Key Insights

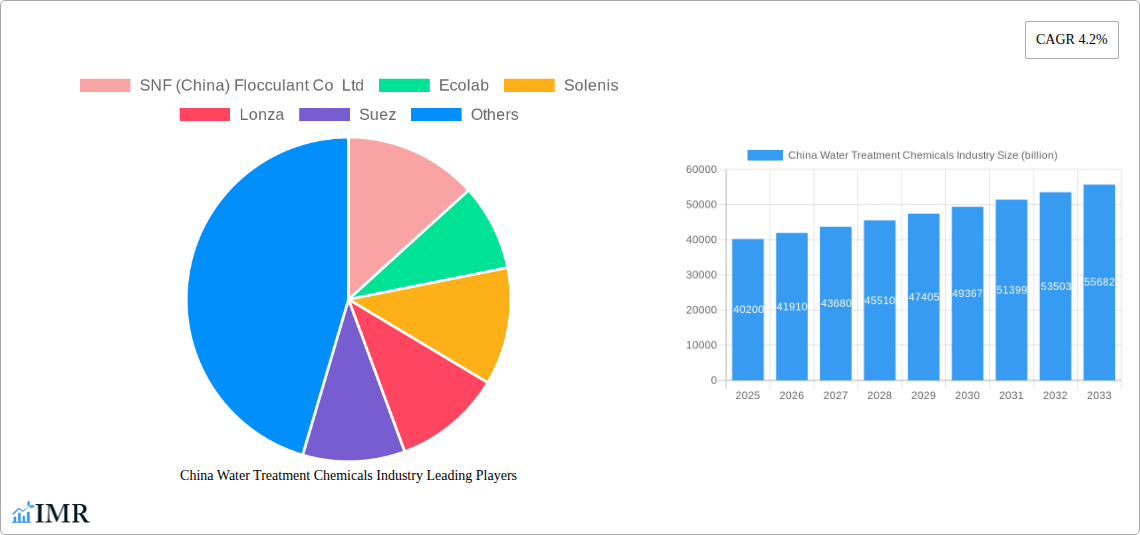

The China Water Treatment Chemicals market is poised for substantial growth, projected to reach $40.2 billion in 2025. This expansion is driven by a 4.2% CAGR through 2033, indicating robust demand and increasing investments in water management solutions. Key growth catalysts include stringent government regulations promoting water conservation and pollution control, coupled with the escalating need for high-quality treated water across various industries. The burgeoning industrial sector, particularly in chemical manufacturing and power generation, necessitates advanced water treatment chemicals to ensure operational efficiency and compliance with environmental standards. Furthermore, the growing emphasis on public health and the increasing demand for safe potable water are also significant contributors to market expansion.

China Water Treatment Chemicals Industry Market Size (In Billion)

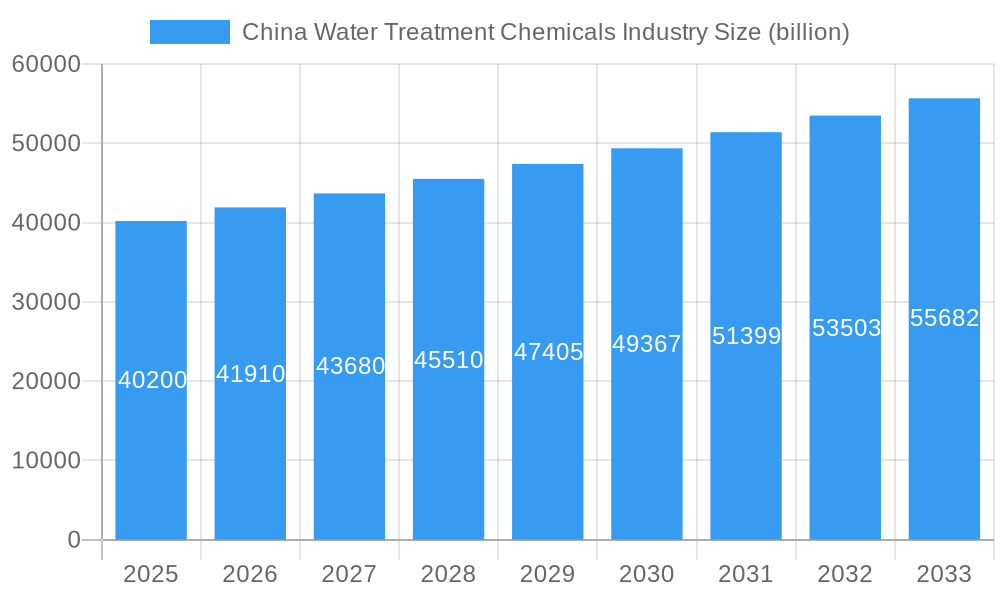

The market is segmented across diverse product types and applications, with Biocides & Disinfectants and Coagulants & Flocculants anticipated to witness significant adoption due to their critical roles in purification processes. Boiling water treatment and cooling water treatment applications are expected to remain dominant, supported by the continuous operational demands of power generation and industrial facilities. Wastewater treatment is also a rapidly expanding segment, driven by both industrial discharge and increasing municipal sewage treatment efforts. The competitive landscape features prominent global and local players like SNF (China) Flocculant Co Ltd, Ecolab, Solenis, and Kemira Oyj, actively contributing to market innovation and penetration through strategic partnerships and product development. Emerging trends such as the adoption of sustainable and eco-friendly water treatment chemicals are also shaping the market's trajectory.

China Water Treatment Chemicals Industry Company Market Share

This comprehensive report delves into the dynamic China Water Treatment Chemicals Industry, offering in-depth analysis of market size, growth drivers, competitive landscape, and future outlook. With a focus on high-traffic keywords, this report is optimized for maximum search engine visibility, making it an indispensable resource for industry professionals seeking strategic insights. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, encompassing historical data from 2019–2024. The report analyzes both parent and child markets, providing a granular view of segment-specific trends and opportunities. All monetary values are presented in billions of USD.

China Water Treatment Chemicals Industry Market Dynamics & Structure

The China Water Treatment Chemicals Industry is characterized by a moderately consolidated market structure, driven by significant investments in infrastructure and stringent environmental regulations. Technological innovation plays a pivotal role, with ongoing research and development focusing on eco-friendly and high-performance chemical solutions. Key drivers include the increasing demand for clean water across municipal and industrial sectors, coupled with government initiatives promoting water conservation and pollution control. Regulatory frameworks, such as the "Water Pollution Prevention and Control Action Plan," are instrumental in shaping market dynamics and pushing for advanced treatment technologies. Competitive product substitutes are emerging, particularly in the realm of biological treatment methods, though chemical solutions maintain a strong foothold due to their efficacy and cost-effectiveness in many applications. End-user demographics are diversifying, with a growing emphasis on specialized chemicals for membrane treatment and industrial wastewater management. Mergers and acquisitions (M&A) are shaping the competitive landscape, with major players seeking to expand their portfolios and geographical reach. For instance, the acquisition of hazardous waste assets by Suez from Veolia in May 2022 for USD 731 million underscores the consolidation trend. Market concentration is influenced by the presence of both large multinational corporations and established domestic manufacturers, each vying for market share through product differentiation and service offerings.

- Market Concentration: Moderately consolidated with key players holding significant market share.

- Technological Innovation Drivers: Focus on sustainable, high-efficiency, and specialized chemicals.

- Regulatory Frameworks: Stringent environmental policies and water quality standards driving demand for advanced treatment.

- Competitive Product Substitutes: Growing adoption of biological and advanced oxidation processes.

- End-user Demographics: Diversifying needs across municipal, industrial (power, chemical, mining), and commercial sectors.

- M&A Trends: Strategic acquisitions and partnerships to gain market share and technological expertise.

China Water Treatment Chemicals Industry Growth Trends & Insights

The China Water Treatment Chemicals Industry is poised for robust growth, fueled by a confluence of escalating water scarcity concerns, expanding industrial output, and proactive government policies aimed at ensuring water security. The market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033), potentially reaching a valuation of over USD 40 billion by 2033. This expansion is underpinned by increasing adoption rates of advanced water treatment chemicals across a spectrum of applications, from potable water purification to complex industrial wastewater management. Technological disruptions are continually reshaping the industry, with a notable shift towards green and sustainable chemical formulations that minimize environmental impact. Consumer behavior is also evolving, with a greater emphasis on long-term cost-effectiveness, compliance with evolving environmental standards, and the reliability of treatment solutions. The burgeoning demand for specialized chemicals for membrane treatment, crucial for desalination and wastewater reuse, is a significant growth engine. Furthermore, the increasing stringency of wastewater discharge regulations is compelling industries to invest in more sophisticated treatment technologies, thereby boosting the demand for coagulants, flocculants, and biocides. The power generation sector, in particular, is a major consumer, requiring efficient cooling water treatment chemicals to optimize plant operations and prevent scale formation. The chemical manufacturing industry also presents a substantial market, driven by the need to treat complex effluent streams. China's ongoing urbanization and population growth continue to drive demand for effective municipal wastewater treatment solutions, further solidifying the market's upward trajectory. The adoption of smart water management systems, integrating chemical dosing with real-time monitoring, is also becoming more prevalent, enhancing efficiency and reducing chemical consumption. Overall, the industry's growth is a testament to China's commitment to sustainable water resource management and its industrial modernization efforts.

Dominant Regions, Countries, or Segments in China Water Treatment Chemicals Industry

The Wastewater Treatment segment stands out as a dominant force within the China Water Treatment Chemicals Industry, exhibiting exceptional growth potential and significant market share. This dominance is propelled by a multi-faceted interplay of stringent environmental regulations, escalating industrial and urban pollution, and a national imperative to improve water quality across the country. The sheer volume of wastewater generated by China's vast industrial base and rapidly expanding urban centers necessitates a continuous and substantial supply of effective treatment chemicals. Within the wastewater treatment application, Coagulants & Flocculants emerge as a key product category, demonstrating high consumption rates due to their critical role in removing suspended solids and dissolved impurities. Their widespread application in both municipal and industrial wastewater plants makes them indispensable.

Geographically, the eastern coastal provinces, including Jiangsu, Shandong, and Guangdong, are leading the charge in water treatment chemical consumption. These regions are characterized by a high concentration of industrial activities, particularly in chemical manufacturing, power generation, and textiles, all of which are significant generators of wastewater. Furthermore, these provinces are at the forefront of implementing advanced environmental protection measures and investing heavily in water infrastructure development. The presence of major industrial hubs and significant urban populations in these areas directly translates into a higher demand for a comprehensive range of water treatment chemicals.

The Power Generation end-user industry is another significant driver of market growth, particularly in its demand for Cooling Water Treatment chemicals. Ensuring the efficient and uninterrupted operation of power plants relies heavily on preventing scaling, corrosion, and biofouling in cooling systems. This directly fuels the demand for specialized corrosion inhibitors, scale inhibitors, and biocides. Similarly, the Chemical Manufacturing sector contributes substantially to the market, requiring advanced chemical solutions to treat complex and often hazardous effluent streams, making segments like pH Adjuster and Softener, and specialty biocides crucial. The Municipal segment's demand for raw water and potable water preparation chemicals, alongside wastewater treatment, remains a foundational pillar of the market.

- Dominant Application: Wastewater Treatment, driven by pollution control and regulatory compliance.

- Key Product Category within Wastewater: Coagulants & Flocculants, essential for solid-liquid separation.

- Leading Geographical Regions: Eastern coastal provinces (Jiangsu, Shandong, Guangdong) due to industrial density and environmental focus.

- Significant End-user Industry: Power Generation, demanding robust cooling water treatment solutions.

- Growing End-user Industry: Chemical Manufacturing, requiring specialized and hazardous waste treatment chemicals.

- Municipal Sector's Role: Consistent demand for potable water preparation and wastewater management.

China Water Treatment Chemicals Industry Product Landscape

The product landscape within the China Water Treatment Chemicals Industry is marked by continuous innovation and a growing emphasis on performance and sustainability. Coagulants & Flocculants remain foundational, with ongoing advancements in polyaluminum chloride (PAC) and polyacrylamide (PAM) variants offering improved efficiency and reduced sludge generation. Biocides & Disinfectants are evolving towards less toxic and more targeted formulations, addressing the growing concerns around waterborne pathogens and biofouling in industrial systems. Corrosion & Scale Inhibitors are increasingly sophisticated, featuring multifunctional capabilities that provide comprehensive protection for diverse water systems, from industrial boilers to municipal water networks. The demand for specialized chemicals for Membrane Treatment, such as antiscalants and cleaners, is surging, driven by the expansion of desalination and water reuse projects. pH Adjusters and Softeners continue to be essential, with formulations optimized for specific water chemistries and operational requirements. Defoamers and Defoaming Agents are critical in processes where foam control is paramount, with new chemistries offering enhanced stability and compatibility. The industry is witnessing a clear trend towards customized solutions, addressing the unique challenges of various industrial processes and environmental conditions, thereby enhancing performance metrics and operational longevity.

Key Drivers, Barriers & Challenges in China Water Treatment Chemicals Industry

Key Drivers: The China Water Treatment Chemicals Industry is propelled by several critical factors. Foremost among these are the stringent environmental regulations and increasing government focus on water resource management and pollution control, exemplified by ambitious targets for water quality improvement. The ever-growing industrial base, including sectors like power generation, chemical manufacturing, and mining, necessitates effective water treatment to maintain operations and comply with discharge standards. Rapid urbanization and population growth are placing immense pressure on potable water supply and wastewater treatment infrastructure, creating sustained demand. Technological advancements in chemical formulations, leading to higher efficiency, lower dosage requirements, and reduced environmental impact, also act as significant drivers, encouraging adoption of newer, superior products. The push for water reuse and desalination further amplifies the need for specialized treatment chemicals, particularly antiscalants and membrane cleaners.

Barriers & Challenges: Despite robust growth, the industry faces notable barriers and challenges. Intense price competition, particularly among domestic manufacturers of commodity chemicals, can erode profit margins. Supply chain disruptions, as evidenced during global events, can impact the availability and cost of raw materials. Navigating the complex and often evolving regulatory landscape can pose compliance challenges for smaller players. The high capital investment required for research and development of novel, high-performance chemicals can be a deterrent for some companies. Furthermore, the perception and adoption rate of greener, more sustainable chemical alternatives can be slower in certain traditional applications, requiring significant market education. The availability of skilled labor for operating advanced chemical production facilities and implementing sophisticated water treatment solutions also presents a challenge.

Emerging Opportunities in China Water Treatment Chemicals Industry

Emerging opportunities within the China Water Treatment Chemicals Industry are primarily centered around sustainable and green chemistry. There is a growing demand for biodegradable flocculants, low-toxicity biocides, and chemical formulations that minimize sludge production and energy consumption. The expansion of the circular economy and water reuse initiatives presents a significant avenue, driving the need for advanced membrane treatment chemicals, such as highly effective antiscalants and specialized cleaning agents for membranes operating under challenging conditions. The IoT and smart water management integration is creating opportunities for intelligent chemical dosing systems that optimize performance and reduce waste, requiring chemicals compatible with real-time monitoring and control. Furthermore, the increasing focus on treating microplastics and emerging contaminants in wastewater offers a niche but growing market for specialized chemical solutions. The development of bio-based water treatment chemicals is another promising area, catering to the increasing preference for natural and environmentally friendly solutions.

Growth Accelerators in the China Water Treatment Chemicals Industry Industry

Several catalysts are accelerating the long-term growth trajectory of the China Water Treatment Chemicals Industry. Continuous technological breakthroughs in polymer science and nanotechnology are leading to the development of highly efficient and specialized water treatment chemicals with novel functionalities. Strategic partnerships and collaborations between global chemical giants and local Chinese enterprises are facilitating knowledge transfer, market access, and the introduction of advanced technologies. Government-backed infrastructure development projects, focused on upgrading municipal water supply and wastewater treatment facilities, are creating a sustained demand for a wide array of treatment chemicals. The increasing emphasis on industrial water efficiency and wastewater recycling across manufacturing sectors is a significant growth accelerator, pushing industries to adopt more sophisticated chemical treatment regimes. Furthermore, export market expansion for Chinese water treatment chemical manufacturers, driven by their cost competitiveness and improving product quality, is another key growth driver.

Key Players Shaping the China Water Treatment Chemicals Industry Market

- SNF (China) Flocculant Co Ltd

- Ecolab

- Solenis

- Lonza

- Suez

- Kemira Oyj

- Dow

- Wujin Fine Chemical Factory

- Veolia

- Kurita Water Industries Ltd

Notable Milestones in China Water Treatment Chemicals Industry Sector

- November 2022: Ecolab partnered with the Egyptian Government on the National Water Project to mitigate the country's water challenges. The collaboration between the Government and the company was planned for four years.

- May 2022: Suez and Veolia signed an agreement for the acquisition by Suez of all the hazardous waste assets in France as part of the commitments made by Veolia to address the European Commission competition concerns. The assets represented an enterprise value of USD 731 million.

In-Depth China Water Treatment Chemicals Industry Market Outlook

The future outlook for the China Water Treatment Chemicals Industry remains exceptionally bright, fueled by ongoing government commitments to environmental protection and sustainable development. Growth accelerators such as continued innovation in eco-friendly chemical formulations, particularly biodegradable and bio-based solutions, will shape market demand. Strategic market expansion, driven by both domestic infrastructure development and increasing export opportunities for Chinese manufacturers, will further bolster industry growth. The integration of smart technologies for optimized chemical dosing and real-time monitoring presents significant opportunities for value-added services and product differentiation. As China continues to prioritize water security and environmental stewardship, the demand for advanced, efficient, and sustainable water treatment chemicals is set to surge, creating a dynamic and expanding market for all stakeholders.

China Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides & Disinfectants

- 1.2. Coagulants & Flocculants

- 1.3. Corrosion & Scale Inhibitors

- 1.4. Defoamer and Defoaming Agent

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. Application

- 2.1. Boiling Water Treatment

- 2.2. Cooling Water Treatment

- 2.3. Membrane Treatment

- 2.4. Green Water Treatment

- 2.5. Raw Water/Potable Water Preparation

- 2.6. Wastewater Treatment

-

3. End-user Industry

- 3.1. Commercial and Institutional

- 3.2. Power Generation

- 3.3. Chemical Manufacturing

- 3.4. Mining & Mineral Processing

- 3.5. Municipal

- 3.6. Other End-user Industries

China Water Treatment Chemicals Industry Segmentation By Geography

- 1. China

China Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of China Water Treatment Chemicals Industry

China Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers

- 3.4. Market Trends

- 3.4.1. Corrosion & Scale Inhibitors to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides & Disinfectants

- 5.1.2. Coagulants & Flocculants

- 5.1.3. Corrosion & Scale Inhibitors

- 5.1.4. Defoamer and Defoaming Agent

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Boiling Water Treatment

- 5.2.2. Cooling Water Treatment

- 5.2.3. Membrane Treatment

- 5.2.4. Green Water Treatment

- 5.2.5. Raw Water/Potable Water Preparation

- 5.2.6. Wastewater Treatment

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial and Institutional

- 5.3.2. Power Generation

- 5.3.3. Chemical Manufacturing

- 5.3.4. Mining & Mineral Processing

- 5.3.5. Municipal

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SNF (China) Flocculant Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecolab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Solenis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonza

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suez

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kemira Oyj

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dow

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wujin Fine Chemical Factory

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kurita Water Industries Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SNF (China) Flocculant Co Ltd

List of Figures

- Figure 1: China Water Treatment Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: China Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: China Water Treatment Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: China Water Treatment Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: China Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: China Water Treatment Chemicals Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: China Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: China Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Water Treatment Chemicals Industry?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the China Water Treatment Chemicals Industry?

Key companies in the market include SNF (China) Flocculant Co Ltd, Ecolab, Solenis, Lonza, Suez, Kemira Oyj, Dow, Wujin Fine Chemical Factory, Veolia, Kurita Water Industries Ltd *List Not Exhaustive.

3. What are the main segments of the China Water Treatment Chemicals Industry?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers.

6. What are the notable trends driving market growth?

Corrosion & Scale Inhibitors to Dominate the market.

7. Are there any restraints impacting market growth?

Increasing Demand from Power Industry; Reduced Fresh Water Content from Saline Intrusion and Adverse Climatic Conditions; Other Drivers.

8. Can you provide examples of recent developments in the market?

November 2022: Ecolab, a US-based water treatment and purification solutions company, partnered with the Egyptian Government on the National Water Project to mitigate the country's water challenges. The collaboration between the Government and the company was planned for four years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the China Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence