Key Insights

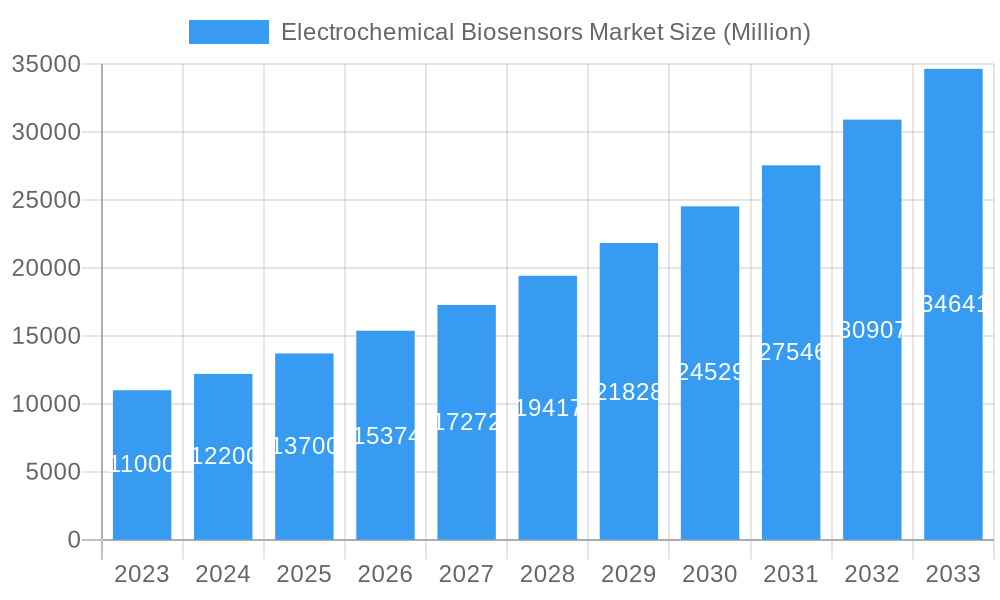

The global Electrochemical Biosensors market is projected for robust expansion, anticipated to reach a substantial market size of approximately $15,000 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 11.20% expected through 2033. This impressive growth trajectory is primarily fueled by escalating demand for advanced diagnostic tools in healthcare, a surge in the utilization of biosensors for environmental monitoring, and their increasing integration into critical industries like oil and gas and automotive for quality control and safety. The market's expansion is further supported by technological advancements leading to more sensitive, selective, and cost-effective biosensing solutions. Key market drivers include the growing prevalence of chronic diseases, necessitating faster and more accurate detection methods, and stringent regulatory requirements for industrial process control and safety, particularly in the chemical and petrochemical sectors.

Electrochemical Biosensors Market Market Size (In Billion)

The market is segmented by sensor type, with Potentiometric and Amperometric sensors expected to dominate due to their established reliability and versatility in detecting various analytes. Conductometric sensors also represent a significant segment. In terms of end-user industries, the Medical sector is a major contributor, driven by point-of-care diagnostics and personalized medicine. The Oil and Gas industry relies on these sensors for efficient exploration, production, and environmental compliance, while the Chemical and Petrochemicals sector utilizes them for process monitoring and quality assurance. Emerging applications in the Food & Beverage industry for contaminant detection and in the Automotive sector for emissions monitoring are also poised for significant growth. While technological innovation is a key driver, the high cost of initial setup for certain advanced systems and the need for specialized training for operation can present as market restraints. Nevertheless, the overarching trend points towards increased adoption and innovation across all identified segments.

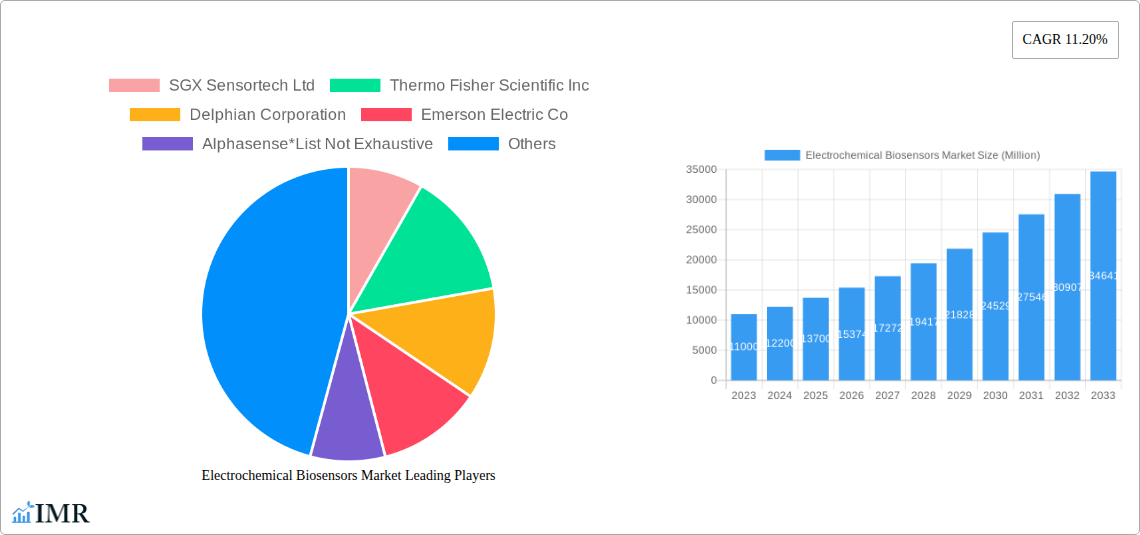

Electrochemical Biosensors Market Company Market Share

Unlock critical insights into the dynamic Electrochemical Biosensors Market with our in-depth report. This comprehensive study covers the historical period from 2019-2024, the base year of 2025, and provides detailed forecasts through 2033. Gain a competitive edge by understanding market dynamics, growth trends, dominant regions, product landscapes, key drivers, emerging opportunities, and the influential players shaping this rapidly evolving sector. We delve into segments like Potentiometric Sensors, Amperometric Sensors, and Conductometric Sensors, and analyze their impact across end-user industries including Oil and Gas, Chemical and Petrochemicals, Medical, Automotive, and Food & Beverage.

Electrochemical Biosensors Market Market Dynamics & Structure

The Electrochemical Biosensors Market is characterized by a moderate level of concentration, with key players like Thermo Fisher Scientific Inc., SGX Sensortech Ltd., and MSA Safety strategically investing in technological innovation to capture market share. Technological advancement, particularly in miniaturization and sensitivity, acts as a primary driver, enabling wider applications across diverse industries. Regulatory frameworks, while sometimes posing adoption challenges, also foster growth by ensuring product safety and efficacy, especially within the medical and food & beverage sectors. Competitive product substitutes, though present, are increasingly being differentiated by superior performance metrics and specialized functionalities offered by advanced electrochemical biosensors. End-user demographics are shifting, with a growing demand for portable, real-time monitoring solutions in healthcare, environmental sensing, and industrial process control. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with companies seeking to expand their product portfolios and geographic reach. For instance, the market has witnessed an average of 5-7 significant M&A deals annually over the past three years, reflecting strategic consolidation. Barriers to innovation include high R&D costs and the need for extensive validation for specific applications.

- Market Concentration: Moderate, with a few dominant players and a growing number of niche innovators.

- Technological Innovation Drivers: Miniaturization, increased sensitivity, multiplexing capabilities, and integration with IoT platforms.

- Regulatory Frameworks: Essential for medical and environmental applications, driving demand for compliant and certified products.

- Competitive Product Substitutes: Primarily reliant on other sensing technologies, but electrochemical biosensors offer advantages in cost-effectiveness and portability.

- End-User Demographics: Growing adoption in healthcare (diagnostics, point-of-care), environmental monitoring, and industrial safety.

- M&A Trends: Strategic acquisitions aimed at expanding technological capabilities and market presence.

- Barriers to Innovation: High R&D investment, long validation cycles for regulated markets, and skilled workforce requirements.

Electrochemical Biosensors Market Growth Trends & Insights

The Electrochemical Biosensors Market is projected for robust expansion, with an estimated market size of $18,500 Million in 2025, escalating to an impressive $32,100 Million by 2033. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of approximately 7.2% during the forecast period (2025-2033). Market penetration is accelerating across various sectors, driven by the increasing demand for rapid, sensitive, and cost-effective detection methods. Technological disruptions are central to this evolution; for example, the development of novel electrode materials and advanced signal processing techniques are enhancing the performance and applicability of electrochemical biosensors. Consumer behavior shifts are also playing a significant role, with a rising preference for personalized healthcare solutions and proactive environmental monitoring, creating a fertile ground for point-of-care diagnostics and wearable health trackers that utilize electrochemical sensing technology. The integration of biosensors with mobile devices and cloud platforms is further enhancing their accessibility and utility, allowing for real-time data collection and analysis, which is crucial for fields like continuous glucose monitoring and environmental hazard detection. The ability of electrochemical biosensors to detect a wide range of analytes, from biomarkers for disease diagnosis to environmental pollutants, positions them as indispensable tools for addressing global health and sustainability challenges. The market is also witnessing a trend towards miniaturization and the development of disposable biosensors, reducing costs and improving convenience for end-users. This has significantly broadened their applicability in diverse settings, from clinical laboratories to remote environmental monitoring stations. The increasing awareness regarding food safety and the need for rapid detection of contaminants are also significant growth drivers, pushing the adoption of electrochemical biosensors in the food and beverage industry for quality control and authentication. Furthermore, advancements in nanomaterials have enabled the development of highly sensitive and selective electrochemical biosensors, capable of detecting analytes at very low concentrations, which is critical for early disease detection and ultra-trace contaminant analysis. The ongoing research into novel biorecognition elements, such as aptamers and molecularly imprinted polymers, is expanding the range of detectable analytes and improving the specificity of electrochemical biosensors, further fueling market growth.

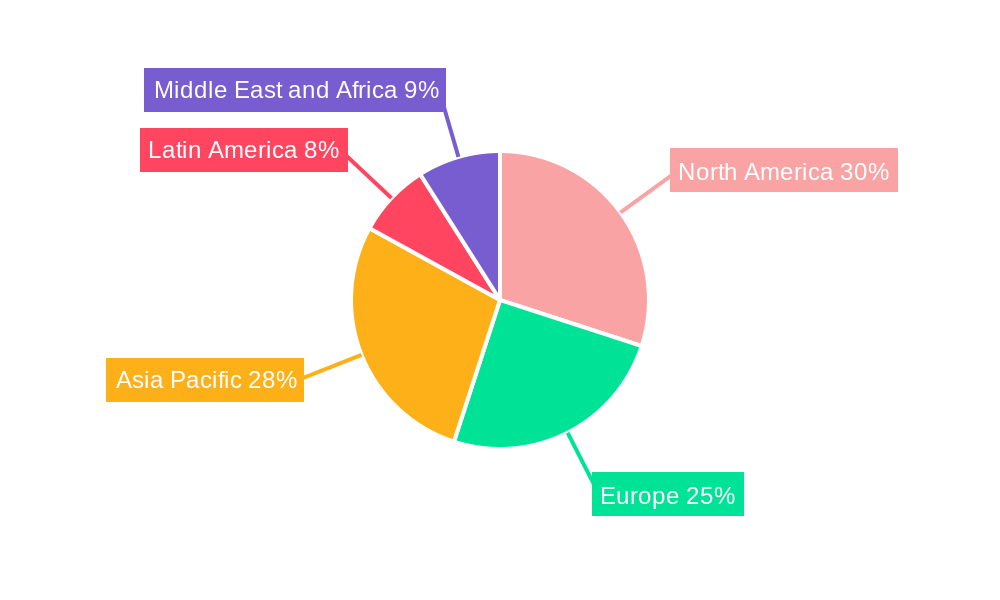

Dominant Regions, Countries, or Segments in Electrochemical Biosensors Market

North America currently dominates the Electrochemical Biosensors Market, representing approximately 35% of the global market share in 2025. This regional dominance is attributed to several key factors, including a strong presence of leading biosensor manufacturers, significant government funding for research and development in healthcare and environmental monitoring, and a high adoption rate of advanced diagnostic technologies. The United States, in particular, is a major contributor, driven by its robust healthcare infrastructure, increasing prevalence of chronic diseases, and stringent environmental regulations that necessitate advanced monitoring solutions. The medical segment within the end-user industry is the most dominant, accounting for an estimated 40% of the market. This is primarily due to the widespread use of electrochemical biosensors in point-of-care diagnostics, glucose monitoring, pregnancy tests, and drug testing. The rising incidence of diabetes and cardiovascular diseases globally further fuels the demand for continuous and accurate glucose monitoring devices.

- Dominant Region: North America (especially the United States).

- Key Drivers: Strong R&D investment, advanced healthcare infrastructure, high demand for diagnostics, supportive government policies, and presence of major industry players.

- Market Share Contribution: Approximately 35% in 2025.

- Dominant End-User Industry Segment: Medical.

- Key Drivers: Growing prevalence of chronic diseases (diabetes, cardiovascular), demand for point-of-care diagnostics, wearable health devices, and advancements in medical technology.

- Market Share Contribution: Approximately 40% in 2025.

- Dominant Sensor Type: Amperometric Sensors.

- Key Drivers: High sensitivity, specificity, and wide applicability in detecting various analytes, including glucose, lactate, and oxygen. Their use in continuous glucose monitoring systems is a major contributor.

- Market Share Contribution: Estimated at 45% of the total sensor market within electrochemical biosensors.

Asia Pacific is emerging as a rapidly growing region, driven by increasing healthcare expenditure, a growing awareness of environmental pollution, and supportive government initiatives for technological advancements. The medical segment in this region is also witnessing substantial growth due to the rising incidence of lifestyle diseases and the expanding demand for home-use diagnostic devices.

Electrochemical Biosensors Market Product Landscape

The product landscape of the Electrochemical Biosensors Market is characterized by continuous innovation and an expanding array of applications. Key product developments focus on enhancing sensitivity, selectivity, portability, and cost-effectiveness. Amperometric sensors, such as those developed by Alphasense for VOC detection, exemplify this trend with their adaptability to detect a range of gases by altering operating voltage. Potentiometric sensors are finding increasing use in pH monitoring and ion-selective detection. The medical segment benefits from miniaturized biosensors for point-of-care diagnostics and continuous monitoring, like those designed for glucose and lactate. Developments like the dual-mode biosensor for circulating tumor DNA by SIBET highlight the integration of multiple detection modalities for improved accuracy.

Key Drivers, Barriers & Challenges in Electrochemical Biosensors Market

Key Drivers:

- Technological Advancements: Miniaturization, increased sensitivity, multiplexing capabilities, and integration with IoT.

- Growing Healthcare Demand: Rising incidence of chronic diseases like diabetes, need for point-of-care diagnostics, and demand for personalized medicine.

- Environmental Monitoring Needs: Strict regulations and increasing awareness of pollution necessitate advanced detection systems.

- Food Safety Concerns: Demand for rapid and accurate detection of contaminants and spoilage indicators in the food and beverage industry.

- Cost-Effectiveness: Electrochemical biosensors offer a more affordable alternative to traditional laboratory methods for many applications.

Barriers & Challenges:

- Regulatory Hurdles: Long and complex approval processes for medical and environmental applications.

- Stability and Shelf-Life: Ensuring the long-term stability and viability of biorecognition elements can be challenging.

- Interference: Minimizing interference from other substances present in the sample matrix is crucial for accuracy.

- High R&D Costs: Significant investment is required for developing novel biosensor technologies.

- Market Education: Educating end-users about the benefits and capabilities of electrochemical biosensors is an ongoing process.

- Supply Chain Disruptions: Global events can impact the availability of key raw materials and components, as seen with xx% of companies reporting minor disruptions in the past year.

Emerging Opportunities in Electrochemical Biosensors Market

Emerging opportunities in the Electrochemical Biosensors Market are vast and varied. The integration of biosensors with wearable technology for continuous health monitoring, including stress levels, hydration, and immune responses, presents a significant growth avenue. The development of highly sensitive and portable devices for detecting biomarkers of early-stage diseases, such as cancer and neurodegenerative disorders, is a key focus area. Furthermore, the expansion of biosensor applications in agriculture for soil analysis, crop health monitoring, and pesticide detection offers untapped market potential. The demand for real-time monitoring in industrial processes for quality control and safety, particularly in the chemical and petrochemical sectors, is also a growing opportunity. The development of "lab-on-a-chip" devices leveraging electrochemical sensing principles will democratize advanced diagnostics.

Growth Accelerators in the Electrochemical Biosensors Market Industry

Several factors are accelerating the growth of the Electrochemical Biosensors Market. Ongoing research into novel nanomaterials, such as graphene and quantum dots, is leading to biosensors with unprecedented sensitivity and selectivity. Strategic partnerships between biosensor manufacturers and healthcare technology companies are fostering innovation and expanding market reach, particularly in the development of integrated diagnostic systems. The increasing availability of venture capital funding for promising biosensor startups is also a significant growth catalyst. Furthermore, the growing trend towards decentralized healthcare and point-of-care testing, driven by the need for rapid diagnosis and reduced healthcare costs, is a major accelerator. The development of user-friendly, smartphone-integrated biosensor platforms is further democratizing access to advanced diagnostic capabilities.

Key Players Shaping the Electrochemical Biosensors Market Market

- SGX Sensortech Ltd

- Thermo Fisher Scientific Inc

- Delphian Corporation

- Emerson Electric Co

- Alphasense

- Ametek Inc

- Figaro USA Inc

- Conductive Technologies Inc

- Dragerwerk AG

- MSA Safety

- Membrapor AG

Notable Milestones in Electrochemical Biosensors Market Sector

- July 2022: Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots.

- September 2021: After extensive research and development in Volatile Organic Compounds, Alphasense launched two new electrochemical sensors, the VOC-A4 and VOC-B4, which have been developed specifically to target VOCs. The Alphasense VOC electrochemical VOC-A4 and VOC-B4 sensors are the perfect companions for the amperometric 4-electrode air quality sensors. The voltage for both the VOC-A4 and VOC-B4 can be altered to operate at V, 0.1V, 0.2V or 0.3V, allowing the option to detect a range of different gases.

In-Depth Electrochemical Biosensors Market Market Outlook

The Electrochemical Biosensors Market is poised for significant future growth, driven by relentless innovation in sensor technology and an ever-expanding range of applications. The integration of artificial intelligence and machine learning with biosensor data analysis will unlock deeper insights and enable more personalized interventions, particularly in healthcare. The development of highly specific and sensitive biosensors for early detection of infectious diseases and biomarkers of neurological disorders represents a critical future opportunity. Furthermore, the increasing focus on sustainable practices and environmental protection will fuel the demand for electrochemical biosensors in industrial process monitoring and pollution control. The market's outlook is exceptionally bright, promising transformative advancements across multiple sectors, with the estimated market value expected to reach $32,100 Million by 2033.

Electrochemical Biosensors Market Segmentation

-

1. Type

- 1.1. Potentiometric Sensors

- 1.2. Amperometric Sensors

- 1.3. Conductometric Sensors

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemicals

- 2.3. Medical

- 2.4. Automotive

- 2.5. Food & Beverage

- 2.6. Other End-user Industry

Electrochemical Biosensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Electrochemical Biosensors Market Regional Market Share

Geographic Coverage of Electrochemical Biosensors Market

Electrochemical Biosensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places

- 3.3. Market Restrains

- 3.3.1. Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements

- 3.4. Market Trends

- 3.4.1. Medical Sector to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Potentiometric Sensors

- 5.1.2. Amperometric Sensors

- 5.1.3. Conductometric Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemicals

- 5.2.3. Medical

- 5.2.4. Automotive

- 5.2.5. Food & Beverage

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Potentiometric Sensors

- 6.1.2. Amperometric Sensors

- 6.1.3. Conductometric Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemical and Petrochemicals

- 6.2.3. Medical

- 6.2.4. Automotive

- 6.2.5. Food & Beverage

- 6.2.6. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Potentiometric Sensors

- 7.1.2. Amperometric Sensors

- 7.1.3. Conductometric Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemical and Petrochemicals

- 7.2.3. Medical

- 7.2.4. Automotive

- 7.2.5. Food & Beverage

- 7.2.6. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Potentiometric Sensors

- 8.1.2. Amperometric Sensors

- 8.1.3. Conductometric Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemical and Petrochemicals

- 8.2.3. Medical

- 8.2.4. Automotive

- 8.2.5. Food & Beverage

- 8.2.6. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Potentiometric Sensors

- 9.1.2. Amperometric Sensors

- 9.1.3. Conductometric Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemical and Petrochemicals

- 9.2.3. Medical

- 9.2.4. Automotive

- 9.2.5. Food & Beverage

- 9.2.6. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Electrochemical Biosensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Potentiometric Sensors

- 10.1.2. Amperometric Sensors

- 10.1.3. Conductometric Sensors

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Chemical and Petrochemicals

- 10.2.3. Medical

- 10.2.4. Automotive

- 10.2.5. Food & Beverage

- 10.2.6. Other End-user Industry

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGX Sensortech Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher Scientific Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delphian Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Emerson Electric Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alphasense*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ametek Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Figaro USA Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Conductive Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dragerwerk AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MSA Safety

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Membrapor AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SGX Sensortech Ltd

List of Figures

- Figure 1: Global Electrochemical Biosensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Latin America Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Electrochemical Biosensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Electrochemical Biosensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Electrochemical Biosensors Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Electrochemical Biosensors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrochemical Biosensors Market?

The projected CAGR is approximately 9.12%.

2. Which companies are prominent players in the Electrochemical Biosensors Market?

Key companies in the market include SGX Sensortech Ltd, Thermo Fisher Scientific Inc, Delphian Corporation, Emerson Electric Co, Alphasense*List Not Exhaustive, Ametek Inc, Figaro USA Inc, Conductive Technologies Inc, Dragerwerk AG, MSA Safety, Membrapor AG.

3. What are the main segments of the Electrochemical Biosensors Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Nanotechnology-based Sensors; Government Rules and Regulations for Safety in Hazardous Places.

6. What are the notable trends driving market growth?

Medical Sector to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Slower Adoption Rates in Small- and Medium-sized Organizations; High Capital Requirements.

8. Can you provide examples of recent developments in the market?

July 2022 - Researchers at the Suzhou Institute of Biomedical Engineering and Technology (SIBET) announced proposing a hand-in-hand structured DNA assembly strategy and developed an electrochemical/fluorescent dual-mode biosensor for circulating tumor DNA based on methylene blue and red-emissive carbon nanodots.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrochemical Biosensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrochemical Biosensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrochemical Biosensors Market?

To stay informed about further developments, trends, and reports in the Electrochemical Biosensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence