Key Insights

The GCC Structural Steel Fabrication market is poised for significant expansion, propelled by substantial infrastructure development initiatives across the region. A burgeoning construction sector, encompassing high-rise buildings, industrial complexes, and large-scale projects, is driving robust demand for steel fabrication services. Government-led economic diversification strategies and transformative mega-projects, such as NEOM in Saudi Arabia, further underpin a positive market outlook. The industry is projected to achieve a compound annual growth rate (CAGR) of 5.1%, indicating sustained market growth. While challenges like volatile steel prices and potential supply chain disruptions exist, the long-term growth prospects remain strong. Key market segments are anticipated to include light steel framing, heavy steel fabrication, and specialized steel structures, each with distinct growth dynamics. Leading industry players, including Hidada Ltd Company, Arabian International Company For Steel Structures, and Al Yamamah Steel Industries Co., are strategically positioned to capitalize on these opportunities amidst anticipated intense competition. The estimated market size in 2025 is projected to reach 43.4 billion, reflecting the region's ongoing substantial investments in construction and infrastructure.

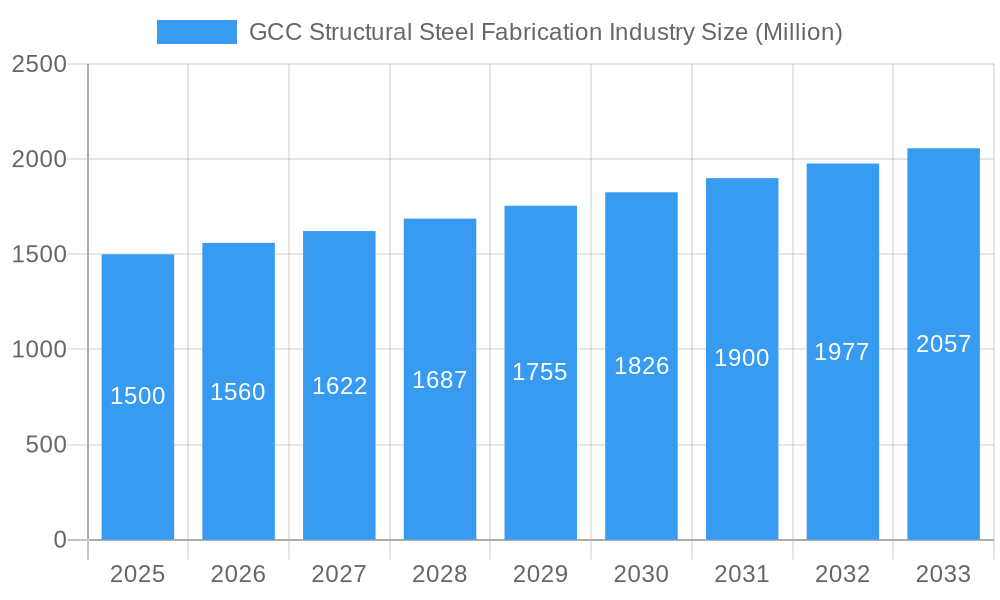

GCC Structural Steel Fabrication Industry Market Size (In Billion)

Technological advancements, including the adoption of Building Information Modeling (BIM) and advanced manufacturing techniques, will be pivotal in shaping the future of the GCC Structural Steel Fabrication industry. These innovations are set to enhance operational efficiency, precision, and sustainability in fabrication processes. Moreover, increasing awareness and demand for sustainable building practices and green steel will influence material selection and fabrication methodologies. The industry's sustained success will depend on its ability to adapt to these evolving trends, effectively manage fluctuating raw material costs, and leverage technological advancements to boost productivity and competitiveness. Regional project diversification and government policies focused on developing resilient infrastructure will also be critical factors influencing the industry's trajectory from 2025 to 2033. Ensuring a skilled workforce and proactively addressing potential labor shortages are paramount for continued market growth.

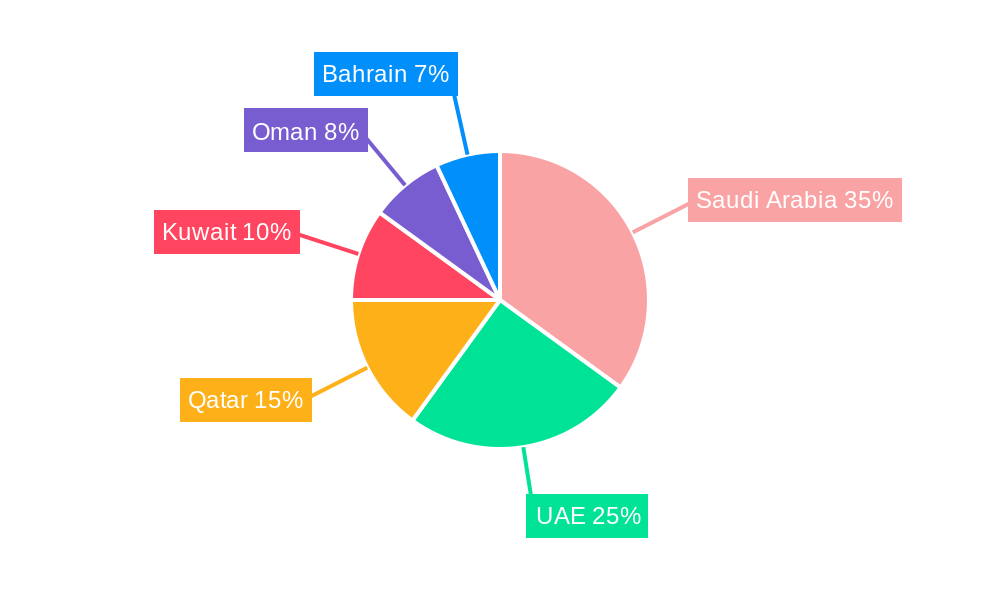

GCC Structural Steel Fabrication Industry Company Market Share

GCC Structural Steel Fabrication Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the GCC structural steel fabrication industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, growth trends, and key players, this report covers the period from 2019 to 2033, encompassing historical data, current market analysis, and future projections. The report's detailed segmentation and analysis of the parent market (GCC Construction) and child market (Steel Fabrication) allows for a granular understanding of the opportunities and challenges within this dynamic sector.

GCC Structural Steel Fabrication Industry Market Dynamics & Structure

This section delves into the intricate dynamics of the GCC structural steel fabrication industry, examining its competitive landscape, the trajectory of technological advancements, the overarching regulatory environment, and prevailing market trends. The market is characterized by a moderately concentrated structure, featuring a cadre of established, dominant players alongside a vibrant ecosystem of agile, regional competitors. Strategic partnerships and a focus on value-added services are increasingly shaping competitive strategies.

- Market Concentration: The top 10 key players, including industry leaders such as Hidada Ltd Company, Arabian International Company For Steel Structures, Al Yamamah Steel Industries Co, Mabani Steel LLC, Al Shahin Company For Metal Industries, IMCC, Standard Steel Fabrication Co LLC, Techno Steel, Aarya Engineering, and Vogue Steel LLC, along with 3 other significant entities, collectively command an estimated xx% of the market share in 2024. This indicates a substantial, yet not entirely saturated, market dominated by a few key influencers.

- Technological Innovation: The industry is witnessing a pronounced surge in the adoption of cutting-edge technologies, most notably Building Information Modeling (BIM) for enhanced design and planning, and sophisticated automated welding systems for superior efficiency and precision. While these advancements are propelling productivity, the significant upfront investment required poses a considerable entry barrier for smaller enterprises, necessitating strategic collaborations or phased adoption plans.

- Regulatory Framework: A robust regulatory framework, encompassing stringent safety standards, environmental impact assessments, and comprehensive building codes, plays a pivotal role in shaping market dynamics. Adherence to these regulations not only ensures responsible industrial practices but also serves as a catalyst for innovation, driving the development of more sustainable and resilient steel fabrication techniques that align with global environmental objectives.

- Competitive Product Substitutes: While alternative construction materials like concrete and advanced composite materials present a degree of competition, structural steel continues to hold its preeminent position. Its inherent strength, exceptional versatility, and superior strength-to-weight ratio make it the preferred choice for a vast array of construction applications, particularly for large-scale and complex projects.

- End-User Demographics: The construction and infrastructure sectors are the principal end-users, their demand intricately linked to the ambitious and ongoing mega-projects that define the GCC region. The residential, commercial, and industrial construction segments, each with its unique requirements, contribute substantially to the overall market demand, creating a diverse and dynamic customer base.

- M&A Trends: The period between 2019 and 2024 has been marked by a notable number of xx Mergers & Acquisitions (M&A) deals within the industry. These strategic transactions are predominantly driven by a desire for market consolidation, the acquisition of specialized capabilities, and the aggressive expansion into new geographical markets and emerging project sectors.

GCC Structural Steel Fabrication Industry Growth Trends & Insights

The GCC structural steel fabrication industry has charted a course of substantial growth throughout the historical period of 2019-2024. This impressive expansion has been primarily propelled by the region's vigorous infrastructure development initiatives and widespread construction activities. The market size, estimated at a robust xx Million in 2025, is poised for continued upward momentum, with projections indicating it will reach a significant xx Million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

This sustained growth is underpinned by substantial government investments channeled into transformative infrastructure projects, the accelerating pace of urbanization across the region, and a dynamic and booming real estate sector. Furthermore, advancements in steel fabrication techniques, coupled with a growing emphasis on sustainable construction practices and the adoption of eco-friendly materials, are acting as powerful catalysts for market expansion. However, the industry must navigate potential headwinds such as the volatility of steel prices and the possibility of economic slowdowns, which could present challenges to its consistent growth trajectory. The increasing adoption rates for advanced technologies, including automated welding and robotic fabrication, are significantly enhancing productivity and elevating the quality standards within the industry. Concurrently, a discernible shift in consumer behavior towards environmentally conscious building materials is increasingly influencing demand for sustainable steel fabrication practices and innovative green steel solutions.

Dominant Regions, Countries, or Segments in GCC Structural Steel Fabrication Industry

Saudi Arabia and the UAE are the dominant markets within the GCC, accounting for approximately xx% and xx% of the total market share, respectively. This dominance is primarily attributable to their robust economies, large-scale infrastructure projects, and favorable government policies supporting construction activities.

Key Drivers in Saudi Arabia:

- Massive infrastructure investments under Vision 2030

- Growing industrial and residential construction sectors

- Government support for sustainable construction practices

Key Drivers in UAE:

- Strong real estate sector and ongoing development projects

- Tourism infrastructure development

- Investment in renewable energy projects

GCC Structural Steel Fabrication Industry Product Landscape

The GCC structural steel fabrication industry offers a comprehensive portfolio of essential structural steel products, including robust beams, foundational columns, versatile plates, and specialized sections, meticulously engineered to meet the diverse and demanding requirements of modern construction projects. The focus of innovation is sharply directed towards enhancing critical attributes such as superior strength, extended durability, and an improved environmental footprint. Consequently, High-Strength Low-Alloy (HSLA) steels are gaining significant traction, alongside advanced corrosion-resistant coatings that promise longevity and reduced maintenance. Product differentiation in this competitive arena is increasingly centered on delivering exceptional quality, exhibiting precise engineering capabilities, and ensuring punctual delivery schedules. Moreover, there is a growing and imperative emphasis on embracing and implementing sustainable manufacturing processes throughout the entire production lifecycle.

Key Drivers, Barriers & Challenges in GCC Structural Steel Fabrication Industry

Key Drivers:

- The relentless pace of urbanization and the ambitious scale of infrastructure development across the GCC countries serve as powerful engines for market growth.

- Significant and sustained government investment in transformative mega-projects, from smart cities to transportation networks, directly fuels demand for structural steel.

- The escalating demand for high-rise buildings, iconic architectural designs, and increasingly complex structural frameworks necessitates advanced steel fabrication solutions.

Challenges & Restraints:

- The inherent volatility of global steel prices poses a significant threat to profit margins and requires robust risk management strategies.

- Growing competition from alternative building materials, each with its own set of advantages, demands continuous innovation and value proposition reinforcement.

- A persistent shortage of skilled labor, coupled with rising labor costs, can impact project timelines and profitability.

- Navigating and adhering to increasingly stringent safety and environmental regulations necessitates ongoing investment in compliance and sustainable practices.

Emerging Opportunities in GCC Structural Steel Fabrication Industry

- Renewable Energy Projects: Significant opportunities exist in the development and fabrication of specialized steel structures for the rapidly expanding renewable energy sector, including solar farms and wind turbine foundations.

- Lightweight & High-Strength Components: The growing demand for lightweight yet high-strength steel components, crucial for efficient transportation and advanced construction, presents a lucrative avenue for innovation and market penetration.

- Modular & Prefabricated Construction: The increasing adoption of modular construction techniques and prefabricated steel structures, which offer speed, efficiency, and cost savings, is creating new market segments and demanding specialized fabrication capabilities.

- Sustainable & Green Technologies: There is a substantial and growing market for sustainable and green steel fabrication technologies, including the use of recycled materials, low-carbon steel production methods, and energy-efficient manufacturing processes.

Growth Accelerators in the GCC Structural Steel Fabrication Industry Industry

The industry's long-term growth is expected to be driven by technological advancements, strategic partnerships, and government initiatives promoting sustainable construction practices. Further market expansion through regional diversification and tapping into new niche sectors such as renewable energy infrastructure holds significant potential for growth.

Key Players Shaping the GCC Structural Steel Fabrication Industry Market

- Hidada Ltd Company

- Arabian International Company For Steel Structures

- Al Yamamah Steel Industries Co

- Mabani Steel LLC

- Al Shahin Company For Metal Industries

- IMCC

- Standard Steel Fabrication Co LLC

- Techno Steel

- Aarya Engineering

- Vogue Steel LLC

- 3 Other Companies

Notable Milestones in GCC Structural Steel Fabrication Industry Sector

- February 2024: Bena Steel Industries extends MoU with Alderley to advance energy transition initiatives in Saudi Arabia, focusing on cleaner technologies like hydrogen.

- February 2024: Tenaris opens a USD 60 million industrial facility in Abu Dhabi, boosting local talent and ADNOC's capabilities.

In-Depth GCC Structural Steel Fabrication Industry Market Outlook

The GCC structural steel fabrication industry is poised for sustained growth, driven by long-term infrastructure development plans and increasing urbanization. Strategic partnerships, technological innovation, and a focus on sustainable construction will be crucial factors shaping the market's future trajectory. The focus on efficient, sustainable, and high-quality fabrication will create new opportunities and attract further investment in this vital sector.

GCC Structural Steel Fabrication Industry Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

GCC Structural Steel Fabrication Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Structural Steel Fabrication Industry Regional Market Share

Geographic Coverage of GCC Structural Steel Fabrication Industry

GCC Structural Steel Fabrication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Spending in Emerging Economies

- 3.3. Market Restrains

- 3.3.1. Increasing Construction Spending in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Construction Industry is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Manufacturing

- 6.1.2. Power and Energy

- 6.1.3. Construction

- 6.1.4. Oil and Gas

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Heavy Sectional Steel

- 6.2.2. Light Sectional Steel

- 6.2.3. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Manufacturing

- 7.1.2. Power and Energy

- 7.1.3. Construction

- 7.1.4. Oil and Gas

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Heavy Sectional Steel

- 7.2.2. Light Sectional Steel

- 7.2.3. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Manufacturing

- 8.1.2. Power and Energy

- 8.1.3. Construction

- 8.1.4. Oil and Gas

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Heavy Sectional Steel

- 8.2.2. Light Sectional Steel

- 8.2.3. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Manufacturing

- 9.1.2. Power and Energy

- 9.1.3. Construction

- 9.1.4. Oil and Gas

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Heavy Sectional Steel

- 9.2.2. Light Sectional Steel

- 9.2.3. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific GCC Structural Steel Fabrication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Manufacturing

- 10.1.2. Power and Energy

- 10.1.3. Construction

- 10.1.4. Oil and Gas

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Heavy Sectional Steel

- 10.2.2. Light Sectional Steel

- 10.2.3. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hidada Ltd Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arabian International Company For Steel Structures

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Yamamah Steel Industries Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mabani Steel LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Al Shahin Company For Metal Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IMCC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Standard Steel Fabrication Co LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Techno Steel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aarya Engineering

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vogue Steel LLC*5 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hidada Ltd Company

List of Figures

- Figure 1: Global GCC Structural Steel Fabrication Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: South America GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: South America GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Structural Steel Fabrication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 39: Global GCC Structural Steel Fabrication Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Structural Steel Fabrication Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Structural Steel Fabrication Industry?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the GCC Structural Steel Fabrication Industry?

Key companies in the market include Hidada Ltd Company, Arabian International Company For Steel Structures, Al Yamamah Steel Industries Co, Mabani Steel LLC, Al Shahin Company For Metal Industries, IMCC, Standard Steel Fabrication Co LLC, Techno Steel, Aarya Engineering, Vogue Steel LLC*5 3 Other Companie.

3. What are the main segments of the GCC Structural Steel Fabrication Industry?

The market segments include End-user Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Spending in Emerging Economies.

6. What are the notable trends driving market growth?

Construction Industry is Dominating the Market.

7. Are there any restraints impacting market growth?

Increasing Construction Spending in Emerging Economies.

8. Can you provide examples of recent developments in the market?

February 2024: Saudi-based steelmaker Bena Steel Industries has extended its Memorandum of Understanding (MoU) with UK energy solutions provider Alderley to advance energy transition initiatives in the kingdom. The MoU focuses on enhancing in-country capabilities, supply chains, and energy solutions to support Saudi Arabia's efforts to ensure energy security globally. This includes the exploration of cleaner technologies such as hydrogen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Structural Steel Fabrication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Structural Steel Fabrication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Structural Steel Fabrication Industry?

To stay informed about further developments, trends, and reports in the GCC Structural Steel Fabrication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence