Key Insights

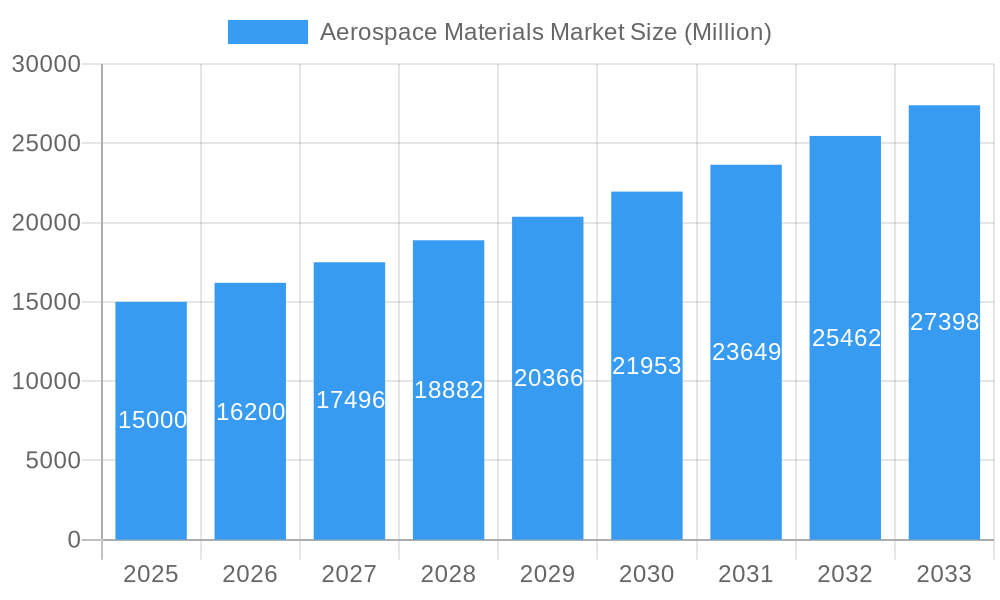

The aerospace materials market is experiencing robust growth, driven by a surge in air travel demand, increasing military spending, and the burgeoning space exploration sector. The market, currently valued at approximately $XX million (assuming a reasonable value based on typical market sizes for similar industries and the provided CAGR), is projected to exhibit a compound annual growth rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements leading to lighter, stronger, and more fuel-efficient aircraft are driving demand for advanced materials like carbon fiber composites and titanium alloys. Furthermore, the growing adoption of sustainable aviation fuels and stricter environmental regulations are incentivizing the use of eco-friendly materials and manufacturing processes within the industry. The increasing focus on defense modernization and the development of advanced aerospace systems, particularly in regions like North America and Asia-Pacific, further contribute to market growth.

Aerospace Materials Market Market Size (In Billion)

However, market growth is not without its challenges. High raw material costs, particularly for specialized alloys and composites, pose a significant restraint. Supply chain disruptions and geopolitical uncertainties can also impact the availability and pricing of essential materials. Competition amongst established players and the emergence of new entrants necessitate continuous innovation and efficient manufacturing processes to maintain market share. The market segmentation reflects this dynamic interplay of factors, with significant growth anticipated across various material types (composites, alloys, adhesives, and foams), aircraft types (commercial, military, and space), and regions. The significant presence of key players such as Boeing, Airbus, and various material suppliers across North America, Europe, and Asia-Pacific highlights the global nature of this expanding market.

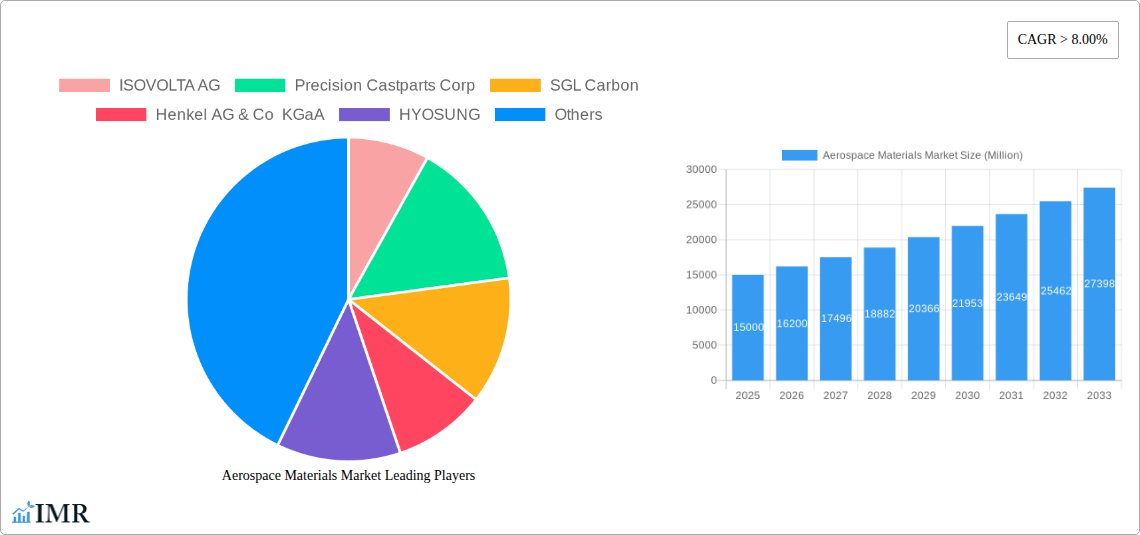

Aerospace Materials Market Company Market Share

Aerospace Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Aerospace Materials Market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key players. With a focus on the parent market (Aerospace industry) and child markets (Alloys, Composites, Adhesives & Sealants, Foams), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year.

Aerospace Materials Market Dynamics & Structure

The Aerospace Materials Market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033. Technological innovation, particularly in lightweight composites and advanced alloys, is a key driver. Stringent regulatory frameworks, focusing on safety and performance standards, influence material selection and manufacturing processes. Competitive product substitutes, such as advanced polymers and bio-based materials, are emerging, posing both challenges and opportunities. End-user demographics, primarily driven by commercial and military aerospace sectors, significantly impact market demand. The market has witnessed several M&A activities, particularly in the composites sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on lightweighting, high-strength materials, and improved durability.

- Regulatory Framework: Stringent safety and performance standards, impacting material certifications.

- Competitive Substitutes: Emergence of advanced polymers and bio-based materials.

- M&A Activity: xx deals recorded between 2019-2024, primarily focused on consolidating the composites sector.

- Innovation Barriers: High R&D costs, lengthy certification processes, and stringent safety regulations.

Aerospace Materials Market Growth Trends & Insights

The Aerospace Materials Market exhibits robust growth, driven by increasing air travel demand, military modernization programs, and space exploration initiatives. The market has demonstrated a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Adoption rates of advanced materials like carbon fiber composites are increasing steadily, driven by their lightweight and high-strength properties. Technological disruptions, including the development of additive manufacturing techniques and bio-inspired materials, are shaping market evolution. Consumer behavior shifts towards fuel-efficient aircraft and sustainable aviation fuels are influencing material choices. Market penetration of advanced materials is projected to reach xx% by 2033.

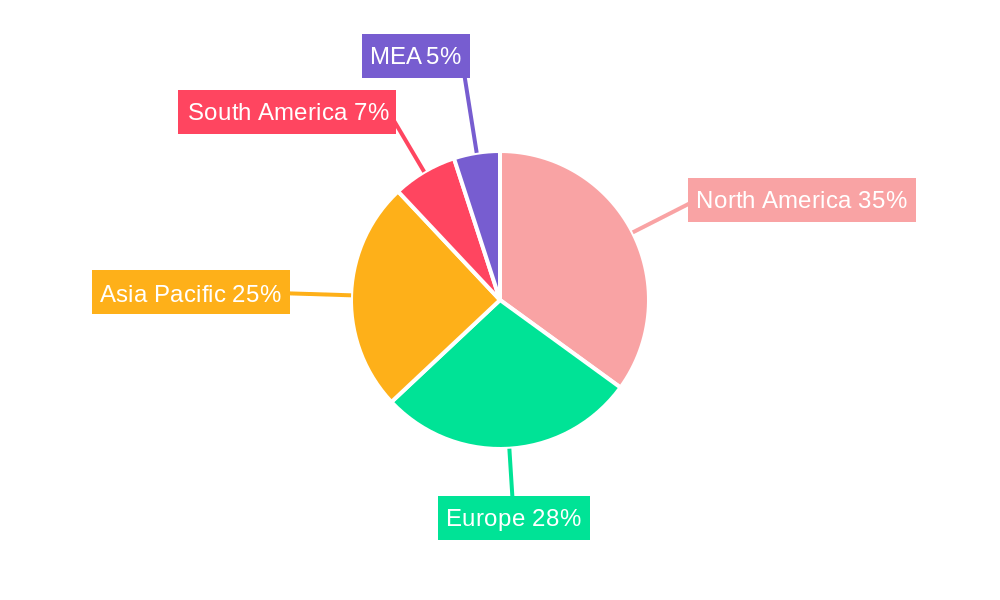

Dominant Regions, Countries, or Segments in Aerospace Materials Market

North America currently holds the largest market share, driven by significant aerospace manufacturing activities and investments in R&D. Europe follows closely, with a strong presence of established aerospace companies and a robust supply chain. The Asia-Pacific region is experiencing rapid growth, fueled by increasing air travel demand and government support for aerospace development. Within segments, Carbon Fiber Composites dominate due to their high strength-to-weight ratio and increasing use in aircraft structures. Titanium alloys are also a significant segment, particularly in high-performance applications.

- Key Drivers:

- Strong growth in commercial aviation and defense spending.

- Increasing demand for lightweight and high-performance materials.

- Government initiatives and funding for aerospace technology development.

- Dominant Regions: North America and Europe.

- Market Share (2025): North America (xx%), Europe (xx%), Asia-Pacific (xx%).

- Growth Potential: Asia-Pacific region showing highest growth potential.

- Dominant Segments: Carbon Fiber Composites and Titanium Alloys.

Aerospace Materials Market Product Landscape

The Aerospace Materials market is witnessing significant product innovation, particularly in advanced composites, lightweight alloys, and high-performance adhesives and sealants. New materials are constantly being developed to meet the demanding requirements of aerospace applications, including increased strength, reduced weight, improved durability, and enhanced resistance to extreme temperatures and environmental conditions. Unique selling propositions often include superior performance characteristics, enhanced safety features, and lifecycle cost reductions. Technological advancements such as additive manufacturing are enabling the creation of complex and customized components, reducing manufacturing time and waste.

Key Drivers, Barriers & Challenges in Aerospace Materials Market

Key Drivers: The increasing demand for fuel-efficient aircraft, coupled with stringent environmental regulations, is a major driver. Government investments in defense and space exploration programs also significantly impact market growth. Technological advancements, such as the development of high-performance composites and lightweight alloys, contribute to the market’s expansion.

Key Challenges: Supply chain disruptions, particularly in the sourcing of raw materials and specialized components, pose a significant challenge. The high cost of research and development for new materials and the lengthy certification processes are also barriers to entry. Intense competition among established players and emerging material suppliers creates a challenging market environment. Estimated supply chain disruptions impacted the market by xx Million in 2024.

Emerging Opportunities in Aerospace Materials Market

Emerging opportunities lie in the development of sustainable and bio-based aerospace materials, reducing the environmental impact of aircraft manufacturing. The integration of smart materials with embedded sensors and actuators presents significant potential for enhanced aircraft performance and maintenance. Untapped markets exist in the rapidly growing space exploration sector, which demands advanced materials with high thermal resistance, radiation shielding, and extreme durability. The increasing demand for personalized and customized aircraft components also presents opportunities for specialized material suppliers.

Growth Accelerators in the Aerospace Materials Market Industry

Strategic partnerships and collaborations between material suppliers and aerospace manufacturers are key growth accelerators, fostering innovation and technology transfer. Investments in research and development are crucial for creating novel materials with superior performance characteristics. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, offers significant growth potential. Technological advancements such as additive manufacturing streamline production, reducing costs and expanding design possibilities.

Key Players Shaping the Aerospace Materials Market Market

- ISOVOLTA AG

- Precision Castparts Corp

- SGL Carbon

- Henkel AG & Co KGaA

- HYOSUNG

- Arkema

- Beacon Adhesives Inc

- The Sherwin-Williams Company

- Jiangsu Hengshen Co Ltd

- Reliance Industries Ltd

- Solvay

- Mitsubishi Chemical Corporation

- Akzo Nobel NV

- Aluminum Corporation of China Limited (Chalco)

- Rogers Corporation

- Evonik Industries AG

- 3M

- PPG Industries Inc

- ATI

- Corporation VSMPO-AVISMA

- BASF SE

- Socomore

- Huntsman International LLC

- Axalta Coating Systems

- Howmet Aerospace

- Toray Industries Inc

- Mankiewicz Gebr & Co

- Greiner AG

- Hexcel Corporation

- Carpenter Technology Corporation

- NIPPON STEEL CORPORATION

- DELO Industrie Klebstoffe GmbH & Co KGaA

- Tata Steel (Corus)

- Acerinox SA (VDM Metals)

- Nanjing Yunhai Special Metal Co Ltd

- Hentzen Coatings Inc

Notable Milestones in Aerospace Materials Market Sector

- October 2022: Toray Composite Materials America partnered with SpecialityMaterials to develop advanced next-generation aerospace materials.

- July 2022: Hexcel partnered with Dassault to supply carbon fiber prepreg for the Falcon 10X program.

- April 2022: ISOVOLTA AG acquired the Aviation and Aerospace business unit from Gurit Holding AG.

In-Depth Aerospace Materials Market Market Outlook

The Aerospace Materials Market is poised for continued strong growth, driven by sustained demand in the commercial and military aerospace sectors, as well as the expanding space exploration industry. Strategic partnerships, investments in R&D, and the adoption of advanced manufacturing techniques will further accelerate market expansion. Opportunities exist for companies to leverage innovative materials, sustainable solutions, and advanced manufacturing technologies to capture market share and drive long-term growth. The market is expected to witness a significant increase in the adoption of lightweight and high-performance materials.

Aerospace Materials Market Segmentation

-

1. Type

-

1.1. Structural

-

1.1.1. Composites

- 1.1.1.1. Glass Fiber

- 1.1.1.2. Carbon Fiber

- 1.1.1.3. Aramid Fiber

- 1.1.1.4. Other Composites

- 1.1.2. Plastics

-

1.1.3. Alloys

- 1.1.3.1. Titanium

- 1.1.3.2. Aluminium

- 1.1.3.3. Steel

- 1.1.3.4. Super

- 1.1.3.5. Magnesium

- 1.1.3.6. Other Alloys

-

1.1.1. Composites

-

1.2. Non-structural

- 1.2.1. Coatings

-

1.2.2. Adhesives and Sealants

- 1.2.2.1. Epoxy

- 1.2.2.2. Polyurethane

- 1.2.2.3. Silicone

- 1.2.2.4. Other Adhesives and Sealants

-

1.2.3. Foams

- 1.2.3.1. Polyethylene

- 1.2.3.2. Other Foams

- 1.2.4. Seals

-

1.1. Structural

-

2. Aircraft Type

- 2.1. General and Commercial

- 2.2. Military and Defense

- 2.3. Space Vehicles

Aerospace Materials Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Aerospace Materials Market Regional Market Share

Geographic Coverage of Aerospace Materials Market

Aerospace Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Composites in Aircraft Manufacturing; Growing Space Industry; Increasing Government Spending on Defense in the United States and European Countries

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Cost of Carbon Fibers; Declining Usage of Alloys

- 3.4. Market Trends

- 3.4.1. Increasing Demand for General and Commercial Aircraft

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Structural

- 5.1.1.1. Composites

- 5.1.1.1.1. Glass Fiber

- 5.1.1.1.2. Carbon Fiber

- 5.1.1.1.3. Aramid Fiber

- 5.1.1.1.4. Other Composites

- 5.1.1.2. Plastics

- 5.1.1.3. Alloys

- 5.1.1.3.1. Titanium

- 5.1.1.3.2. Aluminium

- 5.1.1.3.3. Steel

- 5.1.1.3.4. Super

- 5.1.1.3.5. Magnesium

- 5.1.1.3.6. Other Alloys

- 5.1.1.1. Composites

- 5.1.2. Non-structural

- 5.1.2.1. Coatings

- 5.1.2.2. Adhesives and Sealants

- 5.1.2.2.1. Epoxy

- 5.1.2.2.2. Polyurethane

- 5.1.2.2.3. Silicone

- 5.1.2.2.4. Other Adhesives and Sealants

- 5.1.2.3. Foams

- 5.1.2.3.1. Polyethylene

- 5.1.2.3.2. Other Foams

- 5.1.2.4. Seals

- 5.1.1. Structural

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. General and Commercial

- 5.2.2. Military and Defense

- 5.2.3. Space Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Aerospace Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Structural

- 6.1.1.1. Composites

- 6.1.1.1.1. Glass Fiber

- 6.1.1.1.2. Carbon Fiber

- 6.1.1.1.3. Aramid Fiber

- 6.1.1.1.4. Other Composites

- 6.1.1.2. Plastics

- 6.1.1.3. Alloys

- 6.1.1.3.1. Titanium

- 6.1.1.3.2. Aluminium

- 6.1.1.3.3. Steel

- 6.1.1.3.4. Super

- 6.1.1.3.5. Magnesium

- 6.1.1.3.6. Other Alloys

- 6.1.1.1. Composites

- 6.1.2. Non-structural

- 6.1.2.1. Coatings

- 6.1.2.2. Adhesives and Sealants

- 6.1.2.2.1. Epoxy

- 6.1.2.2.2. Polyurethane

- 6.1.2.2.3. Silicone

- 6.1.2.2.4. Other Adhesives and Sealants

- 6.1.2.3. Foams

- 6.1.2.3.1. Polyethylene

- 6.1.2.3.2. Other Foams

- 6.1.2.4. Seals

- 6.1.1. Structural

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. General and Commercial

- 6.2.2. Military and Defense

- 6.2.3. Space Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Aerospace Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Structural

- 7.1.1.1. Composites

- 7.1.1.1.1. Glass Fiber

- 7.1.1.1.2. Carbon Fiber

- 7.1.1.1.3. Aramid Fiber

- 7.1.1.1.4. Other Composites

- 7.1.1.2. Plastics

- 7.1.1.3. Alloys

- 7.1.1.3.1. Titanium

- 7.1.1.3.2. Aluminium

- 7.1.1.3.3. Steel

- 7.1.1.3.4. Super

- 7.1.1.3.5. Magnesium

- 7.1.1.3.6. Other Alloys

- 7.1.1.1. Composites

- 7.1.2. Non-structural

- 7.1.2.1. Coatings

- 7.1.2.2. Adhesives and Sealants

- 7.1.2.2.1. Epoxy

- 7.1.2.2.2. Polyurethane

- 7.1.2.2.3. Silicone

- 7.1.2.2.4. Other Adhesives and Sealants

- 7.1.2.3. Foams

- 7.1.2.3.1. Polyethylene

- 7.1.2.3.2. Other Foams

- 7.1.2.4. Seals

- 7.1.1. Structural

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. General and Commercial

- 7.2.2. Military and Defense

- 7.2.3. Space Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Aerospace Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Structural

- 8.1.1.1. Composites

- 8.1.1.1.1. Glass Fiber

- 8.1.1.1.2. Carbon Fiber

- 8.1.1.1.3. Aramid Fiber

- 8.1.1.1.4. Other Composites

- 8.1.1.2. Plastics

- 8.1.1.3. Alloys

- 8.1.1.3.1. Titanium

- 8.1.1.3.2. Aluminium

- 8.1.1.3.3. Steel

- 8.1.1.3.4. Super

- 8.1.1.3.5. Magnesium

- 8.1.1.3.6. Other Alloys

- 8.1.1.1. Composites

- 8.1.2. Non-structural

- 8.1.2.1. Coatings

- 8.1.2.2. Adhesives and Sealants

- 8.1.2.2.1. Epoxy

- 8.1.2.2.2. Polyurethane

- 8.1.2.2.3. Silicone

- 8.1.2.2.4. Other Adhesives and Sealants

- 8.1.2.3. Foams

- 8.1.2.3.1. Polyethylene

- 8.1.2.3.2. Other Foams

- 8.1.2.4. Seals

- 8.1.1. Structural

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. General and Commercial

- 8.2.2. Military and Defense

- 8.2.3. Space Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Aerospace Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Structural

- 9.1.1.1. Composites

- 9.1.1.1.1. Glass Fiber

- 9.1.1.1.2. Carbon Fiber

- 9.1.1.1.3. Aramid Fiber

- 9.1.1.1.4. Other Composites

- 9.1.1.2. Plastics

- 9.1.1.3. Alloys

- 9.1.1.3.1. Titanium

- 9.1.1.3.2. Aluminium

- 9.1.1.3.3. Steel

- 9.1.1.3.4. Super

- 9.1.1.3.5. Magnesium

- 9.1.1.3.6. Other Alloys

- 9.1.1.1. Composites

- 9.1.2. Non-structural

- 9.1.2.1. Coatings

- 9.1.2.2. Adhesives and Sealants

- 9.1.2.2.1. Epoxy

- 9.1.2.2.2. Polyurethane

- 9.1.2.2.3. Silicone

- 9.1.2.2.4. Other Adhesives and Sealants

- 9.1.2.3. Foams

- 9.1.2.3.1. Polyethylene

- 9.1.2.3.2. Other Foams

- 9.1.2.4. Seals

- 9.1.1. Structural

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. General and Commercial

- 9.2.2. Military and Defense

- 9.2.3. Space Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ISOVOLTA AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Precision Castparts Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SGL Carbon

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Henkel AG & Co KGaA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HYOSUNG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Arkema

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Beacon Adhesives Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Sherwin-Williams Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jiangsu Hengshen Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Reliance Industries Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Solvay

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mitsubishi Chemical Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Akzo Nobel NV

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Aluminum Corporation of China Limited (Chalco)

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Rogers Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Evonik Industries AG

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 3M

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 PPG Industries Inc

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 ATI

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Corporation VSMPO-AVISMA

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 BASF SE

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 Socomore

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 Huntsman International LLC

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 Axalta Coating Systems

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 Howmet Aerospace

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 Toray Industries Inc *List Not Exhaustive

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.27 Mankiewicz Gebr & Co

- 10.2.27.1. Overview

- 10.2.27.2. Products

- 10.2.27.3. SWOT Analysis

- 10.2.27.4. Recent Developments

- 10.2.27.5. Financials (Based on Availability)

- 10.2.28 Greiner AG

- 10.2.28.1. Overview

- 10.2.28.2. Products

- 10.2.28.3. SWOT Analysis

- 10.2.28.4. Recent Developments

- 10.2.28.5. Financials (Based on Availability)

- 10.2.29 Hexcel Corporation

- 10.2.29.1. Overview

- 10.2.29.2. Products

- 10.2.29.3. SWOT Analysis

- 10.2.29.4. Recent Developments

- 10.2.29.5. Financials (Based on Availability)

- 10.2.30 Carpenter Technology Corporation

- 10.2.30.1. Overview

- 10.2.30.2. Products

- 10.2.30.3. SWOT Analysis

- 10.2.30.4. Recent Developments

- 10.2.30.5. Financials (Based on Availability)

- 10.2.31 NIPPON STEEL CORPORATION

- 10.2.31.1. Overview

- 10.2.31.2. Products

- 10.2.31.3. SWOT Analysis

- 10.2.31.4. Recent Developments

- 10.2.31.5. Financials (Based on Availability)

- 10.2.32 DELO Industrie Klebstoffe GmbH & Co KGaA

- 10.2.32.1. Overview

- 10.2.32.2. Products

- 10.2.32.3. SWOT Analysis

- 10.2.32.4. Recent Developments

- 10.2.32.5. Financials (Based on Availability)

- 10.2.33 Tata Steel (Corus)

- 10.2.33.1. Overview

- 10.2.33.2. Products

- 10.2.33.3. SWOT Analysis

- 10.2.33.4. Recent Developments

- 10.2.33.5. Financials (Based on Availability)

- 10.2.34 Acerinox SA (VDM Metals)

- 10.2.34.1. Overview

- 10.2.34.2. Products

- 10.2.34.3. SWOT Analysis

- 10.2.34.4. Recent Developments

- 10.2.34.5. Financials (Based on Availability)

- 10.2.35 Nanjing Yunhai Special Metal Co Ltd

- 10.2.35.1. Overview

- 10.2.35.2. Products

- 10.2.35.3. SWOT Analysis

- 10.2.35.4. Recent Developments

- 10.2.35.5. Financials (Based on Availability)

- 10.2.36 Hentzen Coatings Inc

- 10.2.36.1. Overview

- 10.2.36.2. Products

- 10.2.36.3. SWOT Analysis

- 10.2.36.4. Recent Developments

- 10.2.36.5. Financials (Based on Availability)

- 10.2.1 ISOVOLTA AG

List of Figures

- Figure 1: Global Aerospace Materials Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Aerospace Materials Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Aerospace Materials Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Aerospace Materials Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 5: Asia Pacific Aerospace Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 6: Asia Pacific Aerospace Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Aerospace Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Aerospace Materials Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Aerospace Materials Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Aerospace Materials Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 11: North America Aerospace Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: North America Aerospace Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Aerospace Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aerospace Materials Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Aerospace Materials Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Aerospace Materials Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 17: Europe Aerospace Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 18: Europe Aerospace Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Aerospace Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Aerospace Materials Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Aerospace Materials Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Aerospace Materials Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 23: Rest of the World Aerospace Materials Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 24: Rest of the World Aerospace Materials Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Aerospace Materials Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace Materials Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aerospace Materials Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 3: Global Aerospace Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aerospace Materials Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Aerospace Materials Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 6: Global Aerospace Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Aerospace Materials Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Aerospace Materials Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aerospace Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Aerospace Materials Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Aerospace Materials Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 20: Global Aerospace Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Spain Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Russia Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Aerospace Materials Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Aerospace Materials Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 30: Global Aerospace Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: South America Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Middle East and Africa Aerospace Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Materials Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Aerospace Materials Market?

Key companies in the market include ISOVOLTA AG, Precision Castparts Corp, SGL Carbon, Henkel AG & Co KGaA, HYOSUNG, Arkema, Beacon Adhesives Inc, The Sherwin-Williams Company, Jiangsu Hengshen Co Ltd, Reliance Industries Ltd, Solvay, Mitsubishi Chemical Corporation, Akzo Nobel NV, Aluminum Corporation of China Limited (Chalco), Rogers Corporation, Evonik Industries AG, 3M, PPG Industries Inc, ATI, Corporation VSMPO-AVISMA, BASF SE, Socomore, Huntsman International LLC, Axalta Coating Systems, Howmet Aerospace, Toray Industries Inc *List Not Exhaustive, Mankiewicz Gebr & Co, Greiner AG, Hexcel Corporation, Carpenter Technology Corporation, NIPPON STEEL CORPORATION, DELO Industrie Klebstoffe GmbH & Co KGaA, Tata Steel (Corus), Acerinox SA (VDM Metals), Nanjing Yunhai Special Metal Co Ltd, Hentzen Coatings Inc.

3. What are the main segments of the Aerospace Materials Market?

The market segments include Type, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Composites in Aircraft Manufacturing; Growing Space Industry; Increasing Government Spending on Defense in the United States and European Countries.

6. What are the notable trends driving market growth?

Increasing Demand for General and Commercial Aircraft.

7. Are there any restraints impacting market growth?

High Manufacturing Cost of Carbon Fibers; Declining Usage of Alloys.

8. Can you provide examples of recent developments in the market?

In October 2022, Toray Composite Materials America partnered with SpecialityMaterials, a boron fiber manufacturer, to develop advanced next-generation aerospace materials with functional properties. This move will strengthen Toray's position in the aerospace materials market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Materials Market?

To stay informed about further developments, trends, and reports in the Aerospace Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence