Key Insights

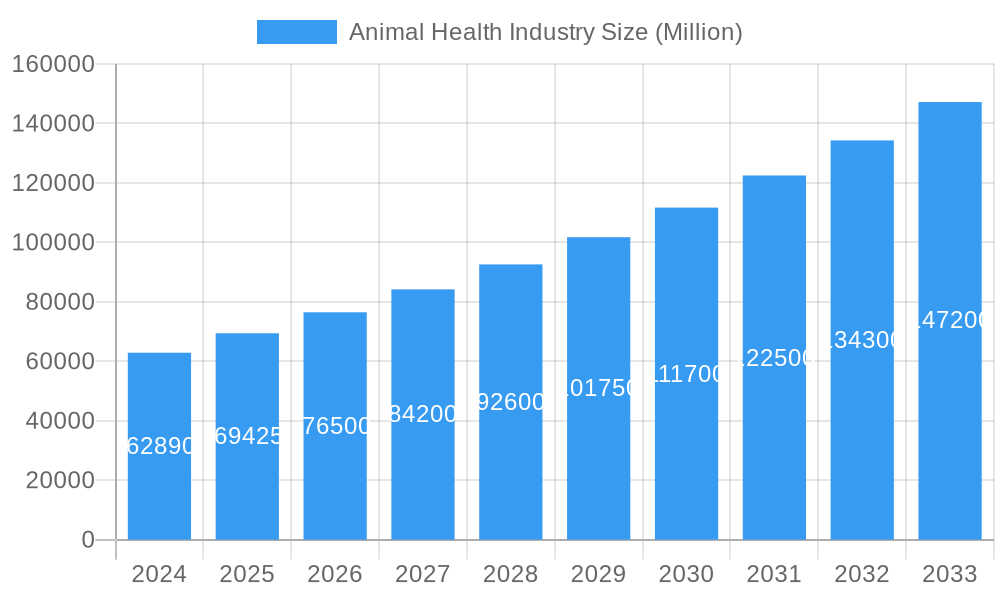

The global animal health industry is poised for significant expansion, with an estimated market size of USD 62.89 billion in 2024. This growth is fueled by a robust CAGR of 10.46% projected over the forecast period, indicating a dynamic and increasingly vital sector. The increasing humanization of pets, coupled with a greater emphasis on food security and the demand for high-quality animal protein, are primary drivers propelling this market forward. Advances in veterinary medicine, including the development of novel therapeutics and sophisticated diagnostic tools, are enhancing animal well-being and productivity. The rising prevalence of zoonotic diseases and the need for effective disease prevention and control further contribute to market acceleration. Key segments like therapeutics, particularly parasiticides and anti-infectives, alongside diagnostic tests, are experiencing substantial demand. Companion animals, specifically dogs and cats, represent a significant and growing segment due to increased pet ownership and a willingness among owners to invest heavily in their pets' health.

Animal Health Industry Market Size (In Billion)

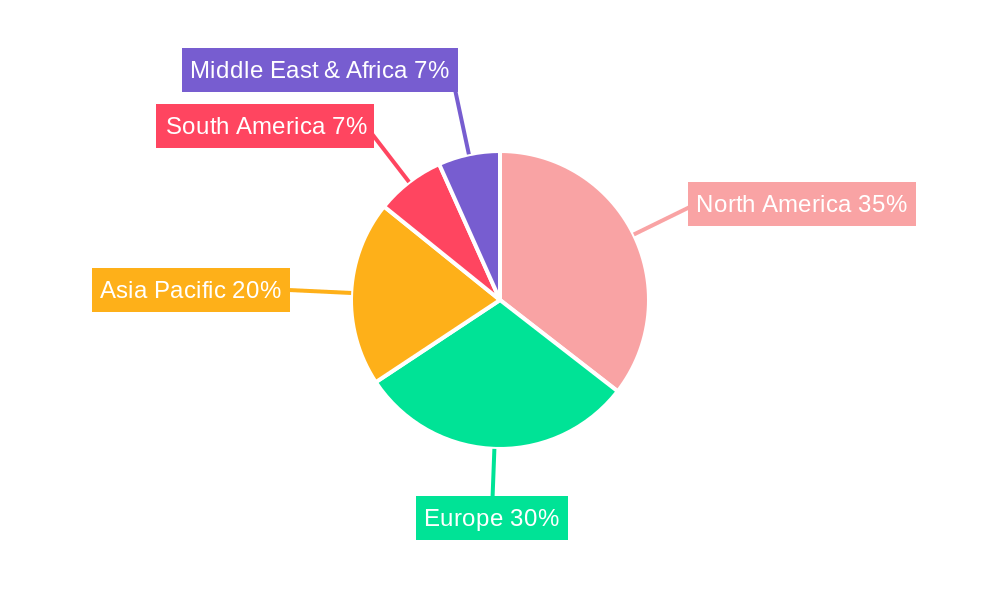

The market's trajectory is also shaped by emerging trends such as the growing adoption of biologicals and advanced biotechnological solutions in animal healthcare. Digitalization and the integration of AI in diagnostics and treatment are also set to revolutionize the industry, offering more personalized and efficient care. Despite strong growth prospects, certain restraints, such as stringent regulatory hurdles for product approvals and the high cost of research and development, can impact the pace of innovation. However, the expanding global reach of veterinary services and a growing awareness of animal welfare across both developed and emerging economies are expected to outweigh these challenges. Geographically, North America and Europe currently dominate the market, but the Asia Pacific region, driven by rapid economic development and increasing pet ownership, is anticipated to exhibit the fastest growth in the coming years.

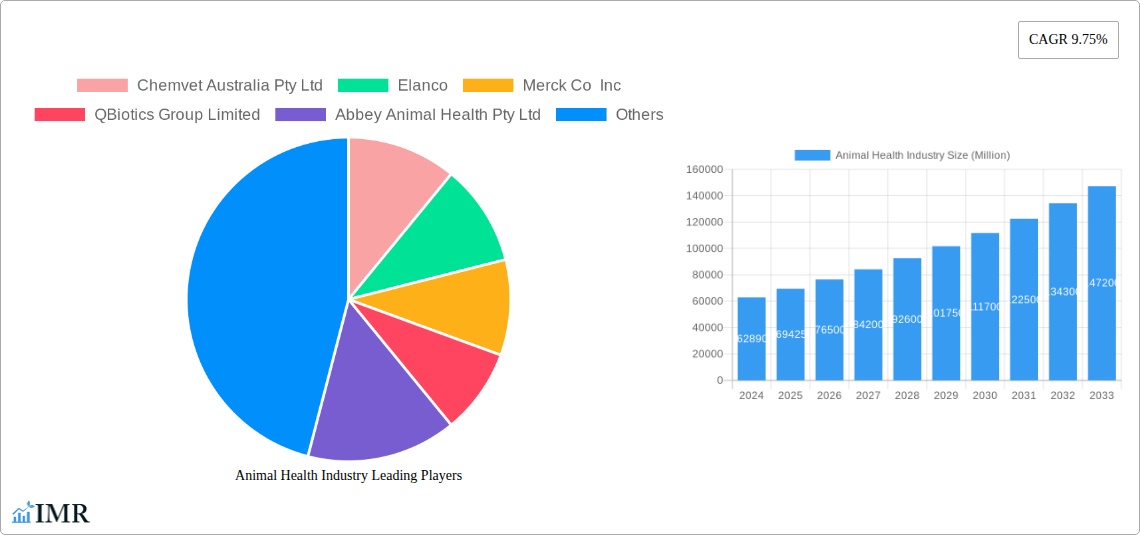

Animal Health Industry Company Market Share

Comprehensive Animal Health Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This in-depth report offers a comprehensive analysis of the global Animal Health Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and future outlook. With a study period spanning from 2019 to 2033, including a base and estimated year of 2025, and a forecast period from 2025 to 2033, this research provides critical insights for industry professionals, investors, and stakeholders. The report leverages high-traffic keywords such as "animal health market," "veterinary pharmaceuticals," "companion animal health," "livestock health," "animal diagnostics," "animal vaccines," and "parasiticides" to maximize search engine visibility. It meticulously breaks down the market by product segments (Therapeutics and Diagnostics) and animal types (Dogs and Cats, Horses, Ruminants, Swine, Poultry, and Other Animal Types), providing granular detail on parent and child markets.

Animal Health Industry Market Dynamics & Structure

The global animal health industry is characterized by a dynamic and evolving market structure, driven by increasing pet humanization, a growing demand for animal protein, and advancements in veterinary medicine. Market concentration varies across segments, with larger pharmaceutical companies holding significant shares in therapeutics, while diagnostic segments exhibit a more fragmented landscape. Technological innovation is a primary driver, fueling the development of novel vaccines, advanced diagnostic tools, and targeted treatments. Regulatory frameworks, though crucial for ensuring product safety and efficacy, can also present barriers to market entry. The competitive landscape features established players and emerging innovators, with companies constantly seeking differentiation through product development and strategic partnerships. End-user demographics are shifting, with a growing emphasis on preventive care and improved welfare for companion animals, alongside increasing investments in biosecurity and disease management for livestock. Mergers and acquisitions (M&A) are a significant trend, with companies acquiring smaller firms to expand their product portfolios, geographical reach, and manufacturing capabilities. For instance, the acquisition of Jurox by Zoetis Inc. exemplifies this trend, aiming to bolster manufacturing and expertise in the Australian market.

- Market Concentration: Therapeutics segment dominated by large multinational corporations, while Diagnostics sees increased participation from specialized companies.

- Technological Innovation: Continuous R&D in vaccines, biologics, and precision diagnostics is reshaping treatment protocols.

- Regulatory Frameworks: Strict approval processes influence product lifecycles and market access, particularly for new chemical entities.

- Competitive Product Substitutes: Advancements in generics and alternative therapies create pricing pressures and necessitate innovation.

- End-User Demographics: Rising disposable incomes and emotional bonds with pets drive demand for premium healthcare and advanced treatments.

- M&A Trends: Consolidation efforts are prevalent, with strategic acquisitions aimed at market expansion and portfolio diversification.

Animal Health Industry Growth Trends & Insights

The global animal health industry is poised for robust growth, driven by a confluence of factors that are reshaping market dynamics and consumer behavior. The market size is projected to expand significantly, fueled by an increasing adoption rate of advanced veterinary care, particularly for companion animals. Technological disruptions, ranging from gene editing for disease prevention to AI-powered diagnostic tools, are revolutionizing the industry, offering more precise and effective solutions. Consumer behavior shifts are also playing a pivotal role, with pet owners increasingly treating their animals as family members, willing to invest more in their health and well-being. This trend is evident in the rising demand for preventative care, specialized diets, and sophisticated medical treatments. The livestock sector also contributes to growth through an emphasis on food safety, efficient production, and disease control to meet the escalating global demand for animal protein. The industry is witnessing a substantial increase in market penetration of innovative products and services, leading to improved animal welfare and productivity.

The CAGR for the animal health market is estimated at an impressive XX% during the forecast period. Market penetration for advanced diagnostics and novel therapeutic solutions is expected to rise from XX% in 2025 to XX% by 2033. The global animal health market size, valued at approximately $XX billion in 2025, is projected to reach $XX billion by 2033. This growth trajectory is underpinned by consistent investments in research and development, leading to a pipeline of groundbreaking innovations. The increasing focus on zoonotic disease prevention further bolsters the demand for vaccines and diagnostic solutions. Furthermore, the expansion of veterinary services in emerging economies, coupled with rising awareness about animal welfare, presents significant opportunities for market players. The integration of digital technologies, such as telemedicine and data analytics, is also enhancing the efficiency and accessibility of animal healthcare. The overall market sentiment remains optimistic, with strong underlying drivers supporting sustained expansion.

Dominant Regions, Countries, or Segments in Animal Health Industry

The global animal health industry is experiencing significant growth, with the Dogs and Cats segment emerging as a dominant force, particularly within the Therapeutics product category. This dominance is fueled by the pervasive trend of pet humanization, where companion animals are increasingly viewed as integral members of the family. This leads to higher disposable incomes being allocated to their healthcare needs, including advanced treatments and preventative measures. Within therapeutics, Vaccines and Parasiticides are key growth drivers, reflecting a societal emphasis on disease prevention and control for beloved pets. The United States and Europe represent leading geographic markets, characterized by high pet ownership rates, advanced veterinary infrastructure, and a strong demand for premium animal healthcare products and services. The market share for companion animal therapeutics is estimated at XX% in 2025, with projections indicating a rise to XX% by 2033.

- Dominant Segment: Dogs and Cats (representing a significant market share in both Therapeutics and Diagnostics)

- Key Drivers: Pet humanization, increasing disposable incomes, growing awareness of animal welfare, demand for advanced medical care.

- Sub-segments Driving Growth: Vaccines, Parasiticides, Anti-infectives, and advanced Diagnostic Imaging and Immunodiagnostic Tests.

- Leading Geographic Markets: North America and Europe

- Dominance Factors: High pet ownership, established veterinary networks, strong economic indicators, supportive regulatory environments.

- Market Share: North America holds an estimated XX% of the global animal health market in 2025, with Europe closely following at XX%.

- Product Segment Dominance: Therapeutics

- Growth Potential: Continued innovation in biologics, novel drug delivery systems, and personalized medicine for companion animals.

- Market Share: Therapeutics accounted for XX% of the total animal health market in 2025, projected to reach XX% by 2033.

Animal Health Industry Product Landscape

The animal health product landscape is characterized by continuous innovation and a diverse range of offerings designed to address the complex health needs of various animal species. In the therapeutics segment, advancements in vaccine technology are leading to more effective and broader-spectrum protection against infectious diseases. Parasiticides are evolving with novel formulations offering longer-lasting protection and improved safety profiles. Anti-infectives are being developed to combat resistant strains, while medical feed additives play a crucial role in optimizing livestock health and productivity. The diagnostics segment is witnessing a surge in sophisticated technologies, including advanced immunodiagnostic tests for rapid disease detection, molecular diagnostics for precise pathogen identification, and innovative diagnostic imaging techniques that enable early and accurate diagnosis. The unique selling propositions of these products lie in their efficacy, safety, ease of administration, and the ability to improve animal welfare and economic returns for producers. Technological advancements are focused on precision medicine, targeted therapies, and non-invasive diagnostic methods.

Key Drivers, Barriers & Challenges in Animal Health Industry

Key Drivers:

- Technological Advancements: Continuous innovation in vaccines, diagnostics, and pharmaceuticals is a primary growth accelerator.

- Rising Pet Ownership & Humanization: Increased spending on companion animal healthcare drives demand for premium products and services.

- Growing Demand for Animal Protein: The need for efficient and safe livestock production fuels investment in animal health solutions.

- Increased Awareness of Zoonotic Diseases: A greater focus on preventing the transmission of diseases from animals to humans bolsters the demand for vaccines and diagnostics.

- Government Initiatives & Funding: Support for animal welfare and food security policies positively impacts market growth.

Barriers & Challenges:

- Stringent Regulatory Approvals: Lengthy and complex approval processes for new veterinary drugs and vaccines can delay market entry and increase R&D costs.

- High R&D Expenses: Developing novel animal health products requires significant financial investment, posing a barrier for smaller companies.

- Counterfeit Products: The prevalence of counterfeit animal health products undermines legitimate businesses and poses risks to animal health.

- Price Sensitivity in Certain Markets: Economic constraints in some regions can limit the adoption of advanced and more expensive veterinary treatments.

- Supply Chain Disruptions: Global events can impact the availability and distribution of raw materials and finished products, affecting market stability.

Emerging Opportunities in Animal Health Industry

Emerging opportunities within the animal health industry are multifaceted, driven by evolving consumer preferences and technological breakthroughs. The burgeoning market for preventive care and wellness products for companion animals presents a significant avenue for growth, encompassing specialized nutrition, supplements, and non-invasive health monitoring devices. The increasing adoption of digital health solutions, including telemedicine platforms, AI-powered diagnostic support, and wearable health trackers, offers substantial potential for enhanced accessibility and personalized care. Furthermore, the growing emphasis on sustainable livestock farming creates opportunities for developing solutions that improve animal welfare, reduce antibiotic reliance, and enhance resource efficiency. The untapped potential in emerging economies, where pet ownership is rising and livestock production is expanding, also represents a fertile ground for market players. Innovations in areas like gene therapy and precision medicine for animals are on the horizon, promising novel approaches to treating and preventing diseases.

Growth Accelerators in the Animal Health Industry Industry

The animal health industry is propelled by several key growth accelerators that ensure sustained long-term expansion. Technological breakthroughs in areas such as biologics, mRNA vaccine technology, and advanced diagnostics are revolutionizing disease prevention and treatment. Strategic partnerships and collaborations between pharmaceutical giants, biotech firms, and academic institutions are fostering innovation and accelerating product development cycles. Market expansion strategies, including entering underserved geographic regions and focusing on niche animal health segments, are also vital. The increasing focus on one health initiatives, recognizing the interconnectedness of human, animal, and environmental health, is driving investment in zoonotic disease prevention and control, further boosting the sector. The continuous development of more targeted and effective therapies, coupled with a growing understanding of animal physiology and disease mechanisms, provides a solid foundation for future growth.

Key Players Shaping the Animal Health Industry Market

- Chemvet Australia Pty Ltd

- Elanco

- Merck Co Inc

- QBiotics Group Limited

- Abbey Animal Health Pty Ltd

- Luoda Pharma Pty Ltd

- Vetoquinol SA

- Jurox Pty Ltd

- Sypharma Pty Ltd

- Ceva Animal Health Pty Ltd

- Boehringer Ingelheim

- Virbac

- Idexx Laboratories

- Zoetis Inc

Notable Milestones in Animal Health Industry Sector

- August 2021: Zoetis Inc. entered an agreement to buy Jurox, a privately held Australian animal health firm. This acquisition is expected to enhance Zoetis's future growth potential, manufacturing capacity, and expanded skills within the Australian animal health market.

- March 2021: Arrotex Pharmaceuticals and Zoetis teamed up to market the pet-care brand's Revolution and Simparica, which are being distributed by Sigma Wholesale. This partnership aimed to expand the reach and availability of key parasiticides for companion animals.

In-Depth Animal Health Industry Market Outlook

The outlook for the animal health industry remains exceptionally strong, driven by a powerful combination of underlying market trends and accelerating innovations. Future market potential is significantly amplified by the continued rise of pet humanization, leading to sustained demand for advanced veterinary care, pharmaceuticals, and diagnostics for companion animals. In the livestock sector, the imperative for food security and efficient production will continue to fuel investments in disease prevention, herd health management, and productivity-enhancing solutions. Strategic opportunities abound for companies that can leverage emerging technologies, such as AI and personalized medicine, to offer more effective and targeted animal health solutions. The growing global awareness of zoonotic diseases will further underscore the importance of preventive measures, creating ongoing demand for vaccines and diagnostic tools. Industry players are well-positioned to capitalize on these trends through continued R&D investment, strategic acquisitions, and a commitment to enhancing animal welfare and productivity worldwide.

Animal Health Industry Segmentation

-

1. Product

-

1.1. Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animal Types

Animal Health Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Health Industry Regional Market Share

Geographic Coverage of Animal Health Industry

Animal Health Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase In Animal Adoption Coupled with Increasing Awareness about Animal Healthcare; Advanced Technology in Animal Healthcare

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Care

- 3.4. Market Trends

- 3.4.1. Vaccines Segment Holds a Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti-infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs and Cats

- 6.2.2. Horses

- 6.2.3. Ruminants

- 6.2.4. Swine

- 6.2.5. Poultry

- 6.2.6. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti-infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs and Cats

- 7.2.2. Horses

- 7.2.3. Ruminants

- 7.2.4. Swine

- 7.2.5. Poultry

- 7.2.6. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti-infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs and Cats

- 8.2.2. Horses

- 8.2.3. Ruminants

- 8.2.4. Swine

- 8.2.5. Poultry

- 8.2.6. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti-infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular Diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs and Cats

- 9.2.2. Horses

- 9.2.3. Ruminants

- 9.2.4. Swine

- 9.2.5. Poultry

- 9.2.6. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Animal Health Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti-infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular Diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs and Cats

- 10.2.2. Horses

- 10.2.3. Ruminants

- 10.2.4. Swine

- 10.2.5. Poultry

- 10.2.6. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chemvet Australia Pty Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck Co Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 QBiotics Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbey Animal Health Pty Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Luoda Pharma Pty Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vetoquinol SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jurox Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sypharma Pty Ltd*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ceva Animal Health Pty Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Boehringer Ingelheim

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Virbac

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Idexx Laboratories

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zoetis Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Chemvet Australia Pty Ltd

List of Figures

- Figure 1: Global Animal Health Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Animal Health Industry Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Animal Health Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Animal Health Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 5: North America Animal Health Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Animal Health Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Animal Health Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Animal Health Industry Revenue (undefined), by Product 2025 & 2033

- Figure 9: South America Animal Health Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Animal Health Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 11: South America Animal Health Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Animal Health Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Animal Health Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Animal Health Industry Revenue (undefined), by Product 2025 & 2033

- Figure 15: Europe Animal Health Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Animal Health Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 17: Europe Animal Health Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Animal Health Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Animal Health Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Animal Health Industry Revenue (undefined), by Product 2025 & 2033

- Figure 21: Middle East & Africa Animal Health Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Animal Health Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Animal Health Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Animal Health Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Animal Health Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Animal Health Industry Revenue (undefined), by Product 2025 & 2033

- Figure 27: Asia Pacific Animal Health Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Animal Health Industry Revenue (undefined), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Animal Health Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Animal Health Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Animal Health Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Global Animal Health Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 6: Global Animal Health Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 12: Global Animal Health Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 17: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 18: Global Animal Health Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 30: Global Animal Health Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Animal Health Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 38: Global Animal Health Industry Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 39: Global Animal Health Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Animal Health Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Health Industry?

The projected CAGR is approximately 10.46%.

2. Which companies are prominent players in the Animal Health Industry?

Key companies in the market include Chemvet Australia Pty Ltd, Elanco, Merck Co Inc, QBiotics Group Limited, Abbey Animal Health Pty Ltd, Luoda Pharma Pty Ltd, Vetoquinol SA, Jurox Pty Ltd, Sypharma Pty Ltd*List Not Exhaustive, Ceva Animal Health Pty Ltd, Boehringer Ingelheim, Virbac, Idexx Laboratories, Zoetis Inc.

3. What are the main segments of the Animal Health Industry?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase In Animal Adoption Coupled with Increasing Awareness about Animal Healthcare; Advanced Technology in Animal Healthcare.

6. What are the notable trends driving market growth?

Vaccines Segment Holds a Major Share in the Market.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Care.

8. Can you provide examples of recent developments in the market?

In August 2021, Zoetis Inc. entered an agreement to buy Jurox, a privately held Australian animal health firm that develops, manufactures, and markets veterinary pharmaceuticals for companion animals and livestock. This provides future growth potential, manufacturing capacity, and expanded skills in the Australian animal health market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Health Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Health Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Health Industry?

To stay informed about further developments, trends, and reports in the Animal Health Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence