Product Substitutes: DCS, PACs (Programmable Automation Controllers), and other advanced control systems.

- End-User Demographics: Growing demand from automotive, electronics, and advanced manufacturing sectors.

- M&A Trends: Strategic acquisitions to gain market share and technological capabilities.

APAC Programmable Logic Controller Market Growth Trends & Insights

The APAC Programmable Logic Controller (PLC) market is poised for robust growth, driven by an escalating demand for industrial automation and digital transformation across the region. The market size is expected to witness a substantial expansion, fueled by increased adoption rates in developing economies and the continuous upgrade cycles in mature markets. Technological disruptions, including the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) into PLC functionalities, are revolutionizing industrial control systems. These advancements enable predictive maintenance, real-time data analytics, and enhanced operational efficiency. Consumer behavior shifts are evident, with businesses prioritizing flexible, scalable, and intelligent automation solutions to maintain a competitive edge. The CAGR is projected to be robust, reflecting the strong industrial backbone of APAC nations and their commitment to modernizing manufacturing processes. Market penetration of advanced PLC solutions is deepening as industries recognize their critical role in achieving smart factory objectives and optimizing production output. The increasing focus on energy efficiency and sustainable manufacturing practices also presents a significant avenue for PLC market expansion, with newer models offering advanced energy management features. The proliferation of robotics and automated assembly lines further necessitates the integration of sophisticated PLC systems for seamless operation and control.

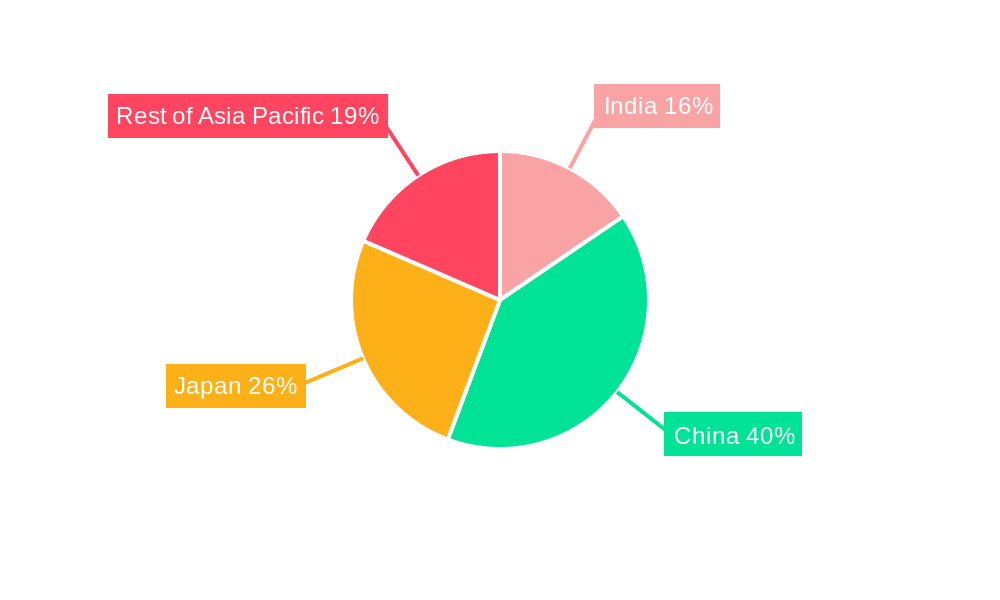

Dominant Regions, Countries, or Segments in APAC Programmable Logic Controller Market

Within the expansive APAC Programmable Logic Controller (PLC) market, several regions, countries, and product segments stand out as key drivers of growth and adoption. China, with its massive manufacturing base and aggressive push towards Industry 4.0, consistently emerges as the dominant country. Its economic policies heavily favor technological advancement and automation, creating a fertile ground for PLC integration across a multitude of industries. The Automotive industry in APAC, particularly in countries like Japan, South Korea, China, and increasingly India, represents a significant end-use segment. The demand for precision, efficiency, and the rapid pace of vehicle production lines directly translates into a high requirement for sophisticated PLCs. Similarly, the burgeoning Electronics manufacturing sector, a cornerstone of the APAC economy, relies heavily on PLCs for automated assembly, quality control, and complex production processes.

From a product type perspective, Modular PLCs are witnessing considerable traction. Their scalability, flexibility, and ability to be customized for specific applications make them ideal for the diverse and evolving needs of APAC industries. These PLCs allow for easy expansion and upgrades, catering to the dynamic nature of manufacturing environments. The growth potential for Modular PLCs is immense, as they offer a cost-effective solution for complex automation challenges.

- Dominant Country: China, driven by government initiatives and a vast manufacturing ecosystem.

- Dominant End-use Industry: Automotive, characterized by high-volume production and intricate assembly lines.

- Dominant End-use Industry: Electronics, a rapidly expanding sector with a strong emphasis on automated production.

- Dominant Product Type: Modular PLCs, offering superior flexibility and scalability.

- Key Drivers: Strong government support for automation, competitive manufacturing costs, and a large consumer base.

- Market Share: China holds the largest market share, followed by Japan and South Korea.

- Growth Potential: Significant growth is anticipated in Southeast Asian economies like Vietnam and Indonesia due to increasing FDI in manufacturing.

APAC Programmable Logic Controller Market Product Landscape

The APAC Programmable Logic Controller (PLC) market's product landscape is defined by continuous innovation and a diverse range of offerings. Manufacturers are focusing on developing PLCs with enhanced processing power, increased memory, and advanced communication capabilities, including support for Ethernet/IP, Profinet, and OPC UA. These advancements enable seamless integration with other automation components, robotics, and enterprise-level systems, facilitating the realization of smart factories. Applications span across a wide spectrum, from discrete manufacturing in the automotive and electronics sectors to complex process control in food processing and chemical plants. Performance metrics are being pushed with features like faster scan times, improved diagnostic capabilities, and integrated safety functions, leading to greater operational reliability and reduced downtime. Unique selling propositions often revolve around ruggedized designs for harsh industrial environments, user-friendly programming interfaces, and comprehensive cybersecurity features.

Key Drivers, Barriers & Challenges in APAC Programmable Logic Controller Market

The APAC Programmable Logic Controller (PLC) market is propelled by several key drivers, primarily the increasing adoption of Industry 4.0 technologies and the growing emphasis on smart manufacturing across the region. Government initiatives supporting industrial automation and the need for enhanced operational efficiency and productivity in sectors like automotive, electronics, and food processing are significant catalysts. Furthermore, the rising labor costs in several APAC nations are encouraging automation investments.

However, the market faces several barriers and challenges. High initial investment costs for sophisticated PLC systems can be a deterrent for small and medium-sized enterprises (SMEs). A shortage of skilled labor capable of programming, installing, and maintaining these advanced systems also poses a significant hurdle. Supply chain disruptions, particularly in the semiconductor industry, can impact the availability and pricing of PLC components. Intense competition among established global players and emerging regional manufacturers can lead to price pressures.

- Key Drivers:

- Industry 4.0 adoption and smart manufacturing initiatives.

- Government support for industrial automation.

- Demand for increased efficiency and productivity.

- Rising labor costs.

- Barriers & Challenges:

- High initial investment costs.

- Shortage of skilled workforce.

- Supply chain disruptions.

- Intense market competition.

- Cybersecurity concerns.

Emerging Opportunities in APAC Programmable Logic Controller Market

Emerging opportunities within the APAC Programmable Logic Controller (PLC) market are primarily centered around the growing demand for edge computing and AI integration. As industries move towards more distributed intelligence, PLCs are being developed to handle complex data processing and analytics directly at the machine level. Untapped markets in developing Southeast Asian nations present substantial growth potential as their manufacturing sectors expand. Innovative applications in areas like precision agriculture, advanced logistics, and the burgeoning renewable energy sector are creating new avenues for PLC adoption. Evolving consumer preferences for personalized products and faster delivery times also necessitate more agile and responsive manufacturing processes, which PLCs are instrumental in enabling.

Growth Accelerators in the APAC Programmable Logic Controller Market Industry

Several catalysts are accelerating the long-term growth of the APAC Programmable Logic Controller (PLC) market. Technological breakthroughs in areas such as AI-powered diagnostics, predictive maintenance capabilities embedded within PLCs, and enhanced cybersecurity features are making these systems more attractive and reliable. Strategic partnerships between PLC manufacturers and software providers are fostering the development of integrated solutions that offer end-to-end automation and data management. Furthermore, aggressive market expansion strategies by leading players, including the establishment of local support and service networks in emerging economies, are widening the accessibility and adoption of PLC technologies across the Asia-Pacific region. The continuous push for digital transformation across all industrial verticals is a fundamental growth accelerator, positioning PLCs as indispensable components of modern manufacturing infrastructure.

Key Players Shaping the APAC Programmable Logic Controller Market Market

- Rockwell Automation

- Honeywell International Inc

- ABB Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Emerson Electric Co (GE)

- Schneider Electric SE

- Omron Corporation

- Robert Bosch GmbH

- Toshiba International Corporation

- Panasonic Corporation

Notable Milestones in APAC Programmable Logic Controller Market Sector

- May 2022: Electronics Corporation of India Limited (ECIL) Hyderabad launched advanced Programmable Logic Controller (PLC) and Supervisory Control and Data Acquisition (SCADA) software for process automation systems. These systems have been instrumental in industrial control applications, with ECIL's PLC and SCADA systems operating effectively at nuclear plants and ISRO centers for four decades.

- August 2021: Bosch Rexroth enhanced its Factory of the Future offerings by integrating critical systems such as the TS 2plus palletized conveyor, a Cartesian 3-axis robot with CKK compact linear modules, and cabinet-free IndraDriveMi servo drive. These were controlled by the IndraControlXM22 PLC with Safety PLC, demonstrating real-time manufacturing transparency through an onboard IoT Gateway for i4.0 data collection and sharing.

In-Depth APAC Programmable Logic Controller Market Market Outlook

The future outlook for the APAC Programmable Logic Controller (PLC) market is exceptionally bright, characterized by sustained growth and innovation. The increasing integration of AI and IoT will empower PLCs with advanced analytical capabilities, driving greater operational intelligence and automation. Emerging economies in Southeast Asia represent significant untapped potential, poised for substantial growth as their manufacturing sectors continue to develop and modernize. Strategic collaborations and the development of comprehensive automation solutions will further accelerate adoption. The market is expected to witness a shift towards more intelligent, interconnected, and cybersecurity-resilient PLC systems, catering to the evolving demands of a digitally transformed industrial landscape. This trajectory positions PLCs as foundational elements for achieving hyper-connected and efficient manufacturing operations across the APAC region.

APAC Programmable Logic Controller Market Segmentation

-

1. Product Type

- 1.1. Compact PLCs

- 1.2. Rack-Mounted PLCs

- 1.3. Modular PLCs

-

2. End-use Industry

- 2.1. Automotive

- 2.2. Electronics

- 2.3. Food Processing

- 2.4. Chemical Processing

- 2.5. Pharmaceutical

APAC Programmable Logic Controller Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Rest of Asia Pacific

APAC Programmable Logic Controller Market Regional Market Share

Geographic Coverage of APAC Programmable Logic Controller Market

APAC Programmable Logic Controller Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased deployments of programmable logic controller system in automotive industry.; Technological advancements in manufacturing industry.

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Automotive Industry Driving Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Compact PLCs

- 5.1.2. Rack-Mounted PLCs

- 5.1.3. Modular PLCs

- 5.2. Market Analysis, Insights and Forecast - by End-use Industry

- 5.2.1. Automotive

- 5.2.2. Electronics

- 5.2.3. Food Processing

- 5.2.4. Chemical Processing

- 5.2.5. Pharmaceutical

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. India APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Compact PLCs

- 6.1.2. Rack-Mounted PLCs

- 6.1.3. Modular PLCs

- 6.2. Market Analysis, Insights and Forecast - by End-use Industry

- 6.2.1. Automotive

- 6.2.2. Electronics

- 6.2.3. Food Processing

- 6.2.4. Chemical Processing

- 6.2.5. Pharmaceutical

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Compact PLCs

- 7.1.2. Rack-Mounted PLCs

- 7.1.3. Modular PLCs

- 7.2. Market Analysis, Insights and Forecast - by End-use Industry

- 7.2.1. Automotive

- 7.2.2. Electronics

- 7.2.3. Food Processing

- 7.2.4. Chemical Processing

- 7.2.5. Pharmaceutical

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Compact PLCs

- 8.1.2. Rack-Mounted PLCs

- 8.1.3. Modular PLCs

- 8.2. Market Analysis, Insights and Forecast - by End-use Industry

- 8.2.1. Automotive

- 8.2.2. Electronics

- 8.2.3. Food Processing

- 8.2.4. Chemical Processing

- 8.2.5. Pharmaceutical

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC Programmable Logic Controller Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Compact PLCs

- 9.1.2. Rack-Mounted PLCs

- 9.1.3. Modular PLCs

- 9.2. Market Analysis, Insights and Forecast - by End-use Industry

- 9.2.1. Automotive

- 9.2.2. Electronics

- 9.2.3. Food Processing

- 9.2.4. Chemical Processing

- 9.2.5. Pharmaceutical

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Rockwell Automation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ABB Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Emerson Electric Co (GE)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Omron Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Toshiba International Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Rockwell Automation

List of Figures

- Figure 1: APAC Programmable Logic Controller Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Programmable Logic Controller Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 3: APAC Programmable Logic Controller Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 6: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 9: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 12: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: APAC Programmable Logic Controller Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: APAC Programmable Logic Controller Market Revenue Million Forecast, by End-use Industry 2020 & 2033

- Table 15: APAC Programmable Logic Controller Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Programmable Logic Controller Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the APAC Programmable Logic Controller Market?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Emerson Electric Co (GE), Schneider Electric SE, Omron Corporation, Robert Bosch GmbH, Toshiba International Corporation, Panasonic Corporation.

3. What are the main segments of the APAC Programmable Logic Controller Market?

The market segments include Product Type, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased deployments of programmable logic controller system in automotive industry.; Technological advancements in manufacturing industry..

6. What are the notable trends driving market growth?

Automotive Industry Driving Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

May 2022 - The advanced Programmable Logic Controller (PLC) and Supervisory Control and Data Acquisition (SCADA) software for process automation systems has been launched by Electronics Corporation of India Limited (ECIL) Hyderabad, a public sector unit under the Department of Atomic Energy. PLC and SCADA are widely utilized in industrial control applications, and ECIL was a player in their development. PLC and SCADA systems supplied by ECIL have been effectively operating at nuclear plants and ISRO centers for the past four decades.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Programmable Logic Controller Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Programmable Logic Controller Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Programmable Logic Controller Market?

To stay informed about further developments, trends, and reports in the APAC Programmable Logic Controller Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence