Key Insights

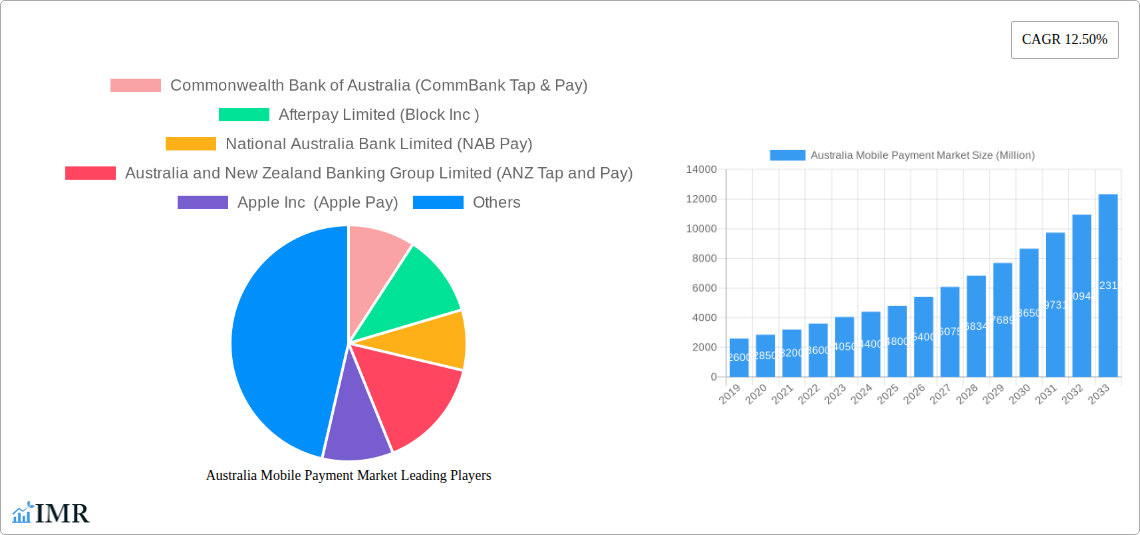

The Australian mobile payment market is projected for substantial expansion, with an estimated market size of $43.18 billion by 2025 and a Compound Annual Growth Rate (CAGR) of 16.9% through 2033. This growth is propelled by increasing smartphone and wearable adoption, enhanced internet connectivity, and a growing consumer preference for contactless transactions. Government support for digital economies and the availability of secure mobile payment platforms further accelerate this momentum. Key players include established financial institutions such as Commonwealth Bank of Australia, National Australia Bank, and ANZ, alongside fintech innovators like Block Inc. and Zip Co, and global tech leaders like Apple, Google, and Samsung. International players like Alipay also contribute to the market's dynamic landscape.

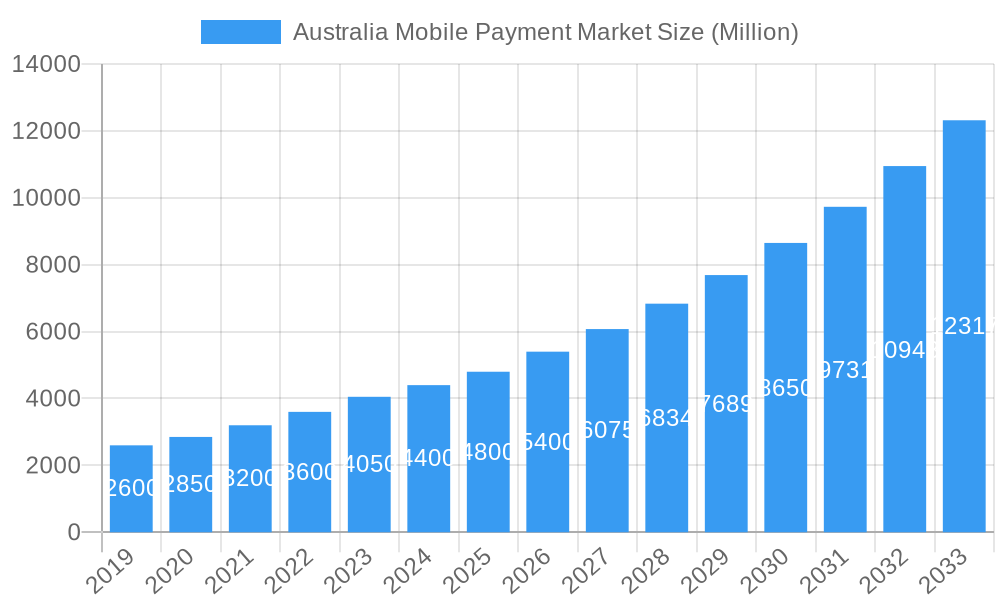

Australia Mobile Payment Market Market Size (In Billion)

The market is segmented into "Proximity" and "Remote" payment types. Proximity payments, utilizing NFC technology, currently lead due to their seamless in-store experience. However, remote payments, crucial for e-commerce and in-app purchases, are expected to grow significantly with the continued rise of online shopping. Emerging trends include the widespread adoption of Buy Now, Pay Later (BNPL) services, offering flexible payment options, and the integration of loyalty programs and personalized offers within mobile payment applications to enhance user engagement. Potential challenges include data privacy and security concerns, alongside the need for consistent platform and device interoperability. Despite these, the Australian mobile payment market offers significant opportunities for innovation and user adoption.

Australia Mobile Payment Market Company Market Share

Australia Mobile Payment Market Analysis: 2019-2033

Report Overview:

This comprehensive report analyzes the Australia mobile payment market, detailing its growth drivers, future potential, and market segmentation. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this analysis examines both overarching and specific market segments. It provides a detailed review of proximity and remote mobile payment types and profiles leading industry players and emerging companies. This report is an essential resource for stakeholders seeking to understand and leverage opportunities within the Australian digital payments ecosystem.

Australia Mobile Payment Market Market Dynamics & Structure

The Australia mobile payment market is characterized by a dynamic interplay of technological innovation, evolving consumer behavior, and a robust regulatory environment. Market concentration is moderately fragmented, with a few dominant players holding significant shares while a growing number of innovative fintech companies vie for market presence. Technological innovation is a primary driver, fueled by advancements in NFC, QR code technology, and biometrics, enhancing security and user experience. Regulatory frameworks, overseen by bodies like the Reserve Bank of Australia, are adapting to the rapid evolution of digital payments, focusing on consumer protection, data security, and interoperability. Competitive product substitutes, including credit/debit cards and traditional banking methods, continue to exist, but mobile payments are steadily gaining traction due to their convenience and speed. End-user demographics skew towards younger, tech-savvy populations, but adoption is expanding across all age groups. Mergers and acquisitions (M&A) trends are active, as larger financial institutions and technology companies seek to integrate innovative mobile payment solutions and expand their market reach. For instance, the acquisition of Afterpay by Block Inc. (formerly Square) signifies a major consolidation within the buy-now-pay-later (BNPL) segment, which is intrinsically linked to mobile payment functionalities.

- Market Concentration: Moderately fragmented with key players and emerging fintechs.

- Technological Innovation: Driven by NFC, QR codes, biometrics, and secure authentication methods.

- Regulatory Framework: Evolving to ensure security, consumer protection, and fair competition.

- Competitive Substitutes: Traditional payment methods are gradually being supplanted by mobile alternatives.

- End-User Demographics: Strong adoption among millennials and Gen Z, with expanding appeal across broader age groups.

- M&A Trends: Active consolidation, particularly in the BNPL and payment gateway sectors.

Australia Mobile Payment Market Growth Trends & Insights

The Australia mobile payment market is experiencing robust growth, driven by increasing smartphone penetration, a burgeoning e-commerce sector, and a growing consumer preference for contactless and convenient transaction methods. From the historical period of 2019-2024, the market has witnessed a significant upswing in the adoption of mobile wallets and contactless payment solutions. Proximity payments, facilitated by NFC technology in smartphones and wearables, have become ubiquitous at point-of-sale terminals, accounting for a substantial portion of the transaction volume. Remote payments, encompassing in-app purchases and online transactions initiated via mobile devices, are also on a steep upward trajectory, propelled by the convenience of stored payment credentials and the rise of mobile-first digital services.

Technological disruptions are continuously reshaping the landscape. The integration of artificial intelligence (AI) and machine learning (ML) for fraud detection and personalized offers is enhancing security and user engagement. Furthermore, the proliferation of QR code payment systems, particularly for peer-to-peer transfers and smaller merchants, offers an accessible entry point for widespread adoption. Consumer behavior has fundamentally shifted, with a marked decline in the use of cash and a growing expectation for seamless, instant payment experiences. The COVID-19 pandemic significantly accelerated this trend, pushing consumers and businesses alike towards contactless solutions.

The market size evolution is projected to show consistent double-digit compound annual growth rate (CAGR) through the forecast period of 2025–2033. Adoption rates for mobile payment applications are expected to surpass traditional payment methods in various transaction categories. Insights into consumer behavior reveal a strong correlation between ease of use, perceived security, and the willingness to adopt new mobile payment solutions. The increasing acceptance of digital currencies and blockchain-based payment systems, while still nascent, represents a potential future disruption.

The estimated year of 2025 is poised to be a pivotal point, with mobile payments becoming a dominant mode of transaction for everyday purchases. The market penetration of mobile payment solutions is anticipated to reach xx% of the total transaction value by 2025, escalating further by 2033. This growth is underpinned by ongoing investment in payment infrastructure, supportive government initiatives aimed at fostering digital inclusion, and the continuous innovation from leading companies in the sector. The overall outlook for the Australian mobile payment market is exceptionally positive, indicating sustained expansion and increasing integration into the fabric of daily commerce.

Dominant Regions, Countries, or Segments in Australia Mobile Payment Market

Within the Australia mobile payment market, the Proximity segment stands out as the dominant driver of growth. This dominance is primarily attributed to the widespread availability of contactless payment infrastructure at a vast network of retail outlets, public transport systems, and service providers across the country. Proximity payments leverage technologies such as Near Field Communication (NFC) and QR codes, enabling swift and secure transactions directly at the point of sale through smartphones, smartwatches, and other wearable devices. The convenience of simply tapping or scanning a device for payment has resonated strongly with Australian consumers, who increasingly prioritize speed and ease in their daily transactions.

The growth in the Proximity segment is further bolstered by several key drivers. Economic policies promoting cashless societies and digital innovation have provided a supportive ecosystem for the expansion of mobile payment solutions. Significant investments in payment infrastructure by financial institutions and technology providers have ensured that merchants are equipped to accept contactless payments, thus creating a virtuous cycle of adoption. The high smartphone penetration rate across Australia, coupled with a growing acceptance of mobile wallets from major providers like Apple Pay, Google Pay, and Samsung Pay, has directly translated into increased usage of proximity payment methods.

Geographically, while the entire nation is embracing mobile payments, urban centers such as Sydney, Melbourne, Brisbane, and Perth tend to exhibit higher adoption rates due to higher population density, greater merchant density, and a more digitally inclined demographic. However, the reach of mobile payment solutions is continuously expanding into regional and rural areas, driven by a desire for modern convenience and financial inclusion.

The market share within the Proximity segment is substantial, estimated to be around xx% of the total mobile payment transaction value in 2025. The growth potential remains immense, as there is still scope for increasing the penetration of this segment in smaller businesses and in specific transaction categories where cash is still prevalent. The constant innovation in user experience, security features, and integration with loyalty programs further solidifies the Proximity segment's leading position. The ability to facilitate quick, touch-free transactions, especially post-pandemic, has cemented its role as the preferred method for many consumers for everyday purchases.

Australia Mobile Payment Market Product Landscape

The Australia mobile payment market showcases a vibrant product landscape, characterized by continuous innovation and a focus on user convenience and security. Mobile wallets, integrated into smartphones and wearable devices, represent the core product offering, enabling users to store credit, debit, and even loyalty cards for seamless transactions. Applications from major tech companies like Apple Pay, Google Pay, and Samsung Pay, alongside those from financial institutions such as CommBank Tap & Pay and ANZ Tap and Pay, are prominent. Buy Now, Pay Later (BNPL) services, often accessible via mobile apps and integrated into the payment checkout, like Afterpay and Zip Pay, have also become integral to the mobile payment ecosystem, offering flexible payment options. Furthermore, the increasing adoption of QR code-based payment solutions, facilitated by companies like PayPal, provides an accessible and cost-effective alternative for a broad range of merchants and consumers.

- Mobile Wallets: Integrated NFC and QR code functionalities for in-store and online payments.

- BNPL Solutions: Mobile-first platforms offering installment payment options for purchases.

- QR Code Payments: Enabling quick, touch-free transactions for various use cases.

- Wearable Payments: Functionality extended to smartwatches and other wearable devices for ultimate convenience.

Key Drivers, Barriers & Challenges in Australia Mobile Payment Market

The Australia mobile payment market is propelled by several key drivers, primarily the pervasive adoption of smartphones, a strong demand for convenient and contactless payment solutions, and supportive government initiatives aimed at fostering a digital economy. Technological advancements in NFC and QR code technology have made mobile transactions faster, more secure, and user-friendly. The increasing presence of fintech companies and innovative payment gateways further fuels competition and service enhancement.

- Drivers:

- High smartphone penetration and internet accessibility.

- Consumer preference for contactless and instant payments.

- Government support for digital transformation and cashless initiatives.

- Innovation from fintech companies and traditional financial institutions.

However, the market also faces significant barriers and challenges. Security concerns and the fear of data breaches remain a persistent apprehension for some consumers. The need for robust and interoperable payment infrastructure across all merchant types, especially small and medium-sized enterprises (SMEs), is critical. Regulatory hurdles and compliance requirements can also pose challenges for new entrants. Competitive pressures from established players and the high cost of implementation for some technologies can also act as restraints.

- Barriers & Challenges:

- Consumer apprehension regarding data security and privacy.

- Need for universal merchant acceptance and interoperability.

- Evolving regulatory landscape and compliance complexities.

- High initial investment costs for some payment technologies.

- Intense competition from established and emerging players.

Emerging Opportunities in Australia Mobile Payment Market

The Australia mobile payment market is ripe with emerging opportunities, particularly in the untapped potential of rural and remote regions, where digital payment adoption is still in its nascent stages. The integration of mobile payments with loyalty programs and personalized retail experiences presents a significant avenue for growth, enhancing customer engagement and driving repeat business. Furthermore, the burgeoning fintech landscape offers fertile ground for innovative solutions, such as embedded finance, instant payment services for gig economy workers, and the exploration of blockchain-based payment systems for cross-border transactions. The increasing demand for sustainable and ethical financial practices also opens doors for mobile payment solutions that champion these values, attracting a growing segment of socially conscious consumers.

- Untapped Markets: Expansion into rural and remote areas for financial inclusion.

- Personalized Experiences: Integration with loyalty programs and tailored offers.

- Fintech Innovation: Development of niche payment solutions and services.

- Sustainable Finance: Mobile payment options aligned with environmental and social responsibility.

Growth Accelerators in the Australia Mobile Payment Market Industry

Several catalysts are accelerating the growth of the Australia mobile payment market. Technological breakthroughs, such as the advancement of biometric authentication and tokenization, are continuously enhancing the security and trustworthiness of mobile transactions, thereby boosting consumer confidence. Strategic partnerships between telecommunication companies, banks, and technology providers are crucial for expanding reach and developing integrated payment ecosystems. For instance, collaborations that embed payment functionalities directly into telecommunication plans or essential service subscriptions can significantly increase adoption rates. Furthermore, market expansion strategies, including the promotion of mobile payment solutions in underserved sectors like public transport and government services, are vital for driving widespread usage. The ongoing digitalization of businesses and the increasing demand for efficient payment processing are also powerful growth accelerators, ensuring the Australian mobile payment market continues its upward trajectory.

Key Players Shaping the Australia Mobile Payment Market Market

- Commonwealth Bank of Australia (CommBank Tap & Pay)

- Afterpay Limited (Block Inc )

- National Australia Bank Limited (NAB Pay)

- Australia and New Zealand Banking Group Limited (ANZ Tap and Pay)

- Apple Inc (Apple Pay)

- Bank Australia Tap and Pay

- Google LLC (Google Pay)

- Paypal Inc (Paypal)

- Alibaba Group Holding Limited (Alipay)

- SAMSUNG ELECTRONICS CO LTD (Samsung Pay)

- Zip Co Limited (ZipPay)

Notable Milestones in Australia Mobile Payment Market Sector

- May 2022: Volopay accepted under Visa's Fintech Fast Track program, significantly expanding its financial management solutions in the Australian market through a partnership with Visa.

- September 2021: PayPal partners with Garage Sale Trail, providing QR codes for touch-free, in-person payments at thousands of garage sales across Australia, facilitating rapid, easy, and touch-free transactions.

In-Depth Australia Mobile Payment Market Market Outlook

The Australia Mobile Payment Market is poised for continued robust expansion, driven by a confluence of accelerating factors. The increasing digital savviness of the Australian populace, coupled with the persistent demand for frictionless and secure payment experiences, will continue to fuel adoption across both proximity and remote payment types. Strategic alliances between established financial institutions and agile fintech innovators will unlock new avenues for service delivery and customer acquisition. The ongoing evolution of regulatory frameworks to accommodate emerging technologies, alongside proactive government initiatives to promote financial inclusion, will further solidify the market's growth trajectory. Consequently, the future outlook indicates sustained double-digit growth, with mobile payments becoming the predominant method for a wide array of commercial transactions in Australia.

Australia Mobile Payment Market Segmentation

-

1. Type

- 1.1. Proximity

- 1.2. Remote

Australia Mobile Payment Market Segmentation By Geography

- 1. Australia

Australia Mobile Payment Market Regional Market Share

Geographic Coverage of Australia Mobile Payment Market

Australia Mobile Payment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness for E-Wallet and E-Commerce to Drive the Market; Development of M-Commerce Platforms and Increasing Internet Penetration

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 3.4. Market Trends

- 3.4.1. Integration with E-commerce Dominating the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mobile Payment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity

- 5.1.2. Remote

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Commonwealth Bank of Australia (CommBank Tap & Pay)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Afterpay Limited (Block Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Australia Bank Limited (NAB Pay)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Australia and New Zealand Banking Group Limited (ANZ Tap and Pay)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apple Inc (Apple Pay)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bank Australia Tap and Pay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google LLC (Google Pay)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paypal Inc (Paypal)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alibaba Group Holding Limited (Alipay)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAMSUNG ELECTRONICS CO LTD (Samsung Pay)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zip Co Limited (ZipPay)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Commonwealth Bank of Australia (CommBank Tap & Pay)

List of Figures

- Figure 1: Australia Mobile Payment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Mobile Payment Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Mobile Payment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Australia Mobile Payment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Australia Mobile Payment Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Australia Mobile Payment Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mobile Payment Market?

The projected CAGR is approximately 16.9%.

2. Which companies are prominent players in the Australia Mobile Payment Market?

Key companies in the market include Commonwealth Bank of Australia (CommBank Tap & Pay), Afterpay Limited (Block Inc ), National Australia Bank Limited (NAB Pay), Australia and New Zealand Banking Group Limited (ANZ Tap and Pay), Apple Inc (Apple Pay), Bank Australia Tap and Pay, Google LLC (Google Pay), Paypal Inc (Paypal), Alibaba Group Holding Limited (Alipay), SAMSUNG ELECTRONICS CO LTD (Samsung Pay), Zip Co Limited (ZipPay).

3. What are the main segments of the Australia Mobile Payment Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 43.18 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness for E-Wallet and E-Commerce to Drive the Market; Development of M-Commerce Platforms and Increasing Internet Penetration.

6. What are the notable trends driving market growth?

Integration with E-commerce Dominating the Growth of the Market.

7. Are there any restraints impacting market growth?

Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices.

8. Can you provide examples of recent developments in the market?

May 2022 - Volopay has been accepted under Visa's Fintech Fast Track program. Volopay, a Y-Combinator-backed corporate cards, and payable management fintech firm, announced today that it had signed a partnership with Visa to participate in Visa's Fintech Fast Track Program, which will significantly expand Volopay's offering of financial management solutions in the Australian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mobile Payment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mobile Payment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mobile Payment Market?

To stay informed about further developments, trends, and reports in the Australia Mobile Payment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence