Key Insights

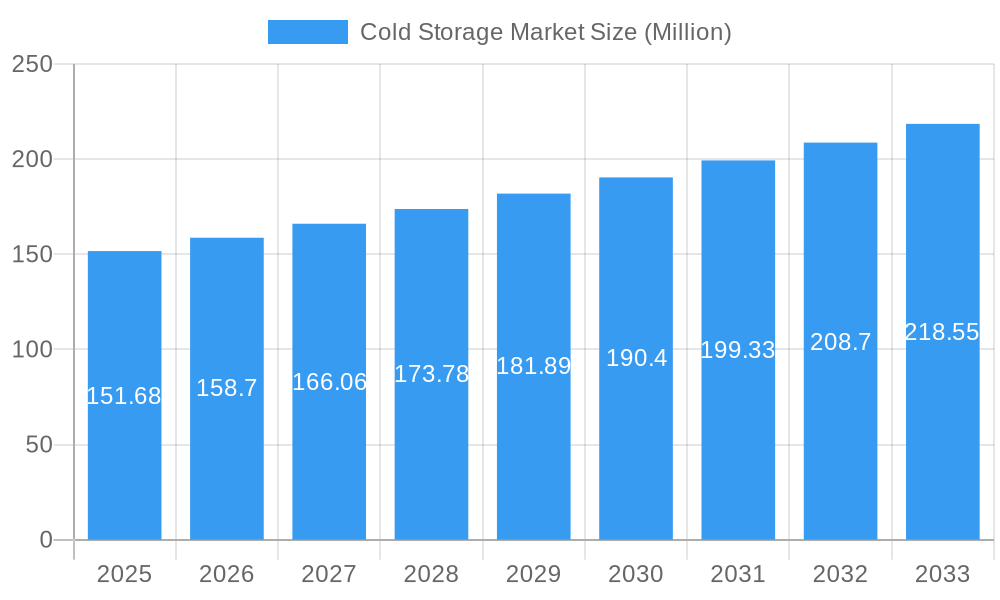

The global Cold Storage Market is poised for robust expansion, with an estimated market size of USD 151.68 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.61% through 2033. This growth is propelled by a confluence of dynamic market drivers, including the escalating demand for temperature-sensitive goods, particularly in the food and beverage and pharmaceutical sectors. The increasing complexity of global supply chains and the rising need for efficient cold chain logistics to minimize product spoilage are further fueling market expansion. Furthermore, advancements in cold storage technologies, such as the adoption of energy-efficient refrigeration systems and sophisticated inventory management software, are enhancing operational efficiency and contributing to market growth. The expanding e-commerce landscape, with its emphasis on rapid delivery of perishable goods, also presents a significant opportunity for the cold storage sector.

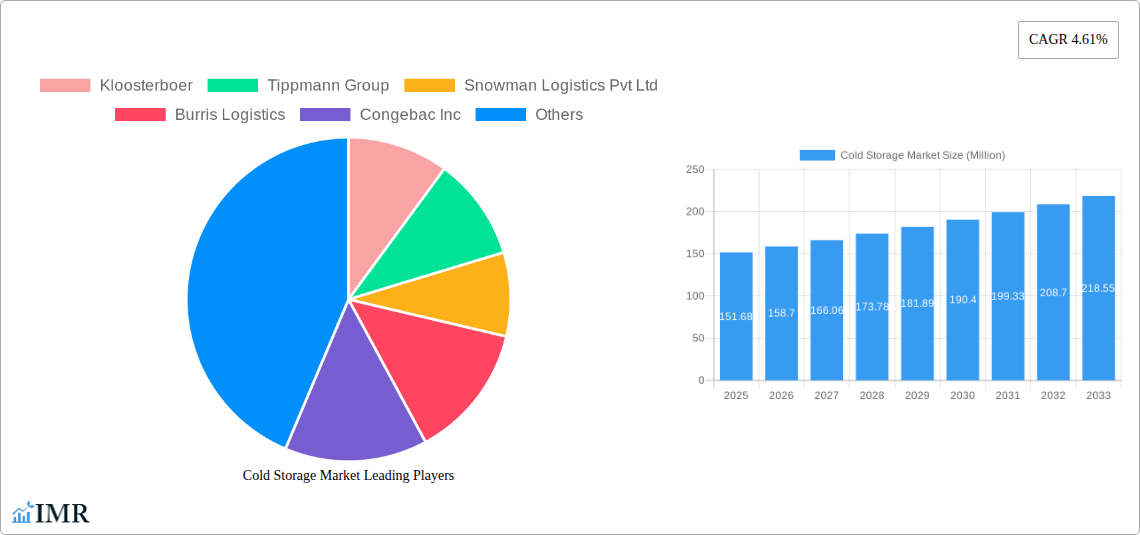

Cold Storage Market Market Size (In Million)

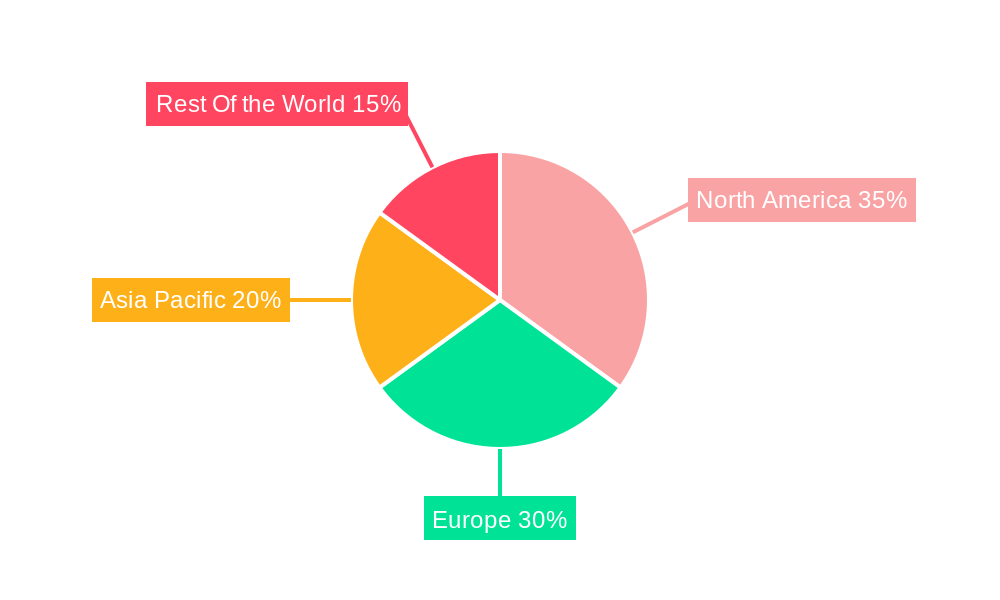

The market is segmented across various construction types, including bulk storage, production stores, and ports, catering to diverse logistical needs. Temperature-controlled environments, encompassing chilled and frozen segments, are critical for preserving the quality and extending the shelf life of products. Key applications range from fruits and vegetables, dairy, fish, meat, and seafood to processed foods and pharmaceuticals, highlighting the pervasive influence of cold storage across multiple industries. North America and Europe currently lead in market share, driven by established infrastructure and stringent quality control standards. However, the Asia Pacific region is anticipated to witness the highest growth rate due to its burgeoning population, increasing disposable incomes, and the rapid development of its food processing and pharmaceutical industries. Key players like Lineage Logistics Holdings, Americold Logistics LLC, and Nichirei Corporation are actively investing in expanding their capacity and technological capabilities to meet the growing global demand for reliable cold chain solutions.

Cold Storage Market Company Market Share

Comprehensive Cold Storage Market Report: Global Outlook and Growth Trajectories (2019-2033)

This in-depth report provides a definitive analysis of the global Cold Storage Market, a critical component of modern supply chains. Spanning from 2019 to 2033, with a detailed focus on the 2025 base and estimated year, this research offers unparalleled insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the strategic moves of leading players. Covering parent and child markets, this report is an essential resource for industry professionals seeking to understand the evolving landscape of temperature-controlled logistics. Values are presented in Million units.

Cold Storage Market Market Dynamics & Structure

The global Cold Storage Market is characterized by a moderate to high level of concentration, with a few key players dominating significant market shares. Technological innovation is a primary driver, focusing on energy efficiency, automation, and real-time monitoring solutions to reduce operational costs and enhance product integrity. Regulatory frameworks, particularly those related to food safety and pharmaceutical storage, are stringent and continuously evolving, necessitating significant compliance investments. Competitive product substitutes are limited within the core cold chain logistics, but advancements in food preservation technologies and decentralized logistics models present indirect challenges. End-user demographics are increasingly diverse, with growing demand from e-commerce grocery, ready-to-eat meals, and the pharmaceutical sector. Mergers and acquisitions (M&A) are a consistent trend, with companies seeking to expand geographical reach, enhance service offerings, and achieve economies of scale. For instance, in the historical period 2019-2024, the volume of M&A deals has shown a steady increase, reflecting consolidation efforts. Innovation barriers include high capital expenditure for infrastructure development and the need for specialized expertise.

- Market Concentration: Moderate to High, driven by significant capital requirements and economies of scale.

- Technological Innovation: Focus on IoT, automation, energy-efficient refrigeration, and advanced inventory management.

- Regulatory Frameworks: Strict adherence to food safety (HACCP, FSMA), pharmaceutical GDP, and environmental regulations.

- End-User Diversification: Growing demand from e-commerce, quick-service restaurants (QSRs), and biopharmaceutical logistics.

- M&A Trends: Strategic acquisitions to gain market share, expand service portfolios, and enter new geographies.

Cold Storage Market Growth Trends & Insights

The Cold Storage Market is experiencing robust growth, driven by escalating demand for temperature-sensitive products, particularly in the food & beverage and pharmaceutical sectors. The forecast period (2025-2033) is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8%, reaching an estimated market size of $340,000 million by 2033. This expansion is fueled by evolving consumer preferences towards fresh and frozen foods, the burgeoning e-commerce grocery market, and the increasing global trade of perishable goods. Technological disruptions, such as the implementation of AI-powered inventory management systems and advanced refrigeration technologies, are enhancing operational efficiency and reducing spoilage rates, thereby improving adoption rates. Consumer behavior shifts towards convenience and health consciousness are further propelling the demand for frozen and chilled food products. The market penetration of modern cold storage facilities is steadily increasing, particularly in emerging economies where existing infrastructure is being upgraded to meet international standards. The expansion of online grocery delivery services has been a significant catalyst, requiring a more sophisticated and widespread cold chain network to maintain product quality from farm to fork. This trend is further reinforced by the growing global population and the need for efficient food distribution to reduce waste.

- Market Size Evolution: Projected to grow from approximately $195,000 million in 2025 to $340,000 million by 2033.

- CAGR: Estimated at 7.8% during the forecast period 2025-2033.

- Adoption Rates: Increasing adoption of automated systems and energy-efficient technologies in existing and new facilities.

- Technological Disruptions: AI for inventory management, IoT for real-time temperature monitoring, and advanced insulation materials.

- Consumer Behavior Shifts: Growing demand for fresh, organic, and ready-to-eat frozen meals; increased reliance on online grocery platforms.

Dominant Regions, Countries, or Segments in Cold Storage Market

North America, particularly the United States, currently holds a dominant position in the global Cold Storage Market, driven by its well-established infrastructure, high per capita consumption of frozen and chilled foods, and a robust pharmaceutical industry. The US cold storage capacity is estimated to be around 180,000 thousand cubic feet in 2025. The Frozen temperature segment is a significant contributor, accounting for over 55% of the total market value due to the widespread demand for frozen foods and pharmaceuticals. Within the application segment, Fruits & Vegetables and Meat, Fish, & Seafood are the largest contributors, followed by Dairy and Processed Food. Economic policies favoring infrastructure development and food security initiatives further bolster growth in this region. Europe, especially countries like the UK, Germany, and France, also represents a mature market with substantial demand and advanced cold chain logistics.

However, the Asia-Pacific region is emerging as the fastest-growing market, driven by rapid urbanization, increasing disposable incomes, and the growing adoption of modern retail and e-commerce. Countries like China and India are witnessing massive investments in cold storage infrastructure to support their expanding food processing and pharmaceutical industries. Government initiatives to improve cold chain logistics, reduce post-harvest losses, and enhance food safety are key drivers in this region. The construction type of Bulk storage facilities remains dominant due to the scale of agricultural production, but the growth in Ports is significant, facilitating international trade of perishable goods.

- Dominant Region: North America (particularly the United States), followed by Europe.

- Fastest Growing Region: Asia-Pacific (China, India).

- Dominant Temperature Segment: Frozen (over 55% market share).

- Key Application Segments: Fruits & Vegetables, Meat, Fish, & Seafood, Dairy, Processed Food, Pharmaceuticals.

- Dominant Construction Type: Bulk storage facilities, with significant growth in Ports for international trade.

- Growth Drivers in Asia-Pacific: Urbanization, rising disposable incomes, e-commerce expansion, and government support.

Cold Storage Market Product Landscape

The Cold Storage Market product landscape is evolving with a strong emphasis on technologically advanced and sustainable solutions. Innovations in refrigeration technology are leading to more energy-efficient systems, such as natural refrigerants and advanced compressors, reducing operational costs and environmental impact. Automated storage and retrieval systems (AS/RS) are becoming increasingly integrated, optimizing space utilization and improving throughput in warehouses. Smart sensors and IoT devices offer real-time monitoring of temperature, humidity, and other critical parameters, ensuring product integrity and enabling proactive issue resolution. The development of modular and expandable cold storage units is also gaining traction, offering flexibility for businesses with fluctuating storage needs. These advancements collectively enhance the performance metrics of cold storage facilities, leading to reduced product spoilage, improved supply chain visibility, and greater operational efficiency.

- Key Innovations: Energy-efficient refrigeration systems (natural refrigerants), automated storage and retrieval systems (AS/RS), IoT-enabled sensors for real-time monitoring.

- Product Applications: Enhanced preservation of perishable goods (food, pharmaceuticals), optimized logistics for e-commerce, and improved supply chain transparency.

- Performance Metrics: Reduced energy consumption, minimized product spoilage, increased throughput, and enhanced traceability.

Key Drivers, Barriers & Challenges in Cold Storage Market

The Cold Storage Market is propelled by several key drivers, including the increasing global demand for fresh and frozen food products, the rapid expansion of the e-commerce grocery sector, and the growing pharmaceutical and healthcare industries requiring strict temperature control for vaccines and biologics. Technological advancements in automation and energy efficiency are also significant growth catalysts.

However, the market faces notable barriers and challenges. High initial capital investment for constructing and maintaining modern cold storage facilities remains a significant hurdle, especially for small and medium-sized enterprises. Stringent regulatory compliance, including food safety standards and environmental regulations regarding refrigerants, adds to operational costs and complexity. Supply chain disruptions, such as logistics bottlenecks and labor shortages, can impact the efficiency of cold chain operations. Furthermore, competition from alternative preservation methods and the need for skilled labor to operate advanced technologies present ongoing challenges.

- Key Drivers: Rising demand for perishable goods, e-commerce growth, pharmaceutical cold chain requirements, technological advancements.

- Barriers & Challenges: High initial investment, stringent regulations, supply chain disruptions, labor shortages, competitive pressures.

Emerging Opportunities in Cold Storage Market

Emerging opportunities in the Cold Storage Market are diverse and capitalize on evolving consumer demands and technological advancements. The growing popularity of plant-based foods and alternative proteins, which often require specific temperature control for freshness and quality, presents a significant untapped market. The expansion of specialized cold chain logistics for direct-to-consumer (DTC) meal kit services and direct farm-to-table models offers new avenues for growth. Furthermore, the increasing focus on sustainability is driving demand for eco-friendly cold storage solutions, including facilities powered by renewable energy and those utilizing natural refrigerants. Developing cold chain infrastructure in emerging economies and for niche applications like lab-grown meat also represents considerable untapped potential.

- Untapped Markets: Plant-based foods, alternative proteins, lab-grown meat, direct-to-consumer (DTC) meal kits.

- Innovative Applications: Specialized logistics for temperature-sensitive biologics, direct farm-to-table distribution.

- Evolving Consumer Preferences: Demand for sustainable and eco-friendly cold chain solutions.

Growth Accelerators in the Cold Storage Market Industry

Several factors are acting as significant growth accelerators for the Cold Storage Market. The ongoing digital transformation, including the integration of AI, IoT, and blockchain, is enhancing supply chain visibility, optimizing operations, and reducing waste. Strategic partnerships between cold storage providers and logistics companies, as well as food manufacturers and pharmaceutical firms, are crucial for expanding service offerings and market reach. Furthermore, government initiatives aimed at modernizing agricultural supply chains, ensuring food security, and promoting efficient distribution networks are creating a favorable investment climate. The increasing global trade of temperature-sensitive goods, driven by globalization and the demand for diverse food products, is also a powerful accelerator, necessitating robust cold chain infrastructure across international borders.

- Technological Breakthroughs: AI-driven optimization, IoT for real-time monitoring, blockchain for enhanced traceability.

- Strategic Partnerships: Collaborations for expanded service offerings and market access.

- Market Expansion Strategies: Investments in emerging economies, development of specialized cold chain solutions.

Key Players Shaping the Cold Storage Market Market

- Kloosterboer

- Tippmann Group

- Snowman Logistics Pvt Ltd

- Burris Logistics

- Congebac Inc

- Cloverleaf Cold Storage

- The United States Cold Storage

- Lineage Logistics Holdings

- NewCold

- VX Cold Chain Logistics

- Constellation Cold Logistics

- Nichirei Corporation

- Americold Logistics LLC

Notable Milestones in Cold Storage Market Sector

- March 2023: Lineage Logistics established a new Southern Europe headquarters in Madrid, Spain, demonstrating their commitment to the region and laying the groundwork for future expansion. This move strengthens their hub network across Europe.

- March 2023: Americold Property Trust launched a facility extension at Santa Perpetua, Barcelona, Spain. This expansion added 11 loading bays and 12,000 pallet places, increasing the facility's capacity to over 20,000 pallet spaces for frozen, refrigerated, and ambient produce, and enhancing services for clients across Europe.

In-Depth Cold Storage Market Market Outlook

The future of the Cold Storage Market is exceptionally promising, driven by a confluence of sustained demand for temperature-controlled goods and continuous technological advancements. Growth accelerators such as digitalization, strategic collaborations, and supportive government policies are expected to fuel expansion. The increasing focus on sustainability will further shape market trends, favoring energy-efficient solutions and eco-friendly practices. Emerging opportunities in niche applications and underserved markets, coupled with the robust growth in e-commerce and the pharmaceutical sector, position the cold storage industry for significant long-term value creation and strategic investment. The market is poised for continued innovation and expansion to meet the evolving needs of a globalized and health-conscious consumer base.

Cold Storage Market Segmentation

-

1. Construction Type

- 1.1. Bulk storage

- 1.2. Production stores

- 1.3. Ports

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Fruits & Vegetables

- 3.2. Dairy, Fish, Meat, & Seafood

- 3.3. Processed Food

- 3.4. Pharmaceuticals

- 3.5. Others

Cold Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest Of the World

Cold Storage Market Regional Market Share

Geographic Coverage of Cold Storage Market

Cold Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Bulk storage

- 5.1.2. Production stores

- 5.1.3. Ports

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Fruits & Vegetables

- 5.3.2. Dairy, Fish, Meat, & Seafood

- 5.3.3. Processed Food

- 5.3.4. Pharmaceuticals

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest Of the World

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. North America Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Bulk storage

- 6.1.2. Production stores

- 6.1.3. Ports

- 6.2. Market Analysis, Insights and Forecast - by Temperature

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Fruits & Vegetables

- 6.3.2. Dairy, Fish, Meat, & Seafood

- 6.3.3. Processed Food

- 6.3.4. Pharmaceuticals

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Europe Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Bulk storage

- 7.1.2. Production stores

- 7.1.3. Ports

- 7.2. Market Analysis, Insights and Forecast - by Temperature

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Fruits & Vegetables

- 7.3.2. Dairy, Fish, Meat, & Seafood

- 7.3.3. Processed Food

- 7.3.4. Pharmaceuticals

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Asia Pacific Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Bulk storage

- 8.1.2. Production stores

- 8.1.3. Ports

- 8.2. Market Analysis, Insights and Forecast - by Temperature

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Fruits & Vegetables

- 8.3.2. Dairy, Fish, Meat, & Seafood

- 8.3.3. Processed Food

- 8.3.4. Pharmaceuticals

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. Rest Of the World Cold Storage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Bulk storage

- 9.1.2. Production stores

- 9.1.3. Ports

- 9.2. Market Analysis, Insights and Forecast - by Temperature

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Fruits & Vegetables

- 9.3.2. Dairy, Fish, Meat, & Seafood

- 9.3.3. Processed Food

- 9.3.4. Pharmaceuticals

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kloosterboer

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tippmann Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Snowman Logistics Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Burris Logistics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Congebac Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cloverleaf Cold Storage

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 The United States Cold Storage

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lineage Logistics Holdings

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NewCold

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 VX Cold Chain Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Constellation Cold Logistics**List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Nichirei Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Americold Logistics LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Kloosterboer

List of Figures

- Figure 1: Global Cold Storage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 3: North America Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 4: North America Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 5: North America Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 6: North America Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 11: Europe Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 12: Europe Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 13: Europe Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 14: Europe Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 19: Asia Pacific Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 20: Asia Pacific Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 21: Asia Pacific Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 22: Asia Pacific Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Cold Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest Of the World Cold Storage Market Revenue (Million), by Construction Type 2025 & 2033

- Figure 27: Rest Of the World Cold Storage Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Rest Of the World Cold Storage Market Revenue (Million), by Temperature 2025 & 2033

- Figure 29: Rest Of the World Cold Storage Market Revenue Share (%), by Temperature 2025 & 2033

- Figure 30: Rest Of the World Cold Storage Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest Of the World Cold Storage Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest Of the World Cold Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest Of the World Cold Storage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 2: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cold Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 10: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 11: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 15: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Cold Storage Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 18: Global Cold Storage Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 19: Global Cold Storage Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Cold Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Storage Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Cold Storage Market?

Key companies in the market include Kloosterboer, Tippmann Group, Snowman Logistics Pvt Ltd, Burris Logistics, Congebac Inc, Cloverleaf Cold Storage, The United States Cold Storage, Lineage Logistics Holdings, NewCold, VX Cold Chain Logistics, Constellation Cold Logistics**List Not Exhaustive, Nichirei Corporation, Americold Logistics LLC.

3. What are the main segments of the Cold Storage Market?

The market segments include Construction Type, Temperature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.68 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Rapid Growth in Import and Export Activities of Food Items and Pharmaceutical.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

March 2023: Lineage Logistics, one of the top global suppliers of temperature-controlled industrial REIT and logistics solutions, established a new Southern Europe headquarters in Madrid, Spain. Lineage's new offices in Madrid demonstrate the company's ongoing commitment to the area and create the groundwork for future expansion. Also, the increasing attention on Southern Europe strengthens ties to the hub network of Lineage Logistics in Northern Europe and elsewhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Storage Market?

To stay informed about further developments, trends, and reports in the Cold Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence