Key Insights

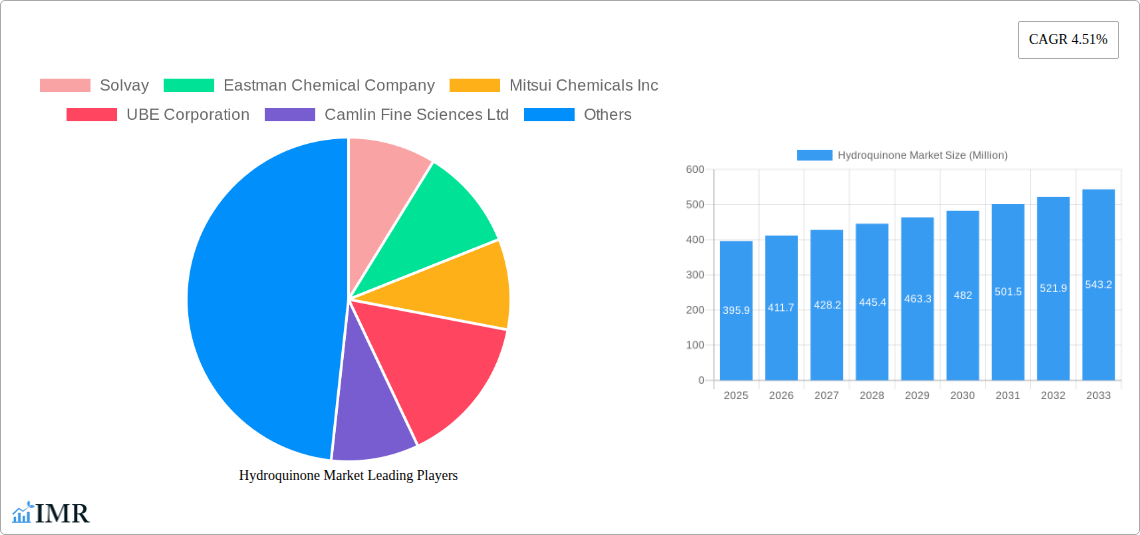

The global Hydroquinone market is poised for steady expansion, driven by its diverse applications across key industries. With an estimated market size of USD 395.9 million in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4% through 2033. This growth is significantly fueled by its crucial role as an intermediate in chemical synthesis, a vital antioxidant in various formulations, and an effective polymerization inhibitor in manufacturing processes. The increasing demand for high-performance polymers, advanced paints and adhesives, and specialized rubber products directly translates into a higher consumption of hydroquinone. Furthermore, its application in the cosmetics industry as a skin-lightening agent, although facing some regulatory scrutiny in certain regions, continues to contribute to market dynamics, particularly in emerging economies.

Hydroquinone Market Market Size (In Million)

The market's trajectory is shaped by a confluence of factors. While the demand for industrial applications like polymerization inhibition remains robust, particularly in regions with a strong manufacturing base such as Asia Pacific and North America, the antioxidant segment is also experiencing healthy growth. Emerging applications in photosensitive chemicals and other niche areas are expected to offer further avenues for market penetration. Key restraints include evolving regulatory landscapes concerning its use in consumer products and the increasing availability of alternative compounds in specific applications. Nevertheless, the intrinsic properties of hydroquinone and its established efficacy in numerous industrial processes are expected to sustain its market relevance and drive its growth trajectory. The competitive landscape is characterized by the presence of established global players and emerging regional manufacturers, all vying for market share through product innovation and strategic collaborations.

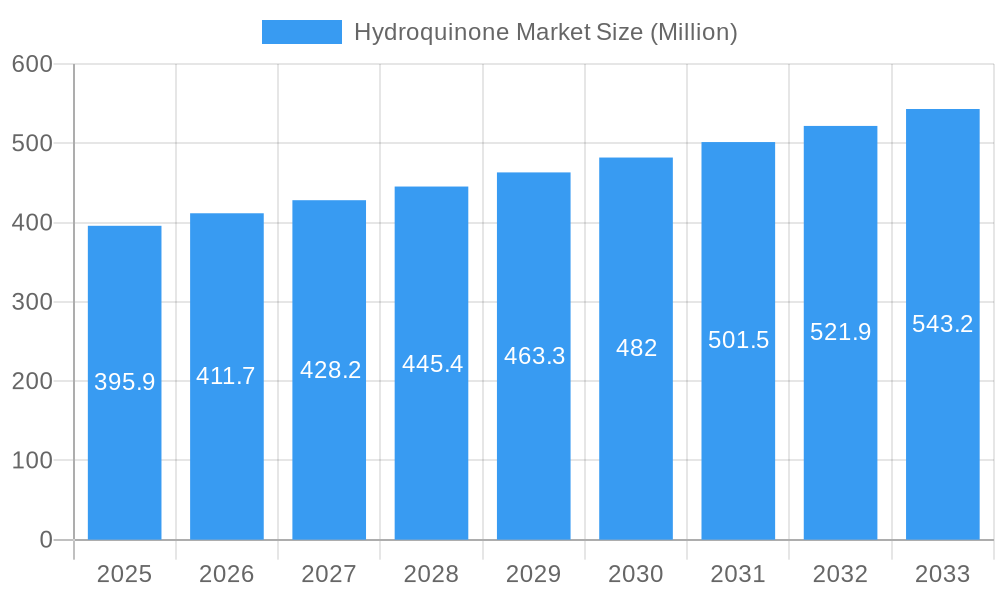

Hydroquinone Market Company Market Share

This in-depth report provides a comprehensive analysis of the global Hydroquinone (HQ) market, offering critical insights into its present state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, regional dominance, product landscape, key drivers and challenges, emerging opportunities, growth accelerators, and the competitive ecosystem. With a focus on high-traffic SEO keywords like "hydroquinone market," "HQ applications," "intermediate chemicals," "antioxidants market," and "polymerization inhibitors," this report is designed to maximize search engine visibility and provide actionable intelligence for industry professionals.

Hydroquinone Market Dynamics & Structure

The global hydroquinone market exhibits a moderately consolidated structure, characterized by the presence of a few key global players alongside several regional manufacturers. Technological innovation is a significant driver, with ongoing research focused on improving production efficiency, developing purer grades of hydroquinone for sensitive applications, and exploring novel synthesis routes. Regulatory frameworks, particularly concerning environmental impact and worker safety in manufacturing processes, play a crucial role in shaping market entry and operational standards.

- Market Concentration: Dominated by a blend of large chemical conglomerates and specialized manufacturers.

- Technological Innovation: Focus on sustainable production, high-purity grades, and alternative synthesis methods.

- Regulatory Frameworks: Stringent environmental and safety regulations impact manufacturing and product approvals.

- Competitive Product Substitutes: While direct substitutes for certain high-performance applications are limited, alternative chemicals are explored for less critical uses, influencing pricing strategies.

- End-user Demographics: Shifting demand from traditional industries towards specialized applications in cosmetics and advanced polymers.

- M&A Trends: Strategic acquisitions are observed as companies aim to expand their product portfolios, market reach, and technological capabilities. The volume of M&A deals is projected to remain steady, driven by consolidation efforts and the pursuit of synergistic growth.

Hydroquinone Market Growth Trends & Insights

The hydroquinone market is poised for robust growth over the forecast period (2025-2033), driven by its indispensable role across a diverse range of applications and a sustained demand from key end-user industries. The market size evolution is projected to be significant, with an estimated market size of over xx million units in 2025, expanding at a healthy CAGR. Adoption rates are steadily increasing, particularly for hydroquinone's use as a polymerization inhibitor in the production of various plastics and as a critical intermediate in the synthesis of specialty chemicals.

Technological disruptions are not significantly posing a threat to the core demand for hydroquinone; rather, advancements in its production methods are enhancing its sustainability and cost-effectiveness. Consumer behavior shifts are indirectly influencing the market, with a growing demand for skincare products incorporating antioxidants, where hydroquinone derivatives (though regulated) or alternative brightening agents are considered. However, the primary growth impetus remains firmly rooted in industrial applications. The market's penetration is deep within the polymers and chemical synthesis sectors, with expanding opportunities in niche segments. The historical period (2019-2024) has laid a strong foundation, marked by consistent demand and gradual capacity expansions by key manufacturers. The estimated year of 2025 is anticipated to witness a strong baseline for subsequent growth, reflecting the ongoing industrial recovery and expansion across global economies.

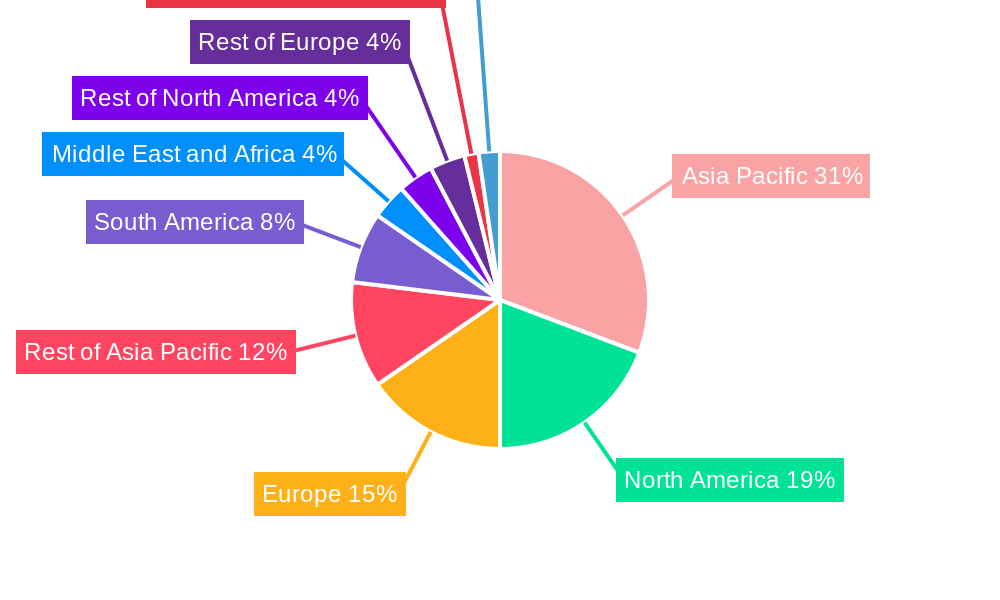

Dominant Regions, Countries, or Segments in Hydroquinone Market

The hydroquinone market’s dominance is currently characterized by a strong performance in the Asia Pacific region, driven by its robust manufacturing base and burgeoning demand from the polymers and chemical synthesis sectors. China, in particular, stands out as a significant contributor to both production and consumption, supported by favorable economic policies and continuous infrastructure development in its chemical industry.

- Dominant Region: Asia Pacific

- Key Drivers:

- Large Manufacturing Hub: Extensive presence of chemical and polymer manufacturing industries.

- Growing Industrialization: Rapid industrial development across countries like China, India, and Southeast Asian nations.

- Favorable Economic Policies: Government initiatives supporting chemical production and export.

- Cost-Effective Production: Lower manufacturing costs compared to developed regions.

- Expanding End-User Industries: High demand from sectors like polymers, paints and adhesives, and rubber.

- Key Drivers:

- Dominant Application Segment: Intermediate

- Market Share: Estimated at over xx% of the total hydroquinone market in 2025.

- Dominance Factors:

- Versatility: Hydroquinone serves as a crucial building block for a wide array of downstream chemicals, including agrochemicals, pharmaceuticals, and dyes.

- Demand from Specialty Chemicals: Increasing need for specialized chemical compounds fuels the demand for hydroquinone as an intermediate.

- Growth in Downstream Industries: Expansion of industries reliant on these chemical derivatives directly translates to higher demand for hydroquinone.

- Dominant End-user Industry: Polymers

- Market Share: Expected to account for over xx% of the hydroquinone market in 2025.

- Dominance Factors:

- Polymerization Inhibitor: Essential for controlling the polymerization process, preventing premature curing and improving shelf life of monomers.

- Growth in Plastics Manufacturing: The continuous expansion of the global plastics industry, from packaging to automotive components, underpins this demand.

- Adhesive and Sealant Applications: Used in the formulation of various adhesives and sealants, further bolstering its consumption.

- Rubber Industry Integration: Employed in rubber manufacturing processes to enhance product stability and performance.

Hydroquinone Market Product Landscape

The hydroquinone product landscape is defined by its diverse applications, with key products catering to specific industry needs. High-purity hydroquinone is essential for sensitive applications like photographic chemicals and certain cosmetic formulations, while industrial grades are predominantly used as intermediates and polymerization inhibitors. Innovation is focused on developing more environmentally friendly production processes and ensuring consistent quality and performance. The unique selling proposition often lies in the purity levels offered and the reliability of supply.

Key Drivers, Barriers & Challenges in Hydroquinone Market

Key Drivers:

- Growing Demand in Polymers: Essential as a polymerization inhibitor, driving consumption in plastics and rubber manufacturing.

- Role as a Chemical Intermediate: Critical for the synthesis of various specialty chemicals, dyes, and agrochemicals.

- Expanding Cosmetics Industry: Demand for skin-lightening agents and antioxidants (though often derivatives or alternatives due to regulations).

- Technological Advancements: Improved production methods leading to higher purity and cost-effectiveness.

- Industrial Growth in Emerging Economies: Rising manufacturing activities in Asia Pacific and other developing regions.

Barriers & Challenges:

- Regulatory Scrutiny: Environmental regulations concerning its production and health concerns associated with its use in certain consumer products.

- Volatile Raw Material Prices: Fluctuations in the cost of precursor chemicals can impact profitability.

- Competition from Alternatives: In some applications, alternative chemicals are being explored, posing a competitive threat.

- Supply Chain Disruptions: Global logistics challenges and potential for raw material shortages.

- Health and Safety Concerns: Stringent handling and disposal protocols required due to its chemical nature.

- Market Saturation in Certain Regions: Mature markets may experience slower growth rates.

Emerging Opportunities in Hydroquinone Market

Emerging opportunities in the hydroquinone market lie in the development of sustainable production methods, catering to the growing global emphasis on eco-friendly chemical manufacturing. The expansion of advanced materials and specialty polymers presents new avenues for hydroquinone as a critical component. Furthermore, exploring its potential in niche pharmaceutical intermediates and as a stabilizer in novel material formulations could unlock significant growth potential. The increasing focus on precision agriculture also hints at potential opportunities for hydroquinone derivatives in agrochemical applications.

Growth Accelerators in the Hydroquinone Market Industry

Long-term growth in the hydroquinone market will be significantly accelerated by continued investments in research and development focused on greener manufacturing processes and higher-purity products. Strategic partnerships between manufacturers and end-users will streamline the supply chain and foster innovation. Market expansion strategies targeting rapidly industrializing nations and the development of novel applications in high-growth sectors such as advanced composites and electronics will also act as significant catalysts for sustained growth.

Key Players Shaping the Hydroquinone Market Market

- Solvay

- Eastman Chemical Company

- Mitsui Chemicals Inc

- UBE Corporation

- Camlin Fine Sciences Ltd

- YanCheng FengYang Chemical Co Ltd

- Haihang Industry

- TIANJIN ZHONGXIN CHEMTECH CO LTD (ZX CHEMTECH)

- Honeywell International Inc

- Shanxi Jin-jin Chemical Co Ltd

- Kawaguchi Chemical Industry Co Ltd

Notable Milestones in Hydroquinone Market Sector

- February 2023: Solvay commenced the commercial production of its International Sustainability and Carbon Certification (ISCC) PLUS hydroquinone (HQ) product in Saint-Fons, France, highlighting a significant step towards sustainable hydroquinone manufacturing and supply.

In-Depth Hydroquinone Market Market Outlook

The future outlook for the hydroquinone market remains highly positive, propelled by its fundamental role in a wide array of industrial processes and its adaptability to evolving technological landscapes. Key growth accelerators include the persistent demand from the robust global polymer industry, the expanding need for chemical intermediates in specialty applications, and emerging opportunities in the advanced materials sector. Strategic investments in sustainable production technologies and targeted market penetration in high-growth regions will be crucial for unlocking the full potential of this dynamic market. The continuous pursuit of innovation, coupled with strategic collaborations, will ensure the hydroquinone market's sustained expansion and relevance in the years to come.

Hydroquinone Market Segmentation

-

1. Application

- 1.1. Intermediate

- 1.2. Antioxidant

- 1.3. Polymerization Inhibitor

- 1.4. Photosensitive Chemical

- 1.5. Other Applications

-

2. End-user Industry

- 2.1. Cosmetics

- 2.2. Polymers

- 2.3. Paints and Adhesives

- 2.4. Rubber

- 2.5. Other End-user Industries

Hydroquinone Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Spain

- 3.7. Turkey

- 3.8. Nordic Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Qatar

- 5.4. Egypt

- 5.5. Nigeria

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Hydroquinone Market Regional Market Share

Geographic Coverage of Hydroquinone Market

Hydroquinone Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Rubber; Surging Demand for Hydroquinone from the Paint Industry

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Rubber; Surging Demand for Hydroquinone from the Paint Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Rubber Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Intermediate

- 5.1.2. Antioxidant

- 5.1.3. Polymerization Inhibitor

- 5.1.4. Photosensitive Chemical

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Cosmetics

- 5.2.2. Polymers

- 5.2.3. Paints and Adhesives

- 5.2.4. Rubber

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Intermediate

- 6.1.2. Antioxidant

- 6.1.3. Polymerization Inhibitor

- 6.1.4. Photosensitive Chemical

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Cosmetics

- 6.2.2. Polymers

- 6.2.3. Paints and Adhesives

- 6.2.4. Rubber

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Intermediate

- 7.1.2. Antioxidant

- 7.1.3. Polymerization Inhibitor

- 7.1.4. Photosensitive Chemical

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Cosmetics

- 7.2.2. Polymers

- 7.2.3. Paints and Adhesives

- 7.2.4. Rubber

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Intermediate

- 8.1.2. Antioxidant

- 8.1.3. Polymerization Inhibitor

- 8.1.4. Photosensitive Chemical

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Cosmetics

- 8.2.2. Polymers

- 8.2.3. Paints and Adhesives

- 8.2.4. Rubber

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Intermediate

- 9.1.2. Antioxidant

- 9.1.3. Polymerization Inhibitor

- 9.1.4. Photosensitive Chemical

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Cosmetics

- 9.2.2. Polymers

- 9.2.3. Paints and Adhesives

- 9.2.4. Rubber

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Hydroquinone Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Intermediate

- 10.1.2. Antioxidant

- 10.1.3. Polymerization Inhibitor

- 10.1.4. Photosensitive Chemical

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Cosmetics

- 10.2.2. Polymers

- 10.2.3. Paints and Adhesives

- 10.2.4. Rubber

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Solvay

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eastman Chemical Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsui Chemicals Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UBE Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Camlin Fine Sciences Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 YanCheng FengYang Chemical Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haihang Industry

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TIANJIN ZHONGXIN CHEMTECH CO LTD (ZX CHEMTECH)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Honeywell International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shanxi Jin-jin Chemical Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kawaguchi Chemical Industry Co Ltd*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Solvay

List of Figures

- Figure 1: Global Hydroquinone Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Hydroquinone Market Revenue (undefined), by Application 2025 & 2033

- Figure 3: Asia Pacific Hydroquinone Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Hydroquinone Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Hydroquinone Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Hydroquinone Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Hydroquinone Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Hydroquinone Market Revenue (undefined), by Application 2025 & 2033

- Figure 9: North America Hydroquinone Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Hydroquinone Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Hydroquinone Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Hydroquinone Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Hydroquinone Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hydroquinone Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Hydroquinone Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Hydroquinone Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Hydroquinone Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Hydroquinone Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Hydroquinone Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Hydroquinone Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: South America Hydroquinone Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Hydroquinone Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Hydroquinone Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Hydroquinone Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Hydroquinone Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Hydroquinone Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Middle East and Africa Hydroquinone Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Hydroquinone Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Hydroquinone Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Hydroquinone Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Hydroquinone Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Hydroquinone Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Hydroquinone Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Thailand Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Hydroquinone Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United States Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Mexico Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Hydroquinone Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Germany Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Italy Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Russia Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Turkey Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Nordic Countries Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 37: Global Hydroquinone Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Brazil Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Argentina Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Colombia Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Hydroquinone Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 43: Global Hydroquinone Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Hydroquinone Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 45: Saudi Arabia Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Arab Emirates Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Qatar Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Egypt Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Nigeria Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East and Africa Hydroquinone Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydroquinone Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Hydroquinone Market?

Key companies in the market include Solvay, Eastman Chemical Company, Mitsui Chemicals Inc, UBE Corporation, Camlin Fine Sciences Ltd, YanCheng FengYang Chemical Co Ltd, Haihang Industry, TIANJIN ZHONGXIN CHEMTECH CO LTD (ZX CHEMTECH), Honeywell International Inc, Shanxi Jin-jin Chemical Co Ltd, Kawaguchi Chemical Industry Co Ltd*List Not Exhaustive.

3. What are the main segments of the Hydroquinone Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Rubber; Surging Demand for Hydroquinone from the Paint Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Rubber Industry.

7. Are there any restraints impacting market growth?

Rising Demand for Rubber; Surging Demand for Hydroquinone from the Paint Industry.

8. Can you provide examples of recent developments in the market?

February 2023: Solvay commenced the commercial production of its International Sustainability and Carbon Certification (ISCC) PLUS hydroquinone (HQ) product in Saint-Fons, France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydroquinone Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydroquinone Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydroquinone Market?

To stay informed about further developments, trends, and reports in the Hydroquinone Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence