Key Insights

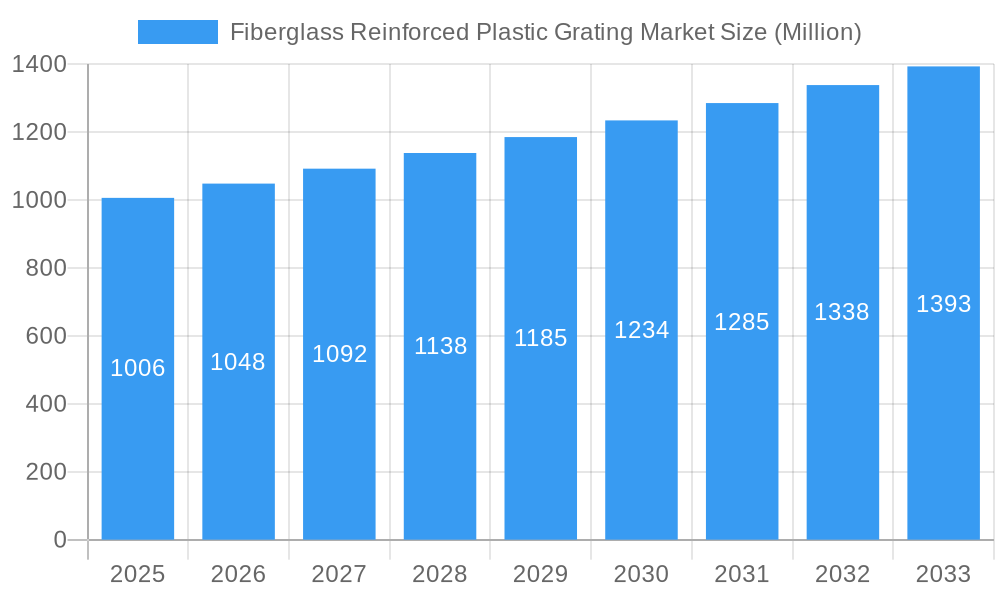

The global Fiberglass Reinforced Plastic (FRP) Grating market is poised for significant expansion, projected to reach $1006 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This growth is fueled by the inherent advantages of FRP gratings, including their exceptional corrosion resistance, high strength-to-weight ratio, electrical insulation properties, and low maintenance requirements. These attributes make them a superior alternative to traditional materials like steel and aluminum in demanding environments. Key drivers for market expansion include the increasing industrialization and infrastructure development across emerging economies, particularly in the Asia Pacific region. Furthermore, stringent safety regulations in sectors like Oil & Gas and Waste & Water Treatment are mandating the use of corrosion-resistant and non-conductive materials, directly benefiting the FRP grating market. The growing emphasis on sustainable construction practices also contributes, as FRP gratings offer a longer lifespan and reduced environmental impact compared to conventional options.

Fiberglass Reinforced Plastic Grating Market Market Size (In Billion)

The FRP grating market is characterized by diverse applications, with Stair Treads, Walkways, and Platforms representing significant demand segments due to their critical role in safety and accessibility across various industrial and commercial settings. The Oil & Gas, Plant & Chemical Processing, and Waste & Water Treatment industries are the primary end-users, driven by the need for reliable and durable solutions in corrosive and hazardous environments. While the market presents considerable opportunities, restraints such as higher initial costs compared to some traditional materials and the availability of cheaper substitutes in less demanding applications need to be navigated. However, the long-term cost savings associated with FRP's durability and low maintenance are increasingly swaying end-users. Technological advancements in manufacturing processes, such as improved pultrusion and molding techniques, are also contributing to enhanced product performance and cost-effectiveness, further solidifying the market's upward trajectory.

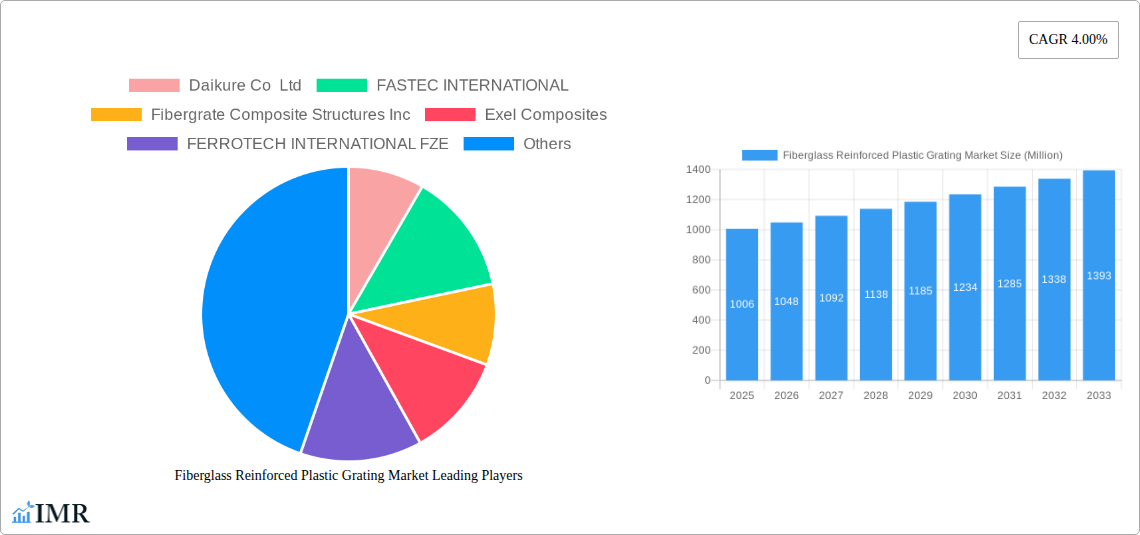

Fiberglass Reinforced Plastic Grating Market Company Market Share

Fiberglass Reinforced Plastic Grating Market: Comprehensive Outlook & Growth Trajectory (2019-2033)

This report delivers an in-depth analysis of the global Fiberglass Reinforced Plastic (FRP) Grating market, projecting its expansion from 2019 to 2033, with a base year of 2025. Explore key market dynamics, growth trends, dominant segments, product innovations, and the strategic landscapes of leading players. Understand the critical drivers, emerging opportunities, and challenges shaping this dynamic industry. This report is your definitive guide to informed decision-making in the FRP grating sector, leveraging high-traffic keywords like "FRP grating," "fiberglass grating market," "composite grating," "corrosion-resistant grating," and "industrial flooring solutions."

Fiberglass Reinforced Plastic Grating Market Market Dynamics & Structure

The Fiberglass Reinforced Plastic (FRP) Grating market exhibits a moderately concentrated structure, with a blend of established global manufacturers and specialized regional players. Technological innovation remains a primary driver, fueled by demand for lighter, more durable, and corrosion-resistant alternatives to traditional materials like steel and aluminum. Regulatory frameworks, particularly those emphasizing safety and environmental compliance in industries like chemical processing and waste treatment, also play a significant role in shaping product development and adoption. The competitive landscape is characterized by the continuous introduction of advanced resin systems and manufacturing processes, enhancing the performance characteristics of FRP gratings. End-user demographics reveal a growing reliance on FRP gratings in infrastructure development, offshore platforms, and manufacturing facilities where corrosive environments are prevalent. Mergers and Acquisitions (M&A) trends, while not as dominant as in more mature industries, are observed as companies seek to expand their product portfolios and geographic reach. For instance, the last five years have seen approximately 5-7 significant M&A activities, consolidating market share and fostering innovation through synergy. Barriers to innovation include the initial capital investment required for advanced manufacturing technologies and the need for extensive product testing and certification to meet stringent industry standards.

- Market Concentration: Moderately concentrated with key global players and emerging regional competitors.

- Technological Innovation: Driven by demand for enhanced corrosion resistance, strength-to-weight ratio, and customization.

- Regulatory Frameworks: Increasingly stringent regulations in sectors like Oil & Gas and Waste & Water Treatment favor durable and safe FRP solutions.

- Competitive Product Substitutes: Steel, aluminum, and traditional concrete gratings are primary substitutes.

- End-User Demographics: Growing adoption in demanding industrial environments and infrastructure projects.

- M&A Trends: Strategic acquisitions aimed at market expansion and technological integration.

- Innovation Barriers: High initial investment costs and rigorous certification processes.

Fiberglass Reinforced Plastic Grating Market Growth Trends & Insights

The Fiberglass Reinforced Plastic (FRP) Grating market is poised for robust growth, driven by escalating demand for high-performance, corrosion-resistant, and lightweight structural materials across a multitude of industries. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at approximately 5.8%, a testament to the increasing preference for FRP solutions over traditional metal and concrete gratings. This upward trajectory is underpinned by significant market penetration in sectors such as Oil & Gas, Plant & Chemical Processing, and Waste & Water Treatment, where the inherent properties of FRP gratings – superior chemical resistance, non-conductivity, and low maintenance requirements – offer distinct advantages. Technological disruptions, including advancements in resin formulations and manufacturing techniques, are further enhancing the performance capabilities and cost-effectiveness of FRP gratings, making them more accessible to a wider range of applications. Consumer behavior is shifting towards prioritizing lifecycle costs, durability, and environmental sustainability, factors where FRP gratings excel. The market size is expected to grow from an estimated $2,500 million in 2025 to over $3,800 million by 2033. Adoption rates are accelerating, particularly in developing economies undergoing rapid industrialization and infrastructure development. The transition from traditional materials to FRP is becoming more pronounced as industries recognize the long-term benefits and reduced operational downtime associated with FRP installations. Furthermore, the increasing emphasis on workplace safety and the need for non-slip, high-visibility solutions in industrial settings are also contributing to the heightened demand for advanced FRP grating products. The market's evolution is marked by a continuous pursuit of lighter, stronger, and more specialized FRP grating solutions tailored to specific application needs, driving innovation and expanding its reach into new and emerging markets.

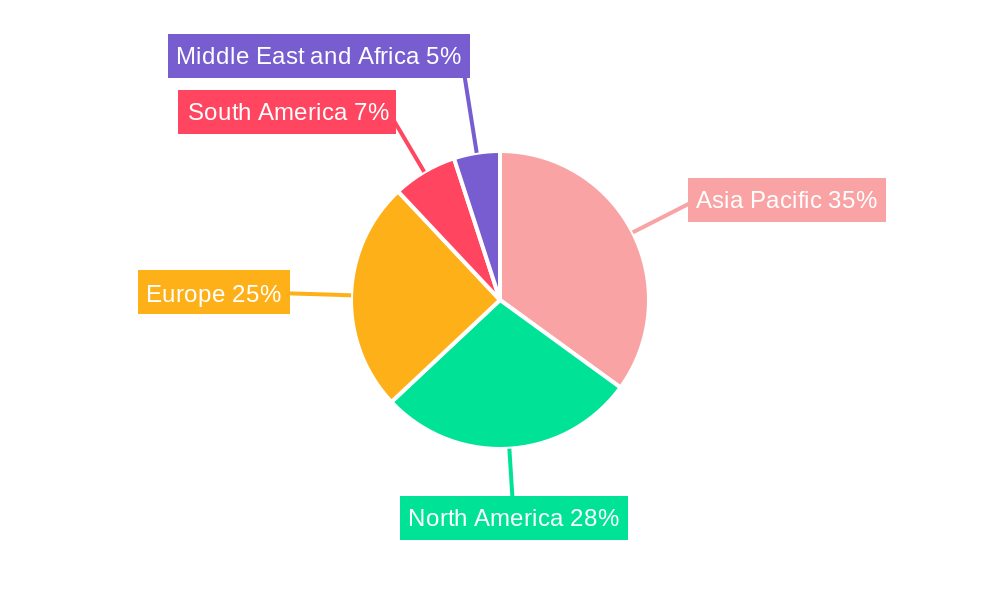

Dominant Regions, Countries, or Segments in Fiberglass Reinforced Plastic Grating Market

The Fiberglass Reinforced Plastic (FRP) Grating market's dominance is intricately linked to the industrial prowess and infrastructure development across various regions and specific segments. North America and Europe currently lead the market, driven by mature industrial bases in Oil & Gas, chemical processing, and robust construction sectors. Within these regions, the Oil & Gas end-user segment consistently commands a significant market share, estimated at around 25-30% of the total market value in 2025. This is attributable to the pervasive use of FRP gratings in offshore platforms, refineries, and chemical plants where extreme corrosion resistance is paramount. The Plant & Chemical Processing sector follows closely, with an estimated market share of 20-25%, due to the need for chemical-resistant flooring, walkways, and platforms.

Dominant End-User Segment: Oil & Gas.

- Key Drivers: Extreme corrosive environments, need for safety and durability in offshore and onshore facilities, regulatory compliance for hazardous locations.

- Market Share (Estimated 2025): 25-30% of the total market value.

- Growth Potential: Continued investment in energy infrastructure and stricter safety standards.

Leading Region: North America.

- Key Drivers: Established industrial infrastructure, significant Oil & Gas and chemical processing industries, strong emphasis on safety and longevity in construction.

- Market Share (Estimated 2025): Approximately 30-35% of the global market.

- Growth Potential: Ongoing infrastructure upgrades and demand for corrosion-resistant solutions.

Dominant Type: Polyester gratings are expected to hold the largest market share, estimated at around 45-50% in 2025. This is due to their excellent balance of cost-effectiveness and corrosion resistance, making them suitable for a wide range of applications. Vinyl Ester gratings follow, particularly in highly aggressive chemical environments.

- Polyester Grating:

- Key Drivers: Cost-effectiveness, good corrosion resistance, versatility for general industrial applications.

- Market Share (Estimated 2025): 45-50%.

- Polyester Grating:

Dominant Manufacturing Process: Molded FRP grating is anticipated to lead, holding an estimated 60-65% market share in 2025. Its ease of fabrication for complex shapes and its cost-effectiveness for standard panel sizes contribute to its widespread adoption.

- Molded Grating:

- Key Drivers: Cost-efficiency for standard panel production, ease of customization for specific patterns and mesh sizes, inherent strength and load-bearing capacity.

- Market Share (Estimated 2025): 60-65%.

- Molded Grating:

The Asia-Pacific region is emerging as a high-growth area, driven by rapid industrialization, increasing infrastructure investments, and a growing awareness of the benefits of FRP gratings. Countries like China and India are witnessing substantial demand from the construction and manufacturing sectors.

Fiberglass Reinforced Plastic Grating Market Product Landscape

The Fiberglass Reinforced Plastic (FRP) Grating market is characterized by continuous product innovation focused on enhancing performance and expanding application versatility. Key product advancements include the development of specialized resin systems, such as high-performance vinyl ester and phenolic resins, offering superior resistance to extreme temperatures, harsh chemicals, and fire. Manufacturers are also focusing on optimizing structural integrity through advanced pultrusion and molding techniques, resulting in gratings with higher load-bearing capacities and improved impact resistance. Unique selling propositions often revolve around tailored solutions, including custom mesh sizes, panel dimensions, and integrated anti-slip surfaces. Technological advancements are leading to lighter yet stronger grating options, reducing installation complexity and overall project costs.

Key Drivers, Barriers & Challenges in Fiberglass Reinforced Plastic Grating Market

Key Drivers:

- Corrosion Resistance: The primary driver for FRP grating adoption, offering superior longevity in aggressive chemical and environmental conditions compared to traditional materials.

- Lightweight & High Strength: Facilitates easier handling, transportation, and installation, leading to reduced labor costs and project timelines.

- Non-Conductivity: Essential for electrical safety in hazardous environments, preventing electrical shock.

- Low Maintenance: Resists rust, rot, and degradation, minimizing upkeep and replacement costs over its lifecycle.

- Growing Infrastructure Development: Increased construction of industrial facilities, bridges, and offshore platforms fuels demand.

- Environmental Regulations: Stricter safety and environmental standards in industries like waste treatment favor durable and safe FRP solutions.

Barriers & Challenges:

- Higher Initial Cost: Compared to some traditional materials like untreated steel, the upfront cost of FRP gratings can be a deterrent in cost-sensitive projects.

- UV Degradation: Certain resin types can be susceptible to degradation from prolonged UV exposure, requiring protective coatings or specialized formulations for outdoor applications.

- Fire Resistance Limitations: While phenolic resins offer good fire resistance, standard polyester gratings may require additional fire-retardant additives for specific applications.

- Limited Thermal Expansion: While generally less than metals, significant temperature fluctuations can lead to thermal expansion, requiring consideration in design.

- Supply Chain Volatility: Fluctuations in the price and availability of raw materials, such as fiberglass and resins, can impact production costs and lead times.

- Awareness and Education: In some emerging markets, a lack of awareness regarding the benefits and applications of FRP gratings can hinder adoption.

Emerging Opportunities in Fiberglass Reinforced Plastic Grating Market

Emerging opportunities in the Fiberglass Reinforced Plastic (FRP) Grating market lie in the expanding applications in renewable energy sectors, such as solar panel installations and wind turbine platforms, where corrosion resistance and lightweight properties are crucial. The growing trend towards retrofitting older industrial facilities with more durable and safe materials presents a significant avenue for growth. Furthermore, the development of advanced composite materials with enhanced fire retardancy and extreme temperature resistance will open doors to new applications in the aerospace and specialized industrial sectors. The increasing demand for sustainable building materials also positions FRP gratings favorably, as their long lifespan and recyclability contribute to eco-friendly construction practices. Untapped markets in developing economies with increasing industrialization offer substantial growth potential.

Growth Accelerators in the Fiberglass Reinforced Plastic Grating Market Industry

Several catalysts are accelerating the growth of the Fiberglass Reinforced Plastic (FRP) Grating market. Technological breakthroughs in resin chemistry and manufacturing processes are leading to FRP gratings with superior mechanical properties, enhanced fire resistance, and improved UV stability, broadening their applicability. Strategic partnerships between raw material suppliers and grating manufacturers are optimizing supply chains and driving down production costs. Market expansion strategies, including the penetration of emerging economies and the development of standardized product lines, are also contributing to sustained growth. The increasing adoption of prefabricated FRP components in construction projects is further accelerating demand by streamlining installation processes and reducing project timelines.

Key Players Shaping the Fiberglass Reinforced Plastic Grating Market Market

- Daikure Co Ltd

- FASTEC INTERNATIONAL

- Fibergrate Composite Structures Inc

- Exel Composites

- FERROTECH INTERNATIONAL FZE

- Bedford Reinforced Plastics

- Eurograte

- AGC MATEX CO LTD

- SEASAFE INC

- STRONGWELL CORPORATION

- Gebrüder MEISER GmbH

- Techno-Composites Domine GmbH

- Valmont Industries Inc

Notable Milestones in Fiberglass Reinforced Plastic Grating Market Sector

- 2019: Introduction of new high-performance phenolic resin formulations offering superior fire and chemical resistance.

- 2020: Significant investment in automated manufacturing processes by leading players to enhance production efficiency and reduce costs.

- 2021: Increased focus on developing sustainable and recyclable FRP grating solutions in response to environmental concerns.

- 2022: Launch of advanced anti-slip surface technologies for enhanced safety in wet and oily industrial environments.

- 2023: Growing adoption of BIM (Building Information Modeling) for FRP grating design and integration in construction projects.

- Early 2024: Development of ultra-lightweight FRP gratings for specialized applications requiring extreme weight reduction.

In-Depth Fiberglass Reinforced Plastic Grating Market Market Outlook

The Fiberglass Reinforced Plastic (FRP) Grating market is set for sustained and robust growth, driven by the undeniable advantages of FRP over traditional materials. Future market potential is amplified by ongoing technological advancements that promise even higher performance characteristics, such as extreme temperature tolerance and enhanced fire retardancy. Strategic opportunities lie in penetrating emerging markets with increasing industrialization and infrastructure needs, and in developing customized solutions for niche applications. The continued emphasis on safety, durability, and sustainability across industries will act as a powerful tailwind for FRP gratings, solidifying their position as the material of choice for challenging environments.

Fiberglass Reinforced Plastic Grating Market Segmentation

-

1. Type

- 1.1. Polyester

- 1.2. Vinyl Ester

- 1.3. Phenolic

- 1.4. Epoxy

-

2. Manufacturing Process

- 2.1. Pultruded

- 2.2. Molded

-

3. Application

- 3.1. Stair Treads

- 3.2. Walkways

- 3.3. Platforms

- 3.4. Floor Systems

-

4. End-User

- 4.1. Oil & Gas

- 4.2. Plant & Chemical Processing

- 4.3. Waste & Water Treatment

- 4.4. Pulp & Paper

- 4.5. Construction

- 4.6. Others

Fiberglass Reinforced Plastic Grating Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fiberglass Reinforced Plastic Grating Market Regional Market Share

Geographic Coverage of Fiberglass Reinforced Plastic Grating Market

Fiberglass Reinforced Plastic Grating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for FRP Gratings over Iron and Steel Gratings; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Sudden Impact of COVID-19 Outbreak; Other Restraints

- 3.4. Market Trends

- 3.4.1. Pultruded Segment to be the Largest Segment for FRP Grating Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyester

- 5.1.2. Vinyl Ester

- 5.1.3. Phenolic

- 5.1.4. Epoxy

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.2.1. Pultruded

- 5.2.2. Molded

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Stair Treads

- 5.3.2. Walkways

- 5.3.3. Platforms

- 5.3.4. Floor Systems

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Oil & Gas

- 5.4.2. Plant & Chemical Processing

- 5.4.3. Waste & Water Treatment

- 5.4.4. Pulp & Paper

- 5.4.5. Construction

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Polyester

- 6.1.2. Vinyl Ester

- 6.1.3. Phenolic

- 6.1.4. Epoxy

- 6.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6.2.1. Pultruded

- 6.2.2. Molded

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Stair Treads

- 6.3.2. Walkways

- 6.3.3. Platforms

- 6.3.4. Floor Systems

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Oil & Gas

- 6.4.2. Plant & Chemical Processing

- 6.4.3. Waste & Water Treatment

- 6.4.4. Pulp & Paper

- 6.4.5. Construction

- 6.4.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Polyester

- 7.1.2. Vinyl Ester

- 7.1.3. Phenolic

- 7.1.4. Epoxy

- 7.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7.2.1. Pultruded

- 7.2.2. Molded

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Stair Treads

- 7.3.2. Walkways

- 7.3.3. Platforms

- 7.3.4. Floor Systems

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Oil & Gas

- 7.4.2. Plant & Chemical Processing

- 7.4.3. Waste & Water Treatment

- 7.4.4. Pulp & Paper

- 7.4.5. Construction

- 7.4.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Polyester

- 8.1.2. Vinyl Ester

- 8.1.3. Phenolic

- 8.1.4. Epoxy

- 8.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8.2.1. Pultruded

- 8.2.2. Molded

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Stair Treads

- 8.3.2. Walkways

- 8.3.3. Platforms

- 8.3.4. Floor Systems

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Oil & Gas

- 8.4.2. Plant & Chemical Processing

- 8.4.3. Waste & Water Treatment

- 8.4.4. Pulp & Paper

- 8.4.5. Construction

- 8.4.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Polyester

- 9.1.2. Vinyl Ester

- 9.1.3. Phenolic

- 9.1.4. Epoxy

- 9.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 9.2.1. Pultruded

- 9.2.2. Molded

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Stair Treads

- 9.3.2. Walkways

- 9.3.3. Platforms

- 9.3.4. Floor Systems

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Oil & Gas

- 9.4.2. Plant & Chemical Processing

- 9.4.3. Waste & Water Treatment

- 9.4.4. Pulp & Paper

- 9.4.5. Construction

- 9.4.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Fiberglass Reinforced Plastic Grating Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Polyester

- 10.1.2. Vinyl Ester

- 10.1.3. Phenolic

- 10.1.4. Epoxy

- 10.2. Market Analysis, Insights and Forecast - by Manufacturing Process

- 10.2.1. Pultruded

- 10.2.2. Molded

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Stair Treads

- 10.3.2. Walkways

- 10.3.3. Platforms

- 10.3.4. Floor Systems

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Oil & Gas

- 10.4.2. Plant & Chemical Processing

- 10.4.3. Waste & Water Treatment

- 10.4.4. Pulp & Paper

- 10.4.5. Construction

- 10.4.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Daikure Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FASTEC INTERNATIONAL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fibergrate Composite Structures Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exel Composites

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FERROTECH INTERNATIONAL FZE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bedford Reinforced Plastics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eurograte

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGC MATEX CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SEASAFE INC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 STRONGWELL CORPORATION

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gebrüder MEISER GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Techno-Composites Domine GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Valmont Industries Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Daikure Co Ltd

List of Figures

- Figure 1: Global Fiberglass Reinforced Plastic Grating Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Manufacturing Process 2025 & 2033

- Figure 5: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Manufacturing Process 2025 & 2033

- Figure 6: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by End-User 2025 & 2033

- Figure 9: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Type 2025 & 2033

- Figure 13: North America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Manufacturing Process 2025 & 2033

- Figure 15: North America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Manufacturing Process 2025 & 2033

- Figure 16: North America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: North America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by End-User 2025 & 2033

- Figure 19: North America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: North America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: North America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Type 2025 & 2033

- Figure 23: Europe Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Manufacturing Process 2025 & 2033

- Figure 25: Europe Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Manufacturing Process 2025 & 2033

- Figure 26: Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Application 2025 & 2033

- Figure 27: Europe Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by End-User 2025 & 2033

- Figure 29: Europe Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Type 2025 & 2033

- Figure 33: South America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Manufacturing Process 2025 & 2033

- Figure 35: South America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Manufacturing Process 2025 & 2033

- Figure 36: South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: South America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by End-User 2025 & 2033

- Figure 39: South America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Type 2025 & 2033

- Figure 43: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Manufacturing Process 2025 & 2033

- Figure 45: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Manufacturing Process 2025 & 2033

- Figure 46: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Application 2025 & 2033

- Figure 47: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Application 2025 & 2033

- Figure 48: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by End-User 2025 & 2033

- Figure 49: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 3: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 5: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 8: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 10: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: China Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Japan Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: South Korea Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 18: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 20: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: United States Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Canada Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Mexico Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 26: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 28: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Germany Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: France Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 36: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 38: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Brazil Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Argentina Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 43: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 44: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 45: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 46: Global Fiberglass Reinforced Plastic Grating Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 47: Saudi Arabia Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: South Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa Fiberglass Reinforced Plastic Grating Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiberglass Reinforced Plastic Grating Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Fiberglass Reinforced Plastic Grating Market?

Key companies in the market include Daikure Co Ltd, FASTEC INTERNATIONAL, Fibergrate Composite Structures Inc, Exel Composites, FERROTECH INTERNATIONAL FZE, Bedford Reinforced Plastics, Eurograte, AGC MATEX CO LTD, SEASAFE INC, STRONGWELL CORPORATION, Gebrüder MEISER GmbH, Techno-Composites Domine GmbH, Valmont Industries Inc *List Not Exhaustive.

3. What are the main segments of the Fiberglass Reinforced Plastic Grating Market?

The market segments include Type, Manufacturing Process, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for FRP Gratings over Iron and Steel Gratings; Other Drivers.

6. What are the notable trends driving market growth?

Pultruded Segment to be the Largest Segment for FRP Grating Market.

7. Are there any restraints impacting market growth?

; Sudden Impact of COVID-19 Outbreak; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fiberglass Reinforced Plastic Grating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fiberglass Reinforced Plastic Grating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fiberglass Reinforced Plastic Grating Market?

To stay informed about further developments, trends, and reports in the Fiberglass Reinforced Plastic Grating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence