Key Insights

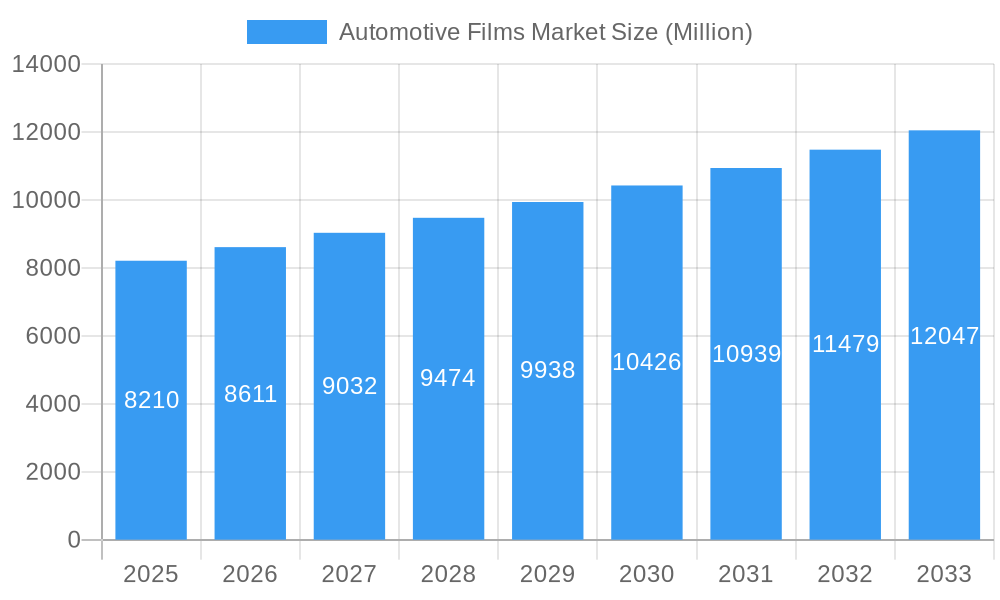

The global Automotive Films Market is poised for significant expansion, with an estimated market size of $8.21 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 4.89% expected throughout the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing consumer demand for enhanced vehicle aesthetics and personalized styling, leading to a surge in the adoption of automotive wrapping films. Furthermore, the growing awareness and regulatory push towards UV protection and thermal comfort within vehicles are propelling the demand for advanced window films, particularly ceramic and metallized variants. The automotive paint protection film segment is also witnessing substantial growth as car owners prioritize safeguarding their vehicles against minor damages, road debris, and environmental factors, thereby preserving resale value.

Automotive Films Market Market Size (In Billion)

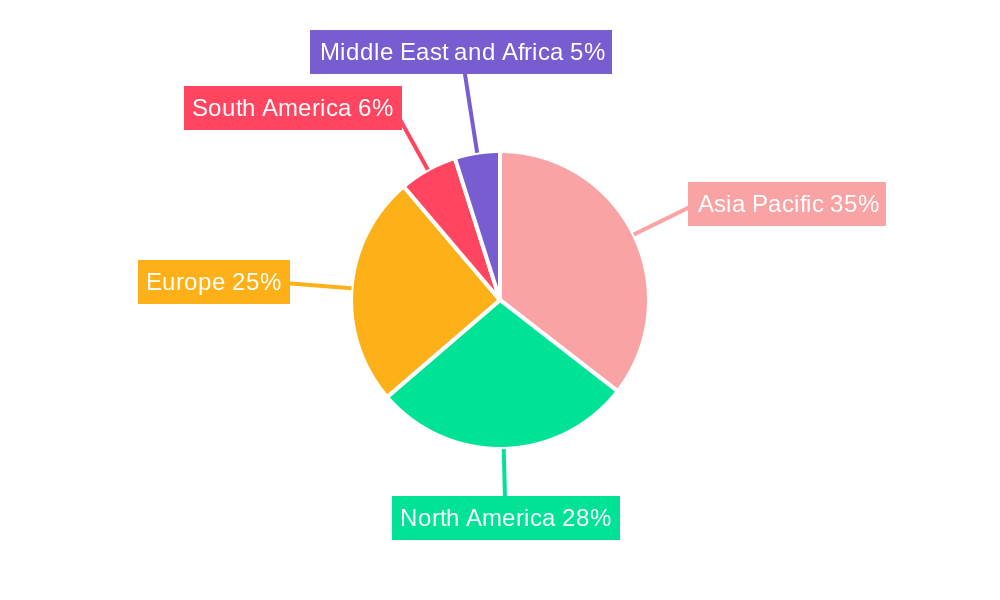

The market landscape is characterized by a strong emphasis on product innovation, with manufacturers continuously developing films with improved durability, advanced heat rejection properties, and enhanced aesthetic options. Geographically, the Asia Pacific region is expected to emerge as a dominant force, driven by the burgeoning automotive industry in countries like China and India, alongside increasing disposable incomes and a growing car parc. North America and Europe will remain substantial markets, driven by a mature automotive aftermarket and a strong consumer preference for vehicle customization and protection. While the market demonstrates a positive outlook, challenges such as the fluctuating prices of raw materials and increasing competition from alternative protection methods could present minor headwinds. However, the inherent benefits and evolving technological advancements in automotive films are expected to outweigh these constraints, ensuring sustained market growth.

Automotive Films Market Company Market Share

Comprehensive Automotive Films Market Report: Trends, Dynamics, and Future Outlook (2019-2033)

Unlock deep insights into the global Automotive Films Market with this definitive report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides an exhaustive breakdown of market size, growth trajectories, and influencing factors. Featuring granular segmentation by Film Type, Vehicle Type, and extensive coverage of key industry players and developments, this report is essential for strategists, manufacturers, and investors navigating the dynamic automotive aftermarket.

Automotive Films Market Market Dynamics & Structure

The automotive films market is characterized by a moderately concentrated structure, with a few dominant global players alongside a growing number of regional and specialized manufacturers. Technological innovation is a primary driver, with continuous advancements in material science leading to films with enhanced durability, UV protection, aesthetic appeal, and energy efficiency. Key innovations include the development of advanced ceramic and carbon window films offering superior heat rejection and optical clarity, as well as the evolution of paint protection films (PPF) with self-healing properties. Regulatory frameworks, particularly concerning vehicle safety, emissions standards, and product labeling, play a crucial role in shaping market access and product development. Competition from alternative solutions, such as factory-tinted glass and aftermarket cosmetic modifications, presents a constant challenge, albeit one mitigated by the superior performance and customizability of applied films. End-user demographics are shifting, with an increasing demand for premium and performance-oriented automotive aftermarket products driven by a growing middle class in emerging economies and a desire for vehicle personalization among affluent consumers globally. Mergers and acquisitions (M&A) are a significant trend, enabling market consolidation, technology integration, and expanded geographic reach. For instance, the acquisition of Ai-Red Technology by Eastman Chemical Company underscores the strategic importance of expanding capabilities in the Asia Pacific region.

- Market Concentration: Moderately concentrated, with a mix of multinational corporations and specialized regional players.

- Technological Innovation: Driven by advancements in ceramic, carbon, and self-healing film technologies.

- Regulatory Frameworks: Impacting safety standards, environmental compliance, and product certifications.

- Competitive Substitutes: Factory-tinted glass, aftermarket coatings, and vehicle wraps.

- End-User Demographics: Growing demand for personalization, protection, and premium features.

- M&A Trends: Strategic acquisitions for market expansion and technology enhancement are prevalent.

Automotive Films Market Growth Trends & Insights

The automotive films market is projected to experience robust growth, driven by escalating consumer demand for vehicle personalization, enhanced aesthetics, and protective functionalities. The global market size is estimated to reach xx billion by 2025 and is forecasted to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This growth is propelled by several key trends. Firstly, the rising disposable incomes in emerging economies have led to an increased adoption of passenger vehicles, consequently boosting the aftermarket demand for automotive films. Secondly, growing environmental awareness and stricter regulations on UV radiation and solar heat gain are fostering the adoption of energy-efficient window films, contributing significantly to market penetration. Technological advancements in film composition, such as the introduction of nano-ceramic and advanced carbon-based window tints, offer superior performance characteristics, including exceptional heat rejection, UV blocking, and optical clarity without compromising visibility, thus driving consumer preference. Furthermore, the surging popularity of automotive customization and the "show car" culture fuels the demand for both aesthetically enhancing and protective films like paint protection films (PPF) and vehicle wrapping films. Consumer behavior is increasingly influenced by social media trends and a desire to maintain vehicle resale value, making protective and appearance-enhancing films a priority. The market is also witnessing a shift towards premium, high-performance films that offer a superior blend of functionality and aesthetics. The integration of smart technologies into films, offering dynamic tinting capabilities or integrated sensors, represents a future growth avenue. The increasing focus on sustainability in manufacturing, as exemplified by Toray Industries' development of eco-friendly PET films, is also expected to influence market dynamics and consumer choices in the long term. The strategic acquisitions and collaborations observed within the industry are aimed at expanding product portfolios and market reach, further accelerating growth.

Dominant Regions, Countries, or Segments in Automotive Films Market

The Automotive Paint Protection Films segment, particularly within the Passenger Vehicles category, is identified as a dominant force driving market growth. This dominance is fueled by a confluence of economic policies, consumer purchasing power, and evolving lifestyle trends across key automotive markets. In regions like North America and Europe, there's a high level of disposable income, leading consumers to invest significantly in vehicle care and protection. This translates to a substantial demand for high-quality paint protection films that safeguard vehicle paintwork from environmental damage, road debris, and minor abrasions, thereby preserving resale value. The established automotive aftermarket infrastructure in these regions, including a widespread network of professional installers and detailing centers, further facilitates the adoption of PPF.

Economically, countries like the United States and Germany are leading the charge due to their mature automotive sectors and a consumer base that highly values vehicle aesthetics and longevity. The trend of vehicle customization and personalization is also a significant growth catalyst, with PPF acting as a foundational layer before the application of decorative wraps or ceramic coatings. The rising prevalence of luxury and performance vehicles, which consumers are keen to protect, further bolsters the demand for premium PPF.

In terms of Film Type, Ceramic Window Tint and Carbon Window Tint are experiencing exceptional growth within the broader window film segment. These advanced film technologies offer superior heat rejection, UV protection, and privacy without the metallic interference common in older metallized tints. Consumer awareness regarding the health benefits of UV protection and the desire for a more comfortable driving experience during hot weather are key drivers behind the preference for ceramic and carbon films. Countries in warmer climates, such as Australia and parts of the Middle East, are witnessing particularly high adoption rates of these advanced window films.

Emerging markets in the Asia Pacific region, especially China and India, are rapidly contributing to growth, driven by a burgeoning middle class, increasing vehicle ownership, and a growing demand for aftermarket upgrades. While passenger vehicles currently dominate, the Commercial Vehicles segment is also showing promising growth as fleet operators recognize the benefits of window films for driver comfort, reduced HVAC load, and improved cargo protection. The interplay between these segments, driven by technological advancements, consumer consciousness, and economic prosperity, solidifies the dominance of automotive paint protection films and advanced window tint types within the passenger vehicle segment as the primary growth engine for the global automotive films market.

Automotive Films Market Product Landscape

The automotive films market is characterized by a landscape of continually evolving product innovations focused on enhancing vehicle performance, aesthetics, and durability. Key advancements include the development of self-healing paint protection films (PPF) that can automatically repair minor scratches and swirl marks, significantly extending the pristine appearance of a vehicle's paintwork. In the window tint segment, ceramic and carbon films are gaining prominence due to their superior infrared rejection capabilities, leading to reduced cabin temperatures and improved fuel efficiency without compromising visibility. Furthermore, advancements in manufacturing processes have led to films with enhanced scratch resistance, UV protection exceeding 99%, and a wider spectrum of color and tint options for greater customization. The integration of advanced adhesives ensures easier application and removal, minimizing residue and potential damage to vehicle surfaces.

Key Drivers, Barriers & Challenges in Automotive Films Market

Key Drivers:

- Growing Demand for Vehicle Personalization & Aesthetics: Consumers increasingly seek to customize their vehicles for a unique look and feel, driving demand for wrapping films and specialized window tints.

- Enhanced Vehicle Protection: The desire to preserve vehicle resale value and protect against environmental damage, road debris, and scratches fuels the demand for paint protection films (PPF).

- UV Protection & Heat Rejection: Growing awareness of health benefits and the pursuit of a comfortable driving experience in hot climates propel the adoption of advanced window films that block UV rays and solar heat.

- Technological Advancements: Continuous innovation in film materials and manufacturing processes leads to superior performance characteristics, such as self-healing properties, improved optical clarity, and better durability.

- Economic Growth & Rising Disposable Incomes: Increased purchasing power, particularly in emerging markets, allows more consumers to invest in premium automotive aftermarket products.

Barriers & Challenges:

- High Initial Investment for Premium Films: Advanced films, especially high-performance PPF and ceramic window tints, can be expensive, posing a barrier for price-sensitive consumers.

- Availability of Skilled Installers: The proper application of automotive films requires specialized skills and equipment. A shortage of trained professionals can lead to poor installation quality, customer dissatisfaction, and hinder market growth.

- Counterfeit Products & Market Saturation: The prevalence of lower-quality counterfeit films can dilute brand reputation and lead to consumer distrust. Intense competition among numerous manufacturers and distributors can also create market saturation.

- Regulatory Compliance & Varied Local Laws: Different regions and countries have varying regulations regarding window tinting (e.g., VLT percentages), which can complicate market entry and product standardization.

- Supply Chain Disruptions: Global events and logistical challenges can impact the availability and cost of raw materials and finished products, affecting production schedules and pricing.

Emerging Opportunities in Automotive Films Market

Emerging opportunities in the automotive films market are largely centered around sustainability, smart functionalities, and the expansion into new vehicle segments. The increasing global focus on eco-friendly products presents a significant avenue for manufacturers developing biodegradable or recyclable films, and those utilizing sustainable manufacturing processes, as demonstrated by Toray Industries' PET film initiative. The integration of "smart" technologies within films, such as dynamic tinting that adjusts based on light intensity or integrated sensors for driver assistance systems, represents a frontier for innovation. Furthermore, the growing adoption of electric vehicles (EVs) and autonomous driving technologies offers new application potentials, including films designed to manage heat dissipation in battery systems or enhance sensor visibility. The expansion of automotive films into niche commercial vehicle applications, such as refrigerated trucks or specialized transport, also presents untapped market potential.

Growth Accelerators in the Automotive Films Market Industry

The automotive films market industry is experiencing accelerated growth driven by several key catalysts. Technological breakthroughs in material science are continuously yielding films with superior performance attributes, such as enhanced UV protection, advanced heat rejection capabilities (especially from ceramic and carbon window films), and self-healing properties in paint protection films. Strategic partnerships and collaborations between film manufacturers, automotive OEMs, and aftermarket service providers are expanding market reach and facilitating product integration into new vehicle models. The increasing consumer awareness regarding the benefits of automotive films, driven by marketing efforts and positive word-of-mouth, is significantly boosting adoption rates. Furthermore, the growing trend of vehicle customization and the desire to maintain vehicle aesthetics and resale value are powerful market expansion strategies that continue to fuel demand.

Key Players Shaping the Automotive Films Market Market

- Saint-Gobain

- ADS Window Films Ltd

- LINTEC Corporation

- 3M

- HEXIS SAS

- Sun Tint

- Garware Suncontrol Film

- Eastman Chemical Company

- Avery Dennison Corporation

- TORAY INDUSTRIES INC

- All Pro Window Films

- Johnson Window Films Inc

- FILMTACK PTE LTD

- Nexfil USA

- Global Window Films

Notable Milestones in Automotive Films Market Sector

- February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region, reinforcing Eastman's commitment to growth in Performance Films.

- December 2022: Toray Industries, Inc. developed a polyethylene terephthalate (PET) film that combines excellent applicability and adhesion for water-based and solvent-free coatings, aiming to eliminate solvent-derived carbon-dioxide emissions and promote eco-friendly film products.

In-Depth Automotive Films Market Market Outlook

The automotive films market is poised for sustained and significant growth, propelled by a dynamic interplay of consumer demand, technological innovation, and evolving industry trends. The increasing emphasis on vehicle aesthetics, protection, and performance, coupled with a growing environmental consciousness among consumers, will continue to drive the adoption of advanced window films and paint protection solutions. Strategic investments in research and development, particularly in areas like sustainable materials and smart film functionalities, will unlock new market opportunities. Expansion into emerging economies and specialized vehicle segments will further broaden the market's reach. Companies that can effectively leverage technological advancements, forge strong distribution networks, and adapt to shifting consumer preferences will be best positioned to capitalize on the future potential of this robust and evolving market.

Automotive Films Market Segmentation

-

1. Film Type

-

1.1. Window Films/Tints

- 1.1.1. Dyed Window Tint

- 1.1.2. Metallized Window Tint

- 1.1.3. Ceramic Window Tint

- 1.1.4. Carbon Window Tint

- 1.1.5. Other Wi

- 1.2. Automotive Paint Protection Films

- 1.3. Automotive Wrapping Films

-

1.1. Window Films/Tints

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

Automotive Films Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Automotive Films Market Regional Market Share

Geographic Coverage of Automotive Films Market

Automotive Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Concern for Safety

- 3.2.2 Security

- 3.2.3 and Privacy; Significant Demand for Automotive Films in Asia-Pacific and Europe

- 3.3. Market Restrains

- 3.3.1. Technical Issues with Dyed and Metallized Automotive Window Films; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Passenger Vehicles Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Film Type

- 5.1.1. Window Films/Tints

- 5.1.1.1. Dyed Window Tint

- 5.1.1.2. Metallized Window Tint

- 5.1.1.3. Ceramic Window Tint

- 5.1.1.4. Carbon Window Tint

- 5.1.1.5. Other Wi

- 5.1.2. Automotive Paint Protection Films

- 5.1.3. Automotive Wrapping Films

- 5.1.1. Window Films/Tints

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Film Type

- 6. Asia Pacific Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Film Type

- 6.1.1. Window Films/Tints

- 6.1.1.1. Dyed Window Tint

- 6.1.1.2. Metallized Window Tint

- 6.1.1.3. Ceramic Window Tint

- 6.1.1.4. Carbon Window Tint

- 6.1.1.5. Other Wi

- 6.1.2. Automotive Paint Protection Films

- 6.1.3. Automotive Wrapping Films

- 6.1.1. Window Films/Tints

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Film Type

- 7. North America Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Film Type

- 7.1.1. Window Films/Tints

- 7.1.1.1. Dyed Window Tint

- 7.1.1.2. Metallized Window Tint

- 7.1.1.3. Ceramic Window Tint

- 7.1.1.4. Carbon Window Tint

- 7.1.1.5. Other Wi

- 7.1.2. Automotive Paint Protection Films

- 7.1.3. Automotive Wrapping Films

- 7.1.1. Window Films/Tints

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Film Type

- 8. Europe Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Film Type

- 8.1.1. Window Films/Tints

- 8.1.1.1. Dyed Window Tint

- 8.1.1.2. Metallized Window Tint

- 8.1.1.3. Ceramic Window Tint

- 8.1.1.4. Carbon Window Tint

- 8.1.1.5. Other Wi

- 8.1.2. Automotive Paint Protection Films

- 8.1.3. Automotive Wrapping Films

- 8.1.1. Window Films/Tints

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Film Type

- 9. South America Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Film Type

- 9.1.1. Window Films/Tints

- 9.1.1.1. Dyed Window Tint

- 9.1.1.2. Metallized Window Tint

- 9.1.1.3. Ceramic Window Tint

- 9.1.1.4. Carbon Window Tint

- 9.1.1.5. Other Wi

- 9.1.2. Automotive Paint Protection Films

- 9.1.3. Automotive Wrapping Films

- 9.1.1. Window Films/Tints

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Vehicles

- 9.2.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Film Type

- 10. Middle East and Africa Automotive Films Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Film Type

- 10.1.1. Window Films/Tints

- 10.1.1.1. Dyed Window Tint

- 10.1.1.2. Metallized Window Tint

- 10.1.1.3. Ceramic Window Tint

- 10.1.1.4. Carbon Window Tint

- 10.1.1.5. Other Wi

- 10.1.2. Automotive Paint Protection Films

- 10.1.3. Automotive Wrapping Films

- 10.1.1. Window Films/Tints

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Vehicles

- 10.2.2. Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Film Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Saint-Gobain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ADS Window Films Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LINTEC Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HEXIS SAS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Tint

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garware Suncontrol Film

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eastman Chemical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TORAY INDUSTRIES INC *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 All Pro Window Films

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Johnson Window Films Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FILMTACK PTE LTD

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nexfil USA

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Global Window Films

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Saint-Gobain

List of Figures

- Figure 1: Global Automotive Films Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Automotive Films Market Revenue (undefined), by Film Type 2025 & 2033

- Figure 3: Asia Pacific Automotive Films Market Revenue Share (%), by Film Type 2025 & 2033

- Figure 4: Asia Pacific Automotive Films Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: Asia Pacific Automotive Films Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: Asia Pacific Automotive Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Automotive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Automotive Films Market Revenue (undefined), by Film Type 2025 & 2033

- Figure 9: North America Automotive Films Market Revenue Share (%), by Film Type 2025 & 2033

- Figure 10: North America Automotive Films Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: North America Automotive Films Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: North America Automotive Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Automotive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Automotive Films Market Revenue (undefined), by Film Type 2025 & 2033

- Figure 15: Europe Automotive Films Market Revenue Share (%), by Film Type 2025 & 2033

- Figure 16: Europe Automotive Films Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 17: Europe Automotive Films Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Europe Automotive Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Automotive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Automotive Films Market Revenue (undefined), by Film Type 2025 & 2033

- Figure 21: South America Automotive Films Market Revenue Share (%), by Film Type 2025 & 2033

- Figure 22: South America Automotive Films Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 23: South America Automotive Films Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Automotive Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Automotive Films Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive Films Market Revenue (undefined), by Film Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive Films Market Revenue Share (%), by Film Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive Films Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive Films Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive Films Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive Films Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 2: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Films Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 5: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 13: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 19: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Automotive Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 27: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Films Market Revenue undefined Forecast, by Film Type 2020 & 2033

- Table 33: Global Automotive Films Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Films Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Automotive Films Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Films Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Automotive Films Market?

Key companies in the market include Saint-Gobain, ADS Window Films Ltd, LINTEC Corporation, 3M, HEXIS SAS, Sun Tint, Garware Suncontrol Film, Eastman Chemical Company, Avery Dennison Corporation, TORAY INDUSTRIES INC *List Not Exhaustive, All Pro Window Films, Johnson Window Films Inc, FILMTACK PTE LTD, Nexfil USA, Global Window Films.

3. What are the main segments of the Automotive Films Market?

The market segments include Film Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concern for Safety. Security. and Privacy; Significant Demand for Automotive Films in Asia-Pacific and Europe.

6. What are the notable trends driving market growth?

Increasing Demand from the Passenger Vehicles Segment.

7. Are there any restraints impacting market growth?

Technical Issues with Dyed and Metallized Automotive Window Films; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region. This acquisition demonstrates Eastman's commitment to driving growth in Performance Films and the paint protection and window film markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Films Market?

To stay informed about further developments, trends, and reports in the Automotive Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence