Key Insights

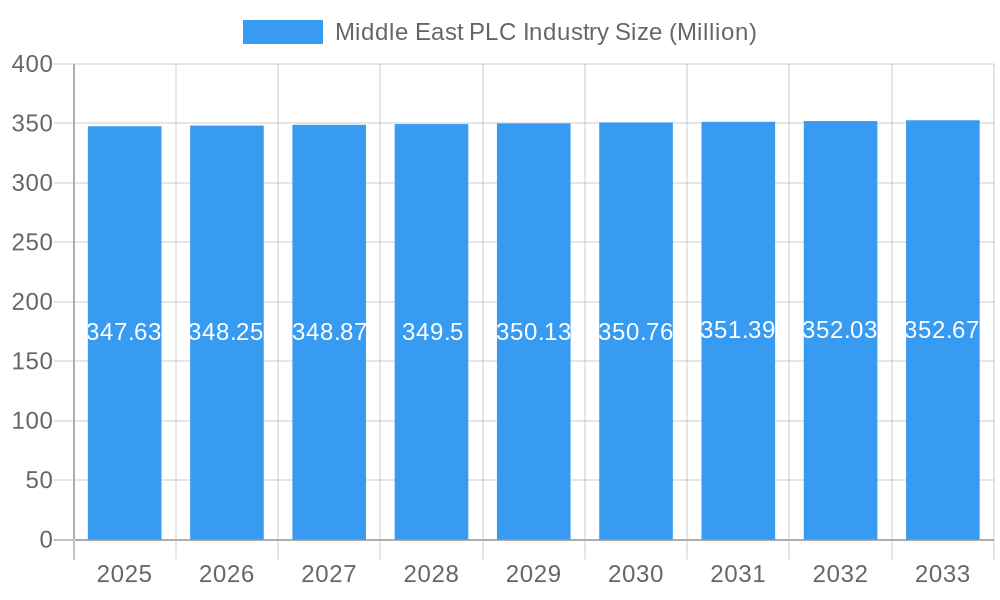

The Middle East programmable logic controller (PLC) market, valued at $347.63 million in 2025, exhibits a modest Compound Annual Growth Rate (CAGR) of 0.17%. This relatively low growth reflects a mature market with existing infrastructure and a moderate pace of industrial automation adoption across various sectors. Key drivers include the ongoing expansion of industrial automation in sectors such as food and beverage, automotive, and oil and gas, driven by the need for enhanced efficiency and productivity. Government initiatives promoting industrial diversification and technological advancements in the region also contribute positively. However, restraints include the relatively high initial investment costs associated with PLC implementation and a potential skills gap in PLC programming and maintenance, particularly in smaller companies. The market is segmented by type (hardware, software, services), end-user industry (food, tobacco, and beverage; automotive; chemical and petrochemical; energy and utilities; pharmaceutical; oil and gas; other), and country (UAE, Saudi Arabia, Israel, Oman, and Rest of Middle East). The UAE and Saudi Arabia are expected to remain the largest markets due to their significant industrial bases and ongoing infrastructure development projects. Growth will likely be driven by increased adoption of advanced PLC technologies like cloud-based PLCs and industrial IoT integration, particularly in the oil & gas and chemical industries where robust process control is critical. The competitive landscape is marked by a mix of global players like Rockwell Automation, Honeywell, and Siemens, alongside regional players, indicating a blend of established technologies and local market expertise.

Middle East PLC Industry Market Size (In Million)

The forecast period (2025-2033) suggests a gradual expansion of the Middle East PLC market, propelled by sustained investment in industrial infrastructure and digital transformation. However, the low CAGR suggests that significant disruptions or major technological shifts are not anticipated in the near future. Future growth will depend on the successful implementation of smart city initiatives, expanding digitalization efforts across various sectors, and continued investments in automation by larger industrial corporations. The focus will likely be on improving operational efficiency, reducing downtime, and ensuring greater process control. Competition will likely intensify, driven by the entrance of new technology providers offering innovative solutions integrated with emerging technologies.

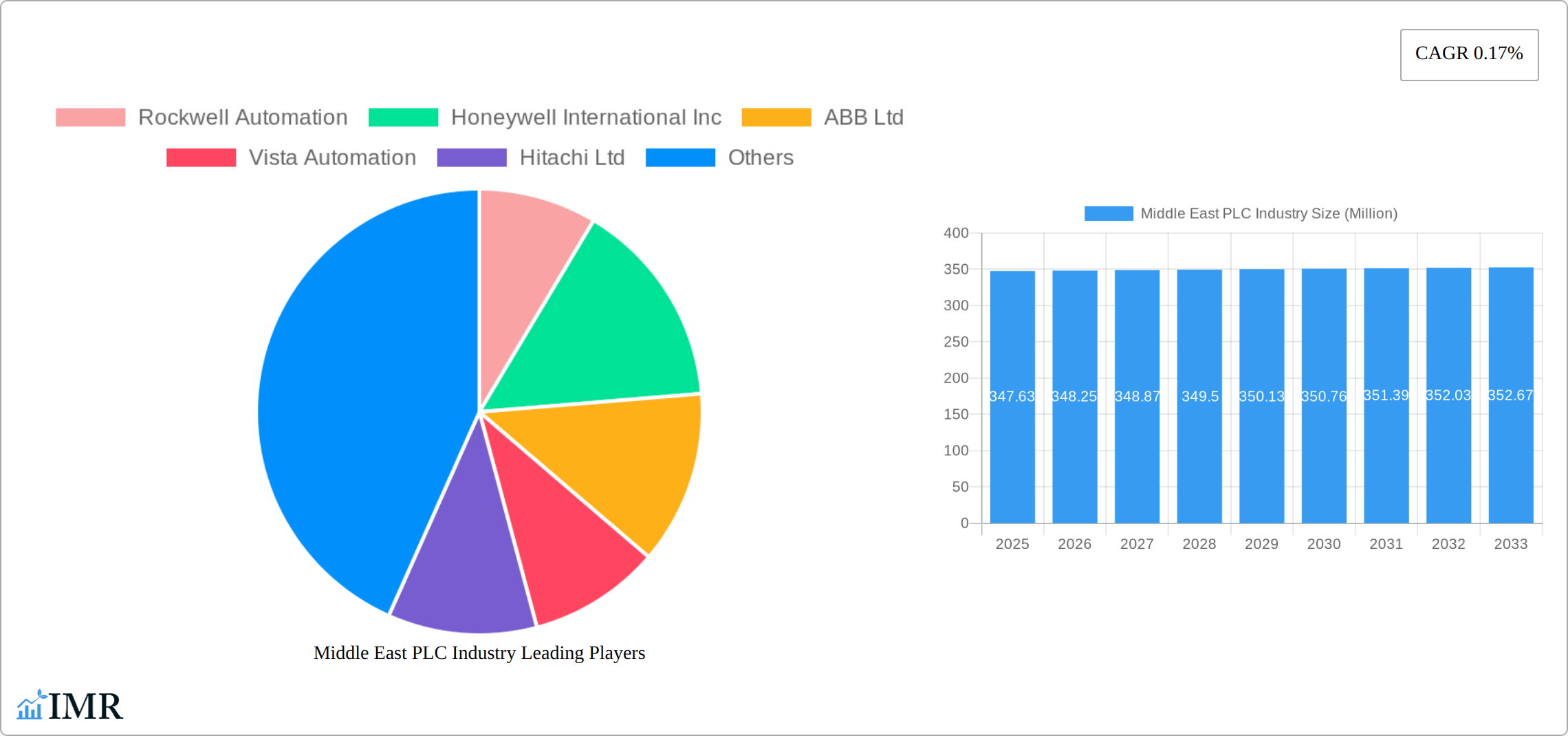

Middle East PLC Industry Company Market Share

Middle East PLC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East Programmable Logic Controller (PLC) industry, covering market dynamics, growth trends, regional dominance, key players, and future outlook. The report utilizes data from the study period of 2019-2024, with the base year being 2025 and the forecast period spanning 2025-2033. The market is segmented by type (Hardware, Software, Services), end-user industry (Food, Tobacco & Beverage, Automotive, Chemical & Petrochemical, Energy & Utilities, Pharmaceutical, Oil & Gas, Other), and country (UAE, Saudi Arabia, Israel, Oman, Rest of Middle East). This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The total market size in 2025 is estimated at xx Million.

Middle East PLC Industry Market Dynamics & Structure

The Middle East PLC market exhibits moderate concentration, with key players like Rockwell Automation, Honeywell, Siemens, and others holding substantial market share. While precise figures for 2025 are unavailable, estimates suggest a collective share exceeding [Insert estimated percentage or range, e.g., 60%] by leading vendors. This dynamic landscape is fueled by rapid technological advancements, primarily driven by the increasing adoption of Industrial IoT (IIoT) and Industry 4.0 initiatives across diverse sectors like oil & gas, manufacturing, and infrastructure. This adoption is fostering demand for advanced automation solutions and creating lucrative opportunities for PLC providers. However, the market faces challenges such as significant initial investment costs for PLC implementation and a persistent skills gap in PLC programming and maintenance. Furthermore, regulatory environments vary considerably across the Middle Eastern countries, influencing market entry strategies and operational complexities for both local and international players. The market is further shaped by ongoing mergers and acquisitions (M&A) activity, with an estimated [Insert Number] M&A deals occurring between 2019 and 2024, mainly focused on geographic expansion and bolstering technological capabilities. While simpler control systems exist as competitive substitutes, PLCs maintain their dominance due to inherent flexibility, scalability, and robust performance in demanding industrial settings. The end-user demographic is also evolving, reflecting a broad and growing focus on automation across various sectors.

- Market Concentration: Moderately concentrated, with leading vendors holding a significant collective market share.

- Technological Innovation: IIoT and Industry 4.0 are primary growth drivers, fostering demand for advanced automation.

- Regulatory Framework: Varied regulatory environments across countries impact market access and operations.

- Competitive Landscape: Simpler control systems offer limited competition; PLCs retain dominance due to scalability and flexibility.

- M&A Activity: Significant M&A activity (estimated [Insert Number] deals between 2019-2024) aimed at expansion and technological enhancement.

- Innovation Barriers: High initial investment costs and a skills gap in PLC programming and maintenance pose challenges.

Middle East PLC Industry Growth Trends & Insights

The Middle East PLC market experienced robust growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to factors like rising industrial automation across various sectors, increasing government investments in infrastructure projects, and the burgeoning oil and gas industry. The adoption rate of PLCs is steadily increasing, particularly in sectors like energy and utilities, and chemical and petrochemical processing, reflecting the region’s focus on industrial diversification and technological advancement. Technological disruptions, such as the integration of cloud computing and AI into PLC systems, are further accelerating growth. Consumer behavior shifts towards automation and smart manufacturing are propelling demand for advanced PLC solutions. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Market penetration is projected to reach xx% by 2033.

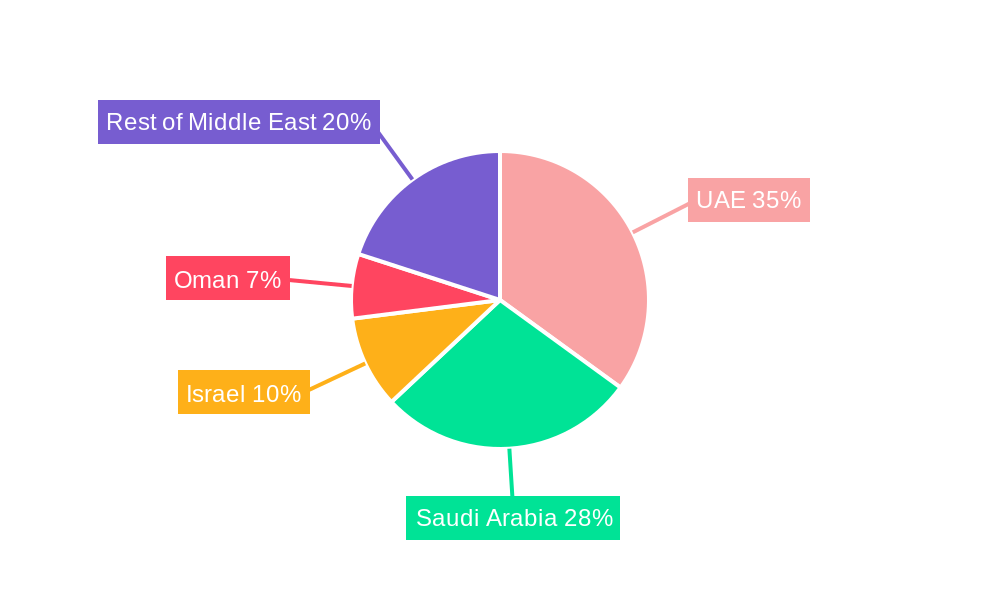

Dominant Regions, Countries, or Segments in Middle East PLC Industry

The UAE and Saudi Arabia represent the dominant markets within the Middle East PLC industry, driven by robust economic growth, significant investments in infrastructure development, and the presence of large-scale industrial projects. The energy and utilities sector is a major driver, followed by the chemical and petrochemical industries. Within the segmentation by type, the hardware segment holds the largest market share, but software and services are experiencing faster growth, reflecting the increasing demand for integrated automation solutions.

- Key Drivers (UAE & Saudi Arabia):

- Large-scale infrastructure projects

- Growing industrial automation adoption across sectors

- Significant government investments in technology and infrastructure development

- Expansion of Oil & Gas Industry

- Dominant Segments:

- By Type: Hardware (xx Million in 2025), Software (xx Million in 2025), Services (xx Million in 2025)

- By End-User: Energy & Utilities (xx Million in 2025), Chemical & Petrochemical (xx Million in 2025)

Middle East PLC Industry Product Landscape

The Middle East PLC market presents a diverse range of products, from basic to highly sophisticated systems integrated with advanced communication protocols such as Ethernet/IP and PROFINET. Recent innovations focus on enhanced connectivity, robust cybersecurity features, and advanced analytics capabilities. These advancements facilitate real-time data monitoring, predictive maintenance, and significant improvements in operational efficiency. Key selling propositions consistently include reliability, scalability, and user-friendly programming, catering to a broad spectrum of industrial requirements. The integration of AI and machine learning is a rapidly expanding trend, offering potential for autonomous control, optimized performance, and reduced operational costs. This translates to significant value propositions for end-users in terms of productivity gains and cost efficiencies.

Key Drivers, Barriers & Challenges in Middle East PLC Industry

Key Drivers: Government initiatives promoting industrial automation, rising investments in infrastructure projects, and the expansion of diverse industrial sectors. The growing demand for advanced automation solutions in energy and utilities, as well as increasing focus on operational efficiency and predictive maintenance are key drivers.

Key Challenges: High initial investment costs can hinder adoption, particularly for SMEs. Supply chain disruptions due to geopolitical factors and skills shortages in PLC programming and maintenance pose significant challenges. Strict regulatory compliance requirements also represent barriers to entry for certain companies. Competition from established international players and the emergence of new technologies can also create challenges. Increased cyber-security threats and the need to maintain robust cyber-security measures pose another barrier to market growth.

Emerging Opportunities in Middle East PLC Industry

Significant emerging opportunities include the seamless integration of PLC systems with cloud-based platforms, enabling remote monitoring and control, improved data accessibility, and enhanced collaboration. The expansion of the IIoT presents immense potential for the development of connected and intelligent industrial systems, fostering better decision-making and optimization of industrial processes. Untapped markets in smaller industrial sectors, including food processing, pharmaceuticals, and textiles, offer considerable growth prospects. Furthermore, supportive government policies and initiatives promoting digital transformation are creating additional growth opportunities for PLC vendors and integrators. The sustained demand for advanced automation solutions across diverse industrial sectors is poised to unlock considerable growth potential for years to come.

Growth Accelerators in the Middle East PLC Industry

Several factors are accelerating growth in the Middle East PLC industry. Technological advancements, such as the development of more efficient and user-friendly PLCs, alongside the increasing adoption of sophisticated analytics and AI-driven solutions, are significantly impacting market expansion. Strategic partnerships between PLC vendors and system integrators are crucial for effective market penetration and providing comprehensive solutions to end-users. Government initiatives promoting industrial automation, coupled with the region's ongoing infrastructure development and economic diversification, are creating a favorable environment for sustained and robust PLC market growth. These combined forces point towards a strong and positive outlook for the Middle East PLC market in the coming years.

Key Players Shaping the Middle East PLC Industry Market

Notable Milestones in Middle East PLC Industry Sector

- 2020-July: ABB launches new PLC range with enhanced cybersecurity features.

- 2021-November: Siemens announces a strategic partnership with a local system integrator to expand its market reach in Saudi Arabia.

- 2022-March: Rockwell Automation acquires a regional automation company, enhancing its presence in the UAE.

- 2023-June: Several key players announce investments in developing IIoT-enabled PLC solutions for the Middle East.

In-Depth Middle East PLC Industry Market Outlook

The Middle East PLC market exhibits strong potential for continued growth, driven by ongoing industrialization, increasing automation across various sectors, and the region's commitment to technological advancement. The integration of advanced technologies like AI and IIoT, coupled with strategic partnerships and government initiatives, will further fuel market expansion. Opportunities exist in exploring niche market segments and developing specialized PLC solutions tailored to specific industrial needs. The long-term outlook is positive, anticipating sustained growth in market size and penetration, presenting lucrative opportunities for players across the value chain.

Middle East PLC Industry Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End-User Industry

- 2.1. Food, Tobacco, and Beverage

- 2.2. Automotive

- 2.3. Chemical and Petrochemical

- 2.4. Energy and Utilities

- 2.5. Pharmaceutical

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Middle East PLC Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East PLC Industry Regional Market Share

Geographic Coverage of Middle East PLC Industry

Middle East PLC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Oil Segment Accounts for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East PLC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food, Tobacco, and Beverage

- 5.2.2. Automotive

- 5.2.3. Chemical and Petrochemical

- 5.2.4. Energy and Utilities

- 5.2.5. Pharmaceutical

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rockwell Automation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vista Automation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Emerson Electric Co (GE)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Omron Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Control Tech

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rockwell Automation

List of Figures

- Figure 1: Middle East PLC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East PLC Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East PLC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East PLC Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East PLC Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East PLC Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East PLC Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East PLC Industry?

The projected CAGR is approximately 0.17%.

2. Which companies are prominent players in the Middle East PLC Industry?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Vista Automation, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Emerson Electric Co (GE), Omron Corporation, Robert Bosch GmbH, Panasonic Corporation, Control Tech.

3. What are the main segments of the Middle East PLC Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 347.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Oil and Gas Sector in the Region Driving the PLC Market; Increasing Usage of Automation System in Different End-user Verticals.

6. What are the notable trends driving market growth?

Oil Segment Accounts for Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East PLC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East PLC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East PLC Industry?

To stay informed about further developments, trends, and reports in the Middle East PLC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence