Key Insights

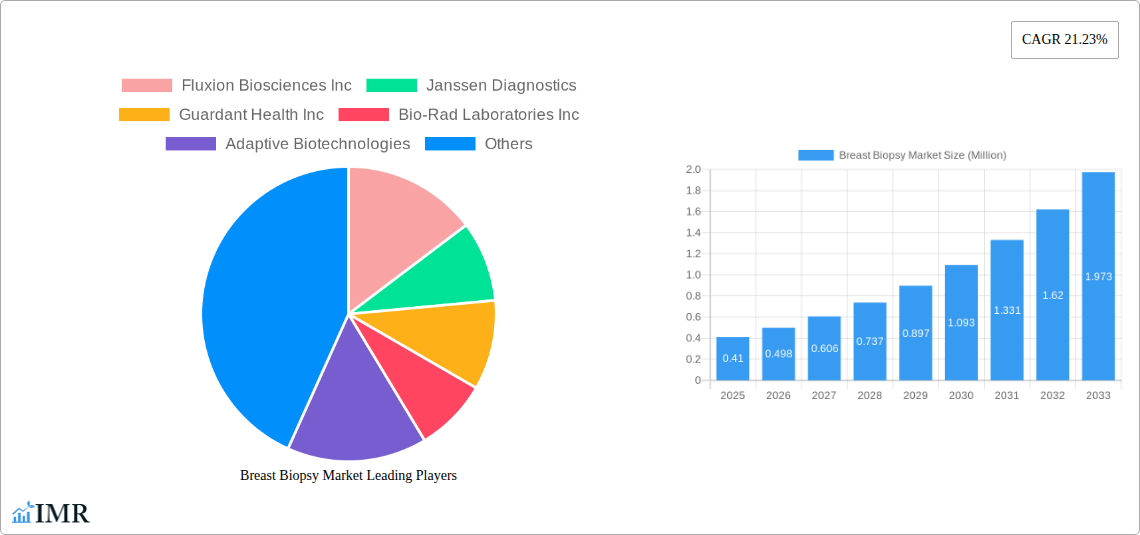

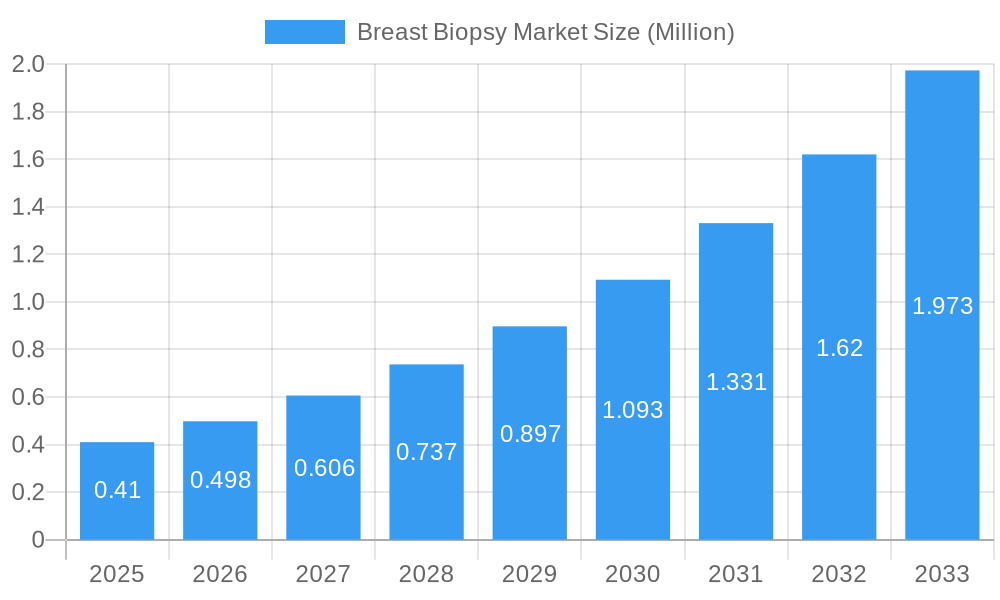

The global Breast Biopsy Market is poised for significant expansion, with a current market size estimated at $0.41 million in 2025. This robust growth is driven by a projected Compound Annual Growth Rate (CAGR) of 21.23% over the forecast period from 2025 to 2033. This remarkable surge is fueled by several key factors. The increasing incidence of breast cancer globally, coupled with a growing emphasis on early detection and diagnosis through advanced screening techniques, is a primary catalyst. Furthermore, technological advancements in imaging modalities like mammography, ultrasound, and MRI, which enhance the precision of lesion identification, directly contribute to higher biopsy volumes. The development and adoption of minimally invasive biopsy techniques, offering improved patient comfort and reduced recovery times, are also playing a crucial role in market expansion. Moreover, a rising awareness among women regarding breast health and the importance of regular check-ups further bolsters demand for diagnostic procedures, including breast biopsies.

Breast Biopsy Market Market Size (In Million)

The market's trajectory is further shaped by evolving trends such as the increasing integration of artificial intelligence (AI) and machine learning (ML) in image analysis for more accurate lesion detection and characterization. The growing prominence of liquid biopsies as a complementary diagnostic tool, while not directly a biopsy procedure, influences the broader landscape of breast cancer diagnostics. However, certain restraints could temper the growth pace. These include the high cost associated with advanced biopsy equipment and procedures, potential reimbursement challenges in some regions, and the availability of skilled professionals to operate sophisticated diagnostic tools. Nevertheless, the strong market fundamentals, driven by the urgent need for timely and accurate breast cancer diagnosis and the continuous innovation within the industry, suggest a highly promising future for the breast biopsy market.

Breast Biopsy Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global Breast Biopsy Market, exploring its current landscape, historical trends, and future trajectory. With a focus on technological advancements in non-invasive diagnostics and personalized medicine, the report examines the critical role of breast biopsy in early breast cancer detection, prognosis, and treatment selection. The study period spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, encompassing historical data from 2019 to 2024. This report is an essential resource for stakeholders seeking to understand the market dynamics, growth opportunities, and competitive forces within the rapidly evolving breast biopsy sector.

Breast Biopsy Market Market Dynamics & Structure

The Breast Biopsy Market is characterized by a moderate to high level of market concentration, driven by significant technological innovation and stringent regulatory frameworks. Key drivers include the increasing incidence of breast cancer globally, rising awareness campaigns, and the growing demand for minimally invasive diagnostic procedures over traditional surgical biopsies. Technological advancements, particularly in liquid biopsy techniques and advanced imaging, are pushing the boundaries of early detection and non-invasive diagnostics. Regulatory bodies play a crucial role in approving new diagnostic tools and ensuring their efficacy and safety, influencing market entry and adoption rates. Competitive product substitutes, such as advanced imaging modalities and genetic testing, are also shaping the market landscape, albeit with breast biopsy remaining a cornerstone diagnostic tool. End-user demographics are increasingly favoring patients seeking less invasive procedures with faster recovery times. Mergers and acquisitions (M&A) trends indicate a consolidation among key players aiming to expand their product portfolios and geographic reach, with an estimated X deal volumes observed during the historical period. Barriers to innovation include high research and development costs and lengthy regulatory approval processes.

- Market Concentration: Dominated by a few key players, with increasing fragmentation in niche segments.

- Technological Innovation: Driven by advancements in liquid biopsy, molecular diagnostics, and AI-powered imaging.

- Regulatory Frameworks: FDA and EMA approvals are critical for market access and product validation.

- Competitive Substitutes: Advanced mammography, MRI, and genetic screening offer complementary diagnostic pathways.

- End-User Demographics: Growing preference for minimally invasive procedures and personalized treatment approaches.

- M&A Trends: Strategic acquisitions to gain market share, acquire novel technologies, and expand service offerings.

- Innovation Barriers: High R&D investment, clinical validation challenges, and reimbursement policies.

Breast Biopsy Market Growth Trends & Insights

The Breast Biopsy Market is poised for significant growth, driven by a confluence of factors including an escalating global breast cancer burden, amplified by aging populations and lifestyle changes. The increasing adoption of advanced diagnostic technologies, particularly liquid biopsy, is revolutionizing early detection and treatment monitoring. This shift from traditional invasive methods to less invasive alternatives like circulating tumor cells (CTCs) and circulating cell-free DNA (cfDNA) offers patients improved comfort and reduced recovery times, thereby accelerating market penetration. Technological disruptions, such as the integration of artificial intelligence (AI) in image analysis and the development of more sensitive biomarker detection platforms, are enhancing diagnostic accuracy and predictive capabilities. Consumer behavior is also evolving, with a growing demand for personalized medicine and proactive health management, leading patients to seek earlier and more precise diagnostic information. The market size is projected to expand at a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, reaching an estimated value of $XX,XXX million by 2033. Market penetration for advanced breast biopsy techniques, particularly liquid biopsies, is expected to surge as reimbursement policies become more favorable and clinical utility is further validated. The increasing prevalence of early-stage breast cancer diagnoses, facilitated by these advanced methods, is a key growth indicator. Furthermore, the growing focus on routine screening programs and the development of novel therapeutic strategies that rely on precise diagnostic biomarkers are fueling market expansion. The demand for companion diagnostics, which identify specific genetic mutations or protein expressions to guide targeted therapies, is also a significant growth accelerator within the breast biopsy market.

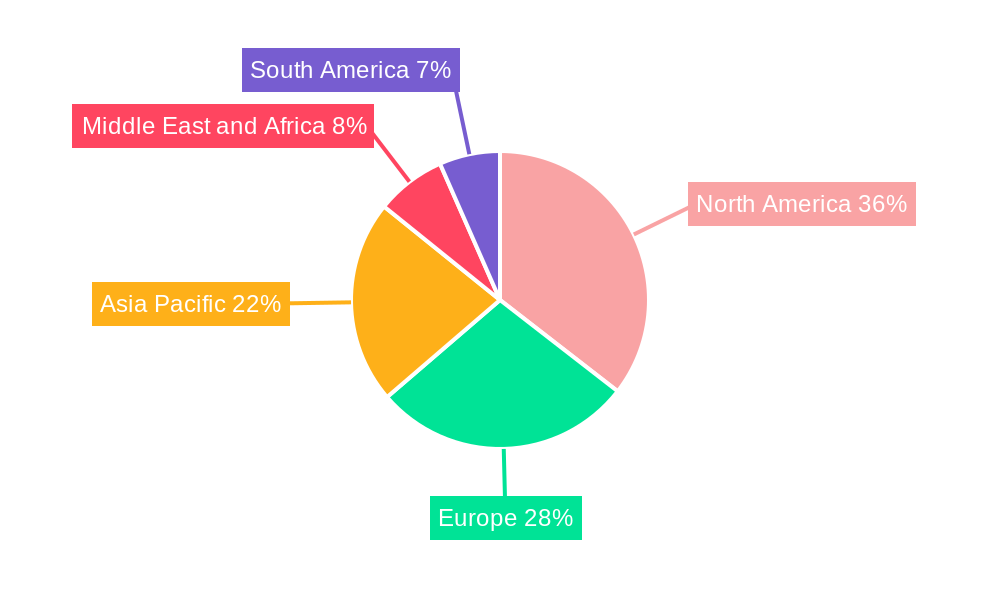

Dominant Regions, Countries, or Segments in Breast Biopsy Market

The Circulating Biomarkers segment, specifically Circulating Tumor Cells (CTCs) and Circulating Cell-free DNA (cfDNA), is emerging as the dominant force driving growth in the global Breast Biopsy Market. North America, particularly the United States, currently holds the largest market share, attributed to its advanced healthcare infrastructure, high disposable income, robust research and development initiatives, and a strong emphasis on early cancer detection programs. The region benefits from a high prevalence of breast cancer coupled with a proactive approach to screening and diagnosis. European countries, including Germany, the UK, and France, represent another significant market, driven by increasing healthcare expenditure, supportive government policies, and the growing adoption of innovative diagnostic technologies. The Asia Pacific region is anticipated to witness the fastest growth, fueled by rising healthcare awareness, improving economic conditions, a growing patient pool, and increasing investments in medical infrastructure and research.

Dominant Segment: Circulating Biomarkers

- Circulating Tumor Cells (CTCs): Advancements in isolation and detection technologies are enhancing their role in early detection, monitoring treatment response, and detecting minimal residual disease.

- Circulating Cell-free DNA (cfDNA): Its high sensitivity and specificity for detecting tumor-derived mutations make it a critical biomarker for non-invasive diagnosis, prognosis, and treatment selection.

- Extracellular Vesicles: Emerging as a promising area for biomarker discovery and diagnostics, offering insights into tumor biology.

- Other Circulating Biomarkers: Including exosomes and circulating microRNAs, further expanding the diagnostic potential.

Dominant Regions & Countries:

- North America (USA): Leading market due to advanced healthcare systems, high R&D investments, and widespread adoption of early screening.

- Europe (Germany, UK, France): Significant market share driven by increasing healthcare spending and technological integration.

- Asia Pacific (China, Japan, India): Fastest-growing region due to improving healthcare access and rising cancer incidence.

Key drivers for regional dominance include economic policies that promote healthcare innovation, robust clinical trial infrastructure, and the presence of leading research institutions and pharmaceutical companies. The high market share within these regions is further bolstered by favorable reimbursement landscapes for advanced diagnostic tests and a growing patient base seeking personalized treatment options.

Breast Biopsy Market Product Landscape

The product landscape of the Breast Biopsy Market is characterized by continuous innovation, focusing on enhancing diagnostic accuracy, minimizing invasiveness, and enabling personalized treatment strategies. Emerging products include highly sensitive liquid biopsy kits capable of detecting ultra-low levels of circulating tumor DNA (ctDNA) and sophisticated platforms for enumerating and characterizing circulating tumor cells (CTCs). Advanced imaging technologies integrated with AI are also playing a crucial role in improving lesion detection and characterization, guiding biopsy procedures with greater precision. The unique selling propositions of these innovations lie in their ability to provide real-time molecular profiling of tumors, predict treatment response, and monitor disease progression non-invasively, thus reducing the need for repeated tissue biopsies and improving patient outcomes. For example, Fluxion Biosciences Inc. and Janssen Diagnostics are at the forefront of CTC enumeration, while Guardant Health Inc. and F Hoffmann-La Roche Ltd are leaders in cfDNA-based diagnostics.

Key Drivers, Barriers & Challenges in Breast Biopsy Market

Key Drivers: The Breast Biopsy Market is propelled by several critical factors. The escalating global incidence of breast cancer, coupled with an increasing demand for early detection and personalized medicine, serves as a primary growth engine. Technological advancements in liquid biopsy, offering non-invasive alternatives to traditional methods, are revolutionizing diagnostic capabilities. Growing awareness campaigns and government initiatives promoting cancer screening further fuel market expansion. The development of targeted therapies, which necessitate precise diagnostic biomarkers, also drives the demand for advanced breast biopsy techniques.

Key Barriers & Challenges: Despite its growth potential, the market faces significant challenges. High research and development costs associated with developing novel diagnostic technologies pose a substantial barrier. Stringent and lengthy regulatory approval processes in various countries can delay market entry and adoption. Reimbursement policies for advanced breast biopsy techniques can be inconsistent, impacting accessibility for patients. Furthermore, the need for extensive clinical validation and standardization of liquid biopsy assays remains a critical hurdle. Competitive pressures from established diagnostic methods and the ongoing need for physician education on new technologies also present challenges. Supply chain disruptions, particularly for specialized reagents and equipment, can also impact market stability.

Emerging Opportunities in Breast Biopsy Market

Emerging opportunities within the Breast Biopsy Market lie in the expansion of liquid biopsy applications beyond diagnosis to include prognosis, monitoring treatment efficacy, and detecting minimal residual disease. The development of multi-cancer early detection (MCED) tests, incorporating breast cancer as a component, presents a significant untapped market. Further innovation in exosome-based diagnostics holds promise for novel biomarker discovery and non-invasive detection. Growing demand for at-home or point-of-care diagnostic solutions, driven by patient convenience and accessibility, also represents a substantial opportunity. Evolving consumer preferences for proactive health management and personalized wellness plans are creating a need for more accessible and informative diagnostic tools.

Growth Accelerators in the Breast Biopsy Market Industry

Several key growth accelerators are shaping the future of the Breast Biopsy Market. Technological breakthroughs in next-generation sequencing (NGS) and digital PCR are significantly enhancing the sensitivity and specificity of biomarker detection, particularly for cfDNA. Strategic partnerships between diagnostic companies, pharmaceutical firms, and academic institutions are fostering collaborative research and accelerating product development and commercialization. Market expansion strategies targeting underserved populations and emerging economies are opening new avenues for growth. The increasing focus on companion diagnostics to guide targeted therapy selection is a significant accelerator, as is the growing body of clinical evidence demonstrating the value of liquid biopsies in real-world patient care.

Key Players Shaping the Breast Biopsy Market Market

- Fluxion Biosciences Inc.

- Janssen Diagnostics

- Guardant Health Inc.

- Bio-Rad Laboratories Inc.

- Adaptive Biotechnologies

- F Hoffmann-La Roche Ltd

- Epic Sciences

- PapGene

- Qiagen

- Pathway Genomics (OME Care)

- Exosome Diagnostics Inc.

- Illumina Inc.

- Myriad Genetics

- Biocept Inc.

- Biodesix

Notable Milestones in Breast Biopsy Market Sector

- 2019: Launch of new cfDNA-based liquid biopsy assays with improved sensitivity for detecting actionable mutations.

- 2020: FDA approval for a novel CTC enumeration platform enabling real-time monitoring of treatment response.

- 2021: Major acquisition of a liquid biopsy technology company by a leading diagnostic conglomerate.

- 2022: Publication of landmark studies demonstrating the clinical utility of liquid biopsies in early-stage breast cancer management.

- 2023: Introduction of advanced AI-powered imaging analysis tools for enhanced breast lesion characterization.

- 2024: Increased investment in research for extracellular vesicle-based biomarkers for breast cancer detection.

In-Depth Breast Biopsy Market Market Outlook

The Breast Biopsy Market is on an upward trajectory, driven by sustained innovation and an increasing imperative for early and precise cancer detection. Growth accelerators such as advancements in liquid biopsy technology, strategic collaborations, and the expanding role of companion diagnostics will continue to shape market dynamics. The future outlook suggests a greater integration of non-invasive diagnostic tools into routine clinical practice, leading to improved patient outcomes and more personalized treatment strategies. The market is well-positioned to capitalize on the growing demand for accessible and accurate diagnostic solutions, with significant potential for expansion in both developed and emerging economies. Strategic opportunities lie in the development of cost-effective and highly accurate diagnostic platforms, addressing unmet clinical needs, and fostering greater adoption through education and supportive reimbursement policies.

Breast Biopsy Market Segmentation

-

1. Circulating Biomarkers

- 1.1. Circulating Tumor Cells (CTCs)

- 1.2. Circulating Cell-free DNA (cfDNA)

- 1.3. Extracellular Vesicles

- 1.4. Other Circulating Biomarkers

Breast Biopsy Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Breast Biopsy Market Regional Market Share

Geographic Coverage of Breast Biopsy Market

Breast Biopsy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Breast Cancer; Increasing Demand for Better Minimally Invasive Therapies; Technological Advancements in the Early Stage Detection of Breast Cancer

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Issues; Poor Reimbursement Policies

- 3.4. Market Trends

- 3.4.1. The Circulating Cell-free DNA (cfDNA) Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 5.1.1. Circulating Tumor Cells (CTCs)

- 5.1.2. Circulating Cell-free DNA (cfDNA)

- 5.1.3. Extracellular Vesicles

- 5.1.4. Other Circulating Biomarkers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 6. North America Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 6.1.1. Circulating Tumor Cells (CTCs)

- 6.1.2. Circulating Cell-free DNA (cfDNA)

- 6.1.3. Extracellular Vesicles

- 6.1.4. Other Circulating Biomarkers

- 6.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 7. Europe Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 7.1.1. Circulating Tumor Cells (CTCs)

- 7.1.2. Circulating Cell-free DNA (cfDNA)

- 7.1.3. Extracellular Vesicles

- 7.1.4. Other Circulating Biomarkers

- 7.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 8. Asia Pacific Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 8.1.1. Circulating Tumor Cells (CTCs)

- 8.1.2. Circulating Cell-free DNA (cfDNA)

- 8.1.3. Extracellular Vesicles

- 8.1.4. Other Circulating Biomarkers

- 8.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 9. Middle East and Africa Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 9.1.1. Circulating Tumor Cells (CTCs)

- 9.1.2. Circulating Cell-free DNA (cfDNA)

- 9.1.3. Extracellular Vesicles

- 9.1.4. Other Circulating Biomarkers

- 9.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 10. South America Breast Biopsy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 10.1.1. Circulating Tumor Cells (CTCs)

- 10.1.2. Circulating Cell-free DNA (cfDNA)

- 10.1.3. Extracellular Vesicles

- 10.1.4. Other Circulating Biomarkers

- 10.1. Market Analysis, Insights and Forecast - by Circulating Biomarkers

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fluxion Biosciences Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Janssen Diagnostics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guardant Health Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Adaptive Biotechnologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F Hoffmann-La Roche Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Epic Sciences

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PapGene

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qiagen

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pathway Genomics (OME Care)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Exosome Diagnostics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Illumina Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Myriad Genetics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Biocept Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Biodesix

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Fluxion Biosciences Inc

List of Figures

- Figure 1: Global Breast Biopsy Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Breast Biopsy Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Breast Biopsy Market Revenue (Million), by Circulating Biomarkers 2025 & 2033

- Figure 4: North America Breast Biopsy Market Volume (K Unit), by Circulating Biomarkers 2025 & 2033

- Figure 5: North America Breast Biopsy Market Revenue Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 6: North America Breast Biopsy Market Volume Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 7: North America Breast Biopsy Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Breast Biopsy Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Breast Biopsy Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Breast Biopsy Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Breast Biopsy Market Revenue (Million), by Circulating Biomarkers 2025 & 2033

- Figure 12: Europe Breast Biopsy Market Volume (K Unit), by Circulating Biomarkers 2025 & 2033

- Figure 13: Europe Breast Biopsy Market Revenue Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 14: Europe Breast Biopsy Market Volume Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 15: Europe Breast Biopsy Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Breast Biopsy Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Breast Biopsy Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Breast Biopsy Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Breast Biopsy Market Revenue (Million), by Circulating Biomarkers 2025 & 2033

- Figure 20: Asia Pacific Breast Biopsy Market Volume (K Unit), by Circulating Biomarkers 2025 & 2033

- Figure 21: Asia Pacific Breast Biopsy Market Revenue Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 22: Asia Pacific Breast Biopsy Market Volume Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 23: Asia Pacific Breast Biopsy Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Breast Biopsy Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Breast Biopsy Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Breast Biopsy Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Breast Biopsy Market Revenue (Million), by Circulating Biomarkers 2025 & 2033

- Figure 28: Middle East and Africa Breast Biopsy Market Volume (K Unit), by Circulating Biomarkers 2025 & 2033

- Figure 29: Middle East and Africa Breast Biopsy Market Revenue Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 30: Middle East and Africa Breast Biopsy Market Volume Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 31: Middle East and Africa Breast Biopsy Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East and Africa Breast Biopsy Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East and Africa Breast Biopsy Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Breast Biopsy Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Breast Biopsy Market Revenue (Million), by Circulating Biomarkers 2025 & 2033

- Figure 36: South America Breast Biopsy Market Volume (K Unit), by Circulating Biomarkers 2025 & 2033

- Figure 37: South America Breast Biopsy Market Revenue Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 38: South America Breast Biopsy Market Volume Share (%), by Circulating Biomarkers 2025 & 2033

- Figure 39: South America Breast Biopsy Market Revenue (Million), by Country 2025 & 2033

- Figure 40: South America Breast Biopsy Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: South America Breast Biopsy Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Breast Biopsy Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 2: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 3: Global Breast Biopsy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Breast Biopsy Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 6: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 7: Global Breast Biopsy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Breast Biopsy Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 16: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 17: Global Breast Biopsy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Breast Biopsy Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Italy Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 32: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 33: Global Breast Biopsy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Breast Biopsy Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Japan Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Australia Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Australia Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: South Korea Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Korea Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 48: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 49: Global Breast Biopsy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Breast Biopsy Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: GCC Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: GCC Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: South Africa Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Breast Biopsy Market Revenue Million Forecast, by Circulating Biomarkers 2020 & 2033

- Table 58: Global Breast Biopsy Market Volume K Unit Forecast, by Circulating Biomarkers 2020 & 2033

- Table 59: Global Breast Biopsy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Breast Biopsy Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Brazil Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Argentina Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Breast Biopsy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Breast Biopsy Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Breast Biopsy Market?

The projected CAGR is approximately 21.23%.

2. Which companies are prominent players in the Breast Biopsy Market?

Key companies in the market include Fluxion Biosciences Inc, Janssen Diagnostics, Guardant Health Inc, Bio-Rad Laboratories Inc, Adaptive Biotechnologies, F Hoffmann-La Roche Ltd, Epic Sciences, PapGene, Qiagen, Pathway Genomics (OME Care), Exosome Diagnostics Inc, Illumina Inc, Myriad Genetics, Biocept Inc, Biodesix.

3. What are the main segments of the Breast Biopsy Market?

The market segments include Circulating Biomarkers.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Breast Cancer; Increasing Demand for Better Minimally Invasive Therapies; Technological Advancements in the Early Stage Detection of Breast Cancer.

6. What are the notable trends driving market growth?

The Circulating Cell-free DNA (cfDNA) Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulatory Issues; Poor Reimbursement Policies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Breast Biopsy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Breast Biopsy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Breast Biopsy Market?

To stay informed about further developments, trends, and reports in the Breast Biopsy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence