Key Insights

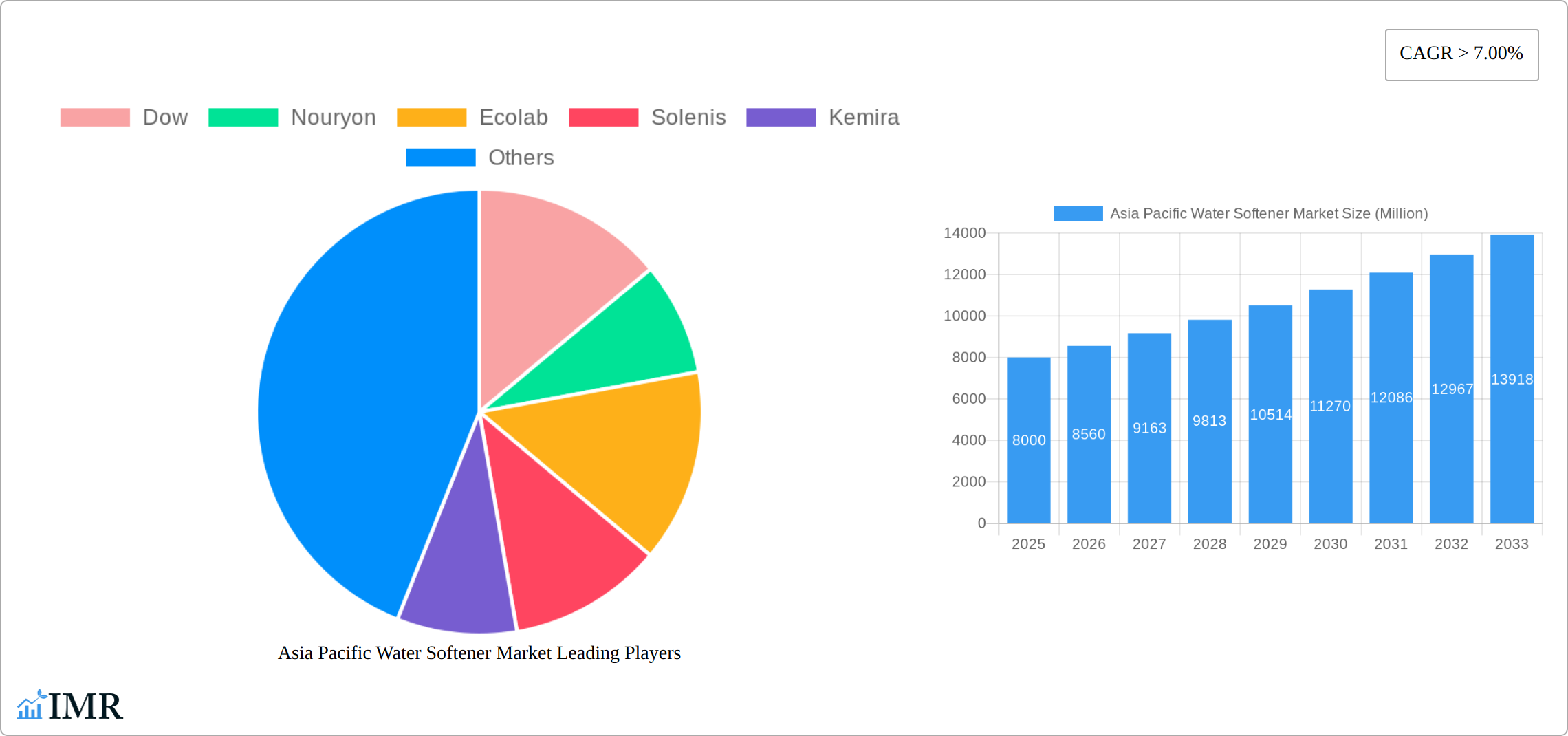

The Asia Pacific water softener market is poised for substantial growth, fueled by rapid urbanization, rising disposable incomes, and heightened consumer awareness regarding water quality. With a projected CAGR of 5.47%, the market is expected to reach $9.64 billion by 2025. Key growth drivers include escalating demand for softened water in residential and commercial sectors, particularly in regions with high water hardness. Additionally, stringent environmental regulations promoting water conservation and quality enhancement are significantly contributing to market expansion. The adoption of advanced water softening technologies, including salt-free systems and magnetic conditioners, further accelerates this growth. While initial investment and maintenance costs present challenges, the long-term advantages of improved water quality and extended appliance lifespan are expected to mitigate these concerns. The market is segmented by product type (salt-based, salt-free), application (residential, commercial, industrial), and geography, offering diverse opportunities for industry players. Leading companies such as Dow, Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries Ltd, Suez, and SNF are actively investing in R&D to drive innovation and secure market share. The Asia Pacific region presents considerable growth potential due to its large and growing population, robust economic development, and increasing health consciousness related to water quality.

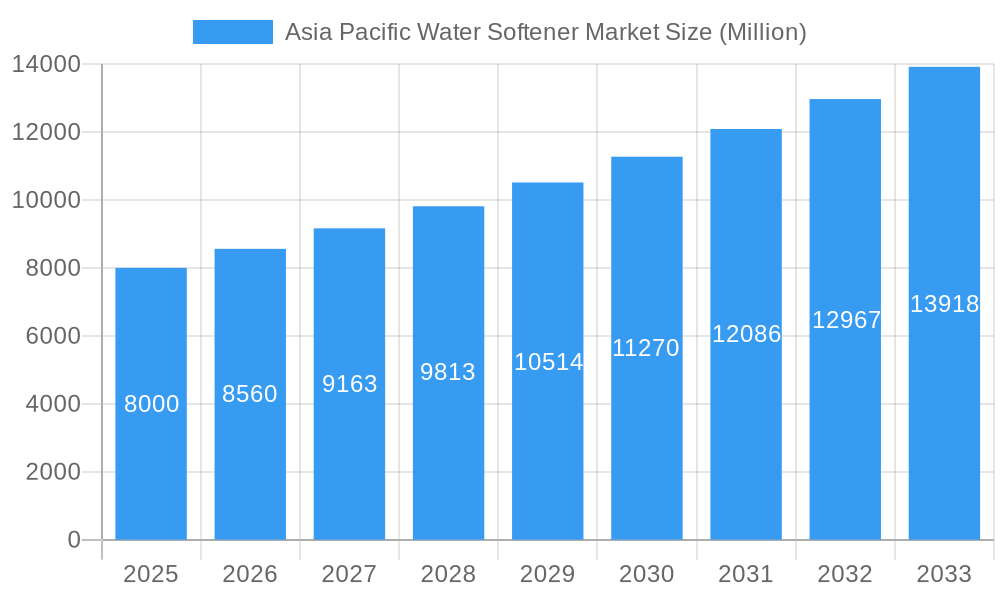

Asia Pacific Water Softener Market Market Size (In Billion)

The forecast period through 2025 anticipates sustained market expansion. The market size was estimated at $9.64 billion in 2025, with significant growth anticipated across all segments. The residential sector is projected to lead market dominance, followed by the commercial sector. Technological advancements, focusing on energy efficiency and eco-friendly solutions, will be pivotal in shaping future market trends. Continuous innovation from key manufacturers, supported by favorable governmental policies across Asia Pacific nations, will drive market growth throughout the forecast period.

Asia Pacific Water Softener Market Company Market Share

Asia Pacific Water Softener Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia Pacific water softener market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market segment. The report encompasses both the parent market (water treatment chemicals) and the child market (water softeners), providing a holistic view. The total market size in 2025 is estimated at xx Million units.

Asia Pacific Water Softener Market Dynamics & Structure

This section delves into the intricate structure of the Asia Pacific water softener market, analyzing factors influencing its growth and competitive landscape. The market is moderately concentrated, with key players holding significant shares, but with room for smaller, specialized firms to thrive. Technological innovation, driven by the demand for efficient and sustainable water treatment solutions, is a major driver. Stringent regulatory frameworks regarding water quality in several APAC countries further stimulate market growth. However, the presence of competitive substitutes, such as water filters and bottled water, poses a challenge. The end-user demographics are diverse, encompassing residential, commercial, and industrial sectors, each with unique needs and purchasing behaviors. M&A activity within the industry has been relatively moderate in recent years, with xx major deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 55% market share in 2025.

- Technological Innovation: Focus on ion exchange resins, advanced filtration technologies, and automation.

- Regulatory Landscape: Stringent water quality regulations in countries like Japan, South Korea, and Australia.

- Competitive Substitutes: Water filters, bottled water, reverse osmosis systems.

- End-User Demographics: Residential, commercial (hotels, restaurants), and industrial (manufacturing).

- M&A Activity: xx major deals between 2019 and 2024, indicating consolidation trends.

- Innovation Barriers: High R&D costs, stringent regulatory approvals.

Asia Pacific Water Softener Market Growth Trends & Insights

The Asia Pacific water softener market is exhibiting dynamic and sustained growth, propelled by a confluence of factors including heightened consumer consciousness regarding water quality and health, escalating disposable incomes across a burgeoning middle class, and rapid urbanization driving demand for enhanced domestic and industrial water solutions. The market size experienced a Compound Annual Growth Rate (CAGR) of approximately X.X% during the historical period (2019-2024). Projections indicate this robust momentum will continue, with an anticipated CAGR of X.X% during the forecast period (2025-2033), leading to an estimated market volume of XX Million units by 2033. Adoption is particularly mature in developed economies such as Japan and Australia, characterized by stringent water quality standards and higher purchasing power. Conversely, rapidly developing economies like India and Indonesia present substantial untapped potential and significant growth opportunities due to their vast populations and increasing infrastructure development. The market is further energized by technological innovations, most notably the integration of smart technologies in water softeners, offering features like automated regeneration cycles, remote monitoring, and enhanced energy efficiency, thereby accelerating market expansion. Shifting consumer preferences towards convenient, eco-friendly, and technologically advanced home appliances are also a significant growth driver. Despite this positive trajectory, market penetration in certain sub-segments and emerging economies remains relatively low, underscoring considerable opportunities for market players to innovate and expand their reach.

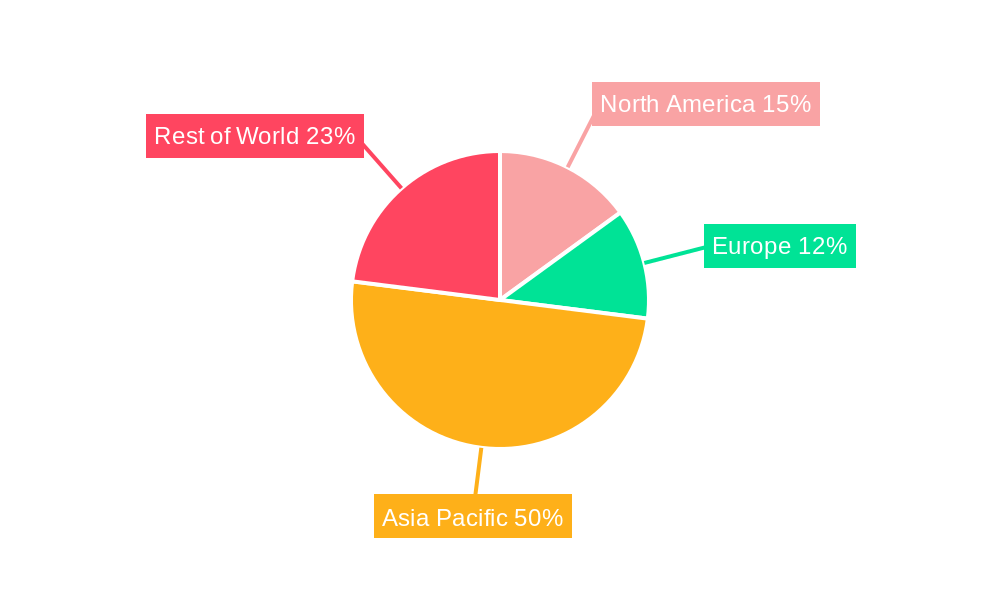

Dominant Regions, Countries, or Segments in Asia Pacific Water Softener Market

Currently, Japan and Australia stand as the leading markets within the Asia Pacific water softener landscape. This dominance is attributed to a combination of factors: high consumer awareness and concern for water quality, well-established water treatment infrastructure, and robust economic conditions supporting the adoption of advanced water purification technologies. In contrast, China and India are emerging as critical growth engines, driven by the transformative forces of rapid urbanization, accelerated industrialization, and a rapidly expanding middle class with increasing purchasing power. The residential segment constitutes the largest share of the market, reflecting a growing emphasis on household health and appliance longevity. However, significant growth is also being witnessed in the commercial and industrial segments, as businesses increasingly recognize the benefits of soft water for operational efficiency and product quality.

- Japan: Characterized by high consumer awareness, sophisticated existing infrastructure, and strong purchasing power.

- Australia: Mirrors Japan's trends with a significant presence of hard water issues in numerous regions, driving demand.

- China: Fueled by unprecedented urbanization, a booming industrial sector, and a continuously growing affluent consumer base.

- India: Represents a vast demographic opportunity, with rising disposable incomes in urban centers and a growing understanding of the importance of water quality for health and domestic use.

- Commercial Segment Growth: Primarily propelled by the hospitality sector (hotels, restaurants) and the food and beverage industry, where water quality directly impacts service and product standards.

- Industrial Segment Growth: Driven by the stringent water requirements of sectors like manufacturing (electronics, textiles), power generation (boiler feed water), and pharmaceuticals, where water softness is crucial for preventing scale buildup and ensuring product integrity.

Asia Pacific Water Softener Market Product Landscape

The Asia Pacific water softener market offers a diverse range of products, including traditional ion exchange systems, point-of-use (POU) softeners, and whole-house systems. Innovations focus on improving efficiency, reducing salt consumption, and enhancing user experience through smart features and automated controls. Unique selling propositions often include ease of installation, low maintenance requirements, and superior water quality. Advancements in resin technology and control systems are key drivers of product differentiation.

Key Drivers, Barriers & Challenges in Asia Pacific Water Softener Market

Key Drivers:

- Rising consumer awareness of water quality issues.

- Increasing disposable incomes across the region.

- Stringent government regulations on water quality.

- Technological advancements, such as smart water softeners.

Key Challenges:

- High initial investment costs for larger systems.

- Salt consumption and environmental concerns associated with traditional systems.

- Competition from alternative water treatment technologies.

- Supply chain disruptions affecting raw material availability.

- xx% increase in raw material costs since 2022 impacting profitability.

Emerging Opportunities in Asia Pacific Water Softener Market

- Growing demand for eco-friendly water softeners with reduced salt consumption.

- Expanding applications in industrial sectors beyond traditional uses.

- Opportunities in rural and underserved areas with limited access to clean water.

- Increasing adoption of water softener rental services.

- Development of integrated water treatment systems combining softening with other purification technologies.

Growth Accelerators in the Asia Pacific Water Softener Market Industry

The Asia Pacific water softener market's growth trajectory is significantly influenced by a range of potent accelerators. At the forefront are continuous technological advancements, particularly in the development of highly efficient ion exchange resins with extended lifespans and the integration of sophisticated, user-friendly smart control systems that optimize regeneration cycles and minimize resource consumption. Strategic collaborations and partnerships between leading water softener manufacturers, water treatment service providers, and distribution networks are crucial for expanding market reach, enhancing customer service, and driving adoption across diverse geographical and demographic segments. Furthermore, supportive government initiatives aimed at promoting water conservation, improving overall water quality standards, and encouraging the adoption of sustainable technologies are playing a vital role in market expansion. The strategic focus on penetrating emerging markets and addressing the unique needs of previously untapped market segments remains a key growth strategy for industry players seeking to capitalize on the region's immense potential.

Notable Milestones in Asia Pacific Water Softener Market Sector

- 2021 Q3: A prominent industry leader unveiled an innovative range of smart water softeners designed for enhanced efficiency and user convenience.

- 2022 Q1: A significant multinational corporation expanded its market presence through the strategic acquisition of a well-regarded regional water softener company.

- 2023 Q2: The market witnessed the introduction of a next-generation ion exchange resin technology, promising superior performance and longer operational life.

- Additional significant developments and strategic moves will be detailed in the comprehensive market report.

In-Depth Asia Pacific Water Softener Market Market Outlook

The Asia Pacific water softener market is poised for continued robust growth driven by technological advancements, rising consumer awareness, and favorable government policies. Strategic opportunities exist in leveraging technological innovations to create more efficient and sustainable products, expanding market reach into underserved areas, and establishing strategic partnerships to enhance market penetration and distribution. The market's future growth will be influenced by factors such as raw material price fluctuations, technological breakthroughs, and evolving consumer preferences. The projected xx% CAGR during the forecast period demonstrates significant long-term market potential.

Asia Pacific Water Softener Market Segmentation

-

1. Product Type

- 1.1. Flocculants & Coagulants

- 1.2. Biocides & Disinfectants

- 1.3. Defoamers & Defoaming Agents

- 1.4. pH & Adjusters & Softeners

- 1.5. Scale & Corrosion Inhibitors

- 1.6. Others

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil & Gas

- 2.3. Chemical Manufcaturing

- 2.4. Mining & Mineral Processing

- 2.5. Municipal

- 2.6. Food & Beverage

- 2.7. Pulp & Paper

- 2.8. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia Pacific Water Softener Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia Pacific Water Softener Market Regional Market Share

Geographic Coverage of Asia Pacific Water Softener Market

Asia Pacific Water Softener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Ground and Surface Water Pollution; Growing Demand from Power and Industrial Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Rising Ground and Surface Water Pollution; Growing Demand from Power and Industrial Applications; Other Drivers

- 3.4. Market Trends

- 3.4.1. Scale & Corrosion Inhibitors to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Flocculants & Coagulants

- 5.1.2. Biocides & Disinfectants

- 5.1.3. Defoamers & Defoaming Agents

- 5.1.4. pH & Adjusters & Softeners

- 5.1.5. Scale & Corrosion Inhibitors

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil & Gas

- 5.2.3. Chemical Manufcaturing

- 5.2.4. Mining & Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Food & Beverage

- 5.2.7. Pulp & Paper

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Flocculants & Coagulants

- 6.1.2. Biocides & Disinfectants

- 6.1.3. Defoamers & Defoaming Agents

- 6.1.4. pH & Adjusters & Softeners

- 6.1.5. Scale & Corrosion Inhibitors

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil & Gas

- 6.2.3. Chemical Manufcaturing

- 6.2.4. Mining & Mineral Processing

- 6.2.5. Municipal

- 6.2.6. Food & Beverage

- 6.2.7. Pulp & Paper

- 6.2.8. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Flocculants & Coagulants

- 7.1.2. Biocides & Disinfectants

- 7.1.3. Defoamers & Defoaming Agents

- 7.1.4. pH & Adjusters & Softeners

- 7.1.5. Scale & Corrosion Inhibitors

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil & Gas

- 7.2.3. Chemical Manufcaturing

- 7.2.4. Mining & Mineral Processing

- 7.2.5. Municipal

- 7.2.6. Food & Beverage

- 7.2.7. Pulp & Paper

- 7.2.8. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Flocculants & Coagulants

- 8.1.2. Biocides & Disinfectants

- 8.1.3. Defoamers & Defoaming Agents

- 8.1.4. pH & Adjusters & Softeners

- 8.1.5. Scale & Corrosion Inhibitors

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil & Gas

- 8.2.3. Chemical Manufcaturing

- 8.2.4. Mining & Mineral Processing

- 8.2.5. Municipal

- 8.2.6. Food & Beverage

- 8.2.7. Pulp & Paper

- 8.2.8. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Flocculants & Coagulants

- 9.1.2. Biocides & Disinfectants

- 9.1.3. Defoamers & Defoaming Agents

- 9.1.4. pH & Adjusters & Softeners

- 9.1.5. Scale & Corrosion Inhibitors

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power

- 9.2.2. Oil & Gas

- 9.2.3. Chemical Manufcaturing

- 9.2.4. Mining & Mineral Processing

- 9.2.5. Municipal

- 9.2.6. Food & Beverage

- 9.2.7. Pulp & Paper

- 9.2.8. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. ASEAN Countries Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Flocculants & Coagulants

- 10.1.2. Biocides & Disinfectants

- 10.1.3. Defoamers & Defoaming Agents

- 10.1.4. pH & Adjusters & Softeners

- 10.1.5. Scale & Corrosion Inhibitors

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power

- 10.2.2. Oil & Gas

- 10.2.3. Chemical Manufcaturing

- 10.2.4. Mining & Mineral Processing

- 10.2.5. Municipal

- 10.2.6. Food & Beverage

- 10.2.7. Pulp & Paper

- 10.2.8. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Asia Pacific Asia Pacific Water Softener Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Flocculants & Coagulants

- 11.1.2. Biocides & Disinfectants

- 11.1.3. Defoamers & Defoaming Agents

- 11.1.4. pH & Adjusters & Softeners

- 11.1.5. Scale & Corrosion Inhibitors

- 11.1.6. Others

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Power

- 11.2.2. Oil & Gas

- 11.2.3. Chemical Manufcaturing

- 11.2.4. Mining & Mineral Processing

- 11.2.5. Municipal

- 11.2.6. Food & Beverage

- 11.2.7. Pulp & Paper

- 11.2.8. Others

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nouryon

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ecolab

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Solenis

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kemira

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Solvay

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Lonza

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kurita Water Industries Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Suez

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SNF*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Asia Pacific Water Softener Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: China Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: China Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: China Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: India Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: India Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 13: India Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: India Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Japan Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Japan Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 21: Japan Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Japan Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Japan Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Japan Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: South Korea Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South Korea Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: South Korea Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South Korea Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: South Korea Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South Korea Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: ASEAN Countries Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: ASEAN Countries Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 37: ASEAN Countries Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: ASEAN Countries Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia Pacific Water Softener Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Asia Pacific Water Softener Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Asia Pacific Water Softener Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Water Softener Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Asia Pacific Water Softener Market?

Key companies in the market include Dow, Nouryon, Ecolab, Solenis, Kemira, Solvay, Lonza, Kurita Water Industries Ltd, Suez, SNF*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Water Softener Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.64 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Ground and Surface Water Pollution; Growing Demand from Power and Industrial Applications; Other Drivers.

6. What are the notable trends driving market growth?

Scale & Corrosion Inhibitors to Dominate the Market.

7. Are there any restraints impacting market growth?

; Rising Ground and Surface Water Pollution; Growing Demand from Power and Industrial Applications; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Water Softener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Water Softener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Water Softener Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Water Softener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence