Key Insights

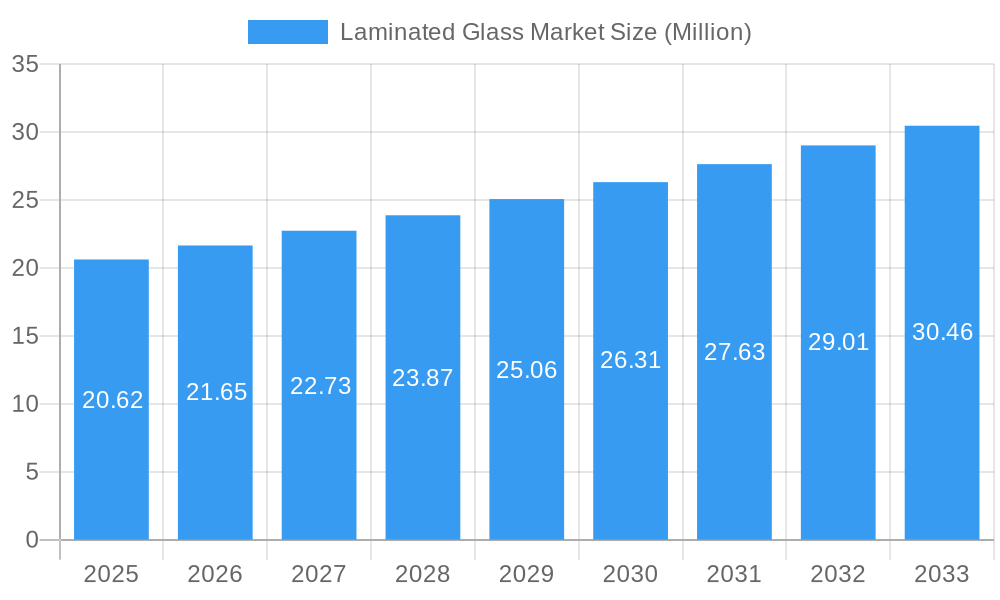

The global laminated glass market is poised for significant expansion, projected to reach $20.62 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 5.00% over the forecast period of 2025-2033. This growth is primarily driven by the increasing demand for safety and security in architectural, automotive, and electronics applications. The inherent properties of laminated glass, such as its shatter-resistance, UV protection, and acoustic insulation, make it a preferred choice across various end-user industries. The building and construction sector, propelled by stringent building codes and a growing emphasis on energy-efficient and sustainable materials, is a major contributor to this market's upward trajectory. Similarly, the automotive industry's focus on enhanced vehicle safety and lightweighting solutions further bolsters the demand for laminated glass. Innovations in interlayer technologies, leading to improved performance characteristics like enhanced impact resistance and advanced acoustic dampening, are also playing a crucial role in market expansion.

Laminated Glass Market Market Size (In Million)

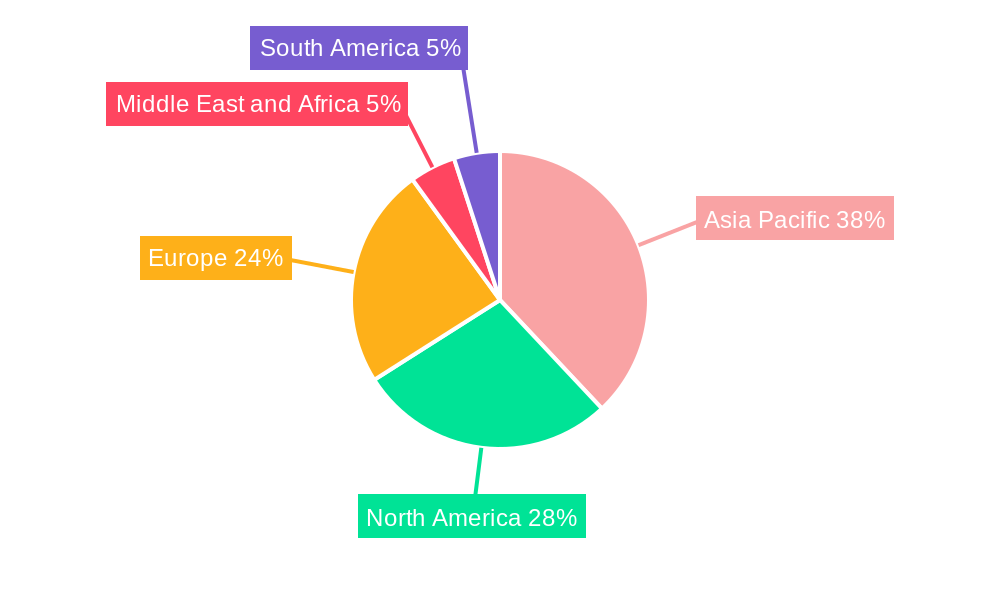

The market is segmented by type, with Polyvinyl Butyral (PVB) leading due to its widespread adoption and cost-effectiveness. However, advancements in alternative interlayers like Sentryglas Plus (SGP) and Ethylene-vinyl Acetate (EVA) are creating niche opportunities and catering to specific high-performance requirements. Geographically, the Asia Pacific region is expected to dominate the market, fueled by rapid urbanization, substantial infrastructure development in countries like China and India, and a burgeoning automotive manufacturing base. North America and Europe, with their established markets and strong regulatory frameworks promoting safety standards, will continue to be significant contributors. Emerging trends such as the integration of smart technologies into glass, including self-tinting and energy-generating capabilities, are set to further reshape the laminated glass landscape, presenting new avenues for growth and innovation for key players like Nippon Sheet Glass, Saint-Gobain, and Guardian Industries.

Laminated Glass Market Company Market Share

Comprehensive Laminated Glass Market Report: Analysis, Trends, and Forecast (2019-2033)

This in-depth report provides a detailed analysis of the global Laminated Glass Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and a comprehensive outlook. The study covers the historical period from 2019 to 2024, with the base year in 2025, and projects market evolution through 2033. Valued in Million units, this report is an essential resource for industry professionals seeking to understand market trajectories and strategic imperatives in the architectural glass, automotive glass, and specialty glass sectors.

Laminated Glass Market Dynamics & Structure

The Laminated Glass Market is characterized by a moderately concentrated structure, with key players such as Nippon Sheet Glass Co Ltd, Saint-Gobain, Guardian Industries Holdings, and AGC Inc. holding significant market shares, estimated to be between 10-15% each. Technological innovation is a primary driver, with continuous advancements in interlayer materials like Polyvinyl Butyral (PVB) and Sentryglas Plus (SGP) enhancing safety, security, and acoustic performance. Stringent regulatory frameworks worldwide mandating enhanced safety standards in construction and automotive applications further bolster market demand. Competitive product substitutes, such as toughened glass or polycarbonate, pose a challenge but often lack the superior safety and security features of laminated glass. End-user demographics are shifting towards greater demand for energy-efficient and aesthetically pleasing solutions in the building and construction sector, while the automotive industry focuses on lightweighting and enhanced occupant safety. Mergers and acquisitions (M&A) activity remains a strategic tool for market consolidation and expansion. For instance, an estimated 5-8 M&A deals are anticipated annually within the broader glass industry, impacting the laminated glass landscape. Innovation barriers include high R&D costs and the need for specialized manufacturing equipment.

- Market Concentration: Moderately concentrated with leading players holding significant market share.

- Technological Innovation: Driven by advancements in PVB, SGP, and EVA interlayers.

- Regulatory Frameworks: Mandates for enhanced safety and security in construction and automotive sectors.

- Competitive Substitutes: Toughened glass and polycarbonate, though often inferior in safety.

- End-user Demographics: Growing demand for energy-efficient, safe, and aesthetically appealing glass.

- M&A Trends: Strategic consolidation and expansion through acquisitions.

Laminated Glass Market Growth Trends & Insights

The Laminated Glass Market is projected for robust growth driven by escalating safety concerns, stringent regulations, and increasing demand for advanced architectural and automotive solutions. The market size is expected to evolve from approximately \$XX,XXX million in 2024 to over \$YY,YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. Adoption rates for laminated glass are on the rise across both residential and commercial building and construction projects, particularly in regions with high seismic activity or a focus on hurricane resistance. Technological disruptions are enabling thinner, lighter, and stronger laminated glass products, leading to increased adoption in the automotive sector for enhanced fuel efficiency and passenger safety. Consumer behavior shifts are evident, with a growing preference for products that offer enhanced acoustic insulation, UV protection, and aesthetic versatility, all of which are key attributes of laminated glass. The electronics segment, while smaller, is also witnessing growth with the application of laminated glass in displays and touchscreens requiring durability and safety. The market penetration of laminated glass in new construction is estimated to reach 70-80% by 2030 in developed economies.

Dominant Regions, Countries, or Segments in Laminated Glass Market

The Building and Construction end-user industry currently stands as the dominant segment within the global Laminated Glass Market, driven by extensive applications in facades, windows, skylights, and interior partitions. Its market share is estimated to be around 55-60%. North America and Europe are the leading regions, accounting for approximately 30-35% and 25-30% of the global market respectively, due to strict building codes mandating safety glass and a strong emphasis on sustainable and energy-efficient construction practices. Countries like the United States, Germany, and the United Kingdom are significant contributors.

Within the Type segment, Polyvinyl Butyral (PVB) dominates, holding an estimated market share of 70-75%, owing to its cost-effectiveness, excellent adhesion properties, and good optical clarity, making it ideal for a wide range of applications. Sentryglas Plus (SGP) is gaining traction in high-security applications and structural glazing due to its superior strength and rigidity.

Key drivers for the dominance of the building and construction sector include:

- Economic Policies: Government initiatives promoting green building certifications and energy efficiency standards.

- Infrastructure Development: Continuous urban development and renovation projects.

- Regulatory Frameworks: Building codes mandating the use of safety glass for accident prevention and security.

- Consumer Demand: Increasing preference for aesthetically pleasing, durable, and energy-efficient building materials.

The automotive sector is the second-largest segment, expected to witness substantial growth due to advancements in vehicle safety features and the trend towards lighter, more fuel-efficient vehicles. The electronics segment, though nascent, shows significant potential for growth driven by the increasing demand for durable and aesthetically appealing glass in consumer electronics.

Laminated Glass Market Product Landscape

The Laminated Glass Market is witnessing continuous product innovation aimed at enhancing safety, security, and functionality. Innovations include the development of thicker interlayers for improved acoustic performance, advanced UV-blocking films for enhanced durability and occupant comfort, and fire-rated laminated glass for increased building safety. Applications are expanding beyond traditional windows and windshields to include architectural features like balustrades, overhead glazing, and even furniture. Performance metrics are being optimized for impact resistance, projectile penetration resistance, and blast mitigation. Unique selling propositions for manufacturers revolve around offering customized solutions, superior optical clarity, and integrated functionalities such as smart tinting or self-cleaning properties. Technological advancements are enabling the creation of lighter yet stronger laminated glass, catering to the growing demand for sustainable and high-performance building materials and automotive components.

Key Drivers, Barriers & Challenges in Laminated Glass Market

Key Drivers:

The primary forces propelling the Laminated Glass Market include stringent safety regulations worldwide, particularly in the automotive and building & construction sectors, mandating the use of safety glass. Growing consumer awareness regarding security and protection against accidents and environmental hazards further fuels demand. Technological advancements in interlayer materials like PVB and SGP, leading to enhanced performance characteristics such as improved acoustic insulation, UV resistance, and blast mitigation capabilities, are also significant growth drivers. Furthermore, the increasing global focus on sustainable construction and energy-efficient buildings necessitates the use of advanced glazing solutions, where laminated glass plays a crucial role.

Barriers & Challenges:

Despite the positive outlook, the Laminated Glass Market faces several challenges. Higher manufacturing costs compared to monolithic glass can be a restraint, particularly in price-sensitive markets. The complexity of the manufacturing process and the need for specialized equipment can also pose barriers to entry for new players. Supply chain disruptions and fluctuations in raw material prices, such as the cost of interlayers and glass, can impact profitability. Moreover, the availability of cheaper, though less safe, alternatives like toughened glass in certain applications can limit market penetration. Intense competition among established players and emerging manufacturers also exerts downward pressure on pricing.

Emerging Opportunities in Laminated Glass Market

Emerging opportunities within the Laminated Glass Market lie in the increasing demand for smart glass technologies, where laminated glass serves as the ideal substrate for integrating electronic films for dynamic tinting and privacy control. The growing trend of sustainable architecture and green building initiatives presents opportunities for high-performance, energy-efficient laminated glass solutions. The expansion of urban infrastructure in developing economies, coupled with a rising emphasis on safety and security, opens up new geographical markets. Furthermore, innovative applications in the electronics sector, such as robust touchscreens and protective coverings for sensitive devices, represent an untapped market segment with significant growth potential. The development of specialized laminated glass for defense applications, offering enhanced ballistic protection, also presents a niche but lucrative opportunity.

Growth Accelerators in the Laminated Glass Market Industry

Several catalysts are accelerating long-term growth in the Laminated Glass Market. Technological breakthroughs in developing advanced interlayer materials that offer superior performance at reduced thicknesses are key accelerators. Strategic partnerships and collaborations between glass manufacturers, interlayer producers, and technology providers are fostering innovation and expanding market reach. The increasing adoption of Building Information Modeling (BIM) in the construction industry facilitates the seamless integration of advanced glazing solutions, including laminated glass. Furthermore, government incentives for energy-efficient buildings and the growing global focus on urban resilience against natural disasters are creating sustained demand. Expansion into emerging economies, driven by rapid industrialization and infrastructure development, will also significantly contribute to market growth.

Key Players Shaping the Laminated Glass Market Market

- Nippon Sheet Glass Co Ltd

- Saint-Gobain

- Guardian Industries Holdings

- Central Glass Co Ltd

- Asahi India Glass Limited

- Fuyao Group

- GSC GLASS LTD

- Taiwan Glass Ind Corp

- AGC Inc.

- Stevenage Glass Company Ltd

- CARDINAL GLASS INDUSTRIES INC

Notable Milestones in Laminated Glass Market Sector

- February 2023: Saint-Gobain and AGC collaborated on the development of a pilot breakthrough flat glass line intended to significantly cut direct CO2 emissions. AGC's patterned glass production line in Barevka, Czech Republic, will be transformed into a high-performing, cutting-edge production line, 50% electrified and 50% fueled by a combination of oxygen and gas. This initiative highlights a strong industry push towards sustainability and reduced environmental impact in glass manufacturing.

- January 2023: AGC Inc. commenced a trial of cloud-based data linking of glass types and quantities between supply chains utilizing "R7," a unique glass quoting system. Full-scale operations were expected to begin in the first half of 2023. This DX activity across the supply chain aims to transform work styles in the architectural glass industry, enhancing efficiency and collaboration.

In-Depth Laminated Glass Market Market Outlook

The future outlook for the Laminated Glass Market remains exceptionally strong, driven by a confluence of sustained demand from the building and construction and automotive sectors, coupled with ongoing technological advancements. The increasing global focus on safety, security, and energy efficiency will continue to position laminated glass as a preferred material. Emerging opportunities in smart glass technologies and specialized applications in electronics and defense are expected to unlock new revenue streams. Strategic investments in R&D for lighter, stronger, and more sustainable laminated glass solutions, alongside expansion into high-growth emerging markets, will be critical for market leaders. The industry's commitment to reducing its carbon footprint, as evidenced by recent collaborations, will also shape future product development and manufacturing practices, further solidifying the market's growth trajectory.

Laminated Glass Market Segmentation

-

1. Type

- 1.1. Polyvinyl Butyral (PVB)

- 1.2. Sentryglas Plus (SGP)

- 1.3. Ethylene-vinyl Acetate (EVA)

- 1.4. Other Ty

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Building and Construction

- 2.3. Electronics

- 2.4. Other End-user Industries (Security and Defense)

Laminated Glass Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Thailand

- 1.6. Malaysia

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Nigeria

- 5.4. Egypt

- 5.5. Qatar

- 5.6. United Arab Emirates

- 5.7. Rest of Middle East and Africa

Laminated Glass Market Regional Market Share

Geographic Coverage of Laminated Glass Market

Laminated Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application in Replacement of Bricks with Structural Glass; Advancements in Technology

- 3.3. Market Restrains

- 3.3.1. High Cost of Manufacturing; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyvinyl Butyral (PVB)

- 5.1.2. Sentryglas Plus (SGP)

- 5.1.3. Ethylene-vinyl Acetate (EVA)

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Building and Construction

- 5.2.3. Electronics

- 5.2.4. Other End-user Industries (Security and Defense)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Polyvinyl Butyral (PVB)

- 6.1.2. Sentryglas Plus (SGP)

- 6.1.3. Ethylene-vinyl Acetate (EVA)

- 6.1.4. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Building and Construction

- 6.2.3. Electronics

- 6.2.4. Other End-user Industries (Security and Defense)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Polyvinyl Butyral (PVB)

- 7.1.2. Sentryglas Plus (SGP)

- 7.1.3. Ethylene-vinyl Acetate (EVA)

- 7.1.4. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Building and Construction

- 7.2.3. Electronics

- 7.2.4. Other End-user Industries (Security and Defense)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Polyvinyl Butyral (PVB)

- 8.1.2. Sentryglas Plus (SGP)

- 8.1.3. Ethylene-vinyl Acetate (EVA)

- 8.1.4. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Building and Construction

- 8.2.3. Electronics

- 8.2.4. Other End-user Industries (Security and Defense)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Polyvinyl Butyral (PVB)

- 9.1.2. Sentryglas Plus (SGP)

- 9.1.3. Ethylene-vinyl Acetate (EVA)

- 9.1.4. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Building and Construction

- 9.2.3. Electronics

- 9.2.4. Other End-user Industries (Security and Defense)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Laminated Glass Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Polyvinyl Butyral (PVB)

- 10.1.2. Sentryglas Plus (SGP)

- 10.1.3. Ethylene-vinyl Acetate (EVA)

- 10.1.4. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Building and Construction

- 10.2.3. Electronics

- 10.2.4. Other End-user Industries (Security and Defense)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nippon Sheet Glass Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guardian Industries Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Central Glass Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asahi India Glass Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fuyao Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GSC GLASS LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Taiwan Glass Ind Corp *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AGC Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stevenage Glass Company Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CARDINAL GLASS INDUSTRIES INC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nippon Sheet Glass Co Ltd

List of Figures

- Figure 1: Global Laminated Glass Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Laminated Glass Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Laminated Glass Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Laminated Glass Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Laminated Glass Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Laminated Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Laminated Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Laminated Glass Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Laminated Glass Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Laminated Glass Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Laminated Glass Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Laminated Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Laminated Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Laminated Glass Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Laminated Glass Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Laminated Glass Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Laminated Glass Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Laminated Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Laminated Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Laminated Glass Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Laminated Glass Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Laminated Glass Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Laminated Glass Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Laminated Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Laminated Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Laminated Glass Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Laminated Glass Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Laminated Glass Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Laminated Glass Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Laminated Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Laminated Glass Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Laminated Glass Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Laminated Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Thailand Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Laminated Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Laminated Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Spain Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Turkey Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Russia Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: NORDIC Countries Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Laminated Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Colombia Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Laminated Glass Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Laminated Glass Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Laminated Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Nigeria Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Egypt Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Qatar Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: United Arab Emirates Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Laminated Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laminated Glass Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Laminated Glass Market?

Key companies in the market include Nippon Sheet Glass Co Ltd, Saint-Gobain, Guardian Industries Holdings, Central Glass Co Ltd, Asahi India Glass Limited, Fuyao Group, GSC GLASS LTD, Taiwan Glass Ind Corp *List Not Exhaustive, AGC Inc, Stevenage Glass Company Ltd, CARDINAL GLASS INDUSTRIES INC.

3. What are the main segments of the Laminated Glass Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application in Replacement of Bricks with Structural Glass; Advancements in Technology.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Manufacturing; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Saint-Gobain and AGC collaborated on the development of a pilot breakthrough flat glass line that is intended to cut direct CO2 emissions significantly. In the framework of this research and development project, AGC's patterned glass production line in Barevka, Czech Republic, will be completely transformed into a high-performing, cutting-edge production line, which will be 50% electrified and 50% fueled by a combination of oxygen and gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laminated Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laminated Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laminated Glass Market?

To stay informed about further developments, trends, and reports in the Laminated Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence