Key Insights

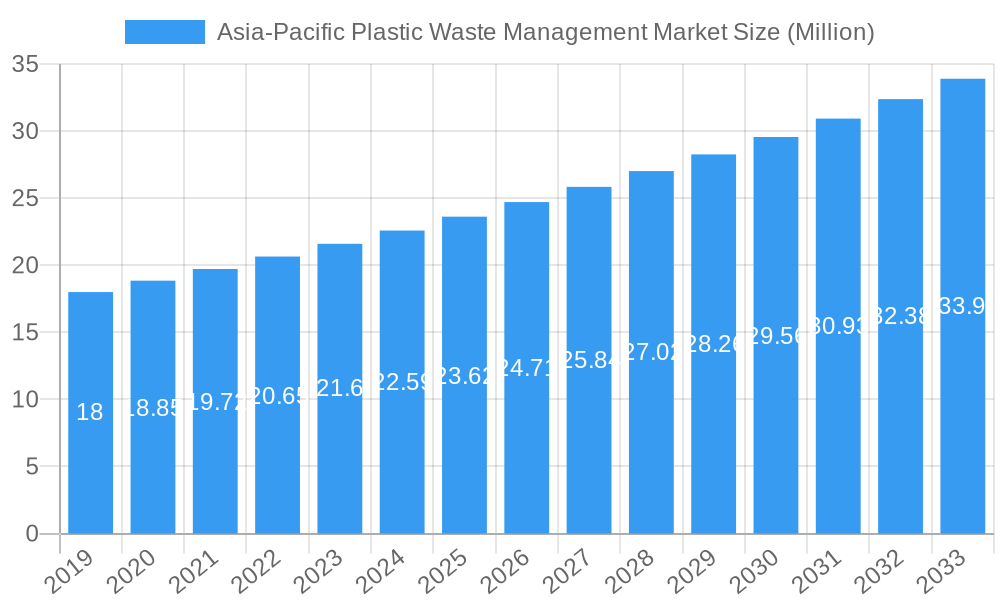

The Asia-Pacific plastic waste management market is projected to reach a significant valuation of USD 21.31 million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.45% throughout the forecast period of 2025-2033. This substantial growth is primarily driven by escalating plastic consumption across various sectors, including residential, commercial, and industrial applications, coupled with increasing environmental awareness and stricter governmental regulations aimed at mitigating plastic pollution. The region's dynamic economic development and burgeoning populations contribute to higher waste generation, making effective plastic waste management a critical imperative. Key segments like Polyethylene (PE) and Polypropylene (PP) dominate the plastic waste landscape due to their widespread use in packaging and consumer goods. The increasing focus on circular economy principles is fueling the adoption of advanced recycling and chemical treatment technologies, presenting significant opportunities for market players.

Asia-Pacific Plastic Waste Management Market Market Size (In Million)

The market’s expansion is further bolstered by government initiatives and private sector investments in sustainable waste management infrastructure. Innovations in plastic recycling technologies, such as chemical recycling, are gaining traction, offering solutions for difficult-to-recycle plastics. However, challenges such as inadequate waste collection infrastructure in certain areas, low public participation in segregation, and the high cost of implementing advanced treatment technologies can act as restraints. Despite these hurdles, the strong market potential, driven by the urgent need to address plastic pollution and promote resource recovery, is attracting considerable investment and fostering collaborations among key stakeholders, including companies like Hitachi Zosen Corporation, SUEZ, and Waste Management Inc. The Asia-Pacific region, with its diverse economies and significant manufacturing hubs, is poised to be a central player in shaping the future of global plastic waste management solutions.

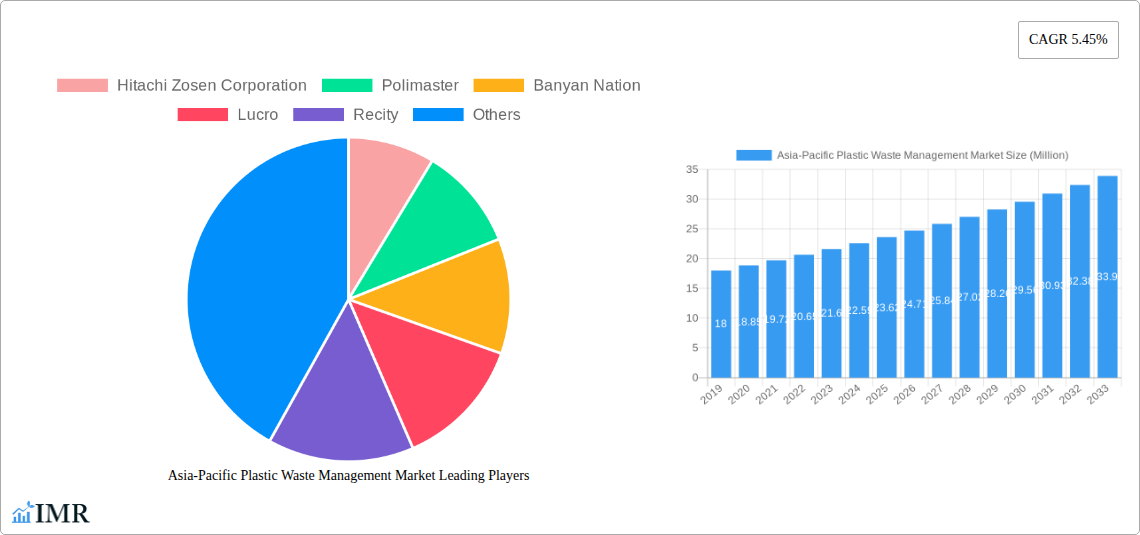

Asia-Pacific Plastic Waste Management Market Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific Plastic Waste Management Market, a sector critical for addressing escalating environmental concerns and fostering a circular economy. With a focus on the study period from 2019 to 2033, and utilizing 2025 as the base and estimated year, this analysis provides invaluable insights into market dynamics, growth trends, regional dominance, product innovation, key drivers, barriers, emerging opportunities, growth accelerators, and the pivotal players shaping this vital industry. Expect to find quantitative data presented in Million units, alongside qualitative analysis to equip industry professionals with actionable intelligence for strategic decision-making.

Asia-Pacific Plastic Waste Management Market Dynamics & Structure

The Asia-Pacific Plastic Waste Management Market is characterized by a moderate to high market concentration, with a few major players dominating key segments, alongside a growing number of innovative startups. Technological innovation is a primary driver, fueled by increasing investment in advanced recycling technologies and waste-to-energy solutions. Regulatory frameworks are becoming increasingly stringent across the region, with governments implementing extended producer responsibility (EPR) schemes and bans on single-use plastics, fostering a more structured approach to plastic waste management. Competitive product substitutes, such as biodegradable and compostable alternatives, are gaining traction but face challenges in cost-competitiveness and widespread adoption. End-user demographics are shifting, with a growing awareness of environmental issues driving demand for sustainable solutions from residential, commercial, and industrial sectors. Mergers and acquisitions (M&A) trends are on the rise as established companies seek to expand their geographical reach and technological capabilities, while also integrating smaller, innovative entities. For instance, the past five years have seen approximately 25 M&A deals valued at over USD 500 Million, indicating consolidation and strategic expansion. Barriers to innovation include the high capital expenditure required for advanced infrastructure and the complex logistics of waste collection and processing.

- Market Concentration: Dominated by a mix of large multinational corporations and regional specialists.

- Technological Innovation Drivers: Advancements in chemical recycling, AI-powered sorting, and waste-to-fuel technologies.

- Regulatory Frameworks: Increasing government mandates, EPR policies, and landfill diversion targets.

- Competitive Product Substitutes: Growth in bioplastics and alternative materials, but cost remains a barrier.

- End-User Demographics: Rising consumer and corporate demand for eco-friendly solutions.

- M&A Trends: Strategic acquisitions to gain market share and technological expertise.

Asia-Pacific Plastic Waste Management Market Growth Trends & Insights

The Asia-Pacific Plastic Waste Management Market is projected for robust growth, driven by a confluence of factors including rising plastic consumption, inadequate existing waste management infrastructure, and a growing societal imperative for environmental protection. The CAGR for the forecast period 2025–2033 is estimated at 7.8%, with the market size expected to grow from approximately USD 45,000 Million in 2025 to over USD 85,000 Million by 2033. Adoption rates of advanced recycling technologies, such as chemical recycling and advanced mechanical recycling, are on the rise, spurred by the economic viability of recovering valuable materials from waste streams. Technological disruptions, including the development of more efficient sorting mechanisms and novel waste-to-energy processes, are transforming the landscape. Consumer behavior shifts are also playing a significant role, with increased demand for products made from recycled content and a greater willingness to participate in recycling programs. Market penetration of formal waste management services is expanding, particularly in developing economies within the region, addressing the historical prevalence of informal waste picking. The increasing focus on a circular economy is fostering new business models and investment opportunities. For example, the market penetration of advanced recycling technologies has grown from 8% in 2019 to an estimated 15% in 2024, indicating a strong upward trend. Furthermore, consumer preference for products with recycled content has seen an increase of approximately 20% in the last two years across key markets like Japan and South Korea.

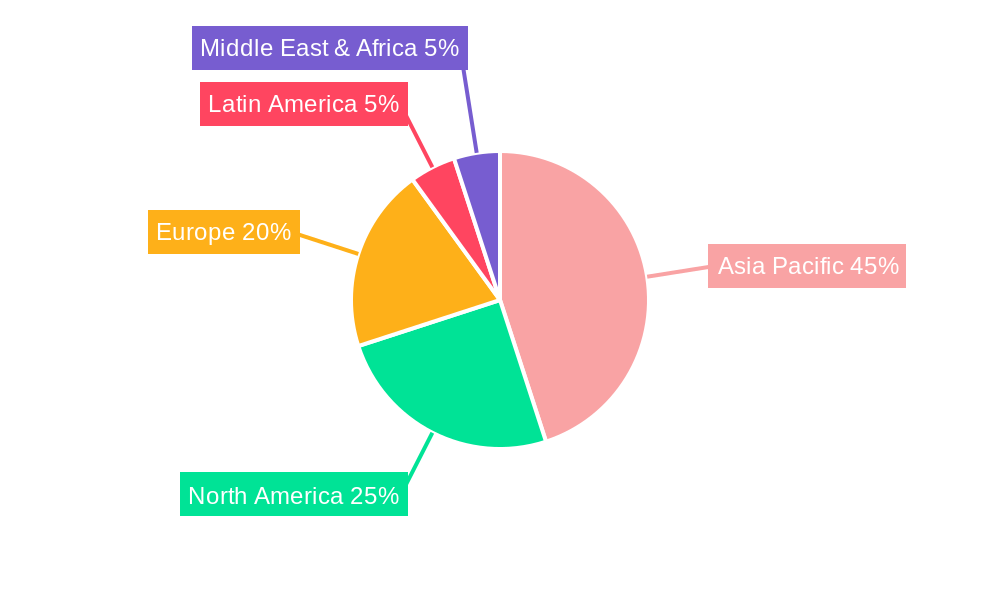

Dominant Regions, Countries, or Segments in Asia-Pacific Plastic Waste Management Market

The Polyethylene (PE) segment, encompassing both High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE), is currently the dominant force in the Asia-Pacific Plastic Waste Management Market, accounting for an estimated 35% of the market share in 2025. This dominance is attributed to its widespread use in packaging, films, and containers, making it a significant component of the overall plastic waste stream. From a geographical perspective, China stands as the largest market, driven by its massive industrial output, large population, and increasing regulatory pressure to manage its substantial plastic waste generation. China's market share is estimated at 40% of the total Asia-Pacific market in 2025, with significant investments in recycling infrastructure and advanced treatment technologies.

- Dominant Polymer Segment: Polyethylene (PE) leads due to its ubiquitous presence in consumer and industrial products.

- Drivers: High consumption in packaging, films, and single-use items.

- Growth Potential: Expected to maintain its leading position with advancements in PE recycling.

- Dominant Country: China leads the market due to its scale of plastic production and consumption, coupled with ambitious waste management targets.

- Economic Policies: Government initiatives promoting a circular economy and stringent waste regulations.

- Infrastructure Development: Significant investments in sorting, recycling, and waste-to-energy facilities.

- Market Share: Estimated at 40% of the Asia-Pacific market in 2025.

- Dominant Source Segment: The Commercial sector is a significant contributor to plastic waste, driven by retail, hospitality, and office environments.

- Key Drivers: Packaging from goods, disposable items in food service, and office supplies.

- Growth Potential: Increasing corporate sustainability initiatives are boosting demand for waste management services.

- Dominant Treatment: Recycling remains the most prevalent and preferred treatment method, especially for PET and PE.

- Factors: Growing economic incentives for recycled materials and supportive government policies.

- Advancements: Development of both mechanical and chemical recycling technologies to improve efficiency and material quality.

Asia-Pacific Plastic Waste Management Market Product Landscape

The product landscape in the Asia-Pacific Plastic Waste Management Market is evolving rapidly, with a focus on enhancing the efficiency and effectiveness of waste processing. Innovations include advanced sorting technologies utilizing AI and machine learning for precise material identification, and improved mechanical recycling equipment that yields higher-quality recycled resins. Chemical recycling technologies, such as pyrolysis and gasification, are emerging as significant advancements, enabling the conversion of mixed plastic waste into valuable feedstocks. Applications range from the production of new plastic packaging and textiles to the creation of construction materials and fuels, demonstrating the versatility of recovered plastic resources.

Key Drivers, Barriers & Challenges in Asia-Pacific Plastic Waste Management Market

Key Drivers:

- Escalating Plastic Consumption: Driven by economic growth and population expansion across the region.

- Stringent Environmental Regulations: Government mandates for waste reduction, recycling, and landfill diversion.

- Growing Environmental Awareness: Increased public concern regarding plastic pollution and its ecological impact.

- Technological Advancements: Innovations in sorting, recycling, and waste-to-energy technologies enhancing efficiency and cost-effectiveness.

- Circular Economy Initiatives: Global and regional push towards sustainable resource management and closed-loop systems.

Barriers & Challenges:

- Inadequate Infrastructure: Lack of widespread and advanced waste collection and processing facilities in many developing economies.

- High Capital Investment: Significant upfront costs for establishing modern waste management infrastructure and advanced recycling plants.

- Complex Waste Streams: The diversity and contamination levels of plastic waste can pose challenges for efficient processing.

- Informal Waste Sector: Integrating and formalizing informal waste pickers while ensuring safe working conditions and fair compensation.

- Price Volatility of Recycled Materials: Fluctuations in the market price of virgin plastics can impact the economic viability of recycled materials.

- Limited Consumer Engagement: Inconsistent participation in recycling programs and improper waste segregation in some areas.

Emerging Opportunities in Asia-Pacific Plastic Waste Management Market

Emerging opportunities lie in the development of advanced chemical recycling facilities capable of handling a wider range of plastic types, and the expansion of waste-to-energy projects that can provide reliable energy solutions. The growing demand for recycled content in product manufacturing presents a significant opportunity for businesses to establish closed-loop systems. Furthermore, the development of digital platforms for waste tracking and management, coupled with innovative collection schemes, can optimize logistics and increase recycling rates. There is also a substantial opportunity in developing countries for establishing foundational waste management infrastructure and public awareness campaigns.

Growth Accelerators in the Asia-Pacific Plastic Waste Management Market Industry

Growth accelerators in the Asia-Pacific Plastic Waste Management Market are being driven by significant technological breakthroughs in areas like advanced chemical recycling and AI-powered waste sorting. Strategic partnerships between waste management companies, chemical producers, and consumer goods manufacturers are fostering collaboration and driving investment. Market expansion strategies, particularly into emerging economies with growing populations and increasing plastic usage, are crucial for long-term growth. Government incentives, such as tax breaks for recycling facilities and subsidies for sustainable packaging, are also playing a pivotal role in accelerating market development.

Key Players Shaping the Asia-Pacific Plastic Waste Management Market

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co Ltd

Notable Milestones in Asia-Pacific Plastic Waste Management Market Sector

- April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

- March 2023: The World Bank's Board of Executives approved a USD 250 million IBRD loan. This funding aims to combat plastic pollution from municipal solid waste and agricultural plastic film in rural regions of China's Shaanxi Province. It also seeks to enhance the province's plastic waste management practices to set a blueprint for national-level initiatives.

In-Depth Asia-Pacific Plastic Waste Management Market Market Outlook

The future outlook for the Asia-Pacific Plastic Waste Management Market is exceptionally bright, driven by an intrinsic shift towards a sustainable, circular economy. Growth accelerators include continued innovation in chemical recycling, enabling higher-value recovery from mixed plastic waste, and the widespread adoption of AI for optimized sorting and logistics. Strategic partnerships between governments, industry giants, and innovative startups will foster a collaborative ecosystem, while ambitious national policies will continue to shape the regulatory landscape. The increasing demand for recycled content across diverse industries, coupled with growing consumer preference for eco-conscious products, will fuel market expansion, particularly in rapidly developing economies within the region.

Asia-Pacific Plastic Waste Management Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Terephthalate (PET)

- 1.5. Other Polymers

-

2. Source

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Other Sources (Construction, Healthcare, etc.)

-

3. Treatment

- 3.1. Recycling

- 3.2. Chemical Treatment

- 3.3. Landfill

- 3.4. Other Treatments

Asia-Pacific Plastic Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Waste Management Market Regional Market Share

Geographic Coverage of Asia-Pacific Plastic Waste Management Market

Asia-Pacific Plastic Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.3. Market Restrains

- 3.3.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Terephthalate (PET)

- 5.1.5. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Other Sources (Construction, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Treatment

- 5.3.1. Recycling

- 5.3.2. Chemical Treatment

- 5.3.3. Landfill

- 5.3.4. Other Treatments

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polimaster

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banyan Nation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUEZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Management Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agilyx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GreenTech Environmental Co Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hitachi Zosen Corporation

List of Figures

- Figure 1: Asia-Pacific Plastic Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Plastic Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 2: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 3: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 6: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 7: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 10: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 11: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 14: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 15: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Waste Management Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Plastic Waste Management Market?

Key companies in the market include Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, GreenTech Environmental Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Plastic Waste Management Market?

The market segments include Polymer, Source, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

6. What are the notable trends driving market growth?

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific.

7. Are there any restraints impacting market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

8. Can you provide examples of recent developments in the market?

April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence