Key Insights

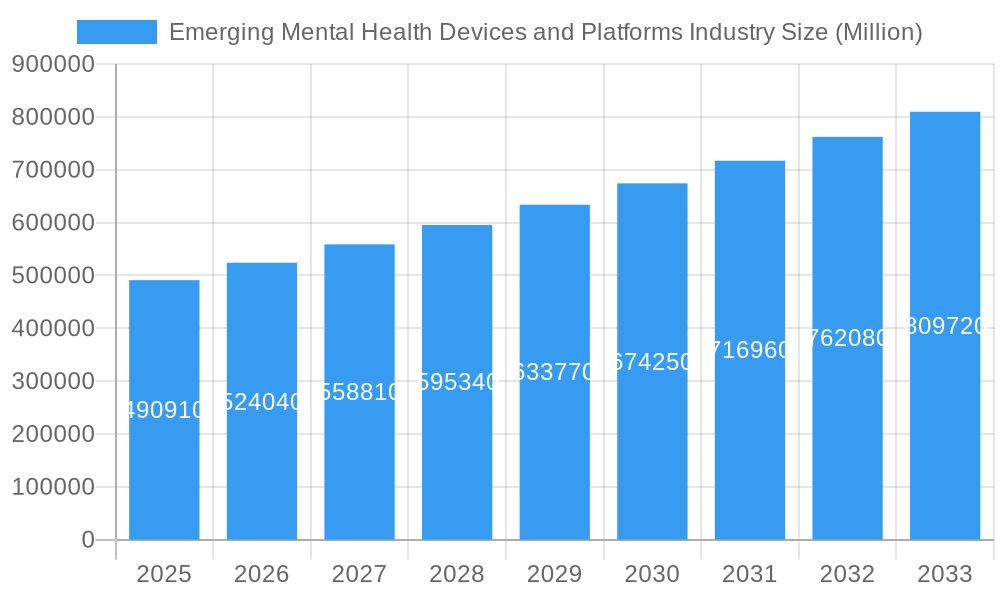

The Emerging Mental Health Devices and Platforms Industry is poised for substantial growth, with a current market size estimated at $490.91 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This robust expansion is fueled by a confluence of factors, including increasing global awareness and destigmatization of mental health issues, a surge in digital health adoption, and a growing demand for accessible and personalized mental wellness solutions. The COVID-19 pandemic, in particular, accelerated the acceptance and utilization of telehealth and digital mental health tools, creating a lasting shift in how individuals seek and receive care. Key market drivers include technological advancements in AI and machine learning for personalized interventions, the rising prevalence of mental health conditions like stress, anxiety, and depression, and the proactive initiatives by governments and healthcare organizations to integrate mental health services into mainstream healthcare.

Emerging Mental Health Devices and Platforms Industry Market Size (In Billion)

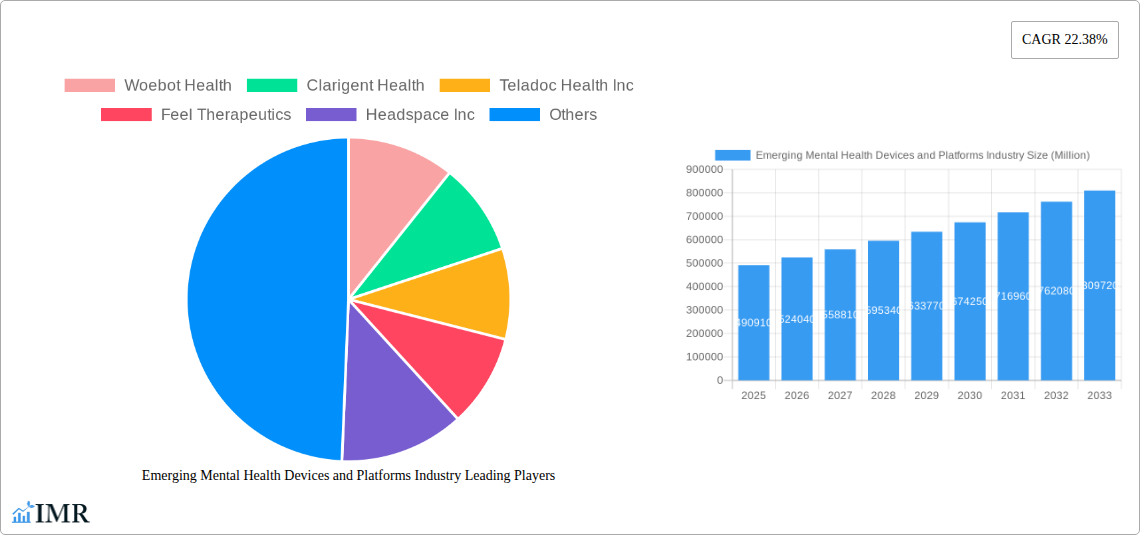

The market is segmented into Platforms and Devices, with applications spanning the management of Stress, Anxiety, Depression, Bipolar Disorder, and other related conditions. Leading companies such as Woebot Health, Headspace Inc., Calm, and Talkspace Inc. are at the forefront of innovation, offering a diverse range of digital therapeutics, mindfulness applications, and virtual therapy services. Despite the optimistic growth trajectory, certain restraints such as regulatory hurdles, data privacy concerns, and the need for greater clinical validation of digital solutions could pose challenges. However, the industry's inherent adaptability and continuous innovation in areas like wearable sensors for physiological monitoring and AI-powered chatbots for immediate support are expected to overcome these obstacles, further solidifying its crucial role in the future of mental healthcare delivery. The global reach of these solutions is expanding, with North America and Europe currently leading market penetration, followed by the Asia Pacific region, which is exhibiting rapid growth potential.

Emerging Mental Health Devices and Platforms Industry Company Market Share

Emerging Mental Health Devices and Platforms Market: A Comprehensive Industry Analysis (2019-2033)

This in-depth report offers a panoramic view of the burgeoning Emerging Mental Health Devices and Platforms Industry, a sector poised for exponential growth driven by increasing mental health awareness, technological advancements, and the growing demand for accessible and personalized care. Delve into the market dynamics, growth trajectories, dominant segments, and key players shaping the future of digital mental wellness. This report is your essential guide to understanding market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. We present quantitative insights, including market share percentages and M&A deal volumes, alongside qualitative factors like innovation barriers, to provide a holistic understanding of the landscape.

Emerging Mental Health Devices and Platforms Industry Market Dynamics & Structure

The Emerging Mental Health Devices and Platforms Industry is characterized by dynamic market concentration, with a blend of established technology giants and innovative startups vying for market share. Technological innovation is the primary driver, fueled by advancements in AI, machine learning, virtual reality (VR), and wearable technology, enabling more sophisticated diagnostic and therapeutic solutions. Regulatory frameworks are evolving to address data privacy, efficacy, and reimbursement for digital mental health solutions, influencing market entry and product development. Competitive product substitutes range from traditional therapy and medication to other digital wellness apps, creating a multifaceted competitive landscape. End-user demographics are expanding beyond traditional patient groups to include proactive wellness seekers, corporate employees, and student populations. Mergers and acquisitions (M&A) are on the rise as larger entities seek to integrate innovative technologies and expand their service offerings.

- Market Concentration: Fragmented with increasing consolidation through strategic acquisitions.

- Technological Innovation Drivers: AI-powered chatbots, personalized interventions, VR/AR for therapy, biosensors, and remote monitoring.

- Regulatory Frameworks: HIPAA compliance, FDA approvals for certain devices, and evolving telehealth regulations.

- Competitive Product Substitutes: Traditional psychotherapy, psychiatric medications, peer support groups, and general wellness apps.

- End-User Demographics: Adolescents, young adults, working professionals, elderly, and specific patient populations with chronic conditions.

- M&A Trends: Acquisitions of innovative startups by larger healthcare providers and technology companies to enhance digital mental health portfolios.

Emerging Mental Health Devices and Platforms Industry Growth Trends & Insights

The Emerging Mental Health Devices and Platforms Industry is experiencing a significant surge, with the market size expected to witness substantial expansion. Driven by increasing global mental health crises and a growing acceptance of digital interventions, adoption rates for these solutions are soaring. Technological disruptions are continuously reshaping the industry, with AI-driven personalization, the integration of biosensors for objective data collection, and the immersive capabilities of VR/AR therapy platforms at the forefront. Consumer behavior is shifting towards seeking more convenient, accessible, and stigma-free mental healthcare options, further accelerating market penetration. This evolution signifies a paradigm shift in how mental well-being is addressed, moving towards proactive, preventative, and personalized care models. The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of XX% from the base year 2025, reaching an estimated market size of $XXX billion in units by 2033. The historical period (2019-2024) has laid the groundwork for this rapid growth, with increasing venture capital funding and the COVID-19 pandemic acting as significant catalysts for digital health adoption. The estimated year 2025 marks a pivotal point for the industry as it solidifies its position as a mainstream component of mental healthcare.

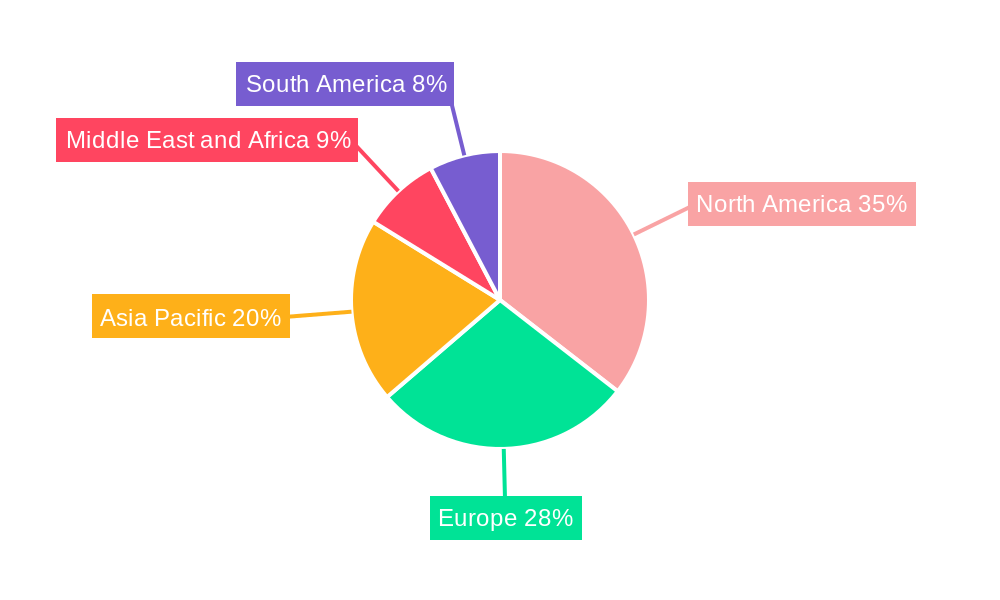

Dominant Regions, Countries, or Segments in Emerging Mental Health Devices and Platforms Industry

The Platforms segment, within the Product Type category, is currently the dominant force driving growth in the Emerging Mental Health Devices and Platforms Industry. This dominance is attributed to the scalability, accessibility, and broad applicability of digital platforms in delivering mental health support across various conditions and user groups. North America leads as the dominant region, propelled by robust healthcare infrastructure, high disposable incomes, significant investment in digital health innovation, and favorable regulatory environments that support telehealth and digital therapeutics. The United States, in particular, stands out as a key country due to its early adoption of technology, a large patient base with mental health needs, and a thriving venture capital ecosystem supporting mental health startups. Within the Applications segment, Stress and Anxiety are the most significant contributors to market growth, reflecting the pervasive nature of these conditions in modern society and the high demand for readily available coping mechanisms and therapeutic interventions.

- Dominant Segment (Product Type): Platforms, offering scalable and accessible digital mental health solutions.

- Dominant Region: North America, driven by advanced healthcare systems and investment in digital health.

- Key Country: United States, a leader in technological adoption and mental health awareness.

- Dominant Applications: Stress and Anxiety, due to widespread prevalence and demand for immediate support.

- Drivers of Dominance:

- Economic Policies: Government initiatives and funding for mental health services.

- Infrastructure: Advanced digital connectivity and widespread smartphone penetration.

- Technological Adoption: High receptiveness to digital health solutions among the population.

- Awareness and Stigma Reduction: Increasing societal focus on mental well-being.

- Insurance Reimbursement: Growing inclusion of digital mental health services in insurance plans.

Emerging Mental Health Devices and Platforms Industry Product Landscape

The product landscape of the Emerging Mental Health Devices and Platforms Industry is rich with innovation, encompassing sophisticated platforms and advanced devices designed to address a spectrum of mental health needs. Platforms often feature AI-powered chatbots like Woebot Health, offering conversational therapy, personalized coping strategies, and mood tracking capabilities. Devices include wearable biosensors that monitor physiological indicators of stress and anxiety, such as heart rate variability and sleep patterns. Applications are tailored for conditions like stress, anxiety, and depression, with specialized tools for bipolar disorder and other emerging mental health concerns. Unique selling propositions lie in their data-driven personalization, 24/7 accessibility, and the ability to bridge gaps in traditional care. Technological advancements are continuously improving user engagement, therapeutic efficacy, and data security, making these solutions increasingly integrated into comprehensive mental healthcare.

Key Drivers, Barriers & Challenges in Emerging Mental Health Devices and Platforms Industry

Key Drivers:

- Technological Advancements: The relentless progress in AI, machine learning, VR, and wearable technology fuels the development of more sophisticated and personalized mental health solutions.

- Increased Mental Health Awareness: Growing global recognition of mental health issues and the destigmatization of seeking help are driving demand.

- Accessibility and Affordability: Digital platforms offer a more accessible and often more affordable alternative to traditional in-person therapy, especially in underserved areas.

- Remote Monitoring Capabilities: Wearable devices and platforms enable continuous monitoring of patient well-being, facilitating proactive intervention.

Barriers & Challenges:

- Regulatory Hurdles: Navigating complex and evolving regulatory frameworks for digital therapeutics and data privacy remains a significant challenge.

- Data Security and Privacy Concerns: Ensuring the secure handling of sensitive mental health data is paramount and requires robust cybersecurity measures.

- User Adoption and Engagement: Sustaining long-term user engagement with digital platforms can be difficult, requiring compelling user experiences and demonstrable efficacy.

- Reimbursement Policies: Inconsistent and evolving insurance reimbursement policies can hinder widespread adoption by healthcare providers and patients.

- Digital Divide: Unequal access to technology and reliable internet connectivity can exclude certain populations from benefiting from these solutions.

- Clinical Validation and Efficacy Proof: Demonstrating robust clinical evidence for the efficacy of digital mental health tools is crucial for widespread acceptance by clinicians and patients.

Emerging Opportunities in Emerging Mental Health Devices and Platforms Industry

The Emerging Mental Health Devices and Platforms Industry presents a wealth of untapped opportunities. The expansion of VR and AR-based therapeutic applications offers immersive and engaging treatment modalities for phobias, PTSD, and social anxiety. Personalized AI-driven coaching platforms are evolving to cater to niche conditions and specific demographic needs, such as workplace stress or post-partum depression. The integration of mental health monitoring into comprehensive wellness ecosystems, including fitness trackers and smart home devices, presents a significant opportunity for proactive and preventative care. Furthermore, the growing demand for culturally sensitive and language-specific mental health support opens avenues for localized platform development and content creation. The potential to combine hardware and software solutions, like wearable biosensors paired with advanced analytical platforms, promises more holistic and data-rich insights for both users and clinicians.

Growth Accelerators in the Emerging Mental Health Devices and Platforms Industry Industry

Several catalysts are accelerating the growth of the Emerging Mental Health Devices and Platforms Industry. Technological breakthroughs, particularly in AI for predictive analytics and personalized interventions, are key. Strategic partnerships between technology companies, healthcare providers, and insurance payers are expanding market reach and fostering integration into existing healthcare systems. The increasing acceptance and adoption of telehealth services, accelerated by global events, have normalized digital mental health solutions. Furthermore, growing venture capital investment and government initiatives focused on mental health accessibility are fueling innovation and market expansion. The development of robust clinical evidence and the establishment of clear regulatory pathways are also critical growth accelerators, building trust and facilitating wider adoption.

Key Players Shaping the Emerging Mental Health Devices and Platforms Industry Market

- Woebot Health

- Clarigent Health

- Teladoc Health Inc

- Feel Therapeutics

- Headspace Inc

- Spring Care Inc

- Calm

- Talkspace Inc

- Quartet Health Inc

- Electromedical Products International Inc

- Twill Inc (Happify Inc)

Notable Milestones in Emerging Mental Health Devices and Platforms Industry Sector

- September 2023: Novobeing, a digital health company, launched its multi-sensory VR stress management application on the Meta Quest, offering users a transformative journey toward relaxation, stress relief, and mental clarity.

- August 2023: Mantra Health, a clinically-informed digital mental health provider for higher education, entered a new partnership with Charlie Health, the nation's provider of virtual high-acuity mental healthcare for teens and young adults. Mantra Health will add Charlie Health's virtual intensive outpatient program (IOP) to its suite of mental health services, further expanding the levels of care available to students.

In-Depth Emerging Mental Health Devices and Platforms Industry Market Outlook

The future of the Emerging Mental Health Devices and Platforms Industry is exceptionally bright, fueled by sustained growth accelerators. Technological breakthroughs in AI, machine learning, and personalized digital therapeutics will continue to enhance the efficacy and accessibility of mental health solutions. Strategic partnerships between innovative startups, established healthcare organizations, and insurance providers are poised to drive deeper integration into mainstream healthcare. The increasing normalization of telehealth and the growing demand for proactive mental wellness tools will create substantial market expansion opportunities. As regulatory frameworks mature and clinical validation strengthens, user and provider confidence will escalate, further propelling market adoption. The industry's trajectory indicates a transformative impact on how mental well-being is supported globally.

Emerging Mental Health Devices and Platforms Industry Segmentation

-

1. Product Type

- 1.1. Platforms

- 1.2. Devices

-

2. Application

- 2.1. Stress

- 2.2. Anxiety

- 2.3. Depression

- 2.4. Bipolar Disorder

- 2.5. Other Applications

Emerging Mental Health Devices and Platforms Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Emerging Mental Health Devices and Platforms Industry Regional Market Share

Geographic Coverage of Emerging Mental Health Devices and Platforms Industry

Emerging Mental Health Devices and Platforms Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Teleconsultations and Mental Support Platforms; Increased Funding Activity in the Digital Mental Health Environment

- 3.3. Market Restrains

- 3.3.1. Limited Scientific Data that has been Clinically Validated

- 3.4. Market Trends

- 3.4.1. Mental Health Platforms are Expected to Hold a Major Share of the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Platforms

- 5.1.2. Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Stress

- 5.2.2. Anxiety

- 5.2.3. Depression

- 5.2.4. Bipolar Disorder

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Platforms

- 6.1.2. Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Stress

- 6.2.2. Anxiety

- 6.2.3. Depression

- 6.2.4. Bipolar Disorder

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Platforms

- 7.1.2. Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Stress

- 7.2.2. Anxiety

- 7.2.3. Depression

- 7.2.4. Bipolar Disorder

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Platforms

- 8.1.2. Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Stress

- 8.2.2. Anxiety

- 8.2.3. Depression

- 8.2.4. Bipolar Disorder

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Platforms

- 9.1.2. Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Stress

- 9.2.2. Anxiety

- 9.2.3. Depression

- 9.2.4. Bipolar Disorder

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Emerging Mental Health Devices and Platforms Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Platforms

- 10.1.2. Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Stress

- 10.2.2. Anxiety

- 10.2.3. Depression

- 10.2.4. Bipolar Disorder

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Woebot Health

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clarigent Health

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teladoc Health Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Feel Therapeutics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Headspace Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spring Care Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Calm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Talkspace Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Quartet Health Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Electromedical Products International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Twill Inc (Happify Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Woebot Health

List of Figures

- Figure 1: Global Emerging Mental Health Devices and Platforms Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: South America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Emerging Mental Health Devices and Platforms Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Emerging Mental Health Devices and Platforms Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 11: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 29: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 35: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Emerging Mental Health Devices and Platforms Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Emerging Mental Health Devices and Platforms Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Emerging Mental Health Devices and Platforms Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Emerging Mental Health Devices and Platforms Industry?

Key companies in the market include Woebot Health, Clarigent Health, Teladoc Health Inc, Feel Therapeutics, Headspace Inc, Spring Care Inc, Calm, Talkspace Inc, Quartet Health Inc, Electromedical Products International Inc, Twill Inc (Happify Inc ).

3. What are the main segments of the Emerging Mental Health Devices and Platforms Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Teleconsultations and Mental Support Platforms; Increased Funding Activity in the Digital Mental Health Environment.

6. What are the notable trends driving market growth?

Mental Health Platforms are Expected to Hold a Major Share of the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Limited Scientific Data that has been Clinically Validated.

8. Can you provide examples of recent developments in the market?

September 2023: Novobeing, a digital health company, launched its multi-sensory VR stress management application on the Meta Quest, offering users a transformative journey toward relaxation, stress relief, and mental clarity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Emerging Mental Health Devices and Platforms Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Emerging Mental Health Devices and Platforms Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Emerging Mental Health Devices and Platforms Industry?

To stay informed about further developments, trends, and reports in the Emerging Mental Health Devices and Platforms Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence