Key Insights

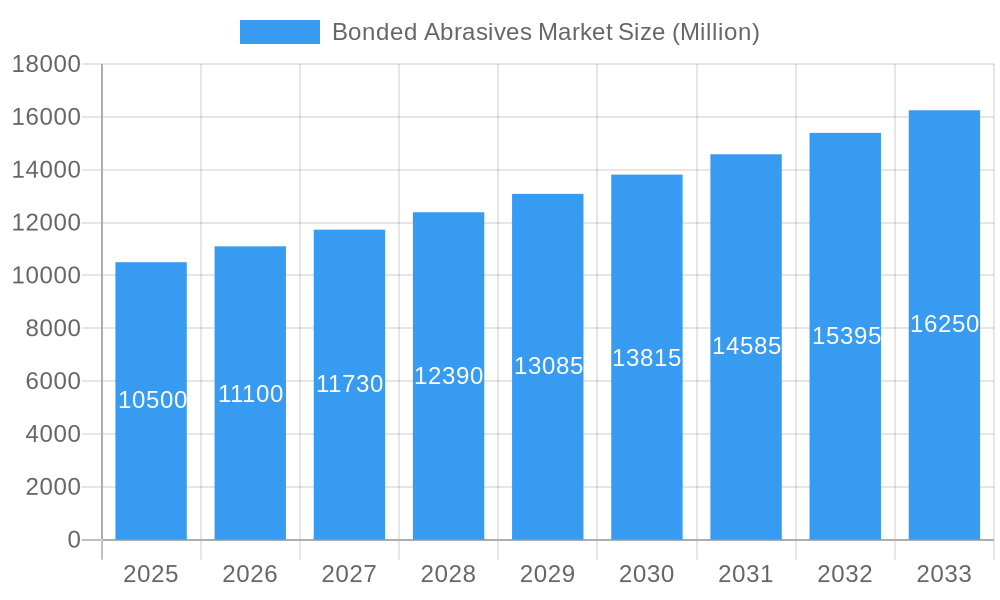

The global Bonded Abrasives Market is projected for significant expansion, expected to reach a market size of $14,200 million by 2025, driven by a compound annual growth rate (CAGR) of 6.8% from the 2025 base year. This growth is propelled by escalating demand in key sectors including automotive, construction, and metalworking, where bonded abrasives are crucial for cutting, grinding, and polishing. The automotive industry's increased vehicle production and component complexity, alongside the construction sector's ongoing infrastructure development, are major contributors. Technological advancements and the introduction of durable, efficient bonded abrasive products further fuel market growth, supported by the adoption of advanced manufacturing and automation.

Bonded Abrasives Market Market Size (In Billion)

Key market trends include the growing emphasis on precision and surface quality in manufacturing, particularly in specialized fields like aerospace. Innovations in bonding agents and abrasive materials enhancing performance and longevity are significant drivers. However, volatile raw material prices and stringent environmental regulations present challenges. Despite these factors, diverse industrial applications and continuous innovation in product development and material science are anticipated to ensure sustained and substantial growth for the bonded abrasives market.

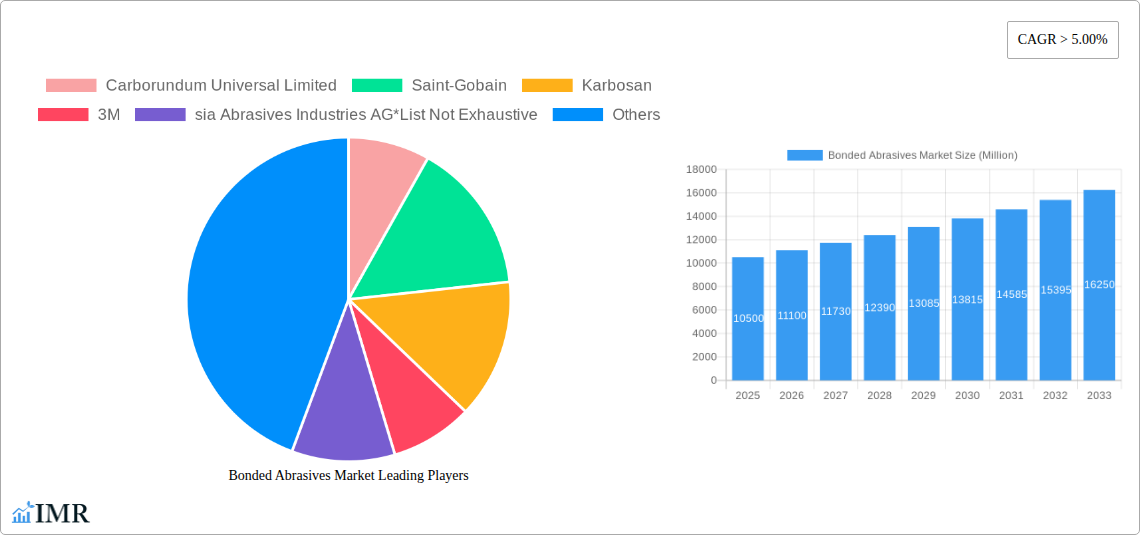

Bonded Abrasives Market Company Market Share

Bonded Abrasives Market Report: Size, Share, Trends, and Forecast 2025-2033

This comprehensive report delves into the global Bonded Abrasives Market, providing an in-depth analysis of its dynamics, growth trends, regional dominance, product landscape, and key players. Examining the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report leverages extensive data and expert insights to offer a definitive outlook for stakeholders. The market, valued in millions of units, is segmented by bond type (Vitrified Bond, Resin Bond, Rubber Bond, Other Bond Types), application (Polishing, Cutting, Grinding, Other Applications), and end-user industry (Automotive, Marine, Aerospace, Construction, Metal Working, Others).

Bonded Abrasives Market Dynamics & Structure

The Bonded Abrasives Market exhibits a moderately consolidated structure, with key players like 3M, Saint-Gobain, and Carborundum Universal Limited holding significant market shares. Technological innovation remains a primary driver, particularly in developing advanced materials for enhanced performance in applications like high-precision grinding and cutting. The demand for durable and efficient abrasive solutions in sectors such as Automotive and Aerospace fuels this innovation. Regulatory frameworks, while generally supportive of industrial growth, can influence material sourcing and environmental compliance. Competitive product substitutes, including superabrasives and advanced coated abrasives, pose a continuous challenge, pushing manufacturers to differentiate through performance and specialized solutions. End-user demographics are shifting towards sectors requiring higher precision and surface finishing, influencing product development. Mergers and acquisitions (M&A) are strategic tools for market expansion and portfolio diversification. For instance, the acquisition of smaller, specialized abrasive manufacturers by larger corporations can lead to enhanced product offerings and broader market reach. Barriers to innovation include the high cost of research and development for novel abrasive formulations and the need for extensive testing to meet industry standards. The market is also influenced by global economic trends, impacting construction and manufacturing output, which are key consumption drivers.

Bonded Abrasives Market Growth Trends & Insights

The Bonded Abrasives Market is projected to experience robust growth, driven by increasing industrialization, infrastructure development, and the rising demand for precision finishing across various end-user industries. The Automotive sector, with its emphasis on lightweighting and enhanced performance, is a significant contributor, requiring advanced abrasive solutions for component manufacturing and finishing. Similarly, the Aerospace industry's stringent requirements for high-tolerance machining and surface integrity further propels market expansion. Technological advancements in abrasive materials and manufacturing processes are leading to the development of specialized bonded abrasives with superior cutting efficiency, extended lifespan, and improved surface finishes. The adoption rate of these advanced products is steadily increasing as industries recognize their value proposition in improving productivity and reducing operational costs. Consumer behavior shifts, particularly the growing preference for products with refined aesthetics and superior quality, indirectly influence the demand for high-quality finishing processes facilitated by bonded abrasives. The market penetration of bonded abrasives is expected to deepen as new applications emerge and existing ones become more sophisticated. For example, advancements in robotics and automation are creating opportunities for specialized bonded abrasive tools for automated manufacturing processes. The overall market size is anticipated to grow at a substantial Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Emerging economies, with their rapidly expanding manufacturing sectors, represent key growth regions. The increasing focus on sustainability is also driving demand for eco-friendly abrasive solutions and processes that minimize waste. The market is evolving from traditional abrasive applications to more specialized, high-value segments, reflecting a broader trend towards precision manufacturing and advanced material processing.

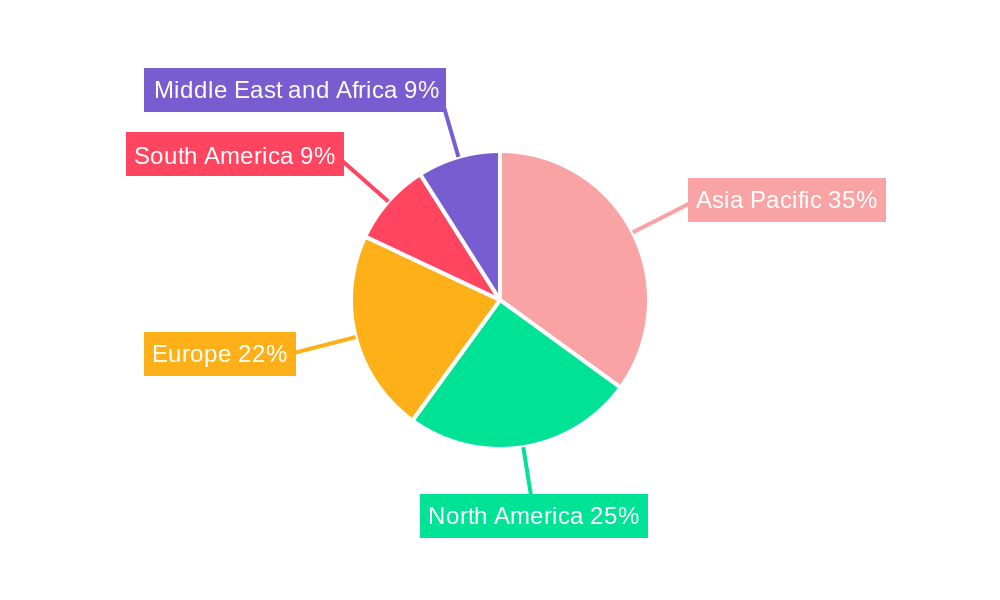

Dominant Regions, Countries, or Segments in Bonded Abrasives Market

The Asia-Pacific region stands as a dominant force in the global Bonded Abrasives Market, largely propelled by the burgeoning manufacturing sectors in countries like China, India, and Southeast Asian nations. This dominance is underpinned by several key drivers, including robust economic policies fostering industrial growth, significant investments in infrastructure development that fuels construction and heavy manufacturing, and a vast domestic market for manufactured goods. Within the Bond Type segment, Vitrified Bond abrasives are experiencing particularly strong demand due to their inherent hardness, rigidity, and resistance to heat, making them ideal for high-speed grinding and cutting operations crucial in metal fabrication and automotive component manufacturing. The Grinding application segment is another major growth engine, essential for shaping, sizing, and finishing metal parts across a multitude of industries. The Metal Working end-user industry, encompassing everything from heavy machinery to precision engineering, represents a cornerstone of the market, with a constant need for effective grinding, cutting, and polishing solutions. Countries like China, with its colossal manufacturing output and ongoing urbanization, are significant contributors to this regional dominance. India's rapidly expanding industrial base and growing automotive sector also play a crucial role. Further supporting this dominance are favorable government initiatives aimed at boosting domestic manufacturing and exports, coupled with a growing skilled workforce. The market share within Asia-Pacific for key segments like Vitrified Bond and Grinding applications is substantial, estimated to be around xx% and xx% respectively. The growth potential in this region remains exceptionally high, driven by ongoing technological adoption and the continuous expansion of manufacturing capabilities.

Bonded Abrasives Market Product Landscape

The Bonded Abrasives Market product landscape is characterized by continuous innovation focused on enhancing performance, durability, and application-specific capabilities. Manufacturers are developing novel abrasive grain compositions, advanced bonding agents, and optimized grain distribution techniques to achieve superior cutting speeds, longer tool life, and exceptional surface finishes. For instance, the development of high-strength resin bonds has enabled the creation of thinner, yet more robust, cutting wheels capable of higher rotational speeds and greater safety. Vitrified Bond products, a significant segment, are seeing advancements in porous structures that improve coolant flow and chip evacuation, leading to cooler grinding operations and reduced workpiece distortion. Applications such as Polishing are benefiting from the development of specialized bonded abrasives that deliver mirror-like finishes with fewer passes. Unique selling propositions often lie in the tailored formulations designed for specific materials, such as heat-resistant abrasives for exotic alloys or precision-grounding wheels for optical components. Technological advancements are also focused on miniaturization for intricate work in electronics and medical device manufacturing, as well as increased toughness and fracture resistance for heavy-duty industrial applications.

Key Drivers, Barriers & Challenges in Bonded Abrasives Market

Key Drivers: The Bonded Abrasives Market is primarily propelled by the sustained global demand for manufactured goods, driving the need for efficient material processing and finishing. Technological advancements in abrasive materials and manufacturing processes, leading to higher performance and durability, are significant drivers. The expansion of key end-user industries like Automotive, Aerospace, and Construction directly fuels market growth. Furthermore, increasing investments in infrastructure development worldwide create a consistent demand for cutting, grinding, and shaping tools.

Barriers & Challenges: A primary challenge is the price sensitivity of some market segments, especially in price-competitive regions. The availability and cost fluctuations of raw materials, such as aluminum oxide and silicon carbide, can impact profit margins and lead to supply chain disruptions. Stringent environmental regulations concerning dust emissions and waste disposal can increase operational costs for manufacturers. Intense competition among established players and emerging low-cost manufacturers poses a constant threat, necessitating continuous innovation and cost optimization. The development of effective substitutes, like advanced coated abrasives and specialized superabrasives, also presents a competitive hurdle.

Emerging Opportunities in Bonded Abrasives Market

Emerging opportunities in the Bonded Abrasives Market are largely concentrated in the development of specialized, high-performance abrasive solutions for niche applications. The growing demand for advanced materials in industries like renewable energy (e.g., solar panel manufacturing) and additive manufacturing presents significant untapped markets. Innovations in abrasive bonding technologies, such as the use of bio-based or recycled materials, align with the increasing global focus on sustainability and could open new avenues for market entry. The increasing adoption of Industry 4.0 principles in manufacturing is driving the need for smart abrasives with integrated sensors or those compatible with robotic grinding and finishing systems, offering opportunities for companies focused on intelligent solutions.

Growth Accelerators in the Bonded Abrasives Market Industry

Several key factors are accelerating long-term growth in the Bonded Abrasives Market. Technological breakthroughs in ceramic and composite bonding agents are leading to abrasives with exceptional hardness and thermal stability, enabling operations at higher speeds and temperatures. Strategic partnerships and collaborations between abrasive manufacturers and end-users, particularly in specialized sectors like Aerospace and medical device manufacturing, are crucial for co-developing tailor-made solutions and ensuring market adoption. Market expansion strategies, including the penetration of emerging economies and the development of distribution networks in underserved regions, are also critical growth accelerators. Furthermore, ongoing research into novel abrasive materials and their applications, such as diamond-bonded abrasives for extremely hard materials, promises to unlock new high-value market segments.

Key Players Shaping the Bonded Abrasives Market Market

- Carborundum Universal Limited

- Saint-Gobain

- Karbosan

- 3M

- Sia Abrasives Industries AG

- DEWALT

- Osborn (DRONCO)

- SAK ABRASIVES LIMITED

- Precision Abrasives Pvt Ltd

- Hermes Schleifmittel GmbH

- Marrose Abrasives

Notable Milestones in Bonded Abrasives Market Sector

- May 2021: Blue Sea Capital invested in Abrasive Technology, a leading provider of super abrasive products for the dental, aerospace, medical, and industrial end markets, to accelerate the company's growth.

In-Depth Bonded Abrasives Market Market Outlook

The future outlook for the Bonded Abrasives Market is highly promising, with continued expansion driven by technological innovation and the evolving needs of global industries. Growth accelerators, including the development of advanced ceramic and composite bonding technologies, are set to enhance abrasive performance and durability. Strategic collaborations between manufacturers and end-users, particularly in high-growth sectors, will facilitate the creation of specialized solutions and accelerate their market adoption. Expansion into emerging economies and the establishment of robust distribution channels will tap into new customer bases. Ongoing research into novel abrasive materials, such as advanced diamond-based products, is poised to create significant opportunities in premium market segments, further shaping the future trajectory of the bonded abrasives industry.

Bonded Abrasives Market Segmentation

-

1. Bond Type

- 1.1. Vitrified Bond

- 1.2. Resin Bond

- 1.3. Rubber Bond

- 1.4. Other Bond Types

-

2. Application

- 2.1. Polishing

- 2.2. Cutting

- 2.3. Grinding

- 2.4. Other Applications

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Marine

- 3.3. Aerospace

- 3.4. Construction

- 3.5. Metal Working

- 3.6. Others

Bonded Abrasives Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Bonded Abrasives Market Regional Market Share

Geographic Coverage of Bonded Abrasives Market

Bonded Abrasives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Growing Construction Sector in Emerging Economies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Pollution in the manufacturing process; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bond Type

- 5.1.1. Vitrified Bond

- 5.1.2. Resin Bond

- 5.1.3. Rubber Bond

- 5.1.4. Other Bond Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Polishing

- 5.2.2. Cutting

- 5.2.3. Grinding

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Marine

- 5.3.3. Aerospace

- 5.3.4. Construction

- 5.3.5. Metal Working

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Bond Type

- 6. Asia Pacific Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Bond Type

- 6.1.1. Vitrified Bond

- 6.1.2. Resin Bond

- 6.1.3. Rubber Bond

- 6.1.4. Other Bond Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Polishing

- 6.2.2. Cutting

- 6.2.3. Grinding

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Marine

- 6.3.3. Aerospace

- 6.3.4. Construction

- 6.3.5. Metal Working

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Bond Type

- 7. North America Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Bond Type

- 7.1.1. Vitrified Bond

- 7.1.2. Resin Bond

- 7.1.3. Rubber Bond

- 7.1.4. Other Bond Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Polishing

- 7.2.2. Cutting

- 7.2.3. Grinding

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Marine

- 7.3.3. Aerospace

- 7.3.4. Construction

- 7.3.5. Metal Working

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Bond Type

- 8. Europe Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Bond Type

- 8.1.1. Vitrified Bond

- 8.1.2. Resin Bond

- 8.1.3. Rubber Bond

- 8.1.4. Other Bond Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Polishing

- 8.2.2. Cutting

- 8.2.3. Grinding

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Marine

- 8.3.3. Aerospace

- 8.3.4. Construction

- 8.3.5. Metal Working

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Bond Type

- 9. South America Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Bond Type

- 9.1.1. Vitrified Bond

- 9.1.2. Resin Bond

- 9.1.3. Rubber Bond

- 9.1.4. Other Bond Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Polishing

- 9.2.2. Cutting

- 9.2.3. Grinding

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Marine

- 9.3.3. Aerospace

- 9.3.4. Construction

- 9.3.5. Metal Working

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Bond Type

- 10. Middle East and Africa Bonded Abrasives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Bond Type

- 10.1.1. Vitrified Bond

- 10.1.2. Resin Bond

- 10.1.3. Rubber Bond

- 10.1.4. Other Bond Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Polishing

- 10.2.2. Cutting

- 10.2.3. Grinding

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Marine

- 10.3.3. Aerospace

- 10.3.4. Construction

- 10.3.5. Metal Working

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Bond Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Carborundum Universal Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Karbosan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 sia Abrasives Industries AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DEWALT

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Osborn (DRONCO)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SAK ABRASIVES LIMITED

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Precision Abrasives Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hermes Schleifmittel GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Marrose Abrasives

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Carborundum Universal Limited

List of Figures

- Figure 1: Global Bonded Abrasives Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Bonded Abrasives Market Revenue (million), by Bond Type 2025 & 2033

- Figure 3: Asia Pacific Bonded Abrasives Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 4: Asia Pacific Bonded Abrasives Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Bonded Abrasives Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Bonded Abrasives Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Bonded Abrasives Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Bonded Abrasives Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Bonded Abrasives Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Bonded Abrasives Market Revenue (million), by Bond Type 2025 & 2033

- Figure 11: North America Bonded Abrasives Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 12: North America Bonded Abrasives Market Revenue (million), by Application 2025 & 2033

- Figure 13: North America Bonded Abrasives Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Bonded Abrasives Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: North America Bonded Abrasives Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Bonded Abrasives Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Bonded Abrasives Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Bonded Abrasives Market Revenue (million), by Bond Type 2025 & 2033

- Figure 19: Europe Bonded Abrasives Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 20: Europe Bonded Abrasives Market Revenue (million), by Application 2025 & 2033

- Figure 21: Europe Bonded Abrasives Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Bonded Abrasives Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: Europe Bonded Abrasives Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Bonded Abrasives Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Bonded Abrasives Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Bonded Abrasives Market Revenue (million), by Bond Type 2025 & 2033

- Figure 27: South America Bonded Abrasives Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 28: South America Bonded Abrasives Market Revenue (million), by Application 2025 & 2033

- Figure 29: South America Bonded Abrasives Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Bonded Abrasives Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 31: South America Bonded Abrasives Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Bonded Abrasives Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Bonded Abrasives Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Bonded Abrasives Market Revenue (million), by Bond Type 2025 & 2033

- Figure 35: Middle East and Africa Bonded Abrasives Market Revenue Share (%), by Bond Type 2025 & 2033

- Figure 36: Middle East and Africa Bonded Abrasives Market Revenue (million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Bonded Abrasives Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Bonded Abrasives Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Bonded Abrasives Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Bonded Abrasives Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Bonded Abrasives Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 2: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Bonded Abrasives Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 6: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 7: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Bonded Abrasives Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: ASEAN Countries Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 16: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Bonded Abrasives Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United States Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 23: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 24: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Bonded Abrasives Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: Germany Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: France Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 32: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 33: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Bonded Abrasives Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Brazil Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of South America Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Global Bonded Abrasives Market Revenue million Forecast, by Bond Type 2020 & 2033

- Table 39: Global Bonded Abrasives Market Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Bonded Abrasives Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Bonded Abrasives Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Bonded Abrasives Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bonded Abrasives Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Bonded Abrasives Market?

Key companies in the market include Carborundum Universal Limited, Saint-Gobain, Karbosan, 3M, sia Abrasives Industries AG*List Not Exhaustive, DEWALT, Osborn (DRONCO), SAK ABRASIVES LIMITED, Precision Abrasives Pvt Ltd, Hermes Schleifmittel GmbH, Marrose Abrasives.

3. What are the main segments of the Bonded Abrasives Market?

The market segments include Bond Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14200 million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Growing Construction Sector in Emerging Economies; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from the Construction Industry.

7. Are there any restraints impacting market growth?

Pollution in the manufacturing process; Other Restraints.

8. Can you provide examples of recent developments in the market?

In May of 2021, Blue Sea Capital invested in Abrasive Technology, a leading provider of super abrasive products for the dental, aerospace, medical, and industrial end markets for accelerating the company's growth in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bonded Abrasives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bonded Abrasives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bonded Abrasives Market?

To stay informed about further developments, trends, and reports in the Bonded Abrasives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence