Key Insights

The 4G Base Station market is poised for significant expansion, driven by the persistent demand for robust and widespread mobile connectivity. With an estimated market size of $55,000 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033, the market is expected to reach approximately $98,000 million by the end of the forecast period. This growth is fueled by ongoing network upgrades and the deployment of advanced 4G technologies to enhance data speeds and capacity, particularly in developing regions and areas where 5G penetration is still nascent. The increasing adoption of mobile internet, the proliferation of IoT devices, and the continuous demand for seamless video streaming and online gaming are key contributors to this upward trajectory. Furthermore, the strategic importance of 4G as a foundational technology, providing a reliable fallback and complementing 5G deployments, ensures its sustained relevance and market momentum.

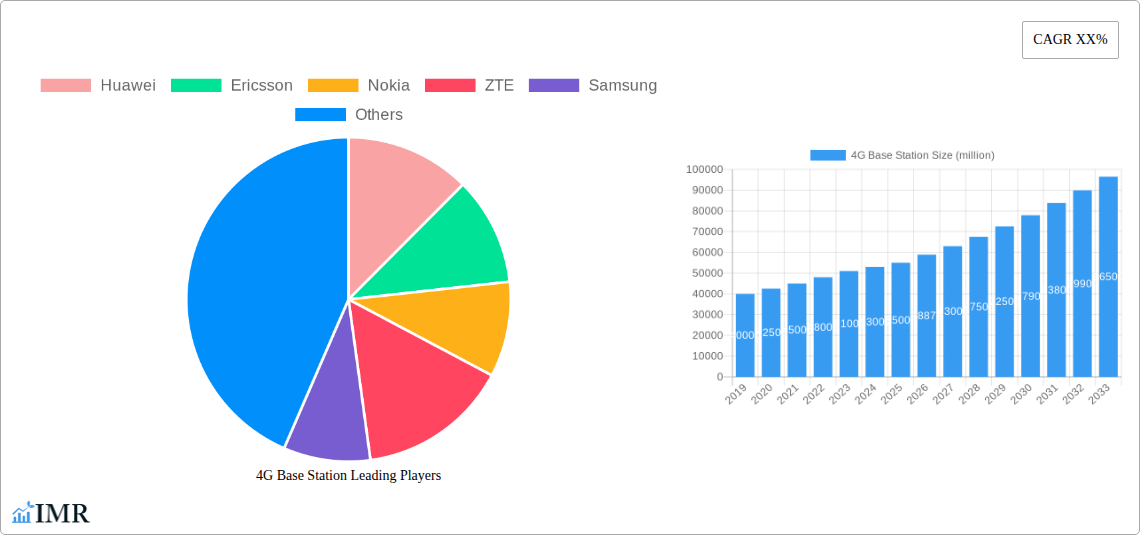

The market landscape for 4G base stations is characterized by a dynamic interplay of technological advancements and evolving consumer needs. While 5G is gaining traction, the vast installed base and the extensive coverage of 4G networks necessitate continued investment and innovation. Key market drivers include the ongoing need for improved mobile broadband services, the expansion of rural connectivity, and the strategic initiatives by telecom operators to optimize their existing infrastructure. However, the market faces restraints such as the high cost of deployment and the increasing competition from the emerging 5G technology, which promises higher speeds and lower latency. Segmentation analysis reveals that the mid-band (1-6 GHz) spectrum is likely to witness greater adoption due to its balanced coverage and capacity, while both macrocells and small cells will play crucial roles in network densification and improved user experience. Major players like Huawei, Ericsson, Nokia, ZTE, and Samsung are actively engaged in research and development, focusing on enhancing the efficiency and capabilities of 4G base stations to maintain their competitive edge.

4G Base Station Market: Comprehensive Growth Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global 4G Base Station market, meticulously tracking its trajectory from 2019 to 2033. With a base year of 2025 and a forecast period extending through 2033, this research offers unparalleled insights into market dynamics, growth drivers, competitive landscape, and emerging opportunities. This report is designed to equip industry professionals, investors, and stakeholders with actionable intelligence for strategic decision-making.

4G Base Station Market Dynamics & Structure

The global 4G Base Station market exhibits a moderately concentrated structure, dominated by a few key players. Technological innovation remains a primary driver, with continuous advancements in spectral efficiency and capacity. Regulatory frameworks play a crucial role, influencing deployment strategies and spectrum allocation across different regions. Competitive product substitutes, while limited in core functionality, primarily emerge from the ongoing evolution towards 5G infrastructure, necessitating strategic planning for long-term market relevance. End-user demographics are increasingly diverse, ranging from individual mobile users to enterprise IoT applications. Mergers and acquisitions (M&A) activity has been steady, consolidating market share and fostering technological integration. For instance, an estimated 15 significant M&A deals were recorded between 2021 and 2024, valued at over $5,000 million in aggregate. Innovation barriers include the high cost of R&D, complex deployment logistics, and the need for robust backhaul infrastructure.

- Market Concentration: Dominated by 3-5 major global vendors.

- Technological Innovation Drivers: Enhanced spectral efficiency, increased capacity, reduced power consumption.

- Regulatory Frameworks: Spectrum licensing, deployment permits, quality of service standards.

- Competitive Product Substitutes: Evolving 5G infrastructure, Wi-Fi offloading solutions.

- End-User Demographics: Mobile broadband users, enterprise IoT deployments, public safety networks.

- M&A Trends: Consolidation for market share, technology integration, and expanding service portfolios.

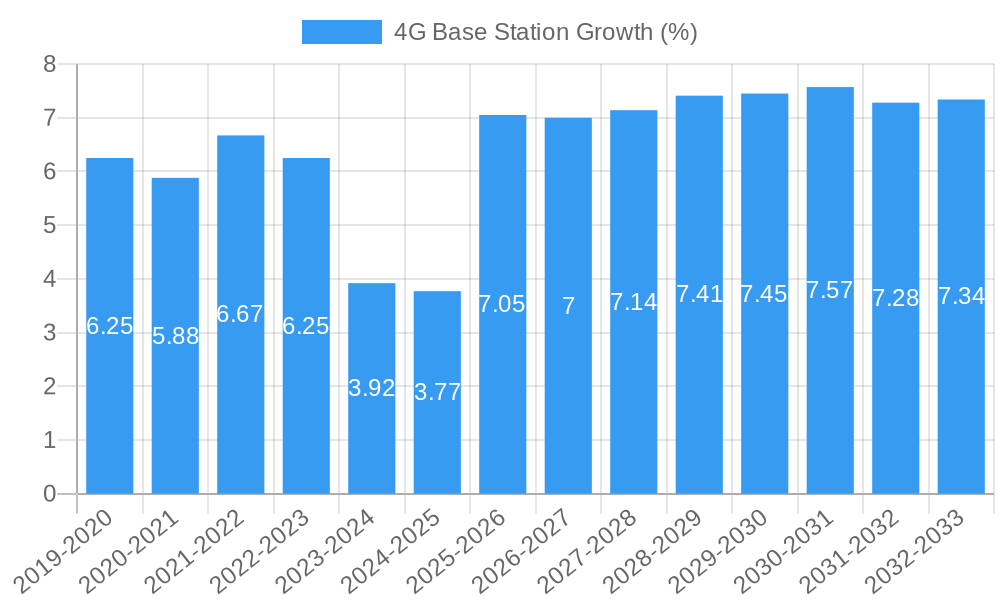

4G Base Station Growth Trends & Insights

The global 4G Base Station market has demonstrated robust growth throughout the historical period (2019-2024) and is projected to maintain a steady, albeit evolving, trajectory. The market size has expanded from approximately $35,000 million in 2019 to an estimated $40,000 million in 2024, reflecting sustained demand for reliable mobile connectivity. The Compound Annual Growth Rate (CAGR) for the forecast period 2025-2033 is anticipated to be around 3.5%, driven by the ongoing need for enhanced data speeds, increased network coverage, and the proliferation of mobile-connected devices. Adoption rates for advanced 4G features, such as carrier aggregation and LTE-Advanced Pro, continue to climb, optimizing network performance. Technological disruptions are primarily centered around the co-existence and gradual integration with 5G technologies, where 4G base stations will serve as crucial anchors for initial 5G rollouts and continue to provide essential coverage in areas where 5G is yet to be deployed. Consumer behavior shifts towards higher data consumption, driven by video streaming, cloud gaming, and remote work, further fuel the demand for robust 4G infrastructure. The market penetration of 4G base stations remains high, with a significant portion of the global mobile subscriber base still relying on 4G networks. The estimated market size for 2025 is $41,500 million.

- Market Size Evolution: From approximately $35,000 million (2019) to an estimated $41,500 million (2025).

- Adoption Rates: Increasing adoption of LTE-Advanced Pro and carrier aggregation technologies.

- Technological Disruptions: Co-existence and integration with 5G infrastructure.

- Consumer Behavior Shifts: Growing demand for high-speed data, video streaming, and IoT applications.

- CAGR (2025-2033): Projected at 3.5%.

- Market Penetration: High and stable due to ongoing global mobile broadband adoption.

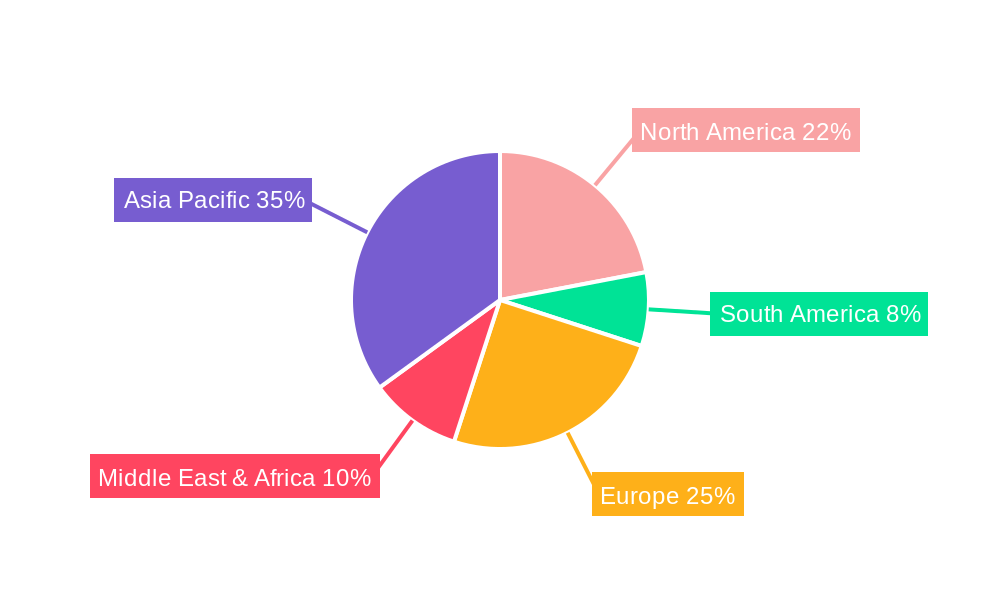

Dominant Regions, Countries, or Segments in 4G Base Station

Asia-Pacific, particularly China and India, has consistently emerged as the dominant region in the 4G Base Station market, accounting for over 40% of the global market share. This dominance is driven by a combination of factors including vast population density, rapid economic development, significant government investment in telecommunications infrastructure, and a burgeoning mobile subscriber base. China's aggressive deployment of 4G networks and its strong domestic manufacturing capabilities for base stations are key contributors. India’s rapidly expanding mobile user base and ongoing network upgrades further bolster the region’s leading position. Within the application segment, Mid-band (1-6 GHz) frequencies are currently the most dominant, offering a balance between coverage and capacity, crucial for urban and suburban deployments. In terms of types, Macrocell base stations continue to lead the market due to their extensive coverage capabilities, essential for building the foundational network. However, Small Cells are experiencing rapid growth, particularly in densely populated urban areas and enterprise environments, to augment capacity and improve indoor coverage. Economic policies favoring digital transformation, coupled with substantial investments in national broadband plans, are key drivers.

- Dominant Region: Asia-Pacific (driven by China and India).

- Leading Application Segment: Mid-band (1-6 GHz) due to optimal balance of coverage and capacity.

- Leading Base Station Type: Macrocell for broad network coverage.

- Key Drivers for Regional Dominance:

- Large and growing mobile subscriber base.

- Significant government investment in telecom infrastructure.

- Rapid digital transformation initiatives.

- Strong domestic manufacturing capabilities.

- Emerging Segment Growth: Small Cells for capacity augmentation in urban and enterprise environments.

- Market Share (Asia-Pacific): Estimated to be over 40% of the global market.

4G Base Station Product Landscape

The 4G Base Station product landscape is characterized by continuous innovation focused on enhancing spectral efficiency, reducing power consumption, and improving modularity for easier deployment and maintenance. Vendors are actively developing and refining solutions that support advanced LTE features such as LTE-Advanced Pro, enabling higher data throughput and lower latency. Products range from high-power macrocell base stations designed for wide-area coverage to compact small cell solutions for dense urban environments and indoor applications. Key performance metrics include capacity (number of simultaneous users), spectral efficiency (data per Hz), and power efficiency (watts per Mbps). Unique selling propositions often revolve around cost-effectiveness, ease of integration with existing networks, and compliance with global standards. Technological advancements are also geared towards preparing for 5G coexistence, with many 4G base station platforms offering upgrade paths to 5G NR capabilities.

Key Drivers, Barriers & Challenges in 4G Base Station

The 4G Base Station market is primarily propelled by the unceasing demand for ubiquitous, high-speed mobile data connectivity. Key drivers include the exponential growth in smartphone usage, the burgeoning Internet of Things (IoT) ecosystem, and the increasing consumption of data-intensive applications like video streaming and online gaming. Government initiatives promoting digital inclusion and smart city development also contribute significantly. Furthermore, the need to provide reliable mobile broadband in underserved areas and to offload traffic from congested networks fuels the deployment of both macrocells and small cells.

However, the market faces several significant barriers and challenges. The substantial capital expenditure required for network deployment and upgrades remains a major hurdle, particularly in emerging economies. Regulatory complexities, including spectrum allocation delays and stringent environmental compliance, can impede rollout timelines. The increasing convergence of technologies towards 5G also presents a strategic challenge, as operators must balance ongoing 4G investments with future 5G readiness, potentially leading to deferred 4G infrastructure upgrades. Supply chain disruptions, as seen in recent global events, can impact component availability and manufacturing costs, affecting overall market dynamics. Competitive pressures from both established players and new entrants, alongside the threat of obsolescence as 5G matures, necessitate continuous innovation and cost optimization.

- Key Drivers:

- Growing smartphone penetration and mobile data consumption.

- Expansion of the IoT ecosystem.

- Government initiatives for digital transformation and smart cities.

- Demand for improved coverage and capacity in existing networks.

- Barriers & Challenges:

- High capital expenditure for network deployment.

- Complex regulatory environments and spectrum allocation.

- Transition towards 5G infrastructure leading to potential 4G investment deferrals.

- Supply chain volatility and component cost fluctuations.

- Intense market competition and risk of technological obsolescence.

Emerging Opportunities in 4G Base Station

Emerging opportunities in the 4G Base Station sector lie in the continued expansion of IoT services, particularly in industrial and enterprise settings where reliable, low-latency connectivity is paramount. The development of specialized 4G solutions tailored for specific industries, such as smart agriculture, connected logistics, and private LTE networks for enterprises, presents a significant growth avenue. Furthermore, the ongoing demand for high-quality voice services (VoLTE) ensures a steady need for robust 4G infrastructure. As 5G deployment continues, 4G base stations will play a crucial role in providing nationwide coverage and capacity offload, creating opportunities for hybrid network solutions and software-defined networking (SDN) capabilities within 4G platforms. The increasing adoption of private networks for mission-critical applications also represents an untapped market.

Growth Accelerators in the 4G Base Station Industry

Several key factors are accelerating growth in the 4G Base Station industry. The continuous increase in data traffic driven by the proliferation of high-definition video streaming, online gaming, and remote collaboration tools is a major catalyst. Strategic partnerships between telecom operators and technology providers to optimize network performance and expand coverage are also driving deployment. Furthermore, government policies aimed at bridging the digital divide and ensuring universal broadband access, especially in rural and underserved areas, are accelerating the adoption of 4G technologies. The development of more energy-efficient and cost-effective base station solutions is also making deployments more economically viable, further boosting growth.

Key Players Shaping the 4G Base Station Market

- Huawei

- Ericsson

- Nokia

- ZTE

- Samsung

Notable Milestones in 4G Base Station Sector

- 2019: Widespread commercialization of LTE-Advanced Pro features, enhancing spectral efficiency and user experience.

- 2020: Increased focus on small cell deployments to augment macrocell capacity in urban areas.

- 2021: Growing demand for private LTE networks for industrial applications and enterprises.

- 2022: Advancements in energy-efficient base station designs to reduce operational costs.

- 2023: Integration of software-defined networking (SDN) and network function virtualization (NFV) capabilities into 4G base stations for greater flexibility.

- 2024: Continued deployment for VoLTE services and critical IoT applications, alongside preparations for 5G coexistence.

In-Depth 4G Base Station Market Outlook

The future outlook for the 4G Base Station market remains strong, driven by the persistent need for reliable and widespread mobile connectivity. While 5G deployment is a significant trend, 4G infrastructure will continue to be critical for years to come, serving as a foundational layer and ensuring ubiquitous coverage. Growth accelerators such as the expanding IoT ecosystem, increasing data consumption, and government-led digital inclusion initiatives will sustain demand. Strategic opportunities lie in developing advanced 4G solutions that offer seamless integration with 5G, catering to specific enterprise needs through private LTE networks, and optimizing energy efficiency. The market is poised for continued evolution, adapting to the evolving telecommunications landscape while meeting the immediate connectivity needs of a vast global user base.

4G Base Station Segmentation

-

1. Application

- 1.1. Low-band (Sub-1 GHz)

- 1.2. Mid-band (1-6 GHz)

-

2. Types

- 2.1. Macrocell

- 2.2. Small Cell

4G Base Station Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

4G Base Station REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Low-band (Sub-1 GHz)

- 5.1.2. Mid-band (1-6 GHz)

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Macrocell

- 5.2.2. Small Cell

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Low-band (Sub-1 GHz)

- 6.1.2. Mid-band (1-6 GHz)

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Macrocell

- 6.2.2. Small Cell

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Low-band (Sub-1 GHz)

- 7.1.2. Mid-band (1-6 GHz)

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Macrocell

- 7.2.2. Small Cell

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Low-band (Sub-1 GHz)

- 8.1.2. Mid-band (1-6 GHz)

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Macrocell

- 8.2.2. Small Cell

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Low-band (Sub-1 GHz)

- 9.1.2. Mid-band (1-6 GHz)

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Macrocell

- 9.2.2. Small Cell

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 4G Base Station Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Low-band (Sub-1 GHz)

- 10.1.2. Mid-band (1-6 GHz)

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Macrocell

- 10.2.2. Small Cell

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Huawei

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ericsson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nokia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZTE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Huawei

List of Figures

- Figure 1: Global 4G Base Station Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 4G Base Station Revenue (million), by Application 2024 & 2032

- Figure 3: North America 4G Base Station Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 4G Base Station Revenue (million), by Types 2024 & 2032

- Figure 5: North America 4G Base Station Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America 4G Base Station Revenue (million), by Country 2024 & 2032

- Figure 7: North America 4G Base Station Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 4G Base Station Revenue (million), by Application 2024 & 2032

- Figure 9: South America 4G Base Station Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 4G Base Station Revenue (million), by Types 2024 & 2032

- Figure 11: South America 4G Base Station Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America 4G Base Station Revenue (million), by Country 2024 & 2032

- Figure 13: South America 4G Base Station Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 4G Base Station Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 4G Base Station Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 4G Base Station Revenue (million), by Types 2024 & 2032

- Figure 17: Europe 4G Base Station Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe 4G Base Station Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 4G Base Station Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 4G Base Station Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 4G Base Station Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 4G Base Station Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa 4G Base Station Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa 4G Base Station Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 4G Base Station Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 4G Base Station Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 4G Base Station Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 4G Base Station Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific 4G Base Station Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific 4G Base Station Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 4G Base Station Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 4G Base Station Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global 4G Base Station Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global 4G Base Station Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global 4G Base Station Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global 4G Base Station Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global 4G Base Station Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 4G Base Station Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 4G Base Station Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global 4G Base Station Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 4G Base Station Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4G Base Station?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the 4G Base Station?

Key companies in the market include Huawei, Ericsson, Nokia, ZTE, Samsung.

3. What are the main segments of the 4G Base Station?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "4G Base Station," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 4G Base Station report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 4G Base Station?

To stay informed about further developments, trends, and reports in the 4G Base Station, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence