Key Insights

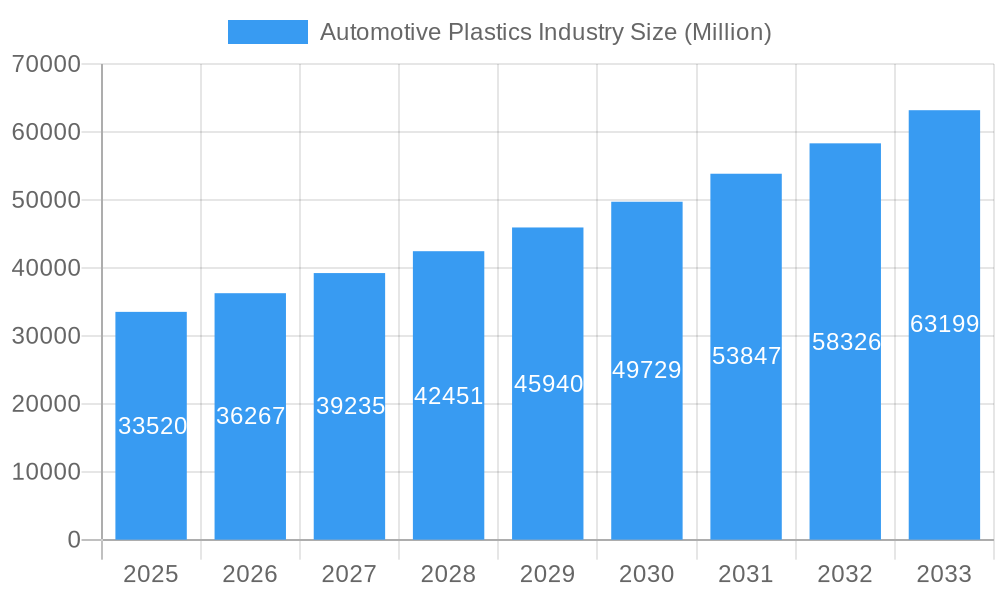

The global Automotive Plastics Market is poised for significant expansion, projected to reach $33.52 billion by 2025, driven by a robust CAGR of 8.17%. This growth trajectory underscores the increasing reliance of vehicle manufacturers on advanced plastic materials to enhance fuel efficiency, reduce weight, and improve overall performance. The adoption of lightweight polymers directly addresses stringent emission regulations and the growing demand for sustainable transportation solutions. Key growth drivers include the rising production of passenger cars and commercial vehicles, coupled with an accelerating shift towards electric vehicles (EVs) where weight reduction is paramount for battery range optimization. Furthermore, innovations in plastic technologies, such as the development of high-strength, durable, and aesthetically pleasing materials, are expanding their application across various vehicle components, from interiors and exteriors to under-the-hood applications.

Automotive Plastics Industry Market Size (In Billion)

The market's dynamism is further illustrated by its segmentation and regional landscape. Polypropylene (PP) and Polyethylene (PE) are anticipated to remain dominant material segments due to their cost-effectiveness and versatility. However, Polyurethane (PU) and Polycarbonate (PC) are expected to witness substantial growth, driven by their superior performance characteristics in demanding applications. The expansion of automotive manufacturing hubs in the Asia Pacific region, particularly China and India, is a major contributor to market growth, supported by expanding vehicle fleets and supportive government policies. North America and Europe, with their strong presence of established automotive manufacturers and a focus on technological advancement, also represent substantial markets. Emerging trends like the integration of smart plastics and the increasing use of recycled and bio-based plastics are set to reshape the competitive landscape, while high material costs and volatile raw material prices present potential restraints to sustained rapid growth.

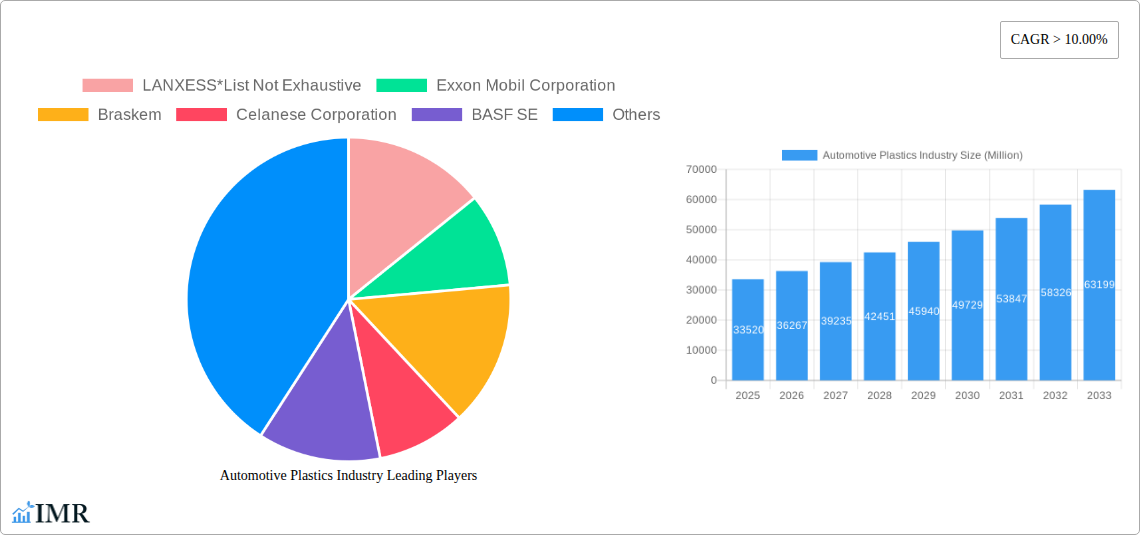

Automotive Plastics Industry Company Market Share

Comprehensive Report: Automotive Plastics Industry Market Analysis & Forecast (2019-2033)

This in-depth report provides a complete overview of the global Automotive Plastics Industry, analyzing its current state, historical trends, and projecting future growth until 2033. With a focus on high-traffic keywords and a detailed breakdown of market segments, applications, and vehicle types, this report is an essential resource for industry professionals seeking strategic insights and competitive intelligence. We meticulously cover the parent and child market dynamics, offering a granular perspective on the evolving landscape. The estimated market size for automotive plastics is projected to reach $XX billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033.

Automotive Plastics Industry Market Dynamics & Structure

The Automotive Plastics Industry is characterized by a moderately consolidated market structure, with key players like LANXESS, Exxon Mobil Corporation, Braskem, Celanese Corporation, BASF SE, DSM, DuPont, Daicel Corporation, Asahi Kasei Advance Corporation, Covestro AG, and Borealis AG holding significant influence. Technological innovation is a primary driver, with continuous advancements in material science, polymer processing, and lightweighting solutions for improved fuel efficiency and emissions reduction. Stringent regulatory frameworks, particularly concerning environmental impact, safety standards, and recyclability, are shaping product development and manufacturing processes. Competitive product substitutes, such as advanced composites and high-strength steels, pose a constant challenge, necessitating ongoing innovation in plastic material performance. End-user demographics are shifting towards a greater demand for sustainable and customizable vehicle interiors and exteriors. Mergers and acquisitions (M&A) continue to play a crucial role in market consolidation and strategic expansion, with an estimated XX M&A deals recorded during the historical period (2019-2024) with a total value of $XX billion. Innovation barriers include the high cost of R&D for novel materials and the lengthy approval processes for new automotive components.

- Market Concentration: Moderately consolidated with leading global chemical and polymer manufacturers.

- Technological Innovation: Driven by lightweighting, sustainability, enhanced durability, and aesthetic improvements.

- Regulatory Frameworks: Focus on emissions, recyclability, safety standards (e.g., ECE R137, FMVSS 208), and Extended Producer Responsibility (EPR).

- Competitive Product Substitutes: Advanced composites, high-strength steel alloys, and aluminum.

- End-User Demographics: Increasing preference for eco-friendly materials, customization, and smart interior features.

- M&A Trends: Strategic acquisitions to enhance product portfolios, expand geographical reach, and secure supply chains. Estimated XX M&A deals in the historical period.

- Innovation Barriers: High R&D expenditure, stringent testing and validation cycles, and fluctuating raw material prices.

Automotive Plastics Industry Growth Trends & Insights

The global Automotive Plastics Industry is experiencing dynamic growth, fueled by an escalating demand for lighter, more fuel-efficient, and environmentally sustainable vehicles. The market size has evolved significantly, with an estimated $XX billion in 2019, projected to reach $XX billion by 2025. This upward trajectory is supported by increasing adoption rates of plastics across various vehicle components, driven by their superior strength-to-weight ratio, design flexibility, and cost-effectiveness compared to traditional materials. Technological disruptions, such as advancements in bio-based and recycled plastics, alongside the development of high-performance engineering polymers, are reshaping the product landscape. Consumer behavior shifts are also playing a pivotal role; a growing environmental consciousness among car buyers is pushing manufacturers to incorporate more sustainable materials and embrace circular economy principles. This has led to increased market penetration of recycled and bio-attributed plastics, with an estimated XX% penetration rate in certain vehicle segments by 2025. The overall CAGR for the automotive plastics market is projected at XX% for the forecast period of 2025–2033, indicating substantial future expansion. The integration of advanced plastics in electric vehicles (EVs) to manage battery weight and thermal management further accelerates this growth.

- Market Size Evolution: From an estimated $XX billion in 2019 to a projected $XX billion by 2025, and expected to reach $XX billion by 2033.

- Adoption Rates: Increasing across exterior (bumpers, body panels), interior (dashboards, seats), and under-bonnet applications (engine covers, fluid reservoirs).

- Technological Disruptions: Rise of sustainable plastics (recycled, bio-based), advanced composites, and smart materials for enhanced functionality.

- Consumer Behavior Shifts: Growing demand for eco-friendly vehicles, lightweight designs, and premium interior finishes.

- Market Penetration: Estimated XX% for sustainable plastics by 2025, with significant potential for further growth.

- CAGR: Projected at XX% during the forecast period of 2025–2033.

- Electric Vehicle (EV) Impact: Growing demand for specialized plastics for battery components, thermal management, and lightweighting in EVs.

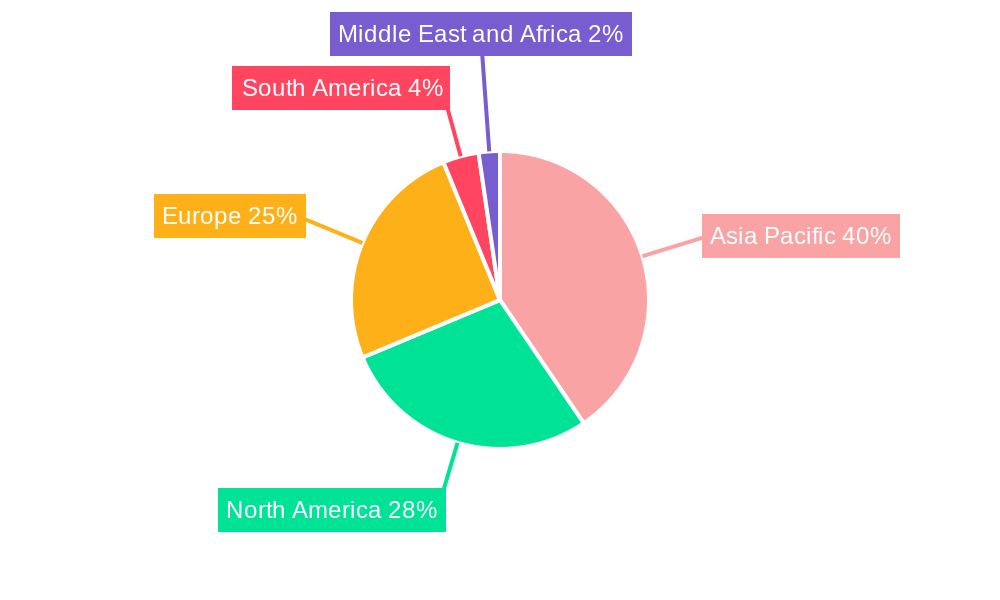

Dominant Regions, Countries, or Segments in Automotive Plastics Industry

The Asia-Pacific region currently dominates the global Automotive Plastics Industry, driven by the robust growth of its automotive manufacturing sector, particularly in China, Japan, and South Korea. China, as the world's largest automotive market, spearheads this dominance, supported by favorable government policies promoting domestic manufacturing, substantial investments in automotive production, and a rapidly expanding middle class with increasing vehicle purchasing power. The Material segment of Polypropylene (PP) is the most dominant, accounting for an estimated XX% of the total automotive plastics market by volume. Its versatility, cost-effectiveness, and excellent impact resistance make it ideal for a wide range of applications, including bumpers, interior trims, and under-hood components. In terms of Vehicle Type, Conventional/Traditional Vehicles still represent the largest share, but Electric Vehicles (EVs) are emerging as a significant growth driver, demanding specialized plastics for battery casings, thermal insulation, and lightweight structural components. The Application segment of Interior components, including dashboards, door panels, and seating, holds a substantial market share due to the continuous demand for aesthetic appeal, comfort, and advanced features.

- Dominant Region: Asia-Pacific, led by China, Japan, and South Korea.

- Key Country: China, with its massive automotive production and consumption.

- Dominant Material: Polypropylene (PP), holding an estimated XX% market share by volume.

- Emerging Vehicle Type: Electric Vehicles (EVs), driving demand for specialized high-performance plastics.

- Dominant Application: Interior components, due to aesthetic and functional requirements.

- Key Drivers for Dominance (Asia-Pacific):

- Economic Policies: Government incentives for manufacturing and R&D.

- Infrastructure: Well-developed automotive supply chains and manufacturing facilities.

- Market Size: Largest global automotive market volume.

- Labor Costs: Competitive manufacturing costs.

- Growth Potential: High growth potential in EVs and sustainable material adoption.

Automotive Plastics Industry Product Landscape

The Automotive Plastics Industry is witnessing an influx of innovative products designed to enhance vehicle performance, safety, and sustainability. Key innovations include the development of high-performance polyamides (PA) for under-hood applications requiring high temperature resistance, advanced polycarbonates (PC) for lightweight glazing and structural components, and advanced acrylonitrile butadiene styrene (ABS) for durable and aesthetically pleasing interior and exterior parts. Polypropylene (PP) continues to evolve with enhanced impact modifiers and recyclability features for bumpers and trim. Polyurethane (PU) finds extensive use in seating foams and sound dampening. The unique selling propositions of these materials lie in their ability to facilitate lightweighting, reduce CO2 emissions, improve fuel efficiency, and offer superior design freedom. Technological advancements are focusing on bio-based alternatives and improved chemical recycling processes for end-of-life plastics, aligning with the industry's sustainability goals.

Key Drivers, Barriers & Challenges in Automotive Plastics Industry

The key drivers propelling the Automotive Plastics Industry include the relentless pursuit of vehicle lightweighting to improve fuel efficiency and reduce emissions, the growing demand for aesthetically pleasing and customizable vehicle interiors and exteriors, and the increasing adoption of electric vehicles (EVs) that require specialized plastics for battery components and thermal management. Technological advancements in polymer science, offering enhanced material properties and processing efficiencies, also act as a significant growth accelerator.

Conversely, key challenges and restraints include the fluctuating prices of petrochemical-based raw materials, posing a threat to cost stability. Stringent environmental regulations and evolving recycling mandates require significant investment in R&D for sustainable materials and end-of-life solutions, potentially impacting profit margins. The competitive pressure from alternative materials like advanced composites and high-strength steels, as well as supply chain disruptions and geopolitical uncertainties, can also hinder market growth. The estimated impact of supply chain disruptions on production timelines has been in the range of XX% in recent years.

Emerging Opportunities in Automotive Plastics Industry

Emerging opportunities in the Automotive Plastics Industry are primarily centered around the burgeoning electric vehicle (EV) market, which presents a substantial demand for specialized plastics in battery systems, thermal management, and lightweight structural components. The increasing global focus on sustainability is creating a significant market for recycled and bio-based plastics, offering manufacturers a chance to develop eco-friendly product lines and meet consumer demand for greener vehicles. Furthermore, the integration of smart materials and advanced functionalities into automotive plastics, such as self-healing coatings or integrated sensors, opens up new avenues for product differentiation and value creation. The growing trend of vehicle personalization and customization also drives demand for plastics that offer a wider range of aesthetic options and design flexibility.

Growth Accelerators in the Automotive Plastics Industry Industry

Several key catalysts are accelerating long-term growth in the Automotive Plastics Industry. Continuous technological breakthroughs in polymer engineering, enabling the creation of lighter, stronger, and more functional plastic materials, are paramount. Strategic partnerships between automotive manufacturers and chemical companies are fostering innovation and accelerating the adoption of new materials and sustainable solutions. The expansion of the EV market globally is a significant growth accelerator, as electric powertrains necessitate extensive use of advanced plastics for weight reduction and safety. Moreover, initiatives promoting the circular economy, including enhanced recycling technologies and the development of bio-attributed plastics, are not only meeting regulatory demands but also creating new market segments and revenue streams.

Key Players Shaping the Automotive Plastics Industry Market

- LANXESS

- Exxon Mobil Corporation

- Braskem

- Celanese Corporation

- BASF SE

- DSM

- DuPont

- Daicel Corporation

- Asahi Kasei Advance Corporation

- Covestro AG

- Borealis AG

Notable Milestones in Automotive Plastics Industry Sector

- September 2022: Citroën and BASF unveiled their all-electric concept car oli [all-ë], a manifesto to how much can be saved by reducing weight and resource usage. BASF's commitment to sustainability, including the ChemCyclingTM project and biomass balance approach, highlights a strategic shift towards renewable resources.

- March 2022: Covestro AG started two polycarbonate compounding production lines at its Greater Noida plant near New Delhi in India. This expansion aims to address the escalating demand for compounded plastics in the automotive, electrical, and electronics sectors.

In-Depth Automotive Plastics Industry Market Outlook

The future market potential for automotive plastics is exceptionally bright, driven by the ongoing automotive industry transformation towards sustainability, electrification, and enhanced performance. Growth accelerators like advanced material innovation, particularly in recycled and bio-based polymers, alongside the expanding EV market, will continue to fuel demand. Strategic opportunities lie in developing lightweight solutions for new energy vehicles and catering to the increasing consumer preference for eco-friendly and customizable automotive interiors and exteriors. The industry is poised for sustained growth, with a projected market value of $XX billion by 2033, underscoring its critical role in the future of mobility.

Automotive Plastics Industry Segmentation

-

1. Material

- 1.1. Polypropylene (PP)

- 1.2. Polyurethane (PU)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Polyethylene (PE)

- 1.5. Acrylonitrile Butadiene Styrene (ABS)

- 1.6. Polyamides (PA)

- 1.7. Polycarbonate (PC)

- 1.8. Other Materials

-

2. Application

- 2.1. Exterior

- 2.2. Interior

- 2.3. Under Bonnet

- 2.4. Other Applications

-

3. Vehicle Type

- 3.1. Conventional/Traditional Vehicles

- 3.2. Electric Vehicles

Automotive Plastics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Plastics Industry Regional Market Share

Geographic Coverage of Automotive Plastics Industry

Automotive Plastics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight Materials from Electric and Hybrid Vehicles; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Challenges Associated with Plastic Recycling; Other Restraints

- 3.4. Market Trends

- 3.4.1. High Demand in Automotive Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyurethane (PU)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Polyethylene (PE)

- 5.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 5.1.6. Polyamides (PA)

- 5.1.7. Polycarbonate (PC)

- 5.1.8. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Exterior

- 5.2.2. Interior

- 5.2.3. Under Bonnet

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Conventional/Traditional Vehicles

- 5.3.2. Electric Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polypropylene (PP)

- 6.1.2. Polyurethane (PU)

- 6.1.3. Polyvinyl Chloride (PVC)

- 6.1.4. Polyethylene (PE)

- 6.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 6.1.6. Polyamides (PA)

- 6.1.7. Polycarbonate (PC)

- 6.1.8. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Exterior

- 6.2.2. Interior

- 6.2.3. Under Bonnet

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Conventional/Traditional Vehicles

- 6.3.2. Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polypropylene (PP)

- 7.1.2. Polyurethane (PU)

- 7.1.3. Polyvinyl Chloride (PVC)

- 7.1.4. Polyethylene (PE)

- 7.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 7.1.6. Polyamides (PA)

- 7.1.7. Polycarbonate (PC)

- 7.1.8. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Exterior

- 7.2.2. Interior

- 7.2.3. Under Bonnet

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Conventional/Traditional Vehicles

- 7.3.2. Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polypropylene (PP)

- 8.1.2. Polyurethane (PU)

- 8.1.3. Polyvinyl Chloride (PVC)

- 8.1.4. Polyethylene (PE)

- 8.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 8.1.6. Polyamides (PA)

- 8.1.7. Polycarbonate (PC)

- 8.1.8. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Exterior

- 8.2.2. Interior

- 8.2.3. Under Bonnet

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Conventional/Traditional Vehicles

- 8.3.2. Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polypropylene (PP)

- 9.1.2. Polyurethane (PU)

- 9.1.3. Polyvinyl Chloride (PVC)

- 9.1.4. Polyethylene (PE)

- 9.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 9.1.6. Polyamides (PA)

- 9.1.7. Polycarbonate (PC)

- 9.1.8. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Exterior

- 9.2.2. Interior

- 9.2.3. Under Bonnet

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Conventional/Traditional Vehicles

- 9.3.2. Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Automotive Plastics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polypropylene (PP)

- 10.1.2. Polyurethane (PU)

- 10.1.3. Polyvinyl Chloride (PVC)

- 10.1.4. Polyethylene (PE)

- 10.1.5. Acrylonitrile Butadiene Styrene (ABS)

- 10.1.6. Polyamides (PA)

- 10.1.7. Polycarbonate (PC)

- 10.1.8. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Exterior

- 10.2.2. Interior

- 10.2.3. Under Bonnet

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Conventional/Traditional Vehicles

- 10.3.2. Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LANXESS*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Exxon Mobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Braskem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Celanese Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BASF SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DSM

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DuPont

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daicel Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Asahi Kasei Advance Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Covestro AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Borealis AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 LANXESS*List Not Exhaustive

List of Figures

- Figure 1: Global Automotive Plastics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Automotive Plastics Industry Revenue (undefined), by Material 2025 & 2033

- Figure 3: Asia Pacific Automotive Plastics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Automotive Plastics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Automotive Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Automotive Plastics Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 7: Asia Pacific Automotive Plastics Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: Asia Pacific Automotive Plastics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific Automotive Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Automotive Plastics Industry Revenue (undefined), by Material 2025 & 2033

- Figure 11: North America Automotive Plastics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: North America Automotive Plastics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 13: North America Automotive Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Automotive Plastics Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: North America Automotive Plastics Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: North America Automotive Plastics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America Automotive Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Automotive Plastics Industry Revenue (undefined), by Material 2025 & 2033

- Figure 19: Europe Automotive Plastics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Automotive Plastics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe Automotive Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Automotive Plastics Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 23: Europe Automotive Plastics Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Europe Automotive Plastics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Automotive Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Plastics Industry Revenue (undefined), by Material 2025 & 2033

- Figure 27: South America Automotive Plastics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Automotive Plastics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: South America Automotive Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Automotive Plastics Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 31: South America Automotive Plastics Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: South America Automotive Plastics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Automotive Plastics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Plastics Industry Revenue (undefined), by Material 2025 & 2033

- Figure 35: Middle East and Africa Automotive Plastics Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Automotive Plastics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 37: Middle East and Africa Automotive Plastics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Automotive Plastics Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Plastics Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Plastics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Plastics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Plastics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Plastics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 15: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Automotive Plastics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: United States Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Canada Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 23: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Automotive Plastics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Germany Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Italy Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 32: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 33: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Plastics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Brazil Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Argentina Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Automotive Plastics Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 39: Global Automotive Plastics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Automotive Plastics Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 41: Global Automotive Plastics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Africa Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Automotive Plastics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Plastics Industry?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the Automotive Plastics Industry?

Key companies in the market include LANXESS*List Not Exhaustive, Exxon Mobil Corporation, Braskem, Celanese Corporation, BASF SE, DSM, DuPont, Daicel Corporation, Asahi Kasei Advance Corporation, Covestro AG, Borealis AG.

3. What are the main segments of the Automotive Plastics Industry?

The market segments include Material, Application, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight Materials from Electric and Hybrid Vehicles; Other Drivers.

6. What are the notable trends driving market growth?

High Demand in Automotive Applications.

7. Are there any restraints impacting market growth?

Challenges Associated with Plastic Recycling; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Citroën and BASF unveiled their all-electric concept car oli [all-ë], a manifesto to how much can be saved by reducing weight and resource usage. BASF has been pursuing an ambitious sustainability strategy for years now. Some of the major cornerstones of this strategy include the ChemCyclingTM project on improving the chemical recycling of plastics, as well as the biomass balance approach, in which fossil resources are replaced with renewables in production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Plastics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Plastics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Plastics Industry?

To stay informed about further developments, trends, and reports in the Automotive Plastics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence