Key Insights

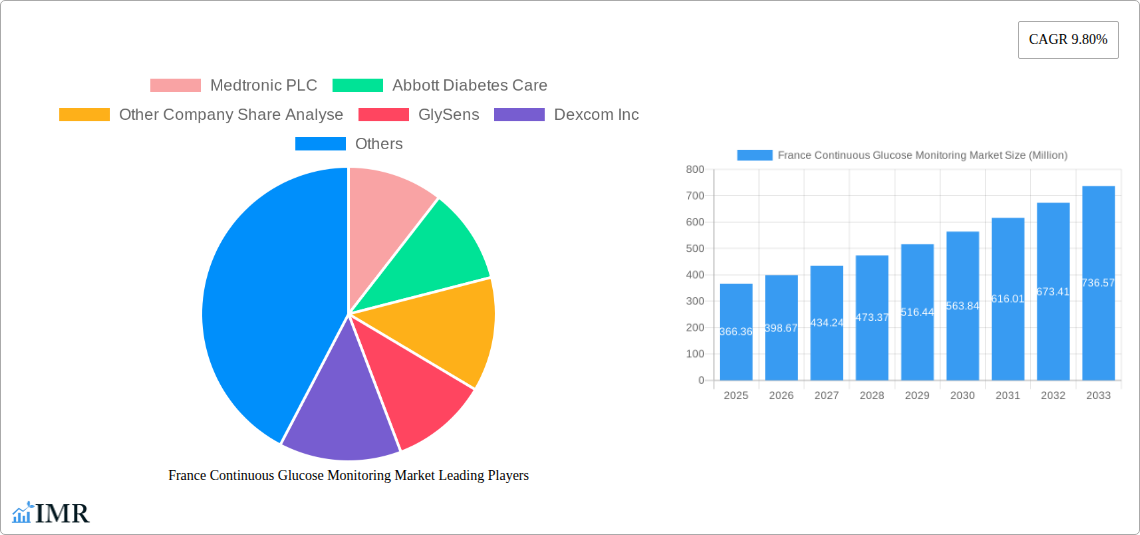

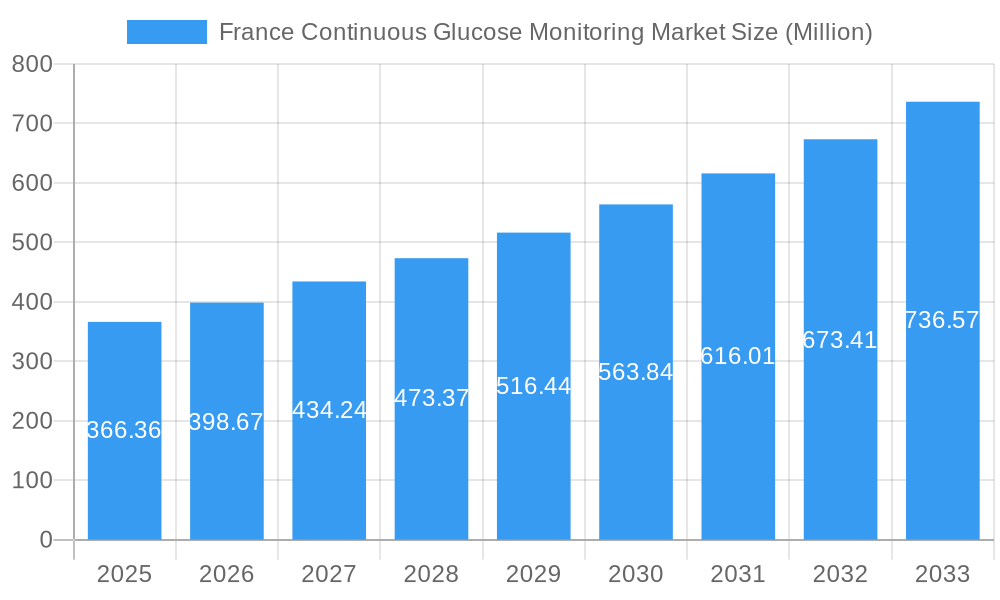

The French Continuous Glucose Monitoring (CGM) market is poised for significant expansion, with a projected market size of 366.36 Million in the base year of 2025. This robust growth is underpinned by a compelling compound annual growth rate (CAGR) of 9.80% anticipated throughout the forecast period of 2025-2033. This upward trajectory is fueled by a confluence of factors, including increasing awareness and adoption of advanced diabetes management technologies, a rising prevalence of diabetes in France, and favorable reimbursement policies that are making CGM systems more accessible to a broader patient demographic. The growing emphasis on proactive health management and the drive to reduce diabetes-related complications are also key contributors, encouraging individuals to embrace these innovative monitoring solutions. Furthermore, continuous technological advancements in CGM devices, such as enhanced accuracy, miniaturization, and improved user experience, are driving innovation and competition within the market, further stimulating growth.

France Continuous Glucose Monitoring Market Market Size (In Million)

The market is segmented by component, with Sensors and Durables playing crucial roles. Key players like Medtronic PLC, Abbott Diabetes Care, Dexcom Inc., Ascensia Diabetes Care, and GlySens are actively engaged in the French market, contributing to its dynamism through product innovation and strategic partnerships. These companies are instrumental in driving the adoption of CGM technology by developing user-friendly devices and robust support systems. While the market presents substantial opportunities, certain factors could influence its growth rate. These include the initial cost of devices for some individuals, the need for ongoing training and support for optimal use, and the evolving regulatory landscape. However, the overall outlook for the French CGM market remains overwhelmingly positive, driven by the urgent need for better diabetes management and the inherent benefits of real-time glucose monitoring in improving patient outcomes and quality of life.

France Continuous Glucose Monitoring Market Company Market Share

This in-depth report provides a granular analysis of the France Continuous Glucose Monitoring (CGM) market, a rapidly expanding segment within the broader diabetes care landscape. Targeting industry professionals, healthcare providers, and market strategists, this research offers critical insights into market dynamics, growth trajectories, and key influencing factors. With a focus on CGM devices, glucose sensors, and durable CGM systems, this report is essential for understanding the present and future of diabetes management in France. The analysis spans a comprehensive study period from 2019 to 2033, with a detailed base year of 2025, an estimated year of 2025, and a robust forecast period from 2025 to 2033, complemented by a historical overview from 2019 to 2024. All quantitative values are presented in Million units.

France Continuous Glucose Monitoring Market Market Dynamics & Structure

The France CGM market exhibits a dynamic and evolving structure, characterized by increasing patient adoption and supportive regulatory advancements. Market concentration is relatively high, with key players like Medtronic PLC, Abbott Diabetes Care, and DexCom Inc. dominating the competitive landscape. Technological innovation is a significant driver, with continuous improvements in sensor accuracy, longevity, and connectivity enhancing user experience and clinical utility. Regulatory frameworks, particularly reimbursement policies, play a pivotal role in market accessibility and growth. For instance, recent expansions in reimbursement coverage for advanced CGM systems have significantly boosted adoption. Competitive product substitutes, such as traditional blood glucose monitoring (BGM), are gradually being displaced by the superior benefits offered by CGM. End-user demographics reveal a growing prevalence of diabetes, with an aging population and increasing incidence of type 1 and type 2 diabetes contributing to sustained demand. Mergers and acquisitions (M&A) trends, though less prominent in recent history, could emerge as companies seek to consolidate market share and expand their product portfolios. Barriers to innovation include the high cost of R&D and stringent regulatory approval processes for novel devices.

- Market Concentration: Dominated by a few key players, with a growing presence of emerging innovators.

- Technological Innovation: Driven by enhanced sensor technology, data analytics, and user-friendly interfaces.

- Regulatory Impact: Reimbursement policies and healthcare authority approvals are critical determinants of market growth.

- End-User Demographics: Rising diabetes prevalence and an aging population fuel sustained demand.

- Competitive Landscape: Intense competition with continuous introduction of advanced CGM solutions.

France Continuous Glucose Monitoring Market Growth Trends & Insights

The France CGM market is poised for significant expansion, driven by increasing awareness of diabetes management benefits, favorable reimbursement policies, and technological advancements. The market size is projected to witness a healthy CAGR over the forecast period, reflecting a substantial shift from traditional monitoring methods to continuous monitoring solutions. Adoption rates are accelerating as healthcare professionals increasingly recommend CGM for better glycemic control and reduced complications. Technological disruptions, such as the integration of AI-powered insights and enhanced connectivity features, are further propelling market growth. Consumer behavior is shifting towards proactive health management, with individuals seeking tools that provide real-time data and empower them to make informed lifestyle decisions. The durable CGM segment is expected to experience robust growth, attributed to the increasing demand for long-term, reliable glucose monitoring solutions. Market penetration of CGM devices is steadily increasing, especially among individuals with intensive insulin therapy and those benefiting from expanded reimbursement coverage. The forecast predicts a significant uplift in overall CGM device shipments and revenue within France, underscoring its importance as a leading European market for diabetes technology.

Dominant Regions, Countries, or Segments in France Continuous Glucose Monitoring Market

Within the France Continuous Glucose Monitoring Market, the Sensors component segment is projected to be a dominant force, driven by the inherent need for these disposable yet critical components in every CGM system. France, as a single country market, stands out due to its advanced healthcare infrastructure, high diabetes prevalence, and proactive government initiatives towards improving diabetes care through technological adoption. The dominance of the Sensors segment can be attributed to several key drivers. Firstly, the recurring nature of sensor replacement ensures a continuous revenue stream and consistent demand. Secondly, advancements in sensor technology, leading to improved accuracy, comfort, and wear time, directly enhance the value proposition for patients, thus boosting sales. For example, innovations leading to longer-lasting sensors or minimally invasive designs will further solidify their market dominance.

The durability of CGM systems is also a significant factor, as patients and healthcare providers seek reliable and long-term solutions. However, the sheer volume of sensor disposables required per patient over time will likely outpace the initial acquisition cost of durable components. This creates a sustained and high-volume demand for the sensor segment. In terms of market share, the Sensors segment is expected to capture a larger portion of the overall market value compared to the durables, due to the higher frequency of purchase.

Key drivers contributing to the dominance of the Sensors segment and France's position include:

- Economic Policies: Supportive reimbursement frameworks and government funding for diabetes management technologies.

- Healthcare Infrastructure: A well-established healthcare system that facilitates the adoption and integration of advanced medical devices.

- Technological Advancements: Continuous innovation in sensor accuracy, biocompatibility, and connectivity.

- Growing Diabetes Prevalence: A rising number of diagnosed individuals requiring effective glucose monitoring solutions.

- Patient Education and Awareness: Increased understanding among patients about the benefits of CGM for disease management.

The market share of the Sensors segment is estimated to be significantly higher, projected to be over 70% of the total component market value in the forecast period, with a steady growth rate. The overall growth potential for CGM in France is substantial, fueled by these factors, making it a critical market for manufacturers and innovators.

France Continuous Glucose Monitoring Market Product Landscape

The France Continuous Glucose Monitoring market is characterized by a steady stream of product innovations aimed at enhancing accuracy, user comfort, and data accessibility. Key advancements include the development of smaller, more discreet sensors with extended wear times, reducing the need for frequent insertions. Smart algorithms are increasingly being integrated, offering predictive insights into glucose trends and personalized treatment recommendations. The connectivity of CGM devices with smartphones and other digital health platforms allows for seamless data sharing with healthcare providers and family members, fostering a more collaborative approach to diabetes management. Performance metrics such as accuracy (MARD - Mean Absolute Relative Difference), response time, and sensor longevity are continuously being improved, setting new benchmarks for the industry. Unique selling propositions often revolve around ease of use, minimal pain during insertion, and robust data analytics capabilities, all contributing to improved patient outcomes and quality of life.

Key Drivers, Barriers & Challenges in France Continuous Glucose Monitoring Market

Key Drivers:

- Technological Advancements: Enhanced sensor accuracy, miniaturization, and improved connectivity are propelling adoption.

- Expanding Reimbursement Policies: Government initiatives to cover CGM for a wider patient population are a significant growth catalyst.

- Growing Diabetes Prevalence: The increasing incidence of type 1 and type 2 diabetes in France directly fuels demand for effective monitoring solutions.

- Increased Patient Awareness: Growing understanding of CGM benefits for improved glycemic control and reduced long-term complications.

- Healthcare Professional Endorsement: Strong recommendations from endocrinologists and diabetes educators drive patient uptake.

Key Barriers & Challenges:

- High Initial Cost: Despite reimbursement, the upfront cost of CGM systems can still be a barrier for some patients.

- Regulatory Hurdles: Stringent approval processes for new devices and updates can slow down market entry.

- Data Overload and Interpretation: Patients and healthcare providers need effective tools and training to interpret and act upon the vast amount of data generated.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of essential components like sensors.

- Competitive Pressures: Intense competition among manufacturers necessitates continuous innovation and competitive pricing strategies. The impact of these challenges can lead to delays in product availability and a slower pace of adoption in certain patient segments.

Emerging Opportunities in France Continuous Glucose Monitoring Market

Emerging opportunities in the France Continuous Glucose Monitoring market lie in the expansion of CGM access to underserved patient populations, including individuals with gestational diabetes and those with type 2 diabetes not on intensive insulin therapy but seeking better glycemic management. The development of more affordable and user-friendly CGM systems presents a significant untapped market. Furthermore, the integration of CGM data with artificial intelligence (AI) and machine learning (ML) for predictive analytics and personalized treatment plans holds immense potential. The increasing demand for remote patient monitoring solutions also opens avenues for CGM manufacturers to collaborate with telehealth providers. Evolving consumer preferences towards proactive health management and wearable technology are also creating new market segments.

Growth Accelerators in the France Continuous Glucose Monitoring Market Industry

Several catalysts are accelerating the growth of the France Continuous Glucose Monitoring market. Technological breakthroughs, such as the development of implantable and longer-lasting CGM sensors, promise to revolutionize diabetes management. Strategic partnerships between CGM manufacturers, pharmaceutical companies developing insulin delivery systems, and digital health platform providers are creating integrated ecosystems for comprehensive diabetes care. Market expansion strategies, including targeted marketing campaigns and educational initiatives for both patients and healthcare professionals, are crucial for driving widespread adoption. The increasing focus on preventative healthcare and the management of chronic diseases by the French government also provides a supportive environment for the sustained growth of the CGM market.

Key Players Shaping the France Continuous Glucose Monitoring Market Market

- Medtronic PLC

- Abbott Diabetes Care

- DexCom Inc

- Ascensia Diabetes Care

- GlySens

Notable Milestones in France Continuous Glucose Monitoring Market Sector

- September 2023: DexCom announced the availability of its Dexcom ONE real-time CGM sensor via reimbursement, in France. Dexcom’s announcement brings the company’s real-time CGM technology to half a million more people with diabetes in France. Specifically, access is now secured to the Dexcom ONE sensor for all patients with type 1 and type 2 diabetes, two years and older, who are undergoing intensive insulin therapy (by external pump or >3 injections per day).

- June 2023: Abbott announced that the French health authority approved the expansion of reimbursement coverage for its FreeStyle Libre 2 system to include all people who use basal insulin as part of their diabetes management. FreeStyle Libre 2 was previously covered only for people with Type 1 and Type 2 diabetes who require intensive insulin therapy. The expanded reimbursement enables more people living with diabetes in France to access the latest CGM technology that can help them make informed health and lifestyle decisions.

In-Depth France Continuous Glucose Monitoring Market Market Outlook

The France Continuous Glucose Monitoring market outlook is exceptionally positive, driven by ongoing technological innovation and an increasingly supportive regulatory and reimbursement landscape. Growth accelerators such as the continuous improvement in sensor accuracy and patient comfort, coupled with the expanding coverage by the French health authority, are expected to significantly increase market penetration. The strategic focus of key players on developing integrated diabetes management solutions, encompassing CGM, insulin delivery, and data analytics, will further solidify market growth. The increasing patient demand for proactive health management tools and the growing awareness of the long-term benefits of early and effective diabetes management are also critical factors contributing to a robust future market potential. This sustained growth trajectory positions France as a pivotal market for CGM advancements and adoption in Europe.

France Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

France Continuous Glucose Monitoring Market Segmentation By Geography

- 1. France

France Continuous Glucose Monitoring Market Regional Market Share

Geographic Coverage of France Continuous Glucose Monitoring Market

France Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Medtronic PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Diabetes Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Other Company Share Analyse

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GlySens

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dexcom Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascensia Diabetes Care

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Medtronic PLC

List of Figures

- Figure 1: France Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Continuous Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: France Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: France Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 3: France Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: France Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2020 & 2033

- Table 6: France Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 7: France Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: France Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Continuous Glucose Monitoring Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the France Continuous Glucose Monitoring Market?

Key companies in the market include Medtronic PLC, Abbott Diabetes Care, Other Company Share Analyse, GlySens, Dexcom Inc, Ascensia Diabetes Care.

3. What are the main segments of the France Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 366.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

September 2023: DexCom announced the availability of its Dexcom ONE real-time CGM sensor via reimbursement, in France. Dexcom’s announcement brings the company’s real-time CGM technology to half a million more people with diabetes in France. Specifically, access is now secured to the Dexcom ONE sensor for all patients with type 1 and type 2 diabetes, two years and older, who are undergoing intensive insulin therapy (by external pump or >3 injections per day).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the France Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence