Key Insights

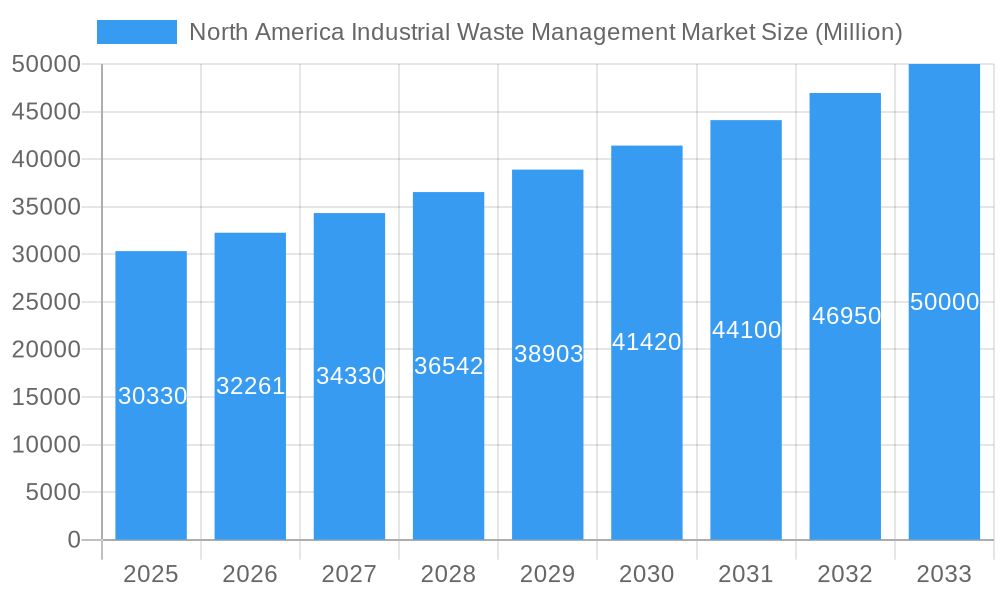

The North America industrial waste management market, valued at $30.33 billion in 2025, is projected to experience robust growth, driven by increasing industrialization, stringent environmental regulations, and rising awareness of sustainable waste disposal practices. The market's Compound Annual Growth Rate (CAGR) of 6.35% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding $50 billion by 2033. Key drivers include the growing need for efficient hazardous waste management, increasing demand for recycling and resource recovery solutions, and the rising adoption of advanced waste treatment technologies. Furthermore, the expanding e-commerce sector contributes significantly to the market's growth, generating substantial volumes of packaging and electronic waste. However, challenges like fluctuating raw material prices and the need for significant infrastructure investments to improve waste collection and processing capabilities could temper growth. The market is segmented by waste type (hazardous, non-hazardous), treatment method (landfilling, incineration, recycling), and service type (collection, processing, disposal). Leading companies, including Waste Management Inc., Republic Services Inc., Waste Connections, and Clean Harbors Inc., are investing heavily in technological advancements and strategic acquisitions to strengthen their market positions.

North America Industrial Waste Management Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and regional players. The market's future growth will be significantly influenced by government policies promoting sustainable waste management practices, advancements in waste-to-energy technologies, and the increasing adoption of circular economy principles. The North American region dominates the market due to its high industrial output and robust regulatory framework. While specific regional data is unavailable, the market's growth is expected to be relatively consistent across major North American regions, reflecting the widespread demand for efficient and sustainable industrial waste management solutions. The forecast period sees continued growth fueled by factors already mentioned, though potential economic downturns could moderately impact growth rates in specific years.

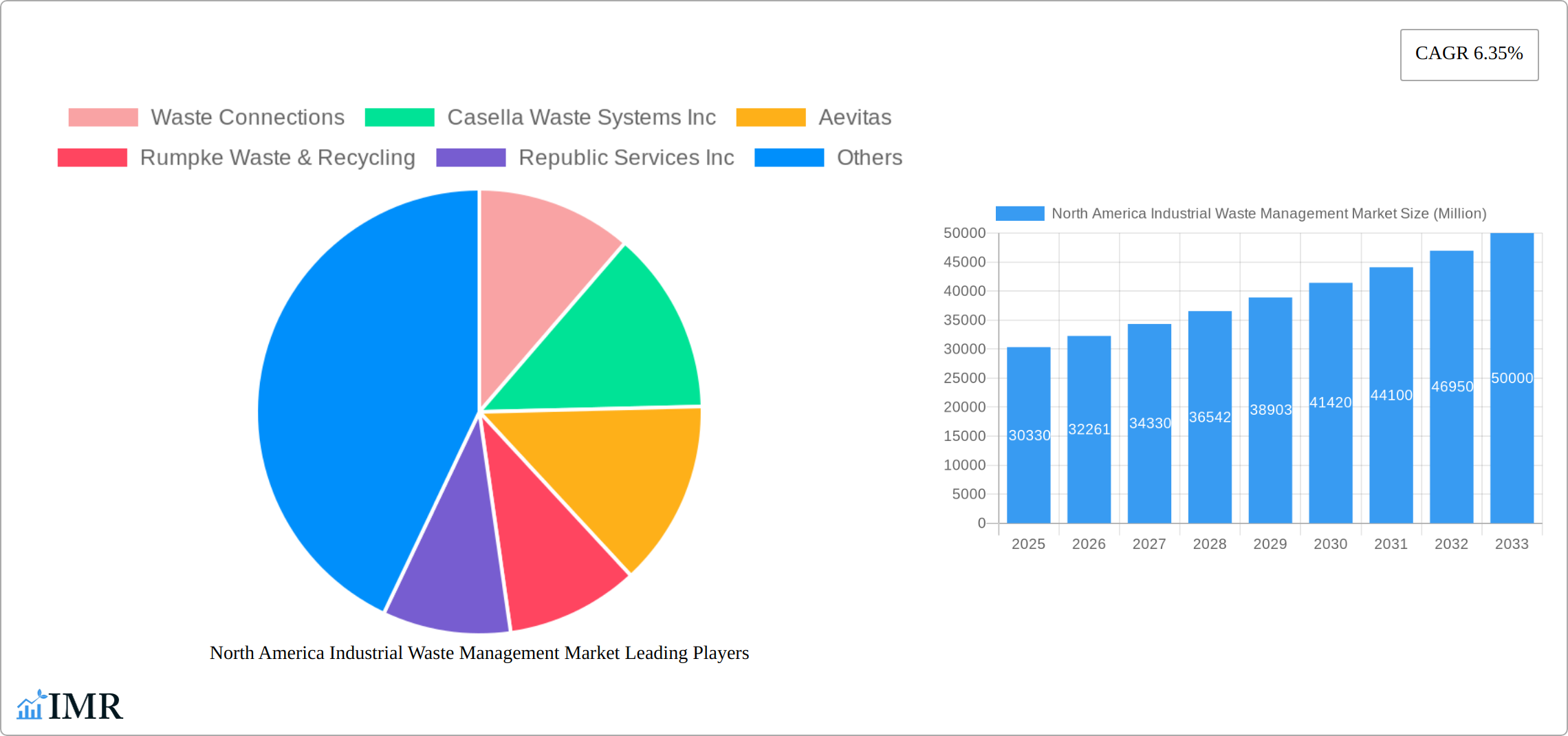

North America Industrial Waste Management Market Company Market Share

North America Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Industrial Waste Management market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It offers valuable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. Parent market: North America Waste Management Market; Child market: Industrial Waste Management.

North America Industrial Waste Management Market Dynamics & Structure

The North America industrial waste management market is characterized by a moderately consolidated structure, with several large players dominating the landscape. The market size in 2024 was estimated at $XX million and is projected to reach $XX million by 2033. Market concentration is influenced by factors like economies of scale and extensive infrastructure. Technological innovation, primarily in waste-to-energy solutions and advanced recycling technologies, is a key driver. Stringent environmental regulations, particularly concerning hazardous waste disposal, significantly shape market practices. The presence of substitute technologies, such as incineration vs. landfill, creates competitive pressures. End-user demographics – with manufacturing, energy, and construction sectors being major contributors – dictate waste generation patterns. M&A activity is considerable, with recent deals like Veolia's acquisition of U.S. Industrial Technologies highlighting the trend towards consolidation and expansion of service offerings.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on waste-to-energy, advanced recycling, and digital waste management solutions.

- Regulatory Framework: Stringent regulations on hazardous waste disposal and environmental protection.

- Competitive Substitutes: Incineration, landfilling, anaerobic digestion, and various recycling methods.

- End-User Demographics: Manufacturing, energy, construction, and chemical industries are key generators of industrial waste.

- M&A Trends: Significant consolidation through acquisitions and mergers to expand market share and service offerings; XX major M&A deals recorded between 2019 and 2024.

North America Industrial Waste Management Market Growth Trends & Insights

The North American industrial waste management market is experiencing steady growth, driven by increasing industrial activity and stricter environmental regulations. The market exhibited a CAGR of xx% during the historical period (2019-2024), and this growth is projected to continue at a CAGR of xx% from 2025 to 2033. Adoption rates of advanced waste management technologies are increasing, albeit gradually, due to high upfront capital investments. Technological disruptions, like AI-powered waste sorting and blockchain-based traceability, are starting to influence market dynamics. Consumer behavior shifts, driven by growing environmental consciousness, are promoting demand for sustainable waste management solutions. Market penetration of advanced recycling technologies remains relatively low, presenting a significant growth opportunity.

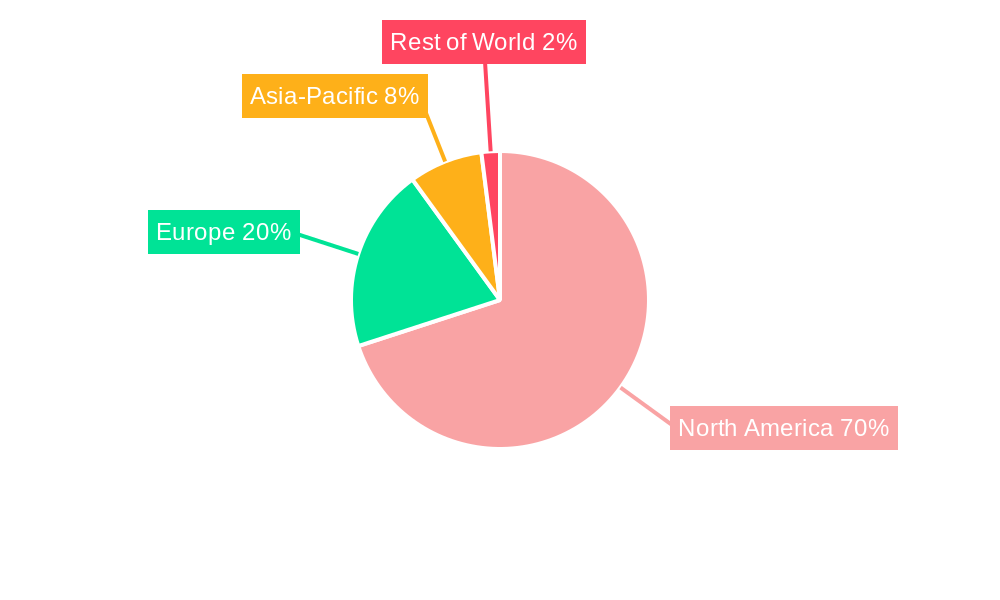

Dominant Regions, Countries, or Segments in North America Industrial Waste Management Market

The Eastern United States currently dominates the North American industrial waste management market, driven by high industrial concentration, established infrastructure, and a robust regulatory framework. Significant growth is anticipated in the Western United States and Canada due to increasing industrial activity and investments in infrastructure development. The hazardous waste management segment holds the largest market share, followed by the non-hazardous waste management segment.

- Key Drivers (Eastern US): High industrial density, advanced infrastructure, stringent regulations, established player presence.

- Growth Potential (Western US & Canada): Increasing industrialization, supportive government policies, investments in new infrastructure.

- Segment Dominance: Hazardous waste management segment accounts for xx% of the market share due to specialized handling needs and high regulatory scrutiny.

North America Industrial Waste Management Market Product Landscape

The North America industrial waste management market encompasses a comprehensive suite of services designed to handle the diverse and often complex waste streams generated by various industries. This includes the meticulous collection and transportation of hazardous and non-hazardous industrial byproducts, ensuring safe and compliant transit. A significant focus is placed on innovative processing and treatment methodologies, aiming to neutralize hazardous materials, reduce waste volume, and recover valuable resources. The ultimate goal is responsible disposal of residual waste, with a strong emphasis on recycling and reuse initiatives to promote a circular economy. Product innovations are relentlessly driven by the pursuit of enhanced operational efficiency, minimized environmental impact through reduced emissions and pollution, and elevated safety standards for both workers and surrounding communities. Key performance metrics, such as high waste diversion rates from landfills, maximized energy recovery rates from waste-to-energy processes, and significant reductions in greenhouse gas emissions, are critical indicators of market success. Unique selling propositions for market players often revolve around integrated, end-to-end service offerings, the deployment of cutting-edge technological capabilities, and the development of highly customized solutions meticulously tailored to the unique operational demands and waste profiles of specific industries. Advancements in technology are revolutionizing the sector, with the adoption of AI-driven waste sorting for improved material identification, increased automation in material handling to boost efficiency and safety, and the ubiquitous implementation of IoT-enabled monitoring systems for real-time data analysis and predictive maintenance.

Key Drivers, Barriers & Challenges in North America Industrial Waste Management Market

Key Drivers:

- Surging Industrial Output and Economic Growth: As North American economies expand, so does the volume of industrial activities, directly leading to increased generation of industrial waste requiring management solutions.

- Stringent Environmental Regulations and Escalating Penalties: Governments across North America are continuously strengthening environmental protection laws, imposing stricter compliance requirements and levying substantial penalties for non-adherence, compelling industries to invest in compliant waste management.

- Pervasive Adoption of Circular Economy Principles: A growing global and regional commitment to the principles of a circular economy is driving demand for waste management services that prioritize resource recovery, recycling, and waste reduction over landfilling.

- Technological Advancements Driving Efficiency and Sustainability: Ongoing innovations in waste processing, treatment, and recycling technologies offer more efficient, cost-effective, and environmentally sound solutions, acting as powerful catalysts for market growth.

- Increased Corporate Social Responsibility (CSR) Initiatives: Companies are increasingly integrating sustainable waste management practices into their CSR strategies, driven by stakeholder expectations and a desire to enhance their brand reputation.

Challenges & Restraints:

- Significant Capital Investment for Advanced Technologies: The implementation of state-of-the-art waste management technologies often requires substantial upfront capital investment, posing a barrier for some businesses, particularly small and medium-sized enterprises.

- Volatility in Recycled Material Commodity Prices: Fluctuations in global commodity markets can impact the economic viability of recycling operations, affecting the profitability and attractiveness of waste diversion services.

- Navigating Evolving Regulatory Landscapes: The dynamic nature of environmental regulations, with potential for policy shifts and evolving compliance requirements, can create uncertainty and necessitate continuous adaptation for waste management providers.

- Intense Market Competition: The North American market is characterized by the presence of established major players and the emergence of new, innovative entrants, leading to competitive pricing pressures and the need for differentiated service offerings.

- Supply Chain Disruptions Affecting Operational Efficiency: Global and regional supply chain disruptions can impact the availability of critical equipment, spare parts, and even the reliable collection and transportation of waste, leading to operational inefficiencies. For instance, these disruptions contributed to a significant decrease in operational efficiency in 2022 for many service providers.

- Public Perception and NIMBYism: Concerns regarding the siting of waste processing and disposal facilities can lead to "Not In My Backyard" (NIMBY) sentiments, posing challenges for the development of new infrastructure.

Emerging Opportunities in North America Industrial Waste Management Market

- Expansion of waste-to-energy and advanced recycling technologies.

- Development of innovative solutions for managing e-waste and plastic waste.

- Growing demand for sustainable and circular economy-focused solutions.

- Opportunities in emerging sectors like renewable energy and green building materials.

- Increased focus on data analytics and digital waste management solutions.

Growth Accelerators in the North America Industrial Waste Management Market Industry

The North American industrial waste management market is poised for substantial growth, propelled by several key accelerators. Revolutionary technological breakthroughs in areas such as advanced waste sorting, sophisticated processing techniques, and highly efficient recycling methods are fundamentally transforming the industry, enabling greater resource recovery and reduced environmental impact. The forging of strategic partnerships between established waste management companies and forward-thinking technology providers is a critical driver, fostering innovation and accelerating the adoption of new solutions across the market. Furthermore, the expansion into new geographical markets and the diligent focus on serving previously underserved customer segments, particularly in rapidly industrializing regions or specialized niche industries, are creating significant new revenue streams and market penetration opportunities. The unwavering government focus on promoting sustainable waste management policies, coupled with substantial investments in the development of robust waste management infrastructure, provides a supportive ecosystem that actively encourages market expansion and technological advancement.

Key Players Shaping the North America Industrial Waste Management Market Market

- Waste Connections

- Casella Waste Systems Inc

- Aevitas (a division of GFL Environmental)

- Rumpke Waste & Recycling

- Republic Services Inc

- FCC Environment Limited

- Biffa

- Stericycle

- Veolia North America

- Waste Management Inc

- Covanta

- Clean Harbors Inc

- GFL Environmental

- Progressive Waste Solutions (now part of Waste Connections)

- List Not Exhaustive

Notable Milestones in North America Industrial Waste Management Market Sector

- October 2023: Veolia North America acquired U.S. Industrial Technologies, expanding its market share and service offerings in the industrial waste management sector.

- June 2023: Casella Waste Systems, Inc. acquired Consolidated Waste Services, LLC (Twin Bridges) for USD 219 million, strengthening its position in the market.

In-Depth North America Industrial Waste Management Market Market Outlook

The North America industrial waste management market is poised for robust growth, driven by technological innovation, supportive regulatory frameworks, and increasing environmental awareness. Strategic partnerships, investments in advanced technologies, and expansion into underserved markets represent significant opportunities. The focus on sustainable waste management practices and circular economy principles will further shape the market's future, leading to increased adoption of efficient and environmentally friendly solutions.

North America Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition Waste

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

North America Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Industrial Waste Management Market Regional Market Share

Geographic Coverage of North America Industrial Waste Management Market

North America Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations; Increasing Number of Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Increasing Number of Industries

- 3.4. Market Trends

- 3.4.1. Oil and gas Production is Expected to Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition Waste

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Connections

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Casella Waste Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aevitas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rumpke Waste & Recycling

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Republic Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FCC Environment Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biffa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stericylce

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia North America

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waste Management Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covanta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Clean Harbors Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Waste Connections

List of Figures

- Figure 1: North America Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: North America Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: North America Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Waste Management Market?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the North America Industrial Waste Management Market?

Key companies in the market include Waste Connections, Casella Waste Systems Inc, Aevitas, Rumpke Waste & Recycling, Republic Services Inc, FCC Environment Limited, Biffa, Stericylce, Veolia North America, Waste Management Inc, Covanta, Clean Harbors Inc **List Not Exhaustive.

3. What are the main segments of the North America Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations; Increasing Number of Industries.

6. What are the notable trends driving market growth?

Oil and gas Production is Expected to Dominated the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Increasing Number of Industries.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia North America, one of the leading integrated providers of environmental services in the U.S. and Canada, announced that it completed the acquisition of U.S. Industrial Technologies, a Michigan-based provider of total waste and recycling services that managed industrial waste streams for automakers as well as other large manufacturers, medium and small businesses and governments and municipalities since 1996. The acquisition was likely to expand the U.S. market share for Veolia’s Environmental Solutions and Services (ESS) division, which is already recognized for its ability to provide customized integrated services for the management and treatment of hazardous, non-hazardous and recyclable waste for thousands of U.S. industrial, commercial and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence