Key Insights

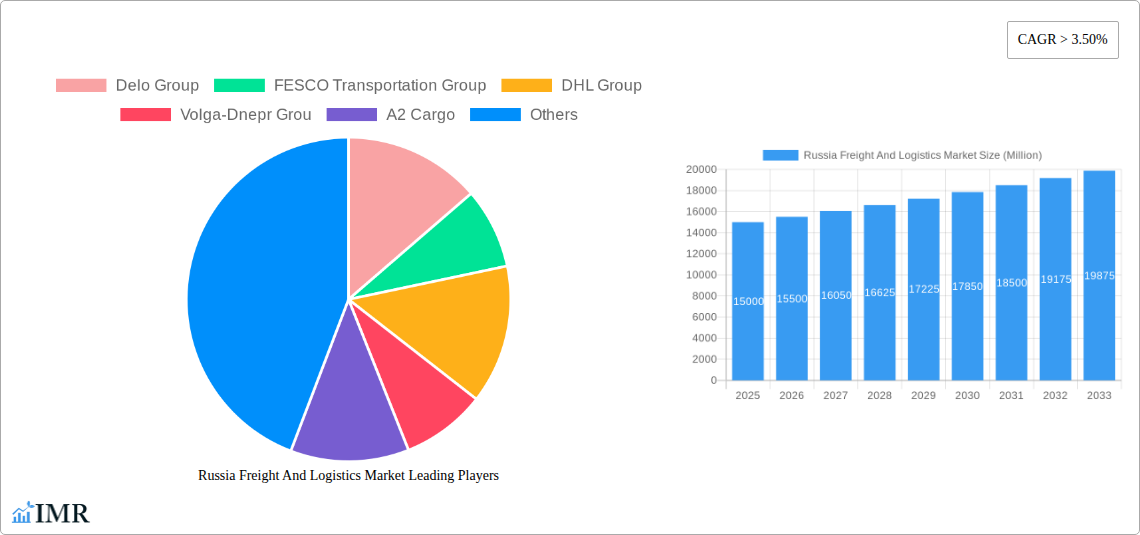

The Russian freight and logistics market is projected for substantial expansion, forecasting a Compound Annual Growth Rate (CAGR) of 6.3%. Commencing from a market size of $17.96 billion in the 2025 base year, this growth trajectory is propelled by escalating e-commerce activities, heightened domestic consumption, and a strategic imperative to optimize internal supply chain operations. Significant infrastructure enhancements across road and rail networks, alongside advancements in warehousing and specialized storage solutions, are also pivotal growth drivers. The evolving demands of key sectors including manufacturing, retail, and oil & gas, all dependent on efficient freight and storage, further shape market dynamics. The domestic freight transport sector, particularly road and rail, is anticipated to experience considerable activity.

Russia Freight And Logistics Market Market Size (In Billion)

While the market exhibits strong growth potential, it is not without its challenges. Geopolitical considerations, global economic fluctuations, and dynamic regulatory environments may introduce complexities affecting trade flows. Nevertheless, the inherent resilience of the Russian market, coupled with technological advancements such as digitalization and automation, is expected to counterbalance these potential impediments. Dominant market trends include the increasing adoption of intermodal transportation for cost and time optimization, a rising demand for efficient last-mile delivery services driven by e-commerce growth, and an emerging focus on sustainability throughout the logistics value chain. Market segmentation highlights the significant contribution of Courier, Express, and Parcel (CEP) services, especially for domestic distribution, and the substantial role of freight forwarding in international logistics. Warehousing and storage, particularly non-temperature-controlled options, constitute another major segment catering to diverse industrial requirements. Leading market participants are strategically investing in network expansion and service portfolio enhancement to secure competitive advantage.

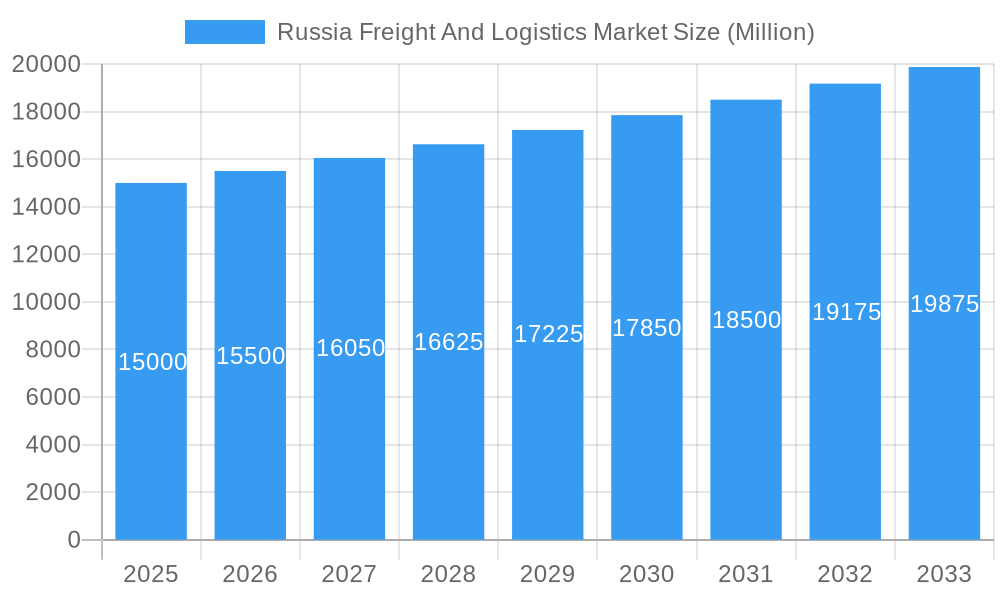

Russia Freight And Logistics Market Company Market Share

Russia Freight And Logistics Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report provides an in-depth analysis of the Russia freight and logistics market, exploring its current dynamics, growth trajectory, and future potential. With a focus on parent and child market segmentation, this study leverages high-traffic keywords such as Russian logistics services, freight forwarding Russia, supply chain management Russia, transportation and logistics Russia, and e-commerce logistics Russia to offer unparalleled market visibility. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report delivers actionable insights for industry stakeholders. All quantitative values are presented in Million units.

Russia Freight And Logistics Market Market Dynamics & Structure

The Russia freight and logistics market is characterized by a moderately concentrated structure, with key players like Delo Group and FESCO Transportation Group holding significant market share. Technological innovation is increasingly driven by digitalization, automation in warehousing, and the adoption of advanced tracking systems. Regulatory frameworks, while evolving, continue to impact operational efficiency, with a focus on infrastructure development and cross-border trade facilitation. Competitive product substitutes are emerging, particularly in the last-mile delivery segment, fueled by e-commerce growth. End-user demographics reveal a growing demand for faster and more reliable logistics solutions across various industries. Mergers and acquisitions (M&A) activity is a key trend, with companies consolidating to achieve economies of scale and expand service portfolios. For instance, recent M&A activities have focused on integrating warehousing and last-mile delivery capabilities. Innovation barriers include high capital investment for new technologies and the need for skilled workforce development in specialized logistics functions.

- Market Concentration: Moderate, with leading players focusing on infrastructure and network expansion.

- Technological Innovation: Driven by digitalization, IoT for tracking, and warehouse automation.

- Regulatory Frameworks: Evolving policies related to infrastructure, customs, and trade agreements.

- Competitive Substitutes: Growing competition from specialized e-commerce logistics providers.

- End-User Demographics: Increasing demand for speed, transparency, and specialized handling.

- M&A Trends: Consolidation for scale, vertical integration, and market entry.

- Example: Acquisition of smaller freight forwarders by larger entities.

- Innovation Barriers: High upfront costs for advanced technology and training needs.

Russia Freight And Logistics Market Growth Trends & Insights

The Russia freight and logistics market is poised for significant expansion, driven by a confluence of economic, technological, and consumer-driven factors. The market size has seen a steady evolution, with projections indicating a robust Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033. Adoption rates of advanced logistics technologies, such as AI-powered route optimization and predictive analytics for inventory management, are on an upward trajectory. Technological disruptions, including the increasing use of drones for last-mile delivery and the development of smart warehousing solutions, are transforming operational efficiencies. Consumer behavior shifts, particularly the surge in e-commerce penetration, are creating unprecedented demand for efficient, reliable, and cost-effective Russian logistics services. This behavioral change necessitates a greater focus on speed, traceability, and flexible delivery options. The market penetration of digital logistics platforms is expected to reach xx% by 2033, reflecting a fundamental shift towards technology-enabled supply chain management. Further analysis reveals a growing preference for integrated logistics solutions that offer end-to-end visibility and control over the supply chain. This trend is particularly evident in the wholesale and retail trade segment, where businesses are increasingly outsourcing their logistics operations to specialized providers to gain a competitive edge.

Dominant Regions, Countries, or Segments in Russia Freight And Logistics Market

The Russia freight and logistics market exhibits distinct patterns of dominance across various segments and regions. Within the End User Industry classification, Manufacturing and Wholesale and Retail Trade are the primary drivers of demand, accounting for approximately xx% and xx% of the market, respectively. This dominance is fueled by the substantial volume of goods produced and distributed within these sectors. The Oil and Gas sector also represents a significant, albeit more specialized, segment, contributing approximately xx% to the market's overall value, primarily through pipeline and specialized freight transport.

In terms of Logistics Functions, Freight Transport and Freight Forwarding represent the largest components. Freight Transport, particularly Road and Rail, handles the bulk of domestic cargo movement, contributing around xx% and xx% of the logistics market respectively. Freight Forwarding, with its reliance on Sea and Inland Waterways and Air modes, plays a crucial role in international trade and specialized cargo movement, accounting for approximately xx% and xx% of the forwarding segment. The Courier, Express, and Parcel (CEP) segment is experiencing rapid growth, driven by e-commerce, and is projected to capture xx% of the logistics market by 2033, with domestic CEP services outperforming international ones.

Geographically, the Western regions of Russia, particularly around Moscow and Saint Petersburg, are dominant due to their high population density, established industrial base, and major transportation hubs. These regions benefit from extensive road and rail networks, facilitating efficient freight forwarding Russia and domestic distribution. Key drivers for this dominance include:

- Economic Policies: Government initiatives promoting industrial development and trade.

- Infrastructure: Well-developed road, rail, and port infrastructure.

- Market Concentration: High presence of major logistics providers and end-users.

- Trade Hubs: Proximity to major international trade routes and border crossings.

The Manufacturing sector's significant contribution stems from its need for raw material import and finished product export. Similarly, the Wholesale and Retail Trade segment's growth is intrinsically linked to consumer demand and the efficient movement of goods through the supply chain. The Oil and Gas sector’s demand for logistics is characterized by specialized heavy-lift and project cargo, often utilizing pipelines and specialized sea vessels.

Russia Freight And Logistics Market Product Landscape

The Russia freight and logistics market is evolving with a focus on enhanced efficiency and visibility through technological integration. Product innovations are centered around digital platforms offering real-time tracking, route optimization using AI, and automated warehouse management systems. Applications range from facilitating seamless e-commerce logistics Russia to managing complex industrial supply chains for the Oil and Gas and Manufacturing sectors. Performance metrics are increasingly being measured by delivery speed, cost reduction, and carbon footprint minimization. Unique selling propositions for logistics providers include the ability to offer end-to-end supply chain solutions, specialized handling for temperature-sensitive goods (in the Warehousing and Storage segment), and reliable cross-border freight forwarding Russia. Technological advancements are also addressing the unique challenges of Russia's vast geography, with innovative solutions for cold chain logistics and last-mile delivery in remote areas.

Key Drivers, Barriers & Challenges in Russia Freight And Logistics Market

Key Drivers:

- Growing E-commerce Penetration: The rapid expansion of online retail fuels demand for efficient Courier, Express, and Parcel (CEP) services and last-mile delivery solutions.

- Industrial Growth: Expansion in sectors like Manufacturing and Construction drives demand for inbound and outbound freight transport.

- Infrastructure Development: Government investments in roads, railways, and ports enhance connectivity and reduce transit times for freight forwarding Russia.

- Technological Advancements: Adoption of digital platforms, automation, and AI optimizes operations and improves service quality.

Barriers & Challenges:

- Vast Geographic Expanse: The sheer size of Russia presents logistical challenges in terms of transit times and last-mile delivery costs.

- Regulatory Hurdles: Complex customs procedures and varying regional regulations can impede cross-border and domestic supply chain management Russia.

- Economic Volatility: Fluctuations in the Russian economy can impact freight volumes and investment in logistics infrastructure.

- Infrastructure Gaps: Despite development, certain regions still suffer from underdeveloped infrastructure, increasing operational costs.

- Skilled Workforce Shortage: A need for trained professionals in specialized logistics roles, particularly in warehousing and cold chain.

- Geopolitical Factors: International sanctions and trade relations can impact cross-border freight forwarding Russia.

Emerging Opportunities in Russia Freight And Logistics Market

Emerging opportunities in the Russia freight and logistics market lie in the continued growth of e-commerce, necessitating enhanced e-commerce logistics Russia solutions and innovative last-mile delivery models. The development of specialized cold chain logistics for the growing Agriculture, Fishing, and Forestry and Wholesale and Retail Trade sectors presents a significant avenue for growth. Furthermore, the increasing demand for sustainable logistics solutions, driven by global environmental concerns, offers opportunities for companies investing in greener transportation options and energy-efficient warehousing. The expansion of logistics infrastructure in remote regions, supported by government initiatives, also presents untapped market potential for transportation and logistics Russia providers.

Growth Accelerators in the Russia Freight And Logistics Market Industry

Catalysts driving long-term growth in the Russia freight and logistics market include ongoing investments in digital transformation, focusing on end-to-end supply chain visibility and automation. Strategic partnerships between logistics providers, technology companies, and major industrial players are fostering innovation and expanding service offerings. Market expansion strategies targeting underserved regions and specialized cargo segments, such as project cargo for the Oil and Gas sector, will further accelerate growth. The development of multimodal transportation hubs and the optimization of intermodal connectivity are crucial for improving efficiency and reducing costs, thereby supporting the sustained expansion of the Russian logistics services sector.

Key Players Shaping the Russia Freight And Logistics Market Market

- Delo Group

- FESCO Transportation Group

- DHL Group

- Volga-Dnepr Group

- A2 Cargo

- Sovtransavto Group

- Volga Shipping

- Eurosib Group

- Delko

- STS Logistics

Notable Milestones in Russia Freight And Logistics Market Sector

- February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos, highlighting a growing emphasis on environmental responsibility within the industry.

- November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. This premium and logistics partnership, in place since the 2014-2015 winter season, includes logistics for all equipment and athlete branding, showcasing DHL's commitment to specialized sports logistics.

- November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies, demonstrating strategic collaboration and expansion within the Russian logistics services sector.

In-Depth Russia Freight And Logistics Market Market Outlook

The Russia freight and logistics market outlook is highly positive, driven by a synergistic combination of technological adoption and evolving market demands. Growth accelerators such as enhanced digital integration, strategic alliances, and targeted market expansion into less developed regions will propel the industry forward. The increasing focus on sustainability and the potential for further infrastructure development are key indicators of robust future growth. Companies that can effectively navigate regulatory landscapes and leverage innovative solutions for complex logistical challenges are well-positioned to capitalize on the expanding market opportunities within transportation and logistics Russia. The continuous evolution of e-commerce and specialized industrial needs will ensure a dynamic and growth-oriented future for the Russian logistics services sector.

Russia Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Russia Freight And Logistics Market Segmentation By Geography

- 1. Russia

Russia Freight And Logistics Market Regional Market Share

Geographic Coverage of Russia Freight And Logistics Market

Russia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Freight And Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delo Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FESCO Transportation Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volga-Dnepr Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 A2 Cargo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sovtransavto Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volga Shipping

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurosib Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delko

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 STS Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delo Group

List of Figures

- Figure 1: Russia Freight And Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Freight And Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Russia Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: Russia Freight And Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Freight And Logistics Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: Russia Freight And Logistics Market Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: Russia Freight And Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Freight And Logistics Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Russia Freight And Logistics Market?

Key companies in the market include Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Grou, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, STS Logistics.

3. What are the main segments of the Russia Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. The premium and logistics partnership has been in place since the 2014-2015 winter season, and it includes logistics for all equipment during the seasons, along with the branding of sports equipment and clothing of athletes.November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Russia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence