Key Insights

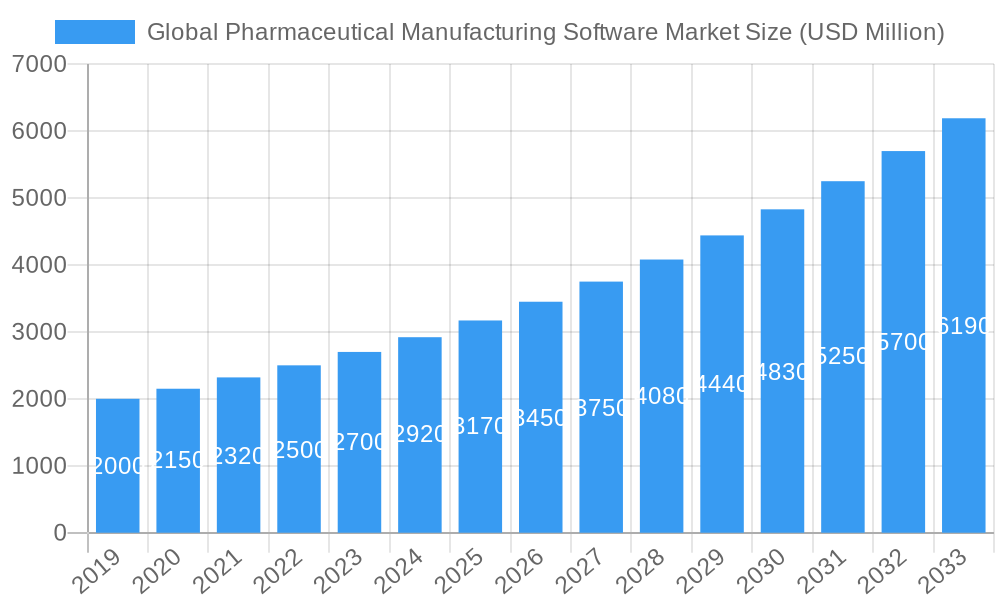

The Global Pharmaceutical Manufacturing Software Market is poised for substantial growth, projected to reach USD 3.41 billion in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 10.1% through 2033. This upward trajectory is primarily fueled by the increasing complexity of pharmaceutical supply chains, the stringent regulatory landscape governing drug production, and the continuous drive for operational efficiency and quality control within the industry. The growing adoption of digital solutions, including cloud-based platforms and advanced analytics, is enabling pharmaceutical manufacturers to streamline processes, ensure compliance, and accelerate product development cycles. Key drivers include the escalating demand for specialized therapeutic drugs, the need for enhanced data integrity and traceability, and the imperative to reduce manufacturing costs while maintaining high product quality. Furthermore, the ongoing digital transformation across the healthcare sector is creating a fertile ground for the integration of sophisticated software solutions that can manage diverse manufacturing operations, from raw material sourcing to finished product distribution.

Global Pharmaceutical Manufacturing Software Market Market Size (In Billion)

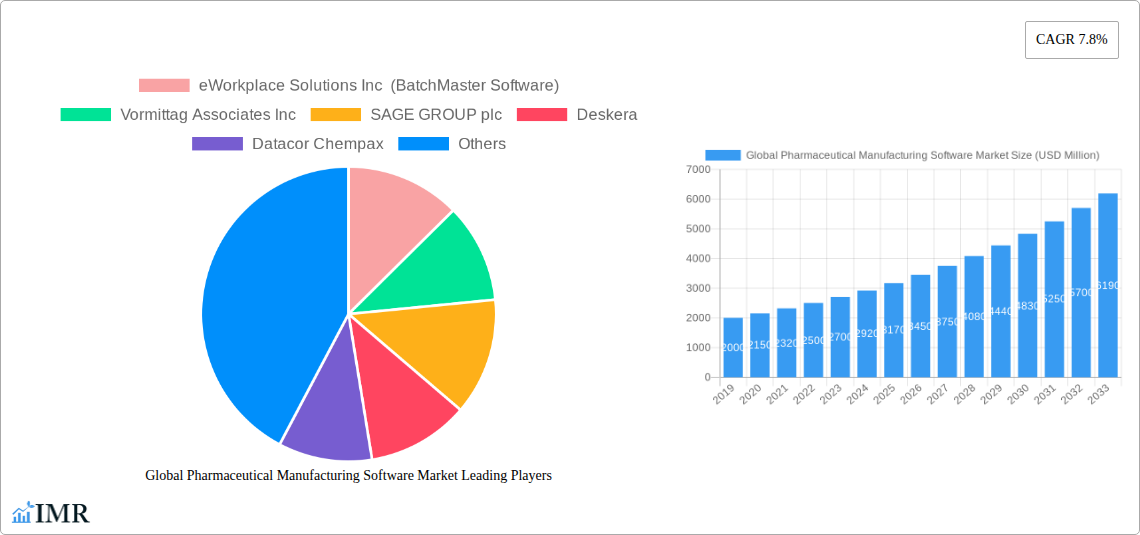

The market is segmented by product type into On-Cloud and On-Premise solutions, with a noticeable shift towards cloud-based offerings due to their scalability, flexibility, and cost-effectiveness. Enterprise segments include Large Enterprises and Small and Medium-Sized Enterprises (SMEs), both of which are increasingly investing in these software solutions to enhance their competitive edge. The proliferation of sophisticated features like real-time monitoring, automated reporting, and predictive maintenance capabilities within these software platforms further bolsters their appeal. Geographically, North America and Europe currently lead the market, driven by established pharmaceutical industries and advanced technological adoption. However, the Asia Pacific region is anticipated to witness the fastest growth, spurred by a burgeoning pharmaceutical manufacturing base, increasing R&D investments, and supportive government initiatives. Companies like eWorkplace Solutions Inc (BatchMaster Software), Vormittag Associates Inc, SAGE GROUP plc, Deskera, Datacor Chempax, Logic ERP Solutions Pvt Ltd, MasterControl Inc, Intellect, Aquilon Software, Fishbowl, Oracle, and ABB are at the forefront, offering innovative solutions to meet the evolving needs of this dynamic market.

Global Pharmaceutical Manufacturing Software Market Company Market Share

Unveiling the Future: Global Pharmaceutical Manufacturing Software Market Report (2019–2033)

This comprehensive report offers an in-depth analysis of the global pharmaceutical manufacturing software market, a critical sector driving innovation and efficiency in drug production. Explore market dynamics, growth trends, regional dominance, and the impact of key players. With insights spanning from 2019 to 2033, this report is your definitive guide to understanding the forces shaping pharmaceutical manufacturing software adoption and future opportunities.

Global Pharmaceutical Manufacturing Software Market Dynamics & Structure

The global pharmaceutical manufacturing software market is characterized by a moderately concentrated landscape, with a few key players holding significant market share while a growing number of niche providers cater to specific needs. Technological innovation remains a primary driver, with advancements in cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) revolutionizing manufacturing processes. Robust regulatory frameworks, including Good Manufacturing Practices (GMP) and FDA guidelines, necessitate stringent quality control and data integrity, further fueling the demand for compliant software solutions. Competitive product substitutes are emerging, particularly from integrated enterprise resource planning (ERP) systems and specialized laboratory information management systems (LIMS), though dedicated pharmaceutical manufacturing software offers deeper functionality. End-user demographics are shifting, with an increasing focus on supply chain visibility and real-time data analytics across large enterprises and a growing adoption by Small and Medium-sized Enterprises (SMEs) seeking cost-effective digital transformation. Mergers and acquisitions (M&A) are a notable trend, as larger entities seek to expand their portfolios and market reach. For instance, the report anticipates a CAGR of XX% for the forecast period. The market size is projected to reach $XX billion by 2033, up from $XX billion in 2025.

- Market Concentration: Dominated by a blend of established ERP providers and specialized life sciences software vendors.

- Technological Innovation Drivers: Cloud migration, AI-powered analytics, automation, and IoT integration.

- Regulatory Frameworks: Stringent compliance requirements (e.g., FDA, EMA) drive demand for validated software.

- Competitive Product Substitutes: Advancements in LIMS, MES, and integrated ERP solutions.

- End-User Demographics: Growing adoption by SMEs and increasing demand for end-to-end visibility from large enterprises.

- M&A Trends: Strategic acquisitions to broaden product offerings and market presence.

Global Pharmaceutical Manufacturing Software Market Growth Trends & Insights

The global pharmaceutical manufacturing software market is experiencing robust growth, propelled by the relentless pursuit of operational excellence and regulatory compliance within the pharmaceutical industry. As of the base year 2025, the market is estimated to be valued at $XX billion, with a projected expansion to $XX billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This significant growth is underpinned by several key trends. The increasing complexity of drug development and manufacturing, coupled with rising global demand for pharmaceuticals, necessitates sophisticated software solutions for managing intricate processes, ensuring product quality, and optimizing supply chains.

The shift towards digital transformation is a paramount driver. Pharmaceutical companies are actively investing in software that enables enhanced data management, process automation, real-time monitoring, and predictive analytics. This adoption is not confined to large enterprises; Small and Medium-sized Enterprises (SMEs) are increasingly recognizing the value proposition of these solutions in terms of improved efficiency, reduced costs, and faster time-to-market. The demand for cloud-based solutions is escalating due to their scalability, flexibility, and accessibility, although on-premise solutions continue to hold a significant market share, particularly for organizations with strict data security policies.

Technological disruptions are constantly reshaping the market. The integration of AI and machine learning is enabling predictive maintenance, optimizing batch yields, and enhancing quality control. The adoption of the Internet of Things (IoT) allows for real-time tracking and monitoring of manufacturing equipment and processes, providing invaluable data for performance improvement and compliance. Furthermore, the growing emphasis on serialization and track-and-trace capabilities to combat counterfeit drugs is a major catalyst for software adoption. Consumer behavior shifts, such as the increasing demand for personalized medicine and biologics, are also influencing the types of software solutions required, necessitating greater flexibility and advanced process control. The historical period (2019–2024) has laid the groundwork for this accelerated growth, with consistent investments in R&D and digital infrastructure by leading pharmaceutical manufacturers. Market penetration is projected to increase from XX% in 2025 to an estimated XX% by 2033.

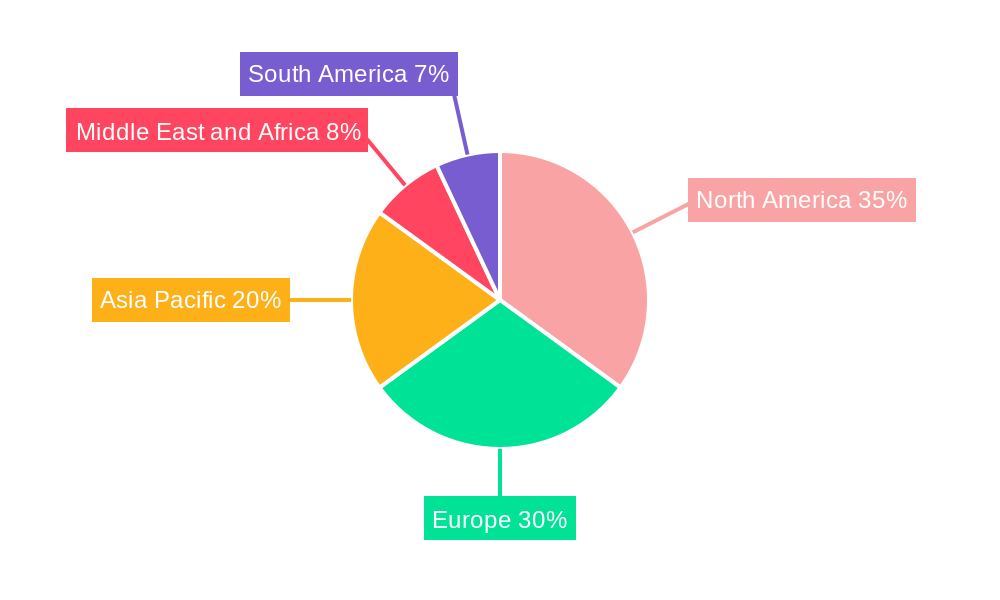

Dominant Regions, Countries, or Segments in Global Pharmaceutical Manufacturing Software Market

The global pharmaceutical manufacturing software market exhibits distinct regional strengths and segment preferences, with North America currently leading the charge, driven by a mature pharmaceutical industry, significant R&D investments, and stringent regulatory oversight. The United States, in particular, accounts for a substantial market share owing to the presence of numerous global pharmaceutical giants and a strong emphasis on technological adoption to maintain a competitive edge. Economic policies that foster innovation and the robust presence of advanced healthcare infrastructure further bolster North America's dominance. The region's focus on quality, safety, and efficiency through advanced software solutions positions it as a benchmark for other markets.

From a product segment perspective, the On-Cloud deployment model is witnessing rapid expansion, particularly within North America and Europe. This is attributed to the scalability, flexibility, and cost-effectiveness offered by cloud solutions, enabling pharmaceutical companies to adapt quickly to changing market demands and regulatory landscapes. The ability to access real-time data from anywhere, coupled with reduced IT infrastructure overheads, makes cloud deployment an attractive option for both large enterprises and SMEs. However, the On-Premise segment remains significant, especially for organizations with highly sensitive data or specific legacy system integrations, maintaining a strong foothold in established markets.

In terms of enterprise size, Large Enterprises continue to be the primary revenue generators, investing heavily in comprehensive, integrated software solutions to manage complex global operations, ensure regulatory compliance across multiple sites, and optimize large-scale production. Their capacity for significant capital expenditure on advanced software, including manufacturing execution systems (MES), enterprise resource planning (ERP), and quality management systems (QMS), drives substantial market value.

Conversely, the Small and Medium-sized Enterprises (SMEs) segment is exhibiting the highest growth potential. As the cost of advanced software solutions becomes more accessible and cloud-based offerings gain traction, SMEs are increasingly adopting these technologies to streamline their operations, improve product quality, and compete more effectively. Government initiatives aimed at supporting SMEs in digital transformation and the growing availability of modular, scalable software packages are key enablers for this segment's expansion. The Asia-Pacific region, with its burgeoning pharmaceutical manufacturing sector and increasing focus on adopting global standards, is emerging as a significant growth frontier, poised to challenge the dominance of established regions in the coming years.

Global Pharmaceutical Manufacturing Software Market Product Landscape

The pharmaceutical manufacturing software product landscape is dynamic, characterized by continuous innovation focused on enhancing efficiency, ensuring compliance, and improving data integrity. On-cloud solutions are increasingly prevalent, offering scalability, accessibility, and faster deployment cycles, supporting agile manufacturing processes. Conversely, on-premise solutions remain vital for organizations requiring absolute control over their data and infrastructure. Key product innovations include advanced analytics modules for predictive maintenance and yield optimization, AI-driven quality control systems, and enhanced serialization and track-and-trace capabilities. These solutions are designed to seamlessly integrate with existing manufacturing equipment and enterprise systems, providing a unified view of operations. Performance metrics often revolve around improved batch cycle times, reduced deviations, enhanced audit readiness, and demonstrable compliance with global regulatory standards. Unique selling propositions include real-time data visibility, automated workflow management, and robust audit trail capabilities, all crucial for the highly regulated pharmaceutical industry.

Key Drivers, Barriers & Challenges in Global Pharmaceutical Manufacturing Software Market

Key Drivers: The global pharmaceutical manufacturing software market is propelled by several critical drivers:

- Increasing Demand for Pharmaceuticals: A growing global population and an aging demographic are fueling the demand for a wider range of pharmaceutical products.

- Stringent Regulatory Compliance: Evolving and rigorous regulations from bodies like the FDA and EMA necessitate advanced software for data integrity, quality control, and serialization.

- Digital Transformation Initiatives: The industry's broad push towards Industry 4.0 and smart manufacturing mandates the adoption of integrated software solutions for efficiency and automation.

- Focus on Quality and Safety: Ensuring product quality and patient safety remains paramount, driving investments in software that enables robust process control and real-time monitoring.

- Technological Advancements: Innovations in cloud computing, AI, IoT, and big data analytics are creating new possibilities for optimizing pharmaceutical manufacturing.

Barriers & Challenges: Despite strong growth potential, the market faces significant hurdles:

- High Implementation Costs: The initial investment for comprehensive pharmaceutical manufacturing software can be substantial, posing a challenge, especially for SMEs.

- Integration Complexity: Integrating new software with existing legacy systems and diverse manufacturing equipment can be technically challenging and time-consuming.

- Data Security and Privacy Concerns: Handling sensitive patient and manufacturing data requires robust cybersecurity measures, adding to the complexity and cost of implementation.

- Resistance to Change: Overcoming inertia and resistance to adopting new technologies within established workforces can be a significant obstacle.

- Skill Gaps: A shortage of skilled personnel proficient in implementing and managing advanced manufacturing software can hinder adoption.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of hardware and the smooth implementation of software solutions, as seen with recent global events. The impact of such disruptions can lead to delays of up to 15-20% in project timelines.

Emerging Opportunities in Global Pharmaceutical Manufacturing Software Market

Emerging opportunities in the global pharmaceutical manufacturing software market lie in the burgeoning field of personalized medicine, which demands highly flexible and adaptable manufacturing processes managed by sophisticated software. The increasing adoption of continuous manufacturing techniques presents a significant avenue for specialized software solutions that can monitor and control these dynamic processes in real-time. Furthermore, the growing focus on sustainability and green manufacturing practices is creating demand for software that optimizes resource utilization, reduces waste, and tracks environmental impact. The untapped potential in emerging economies, particularly in Asia and Africa, where pharmaceutical manufacturing is rapidly expanding, offers substantial growth prospects. The integration of blockchain technology for enhanced supply chain transparency and counterfeit prevention also represents a promising frontier.

Growth Accelerators in the Global Pharmaceutical Manufacturing Software Market Industry

Several key catalysts are accelerating growth in the global pharmaceutical manufacturing software market. The ongoing advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling more sophisticated predictive analytics, process optimization, and automated quality control, driving significant adoption. The expansion of cloud infrastructure and the increasing comfort of pharmaceutical companies with cloud-based solutions are further accelerating deployment and scalability. Strategic partnerships between software providers and pharmaceutical manufacturers, as evidenced by recent collaborations, are vital for tailoring solutions to specific needs and fostering wider market penetration. The global push for digital transformation, coupled with the inherent need for efficiency and compliance in drug production, creates a sustained demand for innovative software.

Key Players Shaping the Global Pharmaceutical Manufacturing Software Market Market

- eWorkplace Solutions Inc (BatchMaster Software)

- Vormittag Associates Inc

- SAGE GROUP plc

- Deskera

- Datacor Chempax

- Logic ERP Solutions Pvt Ltd

- MasterControl Inc

- Intellect

- Aquilon Software

- Fishbowl

- Oracle

- ABB

Notable Milestones in Global Pharmaceutical Manufacturing Software Market Sector

- March 2022: Aizon, a developer of enterprise AI software, and Aggity, a Spanish firm focused on business digital transformation, established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies.

- March 2022: Triastek, Inc. and Siemens Ltd., China, agreed to collaborate on digital technologies for the worldwide pharmaceutical business. Triastek's industry-leading 3D printing and digital pharmaceutical technologies, combined with Siemens' global experience in automation and digitalization, result in unique and disruptive pharmaceutical research and manufacturing solutions.

In-Depth Global Pharmaceutical Manufacturing Software Market Market Outlook

The future of the global pharmaceutical manufacturing software market is exceptionally promising, fueled by continuous technological advancements and the unwavering need for operational excellence. The ongoing integration of AI, machine learning, and IoT will unlock unprecedented levels of automation, predictive capabilities, and real-time process control, fundamentally transforming how drugs are manufactured. The growing emphasis on personalized medicine and advanced biologics will necessitate even more agile and sophisticated software solutions. Strategic partnerships and collaborations will play a pivotal role in driving innovation and market penetration, especially in emerging economies. The increasing adoption by SMEs, empowered by accessible cloud solutions, will further diversify and expand the market. This evolving landscape presents significant opportunities for software providers to deliver value-added solutions that enhance efficiency, ensure regulatory compliance, and ultimately contribute to the development and delivery of life-saving medicines globally. The projected market size of $XX billion by 2033 underscores the robust growth trajectory and immense potential within this critical industry sector.

Global Pharmaceutical Manufacturing Software Market Segmentation

-

1. Product

- 1.1. On-Cloud

- 1.2. On-Premise

-

2. Enterprise

- 2.1. Large Enterprises

- 2.2. Small and Medium-Sized Enterprises (SMEs)

Global Pharmaceutical Manufacturing Software Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Pharmaceutical Manufacturing Software Market Regional Market Share

Geographic Coverage of Global Pharmaceutical Manufacturing Software Market

Global Pharmaceutical Manufacturing Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing

- 3.3. Market Restrains

- 3.3.1. High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment

- 3.4. Market Trends

- 3.4.1. On-Cloud Software is Expected to Hold a Significant Share in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. On-Cloud

- 5.1.2. On-Premise

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-Sized Enterprises (SMEs)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. On-Cloud

- 6.1.2. On-Premise

- 6.2. Market Analysis, Insights and Forecast - by Enterprise

- 6.2.1. Large Enterprises

- 6.2.2. Small and Medium-Sized Enterprises (SMEs)

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. On-Cloud

- 7.1.2. On-Premise

- 7.2. Market Analysis, Insights and Forecast - by Enterprise

- 7.2.1. Large Enterprises

- 7.2.2. Small and Medium-Sized Enterprises (SMEs)

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. On-Cloud

- 8.1.2. On-Premise

- 8.2. Market Analysis, Insights and Forecast - by Enterprise

- 8.2.1. Large Enterprises

- 8.2.2. Small and Medium-Sized Enterprises (SMEs)

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. On-Cloud

- 9.1.2. On-Premise

- 9.2. Market Analysis, Insights and Forecast - by Enterprise

- 9.2.1. Large Enterprises

- 9.2.2. Small and Medium-Sized Enterprises (SMEs)

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Pharmaceutical Manufacturing Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. On-Cloud

- 10.1.2. On-Premise

- 10.2. Market Analysis, Insights and Forecast - by Enterprise

- 10.2.1. Large Enterprises

- 10.2.2. Small and Medium-Sized Enterprises (SMEs)

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vormittag Associates Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAGE GROUP plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deskera

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Datacor Chempax

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Logic ERP Solutions Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MasterControl Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intellect

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aquilon Software

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fishbowl

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ABB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 eWorkplace Solutions Inc (BatchMaster Software)

List of Figures

- Figure 1: Global Global Pharmaceutical Manufacturing Software Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 5: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 6: North America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 9: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 11: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 12: Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 17: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 18: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 23: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 24: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Enterprise 2025 & 2033

- Figure 29: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Enterprise 2025 & 2033

- Figure 30: South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Global Pharmaceutical Manufacturing Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 3: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 6: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 12: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 21: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 30: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 35: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Enterprise 2020 & 2033

- Table 36: Global Pharmaceutical Manufacturing Software Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Pharmaceutical Manufacturing Software Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Pharmaceutical Manufacturing Software Market?

The projected CAGR is approximately 10.1%.

2. Which companies are prominent players in the Global Pharmaceutical Manufacturing Software Market?

Key companies in the market include eWorkplace Solutions Inc (BatchMaster Software), Vormittag Associates Inc, SAGE GROUP plc, Deskera, Datacor Chempax, Logic ERP Solutions Pvt Ltd, MasterControl Inc, Intellect, Aquilon Software, Fishbowl, Oracle, ABB.

3. What are the main segments of the Global Pharmaceutical Manufacturing Software Market?

The market segments include Product, Enterprise.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Adoption of Pharmaceutical Manufacturing Software by Pharmaceutical Companies; Increasing Cost of Drugs Manufacturing.

6. What are the notable trends driving market growth?

On-Cloud Software is Expected to Hold a Significant Share in the Market Studied.

7. Are there any restraints impacting market growth?

High Cost of Pharamceutical Manufacturing Software; Security Concerns Pertaining to On-Cloud Deployment.

8. Can you provide examples of recent developments in the market?

In March 2022, Aizon, a developer of enterprise AI software, and Aggity, a Spanish firm focused on business digital transformation, established a partnership to accelerate digital transformation within manufacturing operations at the world's biggest pharmaceutical and biotech companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Pharmaceutical Manufacturing Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Pharmaceutical Manufacturing Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Pharmaceutical Manufacturing Software Market?

To stay informed about further developments, trends, and reports in the Global Pharmaceutical Manufacturing Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence