Key Insights

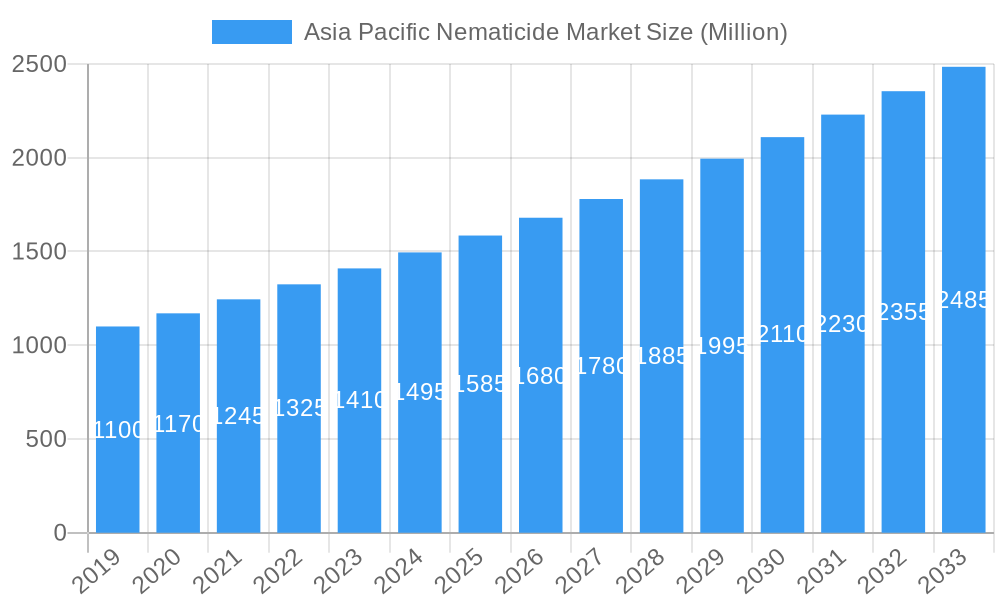

The Asia Pacific nematicide market is poised for robust expansion, projected to reach a substantial market size of approximately USD 1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.30% through 2033. This growth is propelled by a confluence of factors, including the escalating need to protect high-value crops such as fruits, vegetables, and commercial crops from devastating nematode infestations. The region’s substantial agricultural output and increasing awareness among farmers regarding the economic impact of these soil-borne pests are significant drivers. Furthermore, the burgeoning demand for sustainable agricultural practices is fostering the adoption of integrated pest management (IPM) strategies, where nematicides play a crucial role. Key applications like seed treatment and soil treatment are witnessing heightened adoption due to their efficacy in providing early-stage protection to crops. The increasing emphasis on food security and the need to enhance crop yields to meet the demands of a growing population are further underpinning the market's upward trajectory.

Asia Pacific Nematicide Market Market Size (In Billion)

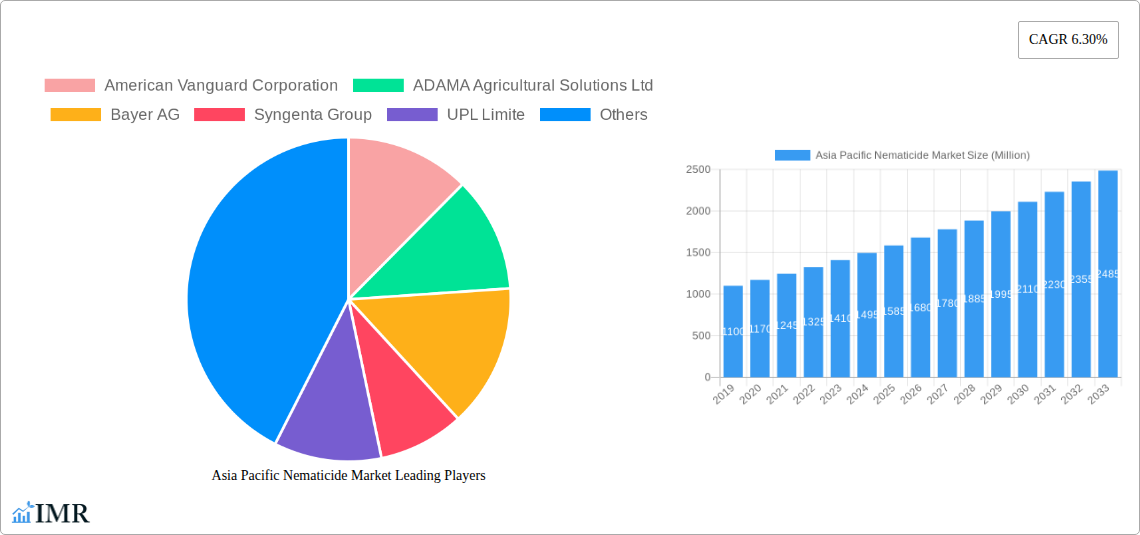

Several trends are shaping the competitive landscape of the Asia Pacific nematicide market. A notable trend is the shift towards more environmentally friendly and bio-based nematicide formulations, driven by stringent regulatory frameworks and growing consumer preference for residue-free produce. Companies are actively investing in research and development to introduce innovative products that offer improved efficacy, reduced toxicity, and better biodegradability. While the market benefits from strong demand, certain restraints could influence its pace. These include the high cost of certain advanced nematicide formulations, the potential for nematode resistance development, and the complex regulatory approval processes in some countries. However, the sustained efforts by key players like Bayer AG, Syngenta Group, and UPL Limited to expand their product portfolios and distribution networks across the region, coupled with government initiatives supporting agricultural modernization, are expected to mitigate these challenges and ensure continued market growth.

Asia Pacific Nematicide Market Company Market Share

Asia Pacific Nematicide Market Report: Unveiling Growth Dynamics and Investment Prospects (2019-2033)

This comprehensive report offers an in-depth analysis of the Asia Pacific Nematicide Market, providing critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, emerging opportunities, and the competitive landscape. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning demand for nematicide solutions in the region. We meticulously dissect market segments, including Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment, Soil Treatment) and Crop Type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental), offering a granular view of market penetration and adoption. Quantified with values in Million Units, this report provides actionable intelligence for agribusinesses, chemical manufacturers, investors, and agricultural professionals navigating the complexities of the Asia Pacific agricultural sector.

Asia Pacific Nematicide Market Market Dynamics & Structure

The Asia Pacific Nematicide Market is characterized by a moderate to high market concentration, with key players like Bayer AG, Syngenta Group, ADAMA Agricultural Solutions Ltd, and UPL Limited holding significant market shares. Technological innovation is a primary driver, fueled by the increasing adoption of advanced formulations and bio-nematicides aimed at sustainable agriculture. The regulatory framework, while evolving, poses a significant barrier to entry for new players, particularly concerning the registration and approval of novel active ingredients. Competitive product substitutes, including biological control agents and resistant crop varieties, exert pressure on traditional chemical nematicides. End-user demographics are shifting, with a growing demand from commercial crop growers, particularly in high-value fruit and vegetable segments, and a rising awareness among farmers regarding the economic impact of nematode infestations. Mergers and acquisitions (M&A) trends indicate strategic consolidation to enhance market reach and product portfolios, as evidenced by ADAMA's acquisition of AgriNova New Zealand Ltd.

- Market Concentration: Dominated by a few key global and regional players.

- Technological Innovation: Focus on sustainable and eco-friendly nematicide solutions.

- Regulatory Hurdles: Stringent registration processes impacting market entry.

- Competitive Landscape: Intense competition from both chemical and biological alternatives.

- End-User Demographics: Increasing demand from commercial agriculture and horticulture.

- M&A Activity: Strategic acquisitions to expand market presence and product offerings.

Asia Pacific Nematicide Market Growth Trends & Insights

The Asia Pacific Nematicide Market is poised for robust growth, driven by an increasing global population and the resultant demand for enhanced food production. This surge necessitates advanced crop protection strategies to mitigate yield losses caused by nematodes, which are significant agricultural pests. The market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period. Adoption rates for nematicides are steadily rising, influenced by greater farmer awareness of the economic damages incurred by nematode infestations and the availability of more effective and targeted application methods. Technological disruptions, such as the development of novel active ingredients with improved environmental profiles and enhanced efficacy, are playing a pivotal role in shaping market trends. Consumer behavior shifts towards higher quality produce also indirectly fuel demand for nematicides that ensure optimal crop health and yield. The penetration of nematicide usage is expected to deepen across both established and emerging agricultural economies within the Asia Pacific region, as farmers increasingly invest in yield-enhancing technologies.

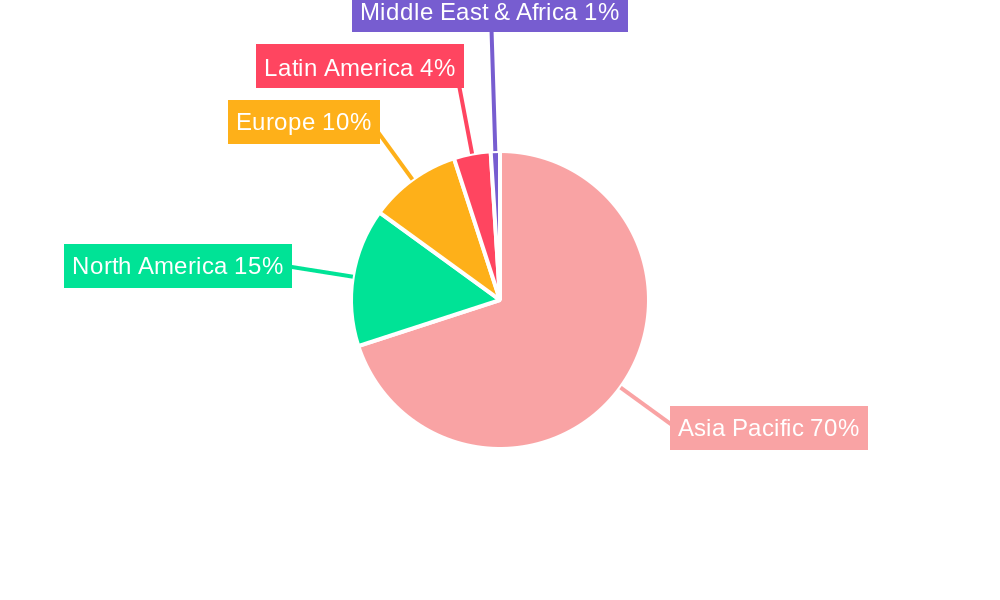

Dominant Regions, Countries, or Segments in Asia Pacific Nematicide Market

The Asia Pacific Nematicide Market's dominance is largely dictated by Commercial Crops and Fruits & Vegetables segments, driven by their high economic value and susceptibility to nematode damage. Geographically, countries like China, India, and Southeast Asian nations are emerging as significant growth engines due to their vast agricultural land, increasing adoption of modern farming practices, and substantial investments in agricultural R&D. The Soil Treatment and Seed Treatment application modes are particularly dominant due to their effectiveness in early-stage pest management, preventing nematode establishment and subsequent crop damage. Economic policies supporting agricultural modernization, coupled with substantial government initiatives aimed at boosting crop yields and ensuring food security, are critical factors underpinning this regional dominance.

- Leading Crop Segments: Commercial Crops and Fruits & Vegetables exhibit the highest demand due to economic significance and vulnerability to nematode damage.

- Key Geographic Hubs: China, India, and Southeast Asian nations are at the forefront of market growth.

- Dominant Application Modes: Soil Treatment and Seed Treatment methods are crucial for early and effective nematode control.

- Driving Economic Factors: Government subsidies, agricultural modernization initiatives, and increased farm mechanization contribute significantly to market expansion.

- Growth Potential: Untapped potential exists in regions with developing agricultural sectors and increasing awareness of nematode management.

Asia Pacific Nematicide Market Product Landscape

The Asia Pacific Nematicide Market product landscape is evolving with a strong emphasis on innovation. Key developments include the introduction of novel chemical nematicides with enhanced efficacy and reduced environmental impact, alongside a significant surge in bio-nematicides derived from microbial agents. These products offer a more sustainable approach to nematode control. Applications are diversifying, with a growing focus on integrated pest management (IPM) strategies that combine chemical and biological nematicides for optimal results. Performance metrics are continuously being improved, with newer formulations exhibiting better residual activity, broader spectrum control, and higher safety profiles for applicators and beneficial organisms. The unique selling propositions often lie in the specificity of action, ease of application, and compliance with stringent environmental regulations, making these advanced nematicides increasingly attractive to progressive farmers.

Key Drivers, Barriers & Challenges in Asia Pacific Nematicide Market

Key Drivers: The Asia Pacific Nematicide Market is propelled by several key drivers. The escalating need for higher agricultural productivity to feed a growing population is paramount. Increasing awareness among farmers about the significant economic losses attributable to nematode infestations is a major catalyst. Furthermore, the ongoing advancements in nematicide formulations, offering improved efficacy and environmental compatibility, are significantly boosting market adoption. Government initiatives promoting sustainable agriculture and food security also play a crucial role in driving the demand for effective nematode control solutions.

Barriers & Challenges: Despite the growth, the market faces significant barriers and challenges. Stringent regulatory approvals for new nematicide products, particularly in developing economies, can lead to extended market entry timelines. The high cost of certain advanced nematicides can be prohibitive for smallholder farmers. Supply chain disruptions, especially in the case of imported active ingredients, pose a persistent challenge. Moreover, growing public concern regarding the environmental impact of synthetic pesticides and the increasing demand for organic produce necessitate the development and adoption of more sustainable and eco-friendly nematicide alternatives, presenting a complex balancing act for manufacturers.

Emerging Opportunities in Asia Pacific Nematicide Market

Emerging opportunities in the Asia Pacific Nematicide Market lie in the increasing demand for integrated pest management (IPM) solutions. The development and promotion of bio-nematicides, offering environmentally friendly alternatives with reduced toxicity, present a significant growth avenue. Untapped markets in developing agricultural economies within the region, where awareness of nematode issues is growing but adoption rates are still low, represent substantial potential. Evolving consumer preferences for residue-free produce are also driving innovation towards more targeted and less persistent nematicide applications. Furthermore, the expansion of precision agriculture technologies, enabling more efficient and targeted nematicide application, opens new avenues for market penetration and value creation.

Growth Accelerators in the Asia Pacific Nematicide Market Industry

Several catalysts are accelerating long-term growth in the Asia Pacific Nematicide Market. Technological breakthroughs in developing novel, highly potent, and environmentally benign nematicide active ingredients are a primary accelerator. Strategic partnerships between global chemical companies and regional distributors are crucial for expanding market reach and ensuring product availability. Furthermore, the increasing trend of market expansion by key players into emerging economies, coupled with investments in local R&D and manufacturing facilities, is significantly boosting market momentum. The adoption of advanced application technologies, such as drone-based spraying and precision soil application, is also acting as a growth accelerator by improving the efficacy and cost-effectiveness of nematicide usage.

Key Players Shaping the Asia Pacific Nematicide Market Market

- American Vanguard Corporation

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Syngenta Group

- UPL Limited

- Corteva Agriscience

Notable Milestones in Asia Pacific Nematicide Market Sector

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

- June 2022: AgriNova New Zealand Ltd was acquired by ADAMA Ltd. With this acquisition, ADAMA expanded its product line in the New Zealand market.

- October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

In-Depth Asia Pacific Nematicide Market Market Outlook

The Asia Pacific Nematicide Market is set to experience a period of significant expansion, driven by the confluence of rising food demand and the persistent threat of nematode damage to crops. Growth accelerators will continue to be fueled by ongoing research and development efforts focused on creating more effective, sustainable, and residue-free nematicide solutions. Strategic collaborations and mergers among key industry players will further consolidate market leadership and expand product portfolios, ensuring wider accessibility of advanced crop protection technologies. The increasing adoption of precision agriculture and digital farming tools will enable more targeted and efficient application of nematicides, enhancing their efficacy and reducing environmental impact. This dynamic environment presents substantial strategic opportunities for market participants to innovate, expand their geographical reach, and cater to the evolving needs of the agricultural sector in the Asia Pacific region.

Asia Pacific Nematicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Seed Treatment

- 1.5. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Seed Treatment

- 3.5. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Asia Pacific Nematicide Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Nematicide Market Regional Market Share

Geographic Coverage of Asia Pacific Nematicide Market

Asia Pacific Nematicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Nematicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Seed Treatment

- 5.1.5. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Seed Treatment

- 5.3.5. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Vanguard Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ADAMA Agricultural Solutions Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corteva Agriscience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Vanguard Corporation

List of Figures

- Figure 1: Asia Pacific Nematicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Nematicide Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Nematicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 2: Asia Pacific Nematicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 3: Asia Pacific Nematicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 4: Asia Pacific Nematicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 5: Asia Pacific Nematicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Nematicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 7: Asia Pacific Nematicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 8: Asia Pacific Nematicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 9: Asia Pacific Nematicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 10: Asia Pacific Nematicide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia Pacific Nematicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Nematicide Market?

The projected CAGR is approximately 11.29%.

2. Which companies are prominent players in the Asia Pacific Nematicide Market?

Key companies in the market include American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, Syngenta Group, UPL Limite, Corteva Agriscience.

3. What are the main segments of the Asia Pacific Nematicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.June 2022: AgriNova New Zealand Ltd was acquired by ADAMA Ltd. With this acquisition, ADAMA expanded its product line in the New Zealand market.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Nematicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Nematicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Nematicide Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Nematicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence