Key Insights

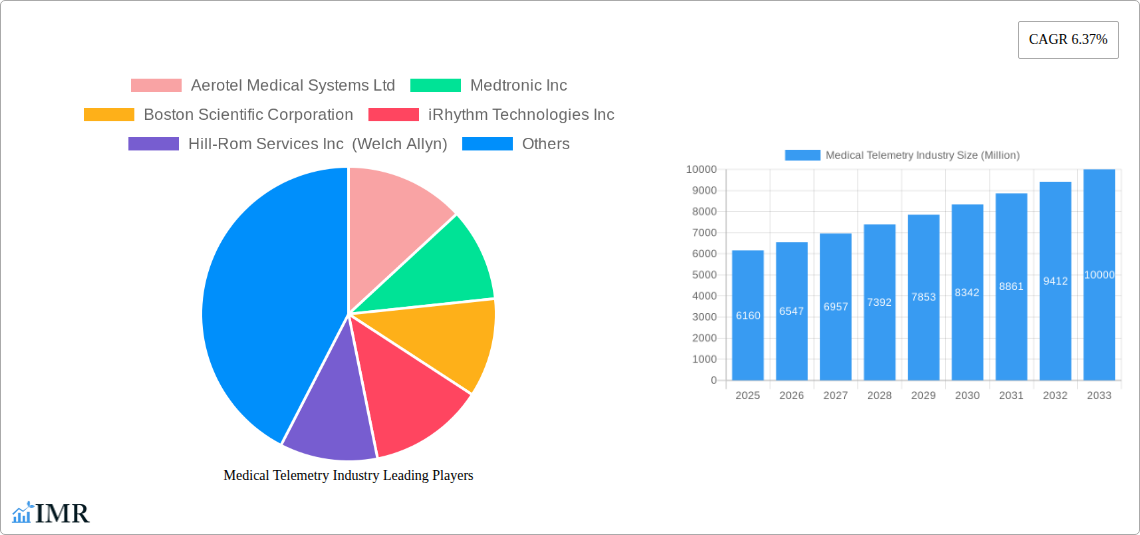

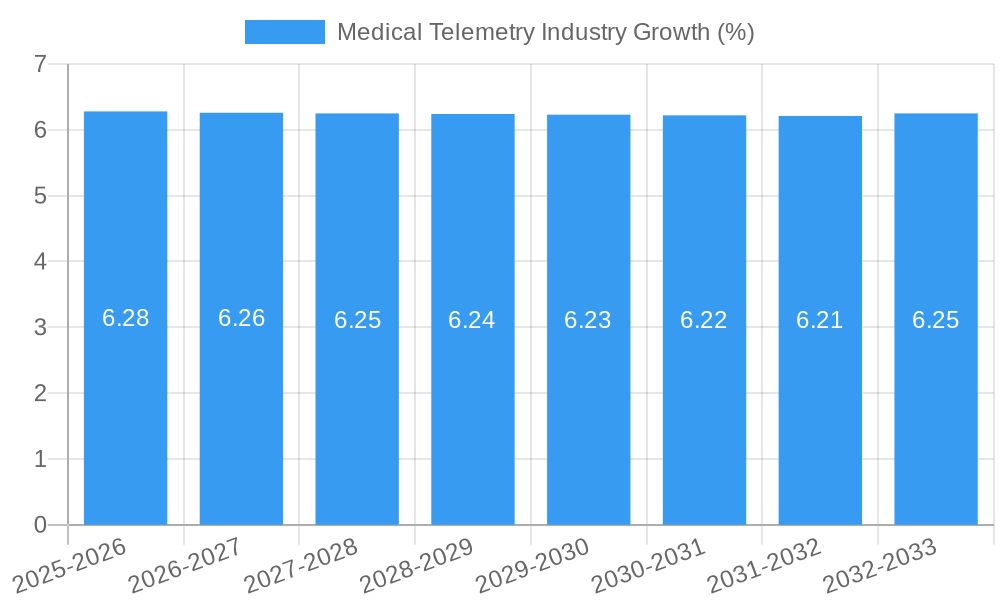

The global Medical Telemetry market is poised for substantial growth, currently valued at an estimated $6.16 billion and projected to expand at a robust Compound Annual Growth Rate (CAGR) of 6.37% through 2033. This upward trajectory is primarily fueled by an increasing prevalence of cardiovascular diseases, such as arrhythmias and myocardial ischemia, which necessitate continuous patient monitoring. The growing adoption of remote patient monitoring (RPM) solutions, driven by their ability to improve patient outcomes, reduce healthcare costs, and enhance convenience for both patients and providers, is a significant market driver. Furthermore, technological advancements in wearable sensors and sophisticated data analytics are enabling more accurate and reliable transmission of physiological data, further bolstering market expansion. The shift towards value-based healthcare models also incentivizes the use of medical telemetry for proactive disease management and preventative care.

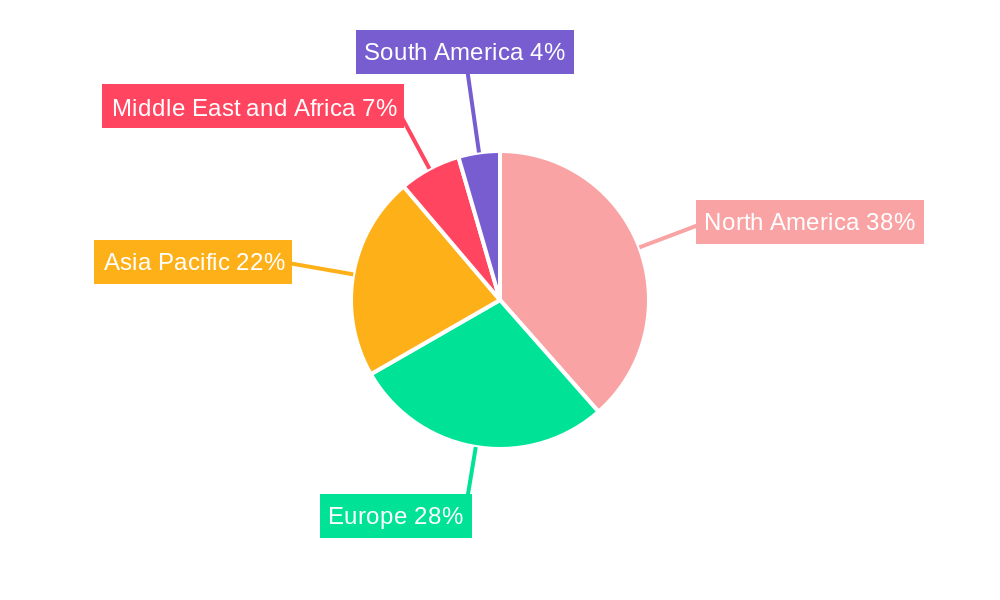

The market is segmented into distinct product categories, with Event Monitoring and Mobile Cardiac Telemetry leading in adoption due to their versatility in diagnosing intermittent cardiac issues. Implantable Loop Recorders also represent a crucial segment for long-term monitoring of unexplained syncope and arrhythmias. On the application front, the management of Arrhythmias remains the dominant segment, directly correlating with the rising incidence of cardiac rhythm disorders. Myocardial Ischemia and Infarction monitoring is another critical application area. Geographically, North America is expected to maintain its leadership position, driven by high healthcare expenditure, early adoption of advanced medical technologies, and a strong regulatory framework supporting RPM. Asia Pacific, however, is anticipated to exhibit the fastest growth, fueled by increasing healthcare infrastructure development, a growing patient population, and rising awareness of cardiac health. Key players like Medtronic, Boston Scientific, iRhythm Technologies, and Philips Healthcare are actively innovating and expanding their offerings to capture this expanding market.

Comprehensive Medical Telemetry Market Report: Insights, Trends, and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Medical Telemetry market, offering critical insights into market dynamics, growth trajectories, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. Leveraging high-traffic keywords such as "remote patient monitoring," "cardiac telemetry," "wearable medical devices," and "digital health," this report is optimized for maximum search engine visibility and is essential for industry professionals, investors, and stakeholders seeking a thorough understanding of this rapidly evolving sector. The analysis encompasses a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. All values are presented in Million units.

Medical Telemetry Industry Market Dynamics & Structure

The medical telemetry market is characterized by a moderately concentrated structure, driven by a blend of established giants and innovative startups. Technological innovation is the primary engine of growth, with advancements in AI, IoT, and miniaturization enabling more sophisticated and accessible remote patient monitoring solutions. Regulatory frameworks, particularly those from the FDA and EMA, play a crucial role in shaping product development and market entry, ensuring patient safety and data integrity. Competitive product substitutes, while emerging in the broader digital health space, are largely addressed by the specialized nature of medical-grade telemetry. End-user demographics are shifting towards an aging global population with increasing prevalence of chronic conditions, boosting demand for continuous health monitoring. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring innovative startups to expand their portfolios and market reach. For instance, XX M&A deals were observed in the historical period (2019-2024).

- Key Dynamics:

- Technological advancements in AI and IoT driving product innovation.

- Stringent regulatory approval processes influencing market accessibility.

- Growing demand from aging populations and individuals with chronic diseases.

- Strategic M&A activities consolidating market share and capabilities.

- High barriers to entry due to regulatory compliance and R&D investments.

Medical Telemetry Industry Growth Trends & Insights

The medical telemetry market is poised for robust growth, projected to expand from an estimated XX Million units in 2025 to XX Million units by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period. This expansion is fueled by an increasing adoption rate of remote patient monitoring (RPM) solutions across diverse healthcare settings, from hospitals to home care. Technological disruptions, such as the integration of machine learning for predictive analytics and the development of more sophisticated wearable sensors, are significantly enhancing the capabilities of medical telemetry devices. Consumer behavior is also shifting, with a greater acceptance of and demand for personalized health management tools and convenient, continuous monitoring options. The market penetration of medical telemetry is expected to rise significantly as healthcare providers recognize its potential to improve patient outcomes, reduce hospital readmissions, and enhance operational efficiency. The global patient population benefiting from remote telemetry is projected to reach XX Million individuals by 2033.

- Market Size Evolution:

- Projected market size of XX Million units in 2025, growing to XX Million units by 2033.

- Expected CAGR of XX% during the forecast period.

- Adoption Rates:

- Increasing adoption across hospitals, clinics, and home healthcare.

- Growing preference for continuous monitoring over episodic diagnostics.

- Technological Disruptions:

- Integration of AI and machine learning for predictive diagnostics.

- Advancements in sensor technology for enhanced accuracy and multi-parameter monitoring.

- Development of secure and interoperable cloud platforms for data management.

- Consumer Behavior Shifts:

- Rising demand for personalized health and wellness solutions.

- Greater comfort with wearable technology for health tracking.

- Preference for convenient and accessible healthcare delivery models.

- Market Penetration:

- Projected increase in market penetration driven by cost-effectiveness and improved patient outcomes.

- Expansion into emerging markets with growing healthcare infrastructure.

Dominant Regions, Countries, or Segments in Medical Telemetry Industry

North America currently dominates the medical telemetry market, driven by a well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and significant government initiatives promoting digital health solutions. The United States, in particular, stands out due to a large patient pool with chronic conditions like arrhythmias and a favorable reimbursement landscape for remote patient monitoring services. The Product segment of Event Monitoring and Mobile Cardiac Telemetry is the primary growth driver, accounting for an estimated XX% market share in 2025. This segment's dominance is attributed to its wide applicability in diagnosing and managing cardiac arrhythmias, a prevalent health concern.

- Leading Region: North America

- Key Country: United States

- Dominance Factors:

- Advanced healthcare infrastructure and high technological adoption.

- Strong reimbursement policies for remote patient monitoring.

- High prevalence of cardiovascular diseases.

- Government initiatives supporting digital health and telehealth.

- Dominant Product Segment: Event Monitoring and Mobile Cardiac Telemetry (MCT)

- Market Share (2025): XX%

- Key Drivers:

- Critical for diagnosing and managing intermittent cardiac arrhythmias.

- Increasing demand for continuous and ambulatory cardiac monitoring.

- Technological advancements enabling longer monitoring periods and higher accuracy.

- Dominant Application Segment: Arrhythmias

- Market Share (2025): XX%

- Key Drivers:

- High incidence and prevalence of various types of arrhythmias globally.

- Need for accurate and timely diagnosis to prevent serious complications.

- Effectiveness of telemetry in detecting asymptomatic or paroxysmal arrhythmias.

Medical Telemetry Industry Product Landscape

The medical telemetry product landscape is marked by continuous innovation, focusing on enhanced accuracy, patient comfort, and data utility. Event Monitoring and Mobile Cardiac Telemetry devices, exemplified by smart patches like the SmartCardia 7L patch, offer multi-lead ECG capabilities with integrated sensors for vital signs such as heart rate, respiration, and SpO2. Implantable Loop Recorders (ILRs) provide long-term, continuous monitoring for patients with suspected arrhythmias. The "Other Products" category encompasses a range of devices including Holter monitors and wearable patches with advanced AI capabilities for predictive insights. These innovations are transforming patient care by enabling proactive interventions and personalized treatment plans.

Key Drivers, Barriers & Challenges in Medical Telemetry Industry

Key Drivers:

- Technological Advancements: AI integration, miniaturization, and IoT connectivity are enhancing device capabilities and user experience.

- Rising Prevalence of Chronic Diseases: The increasing incidence of cardiovascular diseases and other chronic conditions drives the demand for continuous monitoring.

- Government Initiatives & Reimbursement Policies: Favorable policies promoting telehealth and remote patient monitoring accelerate market adoption.

- Aging Global Population: A growing elderly demographic with higher healthcare needs fuels the demand for remote monitoring solutions.

Key Barriers & Challenges:

- Data Security & Privacy Concerns: Ensuring the secure transmission and storage of sensitive patient data is paramount and presents a significant hurdle.

- Regulatory Compliance: Navigating complex and evolving regulatory landscapes across different regions requires substantial investment and expertise.

- Interoperability Issues: Lack of standardized data formats and seamless integration with existing EMR/EHR systems can hinder widespread adoption.

- Initial Cost of Implementation: While offering long-term cost savings, the upfront investment in telemetry devices and infrastructure can be a barrier for some healthcare providers.

- Physician Adoption and Training: Ensuring healthcare professionals are adequately trained and comfortable using telemetry data for clinical decision-making is crucial.

Emerging Opportunities in Medical Telemetry Industry

Emerging opportunities in the medical telemetry market lie in the expansion of wearable medical devices into preventative health and wellness. The integration of advanced AI algorithms for predictive diagnostics of conditions beyond arrhythmias, such as early detection of respiratory distress or sleep apnea, presents a significant growth avenue. Furthermore, the development of disposable, single-use telemetry patches could cater to specific acute care needs and reduce infection risks. Untapped markets in developing economies with growing healthcare needs and increasing mobile penetration also represent substantial opportunities for market expansion. The increasing focus on personalized medicine will drive demand for telemetry solutions that can provide highly individualized health insights.

Growth Accelerators in the Medical Telemetry Industry Industry

Several catalysts are accelerating the growth of the medical telemetry industry. Technological breakthroughs, particularly in wireless communication, miniaturized sensors, and artificial intelligence, are continuously enhancing device functionality and user experience. Strategic partnerships between medical device manufacturers, software providers, and healthcare institutions are crucial for developing integrated solutions and expanding market reach. Market expansion strategies, including entry into new geographical regions and the development of specialized telemetry solutions for niche applications, are also significant growth drivers. The increasing evidence supporting the clinical and economic benefits of remote patient monitoring, highlighted by numerous studies and successful pilot programs, is further bolstering market confidence and investment.

Key Players Shaping the Medical Telemetry Industry Market

- Aerotel Medical Systems Ltd

- Medtronic Inc

- Boston Scientific Corporation

- iRhythm Technologies Inc

- Hill-Rom Services Inc (Welch Allyn)

- BioTelemetry Inc

- Medicalgorithmics SA

- Preventice Solutions Inc

- Philips Healthcare

- BIOTRONIK

- GE Healthcare (GE Company)

- Nihon Kohden Corporation

Notable Milestones in Medical Telemetry Industry Sector

- August 2022: SmartCardia launched the 7L patch, their 7-lead cardiac monitoring patch, which combines medical wearable technology with AI to provide predictive and personalized patient insights through remote monitoring in India. The SmartCardia measures seven lead electrocardiograms (ECG), heart rate, pulse rate, respiration rate, oxygen saturation (SpO2), skin temperature, activity, and posture from a single miniaturized unit at clinical accuracy.

- April 2022: B-Secur launched the next-generation ECG cloud-based platform for use across Holter monitors, wearables, and implantable devices.

In-Depth Medical Telemetry Industry Market Outlook

The medical telemetry industry is set for a period of sustained and accelerated growth. The outlook is shaped by the increasing integration of advanced analytics and AI, leading to more predictive and proactive healthcare interventions. The expansion of remote patient monitoring beyond cardiovascular applications into areas like chronic respiratory disease management and post-operative care presents vast untapped potential. Strategic collaborations and the development of robust cloud-based platforms will be pivotal in ensuring seamless data flow and enhanced interoperability. As healthcare systems globally prioritize efficiency, cost-effectiveness, and improved patient outcomes, the adoption of medical telemetry solutions is expected to become a standard of care, driving significant market expansion and innovation in the coming years.

Medical Telemetry Industry Segmentation

-

1. Product

- 1.1. Event Monitoring and Mobile Cardiac Telemetry

- 1.2. Implantable Loop Recorders

- 1.3. Other Products

-

2. Application

- 2.1. Arrhythmias

- 2.2. Myocardial Ischemia and Infarction

- 2.3. Pacemaker Monitoring

- 2.4. Other Applications

Medical Telemetry Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Telemetry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence and Incidence of Cardiovascular Diseases; Growing Geriatric Population; Technological Advancements in Remote Monitoring Technologies

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices; Complex Reimbursement Policies

- 3.4. Market Trends

- 3.4.1. The Implantable Loop Recorder Segment is Expected to Hold a Major Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 5.1.2. Implantable Loop Recorders

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Arrhythmias

- 5.2.2. Myocardial Ischemia and Infarction

- 5.2.3. Pacemaker Monitoring

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 6.1.2. Implantable Loop Recorders

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Arrhythmias

- 6.2.2. Myocardial Ischemia and Infarction

- 6.2.3. Pacemaker Monitoring

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 7.1.2. Implantable Loop Recorders

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Arrhythmias

- 7.2.2. Myocardial Ischemia and Infarction

- 7.2.3. Pacemaker Monitoring

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 8.1.2. Implantable Loop Recorders

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Arrhythmias

- 8.2.2. Myocardial Ischemia and Infarction

- 8.2.3. Pacemaker Monitoring

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 9.1.2. Implantable Loop Recorders

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Arrhythmias

- 9.2.2. Myocardial Ischemia and Infarction

- 9.2.3. Pacemaker Monitoring

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Event Monitoring and Mobile Cardiac Telemetry

- 10.1.2. Implantable Loop Recorders

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Arrhythmias

- 10.2.2. Myocardial Ischemia and Infarction

- 10.2.3. Pacemaker Monitoring

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Medical Telemetry Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Aerotel Medical Systems Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Medtronic Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Boston Scientific Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 iRhythm Technologies Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hill-Rom Services Inc (Welch Allyn)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 BioTelemetry Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Medicalgorithmics SA

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Preventice Solutions Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Philips Healthcare

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BIOTRONIK

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 GE Healthcare (GE Company)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Nihon Kohden Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Aerotel Medical Systems Ltd

List of Figures

- Figure 1: Global Medical Telemetry Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Medical Telemetry Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Medical Telemetry Industry Revenue (Million), by Product 2024 & 2032

- Figure 24: North America Medical Telemetry Industry Volume (K Unit), by Product 2024 & 2032

- Figure 25: North America Medical Telemetry Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: North America Medical Telemetry Industry Volume Share (%), by Product 2024 & 2032

- Figure 27: North America Medical Telemetry Industry Revenue (Million), by Application 2024 & 2032

- Figure 28: North America Medical Telemetry Industry Volume (K Unit), by Application 2024 & 2032

- Figure 29: North America Medical Telemetry Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America Medical Telemetry Industry Volume Share (%), by Application 2024 & 2032

- Figure 31: North America Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Medical Telemetry Industry Revenue (Million), by Product 2024 & 2032

- Figure 36: Europe Medical Telemetry Industry Volume (K Unit), by Product 2024 & 2032

- Figure 37: Europe Medical Telemetry Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Europe Medical Telemetry Industry Volume Share (%), by Product 2024 & 2032

- Figure 39: Europe Medical Telemetry Industry Revenue (Million), by Application 2024 & 2032

- Figure 40: Europe Medical Telemetry Industry Volume (K Unit), by Application 2024 & 2032

- Figure 41: Europe Medical Telemetry Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Europe Medical Telemetry Industry Volume Share (%), by Application 2024 & 2032

- Figure 43: Europe Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Pacific Medical Telemetry Industry Revenue (Million), by Product 2024 & 2032

- Figure 48: Asia Pacific Medical Telemetry Industry Volume (K Unit), by Product 2024 & 2032

- Figure 49: Asia Pacific Medical Telemetry Industry Revenue Share (%), by Product 2024 & 2032

- Figure 50: Asia Pacific Medical Telemetry Industry Volume Share (%), by Product 2024 & 2032

- Figure 51: Asia Pacific Medical Telemetry Industry Revenue (Million), by Application 2024 & 2032

- Figure 52: Asia Pacific Medical Telemetry Industry Volume (K Unit), by Application 2024 & 2032

- Figure 53: Asia Pacific Medical Telemetry Industry Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Medical Telemetry Industry Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Pacific Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Pacific Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Medical Telemetry Industry Revenue (Million), by Product 2024 & 2032

- Figure 60: Middle East and Africa Medical Telemetry Industry Volume (K Unit), by Product 2024 & 2032

- Figure 61: Middle East and Africa Medical Telemetry Industry Revenue Share (%), by Product 2024 & 2032

- Figure 62: Middle East and Africa Medical Telemetry Industry Volume Share (%), by Product 2024 & 2032

- Figure 63: Middle East and Africa Medical Telemetry Industry Revenue (Million), by Application 2024 & 2032

- Figure 64: Middle East and Africa Medical Telemetry Industry Volume (K Unit), by Application 2024 & 2032

- Figure 65: Middle East and Africa Medical Telemetry Industry Revenue Share (%), by Application 2024 & 2032

- Figure 66: Middle East and Africa Medical Telemetry Industry Volume Share (%), by Application 2024 & 2032

- Figure 67: Middle East and Africa Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Middle East and Africa Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 69: Middle East and Africa Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Middle East and Africa Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: South America Medical Telemetry Industry Revenue (Million), by Product 2024 & 2032

- Figure 72: South America Medical Telemetry Industry Volume (K Unit), by Product 2024 & 2032

- Figure 73: South America Medical Telemetry Industry Revenue Share (%), by Product 2024 & 2032

- Figure 74: South America Medical Telemetry Industry Volume Share (%), by Product 2024 & 2032

- Figure 75: South America Medical Telemetry Industry Revenue (Million), by Application 2024 & 2032

- Figure 76: South America Medical Telemetry Industry Volume (K Unit), by Application 2024 & 2032

- Figure 77: South America Medical Telemetry Industry Revenue Share (%), by Application 2024 & 2032

- Figure 78: South America Medical Telemetry Industry Volume Share (%), by Application 2024 & 2032

- Figure 79: South America Medical Telemetry Industry Revenue (Million), by Country 2024 & 2032

- Figure 80: South America Medical Telemetry Industry Volume (K Unit), by Country 2024 & 2032

- Figure 81: South America Medical Telemetry Industry Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Medical Telemetry Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Telemetry Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Telemetry Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global Medical Telemetry Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Medical Telemetry Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Germany Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: France Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Italy Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Italy Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: China Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: South Korea Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Korea Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: GCC Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: GCC Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: South Africa Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Africa Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Rest of Middle East and Africa Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Brazil Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Brazil Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Argentina Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Argentina Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of South America Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 62: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 63: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 65: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: United States Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: United States Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Canada Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Canada Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Mexico Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Mexico Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 74: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 75: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 76: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 77: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 79: Germany Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Germany Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: United Kingdom Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: United Kingdom Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: France Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: France Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: Italy Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Italy Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Spain Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Spain Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Rest of Europe Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Rest of Europe Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 92: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 93: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 94: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 95: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: China Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: China Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Japan Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Japan Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: India Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: India Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 103: Australia Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Australia Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 105: South Korea Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 106: South Korea Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 107: Rest of Asia Pacific Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: Rest of Asia Pacific Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 109: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 110: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 111: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 112: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 113: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 114: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 115: GCC Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: GCC Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 117: South Africa Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: South Africa Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 119: Rest of Middle East and Africa Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Rest of Middle East and Africa Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 121: Global Medical Telemetry Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 122: Global Medical Telemetry Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 123: Global Medical Telemetry Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 124: Global Medical Telemetry Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 125: Global Medical Telemetry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 126: Global Medical Telemetry Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 127: Brazil Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: Brazil Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 129: Argentina Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: Argentina Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Rest of South America Medical Telemetry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of South America Medical Telemetry Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Telemetry Industry?

The projected CAGR is approximately 6.37%.

2. Which companies are prominent players in the Medical Telemetry Industry?

Key companies in the market include Aerotel Medical Systems Ltd, Medtronic Inc, Boston Scientific Corporation, iRhythm Technologies Inc, Hill-Rom Services Inc (Welch Allyn), BioTelemetry Inc, Medicalgorithmics SA, Preventice Solutions Inc, Philips Healthcare, BIOTRONIK, GE Healthcare (GE Company), Nihon Kohden Corporation.

3. What are the main segments of the Medical Telemetry Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence and Incidence of Cardiovascular Diseases; Growing Geriatric Population; Technological Advancements in Remote Monitoring Technologies.

6. What are the notable trends driving market growth?

The Implantable Loop Recorder Segment is Expected to Hold a Major Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices; Complex Reimbursement Policies.

8. Can you provide examples of recent developments in the market?

August 2022: SmartCardia launched the 7L patch, their 7-lead cardiac monitoring patch, which combines medical wearable technology with AI to provide predictive and personalized patient insights through remote monitoring in India. The SmartCardia measures seven lead electrocardiograms (ECG), heart rate, pulse rate, respiration rate, oxygen saturation (SpO2), skin temperature, activity, and posture from a single miniaturized unit at clinical accuracy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Telemetry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Telemetry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Telemetry Industry?

To stay informed about further developments, trends, and reports in the Medical Telemetry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence