Key Insights

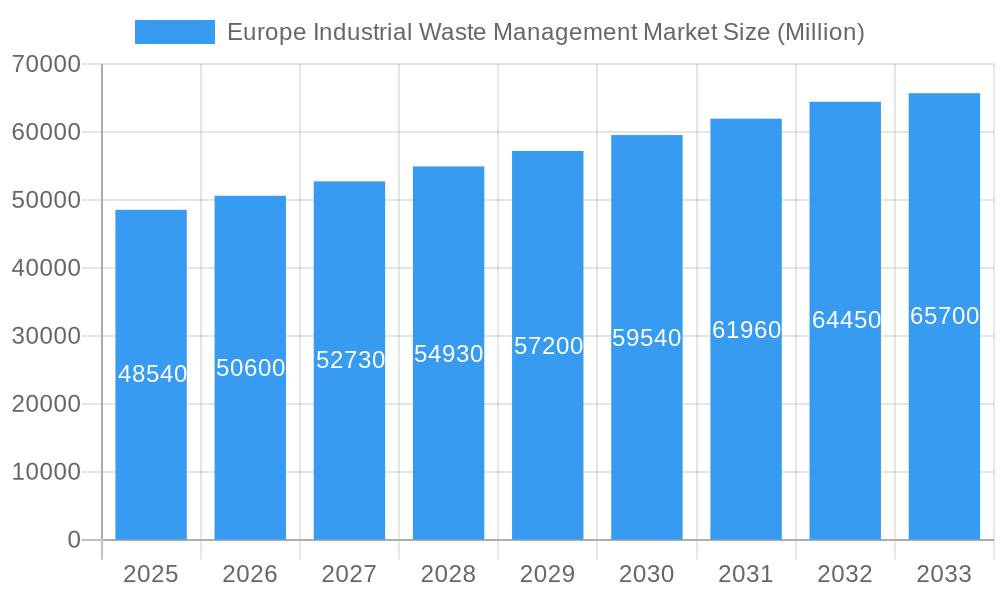

The European industrial waste management market, valued at €48.54 billion in 2025, is projected to experience robust growth, driven by increasing industrial activity, stringent environmental regulations, and a rising focus on sustainable waste management practices across the continent. The compound annual growth rate (CAGR) of 4.26% from 2025 to 2033 indicates a steady expansion, reaching an estimated €65.7 billion by 2033. Key drivers include the growing emphasis on circular economy principles, promoting waste reduction, reuse, and recycling, and a significant increase in demand for specialized waste treatment technologies such as incineration with energy recovery. Furthermore, the escalating costs associated with landfill disposal are pushing industries toward more environmentally friendly and cost-effective solutions. While challenges like fluctuating raw material prices and potential workforce shortages exist, the long-term outlook remains positive, fueled by continuous technological advancements in waste processing and increasing government incentives for sustainable waste management.

Europe Industrial Waste Management Market Market Size (In Billion)

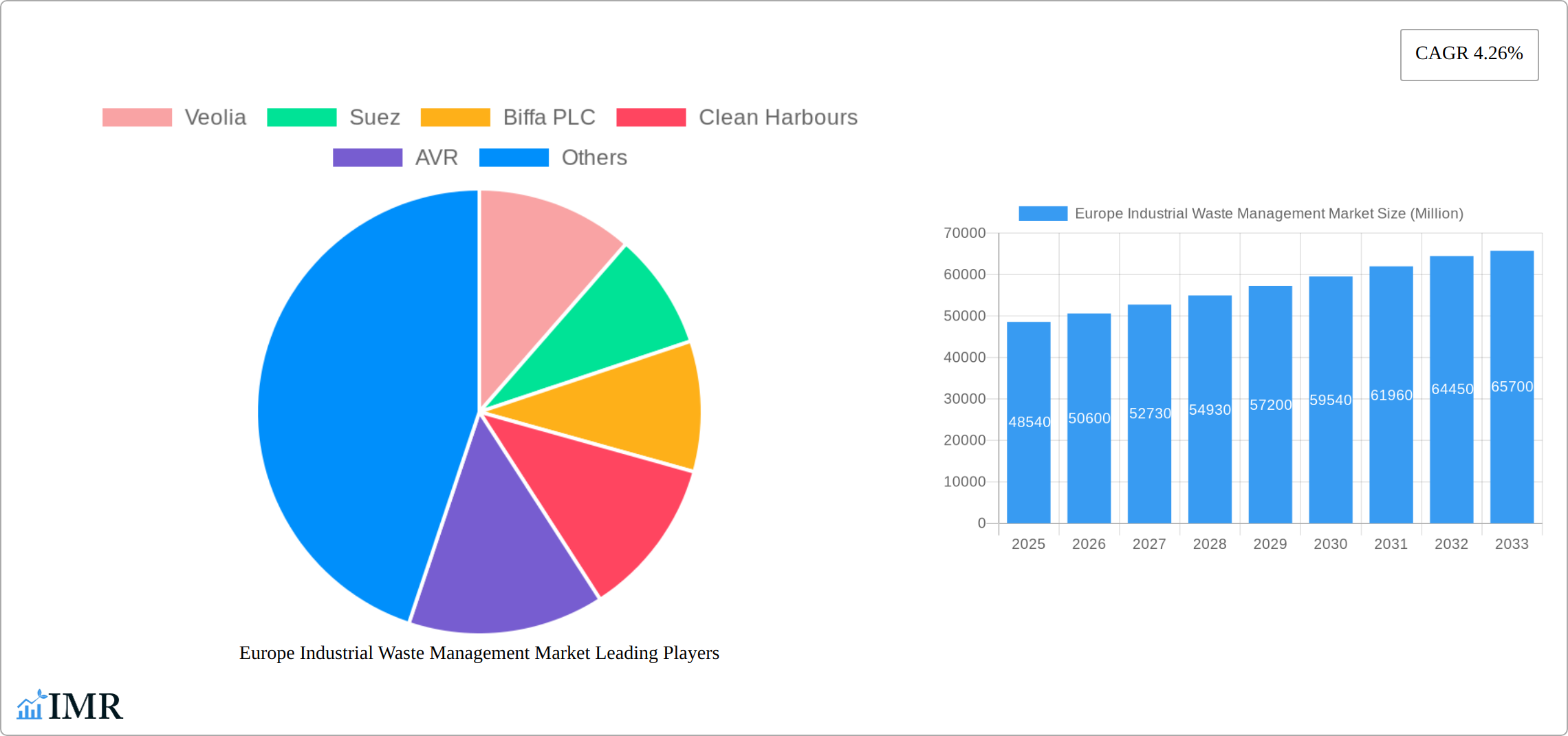

Leading players like Veolia, Suez, Biffa PLC, Clean Harbours, and others are consolidating their market positions through strategic acquisitions, expansion into new regions, and the development of innovative waste management solutions. The market is segmented based on waste type (hazardous and non-hazardous), treatment method (recycling, incineration, landfill), and industry served (manufacturing, construction, energy). Regional variations exist, with countries like Germany and France holding significant market shares due to established infrastructure and robust regulatory frameworks. The market's future growth will largely depend on the continued implementation of effective policies promoting waste reduction and the adoption of advanced technologies to efficiently manage industrial waste while minimizing environmental impact. This includes ongoing investments in recycling infrastructure and technological innovations that improve resource recovery rates and reduce reliance on landfilling.

Europe Industrial Waste Management Market Company Market Share

Europe Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Industrial Waste Management Market, covering market dynamics, growth trends, regional performance, key players, and future outlook. The report uses data from 2019-2024 as its historical period, 2025 as its base and estimated year, and projects the market's trajectory from 2025 to 2033. The market size is presented in million units throughout. This detailed analysis is crucial for investors, industry professionals, and strategic decision-makers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report examines the parent market of Waste Management and the child market of Industrial Waste Management, offering a granular perspective.

Europe Industrial Waste Management Market Dynamics & Structure

The European Industrial Waste Management market is characterized by moderate concentration, with key players like Veolia, Suez, Biffa PLC, Clean Harbours, AVR, Cleanaway Germany, Remondis, Urbaser, Prezero International, and ALBA Group holding significant market share. However, a considerable number of smaller, regional players also contribute to the market landscape. The market structure is influenced by stringent environmental regulations, driving innovation in waste treatment and recycling technologies.

- Market Concentration: The top 10 players hold approximately xx% of the market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Significant investments are being made in advanced recycling technologies, including chemical recycling and AI-powered waste sorting, to improve efficiency and resource recovery.

- Regulatory Frameworks: The EU's Circular Economy Action Plan and national-level waste management regulations are key drivers, shaping market trends and influencing investment decisions. Stricter regulations are pushing companies towards more sustainable waste management practices.

- Competitive Product Substitutes: The rise of alternative waste management methods, such as anaerobic digestion and advanced biofuels, is creating competitive pressure.

- End-User Demographics: The industrial sector, encompassing manufacturing, construction, and energy production, constitutes the primary end-user segment, with variations across regions based on industrial activity.

- M&A Trends: The market has witnessed a moderate level of M&A activity in recent years (xx deals in the past 5 years), driven by consolidation efforts and expansion into new geographical areas. This represents an xx% increase compared to the previous 5-year period.

Europe Industrial Waste Management Market Growth Trends & Insights

The Europe Industrial Waste Management market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing industrial activity, stricter environmental regulations, and rising awareness of sustainable waste management practices. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), driven by several factors:

- The increasing focus on circular economy principles within the European Union is significantly influencing the industrial sector to adopt sustainable waste management solutions.

- Technological advancements in waste processing and recycling are enhancing efficiency and lowering costs, boosting market adoption.

- Stringent governmental regulations regarding industrial waste disposal are further propelling the market growth by making sustainable waste management a necessity.

- Rising consumer demand for environmentally friendly products and services is putting pressure on industries to improve their waste management practices, thereby driving market expansion.

Dominant Regions, Countries, or Segments in Europe Industrial Waste Management Market

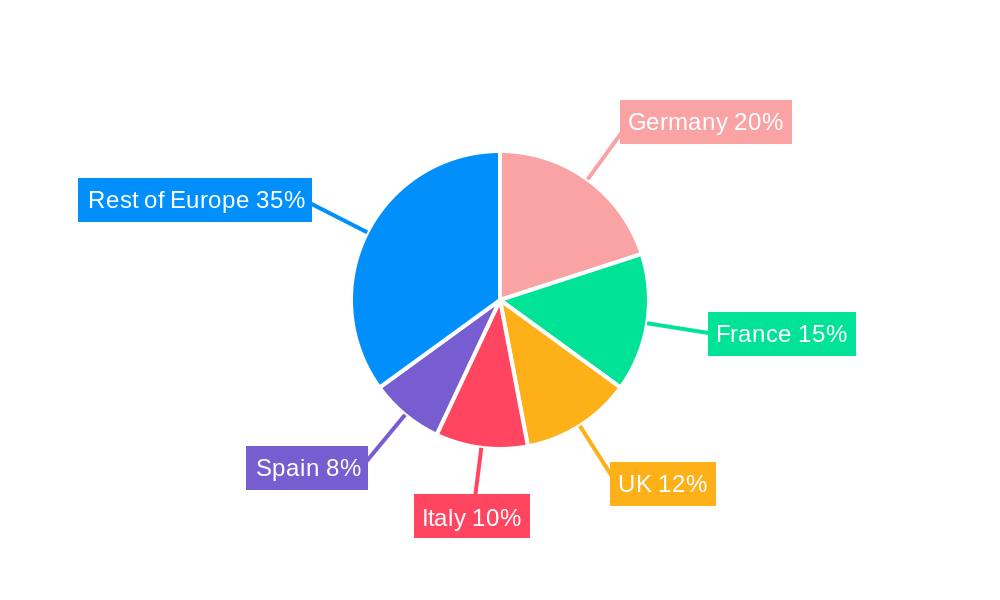

Germany, France, and the United Kingdom continue to be the vanguard of the European industrial waste management market. Their leadership is underpinned by a potent combination of high-volume industrial activity, exceptionally stringent environmental regulations that mandate responsible waste handling, and the presence of sophisticated, well-established waste management infrastructure. In 2025, Germany is projected to command the largest market share at approximately XX%, followed closely by France with XX% and the UK with XX%. These figures underscore their mature and highly regulated markets.

- Key Drivers & Regional Strengths:

- Germany: A powerhouse of industrial output, Germany benefits from its extensive adoption of advanced recycling technologies and a deeply supportive governmental framework that consistently promotes sustainable waste solutions.

- France: The nation is making significant strides with substantial investments in cutting-edge waste-to-energy infrastructure. Furthermore, a strong national commitment to circular economy principles is driving innovation and resource recovery.

- United Kingdom: A palpable surge in public and corporate awareness regarding environmental sustainability, coupled with an increasing embrace of innovative and efficient waste management methodologies, are key catalysts for growth in the UK.

- Market Share Dynamics and Future Growth Horizons: While Germany currently holds the dominant market share, emerging economies within Europe, such as Italy and Spain, are exhibiting considerable growth potential. This is primarily attributed to their expanding industrial sectors and the ongoing development of their waste management infrastructures. Projections indicate that significant investments in state-of-the-art waste treatment facilities and a heightened governmental focus on environmental protection will further accelerate this growth trajectory.

Europe Industrial Waste Management Market Product Landscape

The market offers a diverse range of services, including collection, transportation, treatment, recycling, and disposal of industrial waste. Technological advancements are leading to the development of more efficient and sustainable waste management solutions, such as advanced sorting systems, automated material recovery facilities, and innovative recycling technologies. The focus is shifting towards maximizing resource recovery and minimizing environmental impact, leading to the development of new product offerings and improved service efficiency. This is creating a competitive landscape where companies differentiate themselves through improved technological solutions and a stronger commitment to sustainability.

Key Drivers, Barriers & Challenges in Europe Industrial Waste Management Market

Key Drivers:

- Increasing stringent environmental regulations across Europe are mandating more sustainable waste management practices.

- Growing industrial output is creating larger volumes of waste that need efficient management.

- Technological advancements in waste processing and recycling are offering more cost-effective and environmentally friendly solutions.

Key Challenges & Restraints:

- High capital expenditures for implementing advanced technologies in waste treatment create barriers to entry for small businesses.

- Fluctuating raw material prices can impact the profitability of recycling operations.

- Maintaining a consistently efficient and effective supply chain can be difficult given the diverse range of waste materials and geographical locations. This contributes to an estimated xx% inefficiency across the sector.

Emerging Opportunities in Europe Industrial Waste Management Market

- Advanced Recycling Technologies: Beyond traditional methods, innovative solutions like Chemical Recycling are poised to revolutionize waste management. This technology offers immense potential for processing even the most complex waste streams, enabling the recovery of high-value materials that would otherwise be lost.

- Waste-to-Energy Innovations: The escalating global imperative for sustainable energy solutions is spotlighting Waste-to-Energy (WtE) technologies. These processes not only divert waste from landfills but also generate valuable energy, presenting substantial commercial and environmental opportunities.

- Sustainable Materials Management: With a growing global demand for eco-friendly and sustainable materials, the focus is shifting towards the efficient recycling and processing of Bio-based Materials. This presents a burgeoning market for specialized waste management services and innovative processing techniques.

- Digitalization and IoT Integration: The adoption of digital technologies, including the Internet of Things (IoT) for real-time monitoring, data analytics for optimization, and AI-powered sorting, is set to enhance efficiency and traceability across the waste management value chain.

- Industrial Symbiosis: Fostering collaborations where the waste or by-product of one industry becomes a resource for another is gaining traction, promoting a more integrated and circular approach to industrial waste.

Growth Accelerators in the Europe Industrial Waste Management Market Industry

The Europe Industrial Waste Management market is experiencing robust expansion, fueled by a confluence of powerful accelerators. Paramount among these are rapid technological advancements in waste processing and sophisticated recycling methodologies, which are continuously improving efficiency and recovery rates. Coupled with this is the unwavering support from government policies, which are increasingly incentivizing sustainable practices and penalizing non-compliance. Furthermore, a significant rise in corporate sustainability initiatives, driven by both consumer demand and regulatory pressures, is compelling businesses to invest more in responsible waste management. The proactive development of strategic partnerships between established waste management companies and innovative technology providers is crucial, as it fosters a dynamic ecosystem for innovation and drives market expansion. The ongoing research and commercialization of advanced recycling methods, particularly for challenging waste streams, are anticipated to be significant drivers of substantial market growth in the coming years.

Key Players Shaping the Europe Industrial Waste Management Market Market

- Veolia Environnement

- Suez S.A.

- Biffa PLC

- Clean Harbors, Inc.

- AVR

- Cleanaway Germany GmbH

- Remondis SE & Co. KG

- Urbaser S.A.

- Prezero International GmbH

- ALBA Group PLC & Co. KG

- And over 73 other prominent companies contributing to the market's competitive landscape.

Notable Milestones in Europe Industrial Waste Management Market Sector

- October 2023: Veolia opened over 100 sites in France for public viewing, showcasing its waste management solutions and expertise. This initiative increases public awareness and trust in Veolia's commitment to ecological transformation.

- September 2023: Remondis Group partnered with Evonik to secure the supply of end-of-life mattress foams for chemical recycling, marking a significant step towards sustainable material recovery and circular economy principles.

In-Depth Europe Industrial Waste Management Market Market Outlook

The Europe Industrial Waste Management market is on an upward trajectory, projected to witness significant growth throughout the forecast period. This expansion is driven by a robust interplay of factors, including ongoing technological innovations that are making waste management more efficient and sustainable, increasingly stringent environmental regulations across member states that necessitate advanced solutions, and a pervasive societal and corporate emphasis on sustainability. These dynamics present lucrative opportunities for forward-thinking companies that possess the agility to innovate, adeptly navigate evolving regulatory frameworks, and effectively manage the inherent complexities of diverse industrial waste streams. The burgeoning adoption of circular economy principles, coupled with significant advancements in specialized areas such as chemical recycling and efficient waste-to-energy technologies, is expected to profoundly shape the industry's future landscape. Moreover, strategic acquisitions and partnerships are anticipated to play a pivotal role in market consolidation, driving synergistic growth and expanding the reach of innovative waste management solutions across the continent.

Europe Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

Europe Industrial Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Industrial Waste Management Market Regional Market Share

Geographic Coverage of Europe Industrial Waste Management Market

Europe Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.4. Market Trends

- 3.4.1. Germany Leads the Highest Contribution in the Waste Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Veolia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suez

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biffa PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Clean Harbours

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AVR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanaway Germnay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remondis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Urbaser

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prezero International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALBA Group**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Veolia

List of Figures

- Figure 1: Europe Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Europe Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Europe Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Waste Management Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Europe Industrial Waste Management Market?

Key companies in the market include Veolia, Suez, Biffa PLC, Clean Harbours, AVR, Cleanaway Germnay, Remondis, Urbaser, Prezero International, ALBA Group**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Europe Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

6. What are the notable trends driving market growth?

Germany Leads the Highest Contribution in the Waste Generation.

7. Are there any restraints impacting market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia opened the doors of more than 100 sites operated by the group in France. The sites include drinking water production plants, wastewater treatment plants, waste sorting centers, or energy recovery units, enabling the general public to go behind the scenes of ecological transformation. A unique opportunity to discover the group's innovative solutions and expertise in its core businesses of water, energy, and waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence