Key Insights

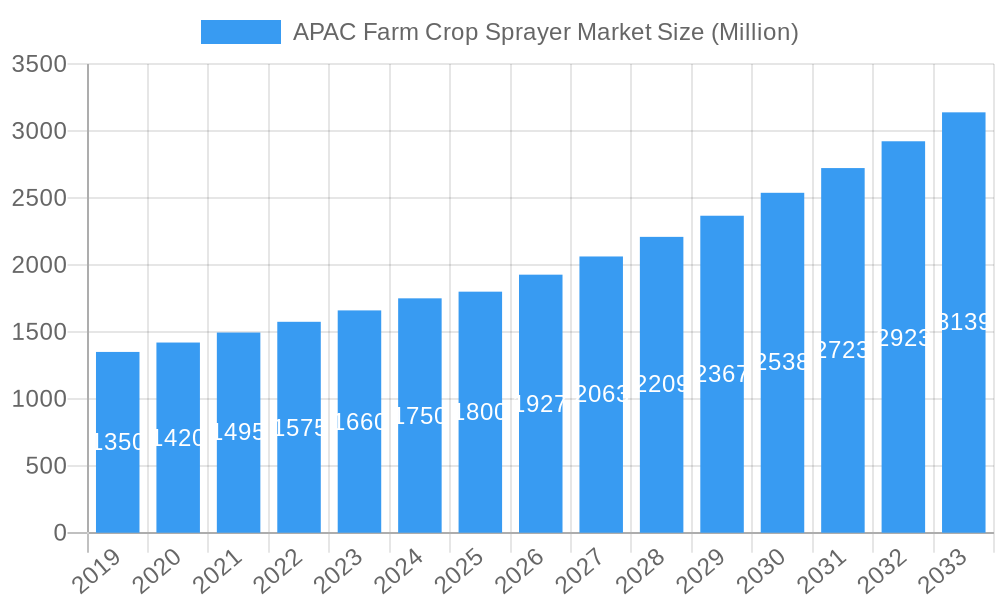

The Asia Pacific (APAC) Farm Crop Sprayer Market is poised for significant expansion, projecting a market size of approximately USD 1,800 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.10% through 2033. This growth is propelled by a confluence of factors, including the increasing adoption of advanced agricultural technologies to enhance crop yields and combat pest infestations, a growing need for efficient and sustainable farming practices, and government initiatives aimed at modernizing the agricultural sector across the region. The burgeoning population in APAC countries necessitates increased food production, directly stimulating demand for effective crop protection solutions like farm crop sprayers. Furthermore, the rising disposable income of farmers and greater access to financing are empowering them to invest in sophisticated spraying equipment that offers precision application and reduced environmental impact. The market is witnessing a surge in demand for both manual and power sprayers, with a notable shift towards automated and smart spraying solutions that offer enhanced efficiency and data-driven insights for optimal crop management.

APAC Farm Crop Sprayer Market Market Size (In Billion)

The market landscape is characterized by dynamic segmentation across production, consumption, import, export, and pricing trends. Production analysis reveals a strong manufacturing base, particularly in countries like China and India, catering to both domestic and international demand. Consumption patterns are influenced by the diverse agricultural practices prevalent across APAC, with a growing emphasis on precision agriculture and integrated pest management. The import and export markets are active, with significant trade flows facilitating the accessibility of a wide range of sprayer technologies. Price trends are influenced by raw material costs, technological advancements, and competitive pressures from a growing number of domestic and international players. Key companies such as Mahindra & Mahindra Ltd, Deere & Company, and AGCO Corporation are actively investing in research and development to introduce innovative products, including drones and smart sprayers, to capture a larger market share. Emerging trends like the integration of IoT and AI for real-time monitoring and application control are expected to further revolutionize the farm crop sprayer market in APAC, driving efficiency and sustainability in agriculture.

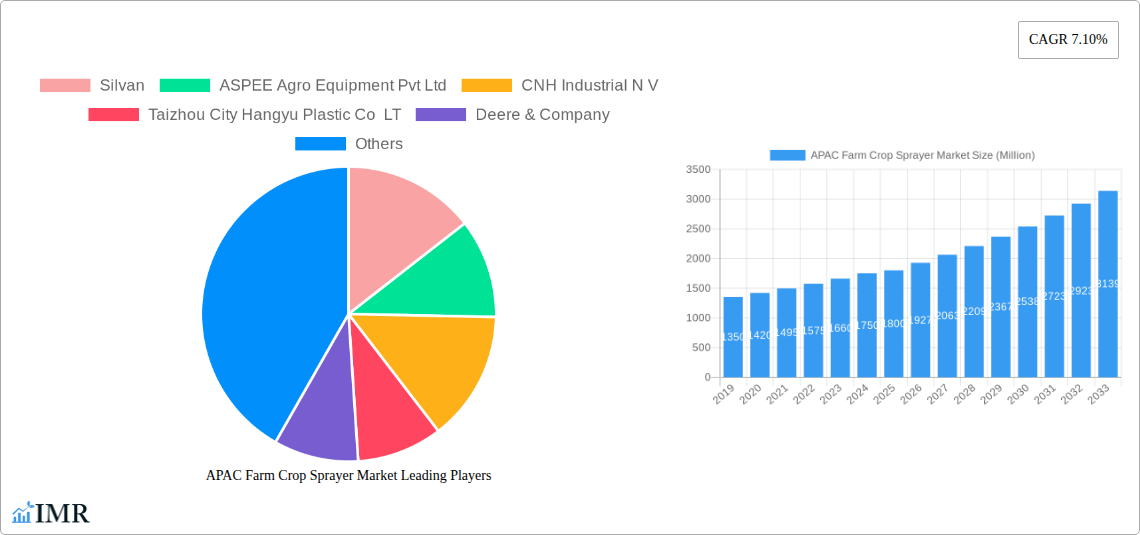

APAC Farm Crop Sprayer Market Company Market Share

APAC Farm Crop Sprayer Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the APAC Farm Crop Sprayer Market, exploring growth drivers, market dynamics, technological innovations, and key player strategies. Covering production, consumption, import/export, and price trends, this study offers unparalleled insights for stakeholders seeking to capitalize on the region's burgeoning agricultural sector. We meticulously analyze the parent farm crop sprayer market and its child market segments, delivering a holistic view of the landscape. All quantitative values are presented in Million units.

APAC Farm Crop Sprayer Market Market Dynamics & Structure

The APAC Farm Crop Sprayer Market is characterized by a moderately concentrated landscape, with a few key players holding significant market share, alongside a growing number of regional and specialized manufacturers. Technological innovation is a primary driver, fueled by the increasing demand for precision agriculture, smart farming solutions, and environmentally friendly spraying technologies. Government initiatives promoting agricultural modernization and crop yield enhancement further bolster market growth. Regulatory frameworks, while varying across countries, are generally focused on ensuring the safe and efficient use of crop protection chemicals and promoting sustainable agricultural practices. Competitive product substitutes include manual spraying methods, drone-based spraying, and integrated pest management techniques, though traditional sprayers remain dominant due to cost-effectiveness and established infrastructure. End-user demographics are shifting, with a growing adoption of advanced machinery by large-scale commercial farms and a rising interest among smallholder farmers in more accessible and efficient solutions. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation by larger players to expand their product portfolios, market reach, and technological capabilities. For instance, recent years have seen an average of 3-5 significant M&A deals annually, aimed at acquiring innovative technologies or gaining access to new geographic markets.

- Market Concentration: Dominated by a blend of global conglomerates and agile local manufacturers.

- Technological Innovation Drivers: Precision spraying, IoT integration, AI-powered solutions, and sustainable technologies.

- Regulatory Frameworks: Emphasis on safety, efficiency, and environmental sustainability in agrochemical application.

- Competitive Product Substitutes: Drones, manual methods, integrated pest management.

- End-User Demographics: Increasing adoption by commercial farms, with growing interest from smallholder farmers.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

APAC Farm Crop Sprayer Market Growth Trends & Insights

The APAC Farm Crop Sprayer Market is poised for robust expansion, driven by a confluence of factors that are reshaping agricultural practices across the region. The market size is projected to evolve from an estimated USD 850.5 Million units in 2025 to USD 1,320.8 Million units by 2033, exhibiting a significant Compound Annual Growth Rate (CAGR) of approximately 5.6% during the forecast period. This growth trajectory is underpinned by the escalating adoption rates of modern spraying technologies, directly influenced by government incentives aimed at boosting agricultural productivity and ensuring food security for a burgeoning population. Technological disruptions, such as the integration of GPS and sensor technologies for targeted spraying, are playing a pivotal role. These advancements not only enhance the efficiency of pesticide and fertilizer application but also contribute to reduced chemical usage, thereby minimizing environmental impact. Consumer behavior shifts are also contributing to the market's dynamism. Farmers are increasingly prioritizing efficiency, cost-effectiveness, and sustainability in their equipment choices. The demand for electrically powered sprayers and automated spray systems is on the rise, reflecting a growing awareness of environmental concerns and a desire to optimize operational costs. Furthermore, the increasing prevalence of large-scale commercial farming operations, particularly in countries like China and India, necessitates the adoption of advanced spraying solutions to manage vast agricultural lands effectively. The report details how market penetration of smart spraying technologies, currently at around 22%, is expected to surge to over 45% by 2033, signaling a profound transformation in the APAC agricultural machinery sector. The increasing mechanization in the agriculture sector, coupled with the need for efficient crop protection solutions to combat evolving pest and disease challenges, further accentuates the positive growth outlook for the APAC farm crop sprayer market. The development of lightweight, durable, and user-friendly sprayers is also making these technologies more accessible to a wider range of farmers, including those with smaller landholdings.

Dominant Regions, Countries, or Segments in APAC Farm Crop Sprayer Market

The APAC Farm Crop Sprayer Market is experiencing dynamic growth, with several regions, countries, and segments contributing significantly to its expansion. China consistently emerges as the dominant country in terms of both Production Analysis and Consumption Analysis, driven by its vast agricultural landmass, substantial government investment in agricultural modernization, and a strong manufacturing base for agricultural machinery. In 2025, China's production is estimated at 3.8 Million units, while its consumption is projected at 2.9 Million units. The country's focus on enhancing crop yields to feed its massive population and its proactive adoption of advanced farming technologies make it a powerhouse in the sprayer market.

Production Analysis:

- China: Leads production due to its extensive manufacturing capabilities and supportive government policies. Estimated production: 3.8 Million units in 2025.

- India: A significant producer, driven by its large agricultural sector and increasing mechanization efforts. Estimated production: 1.2 Million units in 2025.

- Southeast Asian Nations (e.g., Vietnam, Thailand): Growing production capacity, catering to both domestic and regional demand.

Consumption Analysis:

- China: Highest consumption owing to the sheer scale of its agricultural operations and adoption of advanced technologies. Estimated consumption: 2.9 Million units in 2025.

- India: Second largest consumer, with a rapidly growing demand for efficient and affordable spraying solutions. Estimated consumption: 2.1 Million units in 2025.

- Indonesia and Vietnam: Substantial consumption driven by their significant agricultural outputs in key crops.

Import Market Analysis (Value & Volume):

- China: While a major producer, it also imports high-end and specialized spraying equipment. Estimated import value: USD 450 Million in 2025.

- India: Significant importer of advanced agricultural machinery, including specialized sprayers, to bridge technological gaps. Estimated import volume: 0.3 Million units in 2025.

- Australia: Imports high-performance and technologically advanced sprayers for its large-scale commercial farming operations.

Export Market Analysis (Value & Volume):

- China: Dominant exporter, supplying a wide range of sprayers to countries across Asia, Africa, and Latin America. Estimated export volume: 1.5 Million units in 2025.

- India: Growing exporter, particularly of smaller and mid-sized sprayers to neighboring countries. Estimated export value: USD 280 Million in 2025.

- South Korea: Exports niche, high-tech agricultural machinery, including specialized sprayers.

Price Trend Analysis:

- China: Offers competitive pricing for mass-produced sprayers, influencing global price trends.

- India: Competitive pricing, with a focus on affordability for smallholder farmers.

- Developed APAC Nations (e.g., Japan, South Korea, Australia): Higher price points for premium, technologically advanced sprayers.

The dominant segment in terms of market value is Tractor-mounted sprayers, accounting for approximately 45% of the market share in 2025, followed by Self-propelled sprayers at around 25%. The growing adoption of drone technology for spraying represents a rapidly emerging, albeit smaller, segment with significant future potential. Economic policies promoting agricultural subsidies, infrastructure development in rural areas, and the increasing focus on precision agriculture are key drivers of dominance in these regions and segments.

APAC Farm Crop Sprayer Market Product Landscape

The APAC Farm Crop Sprayer Market is witnessing a surge in product innovations, driven by the demand for enhanced efficiency, precision, and sustainability. Key product advancements include the integration of smart technologies like GPS navigation and real-time data analytics for optimized application rates and targeted spraying, minimizing waste and environmental impact. We are seeing a rise in electrically powered sprayers offering reduced noise pollution and lower operating costs compared to traditional engine-driven models. Furthermore, the development of lightweight, durable materials and ergonomic designs is improving user experience and accessibility for a wider range of farmers. Performance metrics are increasingly focused on droplet size control, boom stability, and flow rate accuracy, ensuring optimal pesticide efficacy. Unique selling propositions often revolve around advanced features such as automated boom height adjustment, variable rate application capabilities, and seamless integration with farm management software.

Key Drivers, Barriers & Challenges in APAC Farm Crop Sprayer Market

Key Drivers:

- Increasing Demand for Food Security: Growing population necessitates higher crop yields, driving the adoption of efficient crop protection solutions.

- Government Initiatives & Subsidies: Policies promoting agricultural mechanization and precision farming significantly boost sprayer adoption.

- Technological Advancements: Integration of GPS, sensors, and AI for precision application enhances efficiency and reduces costs.

- Growing Awareness of Sustainable Agriculture: Demand for eco-friendly spraying solutions and reduced chemical usage fuels innovation.

- Rise of Commercial Farming: Large-scale agricultural operations require advanced machinery for efficient land management.

Barriers & Challenges:

- High Initial Cost: Advanced sprayers can have a significant upfront investment, posing a challenge for smallholder farmers.

- Lack of Technical Expertise: Inadequate training and technical know-how for operating and maintaining sophisticated machinery in some regions.

- Infrastructure Deficiencies: Poor rural road networks and limited access to electricity in remote areas can hinder adoption and maintenance.

- Fragmented Land Holdings: Small and scattered land parcels can make the economic viability of large, advanced sprayers challenging.

- Regulatory Compliance: Navigating diverse and sometimes stringent regulations across different APAC countries can be complex for manufacturers and users.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products, leading to production delays and price volatility.

Emerging Opportunities in the APAC Farm Crop Sprayer Market

Emerging opportunities in the APAC Farm Crop Sprayer Market are largely centered around drone-based spraying solutions, which offer unparalleled agility and precision for difficult terrains and specialized crops. The increasing demand for organic farming presents an opportunity for sprayers designed for natural and biological pest control agents. Furthermore, the development of IoT-enabled sprayers that provide real-time data on application, equipment performance, and weather conditions presents a significant opportunity for predictive maintenance and enhanced farm management. Modular and adaptable sprayer designs that can cater to a variety of crops and farm sizes, particularly those offering a combination of electric and manual operation, are also gaining traction. The untapped potential in smaller agricultural economies within Southeast Asia and the Pacific islands offers significant expansion avenues for cost-effective and user-friendly spraying technologies.

Growth Accelerators in the APAC Farm Crop Sprayer Market Industry

The long-term growth of the APAC Farm Crop Sprayer Market is being significantly accelerated by breakthroughs in robotics and automation, paving the way for fully autonomous spraying systems. Strategic partnerships between agricultural technology companies and local distributors are crucial for expanding market reach and providing essential after-sales support. The increasing focus on data-driven farming is creating a demand for sprayers that seamlessly integrate with broader farm management platforms, enabling optimized decision-making. Furthermore, the development of environmentally friendly and biodegradable application solutions is not only meeting regulatory demands but also appealing to a growing segment of environmentally conscious farmers, acting as a powerful growth catalyst.

Key Players Shaping the APAC Farm Crop Sprayer Market Market

- Silvan

- ASPEE Agro Equipment Pvt Ltd

- CNH Industrial N V

- Taizhou City Hangyu Plastic Co LT

- Deere & Company

- Mahindra & Mahindra Ltd

- Hardi Australia

- AGCO Corporation

Notable Milestones in APAC Farm Crop Sprayer Market Sector

- 2023/11: Launch of new drone-integrated sprayer models by a leading manufacturer, enhancing precision application capabilities.

- 2024/02: Significant investment in R&D by a major player to develop advanced electric sprayer technology.

- 2024/07: Acquisition of a specialized precision spraying technology firm by a global agricultural machinery giant to expand its smart farming portfolio.

- 2024/10: Introduction of government subsidy programs in several Southeast Asian countries to promote the adoption of modern agricultural equipment, including crop sprayers.

- 2025/01: Increased focus on developing user-friendly interfaces and training modules for smart sprayers to address the skill gap among farmers.

In-Depth APAC Farm Crop Sprayer Market Market Outlook

The future outlook for the APAC Farm Crop Sprayer Market is exceptionally bright, propelled by sustained growth accelerators. Continued advancements in robotics, AI, and IoT integration will lead to increasingly autonomous and intelligent spraying solutions, driving efficiency and sustainability. Strategic alliances and collaborations will be instrumental in navigating diverse market demands and expanding global footprints. The evolving agricultural landscape, characterized by a growing emphasis on precision, efficiency, and environmental stewardship, presents a fertile ground for innovative spraying technologies. Opportunities lie in addressing the specific needs of smallholder farmers through more accessible and affordable solutions, while simultaneously catering to the sophisticated requirements of large commercial operations with high-tech equipment. The market is set to witness a paradigm shift towards smart, connected, and sustainable crop protection.

APAC Farm Crop Sprayer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

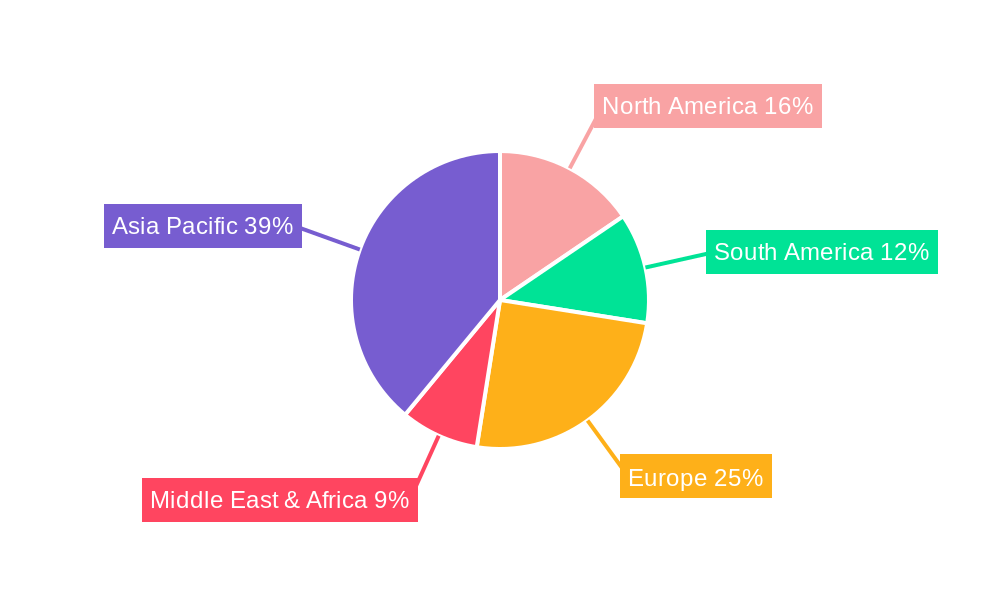

APAC Farm Crop Sprayer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Farm Crop Sprayer Market Regional Market Share

Geographic Coverage of APAC Farm Crop Sprayer Market

APAC Farm Crop Sprayer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. Increase in Average Farm Size Leading to Adoption of Tractor-Mounted Sprayers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific APAC Farm Crop Sprayer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silvan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASPEE Agro Equipment Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CNH Industrial N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taizhou City Hangyu Plastic Co LT

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deere & Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mahindra & Mahindra Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hardi Australia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGCO Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Silvan

List of Figures

- Figure 1: Global APAC Farm Crop Sprayer Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Farm Crop Sprayer Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America APAC Farm Crop Sprayer Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America APAC Farm Crop Sprayer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America APAC Farm Crop Sprayer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America APAC Farm Crop Sprayer Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America APAC Farm Crop Sprayer Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America APAC Farm Crop Sprayer Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America APAC Farm Crop Sprayer Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America APAC Farm Crop Sprayer Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America APAC Farm Crop Sprayer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America APAC Farm Crop Sprayer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America APAC Farm Crop Sprayer Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America APAC Farm Crop Sprayer Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America APAC Farm Crop Sprayer Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe APAC Farm Crop Sprayer Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe APAC Farm Crop Sprayer Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa APAC Farm Crop Sprayer Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific APAC Farm Crop Sprayer Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global APAC Farm Crop Sprayer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific APAC Farm Crop Sprayer Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Farm Crop Sprayer Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the APAC Farm Crop Sprayer Market?

Key companies in the market include Silvan, ASPEE Agro Equipment Pvt Ltd, CNH Industrial N V, Taizhou City Hangyu Plastic Co LT, Deere & Company, Mahindra & Mahindra Ltd, Hardi Australia, AGCO Corporation.

3. What are the main segments of the APAC Farm Crop Sprayer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

Increase in Average Farm Size Leading to Adoption of Tractor-Mounted Sprayers.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Farm Crop Sprayer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Farm Crop Sprayer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Farm Crop Sprayer Market?

To stay informed about further developments, trends, and reports in the APAC Farm Crop Sprayer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence