Key Insights

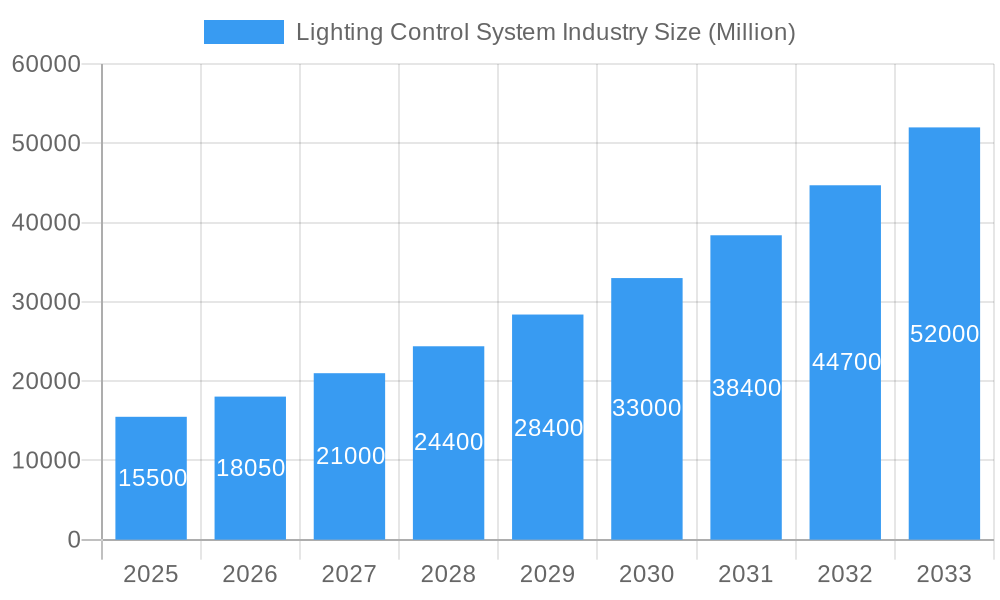

The global Lighting Control System Industry is poised for significant expansion, projected to reach a market size of USD 37.06 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 16.30%. This substantial growth is fueled by a confluence of critical factors, primarily the increasing demand for energy efficiency and sustainability across residential, commercial, and industrial sectors. Government regulations mandating reduced energy consumption and the adoption of smart city initiatives are further accelerating the uptake of advanced lighting control solutions. The trend towards interconnected smart buildings, enabled by sophisticated IoT technologies and wireless communication protocols, is creating a dynamic ecosystem where lighting control systems play a pivotal role in enhancing occupant comfort, security, and operational efficiency. The ongoing development of intelligent lighting solutions that integrate with other building management systems, coupled with advancements in LED technology, are also key catalysts for market expansion.

Lighting Control System Industry Market Size (In Billion)

The market's trajectory is further shaped by distinct trends and segments. The Hardware segment, encompassing LED drivers, sensors, switches and dimmers, relay units, and gateways, forms the backbone of these systems. The Software segment is rapidly evolving, providing the intelligence and connectivity for seamless operation and advanced analytics. Communication protocols are bifurcating into both Wired and Wireless options, with wireless solutions gaining traction due to their flexibility and ease of installation. Applications are broadly categorized into Indoor and Outdoor, each presenting unique opportunities driven by specific needs such as workplace productivity, public safety, and urban beautification. While the market is vibrant, potential restraints such as the initial high cost of advanced systems and the need for skilled installation and maintenance personnel could present challenges. However, the overwhelming benefits in terms of energy savings and operational improvements are expected to outweigh these concerns, leading to sustained market dominance. The Asia Pacific region is anticipated to emerge as a significant growth engine, driven by rapid urbanization and increasing adoption of smart technologies in countries like China and India.

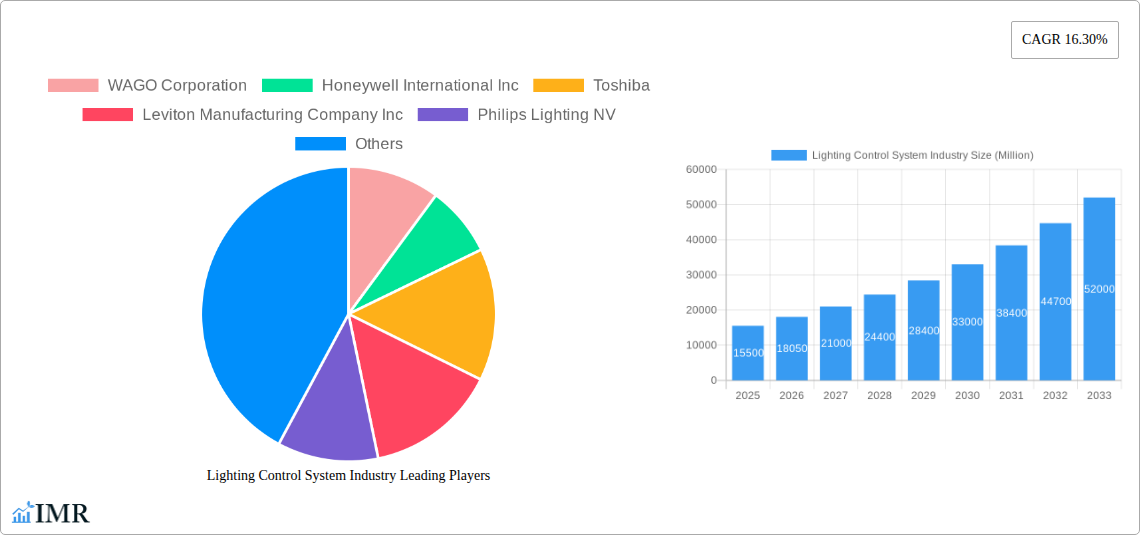

Lighting Control System Industry Company Market Share

Lighting Control System Industry Report: Comprehensive Market Analysis 2019-2033

Unlock unparalleled insights into the dynamic global Lighting Control System Industry with this exhaustive market research report. Spanning the Study Period of 2019–2033, with a Base Year of 2025, this report provides a definitive forecast from 2025–2033, building upon a robust Historical Period of 2019–2024. Delve into the intricate workings of this rapidly evolving sector, encompassing Hardware (LED Drivers, Sensors, Switches and Dimmers, Relay Units, Gateways), Software, and Communication Protocols (Wired, Wireless) across Indoor and Outdoor Applications. Gain a strategic advantage by understanding market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. Quantify growth with precise market size evolution, adoption rates, technological disruptions, and consumer behavior shifts, supported by specific metrics such as CAGR and market penetration. Identify dominant regions, countries, and segments fueling market expansion, driven by economic policies and infrastructure development. Explore the product landscape, detailing innovations, applications, and performance metrics, alongside key drivers, barriers, challenges, emerging opportunities, and growth accelerators. This report features insights from industry giants including WAGO Corporation, Honeywell International Inc, Toshiba, Leviton Manufacturing Company Inc, Philips Lighting NV, Infineon Technologies, Cree Inc, Cisco Systems Inc, Lutron Electronics Co Inc, Schneider Electric, Acuity Brands Inc, Digital Lumens Inc, General Electric Company, Taiwan Semiconductor, and Eaton Corporation PL.

Lighting Control System Industry Market Dynamics & Structure

The Lighting Control System Industry exhibits a moderately concentrated market structure, with key players strategically investing in research and development to fuel technological innovation. Driven by increasing demand for energy efficiency, smart building integration, and occupant comfort, advancements in IoT connectivity, AI-powered analytics, and sophisticated sensor technologies are reshaping the competitive landscape. Regulatory frameworks, particularly those mandating energy conservation and emissions reduction, act as significant drivers for adoption. While established solutions like wired protocols remain prevalent, the burgeoning growth of wireless technologies, such as Zigbee, Bluetooth Mesh, and Wi-Fi, is expanding market accessibility and flexibility. Competitive product substitutes, including basic manual controls, are gradually being phased out in favor of intelligent systems offering enhanced functionality and cost savings over their lifecycle. End-user demographics are shifting towards commercial and industrial sectors seeking operational efficiencies, alongside a growing residential demand for convenience and personalized lighting experiences. Mergers and acquisitions (M&A) are a notable trend, with larger corporations acquiring innovative startups to expand their product portfolios and market reach. For instance, the last five years have seen an estimated 25-30 M&A deals within the smart lighting ecosystem, with an average deal value of $50-100 Million units, signifying consolidation and strategic growth. Innovation barriers include the high cost of initial deployment for some advanced systems and the need for standardization in interoperability across different manufacturers.

Lighting Control System Industry Growth Trends & Insights

The Lighting Control System Industry is poised for significant expansion, driven by an escalating global commitment to sustainability and energy conservation. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 12-15% throughout the forecast period, with the global market size estimated to reach over $35,000 Million units by 2033, up from an estimated $15,000 Million units in 2025. This growth is underpinned by increasing adoption rates of smart lighting solutions across residential, commercial, and industrial applications. Technological disruptions, such as the widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) into lighting control platforms, are enabling predictive maintenance, optimized energy usage, and personalized lighting scenarios. Consumer behavior is shifting demonstrably towards seeking integrated smart home and building solutions, where lighting control plays a pivotal role in enhancing convenience, security, and ambiance. The market penetration of advanced lighting control systems, currently estimated at 25-30% globally, is expected to surge past 60% by 2033, fueled by declining hardware costs and increasing consumer awareness of the long-term economic and environmental benefits. The evolution from basic dimming and on/off functionalities to sophisticated scene setting, daylight harvesting, and occupancy-based control signifies a profound shift in how light is managed. Furthermore, the increasing demand for circadian rhythm lighting in healthcare and educational facilities, alongside the deployment of intelligent street lighting for enhanced public safety and energy savings, are significant growth catalysts. The integration of lighting control systems with other smart building technologies, such as HVAC and security systems, is creating a more holistic and efficient building management ecosystem, further accelerating adoption. The growing awareness of the impact of light on productivity and well-being in workplaces is also a key driver for smart lighting solutions.

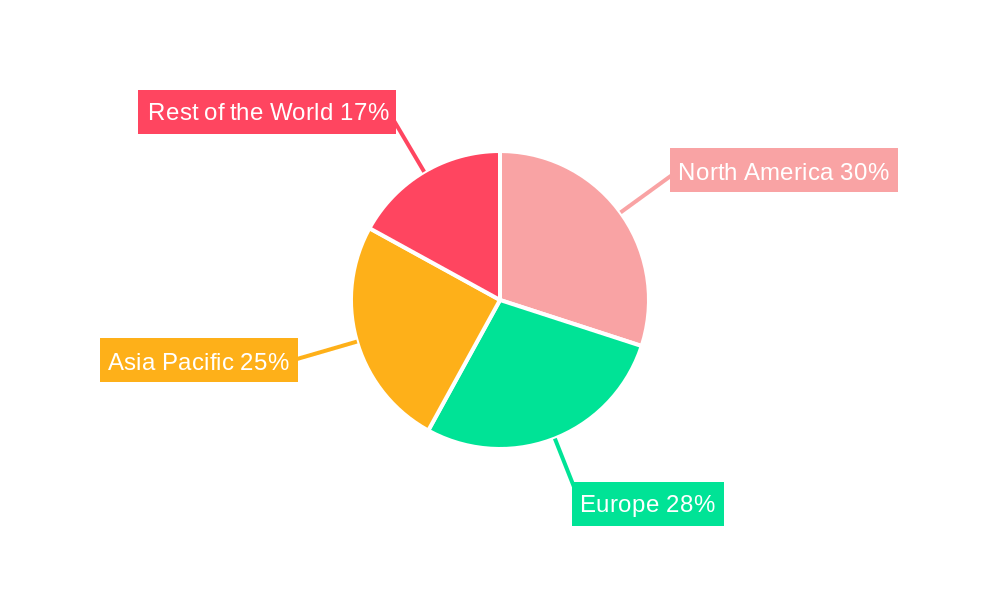

Dominant Regions, Countries, or Segments in Lighting Control System Industry

North America currently dominates the Lighting Control System Industry, driven by a mature market, stringent energy efficiency regulations, and a high prevalence of smart building initiatives. The United States, in particular, is a leading market due to substantial investments in smart city projects and a strong consumer appetite for connected home technologies. The region’s market share is estimated at approximately 30-35% of the global market, valued at around $5,500 Million units in 2025. Key drivers include government incentives for energy-efficient lighting, substantial private sector investments in R&D, and a well-established ecosystem of technology providers and integrators. Infrastructure development, such as the retrofitting of existing commercial buildings with intelligent lighting systems, further bolsters growth.

Within the Type segment, Hardware is the largest contributor, accounting for an estimated 75% of the total market value in 2025, projected to be around $26,250 Million units. LED Drivers and Sensors are particularly significant sub-segments, with their market value expected to reach $7,000 Million units and $6,500 Million units respectively by 2025. The increasing adoption of LED technology as the primary light source necessitates advanced drivers, while sophisticated sensors are crucial for enabling intelligent automation and energy savings.

In terms of Communication Protocol, Wireless solutions are rapidly gaining traction, estimated to capture 55% of the market by 2025, with a market value of $16,500 Million units. The ease of installation, flexibility, and scalability of wireless protocols like Zigbee and Bluetooth Mesh are making them increasingly attractive for both new construction and retrofitting projects.

The Application segment of Indoor lighting control systems commands a larger market share, estimated at 70%, valued at approximately $24,500 Million units in 2025. This dominance is attributed to the extensive use of lighting control in commercial spaces like offices, retail establishments, and hospitality venues, where energy savings, occupant comfort, and operational efficiency are paramount.

Lighting Control System Industry Product Landscape

The product landscape of the Lighting Control System Industry is characterized by a rapid influx of innovative solutions designed to enhance energy efficiency, user experience, and connectivity. Key product advancements include sophisticated AI-driven sensors capable of learning occupant behavior and optimizing lighting accordingly, and highly integrated LED drivers that offer precise dimming and color tuning capabilities. Smart switches and dimmers are evolving to support a wider range of wireless communication protocols, enabling seamless integration into smart home and building ecosystems. Relay units are becoming more compact and energy-efficient, while gateways are increasingly powerful, supporting multiple protocols and cloud connectivity for remote monitoring and management. Unique selling propositions often revolve around interoperability, ease of installation, advanced analytics, and robust security features, ensuring a competitive edge in a discerning market.

Key Drivers, Barriers & Challenges in Lighting Control System Industry

Key Drivers: The primary forces propelling the Lighting Control System Industry include the global imperative for energy efficiency and sustainability, driven by escalating energy costs and environmental concerns. Government regulations and mandates promoting energy conservation are significant catalysts. The burgeoning adoption of the Internet of Things (IoT) and the rise of smart buildings, where lighting control is a foundational component, are further accelerating market growth. Technological advancements in LED lighting, coupled with decreasing costs of sensors and control electronics, are making these systems more accessible and attractive.

Barriers & Challenges: Significant challenges facing the industry include the initial cost of deploying advanced lighting control systems, which can be a deterrent for some smaller businesses or budget-conscious consumers. The complexity of integration with existing infrastructure and the need for skilled technicians for installation and maintenance can also pose hurdles. Furthermore, cybersecurity concerns related to connected lighting systems require robust solutions to ensure data privacy and system integrity. Supply chain disruptions and component shortages, as witnessed in recent years, can impact production and lead times. Competitive pressures from a growing number of market players also necessitate continuous innovation and competitive pricing strategies.

Emerging Opportunities in Lighting Control System Industry

Emerging opportunities in the Lighting Control System Industry lie in the untapped potential of the retrofitting market for older commercial buildings, where significant energy savings can be achieved. The increasing demand for human-centric lighting solutions, designed to mimic natural daylight patterns and improve occupant well-being, presents a growing niche. The integration of lighting control with other smart building systems, such as security and HVAC, to create comprehensive smart environments, offers substantial cross-selling opportunities. Furthermore, the development of localized, low-power wireless communication technologies tailored for specific applications, like smart agriculture or industrial automation, represents an evolving consumer preference and a pathway for market expansion.

Growth Accelerators in the Lighting Control System Industry Industry

The Lighting Control System Industry is experiencing accelerated growth fueled by transformative technological breakthroughs and strategic market expansion initiatives. The widespread integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into lighting control platforms is a key accelerator, enabling predictive analytics, intelligent automation, and personalized lighting experiences that go beyond basic energy savings. Strategic partnerships between lighting manufacturers, technology providers, and building management system (BMS) companies are fostering greater interoperability and creating comprehensive smart building solutions. Market expansion into developing economies, driven by government initiatives promoting energy efficiency and smart city development, is opening up new revenue streams and driving global adoption. The increasing focus on the impact of lighting on health and productivity in commercial and educational environments is also a significant growth catalyst.

Key Players Shaping the Lighting Control System Industry Market

- WAGO Corporation

- Honeywell International Inc

- Toshiba

- Leviton Manufacturing Company Inc

- Philips Lighting NV

- Infineon Technologies

- Cree Inc

- Cisco Systems Inc

- Lutron Electronics Co Inc

- Schneider Electric

- Acuity Brands Inc

- Digital Lumens Inc

- General Electric Company

- Taiwan Semiconductor

- Eaton Corporation PL

Notable Milestones in Lighting Control System Industry Sector

- 2019: Introduction of advanced AI-powered lighting control algorithms for predictive energy management by leading technology firms.

- 2020: Widespread adoption of Zigbee 3.0 for enhanced interoperability in smart lighting ecosystems.

- 2021: Significant increase in M&A activities, with several acquisitions of smaller, innovative smart lighting startups by major industry players.

- 2022: Launch of new Bluetooth Mesh-enabled lighting control solutions offering greater flexibility and scalability for commercial applications.

- 2023: Growing emphasis on cybersecurity features within lighting control systems in response to increasing IoT threats.

- 2024: Advancements in human-centric lighting technologies, integrating tunable white and color-changing capabilities for enhanced well-being in workspaces.

In-Depth Lighting Control System Industry Market Outlook

The outlook for the Lighting Control System Industry remains exceptionally promising, driven by a confluence of technological innovation, policy support, and evolving market demands. The continued integration of AI and IoT will unlock unprecedented levels of automation and efficiency, transforming lighting from a passive utility to an active contributor to intelligent building operations. Growth accelerators such as strategic alliances, the expanding smart city infrastructure, and the increasing consumer preference for integrated smart home solutions will further propel market expansion. Untapped markets in developing regions, coupled with the growing demand for specialized lighting control applications in sectors like healthcare and agriculture, present significant long-term opportunities. The industry is well-positioned for sustained growth, with companies that prioritize innovation, interoperability, and cybersecurity poised to lead the market.

Lighting Control System Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. LED Drivers

- 1.1.2. Sensors

- 1.1.3. Switches and Dimmers

- 1.1.4. Relay Units

- 1.1.5. Gateways

- 1.2. Software

-

1.1. Hardware

-

2. Communication Protocol

- 2.1. Wired

- 2.2. Wireless

-

3. Application

- 3.1. Indoor

- 3.2. Outdoor

Lighting Control System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Lighting Control System Industry Regional Market Share

Geographic Coverage of Lighting Control System Industry

Lighting Control System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand For Energy-efficient Lighting Systems; Growing Modernization And Infrastructural Development

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Installation

- 3.4. Market Trends

- 3.4.1. Smart City Development Initiatives to Drive the market for Smart Lighting

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lighting Control System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. LED Drivers

- 5.1.1.2. Sensors

- 5.1.1.3. Switches and Dimmers

- 5.1.1.4. Relay Units

- 5.1.1.5. Gateways

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Lighting Control System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. LED Drivers

- 6.1.1.2. Sensors

- 6.1.1.3. Switches and Dimmers

- 6.1.1.4. Relay Units

- 6.1.1.5. Gateways

- 6.1.2. Software

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Indoor

- 6.3.2. Outdoor

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Lighting Control System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. LED Drivers

- 7.1.1.2. Sensors

- 7.1.1.3. Switches and Dimmers

- 7.1.1.4. Relay Units

- 7.1.1.5. Gateways

- 7.1.2. Software

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Indoor

- 7.3.2. Outdoor

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Lighting Control System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. LED Drivers

- 8.1.1.2. Sensors

- 8.1.1.3. Switches and Dimmers

- 8.1.1.4. Relay Units

- 8.1.1.5. Gateways

- 8.1.2. Software

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Indoor

- 8.3.2. Outdoor

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Lighting Control System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. LED Drivers

- 9.1.1.2. Sensors

- 9.1.1.3. Switches and Dimmers

- 9.1.1.4. Relay Units

- 9.1.1.5. Gateways

- 9.1.2. Software

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Communication Protocol

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Indoor

- 9.3.2. Outdoor

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 WAGO Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Leviton Manufacturing Company Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Philips Lighting NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Infineon Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cree Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Systems Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Lutron Electronics Co Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Schneider Electric

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Acuity Brands Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Digital Lumens Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 General Electric Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Taiwan Semiconductor

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Eaton Corporation PL

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 WAGO Corporation

List of Figures

- Figure 1: Global Lighting Control System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Lighting Control System Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Lighting Control System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Lighting Control System Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 5: North America Lighting Control System Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 6: North America Lighting Control System Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Lighting Control System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Lighting Control System Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Lighting Control System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Lighting Control System Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Lighting Control System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Lighting Control System Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 13: Europe Lighting Control System Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 14: Europe Lighting Control System Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Lighting Control System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Lighting Control System Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Lighting Control System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Lighting Control System Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Lighting Control System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Lighting Control System Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 21: Asia Pacific Lighting Control System Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 22: Asia Pacific Lighting Control System Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Lighting Control System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Lighting Control System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Lighting Control System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Lighting Control System Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Lighting Control System Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Lighting Control System Industry Revenue (Million), by Communication Protocol 2025 & 2033

- Figure 29: Rest of the World Lighting Control System Industry Revenue Share (%), by Communication Protocol 2025 & 2033

- Figure 30: Rest of the World Lighting Control System Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Lighting Control System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Lighting Control System Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Lighting Control System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lighting Control System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Lighting Control System Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 3: Global Lighting Control System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Lighting Control System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Lighting Control System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Lighting Control System Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 7: Global Lighting Control System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Lighting Control System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Lighting Control System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Lighting Control System Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 13: Global Lighting Control System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Lighting Control System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Lighting Control System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Lighting Control System Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 23: Global Lighting Control System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Lighting Control System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Lighting Control System Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Lighting Control System Industry Revenue Million Forecast, by Communication Protocol 2020 & 2033

- Table 32: Global Lighting Control System Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global Lighting Control System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Latin America Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East Lighting Control System Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lighting Control System Industry?

The projected CAGR is approximately 16.30%.

2. Which companies are prominent players in the Lighting Control System Industry?

Key companies in the market include WAGO Corporation, Honeywell International Inc, Toshiba, Leviton Manufacturing Company Inc, Philips Lighting NV, Infineon Technologies, Cree Inc, Cisco Systems Inc, Lutron Electronics Co Inc, Schneider Electric, Acuity Brands Inc, Digital Lumens Inc, General Electric Company, Taiwan Semiconductor, Eaton Corporation PL.

3. What are the main segments of the Lighting Control System Industry?

The market segments include Type, Communication Protocol, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.06 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand For Energy-efficient Lighting Systems; Growing Modernization And Infrastructural Development.

6. What are the notable trends driving market growth?

Smart City Development Initiatives to Drive the market for Smart Lighting.

7. Are there any restraints impacting market growth?

; High Cost of Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lighting Control System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lighting Control System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lighting Control System Industry?

To stay informed about further developments, trends, and reports in the Lighting Control System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence