Key Insights

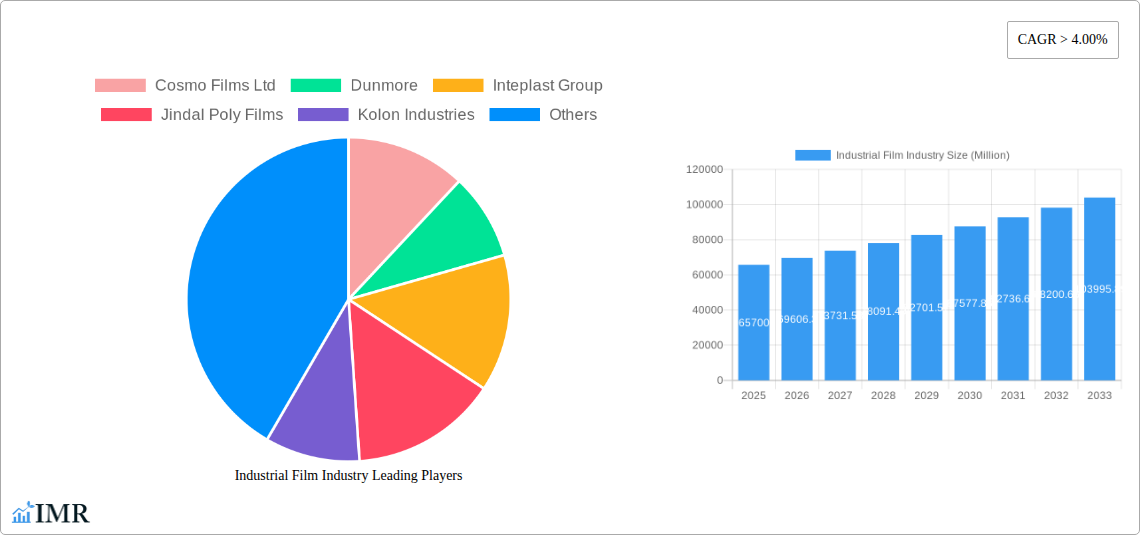

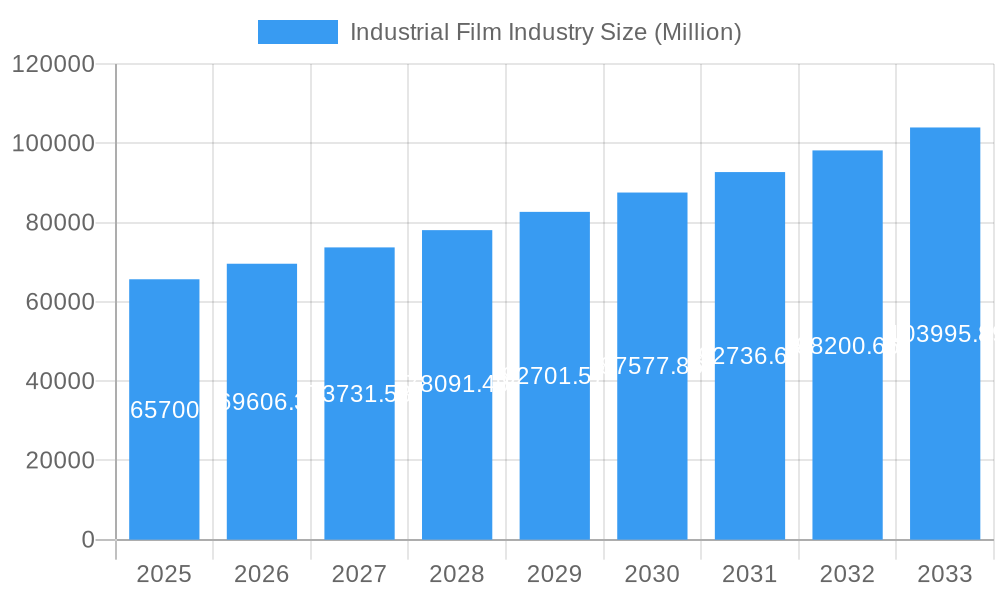

The global Industrial Film Market is poised for significant expansion, with a projected market size of $65.7 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.9% anticipated over the forecast period of 2025-2033. A primary driver for this upward trajectory is the escalating demand from the packaging sector, particularly for industrial packaging applications that require durable and protective films for goods in transit and storage. Furthermore, the agricultural industry's increasing reliance on films for crop protection, greenhouse coverings, and irrigation systems contributes substantially to market expansion. Innovations in material science, leading to the development of advanced films with enhanced properties such as increased strength, better barrier protection, and improved sustainability, are also fueling market growth. The rising adoption of these specialized films across diverse industries, including building and construction for insulation and protective layering, and the healthcare sector for sterile packaging and medical devices, further solidifies the market's positive outlook.

Industrial Film Industry Market Size (In Billion)

The market's dynamic nature is also shaped by key trends such as the growing emphasis on sustainable and recyclable film solutions, driven by stringent environmental regulations and increasing consumer awareness. Manufacturers are actively investing in research and development to create biodegradable and compostable industrial films, as well as films made from recycled materials. Geographically, the Asia Pacific region, led by China and India, is expected to remain a dominant force due to rapid industrialization, a burgeoning manufacturing base, and increasing infrastructure development. While the market presents immense opportunities, certain restraints, such as volatile raw material prices and the cost of implementing advanced manufacturing technologies, could pose challenges. Nevertheless, the continuous innovation in film types, including the evolution of LLDPE, HDPE, and PET films, alongside the exploration of newer polymer formulations, ensures a dynamic and evolving landscape for industrial films.

Industrial Film Industry Company Market Share

This in-depth report delivers critical insights into the global Industrial Film Industry, a rapidly evolving sector vital for numerous applications. With a robust focus on market dynamics, growth trends, regional dominance, product landscape, and key players, this analysis is essential for stakeholders seeking to navigate and capitalize on this dynamic market. The report covers the historical period of 2019-2024, a base year of 2025, and a comprehensive forecast period from 2025-2033, providing a complete market outlook.

Industrial Film Industry Market Dynamics & Structure

The Industrial Film Industry is characterized by a moderate market concentration, with key players leveraging technological innovation and strategic mergers and acquisitions (M&A) to expand their market share. Significant drivers include the demand for enhanced packaging solutions, the development of high-performance films for specialized applications in sectors like automotive and healthcare, and advancements in material science. Regulatory frameworks, particularly concerning environmental sustainability and product safety, are increasingly shaping market entry and product development strategies. The competitive landscape includes both established giants and agile innovators, with a constant interplay between material innovation and cost-efficiency. End-user demographics are shifting towards a greater demand for sustainable and recyclable film solutions.

- Market Concentration: Moderate, with leading companies holding significant, but not dominant, market positions.

- Technological Innovation Drivers: Development of biodegradable films, smart packaging, and films with improved barrier properties.

- Regulatory Frameworks: Increasing focus on REACH compliance, food contact regulations, and waste management directives.

- Competitive Product Substitutes: Competition from rigid packaging, advanced coatings, and alternative material solutions.

- End-User Demographics: Growing demand from e-commerce, healthcare, and the renewable energy sector.

- M&A Trends: Strategic acquisitions focused on expanding product portfolios, geographical reach, and technological capabilities. Estimated M&A deal volume in the parent market is projected to reach $35 billion by 2025.

Industrial Film Industry Growth Trends & Insights

The Industrial Film Market is poised for substantial growth, driven by escalating demand across a spectrum of end-user industries. In the parent market, the global industrial film market size was valued at $150 billion in 2024 and is projected to reach $280 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period (2025-2033). This expansion is fueled by the increasing adoption of advanced film technologies in industrial packaging, agriculture, and construction sectors, where films play a crucial role in product protection, preservation, and efficiency. The child market, specifically focusing on specialty industrial films, is expected to grow even faster, with a CAGR of 8.5%, reaching an estimated value of $95 billion by 2033. Technological disruptions, such as the development of thinner yet stronger films and the integration of antimicrobial properties for healthcare applications, are further accelerating adoption rates. Consumer behavior shifts towards sustainable packaging solutions are also a significant catalyst, pushing manufacturers to invest in research and development of eco-friendly alternatives like biodegradable and recyclable industrial films. This evolution signifies a move towards a more circular economy within the industrial film sector, influencing production methods, material sourcing, and end-of-life product management. The demand for films with superior barrier properties, UV resistance, and thermal insulation is also on the rise, particularly in sectors like transportation and building & construction, reflecting a broader trend towards enhanced performance and longevity in industrial materials.

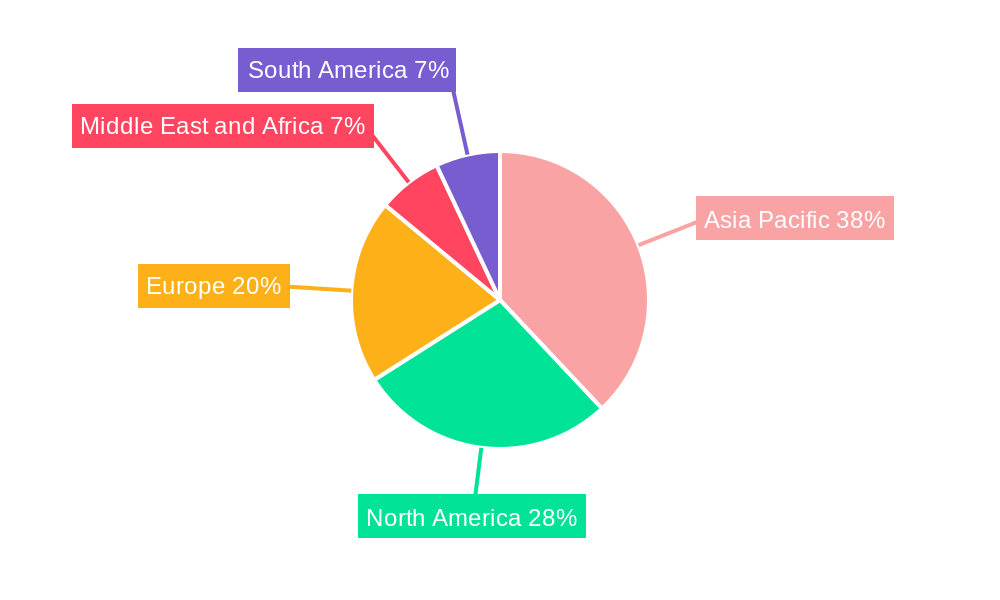

Dominant Regions, Countries, or Segments in Industrial Film Industry

The Industrial Film Industry is witnessing significant growth driven by several key regions and segments, with Asia Pacific emerging as the dominant force. This region's leadership is underpinned by rapid industrialization, a burgeoning manufacturing base, and robust infrastructure development, particularly in countries like China and India. The parent market's Asia Pacific segment was valued at $55 billion in 2024 and is projected to reach $110 billion by 2033. Within the child market, specialty industrial films in Asia Pacific are expected to see a CAGR of 9.0%, reaching $40 billion by 2033.

Dominant Region: Asia Pacific

- Key Drivers:

- Rapid economic growth and expanding manufacturing capabilities.

- Government initiatives promoting domestic production and infrastructure development.

- High demand for industrial packaging due to the booming e-commerce sector.

- Increasing investment in the agriculture sector, driving demand for agricultural films.

- Market Share: Asia Pacific holds approximately 37% of the global industrial film market in 2025.

- Growth Potential: Strong growth potential driven by ongoing urbanization and increasing disposable incomes.

- Key Drivers:

Dominant Segment (by Type): Polypropylene (PP) films, valued at $40 billion in the parent market in 2025, are a primary driver due to their versatility, cost-effectiveness, and wide range of applications in packaging, textiles, and automotive components. The child market for PP specialty films is projected to reach $15 billion by 2033.

Dominant Segment (by End-user Industry): Industrial Packaging, representing $65 billion in the parent market in 2025, is the largest end-user industry for industrial films. The child market for industrial packaging specialty films is projected to reach $30 billion by 2033. This dominance is attributed to the critical role films play in protecting goods during transit, storage, and handling, with growth accelerated by global trade and the rise of e-commerce.

Industrial Film Industry Product Landscape

The Industrial Film Industry product landscape is characterized by continuous innovation focused on enhanced performance and sustainability. Key product innovations include the development of advanced barrier films that significantly extend shelf-life for packaged goods, crucial for the food and pharmaceutical sectors. High-strength, low-thickness films made from Linear Low-Density Polyethylene (LLDPE) and Polypropylene (PP) are gaining traction for their material efficiency and reduced environmental footprint. In the child market, there's a notable rise in specialty films such as high-temperature resistant films for the automotive industry and bio-based films derived from renewable resources. Applications span across virtually all industrial sectors, from protective wraps for construction materials to specialized films for medical devices, each tailored with specific performance metrics like puncture resistance, UV stability, and chemical inertness.

Key Drivers, Barriers & Challenges in Industrial Film Industry

Key Drivers:

- Technological Advancements: Innovations in film extrusion, material science, and additive technologies are creating films with superior properties like enhanced barrier capabilities, increased strength, and improved recyclability. For instance, the development of multilayer films with advanced polymer combinations drives demand.

- Growing Demand for Sustainable Packaging: Increasing environmental consciousness and regulatory pressure are pushing for the adoption of biodegradable, compostable, and recyclable industrial films. The parent market's sustainable film segment is projected to grow at 8.0% CAGR.

- Expansion of End-User Industries: Growth in sectors like e-commerce, healthcare, agriculture, and building & construction directly translates to increased demand for protective and functional industrial films. The industrial packaging segment alone is a significant growth area, expected to reach $65 billion in 2025.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of petroleum-based feedstocks, the primary raw materials for most industrial films, can significantly impact production costs and profit margins.

- Stringent Environmental Regulations: While driving innovation in sustainability, complex and evolving regulations regarding plastic waste management and chemical content can pose compliance challenges and increase R&D costs.

- Intense Competition and Pricing Pressure: The market is highly competitive, with numerous players leading to significant pricing pressures, particularly for commodity films. This can limit profitability for smaller manufacturers.

- Supply Chain Disruptions: Global supply chain issues, geopolitical instability, and logistical challenges can affect the availability and cost of raw materials and finished products.

Emerging Opportunities in Industrial Film Industry

Emerging opportunities in the Industrial Film Industry lie in the development and adoption of advanced, sustainable solutions. The increasing global focus on a circular economy presents a significant avenue for growth in biodegradable, compostable, and high-recycled content industrial films. The parent market for bio-based films is projected to grow by 7.5% annually, reaching $18 billion by 2033. Furthermore, the expansion of e-commerce necessitates innovative and protective packaging films, creating opportunities for lightweight, durable, and tamper-evident solutions. The child market for smart films, incorporating features like sensors for temperature monitoring or indicators for product freshness, is also a nascent but promising area. Untapped markets in developing economies with growing industrial bases also represent substantial growth potential.

Growth Accelerators in the Industrial Film Industry Industry

Several key catalysts are accelerating the growth of the Industrial Film Industry. Technological breakthroughs in polymer science are enabling the creation of films with unprecedented performance characteristics, such as extreme temperature resistance and enhanced chemical inertness, opening up new applications in specialized industries. Strategic partnerships and collaborations between film manufacturers, raw material suppliers, and end-users are fostering innovation and facilitating market penetration for advanced products. For instance, collaborations focused on developing closed-loop recycling systems for industrial films are gaining momentum. Market expansion strategies, particularly in rapidly industrializing regions, coupled with a growing emphasis on premium, high-performance films, are further propelling the industry forward.

Key Players Shaping the Industrial Film Industry Market

- Cosmo Films Ltd

- Dunmore

- Inteplast Group

- Jindal Poly Films

- Kolon Industries

- Mitsui Chemicals Tohcello Inc

- Polyplex

- Raven Industries Inc

- Saint-Gobain Performance Plastics

- Sigma Plastics Group

- Solvay

- Toyobo Co LTD

- Treofan Group

- Trioplast Industrier AB

- Berry Global Group Inc.

- ExxonMobil Chemical Company

- Toray Industries, Inc.

Notable Milestones in Industrial Film Industry Sector

- 2020: Increased investment in R&D for biodegradable and compostable films in response to growing environmental concerns.

- 2021: Major manufacturers announce significant capacity expansions for high-performance films to meet rising demand from the electronics and automotive sectors.

- 2022: Launch of novel multilayer films with superior barrier properties, extending shelf life for perishable goods.

- 2023: Growing number of M&A activities focused on acquiring specialized film manufacturers with advanced technological capabilities.

- 2024: Increased adoption of AI and automation in film production to enhance efficiency and reduce waste.

- 2025 (Estimated): Development and commercialization of new bio-based polymers for industrial film applications.

In-Depth Industrial Film Industry Market Outlook

The Industrial Film Industry is on a trajectory of robust and sustained growth, driven by a confluence of technological innovation, evolving market demands, and increasing environmental consciousness. The outlook is characterized by a strong emphasis on sustainability, with biodegradable and recyclable films poised to capture significant market share. The continued expansion of end-user industries, particularly industrial packaging and healthcare, will remain a primary growth engine. Strategic investments in advanced manufacturing technologies and a focus on developing specialized films tailored for niche applications will be crucial for companies aiming to lead in this dynamic market. The parent market is projected to reach $280 billion by 2033, with the child market for specialty films showing even more accelerated growth. This presents a highly opportune environment for stakeholders willing to adapt to new trends and invest in cutting-edge solutions.

Industrial Film Industry Segmentation

-

1. Type

- 1.1. Linear Low Density Polyethylene (LLDPE)

- 1.2. Low-Density Polyethylene (LDPE)

- 1.3. High-Density Polyethylene (HDPE)

- 1.4. Polyethylene Terephthalate (PET)

- 1.5. Polypropylene (PP)

- 1.6. Polyvinyl Chloride (PVC)

- 1.7. Polyamide

- 1.8. Others

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Industrial Packaging

- 2.3. Building & Construction

- 2.4. Healthcare

- 2.5. Transportation

- 2.6. Others

Industrial Film Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Industrial Film Industry Regional Market Share

Geographic Coverage of Industrial Film Industry

Industrial Film Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Packaging in Food Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Packaging in Food Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing demand from Agriculture Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Linear Low Density Polyethylene (LLDPE)

- 5.1.2. Low-Density Polyethylene (LDPE)

- 5.1.3. High-Density Polyethylene (HDPE)

- 5.1.4. Polyethylene Terephthalate (PET)

- 5.1.5. Polypropylene (PP)

- 5.1.6. Polyvinyl Chloride (PVC)

- 5.1.7. Polyamide

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Industrial Packaging

- 5.2.3. Building & Construction

- 5.2.4. Healthcare

- 5.2.5. Transportation

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Linear Low Density Polyethylene (LLDPE)

- 6.1.2. Low-Density Polyethylene (LDPE)

- 6.1.3. High-Density Polyethylene (HDPE)

- 6.1.4. Polyethylene Terephthalate (PET)

- 6.1.5. Polypropylene (PP)

- 6.1.6. Polyvinyl Chloride (PVC)

- 6.1.7. Polyamide

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Agriculture

- 6.2.2. Industrial Packaging

- 6.2.3. Building & Construction

- 6.2.4. Healthcare

- 6.2.5. Transportation

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Linear Low Density Polyethylene (LLDPE)

- 7.1.2. Low-Density Polyethylene (LDPE)

- 7.1.3. High-Density Polyethylene (HDPE)

- 7.1.4. Polyethylene Terephthalate (PET)

- 7.1.5. Polypropylene (PP)

- 7.1.6. Polyvinyl Chloride (PVC)

- 7.1.7. Polyamide

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Agriculture

- 7.2.2. Industrial Packaging

- 7.2.3. Building & Construction

- 7.2.4. Healthcare

- 7.2.5. Transportation

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Linear Low Density Polyethylene (LLDPE)

- 8.1.2. Low-Density Polyethylene (LDPE)

- 8.1.3. High-Density Polyethylene (HDPE)

- 8.1.4. Polyethylene Terephthalate (PET)

- 8.1.5. Polypropylene (PP)

- 8.1.6. Polyvinyl Chloride (PVC)

- 8.1.7. Polyamide

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Agriculture

- 8.2.2. Industrial Packaging

- 8.2.3. Building & Construction

- 8.2.4. Healthcare

- 8.2.5. Transportation

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Linear Low Density Polyethylene (LLDPE)

- 9.1.2. Low-Density Polyethylene (LDPE)

- 9.1.3. High-Density Polyethylene (HDPE)

- 9.1.4. Polyethylene Terephthalate (PET)

- 9.1.5. Polypropylene (PP)

- 9.1.6. Polyvinyl Chloride (PVC)

- 9.1.7. Polyamide

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Agriculture

- 9.2.2. Industrial Packaging

- 9.2.3. Building & Construction

- 9.2.4. Healthcare

- 9.2.5. Transportation

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Film Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Linear Low Density Polyethylene (LLDPE)

- 10.1.2. Low-Density Polyethylene (LDPE)

- 10.1.3. High-Density Polyethylene (HDPE)

- 10.1.4. Polyethylene Terephthalate (PET)

- 10.1.5. Polypropylene (PP)

- 10.1.6. Polyvinyl Chloride (PVC)

- 10.1.7. Polyamide

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Agriculture

- 10.2.2. Industrial Packaging

- 10.2.3. Building & Construction

- 10.2.4. Healthcare

- 10.2.5. Transportation

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cosmo Films Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dunmore

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inteplast Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jindal Poly Films

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kolon Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsui Chemicals Tohcello Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Polyplex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raven Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saint-Gobain Performance Plastics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sigma Plastics Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Solvay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Toyobo Co LTD

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Treofan Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Trioplast Industrier AB*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cosmo Films Ltd

List of Figures

- Figure 1: Global Industrial Film Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: North America Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Europe Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: South America Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Film Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa Industrial Film Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Industrial Film Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Industrial Film Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Industrial Film Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Film Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Industrial Film Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Industrial Film Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Film Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Industrial Film Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Industrial Film Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Film Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Industrial Film Industry?

Key companies in the market include Cosmo Films Ltd, Dunmore, Inteplast Group, Jindal Poly Films, Kolon Industries, Mitsui Chemicals Tohcello Inc, Polyplex, Raven Industries Inc, Saint-Gobain Performance Plastics, Sigma Plastics Group, Solvay, Toyobo Co LTD, Treofan Group, Trioplast Industrier AB*List Not Exhaustive.

3. What are the main segments of the Industrial Film Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Packaging in Food Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing demand from Agriculture Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand for Packaging in Food Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Film Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Film Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Film Industry?

To stay informed about further developments, trends, and reports in the Industrial Film Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence