Key Insights

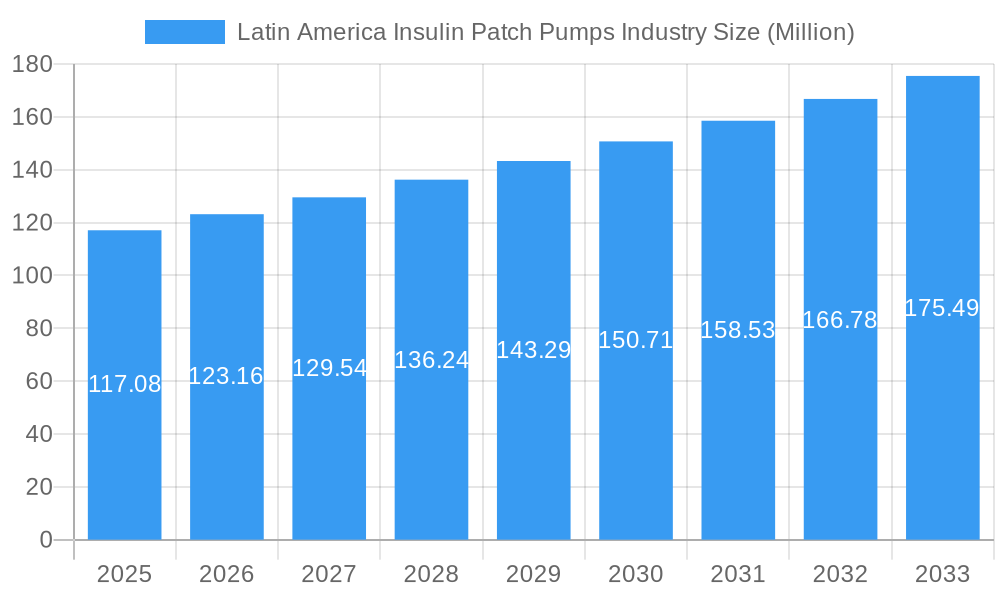

The Latin America Insulin Patch Pump market is poised for substantial expansion, projected to reach an estimated $117.08 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This growth is primarily fueled by the increasing prevalence of diabetes across the region, a growing awareness of advanced diabetes management solutions, and favorable reimbursement policies in key markets like Brazil and Mexico. The shift towards less invasive and more convenient insulin delivery systems, such as patch pumps, is a significant driver, offering patients greater mobility and improved quality of life compared to traditional insulin injections. Technological advancements, including the integration of continuous glucose monitoring (CGM) with insulin patch pumps, are further enhancing their appeal and effectiveness, leading to better glycemic control and reduced complications.

Latin America Insulin Patch Pumps Industry Market Size (In Million)

Despite the promising outlook, the market faces certain restraints. The high initial cost of these advanced devices can be a barrier to adoption for a significant portion of the population, particularly in regions with lower disposable incomes. Limited awareness and understanding of patch pump technology among both patients and healthcare providers in some areas also pose a challenge. However, as economies of scale are achieved and manufacturers focus on developing more affordable options, these restraints are expected to diminish. The market is segmented into key components: Insulin Pump Monitors, Insulin Infusion Pumps, and Reservoirs. Geographically, Mexico and Brazil are expected to lead the market, followed by the Rest of Latin America, driven by targeted initiatives and growing healthcare infrastructure. Key industry players like Roche, Insulet, Ypsomed, and Medtronic are actively investing in research and development and expanding their presence in this dynamic region.

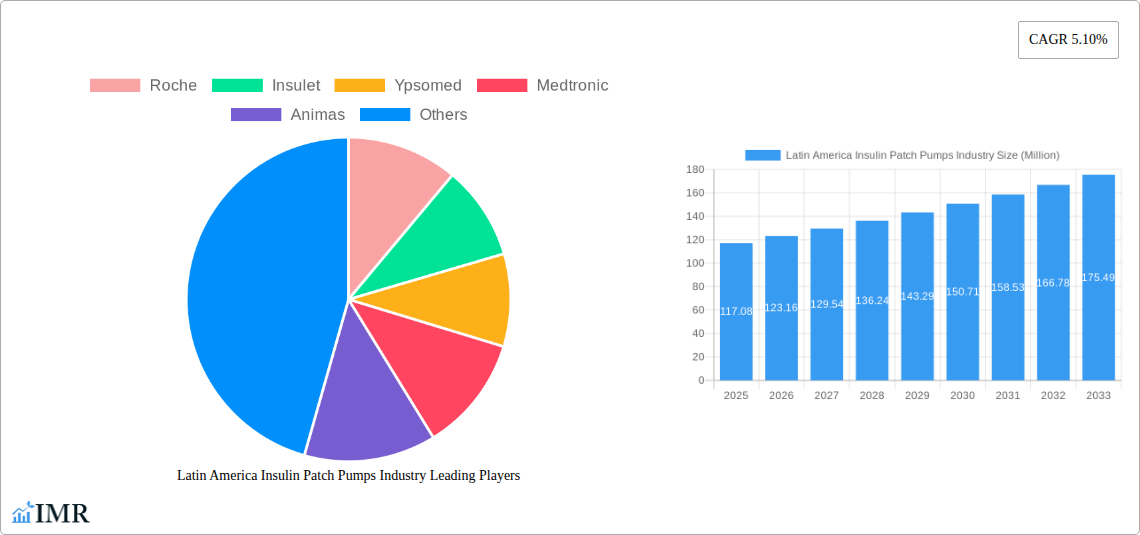

Latin America Insulin Patch Pumps Industry Company Market Share

Latin America Insulin Patch Pumps Industry Market Dynamics & Structure

The Latin America insulin patch pump market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and increasing patient demand. Market concentration is moderate, with key players such as Roche, Insulet, Ypsomed, Medtronic, Animas, and Tandem Diabetes Care vying for significant market share. Technological innovation is a primary driver, with continuous development in miniaturization, connectivity, and automated insulin delivery systems aimed at enhancing patient convenience and glycemic control. Regulatory frameworks across Latin American countries are gradually aligning with global standards, fostering market entry for innovative devices but also posing compliance challenges. Competitive product substitutes, including traditional insulin pens and syringes, remain prevalent, necessitating clear value propositions for patch pumps. End-user demographics are shifting towards a younger, tech-savvy population with type 1 and type 2 diabetes seeking more integrated diabetes management solutions. Mergers and acquisitions (M&A) trends are present, though less pronounced than in developed markets, indicating potential for consolidation as the market matures.

- Market Concentration: Moderate, with a few key global players holding substantial influence.

- Technological Innovation: Driven by miniaturization, Bluetooth connectivity, automated insulin delivery, and smartphone integration.

- Regulatory Frameworks: Maturing, with increasing adoption of international standards, impacting market access and product approvals.

- Competitive Product Substitutes: Traditional insulin delivery methods remain a significant competitive force.

- End-User Demographics: Growing adoption among younger, digitally inclined individuals with diabetes.

- M&A Trends: Present, with potential for future consolidation as market maturity increases.

Latin America Insulin Patch Pumps Industry Growth Trends & Insights

The Latin America insulin patch pumps market is poised for significant expansion, driven by a confluence of factors that are reshaping diabetes management across the region. Market size is projected to witness robust growth, fueled by an increasing prevalence of diabetes, a growing awareness of advanced therapeutic options, and a rising disposable income in certain segments of the population. Adoption rates for insulin patch pumps are expected to accelerate as healthcare providers and patients recognize the benefits of continuous insulin delivery, improved glycemic control, and enhanced quality of life. Technological disruptions are a cornerstone of this growth, with the integration of continuous glucose monitoring (CGM) systems and the development of sophisticated algorithms for automated insulin delivery (AID) systems fundamentally transforming the patient experience.

Consumer behavior shifts are also playing a crucial role. Patients are increasingly seeking discreet, user-friendly, and connected devices that empower them to manage their diabetes proactively. The desire for greater autonomy and a less intrusive management regimen is driving demand for patch pumps over traditional injection methods. Furthermore, the growing emphasis on preventative healthcare and the management of chronic diseases like diabetes by governments and private healthcare payers is creating a more conducive environment for the adoption of advanced medical technologies. This evolving landscape presents a substantial opportunity for manufacturers and innovators in the insulin patch pump sector.

The forecast period, 2025–2033, is anticipated to be a period of accelerated growth, with a Compound Annual Growth Rate (CAGR) projected to exceed 15%. This robust growth will be underpinned by increasing market penetration, especially in urban centers and among populations with greater access to private healthcare. The introduction of more affordable and technologically advanced patch pump solutions will further broaden accessibility. Key market drivers include rising diabetes incidence and prevalence, growing health consciousness, and supportive government initiatives aimed at improving diabetes care. The market penetration of insulin patch pumps, currently in the single digits across much of Latin America, is expected to climb significantly as awareness and affordability improve.

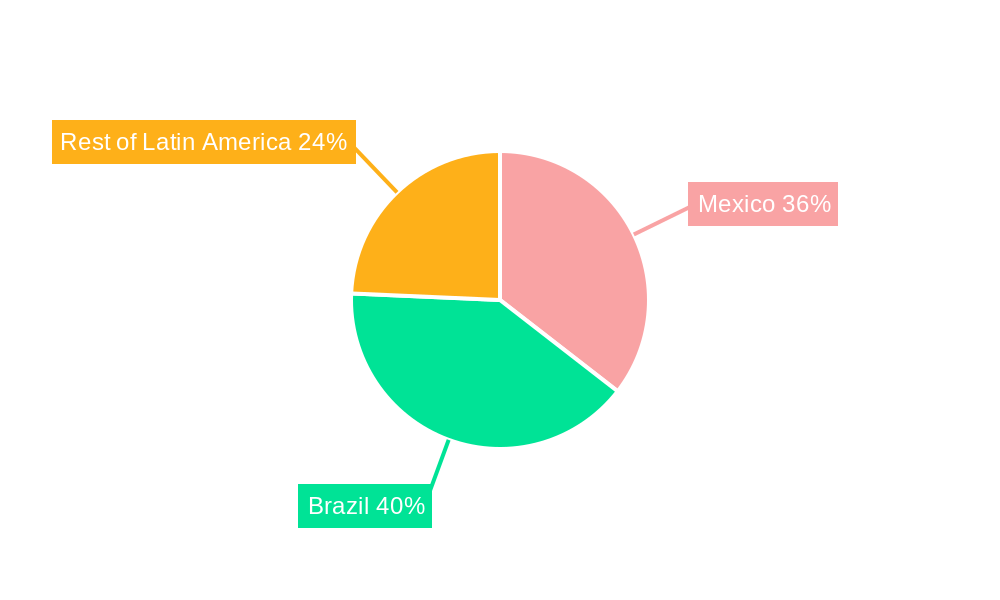

Dominant Regions, Countries, or Segments in Latin America Insulin Patch Pumps Industry

Brazil and Mexico are expected to be the dominant markets within Latin America for insulin patch pumps, each representing substantial growth potential and current adoption. These countries possess larger populations, a higher prevalence of diabetes, and more developed healthcare infrastructures compared to other nations in the region. Brazil, with its vast population and a growing middle class, is a key focus for advanced medical device manufacturers. The country's healthcare system, while facing challenges, is increasingly incorporating modern technologies.

- Brazil: Expected to lead the market in terms of volume and value, driven by:

- High Diabetes Prevalence: One of the highest rates of diabetes in Latin America, creating a large patient pool.

- Growing Middle Class: Increased disposable income allows for greater adoption of premium medical devices.

- Government Initiatives: Growing focus on chronic disease management and access to advanced treatments.

- Developing Healthcare Infrastructure: Expansion of private healthcare facilities and increasing awareness of advanced diabetes care.

Mexico follows closely as another significant market, bolstered by its own substantial diabetes burden and a relatively well-established healthcare system. The country's proximity to the United States also facilitates the introduction of new technologies and clinical best practices.

- Mexico: A strong contender with significant growth prospects due to:

- Epidemiological Trends: High and rising incidence of type 1 and type 2 diabetes.

- Technological Adoption: A receptive market for innovative medical devices, particularly in urban areas.

- Healthcare Reforms: Ongoing efforts to improve access to quality healthcare and chronic disease management.

- Insurance Coverage: Expansion of private health insurance plans that may cover advanced diabetes management devices.

The "Rest of Latin America" segment, while fragmented, presents a collective opportunity for growth, with countries like Argentina, Colombia, and Chile showing nascent but promising adoption rates. These markets often benefit from the spillover of innovation and market strategies developed in Brazil and Mexico.

Among the device segments, the Insulin Infusion Pump segment is anticipated to dominate, as it represents the core technology of patch pump systems. However, the Insulin Pump Monitors and Reservoir segments are also critical and will experience proportional growth. The increasing integration of smart monitoring features and the demand for convenient, high-capacity reservoirs will drive innovation and market share within these sub-segments.

Latin America Insulin Patch Pumps Industry Product Landscape

The Latin America insulin patch pump industry is witnessing a surge in product innovation characterized by miniaturization, enhanced connectivity, and user-centric design. Manufacturers are focusing on developing discreet, lightweight, and waterproof devices that offer greater comfort and ease of use. Key advancements include tubeless designs, integrated CGM capabilities, and smartphone-controlled interfaces that provide real-time glucose data and insulin delivery management. Performance metrics are being optimized for accuracy, reliability, and extended battery life. Unique selling propositions often revolve around improved glycemic control through advanced algorithms, simplified bolus calculations, and personalized insulin delivery profiles, ultimately aiming to reduce the burden of diabetes management for patients.

Key Drivers, Barriers & Challenges in Latin America Insulin Patch Pumps Industry

Key Drivers:

- Rising Diabetes Prevalence: A growing population of individuals with type 1 and type 2 diabetes creates a substantial and expanding market.

- Technological Advancements: Innovations in miniaturization, connectivity, and automated insulin delivery enhance product appeal and efficacy.

- Increasing Patient Awareness: Growing understanding of the benefits of continuous insulin delivery and advanced diabetes management.

- Government and Payer Support: Emerging policies and reimbursement frameworks that encourage adoption of advanced diabetes technologies.

- Desire for Improved Quality of Life: Patients seeking less intrusive and more convenient ways to manage their condition.

Barriers & Challenges:

- High Cost of Devices: Insulin patch pumps remain significantly more expensive than traditional insulin delivery methods, posing an affordability challenge for many patients.

- Limited Reimbursement Policies: Inconsistent and often insufficient insurance coverage for advanced diabetes devices across many Latin American countries.

- Lack of Awareness and Education: Insufficient understanding of patch pump technology among both patients and healthcare providers in some regions.

- Infrastructure and Technical Support: Challenges in establishing robust distribution networks and providing adequate technical support and training across diverse geographies.

- Regulatory Hurdles: Navigating varied regulatory approval processes in different countries can be time-consuming and complex.

- Competitive Pressure: Continued strong presence and affordability of insulin pens and syringes.

Emerging Opportunities in Latin America Insulin Patch Pumps Industry

Emerging opportunities lie in the development of more affordable and accessible insulin patch pump solutions tailored to the economic realities of the Latin American market. Untapped markets in smaller countries and rural areas present significant growth potential as awareness and infrastructure improve. Innovative applications, such as remote patient monitoring capabilities for healthcare providers and predictive analytics for personalized therapy, are also emerging trends. Evolving consumer preferences for integrated digital health ecosystems, where insulin pumps seamlessly connect with other health tracking devices and apps, offer further avenues for expansion. The potential for strategic partnerships with local healthcare providers and government health programs to drive wider adoption remains a key opportunity.

Growth Accelerators in the Latin America Insulin Patch Pumps Industry Industry

Several catalysts are accelerating the long-term growth of the Latin America insulin patch pumps industry. Technological breakthroughs in artificial pancreas systems, integrating CGM with sophisticated algorithms for fully automated insulin delivery, are a significant driver. Strategic partnerships between device manufacturers, pharmaceutical companies, and local distributors are crucial for expanding market reach and improving product accessibility. Market expansion strategies focusing on educational initiatives to increase physician and patient awareness, coupled with efforts to influence favorable reimbursement policies, will further bolster growth. The increasing focus on value-based healthcare and the demonstrable clinical and economic benefits of advanced diabetes management technologies are also acting as strong growth accelerators.

Key Players Shaping the Latin America Insulin Patch Pumps Industry Market

- Roche

- Insulet

- Ypsomed

- Medtronic

- Animas

- Tandem Diabetes Care

- Cellnovo

Notable Milestones in Latin America Insulin Patch Pumps Industry Sector

- February 2022: The US Food and Drug Administration (FDA) granted approval for Tandem Diabetes Care's t:slim X2 insulin pump to bolus using the t: connect mobile app. The updated mobile application is intended to allow users of the t: slim X2 insulin pump to easily program and cancel bolus insulin requests through their smartphone. This milestone signifies the growing trend of smartphone integration and remote control capabilities, enhancing user convenience.

- January 2022: FDA approved an automated tubeless insulin pump for people with type 1 diabetes. The Omnipod 5 is fully controlled via a smartphone app, eliminating the need to carry a separate device. It delivers insulin through a pod, smaller than the size of a desktop mouse, that the user manually fills with insulin, adheres to their skin, typically on their stomach, and replaces every three days. This development highlights the shift towards more discreet, tubeless, and app-controlled insulin delivery systems, marking a significant step towards personalized and automated diabetes management.

In-Depth Latin America Insulin Patch Pumps Industry Market Outlook

The in-depth outlook for the Latin America insulin patch pumps industry is exceptionally positive, driven by a compelling synergy of unmet patient needs and rapid technological evolution. Future market potential is immense, fueled by the region's substantial and growing diabetes burden coupled with increasing patient demand for more sophisticated and less disruptive diabetes management solutions. Strategic opportunities abound for companies that can navigate the complex regulatory and reimbursement landscapes while delivering innovative, user-friendly, and cost-effective patch pump technologies. The continued integration of artificial intelligence and machine learning in insulin delivery algorithms, coupled with seamless connectivity to digital health platforms, will further unlock market potential. Focus on expanding access through partnerships and localized manufacturing could significantly accelerate market penetration across the diverse Latin American countries.

Latin America Insulin Patch Pumps Industry Segmentation

-

1. Device

- 1.1. Insulin Pump Monitors

- 1.2. Insulin Infusion Pump

- 1.3. Reserviour

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Rest of Latin America

Latin America Insulin Patch Pumps Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Rest of Latin America

Latin America Insulin Patch Pumps Industry Regional Market Share

Geographic Coverage of Latin America Insulin Patch Pumps Industry

Latin America Insulin Patch Pumps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump Monitors Hold Highest Market Share in Latin America Insulin Infusion Pump Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Insulin Patch Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Insulin Pump Monitors

- 5.1.2. Insulin Infusion Pump

- 5.1.3. Reserviour

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Mexico Latin America Insulin Patch Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Insulin Pump Monitors

- 6.1.2. Insulin Infusion Pump

- 6.1.3. Reserviour

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Brazil Latin America Insulin Patch Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Insulin Pump Monitors

- 7.1.2. Insulin Infusion Pump

- 7.1.3. Reserviour

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of Latin America Latin America Insulin Patch Pumps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Insulin Pump Monitors

- 8.1.2. Insulin Infusion Pump

- 8.1.3. Reserviour

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Roche

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Insulet

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Ypsomed

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Medtronic

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Animas

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Tandem

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cellnovo

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Roche

List of Figures

- Figure 1: Latin America Insulin Patch Pumps Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Insulin Patch Pumps Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 2: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 3: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 8: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 9: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 14: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 15: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 20: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 21: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Latin America Insulin Patch Pumps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin America Insulin Patch Pumps Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Insulin Patch Pumps Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Latin America Insulin Patch Pumps Industry?

Key companies in the market include Roche, Insulet, Ypsomed, Medtronic, Animas, Tandem, Cellnovo.

3. What are the main segments of the Latin America Insulin Patch Pumps Industry?

The market segments include Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump Monitors Hold Highest Market Share in Latin America Insulin Infusion Pump Market in the current year.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

February 2022: The US Food and Drug Administration (FDA) granted approval for Tandem Diabetes Care's t: slim X2 insulin pump to bolus using the t: connect mobile app. The updated mobile application is intended to allow users of the t: slim X2 insulin pump to easily program and cancel bolus insulin requests through their smartphone.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Insulin Patch Pumps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Insulin Patch Pumps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Insulin Patch Pumps Industry?

To stay informed about further developments, trends, and reports in the Latin America Insulin Patch Pumps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence