Key Insights

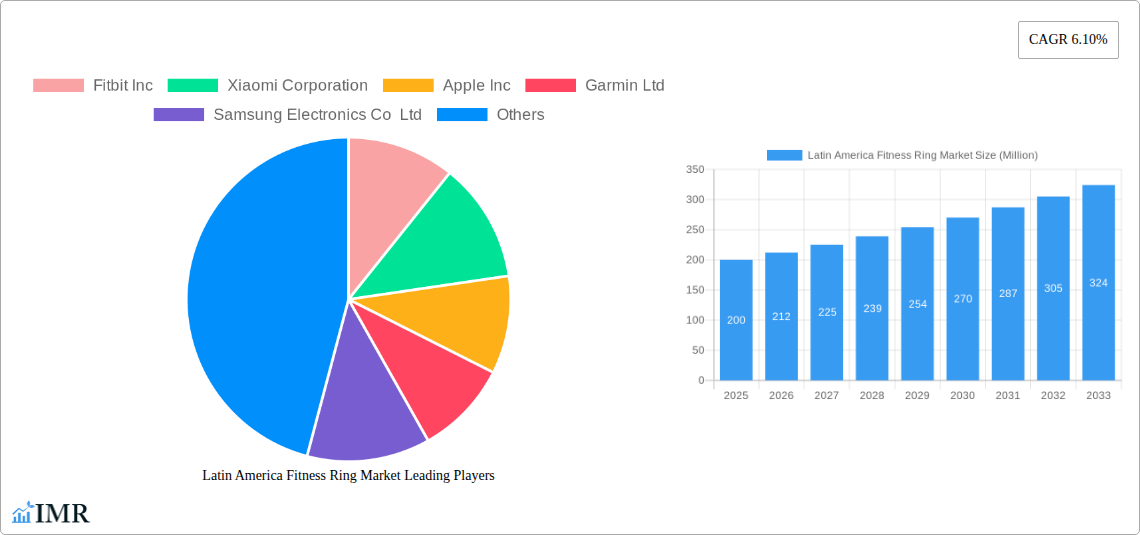

The Latin America fitness ring market is poised for substantial growth, projected to reach approximately $200 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 6.10% through 2033. This robust expansion is fueled by a confluence of powerful drivers, including the escalating health consciousness among consumers, a growing preference for wearable technology that offers discreet yet comprehensive health monitoring, and increasing disposable incomes across key Latin American economies. The market is witnessing a significant shift towards smart fitness rings, which offer advanced features such as continuous heart rate tracking, sleep analysis, blood oxygen monitoring, and even ECG capabilities, catering to a more informed and health-aware consumer base. Early adoption trends are particularly strong in countries like Brazil and Mexico, where digital health adoption is accelerating.

Latin America Fitness Ring Market Market Size (In Million)

Despite the promising outlook, the market faces certain restraints, primarily the relatively high price point of advanced smart fitness rings, which can be a barrier for a significant portion of the population in some Latin American countries. Additionally, the need for greater consumer education regarding the benefits and functionality of fitness rings, especially compared to more established smartwatches and fitness bands, remains a key challenge. However, the increasing efforts by leading companies like Fitbit, Xiaomi, Apple, Garmin, and Samsung to localize their product offerings and marketing strategies, coupled with potential price reductions and the introduction of more affordable basic fitness rings, are expected to mitigate these challenges. The trend towards personalized health insights and preventative care is a major tailwind, positioning fitness rings as integral tools for proactive wellness management across the region.

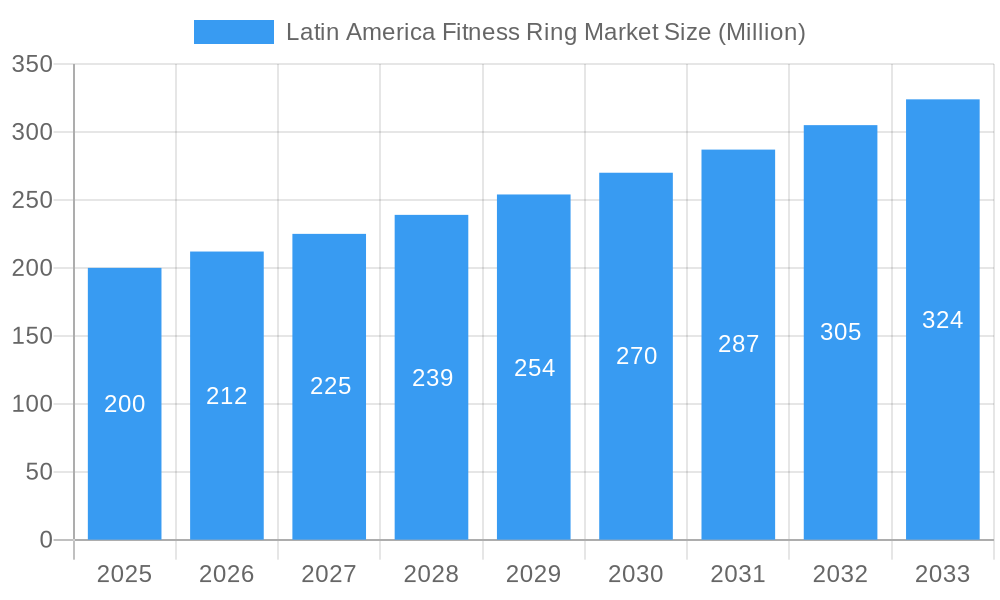

Latin America Fitness Ring Market Company Market Share

This in-depth report provides an unparalleled analysis of the Latin America Fitness Ring Market, offering a detailed examination of market dynamics, growth trends, product landscape, key players, and future opportunities. Spanning the study period of 2019–2033, with a base year of 2025, the report delves into the historical period (2019–2024) and provides a robust forecast period (2025–2033). Essential for fitness wearable manufacturers, technology providers, health and wellness investors, and market strategists, this report unlocks critical insights into this rapidly evolving sector.

Latin America Fitness Ring Market Dynamics & Structure

The Latin America fitness ring market is characterized by a dynamic and evolving landscape, driven by increasing health consciousness and technological advancements. Market concentration is moderate, with key players actively vying for market share. Xiaomi Corporation and Fitbit Inc., a subsidiary of Google, currently hold significant positions, followed by emerging players like Apple Inc. and Garmin Ltd. Samsung Electronics Co Ltd is also making strides in this competitive arena. Technological innovation is a primary driver, with continuous development in sensor accuracy, battery life, and AI-powered health insights. Regulatory frameworks are largely supportive, focusing on data privacy and consumer protection, although specific standards for health tracking accuracy are still maturing. Competitive product substitutes include smartwatches, fitness bands, and even traditional jewelry with integrated tracking capabilities, although fitness rings offer a discreet and focused form factor. End-user demographics are shifting towards a younger, tech-savvy population and a growing segment of health-conscious individuals across all age groups, particularly in urban centers. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation, with smaller innovative startups potentially being acquired by larger established players. Innovation barriers include the high cost of advanced sensor technology and the need for extensive clinical validation for advanced health features like AFib detection.

- Market Concentration: Moderate, with increasing competition.

- Key Players: Xiaomi Corporation, Fitbit Inc., Apple Inc., Garmin Ltd, Samsung Electronics Co Ltd.

- Technological Innovation Drivers: Sensor accuracy, battery efficiency, AI-driven analytics, personalized health insights.

- Regulatory Frameworks: Primarily focused on data privacy and consumer protection.

- Competitive Product Substitutes: Smartwatches, fitness bands, health-focused apps.

- End-User Demographics: Young adults, fitness enthusiasts, health-conscious individuals, elderly seeking discreet monitoring.

- M&A Trends: Expected to increase for market consolidation and technology acquisition.

- Innovation Barriers: High R&D costs, rigorous validation for medical-grade features.

Latin America Fitness Ring Market Growth Trends & Insights

The Latin America fitness ring market is poised for substantial growth, fueled by escalating consumer demand for wearable technology that seamlessly integrates health monitoring into daily life. Market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% from 2025 to 2033, reaching an estimated USD 1.8 billion by the end of the forecast period. The adoption rates are steadily increasing, driven by greater awareness of preventative healthcare and the convenience offered by these discreet devices. Technological disruptions, such as the integration of advanced sensors capable of monitoring a wider array of physiological metrics, are key to this expansion. Consumer behavior is shifting towards personalized wellness solutions, with individuals actively seeking data-driven insights to manage their health, fitness, and sleep patterns. This trend is particularly evident in countries like Brazil, Mexico, and Colombia, where a growing middle class with higher disposable incomes is embracing smart wearables. The market penetration of fitness rings, while still nascent compared to smartwatches, is expected to surge as affordability increases and more specialized features become available. The smart fitness rings segment, in particular, is anticipated to outperform the basic fitness ring segment due to its advanced capabilities and appeal to the digitally native population.

- Projected Market Size (2033): USD 1.8 billion

- Estimated CAGR (2025-2033): 18.5%

- Key Growth Drivers: Increasing health awareness, demand for discreet wearables, advancements in sensor technology, rising disposable incomes.

- Adoption Rates: Steadily increasing, particularly in urban centers.

- Technological Disruptions: Integration of advanced sensors for comprehensive health tracking (e.g., ECG, blood oxygen).

- Consumer Behavior Shifts: Growing preference for personalized wellness, data-driven health management, and preventative care.

- Market Penetration: Expected to rise significantly as product awareness and affordability grow.

- Segment Growth: Smart fitness rings to lead growth over basic fitness rings.

Dominant Regions, Countries, or Segments in Latin America Fitness Ring Market

The Smart Fitness Rings segment is unequivocally the dominant force driving growth within the Latin America Fitness Ring Market. This dominance is underpinned by the segment's ability to offer a richer, more integrated health and wellness experience compared to basic fitness rings. Consumers are increasingly willing to invest in sophisticated devices that provide actionable insights into sleep quality, stress levels, recovery, and even early detection of potential health issues. This preference is evident across key Latin American markets, with Brazil emerging as the leading country due to its large population, robust economic activity, and a burgeoning tech-savvy consumer base. Mexico and Colombia follow closely, exhibiting strong adoption rates and a growing demand for advanced wearable technology.

Key drivers for the dominance of smart fitness rings and the growth in these countries include:

- Technological Sophistication: Smart fitness rings incorporate advanced sensors, such as ECG, SpO2, and skin temperature sensors, offering a more comprehensive health profile.

- Data-Driven Insights: The ability to provide personalized recommendations and detailed analytics on sleep, activity, and recovery resonates strongly with health-conscious individuals.

- Growing Health and Wellness Awareness: A heightened focus on preventative healthcare and proactive health management is propelling the demand for devices that offer continuous monitoring.

- Urbanization and Digital Literacy: Concentration of economic activity and higher digital literacy in major cities like São Paulo, Mexico City, and Bogotá facilitates the adoption of smart wearables.

- Disposable Income Growth: An expanding middle class in key economies has more discretionary income to spend on premium technology products.

- Brand Influence and Ecosystem Integration: Companies like Apple and Google (via Fitbit) are leveraging their existing brand loyalty and integrated ecosystem to drive smart ring adoption.

In Brazil, for instance, the government's increasing focus on public health initiatives and the private sector's investment in digital health solutions create a fertile ground for fitness ring adoption. Similarly, Mexico's large and young population, coupled with a growing e-commerce penetration, further bolsters the demand for smart fitness rings. The market share within the smart fitness rings segment is projected to see Xiaomi Corporation and Fitbit Inc. retaining significant portions, while Apple Inc. is expected to capture a growing share as it expands its wearable offerings. The potential for Garmin Ltd. to leverage its expertise in sports and fitness tracking also presents a notable growth opportunity.

Latin America Fitness Ring Market Product Landscape

The product landscape for Latin America fitness rings is rapidly evolving, marked by continuous innovation in sensor technology and feature sets. Smart Fitness Rings represent the vanguard, integrating advanced biometric sensors capable of tracking heart rate variability, blood oxygen saturation (SpO2), skin temperature, and even offering preliminary atrial fibrillation (AFib) detection, as exemplified by Ultrahuman's recent advancements. These devices go beyond basic step counting to provide comprehensive insights into sleep stages, stress levels, and recovery readiness. Basic Fitness Rings, while less feature-rich, offer a more accessible entry point, primarily focusing on activity tracking, sleep monitoring, and calorie expenditure. Unique selling propositions often revolve around discreet design, long battery life, and specialized health tracking modules, such as those for menstrual cycle prediction and pregnancy tracking. The emphasis is increasingly on turning raw data into actionable advice, empowering users to make informed decisions about their health and lifestyle.

Key Drivers, Barriers & Challenges in Latin America Fitness Ring Market

Key Drivers:

- Rising Health Consciousness: A growing awareness of the importance of preventative healthcare and proactive health management is a primary driver.

- Technological Advancements: Continuous improvements in sensor accuracy, battery life, and data analytics enhance user experience and utility.

- Demand for Discreet Wearables: Fitness rings offer a less obtrusive alternative to smartwatches, appealing to users seeking subtle health tracking.

- Growing E-commerce Penetration: Increased online sales channels facilitate wider accessibility and purchase opportunities across Latin America.

- Influence of Fitness and Wellness Trends: The global surge in fitness and wellness activities naturally translates to increased demand for supporting wearable technology.

Barriers & Challenges:

- High Price Point: Advanced smart fitness rings can be prohibitively expensive for a significant portion of the Latin American population, limiting mass adoption.

- Limited Awareness and Education: A segment of the population may still be unaware of the benefits and functionalities of fitness rings compared to more established wearables.

- Data Privacy Concerns: As these devices collect sensitive personal health data, robust data protection measures and clear communication are crucial to build trust.

- Accuracy and Validation: Ensuring the consistent accuracy of advanced health metrics, especially those with potential medical implications, requires rigorous testing and validation.

- Fragmented Healthcare Systems: Integrating fitness ring data seamlessly with existing healthcare infrastructure can be challenging across different countries.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact product availability and pricing in the region.

Emerging Opportunities in Latin America Fitness Ring Market

Emerging opportunities within the Latin America fitness ring market lie in catering to specialized health needs and expanding into underserved demographics. The development of more affordable basic fitness rings with enhanced tracking capabilities can unlock significant market potential among price-sensitive consumers. Furthermore, the integration of advanced health features, such as continuous glucose monitoring (CGM) compatibility or enhanced stress management tools, presents a significant opportunity to attract users seeking more comprehensive health insights. Untapped markets in smaller Latin American nations, coupled with strategic partnerships with local healthcare providers and insurance companies, can foster wider adoption and create unique value propositions. Evolving consumer preferences for hyper-personalized wellness experiences, including tailored sleep coaching and nutrition recommendations powered by AI, also represent a fertile ground for innovation and market expansion.

Growth Accelerators in the Latin America Fitness Ring Market Industry

Several catalysts are set to accelerate the growth trajectory of the Latin America fitness ring industry. Technological breakthroughs in miniaturized, highly accurate biosensors will enable the development of more sophisticated and multi-functional rings, pushing the boundaries of what these devices can track. Strategic partnerships between fitness ring manufacturers and health and wellness platforms, telehealth providers, and even employers offering wellness programs will drive adoption by integrating these devices into broader health ecosystems. Market expansion strategies focusing on localized marketing campaigns that highlight the specific health benefits relevant to Latin American populations, such as managing chronic conditions or improving sleep quality, will resonate deeply with consumers. Furthermore, increased investment in direct-to-consumer (DTC) channels and robust after-sales support will enhance customer satisfaction and brand loyalty, further fueling long-term growth.

Key Players Shaping the Latin America Fitness Ring Market Market

- Fitbit Inc.

- Xiaomi Corporation

- Apple Inc.

- Garmin Ltd.

- Samsung Electronics Co Ltd.

Notable Milestones in Latin America Fitness Ring Market Sector

- July 2024: Ultrahuman introduced an atrial fibrillation (AFib) detection feature to its Ring AIR smart ring and unveiled PowerPlugs, a platform for customizing health tracking with features like circadian rhythm monitoring, pregnancy mode, menstrual cycle tracking, and weight loss management.

- May 2024: Black Shark, a sub-brand of Xiaomi, announced its entry into the smart ring market, positioning it as a new generation of fitness trackers with undisclosed but intriguing features.

In-Depth Latin America Fitness Ring Market Market Outlook

The future outlook for the Latin America fitness ring market is exceptionally promising, driven by a confluence of technological innovation, shifting consumer priorities, and expanding market reach. The continued refinement of AI-powered analytics will transform raw biometric data into actionable, personalized health recommendations, solidifying the fitness ring's role as a proactive wellness companion. Growth accelerators include the ongoing exploration of integration with digital health platforms and the potential for partnerships with corporate wellness programs, which can significantly broaden user access. Emerging opportunities in developing countries within the region, coupled with a focus on affordability and feature-rich smart fitness rings, will ensure sustained market expansion. The increasing demand for discreet, stylish, and data-rich wearable technology positions fitness rings to capture a substantial share of the growing wearable tech market in Latin America, fostering a healthier and more engaged population.

Latin America Fitness Ring Market Segmentation

-

1. Product Type

- 1.1. Basic Fitness ring

- 1.2. Smart Fitness Rings

Latin America Fitness Ring Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Fitness Ring Market Regional Market Share

Geographic Coverage of Latin America Fitness Ring Market

Latin America Fitness Ring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Health and Wellness; Growth in demand for compact devices

- 3.3. Market Restrains

- 3.3.1. Growing Awareness of Health and Wellness; Growth in demand for compact devices

- 3.4. Market Trends

- 3.4.1. Growing Awareness of Health and Wellness to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Fitness Ring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Basic Fitness ring

- 5.1.2. Smart Fitness Rings

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fitbit Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiaomi Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Apple Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Garmin Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Fitbit Inc

List of Figures

- Figure 1: Latin America Fitness Ring Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Fitness Ring Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Fitness Ring Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Fitness Ring Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Latin America Fitness Ring Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Latin America Fitness Ring Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America Fitness Ring Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Fitness Ring Market?

The projected CAGR is approximately 23.8%.

2. Which companies are prominent players in the Latin America Fitness Ring Market?

Key companies in the market include Fitbit Inc, Xiaomi Corporation, Apple Inc, Garmin Ltd, Samsung Electronics Co Ltd.

3. What are the main segments of the Latin America Fitness Ring Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Health and Wellness; Growth in demand for compact devices.

6. What are the notable trends driving market growth?

Growing Awareness of Health and Wellness to drive the market.

7. Are there any restraints impacting market growth?

Growing Awareness of Health and Wellness; Growth in demand for compact devices.

8. Can you provide examples of recent developments in the market?

July 2024 - Ultrahuman has introduced an atrial fibrillation (AFib) detection feature to its Ring AIR smart ring. At the same time, the company unveiled PowerPlugs, a platform allowing users to customize health tracking on the Ring AIR through individual apps and plugins. The PowerPlugs offerings encompass a range of features: AFib detection, circadian rhythm monitoring, pregnancy mode, tracking of the menstrual cycle and ovulation, management of caffeine consumption and Vitamin D intake, jet lag plans, and weight loss management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Fitness Ring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Fitness Ring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Fitness Ring Market?

To stay informed about further developments, trends, and reports in the Latin America Fitness Ring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence