Key Insights

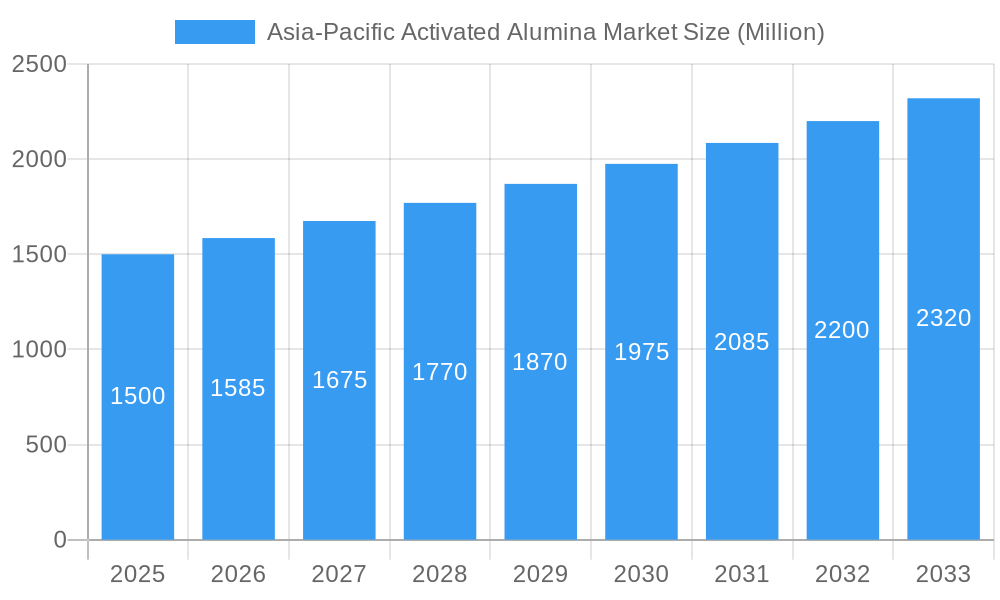

The Asia-Pacific Activated Alumina market is projected for substantial growth, with an estimated market size of $2.21 billion by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 6% during the forecast period of 2025-2033. This expansion is driven by increasing demand in key applications, including catalysis and desiccation. The burgeoning chemical and oil & gas sectors in emerging Asia-Pacific economies are significant contributors to this growth. Additionally, advancements in water treatment technologies and the rising use of activated alumina in the healthcare sector are anticipated to further boost market penetration. The competitive landscape features established global players and emerging regional manufacturers.

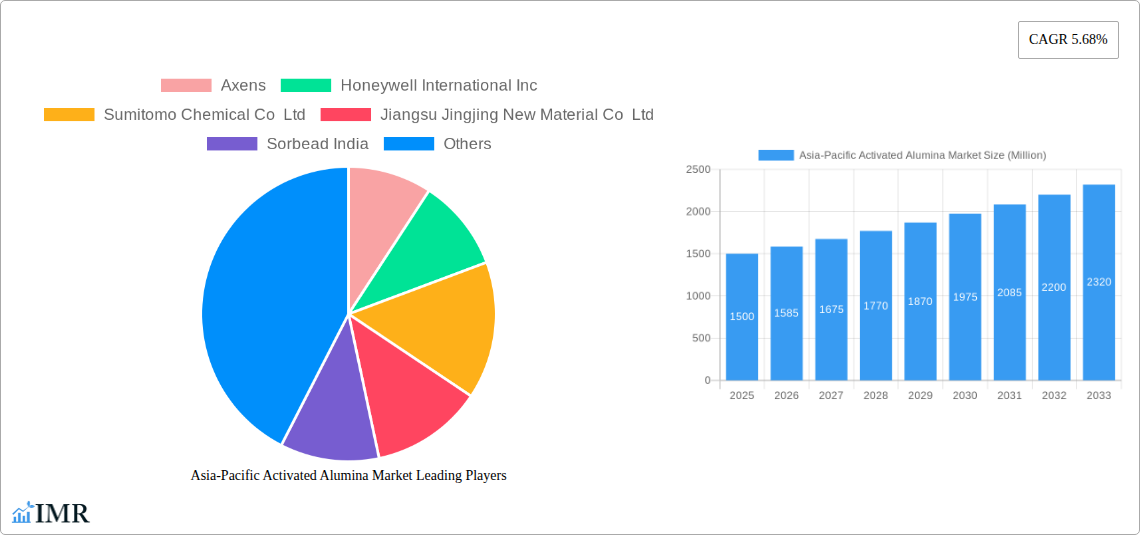

Asia-Pacific Activated Alumina Market Market Size (In Billion)

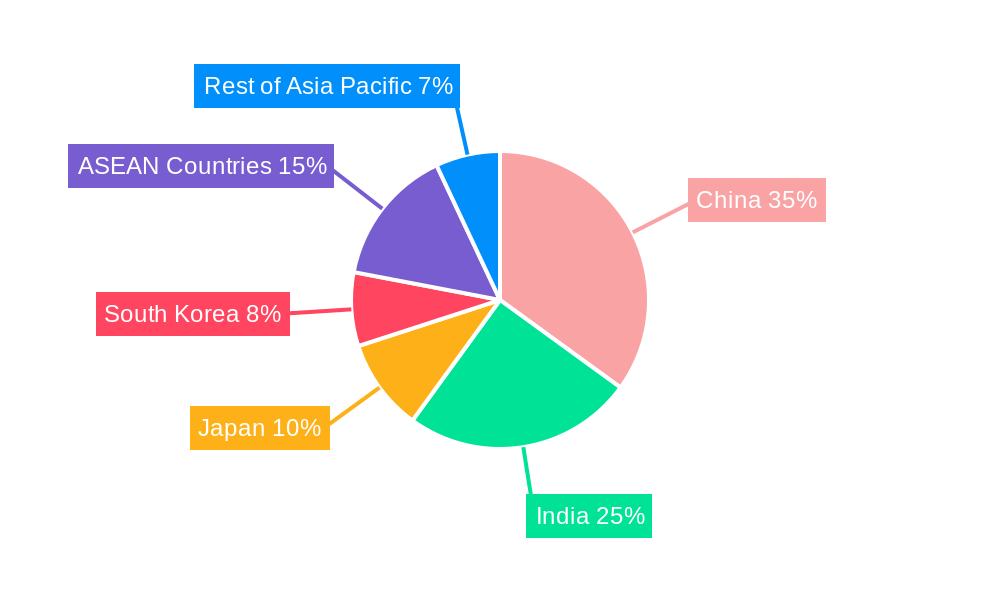

Key market trends include the increasing adoption of activated alumina in advanced purification processes, technological innovations enhancing product performance, and a growing emphasis on sustainable manufacturing. While challenges such as volatile raw material costs and the emergence of substitute materials exist, the indispensable role of activated alumina in critical industrial applications and the region's rapid industrialization are expected to ensure robust market performance. China, India, and ASEAN nations are anticipated to lead growth due to their extensive industrial infrastructure and increasing investments.

Asia-Pacific Activated Alumina Market Company Market Share

This report delivers a detailed analysis of the Asia-Pacific Activated Alumina market, highlighting its crucial role in diverse industrial processes. It explores market dynamics, growth drivers, regional dominance, product innovations, and the competitive strategies of leading companies. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, providing critical insights for industry stakeholders.

Asia-Pacific Activated Alumina Market Market Dynamics & Structure

The Asia-Pacific activated alumina market is characterized by a moderately concentrated structure, with a blend of large multinational corporations and emerging regional players vying for market share. Technological innovation remains a significant driver, particularly in developing more efficient and sustainable activated alumina products for specialized applications in catalysis and adsorption. Stringent environmental regulations across various Asia-Pacific nations are also influencing market dynamics, pushing manufacturers towards greener production processes and more environmentally friendly end-use applications. Competitive product substitutes, such as zeolites and molecular sieves in certain desiccant and adsorbent roles, present a constant challenge, necessitating continuous product differentiation and cost optimization. End-user demographics are rapidly evolving, with robust growth in the chemical and water treatment sectors, demanding higher purity and specialized activated alumina grades. Mergers and acquisitions (M&A) trends are also present, as larger entities seek to consolidate market presence and acquire innovative technologies. While specific M&A deal volumes are proprietary, the strategic importance of activated alumina in critical industries suggests continued consolidation activity. The presence of established players like Axens and Honeywell International Inc. alongside dynamic regional manufacturers like Jiangsu Jingjing New Material Co Ltd and Jiangsu Sanji Industrial Co Ltd highlights the competitive landscape. Barriers to innovation include the significant capital investment required for R&D and the long product development cycles for highly specialized activated alumina grades.

Asia-Pacific Activated Alumina Market Growth Trends & Insights

The Asia-Pacific activated alumina market is poised for substantial growth, driven by increasing industrialization and rising demand for efficient purification and catalytic processes across the region. Leveraging advanced analytical methodologies and extensive market research, this report projects a robust Compound Annual Growth Rate (CAGR) for the activated alumina market. The adoption rates for activated alumina are escalating, fueled by its indispensable role in key industries such as oil and gas refining, chemical manufacturing, and water purification. Technological disruptions, including the development of novel activated alumina structures with enhanced surface area and porosity, are enabling more effective adsorption and catalytic activities, thereby driving market penetration. Consumer behavior shifts are also playing a crucial role, with a growing preference for high-performance and sustainable materials across all end-user industries. The demand for activated alumina in specialized applications, such as in the production of hydrogen peroxide and as a catalyst support in petrochemical processes, is particularly noteworthy. Furthermore, the increasing focus on environmental sustainability and stringent quality standards in water treatment applications are creating new avenues for market expansion. The market size evolution reflects these underlying trends, with consistent upward momentum anticipated throughout the forecast period.

Dominant Regions, Countries, or Segments in Asia-Pacific Activated Alumina Market

The Oil and Gas end-user industry segment is a dominant force propelling the Asia-Pacific activated alumina market. This dominance is largely attributed to the region's vast and expanding oil and gas reserves, coupled with significant investments in refining and petrochemical infrastructure. The continuous need for activated alumina as a desiccant for drying natural gas, a catalyst in various refining processes (e.g., hydrotreating, catalytic cracking), and an adsorbent for removing impurities like sulfur and mercury underscores its critical role. Economic policies in major oil-producing and consuming nations, such as China and India, which prioritize energy security and domestic refining capacity, directly translate into increased demand for activated alumina. Infrastructure development projects in the oil and gas sector, including the construction of new refineries and expansion of existing ones, further amplify this demand.

- Key Drivers in Oil and Gas:

- High demand for natural gas dehydration and purification.

- Extensive use as a catalyst support in petrochemical processes.

- Growth in downstream refining activities and chemical production.

- Stringent quality standards for refined petroleum products.

- Government initiatives promoting energy independence and domestic production.

The Chemical industry is another significant segment driving market growth, owing to the widespread application of activated alumina in the synthesis of various chemicals, as a drying agent in chemical processing, and in pollution control. The burgeoning chemical manufacturing sector in countries like China, India, and Southeast Asian nations fuels this demand.

Asia-Pacific Activated Alumina Market Product Landscape

The Asia-Pacific activated alumina market is witnessing continuous product innovation, focusing on enhancing performance metrics and expanding application versatility. Manufacturers are developing activated alumina with tailored pore structures, higher surface areas, and improved mechanical strength to meet the exacting demands of advanced catalytic and adsorption processes. Unique selling propositions often revolve around specialized grades for specific contaminant removal in water treatment, high-efficiency drying agents for sensitive chemical processes, and robust catalyst supports that offer extended operational life. Technological advancements include surface modification techniques and novel synthesis methods to achieve superior selectivity and activity in catalytic applications. The performance of activated alumina in terms of adsorption capacity, regeneration efficiency, and thermal stability is continuously being optimized.

Key Drivers, Barriers & Challenges in Asia-Pacific Activated Alumina Market

Key Drivers: The Asia-Pacific activated alumina market is propelled by several key drivers. Technologically, advancements in manufacturing processes lead to improved product purity and performance. Economically, the robust growth of key end-user industries like oil and gas, chemical manufacturing, and water treatment in the region directly translates to increased demand. Policy-driven factors, such as stricter environmental regulations mandating the removal of pollutants and the promotion of cleaner industrial practices, further accelerate adoption. For instance, government initiatives to improve air and water quality necessitate the use of activated alumina in emission control and water purification systems.

Barriers & Challenges: Despite the growth, the market faces several challenges. Supply chain disruptions, particularly in sourcing raw materials and managing logistics across vast geographical areas, can impact availability and cost. Regulatory hurdles, such as varying environmental standards and import/export regulations across different Asia-Pacific countries, can create complexities. Competitive pressures from alternative materials like zeolites and molecular sieves, which offer similar functionalities in certain applications, necessitate continuous innovation and competitive pricing strategies. The capital-intensive nature of R&D for highly specialized activated alumina grades also presents a significant barrier for smaller players.

Emerging Opportunities in Asia-Pacific Activated Alumina Market

Emerging opportunities in the Asia-Pacific activated alumina market are significant and diverse. The increasing global focus on sustainability and environmental protection is driving demand for activated alumina in advanced air and water purification systems, particularly in removing emerging contaminants. Untapped markets in developing Asia-Pacific economies, with their rapidly industrializing sectors, present substantial growth potential. Innovative applications, such as the use of activated alumina in selective catalytic reduction (SCR) systems for NOx removal from industrial emissions and vehicle exhausts, are gaining traction. Evolving consumer preferences for cleaner products and processes in industries like pharmaceuticals and food & beverage will also create new avenues for high-purity activated alumina. The development of regenerable activated alumina with extended lifecycles represents a key opportunity for cost reduction and environmental benefits.

Growth Accelerators in the Asia-Pacific Activated Alumina Market Industry

Several growth accelerators are actively shaping the long-term trajectory of the Asia-Pacific activated alumina market. Technological breakthroughs in synthesizing activated alumina with precisely controlled pore structures and surface functionalities are enabling superior performance in catalytic and adsorptive applications. Strategic partnerships between activated alumina manufacturers and end-users, particularly in the chemical and petrochemical sectors, are fostering co-development of tailored solutions and accelerating market penetration. Market expansion strategies, including increased investment in production capacity and R&D by key players, are crucial for meeting the growing regional demand. Furthermore, the increasing adoption of activated alumina in emerging applications like carbon capture and hydrogen production technologies is expected to significantly bolster its market growth. The ongoing development of advanced regeneration technologies for activated alumina also contributes to its economic viability and sustainability, thereby accelerating its adoption.

Key Players Shaping the Asia-Pacific Activated Alumina Market Market

- Axens

- Honeywell International Inc.

- Sumitomo Chemical Co Ltd

- Jiangsu Jingjing New Material Co Ltd

- Sorbead India

- BASF SE

- Zibo XiangRun Environment Engineering Co Ltd

- Jiangsu Sanji Industrial Co Ltd

- CHALCO Shandong Co Ltd

- Huber Engineered Materials

- KIN Filter Engineering Co Limited

Notable Milestones in Asia-Pacific Activated Alumina Market Sector

- 2023: Increased R&D investment in high-performance activated alumina for hydrogen peroxide production.

- 2023: Emergence of advanced regeneration techniques for enhanced product lifecycle.

- 2022: Significant expansion of production capacity by key players to meet rising regional demand.

- 2022: Growing adoption of activated alumina in emerging economies for water treatment.

- 2021: Introduction of novel activated alumina grades for selective pollutant removal.

- 2021: Enhanced focus on sustainable manufacturing practices within the activated alumina industry.

- 2020: Accelerated demand for desiccants in the electronics and pharmaceutical sectors.

- 2020: Increased regulatory scrutiny on industrial emissions driving demand for activated alumina in pollution control.

- 2019: Strategic collaborations between manufacturers and end-users for customized solutions.

In-Depth Asia-Pacific Activated Alumina Market Market Outlook

The future outlook for the Asia-Pacific activated alumina market is exceptionally bright, underpinned by sustained growth accelerators and burgeoning demand across its core applications. Continued advancements in material science will unlock new performance frontiers for activated alumina, enabling its use in highly specialized and critical industrial processes. Strategic partnerships and market expansion initiatives will solidify the regional presence of leading manufacturers, ensuring adequate supply to meet the escalating needs of industries like petrochemicals, water treatment, and renewable energy. The integration of activated alumina in nascent technologies such as carbon capture and advanced battery manufacturing presents a significant opportunity for future market diversification and expansion. The industry is poised to benefit from a confluence of technological innovation, favorable economic conditions in key Asian economies, and an increasing emphasis on environmental sustainability, all contributing to a robust and dynamic market trajectory.

Asia-Pacific Activated Alumina Market Segmentation

-

1. Application

- 1.1. Catalyst

- 1.2. Desiccant

- 1.3. Adsorbent

- 1.4. Other Ap

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water Treatment

- 2.3. Chemical

- 2.4. Healthcare

- 2.5. Other En

Asia-Pacific Activated Alumina Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Activated Alumina Market Regional Market Share

Geographic Coverage of Asia-Pacific Activated Alumina Market

Asia-Pacific Activated Alumina Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Oil and Gas Sector; Increasing Investments in Water Treatment Facilities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Oil and Gas Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Catalyst

- 5.1.2. Desiccant

- 5.1.3. Adsorbent

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water Treatment

- 5.2.3. Chemical

- 5.2.4. Healthcare

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Catalyst

- 6.1.2. Desiccant

- 6.1.3. Adsorbent

- 6.1.4. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Oil and Gas

- 6.2.2. Water Treatment

- 6.2.3. Chemical

- 6.2.4. Healthcare

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Catalyst

- 7.1.2. Desiccant

- 7.1.3. Adsorbent

- 7.1.4. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Oil and Gas

- 7.2.2. Water Treatment

- 7.2.3. Chemical

- 7.2.4. Healthcare

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Catalyst

- 8.1.2. Desiccant

- 8.1.3. Adsorbent

- 8.1.4. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Oil and Gas

- 8.2.2. Water Treatment

- 8.2.3. Chemical

- 8.2.4. Healthcare

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Catalyst

- 9.1.2. Desiccant

- 9.1.3. Adsorbent

- 9.1.4. Other Ap

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Oil and Gas

- 9.2.2. Water Treatment

- 9.2.3. Chemical

- 9.2.4. Healthcare

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. ASEAN Countries Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Catalyst

- 10.1.2. Desiccant

- 10.1.3. Adsorbent

- 10.1.4. Other Ap

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Oil and Gas

- 10.2.2. Water Treatment

- 10.2.3. Chemical

- 10.2.4. Healthcare

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Asia Pacific Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Catalyst

- 11.1.2. Desiccant

- 11.1.3. Adsorbent

- 11.1.4. Other Ap

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Oil and Gas

- 11.2.2. Water Treatment

- 11.2.3. Chemical

- 11.2.4. Healthcare

- 11.2.5. Other En

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Axens

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sumitomo Chemical Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jiangsu Jingjing New Material Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sorbead India

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zibo XiangRun Environment Engineering Co Ltd *List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Jiangsu Sanji Industrial Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CHALCO Shandong Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huber Engineered Materials

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 KIN Filter Engineering Co Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Axens

List of Figures

- Figure 1: Asia-Pacific Activated Alumina Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Activated Alumina Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 5: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 11: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 16: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 17: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 22: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 23: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 28: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 29: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 34: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 35: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 40: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 41: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Activated Alumina Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Asia-Pacific Activated Alumina Market?

Key companies in the market include Axens, Honeywell International Inc, Sumitomo Chemical Co Ltd, Jiangsu Jingjing New Material Co Ltd, Sorbead India, BASF SE, Zibo XiangRun Environment Engineering Co Ltd *List Not Exhaustive, Jiangsu Sanji Industrial Co Ltd, CHALCO Shandong Co Ltd, Huber Engineered Materials, KIN Filter Engineering Co Limited.

3. What are the main segments of the Asia-Pacific Activated Alumina Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.21 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Oil and Gas Sector; Increasing Investments in Water Treatment Facilities; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Oil and Gas Sector.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Activated Alumina Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Activated Alumina Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Activated Alumina Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Activated Alumina Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence