Key Insights

The United States cellulose acetate market is poised for steady expansion, driven by robust demand across its diverse applications. In 2025, the market is valued at an estimated $2.79 billion. This growth trajectory is underpinned by a compound annual growth rate (CAGR) of 4.72% projected over the forecast period of 2025-2033. Key drivers for this sustained growth include the escalating consumption of cigarette filters, a traditional yet significant market segment, and the increasing use of cellulose acetate in photographic films, albeit evolving with digital technologies, still maintaining a niche. Furthermore, the expanding textile industry, which utilizes cellulose acetate for producing fibers with desirable properties like softness and breathability, and its growing adoption in specialized applications such as cosmetics and healthcare for its biodegradable and biocompatible attributes, are contributing significantly to market dynamics. The inherent biodegradability of cellulose acetate also aligns with increasing environmental consciousness and regulatory pressures favoring sustainable materials, further bolstering its market position.

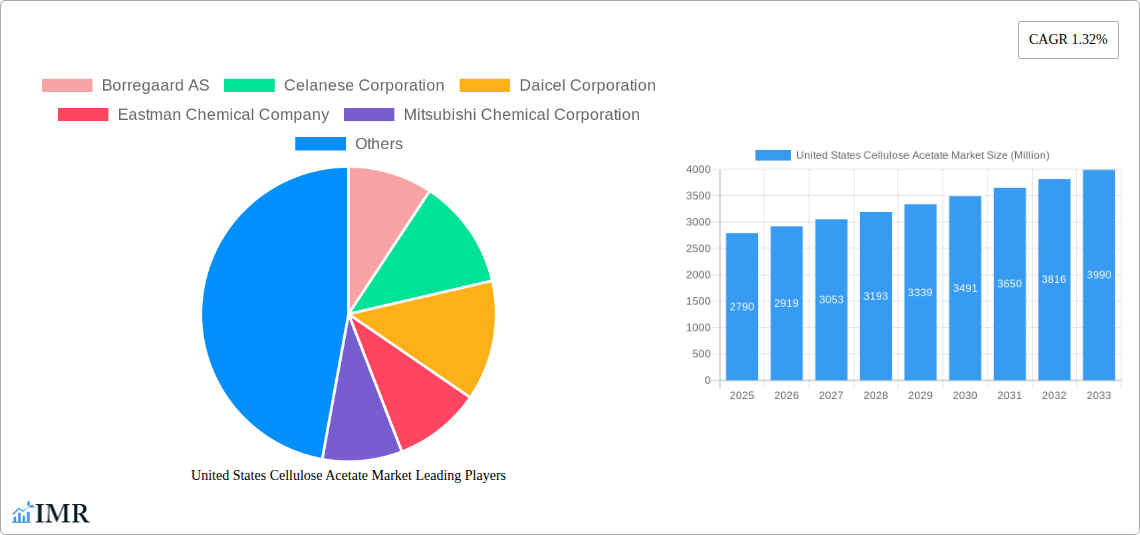

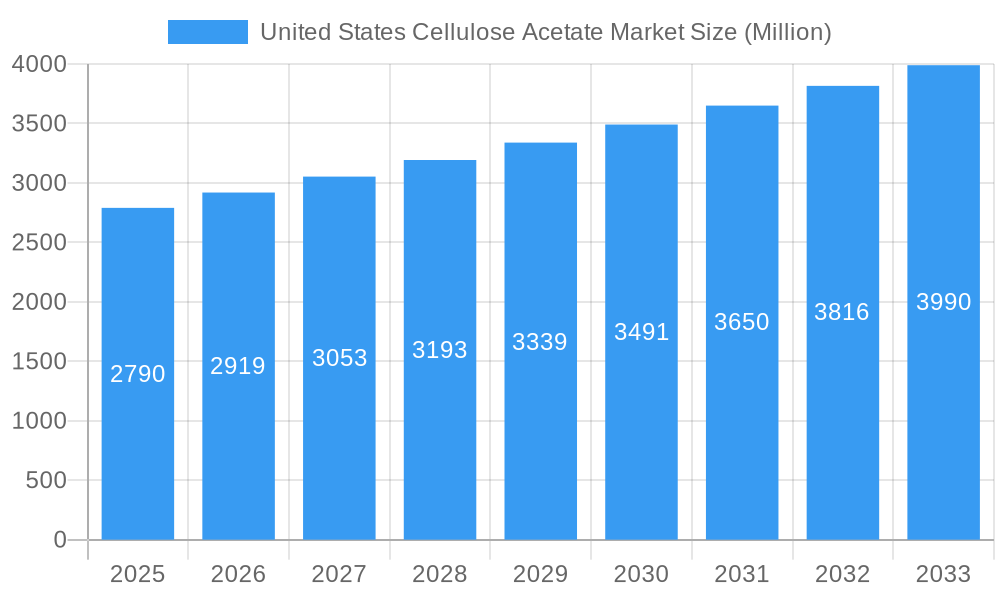

United States Cellulose Acetate Market Market Size (In Billion)

The market is segmented by type into Fibers and Plastics, with both contributing to overall demand. Application-wise, while cigarette filters remain a dominant force, the growth in textiles and other niche applications like cosmetics and healthcare presents significant opportunities. Restraints, such as fluctuating raw material prices and the emergence of alternative synthetic materials in certain applications, are present but are being offset by innovations in production processes and the development of advanced cellulose acetate grades. The United States, with its strong industrial base and significant consumer spending, is a crucial market. Companies like Borregaard AS, Celanese Corporation, Eastman Chemical Company, and Mitsubishi Chemical Corporation are key players actively shaping the market through their product development and strategic expansions. The forecast period indicates continued investment and innovation, ensuring the United States cellulose acetate market remains dynamic and resilient.

United States Cellulose Acetate Market Company Market Share

United States Cellulose Acetate Market Report: Comprehensive Analysis & Forecast 2019-2033

Explore the dynamic United States Cellulose Acetate Market with this in-depth report, covering critical insights from 2019 to 2033. Delve into market dynamics, growth trends, dominant segments, product landscapes, key drivers, challenges, and emerging opportunities. This report provides a data-driven outlook for industry professionals, strategists, and investors navigating the evolving cellulose acetate industry. The total market size is projected to reach $10.5 billion in 2025, with a forecasted CAGR of 5.2% during the 2025-2033 period.

United States Cellulose Acetate Market Market Dynamics & Structure

The United States cellulose acetate market is characterized by a moderate level of concentration, with key players including Borregaard AS, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, Mitsubishi Chemical Corporation, Rotuba, and RYAM holding significant market shares. Technological innovation remains a primary driver, particularly in developing biodegradable and sustainable cellulose acetate variants and enhancing production efficiency. Regulatory frameworks, primarily concerning environmental impact and product safety, influence manufacturing processes and material sourcing. Competitive product substitutes, such as petroleum-based plastics and other natural fibers, pose a constant challenge, necessitating continuous product differentiation and performance improvements. End-user demographics reveal a strong demand from sectors like textiles and filtration, with emerging growth in healthcare and cosmetics. Mergers and acquisitions (M&A) trends are observed, driven by the pursuit of market consolidation, vertical integration, and access to new technologies. For instance, M&A activity in the last five years accounted for an estimated $1.2 billion in deal volumes. Innovation barriers include the high cost of developing novel production methods and obtaining regulatory approvals for new applications.

United States Cellulose Acetate Market Growth Trends & Insights

The United States Cellulose Acetate Market is poised for substantial growth, driven by evolving consumer preferences and increasing industrial applications. The market size, valued at an estimated $9.8 billion in 2024, is projected to expand to $10.5 billion by 2025 and further surge to $15.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. This growth trajectory is underpinned by several key factors. The increasing demand for sustainable and bio-based materials across various industries is a significant catalyst. Cellulose acetate, derived from renewable wood pulp or cotton linters, aligns perfectly with this trend, positioning it as a favored alternative to traditional petroleum-based plastics. The CAGR for the Plastics segment of the market is expected to be 5.5%, indicating strong adoption. Adoption rates for advanced cellulose acetate materials in high-performance applications are on the rise, particularly in the Plastics segment, which is forecast to contribute 35% of the total market revenue by 2033. Technological disruptions, such as advancements in polymerization techniques and the development of specialized cellulose acetate grades with enhanced properties like improved fire resistance and biodegradability, are further fueling market expansion. Consumer behavior shifts towards eco-friendly products and responsible sourcing are creating a more receptive market for cellulose acetate. The market penetration of cellulose acetate in the Textiles sector is estimated to reach 25% by 2030, a notable increase from 18% in 2024. Furthermore, the increasing stringency of environmental regulations globally is compelling industries to seek sustainable material solutions, directly benefiting the cellulose acetate market. The growing emphasis on circular economy principles and the demand for recyclable and biodegradable materials are expected to accelerate the adoption of cellulose acetate in innovative applications. The overall market penetration of cellulose acetate is projected to grow from 40% in 2024 to 55% by 2033 across its key applications.

Dominant Regions, Countries, or Segments in United States Cellulose Acetate Market

The United States Cellulose Acetate Market exhibits dominance across specific segments and applications, driven by a confluence of factors including robust industrial infrastructure, favorable economic policies, and established end-user demand. Among the key segments, Fibers and Plastics are leading the market growth. The Fibers segment, particularly within the Textiles and Cigarette Filters applications, has historically been a powerhouse and is expected to continue its strong performance, contributing approximately 45% to the total market revenue by 2033. The Plastics segment, however, is demonstrating a higher growth rate, driven by innovation and broader application scope. Within the application landscape, Cigarette Filters remain a significant, albeit mature, market, accounting for an estimated 30% of the market in 2025. However, the Plastics application category, encompassing various industrial and consumer goods, is projected to be the fastest-growing, with an estimated CAGR of 5.8% during the forecast period. This is propelled by the increasing demand for sustainable and high-performance plastic materials. The Other Applications (Cosmetics, Healthcare, etc.) segment, while smaller, is exhibiting impressive growth potential, driven by advancements in biomedical applications and the demand for bio-compatible materials. The United States itself acts as a dominant country market, owing to its large manufacturing base and strong consumer demand for both conventional and sustainable products. Economic policies that support domestic manufacturing and encourage the adoption of bio-based materials further bolster its position. Infrastructure development, particularly in areas related to chemical processing and logistics, ensures efficient production and distribution of cellulose acetate. The market share of Plastics is anticipated to grow from 28% in 2025 to 35% by 2033. The dominant factors influencing this dominance include the extensive research and development efforts by major players to create novel cellulose acetate formulations with superior properties, such as enhanced durability, UV resistance, and biodegradability, catering to the evolving needs of industries like automotive, packaging, and consumer electronics.

United States Cellulose Acetate Market Product Landscape

The United States cellulose acetate market is defined by a diverse product landscape catering to a wide array of applications. Key product innovations focus on enhanced sustainability, biodegradability, and performance. Cellulose acetate fibers, known for their silk-like drape and absorbency, are crucial in textiles and non-woven fabrics. Cellulose acetate plastics offer excellent clarity, toughness, and processability, finding utility in eyeglass frames, tool handles, and packaging. The market also features specialized grades for photographic films, medical devices, and cosmetic applications, highlighting a strong emphasis on high-purity and functionalized materials. Unique selling propositions include the bio-based origin of cellulose acetate, contributing to a reduced carbon footprint compared to petrochemical alternatives. Technological advancements are enabling the development of cellulose acetate with improved thermal stability, flame retardancy, and UV resistance, expanding its applicability in demanding environments.

Key Drivers, Barriers & Challenges in United States Cellulose Acetate Market

Key Drivers:

- Growing Demand for Sustainable Materials: Increasing environmental consciousness and regulatory pressures are driving the adoption of bio-based and biodegradable materials like cellulose acetate.

- Versatile Applications: Its wide range of applications, from textiles and cigarette filters to plastics and specialty films, ensures consistent demand across multiple sectors.

- Technological Advancements: Ongoing research and development leading to improved production processes and enhanced material properties are expanding its market reach.

- Favorable Regulatory Environment: Government initiatives promoting sustainable manufacturing and bio-based products are supportive of market growth.

Barriers & Challenges:

- Price Volatility of Raw Materials: Fluctuations in the cost of wood pulp or cotton linters can impact production costs and market pricing.

- Competition from Petrochemical-Based Plastics: Traditional plastics often offer lower price points and established infrastructure, posing a competitive challenge.

- Energy-Intensive Production Processes: The manufacturing of cellulose acetate can be energy-intensive, leading to concerns about its overall environmental footprint if not managed sustainably.

- Limited Biodegradability in Certain Applications: While cellulose acetate is biodegradable, the rate and completeness can vary depending on the specific grade and environmental conditions, leading to concerns in certain disposal scenarios. The impact of raw material price volatility can lead to a 5-7% fluctuation in product pricing annually. Supply chain disruptions, particularly those affecting the availability of high-quality wood pulp, can cause production delays estimated at 2-4 weeks.

Emerging Opportunities in United States Cellulose Acetate Market

Emerging opportunities in the United States cellulose acetate market are centered around innovative applications and a growing focus on circular economy principles. The development of advanced bio-plastics for the packaging industry, offering enhanced biodegradability and compostability, presents a significant avenue. Growth in the healthcare sector, with the use of cellulose acetate in medical devices, wound care, and drug delivery systems, is a promising area. Furthermore, exploring niche applications in 3D printing filaments and sustainable coatings for textiles and paper products can unlock new revenue streams. The increasing consumer demand for eco-friendly products across all sectors will continue to fuel innovation and market expansion for cellulose acetate.

Growth Accelerators in the United States Cellulose Acetate Market Industry

Long-term growth in the United States cellulose acetate market is being propelled by several key catalysts. Strategic partnerships between cellulose acetate manufacturers and end-use industries, such as textile giants and packaging solution providers, are accelerating product development and market penetration. Technological breakthroughs in creating cellulose acetate with tailored properties for high-performance applications, like advanced filtration membranes and biodegradable films, are expanding its utility and value proposition. Market expansion strategies, including a greater focus on export markets and the development of specialized grades for emerging economies, will further drive sustained growth.

Key Players Shaping the United States Cellulose Acetate Market Market

- Borregaard AS

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- Rotuba

- RYAM

Notable Milestones in United States Cellulose Acetate Market Sector

- 2023: Eastman Chemical Company announced a significant investment in expanding its production capacity for cellulose acetate tow, aiming to meet growing demand in the cigarette filter segment.

- 2022: Celanese Corporation launched a new line of sustainable cellulose acetate grades with enhanced biodegradability, targeting the packaging and textile industries.

- 2021: Mitsubishi Chemical Corporation unveiled a novel cellulose acetate-based material for biodegradable food packaging, demonstrating improved barrier properties.

- 2020: Daicel Corporation acquired a smaller competitor, strengthening its position in the specialty cellulose acetate market for medical applications.

- 2019: Borregaard AS showcased advancements in its bio-based acetylated cellulose products, highlighting their potential in creating sustainable alternatives for various industrial uses.

In-Depth United States Cellulose Acetate Market Market Outlook

The United States cellulose acetate market is set for robust expansion, driven by the global imperative for sustainable materials and continuous innovation. Growth accelerators such as strategic collaborations, the development of advanced cellulose acetate grades with superior performance characteristics, and expansion into untapped geographical markets will fortify its market position. The increasing focus on bio-based solutions across industries, coupled with supportive regulatory landscapes, presents significant opportunities for market players to innovate and capture market share. The projected market value of $15.5 billion by 2033 underscores the immense future potential and strategic importance of cellulose acetate in the evolving material landscape.

United States Cellulose Acetate Market Segmentation

-

1. Type

- 1.1. Fibers

- 1.2. Plastics

-

2. Application

- 2.1. Cigarette Filters

- 2.2. Photographic Films

- 2.3. Plastics

- 2.4. Textiles

- 2.5. Other Applications (Cosmetics, Healthcare, etc.)

United States Cellulose Acetate Market Segmentation By Geography

- 1. United States

United States Cellulose Acetate Market Regional Market Share

Geographic Coverage of United States Cellulose Acetate Market

United States Cellulose Acetate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in Textile Industry; Growing Number of Youth Smokers in the Country; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Usage in Textile Industry; Growing Number of Youth Smokers in the Country; Other Drivers

- 3.4. Market Trends

- 3.4.1. High Demand for Cellulose Acetate Fibers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cellulose Acetate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fibers

- 5.1.2. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cigarette Filters

- 5.2.2. Photographic Films

- 5.2.3. Plastics

- 5.2.4. Textiles

- 5.2.5. Other Applications (Cosmetics, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Borregaard AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Celanese Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daicel Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eastman Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Chemical Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rotuba

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RYAM*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Borregaard AS

List of Figures

- Figure 1: United States Cellulose Acetate Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Cellulose Acetate Market Share (%) by Company 2025

List of Tables

- Table 1: United States Cellulose Acetate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: United States Cellulose Acetate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: United States Cellulose Acetate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Cellulose Acetate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: United States Cellulose Acetate Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: United States Cellulose Acetate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cellulose Acetate Market?

The projected CAGR is approximately 4.72%.

2. Which companies are prominent players in the United States Cellulose Acetate Market?

Key companies in the market include Borregaard AS, Celanese Corporation, Daicel Corporation, Eastman Chemical Company, Mitsubishi Chemical Corporation, Rotuba, RYAM*List Not Exhaustive.

3. What are the main segments of the United States Cellulose Acetate Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in Textile Industry; Growing Number of Youth Smokers in the Country; Other Drivers.

6. What are the notable trends driving market growth?

High Demand for Cellulose Acetate Fibers.

7. Are there any restraints impacting market growth?

Increasing Usage in Textile Industry; Growing Number of Youth Smokers in the Country; Other Drivers.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the major players in the market are covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cellulose Acetate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cellulose Acetate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cellulose Acetate Market?

To stay informed about further developments, trends, and reports in the United States Cellulose Acetate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence