Key Insights

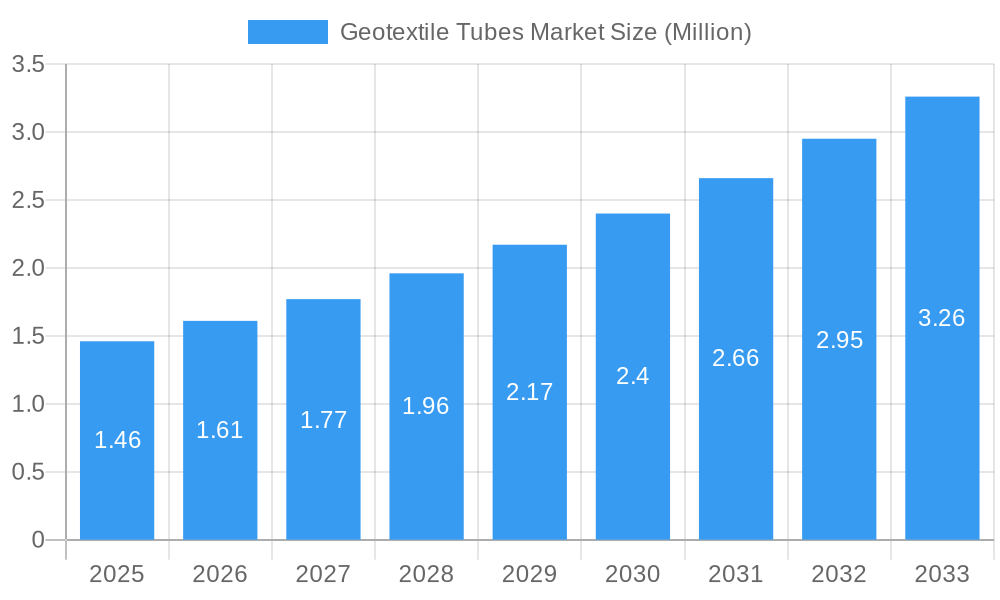

The global Geotextile Tubes market is poised for substantial expansion, with a projected market size of 1.46 Million and a compelling Compound Annual Growth Rate (CAGR) of 10.34% during the forecast period of 2025-2033. This robust growth trajectory is being propelled by increasing investments in infrastructure development across emerging economies, coupled with a growing emphasis on sustainable environmental solutions. Key drivers include the rising demand for effective erosion control in coastal protection and riverbank stabilization projects, as well as the significant role geotextile tubes play in dewatering and sludge management in various industrial applications, particularly in road construction, pavement repair, and drainage systems. The inherent benefits of geotextile tubes, such as their cost-effectiveness, ease of installation, and environmental friendliness compared to traditional methods, are further fueling market adoption.

Geotextile Tubes Market Market Size (In Million)

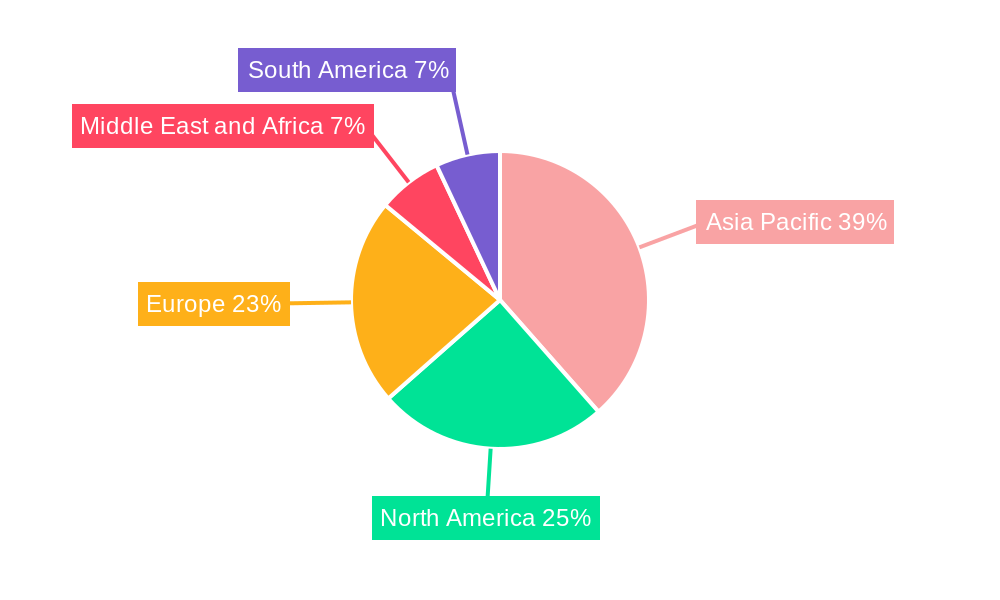

The market segmentation reveals a diverse landscape, with Polypropylene dominating the material segment due to its durability and cost-efficiency, while woven geotextiles are expected to hold a significant share in the type segment, offering superior strength and filtration. Road construction and pavement repair, alongside erosion control applications, are anticipated to be the primary growth engines within the application segment. Geographically, the Asia Pacific region, driven by rapid urbanization and infrastructure projects in countries like China and India, is expected to lead the market, followed by North America and Europe. While the market demonstrates strong growth potential, challenges such as fluctuating raw material prices and the availability of skilled labor for installation could present moderate restraints, necessitating strategic sourcing and workforce development by key players.

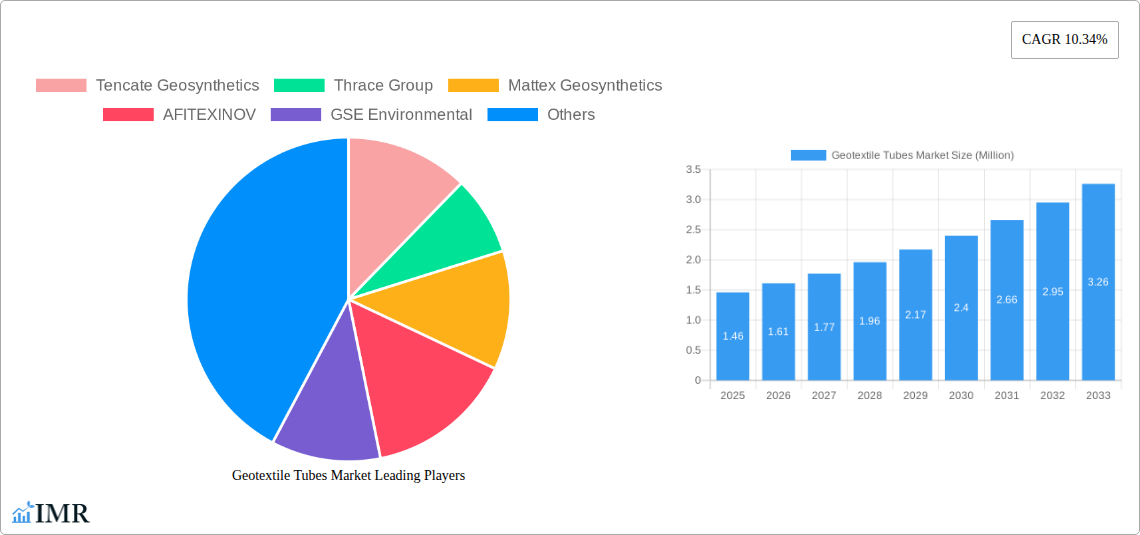

Geotextile Tubes Market Company Market Share

Geotextile Tubes Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

This comprehensive geotextile tubes market report delves into the intricate dynamics, growth trajectories, and competitive landscape of the global geotextile tubes industry. Analyzing the geotextile tubes market size from 2019–2033, with a base year of 2025 and a detailed forecast period of 2025–2033, this report provides actionable insights for stakeholders. Our in-depth analysis covers parent market drivers, child market segment evolution, and the impact of technological advancements on geotextile erosion control, geotextile drainage solutions, and geotextile for infrastructure projects. Explore key industry developments, dominant regions, and a detailed product landscape.

Geotextile Tubes Market Market Dynamics & Structure

The geotextile tubes market exhibits a moderately concentrated structure, with a few key global players dominating a significant portion of the market share. Technological innovation remains a primary driver, with continuous advancements in material science and manufacturing processes enhancing the performance and application range of geotextile tubes. Regulatory frameworks, particularly those concerning environmental protection and sustainable construction practices, are increasingly influencing market growth by promoting the adoption of eco-friendly geotextile solutions. Competitive product substitutes, such as concrete and natural materials, pose a challenge, but the cost-effectiveness, durability, and environmental benefits of geotextile tubes often provide a competitive edge. End-user demographics are expanding, driven by increased awareness and adoption in sectors like civil engineering, infrastructure development, and coastal protection. Mergers and acquisitions (M&A) activity is notable, reflecting the strategic efforts of established companies to consolidate market presence and expand their product portfolios. For instance, the acquisition of a majority stake in Officine Maccaferri by Ambienta SGR SpA in February 2024 signifies ongoing consolidation.

- Market Concentration: Moderate to high, with leading players holding substantial market share.

- Technological Innovation: Focus on enhanced durability, filtration properties, and ease of deployment.

- Regulatory Influence: Growing emphasis on environmental sustainability and infrastructure resilience.

- Competitive Landscape: Competition from traditional materials, but geotextiles offer superior environmental and economic advantages in many applications.

- End-User Expansion: Increasing demand from civil engineering, construction, and environmental management sectors.

- M&A Activity: Strategic acquisitions and partnerships are shaping the competitive landscape.

Geotextile Tubes Market Growth Trends & Insights

The geotextile tubes market is poised for significant expansion, driven by a confluence of factors including escalating global infrastructure development, heightened awareness of environmental protection, and the inherent advantages offered by these geosynthetic solutions. The market size evolution is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. Adoption rates are steadily increasing across diverse applications, particularly in road construction and pavement repair, erosion control, and drainage systems. Technological disruptions are continuously refining manufacturing processes, leading to more durable, cost-effective, and environmentally friendly geotextile tubes. This includes advancements in polypropylene geotextile tubes, polyester geotextile tubes, and the development of specialized non-woven geotextile tubes with superior filtration characteristics. Consumer behavior shifts are also playing a crucial role, with a growing preference for sustainable and resilient construction materials. The need for effective solutions in mitigating coastal erosion and managing stormwater runoff is further accelerating market penetration.

The geotextile tubes market is projected to reach an estimated market value of USD 4,500 million by 2025, driven by the increasing application in coastal defense, riverbank stabilization, and landfill construction. The growing trend towards urbanization and the subsequent need for robust infrastructure further fuels the demand for geotextile tubes in road construction, railway projects, and embankment stabilization. Innovations in material science, such as the development of higher tensile strength polypropylene and polyester fibers, are enhancing the durability and lifespan of geotextile tubes, making them a preferred choice over traditional materials. The market's growth is also supported by a surge in government initiatives and investments in infrastructure development across developing economies, aiming to improve connectivity and disaster resilience. The increasing demand for sustainable construction practices and the rising environmental concerns are acting as significant catalysts for the adoption of geotextile tubes, which offer eco-friendly solutions for soil stabilization and erosion management. The market penetration of geotextile tubes is expected to deepen as awareness of their long-term cost benefits and environmental advantages spreads across various industries.

Dominant Regions, Countries, or Segments in Geotextile Tubes Market

The geotextile tubes market is experiencing robust growth across various regions and segments, with North America and Europe currently holding a dominant position due to their mature infrastructure and stringent environmental regulations. However, the Asia-Pacific region is emerging as a significant growth engine, fueled by rapid industrialization, extensive infrastructure development projects, and increasing investments in coastal protection and water management. Within the material segment, Polypropylene continues to dominate due to its excellent tensile strength, chemical resistance, and cost-effectiveness, making it a preferred choice for a wide array of applications. Polyester also holds a substantial market share, particularly in applications requiring higher tensile strength and UV resistance.

In terms of type, Non-woven geotextile tubes are experiencing accelerated demand due to their superior filtration and separation properties, making them ideal for drainage and soil stabilization applications. The Road Construction and Pavement Repair segment represents the largest application area, driven by the global need for durable and long-lasting road infrastructure. The Erosion control segment is also a major contributor, with geotextile tubes playing a critical role in preventing soil loss in coastal areas, riverbanks, and construction sites.

- Dominant Region: Asia-Pacific is projected to witness the highest growth rate due to extensive infrastructure development and environmental initiatives.

- Leading Material: Polypropylene, owing to its cost-effectiveness and high tensile strength, leading the market with an estimated 45% market share.

- Key Type: Non-woven geotextile tubes are gaining traction due to enhanced filtration and drainage capabilities, estimated to capture 35% of the market by 2025.

- Primary Application: Road Construction and Pavement Repair, contributing over 30% to the global market value.

- Growth Drivers in Asia-Pacific: Increased government spending on infrastructure, rising awareness of disaster management, and significant agricultural development.

- Regional Investments: North America and Europe continue to invest in advanced geotextile solutions for environmental remediation and infrastructure upgrades.

Geotextile Tubes Market Product Landscape

The geotextile tubes market is characterized by continuous product innovation focused on enhancing tensile strength, permeability, durability, and ease of installation. Manufacturers are developing specialized geotextile tubes with tailored properties for specific applications, such as high-performance tubes for extreme marine environments or biodegradable options for temporary erosion control. Key product advancements include the introduction of multi-layered tubes offering superior filtration and confinement, as well as the development of larger diameter tubes for efficient dewatering and sediment control. The performance metrics of these tubes are rigorously tested to ensure compliance with industry standards for soil retention, hydraulic conductivity, and resistance to puncture and abrasion, ensuring reliable performance in critical infrastructure and environmental protection projects.

Key Drivers, Barriers & Challenges in Geotextile Tubes Market

The geotextile tubes market is primarily propelled by the escalating global demand for infrastructure development, particularly in developing economies, coupled with a growing emphasis on sustainable construction practices and environmental protection.

- Key Drivers:

- Infrastructure Development: Increased government spending on roads, railways, and coastal defenses.

- Environmental Regulations: Stricter laws promoting eco-friendly construction and erosion control.

- Cost-Effectiveness: Geotextile tubes offer a more economical solution compared to traditional methods for many applications.

- Durability and Longevity: Enhanced performance in harsh environments, leading to longer infrastructure lifespans.

The primary barriers and challenges facing the geotextile tubes market include the significant upfront investment required for manufacturing facilities, the need for skilled labor for installation, and the competition from established conventional materials.

- Key Barriers & Challenges:

- High Initial Investment: Capital expenditure for advanced manufacturing equipment.

- Skilled Labor Requirement: Specialized training for optimal installation of geotextile tubes.

- Competition: Persistent competition from concrete, riprap, and other traditional materials.

- Supply Chain Disruptions: Potential for delays and increased costs in raw material procurement and finished goods distribution.

Emerging Opportunities in Geotextile Tubes Market

Emerging opportunities in the geotextile tubes market lie in the increasing adoption of these solutions for renewable energy infrastructure, such as solar farm stabilization and offshore wind foundation protection. The growing global focus on water resource management and flood control presents significant opportunities for geotextile tube applications in dam construction, canal lining, and artificial reef creation. Furthermore, the development of advanced, biodegradable, and recyclable geotextile materials is opening new avenues in eco-conscious construction projects and land reclamation initiatives, catering to a niche but rapidly expanding market segment. The integration of smart technologies for real-time monitoring of geotextile performance in critical infrastructure is another promising area for innovation and market penetration.

Growth Accelerators in the Geotextile Tubes Market Industry

Long-term growth in the geotextile tubes market will be significantly accelerated by technological breakthroughs in material science, leading to lighter yet stronger and more permeable geotextile fabrics. Strategic partnerships between geotextile manufacturers, engineering firms, and government bodies will foster wider adoption and development of standardized application guidelines. Market expansion strategies focused on emerging economies, coupled with increased awareness campaigns highlighting the environmental and economic benefits of geotextile tubes, will further solidify their position in the global construction and environmental engineering sectors. The continuous drive for sustainable construction solutions will undoubtedly favor the growth of the geotextile tubes industry.

Key Players Shaping the Geotextile Tubes Market Market

- Tencate Geosynthetics

- Thrace Group

- Mattex Geosynthetics

- AFITEXINOV

- GSE Environmental

- Officine Maccaferri SpA

- Owens Corning

- Carthage Mills Inc

- Kaytech

- Low & Bonar

- Swicofil AG

- Naue GmbH & Co KG

- Asahi Kasei Advance Corporation

- AGRU AMERICA INC

- TYPAR Geosynthetics

- Fibertex Nonwovens AS (Schouw & Co)

- HUESKER

Notable Milestones in Geotextile Tubes Market Sector

- February 2024: Ambienta SGR SpA announced the acquisition of a majority stake in Officine Maccaferri, aiming to enhance its position in the geosynthetics market.

- February 2024: The HUESKER Group established a new subsidiary in South Africa to strengthen its presence and expand its customer base in the region.

- December 2023: Asahi Kasei Advance Corporation unveiled a novel membrane system for dehydrating organic solvents, showcasing innovation in material applications.

- October 2022: Owens Corning invested USD 24.5 million to expand its non-woven geotextile production in Arkansas, boosting its product portfolio and market value.

- July 2022: Huesker Group introduced innovative geotextile container systems for erosion control in coastal transport infrastructure.

- March 2022: BontexGeo Group acquired Geotexan SA, a Spanish company specializing in geosynthetics, expanding its European market footprint.

In-Depth Geotextile Tubes Market Market Outlook

The geotextile tubes market outlook is exceptionally promising, with growth accelerators poised to drive sustained expansion. The increasing integration of advanced computational modeling for design optimization and performance prediction will further enhance the reliability and appeal of geotextile tubes. Strategic collaborations aimed at developing sustainable and biodegradable geotextile solutions will tap into a growing environmentally conscious market segment. Furthermore, the expansion of applications into areas such as aquaculture, land reclamation, and disaster-resilient infrastructure will unlock new revenue streams and solidify the market's robust future potential. The industry is on a trajectory to become a cornerstone of modern, sustainable infrastructure development worldwide.

Geotextile Tubes Market Segmentation

-

1. Material

- 1.1. Polypropylene

- 1.2. Polyester

- 1.3. Polyethylene

- 1.4. Other Materials

-

2. Type

- 2.1. Woven

- 2.2. Non-woven

- 2.3. Knitted

- 2.4. Other Types

-

3. Application

- 3.1. Road Construction and Pavement Repair

- 3.2. Erosion

- 3.3. Drainage

- 3.4. Railworks

- 3.5. Agriculture

- 3.6. Other Applications

Geotextile Tubes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Thailand

- 1.6. Malaysia

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. NORDIC

- 3.7. Spain

- 3.8. Turkey

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. United Arab Emirates

- 5.4. Qatar

- 5.5. Nigeria

- 5.6. Egypt

- 5.7. Rest of Middle East and Africa

Geotextile Tubes Market Regional Market Share

Geographic Coverage of Geotextile Tubes Market

Geotextile Tubes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Usage of Geotextiles in Construction Industry; Increase Usage of Geotextiles in Mining Activities; Stringent Regulatory Framework for Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand in Road Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polypropylene

- 5.1.2. Polyester

- 5.1.3. Polyethylene

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Woven

- 5.2.2. Non-woven

- 5.2.3. Knitted

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Road Construction and Pavement Repair

- 5.3.2. Erosion

- 5.3.3. Drainage

- 5.3.4. Railworks

- 5.3.5. Agriculture

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polypropylene

- 6.1.2. Polyester

- 6.1.3. Polyethylene

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Woven

- 6.2.2. Non-woven

- 6.2.3. Knitted

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Road Construction and Pavement Repair

- 6.3.2. Erosion

- 6.3.3. Drainage

- 6.3.4. Railworks

- 6.3.5. Agriculture

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polypropylene

- 7.1.2. Polyester

- 7.1.3. Polyethylene

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Woven

- 7.2.2. Non-woven

- 7.2.3. Knitted

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Road Construction and Pavement Repair

- 7.3.2. Erosion

- 7.3.3. Drainage

- 7.3.4. Railworks

- 7.3.5. Agriculture

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polypropylene

- 8.1.2. Polyester

- 8.1.3. Polyethylene

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Woven

- 8.2.2. Non-woven

- 8.2.3. Knitted

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Road Construction and Pavement Repair

- 8.3.2. Erosion

- 8.3.3. Drainage

- 8.3.4. Railworks

- 8.3.5. Agriculture

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polypropylene

- 9.1.2. Polyester

- 9.1.3. Polyethylene

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Woven

- 9.2.2. Non-woven

- 9.2.3. Knitted

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Road Construction and Pavement Repair

- 9.3.2. Erosion

- 9.3.3. Drainage

- 9.3.4. Railworks

- 9.3.5. Agriculture

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Geotextile Tubes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polypropylene

- 10.1.2. Polyester

- 10.1.3. Polyethylene

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Woven

- 10.2.2. Non-woven

- 10.2.3. Knitted

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Road Construction and Pavement Repair

- 10.3.2. Erosion

- 10.3.3. Drainage

- 10.3.4. Railworks

- 10.3.5. Agriculture

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tencate Geosynthetics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thrace Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mattex Geosynthetics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AFITEXINOV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GSE Environmental

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Officine Maccaferri SpA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Owens Corning

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carthage Mills Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kaytech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Low & Bonar

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Swicofil AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Naue GmbH & Co KG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Asahi Kasei Advance Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AGRU AMERICA INC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 TYPAR Geosynthetics*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Fibertex Nonwovens AS (Schouw & Co )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 HUESKER

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Tencate Geosynthetics

List of Figures

- Figure 1: Global Geotextile Tubes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 3: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 5: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 7: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Asia Pacific Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 11: North America Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: North America Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 15: North America Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: North America Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 27: South America Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 29: South America Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: South America Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Geotextile Tubes Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Geotextile Tubes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Geotextile Tubes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Japan Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Thailand Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Vietnam Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Asia Pacific Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 19: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Canada Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 26: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Germany Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Italy Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Russia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: NORDIC Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Turkey Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 39: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Brazil Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Argentina Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Colombia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Geotextile Tubes Market Revenue Million Forecast, by Material 2020 & 2033

- Table 47: Global Geotextile Tubes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Geotextile Tubes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 49: Global Geotextile Tubes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Saudi Arabia Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: South Africa Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Arab Emirates Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Qatar Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Nigeria Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Egypt Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Geotextile Tubes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Geotextile Tubes Market?

The projected CAGR is approximately 10.34%.

2. Which companies are prominent players in the Geotextile Tubes Market?

Key companies in the market include Tencate Geosynthetics, Thrace Group, Mattex Geosynthetics, AFITEXINOV, GSE Environmental, Officine Maccaferri SpA, Owens Corning, Carthage Mills Inc, Kaytech, Low & Bonar, Swicofil AG, Naue GmbH & Co KG, Asahi Kasei Advance Corporation, AGRU AMERICA INC, TYPAR Geosynthetics*List Not Exhaustive, Fibertex Nonwovens AS (Schouw & Co ), HUESKER.

3. What are the main segments of the Geotextile Tubes Market?

The market segments include Material, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Usage of Geotextiles in Construction Industry; Increase Usage of Geotextiles in Mining Activities; Stringent Regulatory Framework for Environmental Protection.

6. What are the notable trends driving market growth?

Increasing Demand in Road Construction.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2024: Ambienta SGR SpA announced the acquisition of a majority stake in Officine Maccaferri to hold a majority stake in the company. The transaction is expected to close in Q2 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Geotextile Tubes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Geotextile Tubes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Geotextile Tubes Market?

To stay informed about further developments, trends, and reports in the Geotextile Tubes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence