Key Insights

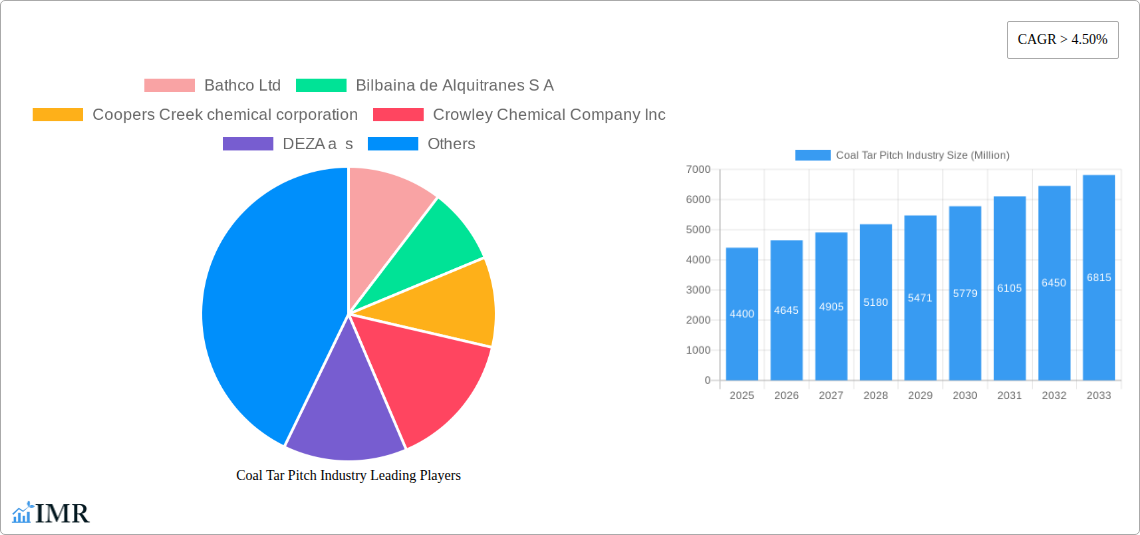

The global Coal Tar Pitch market is poised for robust growth, with an estimated market size of $4.4 billion in 2025. This expansion is driven by the escalating demand from key industries, most notably aluminum smelting, which heavily relies on coal tar pitch for the production of graphite electrodes. The market is projected to grow at a CAGR of 5.5% from 2025 through 2033, indicating a sustained upward trajectory. Other significant applications contributing to this growth include roofing, carbon fiber production, and refractories, each presenting unique opportunities for market participants. The increasing infrastructure development projects globally, coupled with a rise in the manufacturing sector, further bolsters the demand for coal tar pitch. Technological advancements aimed at improving the quality and performance of coal tar pitch are also expected to fuel market expansion.

Coal Tar Pitch Industry Market Size (In Billion)

While the market exhibits strong growth potential, certain factors could influence its trajectory. The escalating environmental regulations and the push towards sustainable alternatives in manufacturing processes might present challenges. However, ongoing research and development into cleaner production methods and the inherent properties of coal tar pitch, such as its excellent binding and impregnating capabilities, are expected to mitigate these concerns. The market is segmented across various grades including Aluminium Grade, Binder and Impregnating Grade, and Special Grade, catering to diverse industrial needs. Key players in the market are actively investing in expanding their production capacities and geographical reach to capitalize on the growing global demand, particularly in the rapidly industrializing Asia Pacific region.

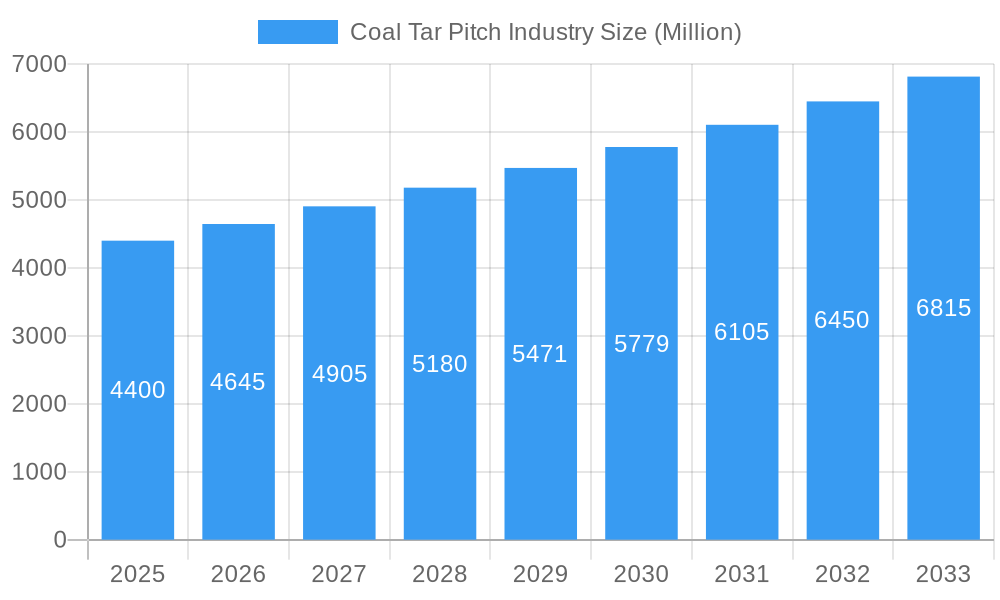

Coal Tar Pitch Industry Company Market Share

Coal Tar Pitch Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Coal Tar Pitch industry, exploring its market dynamics, growth trajectories, regional dominance, product landscape, key drivers, challenges, and future opportunities. With a focus on high-traffic keywords and granular segment analysis, this report is an essential resource for industry professionals seeking to understand the current state and future potential of this vital sector. Our analysis covers a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033.

Coal Tar Pitch Industry Market Dynamics & Structure

The global Coal Tar Pitch market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation plays a crucial role, primarily driven by the demand for high-performance pitches in specialized applications like advanced carbon materials and graphite electrodes. Regulatory frameworks, particularly those concerning environmental emissions and product safety, exert a substantial influence on production processes and market entry. Competitive product substitutes, such as petroleum pitch and synthetic binders, present ongoing challenges, necessitating continuous product differentiation and performance enhancement. End-user demographics are evolving, with a growing emphasis on sustainability and traceability across the value chain. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, aimed at expanding product portfolios, enhancing geographical reach, and achieving economies of scale. For instance, the acquisition of smaller, specialized producers by larger entities is a notable trend, signaling a drive for vertical integration and market control. The global coal tar pitch market size is projected to reach an estimated $xx billion by 2025, with M&A deal volumes in the last five years averaging xx deals annually, valued at approximately $xx billion.

- Market Concentration: Moderately concentrated, with key players dominating production.

- Technological Innovation Drivers: Demand for high-performance pitches, advanced carbon materials, and specialized binders.

- Regulatory Frameworks: Strict environmental regulations, product quality standards, and safety protocols.

- Competitive Product Substitutes: Petroleum pitch, synthetic binders, and alternative carbon precursors.

- End-User Demographics: Increasing demand for sustainable, high-purity, and traceable products.

- M&A Trends: Strategic consolidations for portfolio expansion, geographical reach, and economies of scale.

Coal Tar Pitch Industry Growth Trends & Insights

The Coal Tar Pitch industry is poised for significant growth, driven by the burgeoning demand from its key end-use applications. The global coal tar pitch market growth is estimated to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by the increasing consumption of aluminum, a primary driver for the Aluminium Grade coal tar pitch segment, which is expected to account for a substantial market share. Furthermore, the demand for graphite electrodes in the steel industry, along with the growing applications of carbon fiber in automotive and aerospace sectors, are major contributors to market penetration. Technological disruptions are centered around improving pitch quality, reducing environmental impact during production, and developing specialized pitches with enhanced binding and impregnating properties. Consumer behavior shifts are leaning towards eco-friendly production processes and products with lower impurity levels. The market size of coal tar pitch was approximately $xx billion in 2025, and is projected to reach $xx billion by 2033.

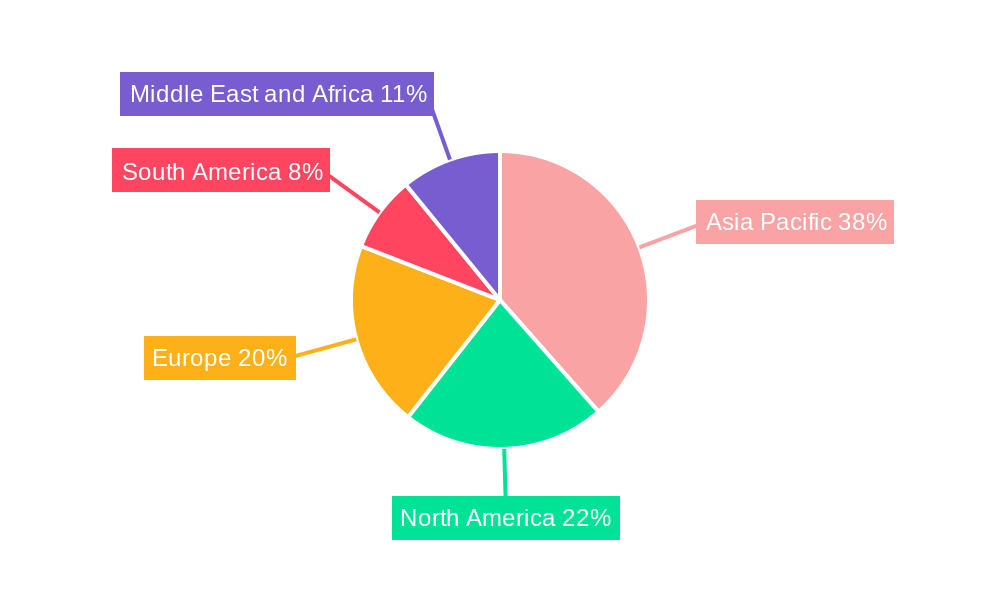

Dominant Regions, Countries, or Segments in Coal Tar Pitch Industry

The Aluminium Grade coal tar pitch segment is a dominant force in the global market, largely propelled by the robust Aluminium Smelting application. China, as the world's largest aluminum producer, significantly influences this segment's growth, supported by favorable government policies and extensive infrastructure development. The country's dominance in aluminum production translates to a substantial and consistent demand for high-quality coal tar pitch. Beyond China, other regions with significant aluminum smelting capacities, such as North America and Europe, also contribute to the demand for Aluminium Grade pitch. However, the Binder and Impregnating Grade coal tar pitch segment, particularly for Graphite Electrodes manufacturing, is also experiencing substantial growth, driven by the global expansion of the steel industry. Japan and South Korea, with their advanced manufacturing capabilities in steel and carbon products, are key markets for this grade.

- Leading Segment: Aluminium Grade Coal Tar Pitch

- Dominant Application: Aluminium Smelting

- Key Regional Drivers:

- China: Massive aluminum production, supportive industrial policies, and extensive infrastructure.

- North America & Europe: Significant aluminum smelting operations and growing demand for high-purity aluminum.

- Japan & South Korea: Leading producers of graphite electrodes and advanced carbon materials.

The market share of Aluminium Grade coal tar pitch is estimated at xx% of the total market value in 2025, with a projected growth rate of xx% during the forecast period. The Binder and Impregnating Grade segment follows closely, driven by the graphite electrodes market, which is projected to grow at a CAGR of xx%. The growth potential in these segments is directly linked to the global industrial output and infrastructure development.

Coal Tar Pitch Industry Product Landscape

The product landscape of the coal tar pitch industry is evolving with a focus on enhanced purity, consistent quality, and tailored properties for specific applications. Innovations are geared towards improving the coking value, softening point, and quinoline insoluble (QI) content to meet the stringent requirements of industries like aluminum smelting and graphite electrode manufacturing. Specialized grades are being developed for advanced applications such as carbon fiber production, offering superior binding and impregnating capabilities. Performance metrics like low volatile matter and high carbon content are crucial selling propositions. Technological advancements in distillation and purification processes are enabling producers to offer higher-value products with reduced environmental footprints.

Key Drivers, Barriers & Challenges in Coal Tar Pitch Industry

Key Drivers:

- Growing Demand for Aluminum: The expanding global demand for aluminum in automotive, construction, and packaging sectors directly fuels the need for Aluminium Grade coal tar pitch.

- Steel Industry Growth: The increasing production of steel, particularly in emerging economies, drives the demand for graphite electrodes, a key application for coal tar pitch.

- Advancements in Carbon Materials: The rising use of carbon fiber in high-performance applications like aerospace and renewable energy presents new opportunities.

- Infrastructure Development: Global infrastructure projects necessitate increased production of aluminum and steel, thus boosting coal tar pitch consumption.

Barriers & Challenges:

- Environmental Regulations: Strict environmental regulations on emissions and waste disposal during coal tar processing can increase production costs and limit expansion.

- Fluctuating Raw Material Prices: The price volatility of coal tar, a primary raw material, can impact profit margins and market stability.

- Availability of Substitutes: The presence of alternative binders and carbon precursors, such as petroleum pitch, poses a competitive threat.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can lead to disruptions in the supply chain, affecting production and delivery. The market size of coal tar pitch is impacted by these challenges, with an estimated xx% of production costs attributable to environmental compliance.

Emerging Opportunities in Coal Tar Pitch Industry

Emerging opportunities in the Coal Tar Pitch industry lie in the development of specialized, high-performance grades for niche applications. The growing interest in advanced battery technologies, such as lithium-ion batteries, presents an opportunity for pitches with specific electrochemical properties. Furthermore, the push towards sustainable manufacturing practices is creating demand for eco-friendly production processes and pitches with lower carbon footprints. Untapped markets in regions undergoing rapid industrialization, coupled with innovative applications in areas like advanced refractories and composites, offer significant growth potential. The development of pitches with enhanced flame retardant properties for specialized construction materials also represents an evolving consumer preference.

Growth Accelerators in the Coal Tar Pitch Industry Industry

Catalysts driving long-term growth in the Coal Tar Pitch industry include sustained investments in research and development to create novel pitch formulations with superior performance characteristics. Strategic partnerships between raw material suppliers and end-users are crucial for ensuring consistent supply and optimizing product development. Market expansion strategies, particularly targeting emerging economies with significant industrial growth, will accelerate adoption rates. The development of proprietary technologies for pitch modification and application will further solidify market positions. Furthermore, a growing emphasis on circular economy principles within the chemical industry may unlock new avenues for utilizing by-products and enhancing sustainability, thereby acting as a significant growth accelerator.

Key Players Shaping the Coal Tar Pitch Industry Market

- Bathco Ltd

- Bilbaina de Alquitranes S A

- Coopers Creek chemical corporation

- Crowley Chemical Company Inc

- DEZA a s

- Hengshui Zehao Chemicals Co Ltd

- Himadri Speciality Chemicals Ltd

- JFE Chemical Corporation

- Koppers Inc

- Mitsubishi Chemical Corporation

- Neptune Hydrocarbons Mfg Pvt Ltd

- Rain Carbon Inc

- Shandong Jiefuyi

Notable Milestones in Coal Tar Pitch Industry Sector

- 2019: Increased focus on environmentally friendly production processes and emission control technologies across major producers.

- 2020: Growing demand for high-purity coal tar pitch for advanced carbon materials driven by the aerospace and automotive sectors.

- 2021: Strategic acquisitions aimed at expanding product portfolios and geographical reach by key players like Rain Carbon Inc.

- 2022: Development of specialized binder grades for electric vehicle battery components.

- 2023: Enhanced regulatory scrutiny on carbon emissions leading to investments in advanced purification technologies.

- 2024: Significant growth in the aluminum smelting sector, particularly in Asia, boosting demand for Aluminium Grade coal tar pitch.

- Recent Developments: Further details on recent developments pertaining to the market studied will be covered in the final report.

In-Depth Coal Tar Pitch Industry Market Outlook

The future market potential of the Coal Tar Pitch industry remains robust, driven by a confluence of factors including sustained global industrial growth, technological advancements, and evolving material science. Strategic opportunities lie in catering to the increasing demand for high-performance carbon materials, developing sustainable production methods, and exploring new applications in emerging sectors like energy storage and advanced composites. The industry's ability to innovate and adapt to stringent environmental regulations will be critical for long-term success. By focusing on product differentiation, operational efficiency, and strategic market expansion, stakeholders can capitalize on the projected growth and secure a strong position in this dynamic market. The estimated market value of $xx billion by 2033 presents a significant opportunity for growth and investment.

Coal Tar Pitch Industry Segmentation

-

1. Grade

- 1.1. Aluminium Grade

- 1.2. Binder and Impregnating Grade

- 1.3. Special Grade

-

2. Application

- 2.1. Aluminium Smelting

- 2.2. Graphite Electrodes

- 2.3. Roofing

- 2.4. Carbon Fiber

- 2.5. Refractories

- 2.6. Other Applications

Coal Tar Pitch Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Coal Tar Pitch Industry Regional Market Share

Geographic Coverage of Coal Tar Pitch Industry

Coal Tar Pitch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Aluminum from various Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Aluminum from various Industries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Aluminum Smelting to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Aluminium Grade

- 5.1.2. Binder and Impregnating Grade

- 5.1.3. Special Grade

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aluminium Smelting

- 5.2.2. Graphite Electrodes

- 5.2.3. Roofing

- 5.2.4. Carbon Fiber

- 5.2.5. Refractories

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. Asia Pacific Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Aluminium Grade

- 6.1.2. Binder and Impregnating Grade

- 6.1.3. Special Grade

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Aluminium Smelting

- 6.2.2. Graphite Electrodes

- 6.2.3. Roofing

- 6.2.4. Carbon Fiber

- 6.2.5. Refractories

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. North America Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Aluminium Grade

- 7.1.2. Binder and Impregnating Grade

- 7.1.3. Special Grade

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Aluminium Smelting

- 7.2.2. Graphite Electrodes

- 7.2.3. Roofing

- 7.2.4. Carbon Fiber

- 7.2.5. Refractories

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Europe Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Aluminium Grade

- 8.1.2. Binder and Impregnating Grade

- 8.1.3. Special Grade

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Aluminium Smelting

- 8.2.2. Graphite Electrodes

- 8.2.3. Roofing

- 8.2.4. Carbon Fiber

- 8.2.5. Refractories

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. South America Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Aluminium Grade

- 9.1.2. Binder and Impregnating Grade

- 9.1.3. Special Grade

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Aluminium Smelting

- 9.2.2. Graphite Electrodes

- 9.2.3. Roofing

- 9.2.4. Carbon Fiber

- 9.2.5. Refractories

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Coal Tar Pitch Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Aluminium Grade

- 10.1.2. Binder and Impregnating Grade

- 10.1.3. Special Grade

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Aluminium Smelting

- 10.2.2. Graphite Electrodes

- 10.2.3. Roofing

- 10.2.4. Carbon Fiber

- 10.2.5. Refractories

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bathco Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bilbaina de Alquitranes S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coopers Creek chemical corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crowley Chemical Company Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DEZA a s

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hengshui Zehao Chemicals Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Himadri Speciality Chemicals Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JFE Chemical Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koppers Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Chemical Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Neptune Hydrocarbons Mfg Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rain Carbon Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shandong Jiefuyi*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Bathco Ltd

List of Figures

- Figure 1: Global Coal Tar Pitch Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Coal Tar Pitch Industry Revenue (undefined), by Grade 2025 & 2033

- Figure 3: Asia Pacific Coal Tar Pitch Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 4: Asia Pacific Coal Tar Pitch Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Coal Tar Pitch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Coal Tar Pitch Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Coal Tar Pitch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Coal Tar Pitch Industry Revenue (undefined), by Grade 2025 & 2033

- Figure 9: North America Coal Tar Pitch Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 10: North America Coal Tar Pitch Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Coal Tar Pitch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Coal Tar Pitch Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Coal Tar Pitch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Coal Tar Pitch Industry Revenue (undefined), by Grade 2025 & 2033

- Figure 15: Europe Coal Tar Pitch Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 16: Europe Coal Tar Pitch Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Coal Tar Pitch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Coal Tar Pitch Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Coal Tar Pitch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coal Tar Pitch Industry Revenue (undefined), by Grade 2025 & 2033

- Figure 21: South America Coal Tar Pitch Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 22: South America Coal Tar Pitch Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Coal Tar Pitch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Coal Tar Pitch Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Coal Tar Pitch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coal Tar Pitch Industry Revenue (undefined), by Grade 2025 & 2033

- Figure 27: Middle East and Africa Coal Tar Pitch Industry Revenue Share (%), by Grade 2025 & 2033

- Figure 28: Middle East and Africa Coal Tar Pitch Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Coal Tar Pitch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Coal Tar Pitch Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coal Tar Pitch Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 2: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 5: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 13: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 19: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 27: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 33: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Coal Tar Pitch Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Coal Tar Pitch Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coal Tar Pitch Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Coal Tar Pitch Industry?

Key companies in the market include Bathco Ltd, Bilbaina de Alquitranes S A, Coopers Creek chemical corporation, Crowley Chemical Company Inc, DEZA a s, Hengshui Zehao Chemicals Co Ltd, Himadri Speciality Chemicals Ltd, JFE Chemical Corporation, Koppers Inc, Mitsubishi Chemical Corporation, Neptune Hydrocarbons Mfg Pvt Ltd, Rain Carbon Inc, Shandong Jiefuyi*List Not Exhaustive.

3. What are the main segments of the Coal Tar Pitch Industry?

The market segments include Grade, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Aluminum from various Industries; Other Drivers.

6. What are the notable trends driving market growth?

Aluminum Smelting to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Aluminum from various Industries; Other Drivers.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the market studied will be covered in the final report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coal Tar Pitch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coal Tar Pitch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coal Tar Pitch Industry?

To stay informed about further developments, trends, and reports in the Coal Tar Pitch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence