Key Insights

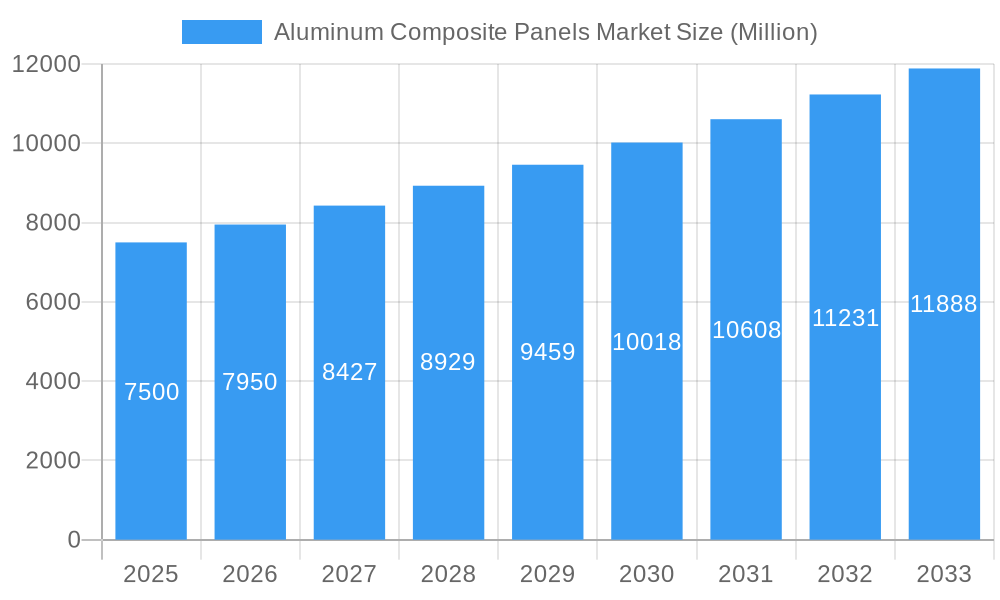

The global Aluminum Composite Panels (ACP) market is experiencing robust growth, projected to surpass \$7,500 million in size by 2025. With a Compound Annual Growth Rate (CAGR) exceeding 6.00%, the market is on a sustained upward trajectory throughout the forecast period ending in 2033. This expansion is primarily fueled by the increasing demand for lightweight, durable, and aesthetically versatile building materials, particularly in the rapidly developing construction and infrastructure sectors. Key drivers include the rising trend of modern architectural designs, a growing emphasis on energy-efficient building solutions, and favorable government initiatives promoting sustainable construction practices. The versatility of ACPs in interior decoration, exterior cladding, insulation, and specialized applications like railway carriers further bolsters their market penetration.

Aluminum Composite Panels Market Market Size (In Billion)

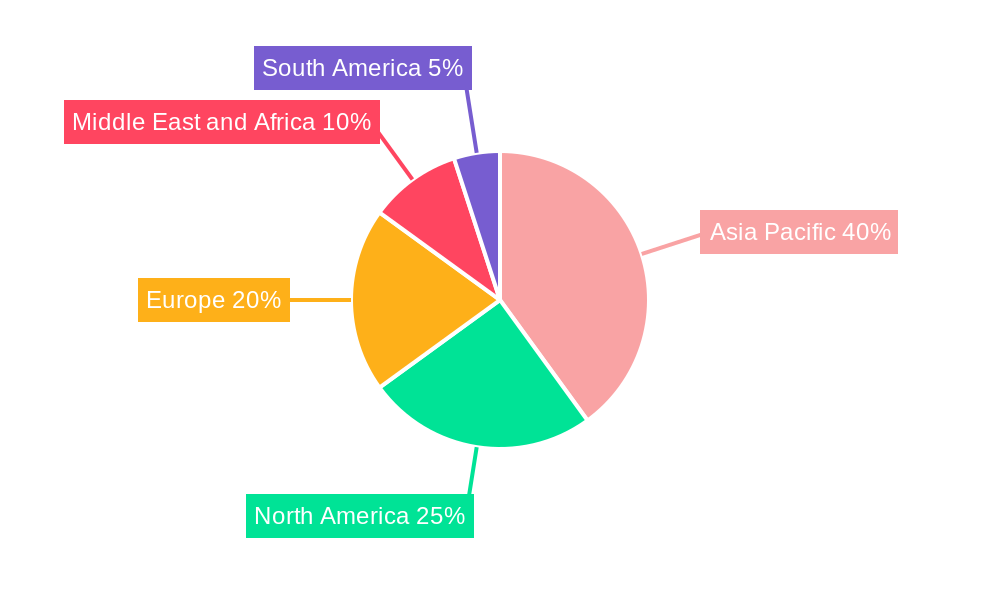

The market segmentation reveals significant opportunities across various top coatings and applications. PE (Polyester) coatings remain a dominant choice due to their cost-effectiveness and suitability for interior applications, while PVDF (Polyvinylidene Fluoride) coatings are gaining traction for their superior weather resistance and longevity in exterior applications. In terms of applications, interior decoration and cladding represent the largest segments, driven by the renovation and new construction activities worldwide. The transportation sector, with its specific demands for lightweight and impact-resistant materials, is also a notable contributor. Geographically, the Asia Pacific region, led by China and India, is expected to command the largest market share, owing to rapid urbanization, substantial infrastructure development, and a burgeoning manufacturing base. North America and Europe also present substantial market potential, driven by stringent building codes and a growing preference for sustainable and high-performance materials.

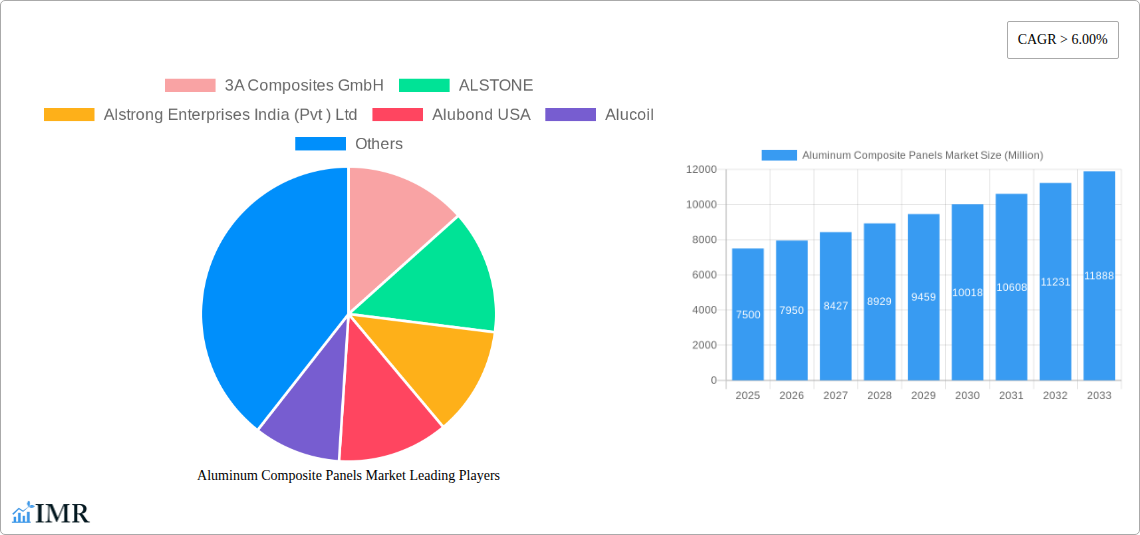

Aluminum Composite Panels Market Company Market Share

Aluminum Composite Panels Market: Comprehensive Growth Analysis, Trends, and Forecast (2019-2033)

This in-depth report offers a definitive analysis of the global Aluminum Composite Panels (ACP) market, providing critical insights into market dynamics, growth trajectories, and future opportunities. Covering the study period of 2019–2033, with a base year of 2025, this report meticulously examines parent and child market segments, essential for strategic decision-making in the rapidly evolving architectural cladding market and building materials sector. With robust data and expert analysis, stakeholders will gain a competitive edge in navigating this dynamic industry.

Aluminum Composite Panels Market Market Dynamics & Structure

The aluminum composite panels market is characterized by a moderately fragmented structure, with a mix of large global players and regional manufacturers vying for market share. Technological innovation is a significant driver, with continuous advancements in panel coatings, fire retardancy, and sustainability features. Regulatory frameworks, particularly concerning building codes and fire safety standards, play a crucial role in shaping product development and market access. Competitive product substitutes, such as traditional aluminum panels, wood, and other composite materials, exert pressure on market pricing and innovation. End-user demographics are shifting towards a greater demand for aesthetic versatility, durability, and energy-efficient building solutions. Mergers and acquisitions (M&A) activity within the sector aims to consolidate market presence, expand product portfolios, and enhance manufacturing capabilities. For instance, recent M&A trends indicate a strong focus on acquiring companies with advanced manufacturing technologies or established distribution networks. Innovation barriers include high research and development costs and the need for extensive product testing and certification.

- Market Concentration: Moderately fragmented, with key players holding significant, but not dominant, market shares.

- Technological Innovation: Driven by advancements in fire-resistant cores, eco-friendly coatings, and customizable aesthetic finishes for facade cladding and interior decoration.

- Regulatory Frameworks: Evolving building codes and fire safety regulations in major economies significantly influence product specifications and market acceptance.

- Competitive Substitutes: Traditional materials and alternative composite solutions present ongoing competition, particularly in price-sensitive markets.

- End-User Demographics: Growing demand for sustainable, visually appealing, and high-performance building materials from the building and construction sector.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand geographical reach. Recent deal volumes are estimated at xx million units in terms of value.

Aluminum Composite Panels Market Growth Trends & Insights

The aluminum composite panels market is projected to witness robust growth driven by increasing urbanization, significant investments in infrastructure development, and a rising preference for aesthetically pleasing and durable building materials. The market size is expected to expand from an estimated $XX billion in 2025 to $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period of 2025–2033. Adoption rates are accelerating globally, fueled by the inherent advantages of ACPs, including their lightweight nature, excellent formability, weather resistance, and ease of installation, making them ideal for diverse applications such as building facades, signage, and decorative elements. Technological disruptions are playing a pivotal role, with manufacturers continuously innovating to introduce panels with enhanced fire resistance, thermal insulation properties, and sustainable material compositions. The demand for PVDF (Polyvinylidene Fluoride) coated aluminum composite panels is particularly strong due to their superior durability and resistance to fading. Consumer behavior is shifting towards more sustainable and aesthetically superior building solutions, with architects and developers increasingly specifying ACPs for both residential and commercial projects. The interior decoration segment is also witnessing substantial growth, as ACPs offer a cost-effective and versatile alternative for wall panels, ceilings, and furniture design. The growing awareness of energy-efficient building practices further propels the adoption of ACPs due to their potential contribution to insulation.

Dominant Regions, Countries, or Segments in Aluminum Composite Panels Market

The Asia Pacific region is currently the dominant force in the global aluminum composite panels market, driven by rapid industrialization, extensive construction activities, and favorable government initiatives supporting infrastructure development in countries like China, India, and Southeast Asian nations. Within this region, China stands out as a leading consumer and producer, accounting for a significant portion of the global market share. The building and construction end-user industry is the primary growth engine, with a relentless demand for innovative and aesthetically appealing materials for high-rise buildings, commercial complexes, and residential projects.

Among the segments, Cladding stands as the most significant application, accounting for an estimated XX% of the market share in 2025. This dominance is attributed to ACPs' ability to provide both functional and decorative benefits to building exteriors, offering excellent weather resistance and design flexibility. The PVDF (Polyvinylidene Fluoride) top coating segment also exhibits strong leadership, driven by its superior durability, UV resistance, and longevity, making it the preferred choice for premium architectural applications. The building and construction end-user industry, as previously mentioned, is the most dominant, reflecting the widespread use of ACPs in creating modern and sustainable architectural designs. Key drivers for this dominance include:

- Rapid Urbanization: An ever-increasing demand for new residential and commercial spaces.

- Infrastructure Development: Government investments in public projects like airports, metro stations, and convention centers.

- Economic Growth: Rising disposable incomes leading to enhanced demand for aesthetically superior and durable construction materials.

- Architectural Trends: A global shift towards contemporary designs that leverage the versatility of ACPs for unique facades and interior finishes.

- Product Innovation: Continuous development of panels with enhanced fire-retardant properties and eco-friendly manufacturing processes.

In terms of growth potential, while Asia Pacific leads, emerging markets in the Middle East and Africa are showing promising growth trajectories due to significant infrastructure projects and increasing adoption of modern building materials. The Transportation end-user industry, particularly for railway carriers and interior fittings, is also a growing segment, showcasing the versatility of ACPs beyond traditional construction.

Aluminum Composite Panels Market Product Landscape

The aluminum composite panels market product landscape is defined by continuous innovation focused on enhancing performance and expanding application possibilities. Key product advancements include the development of panels with superior fire-retardant cores, offering increased safety and compliance with stringent building regulations. Eco-friendly manufacturing processes and the incorporation of recycled materials are also gaining traction, aligning with global sustainability trends. The availability of a wide array of colors, finishes, and textures, including metallic, wood grain, and stone effects, allows for unparalleled design freedom in interior decoration and exterior cladding. Performance metrics such as tensile strength, bending modulus, and weatherability are constantly being optimized to meet the demands of diverse applications, from high-rise building facades to specialized uses in the transportation sector. Unique selling propositions often revolve around a combination of aesthetic appeal, durability, lightweight construction, and cost-effectiveness compared to traditional materials.

Key Drivers, Barriers & Challenges in Aluminum Composite Panels Market

The aluminum composite panels market is propelled by several key drivers. The increasing global focus on sustainable and aesthetically appealing architecture is a primary force, driving demand for versatile materials like ACPs. Advancements in manufacturing technologies, leading to improved product performance, durability, and cost-effectiveness, also contribute significantly. Furthermore, government initiatives promoting green building practices and infrastructure development projects worldwide are creating substantial market opportunities.

- Drivers:

- Rising demand for modern, durable, and aesthetically pleasing building facades.

- Technological advancements in fire resistance and material sustainability.

- Global infrastructure development projects and urbanization trends.

- Cost-effectiveness and ease of installation compared to traditional materials.

However, the market faces several challenges and restraints. Fluctuations in raw material prices, particularly aluminum, can impact production costs and market pricing. Stringent fire safety regulations in some regions can pose a barrier for certain types of ACPs, necessitating ongoing research and development for compliant products. Intense competition from alternative building materials and a fragmented market structure can also exert downward pressure on profit margins.

- Barriers & Challenges:

- Volatility in raw material prices (aluminum).

- Strict fire safety regulations and compliance requirements in certain markets.

- Intense price competition from other building materials.

- Supply chain disruptions and logistical complexities.

Emerging Opportunities in Aluminum Composite Panels Market

Emerging opportunities in the aluminum composite panels market are diverse and promising. The growing demand for high-performance, lightweight materials in the automotive and aerospace sectors presents a significant untapped market. Furthermore, the increasing trend of retrofitting existing buildings for energy efficiency and aesthetic enhancement offers substantial growth potential. The development of innovative ACPs with integrated functionalities, such as self-cleaning surfaces or enhanced insulation capabilities, is expected to create new market niches. Expansion into developing economies with burgeoning construction sectors and evolving architectural preferences also represents a key opportunity for market players.

Growth Accelerators in the Aluminum Composite Panels Market Industry

Several catalysts are accelerating long-term growth in the aluminum composite panels market. Technological breakthroughs in core materials and coatings are continuously improving panel performance, expanding their application range. Strategic partnerships between manufacturers, architects, and developers are fostering innovation and driving the adoption of ACPs in cutting-edge projects. Market expansion strategies, including the penetration of emerging economies and the development of specialized product lines catering to specific industry needs, are also crucial growth accelerators. The increasing emphasis on circular economy principles and the development of recyclable ACPs will further boost their market appeal.

Key Players Shaping the Aluminum Composite Panels Market Market

- 3A Composites GmbH

- ALSTONE

- Alstrong Enterprises India (Pvt ) Ltd

- Alubond USA

- Alucoil

- Arconic Inc

- Eurobond

- GUANGZHOU XINGHE ACP CO LTD

- Interplast (Harwal Group of Companies)

- Jyi Shyang Industrial Co Ltd

- Mitsubishi Chemical Corporation

- Mulford

- Qatar National Aluminium Panel Company

- Yaret Industrial Group Co Ltd

- YingJia Aluminium Co Ltd

Notable Milestones in Aluminum Composite Panels Market Sector

- October 2022: Aludecor, India's one of the leading aluminum composite panel brands, inaugurated its third manufacturing unit in Haridwar, India, significantly boosting its production capacity and market reach.

In-Depth Aluminum Composite Panels Market Market Outlook

The aluminum composite panels market is poised for sustained growth, driven by a confluence of factors including ongoing urbanization, a global drive for sustainable construction, and continuous product innovation. The increasing adoption of ACPs in diverse applications, from high-end architectural facades to interior design, underscores their versatility and appeal. Strategic investments in advanced manufacturing capabilities and a focus on developing eco-friendly solutions will be critical for market players to capitalize on emerging opportunities. The market's outlook remains exceptionally positive, promising substantial growth and innovation in the coming years.

Aluminum Composite Panels Market Segmentation

-

1. Top Coating

- 1.1. PE (Polyester)

- 1.2. PVDF (Polyvinylidene Fluoride)

- 1.3. Other Top Coatings

-

2. Application

- 2.1. Interior Decoration

- 2.2. Hoarding

- 2.3. Insulation

- 2.4. Cladding

- 2.5. Railway Carrier

- 2.6. Column Cover and Beam Wrap

- 2.7. Other Applications

-

3. End-user Industry

- 3.1. Building and Construction

- 3.2. Transportation

- 3.3. Other End-user Industries

Aluminum Composite Panels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Aluminum Composite Panels Market Regional Market Share

Geographic Coverage of Aluminum Composite Panels Market

Aluminum Composite Panels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for PVDF-based Aluminum Composite Panels; Increasing Demand for Strong and Lightweight Materials in Construction and Transportation; Strong Demand for Hoardings from the Advertising Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for PVDF-based Aluminum Composite Panels; Increasing Demand for Strong and Lightweight Materials in Construction and Transportation; Strong Demand for Hoardings from the Advertising Industry

- 3.4. Market Trends

- 3.4.1. Demand for Strong and Lightweight Materials in Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Top Coating

- 5.1.1. PE (Polyester)

- 5.1.2. PVDF (Polyvinylidene Fluoride)

- 5.1.3. Other Top Coatings

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Interior Decoration

- 5.2.2. Hoarding

- 5.2.3. Insulation

- 5.2.4. Cladding

- 5.2.5. Railway Carrier

- 5.2.6. Column Cover and Beam Wrap

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Building and Construction

- 5.3.2. Transportation

- 5.3.3. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Top Coating

- 6. Asia Pacific Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Top Coating

- 6.1.1. PE (Polyester)

- 6.1.2. PVDF (Polyvinylidene Fluoride)

- 6.1.3. Other Top Coatings

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Interior Decoration

- 6.2.2. Hoarding

- 6.2.3. Insulation

- 6.2.4. Cladding

- 6.2.5. Railway Carrier

- 6.2.6. Column Cover and Beam Wrap

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Building and Construction

- 6.3.2. Transportation

- 6.3.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Top Coating

- 7. North America Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Top Coating

- 7.1.1. PE (Polyester)

- 7.1.2. PVDF (Polyvinylidene Fluoride)

- 7.1.3. Other Top Coatings

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Interior Decoration

- 7.2.2. Hoarding

- 7.2.3. Insulation

- 7.2.4. Cladding

- 7.2.5. Railway Carrier

- 7.2.6. Column Cover and Beam Wrap

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Building and Construction

- 7.3.2. Transportation

- 7.3.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Top Coating

- 8. Europe Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Top Coating

- 8.1.1. PE (Polyester)

- 8.1.2. PVDF (Polyvinylidene Fluoride)

- 8.1.3. Other Top Coatings

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Interior Decoration

- 8.2.2. Hoarding

- 8.2.3. Insulation

- 8.2.4. Cladding

- 8.2.5. Railway Carrier

- 8.2.6. Column Cover and Beam Wrap

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Building and Construction

- 8.3.2. Transportation

- 8.3.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Top Coating

- 9. South America Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Top Coating

- 9.1.1. PE (Polyester)

- 9.1.2. PVDF (Polyvinylidene Fluoride)

- 9.1.3. Other Top Coatings

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Interior Decoration

- 9.2.2. Hoarding

- 9.2.3. Insulation

- 9.2.4. Cladding

- 9.2.5. Railway Carrier

- 9.2.6. Column Cover and Beam Wrap

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Building and Construction

- 9.3.2. Transportation

- 9.3.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Top Coating

- 10. Middle East and Africa Aluminum Composite Panels Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Top Coating

- 10.1.1. PE (Polyester)

- 10.1.2. PVDF (Polyvinylidene Fluoride)

- 10.1.3. Other Top Coatings

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Interior Decoration

- 10.2.2. Hoarding

- 10.2.3. Insulation

- 10.2.4. Cladding

- 10.2.5. Railway Carrier

- 10.2.6. Column Cover and Beam Wrap

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Building and Construction

- 10.3.2. Transportation

- 10.3.3. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Top Coating

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3A Composites GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ALSTONE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alstrong Enterprises India (Pvt ) Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alubond USA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alucoil

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arconic Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eurobond

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GUANGZHOU XINGHE ACP CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Interplast (Harwal Group of Companies)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jyi Shyang Industrial Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mitsubishi Chemical Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mulford

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Qatar National Aluminium Panel Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yaret Industrial Group Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 YingJia Aluminium Co Ltd*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 3A Composites GmbH

List of Figures

- Figure 1: Global Aluminum Composite Panels Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Aluminum Composite Panels Market Revenue (undefined), by Top Coating 2025 & 2033

- Figure 3: Asia Pacific Aluminum Composite Panels Market Revenue Share (%), by Top Coating 2025 & 2033

- Figure 4: Asia Pacific Aluminum Composite Panels Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Aluminum Composite Panels Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Aluminum Composite Panels Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Aluminum Composite Panels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Aluminum Composite Panels Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific Aluminum Composite Panels Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Aluminum Composite Panels Market Revenue (undefined), by Top Coating 2025 & 2033

- Figure 11: North America Aluminum Composite Panels Market Revenue Share (%), by Top Coating 2025 & 2033

- Figure 12: North America Aluminum Composite Panels Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: North America Aluminum Composite Panels Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Aluminum Composite Panels Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: North America Aluminum Composite Panels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Aluminum Composite Panels Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: North America Aluminum Composite Panels Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Aluminum Composite Panels Market Revenue (undefined), by Top Coating 2025 & 2033

- Figure 19: Europe Aluminum Composite Panels Market Revenue Share (%), by Top Coating 2025 & 2033

- Figure 20: Europe Aluminum Composite Panels Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Europe Aluminum Composite Panels Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Aluminum Composite Panels Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe Aluminum Composite Panels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Aluminum Composite Panels Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Aluminum Composite Panels Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Aluminum Composite Panels Market Revenue (undefined), by Top Coating 2025 & 2033

- Figure 27: South America Aluminum Composite Panels Market Revenue Share (%), by Top Coating 2025 & 2033

- Figure 28: South America Aluminum Composite Panels Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: South America Aluminum Composite Panels Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Aluminum Composite Panels Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: South America Aluminum Composite Panels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Aluminum Composite Panels Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Aluminum Composite Panels Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Aluminum Composite Panels Market Revenue (undefined), by Top Coating 2025 & 2033

- Figure 35: Middle East and Africa Aluminum Composite Panels Market Revenue Share (%), by Top Coating 2025 & 2033

- Figure 36: Middle East and Africa Aluminum Composite Panels Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: Middle East and Africa Aluminum Composite Panels Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Aluminum Composite Panels Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Aluminum Composite Panels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Aluminum Composite Panels Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Aluminum Composite Panels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 2: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 6: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Japan Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: South Korea Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 15: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: United States Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Canada Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 22: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Germany Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Italy Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 31: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Argentina Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Top Coating 2020 & 2033

- Table 38: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Aluminum Composite Panels Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Aluminum Composite Panels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: South Africa Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Aluminum Composite Panels Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aluminum Composite Panels Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Aluminum Composite Panels Market?

Key companies in the market include 3A Composites GmbH, ALSTONE, Alstrong Enterprises India (Pvt ) Ltd, Alubond USA, Alucoil, Arconic Inc, Eurobond, GUANGZHOU XINGHE ACP CO LTD, Interplast (Harwal Group of Companies), Jyi Shyang Industrial Co Ltd, Mitsubishi Chemical Corporation, Mulford, Qatar National Aluminium Panel Company, Yaret Industrial Group Co Ltd, YingJia Aluminium Co Ltd*List Not Exhaustive.

3. What are the main segments of the Aluminum Composite Panels Market?

The market segments include Top Coating, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for PVDF-based Aluminum Composite Panels; Increasing Demand for Strong and Lightweight Materials in Construction and Transportation; Strong Demand for Hoardings from the Advertising Industry.

6. What are the notable trends driving market growth?

Demand for Strong and Lightweight Materials in Construction.

7. Are there any restraints impacting market growth?

Increasing Demand for PVDF-based Aluminum Composite Panels; Increasing Demand for Strong and Lightweight Materials in Construction and Transportation; Strong Demand for Hoardings from the Advertising Industry.

8. Can you provide examples of recent developments in the market?

October 2022: Aludecor, India's one of the leading aluminum composite panel brands, inaugurated its third manufacturing unit in Haridwar, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aluminum Composite Panels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aluminum Composite Panels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aluminum Composite Panels Market?

To stay informed about further developments, trends, and reports in the Aluminum Composite Panels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence