Key Insights

India's steel fabrication industry is poised for substantial growth, driven by robust infrastructure development, a booming construction sector, and increasing demand from manufacturing. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.37% from 2024 to 2033. Key growth catalysts include extensive public and private investments in roads, railways, and urban infrastructure, alongside a surge in residential, commercial, and industrial construction projects. The "Make in India" initiative and government support for domestic manufacturing further bolster the sector's potential. While raw material price volatility and supply chain issues present challenges, the industry's outlook remains optimistic, with specialized segments like structural steel, pressure vessels, and equipment fabrication catering to diverse market needs. A competitive landscape with numerous key players underscores the industry's dynamism. Despite limited granular regional data, the consistent CAGR suggests widespread growth opportunities across India.

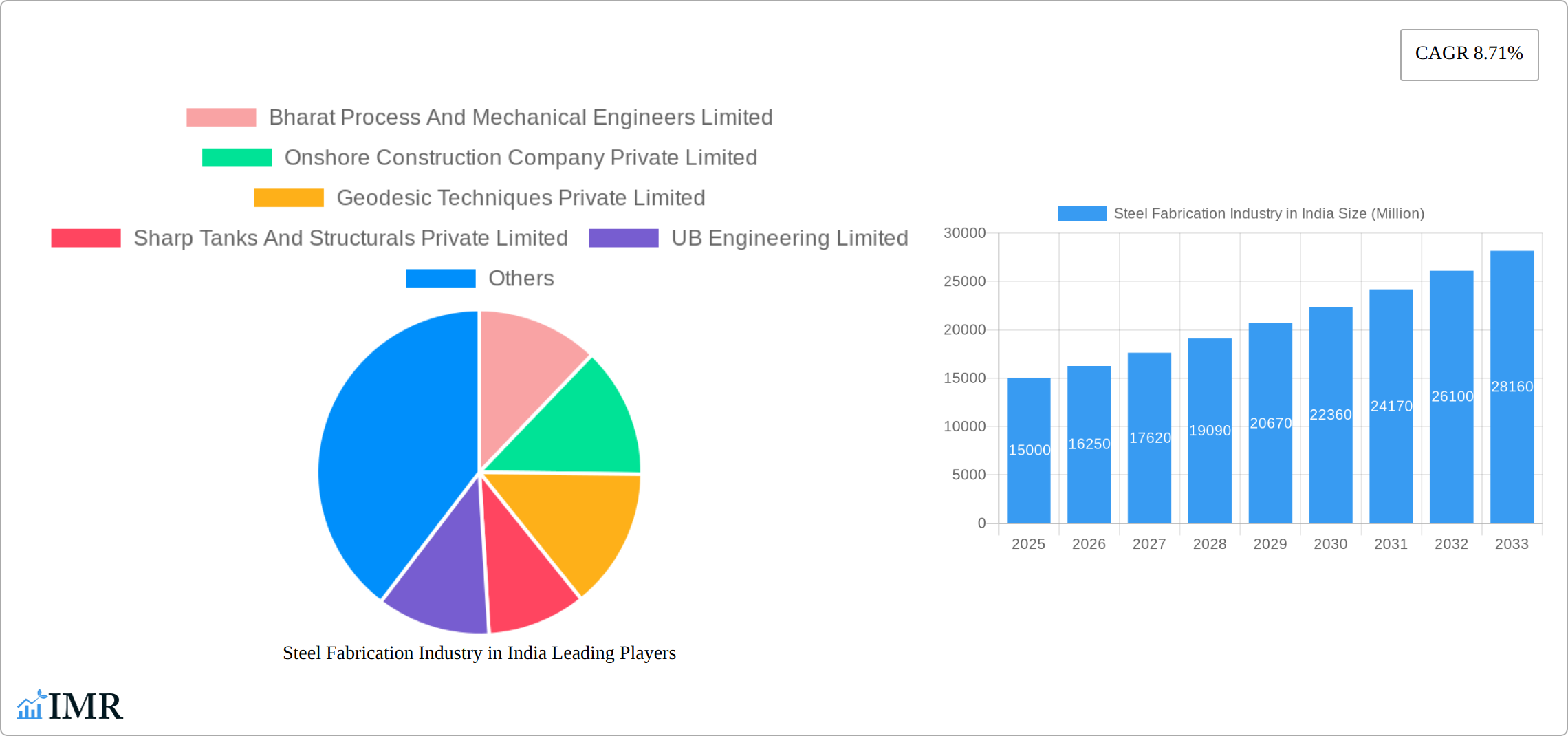

Steel Fabrication Industry in India Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion fueled by ongoing infrastructure projects and sustained construction activity. To capitalize on this growth, companies must prioritize technological upgrades for enhanced efficiency and productivity. Addressing sustainability and environmental considerations will be critical for long-term viability. Strategic collaborations, mergers, and acquisitions are expected to reshape the competitive landscape. Cultivating a skilled workforce and adapting to evolving industry standards are paramount for companies aiming to secure market share in this dynamic sector. The market size in 2024, estimated at 3.38 billion, provides a crucial benchmark for future projections, with the CAGR guiding growth estimations.

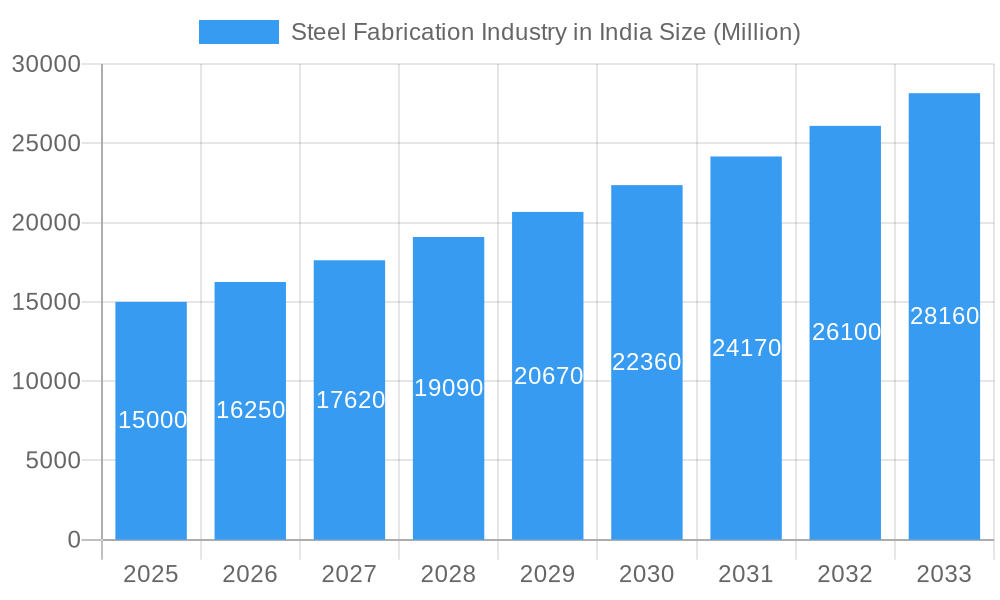

Steel Fabrication Industry in India Company Market Share

Steel Fabrication Industry in India: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Steel Fabrication Industry in India, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this dynamic sector. The parent market is the broader Indian steel industry, while the child market focuses specifically on steel fabrication services and products.

Steel Fabrication Industry in India Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indian steel fabrication industry. The market is characterized by a mix of large established players and smaller specialized firms. Market concentration is moderate, with the top 5 players holding approximately xx% market share (2024).

- Market Concentration: Moderate, top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Driven by automation, advanced welding techniques, and digital fabrication processes. Barriers include high initial investment costs and skill gaps.

- Regulatory Framework: Government initiatives promoting infrastructure development and "Make in India" significantly impact market growth. Compliance with safety and environmental regulations is crucial.

- Competitive Product Substitutes: Alternatives include aluminum and other materials, although steel retains a significant cost and strength advantage in many applications.

- End-User Demographics: The construction, automotive, energy, and infrastructure sectors are major end-users, with varying demand fluctuations based on economic cycles.

- M&A Trends: Recent activity reflects consolidation trends, exemplified by AM Mining's acquisitions of Indian Steel Corpn and Uttam Galva Steels, boosting downstream capabilities and value-added product portfolios. The volume of M&A deals is estimated at xx (Million USD) during 2019-2024.

Steel Fabrication Industry in India Growth Trends & Insights

The Indian steel fabrication market experienced significant growth during the historical period (2019-2024), driven by robust infrastructure spending and industrial expansion. The market size is estimated at xx Million USD in 2025. Technological disruptions, such as the adoption of advanced manufacturing techniques, are further fueling growth. Consumer behavior shifts towards sustainable and efficient construction methods also influence market dynamics. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. Market penetration is expected to increase due to rising demand across various sectors, especially in renewable energy and infrastructure projects. This growth will be further influenced by evolving construction techniques, governmental policies, and economic factors.

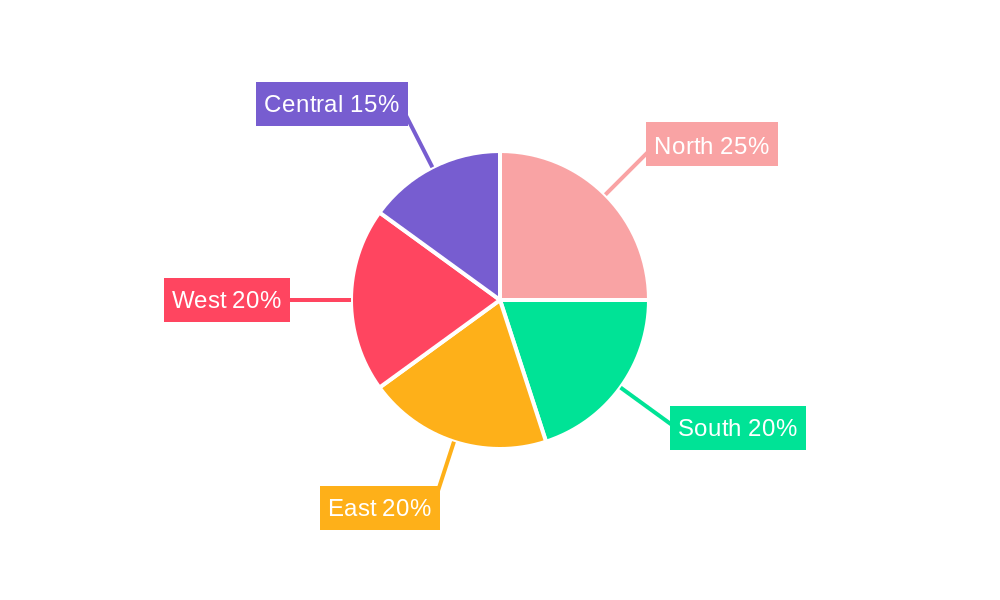

Dominant Regions, Countries, or Segments in Steel Fabrication Industry in India

The western and southern regions of India are currently leading the steel fabrication market due to high concentration of industrial hubs and construction activity. These regions benefit from better infrastructure and access to raw materials.

- Key Drivers: Favorable government policies, significant infrastructure development projects (e.g., smart cities, transportation networks), and robust industrial growth in these regions.

- Market Share & Growth Potential: The western and southern regions currently hold approximately xx% of the total market share, with projected growth exceeding the national average due to continued investment in infrastructure and manufacturing.

- Dominance Factors: Established industrial clusters, skilled labor pools, and proximity to major steel producers contribute to the dominance of these regions. Growth potential is further enhanced by ongoing urbanization and industrial expansion.

Steel Fabrication Industry in India Product Landscape

The Indian steel fabrication industry is a dynamic and diverse sector, offering an extensive portfolio of products that cater to a wide spectrum of industrial and infrastructural needs. Beyond fundamental structural components, the industry excels in delivering highly complex and precisely engineered customized assemblies. Recent groundbreaking innovations are actively reshaping the landscape, with a significant focus on developing lightweight steel structures that offer superior strength-to-weight ratios and ease of installation. Furthermore, advancements in pre-fabricated building components are revolutionizing construction timelines, while the adoption of advanced welding technologies is not only enhancing the quality and durability of fabricated steel but also driving substantial improvements in production efficiency and a reduction in overall manufacturing costs. These cutting-edge developments translate into compelling unique selling propositions for businesses, including accelerated construction cycles, minimized material wastage, and the creation of more sustainable and resource-efficient structures.

Key Drivers, Barriers & Challenges in Steel Fabrication Industry in India

Key Drivers: Increased government spending on infrastructure, rapid urbanization, growth in the renewable energy sector, and rising demand from the automotive industry.

Challenges & Restraints: Fluctuations in raw material prices (steel), intense competition, skilled labor shortages, and the need for continuous technological upgrades to maintain competitiveness. Supply chain disruptions have also impacted production and delivery timelines, leading to an estimated xx% increase in production costs in 2022.

Emerging Opportunities in Steel Fabrication Industry in India

The Indian steel fabrication sector is ripe with untapped market segments offering substantial growth potential. A key area of burgeoning opportunity lies in the specialized fabrication of steel components for the rapidly expanding renewable energy sector, encompassing critical elements for solar power installations and wind turbine towers. The continuous evolution of advanced manufacturing processes also presents a significant avenue for innovation, demanding sophisticated steel solutions. Moreover, the increasing adoption of steel in sustainable and green construction practices, driven by environmental consciousness and regulatory support, is creating new demand. The escalating need for pre-fabricated buildings and modular construction solutions is another powerful catalyst, paving the way for innovative product development and enabling fabricators to expand their reach into diverse new markets and applications.

Growth Accelerators in the Steel Fabrication Industry in India Industry

Several potent growth accelerators are propelling the steel fabrication industry in India forward. Technological advancements are at the forefront, with the integration of automation, sophisticated 3D printing capabilities, and advanced robotics significantly enhancing operational efficiency, precision, and output. Strategic collaborations and partnerships between leading steel producers and fabricators are proving instrumental in streamlining the entire supply chain, from raw material procurement to final product delivery, while simultaneously fostering a culture of innovation and collaborative problem-solving. Furthermore, a concerted effort to expand into new domestic and international markets, particularly targeting export-oriented sectors with high demand for quality steel fabrication, holds immense and largely untapped growth potential, positioning Indian fabricators on the global stage.

Key Players Shaping the Steel Fabrication Industry in India Market

- Bharat Process And Mechanical Engineers Limited

- Onshore Construction Company Private Limited

- Geodesic Techniques Private Limited

- Sharp Tanks And Structurals Private Limited

- UB Engineering Limited

- Space Chem Engineers Private Limited

- Arun Fabricators

- Indhya Engineering Associates

- DD Erectors

- John Erectors Private Limited (List Not Exhaustive)

Notable Milestones in Steel Fabrication Industry in India Sector

- November 2022: AM Mining India completed the acquisition of Uttam Galva Steels, consolidating market share and enhancing downstream capabilities.

- April 2023: AM Mining acquired Indian Steel Corpn for INR 897 crore, further strengthening its position in the value-added steel production segment.

In-Depth Steel Fabrication Industry in India Market Outlook

The steel fabrication industry in India is exceptionally well-positioned for robust and sustained growth in the coming years. This optimistic outlook is primarily underpinned by the nation's continuous and substantial investment in infrastructure development, the ongoing expansion of its industrial base, and the pervasive influence of rapid technological advancements. Strategic alliances, significant investments in cutting-edge automation technologies, and a dedicated focus on developing and implementing sustainable fabrication solutions are identified as critical determinants for maximizing market potential and achieving enduring success. The Indian steel fabrication market is projected to experience remarkable expansion, with an anticipated valuation of **xx Million USD by 2033**, presenting exceptionally lucrative opportunities for both established industry leaders and ambitious new entrants seeking to capitalize on this thriving sector.

Steel Fabrication Industry in India Segmentation

-

1. End-user Industry

- 1.1. Manufacturing

- 1.2. Power and Energy

- 1.3. Construction

- 1.4. Oil and Gas

- 1.5. Other End-user Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

Steel Fabrication Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Steel Fabrication Industry in India Regional Market Share

Geographic Coverage of Steel Fabrication Industry in India

Steel Fabrication Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- 3.4. Market Trends

- 3.4.1. Rising Demand for Pre-engineered Buildings and Components

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Manufacturing

- 5.1.2. Power and Energy

- 5.1.3. Construction

- 5.1.4. Oil and Gas

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Manufacturing

- 6.1.2. Power and Energy

- 6.1.3. Construction

- 6.1.4. Oil and Gas

- 6.1.5. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Heavy Sectional Steel

- 6.2.2. Light Sectional Steel

- 6.2.3. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. South America Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Manufacturing

- 7.1.2. Power and Energy

- 7.1.3. Construction

- 7.1.4. Oil and Gas

- 7.1.5. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Heavy Sectional Steel

- 7.2.2. Light Sectional Steel

- 7.2.3. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Manufacturing

- 8.1.2. Power and Energy

- 8.1.3. Construction

- 8.1.4. Oil and Gas

- 8.1.5. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Heavy Sectional Steel

- 8.2.2. Light Sectional Steel

- 8.2.3. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Middle East & Africa Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Manufacturing

- 9.1.2. Power and Energy

- 9.1.3. Construction

- 9.1.4. Oil and Gas

- 9.1.5. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Heavy Sectional Steel

- 9.2.2. Light Sectional Steel

- 9.2.3. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Asia Pacific Steel Fabrication Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Manufacturing

- 10.1.2. Power and Energy

- 10.1.3. Construction

- 10.1.4. Oil and Gas

- 10.1.5. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Heavy Sectional Steel

- 10.2.2. Light Sectional Steel

- 10.2.3. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bharat Process And Mechanical Engineers Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Onshore Construction Company Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Geodesic Techniques Private Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sharp Tanks And Structurals Private Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UB Engineering Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Space Chem Engineers Private Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arun Fabricators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indhya Engineering Associates

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DD Erectors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 John Erectors Private Limited**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bharat Process And Mechanical Engineers Limited

List of Figures

- Figure 1: Global Steel Fabrication Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: North America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: South America Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: South America Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 17: Europe Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East & Africa Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by End-user Industry 2025 & 2033

- Figure 27: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Steel Fabrication Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Steel Fabrication Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Steel Fabrication Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Steel Fabrication Industry in India Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Steel Fabrication Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 39: Global Steel Fabrication Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Steel Fabrication Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steel Fabrication Industry in India?

The projected CAGR is approximately 4.37%.

2. Which companies are prominent players in the Steel Fabrication Industry in India?

Key companies in the market include Bharat Process And Mechanical Engineers Limited, Onshore Construction Company Private Limited, Geodesic Techniques Private Limited, Sharp Tanks And Structurals Private Limited, UB Engineering Limited, Space Chem Engineers Private Limited, Arun Fabricators, Indhya Engineering Associates, DD Erectors, John Erectors Private Limited**List Not Exhaustive.

3. What are the main segments of the Steel Fabrication Industry in India?

The market segments include End-user Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

6. What are the notable trends driving market growth?

Rising Demand for Pre-engineered Buildings and Components.

7. Are there any restraints impacting market growth?

Rising Demand for Pre-engineered Buildings and Components; Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India.

8. Can you provide examples of recent developments in the market?

April 2023: AM Mining, a joint venture between Arcelor Mittal Luxembourg and Nippon Steel Corporation, Japan to acquire Indian Steel Corpn for INR 897 crore. The acquisition of Indian Steel Corporation will likely enhance downstream capabilities and broaden its product portfolio as the company looks to capitalize on market opportunities presented by the steel industry, especially in high-value-added steel production besides capturing synergies across downstream operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steel Fabrication Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steel Fabrication Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steel Fabrication Industry in India?

To stay informed about further developments, trends, and reports in the Steel Fabrication Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence