Key Insights

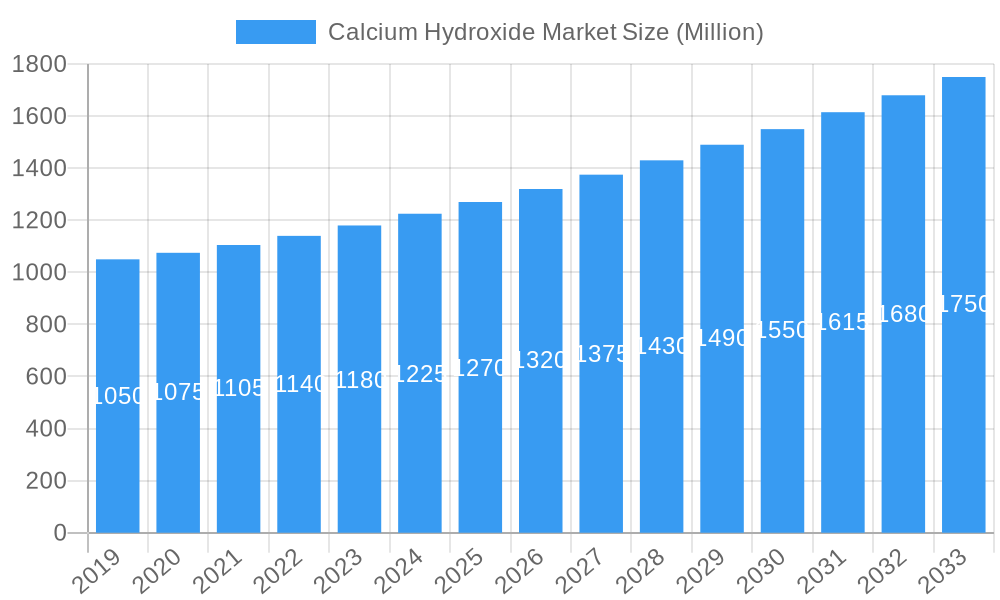

The global Calcium Hydroxide market is projected for substantial growth, anticipated to reach $3.58 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 4.2%. This expansion is fueled by the critical applications of calcium hydroxide across diverse industrial sectors. Water treatment is a primary driver, where its role in pH adjustment, coagulation, and impurity removal is essential for ensuring safe water supplies. The construction industry utilizes calcium hydroxide in mortar, plaster, and cement production for its binding and hardening properties. Environmental gas treatment, particularly flue gas desulfurization, is also a key growth area due to intensifying regulatory demands for cleaner air. Other significant applications include the food and beverage sector for pH control and processing, and the pulp and paper industry for pulping. These varied uses establish a robust and expanding demand for calcium hydroxide.

Calcium Hydroxide Market Market Size (In Billion)

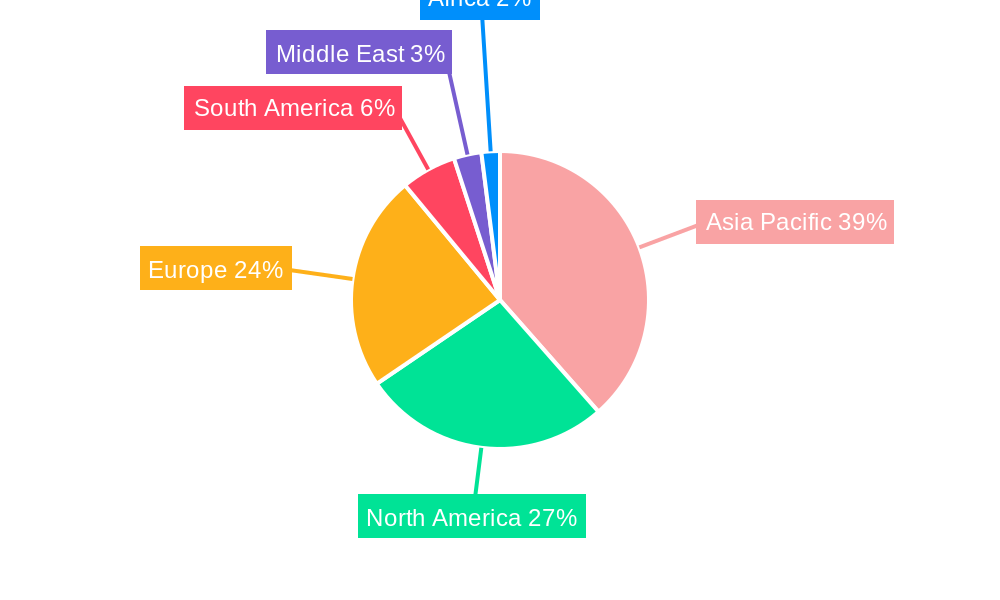

Market growth is further propelled by rising industrialization and urbanization, especially in emerging economies, which boosts construction and manufacturing needs. Increased global emphasis on environmental protection and stricter regulations for emissions and wastewater management significantly drive the use of calcium hydroxide in gas and water treatment. Advancements in production technologies, offering higher purity and specialized grades, also support market expansion by addressing niche applications. Potential restraints include volatile raw material costs, particularly for lime, and the availability of substitutes in certain uses. The Asia Pacific region is expected to lead market growth, driven by rapid industrialization in China and India, followed by North America and Europe, where established industries and stringent environmental regulations sustain demand.

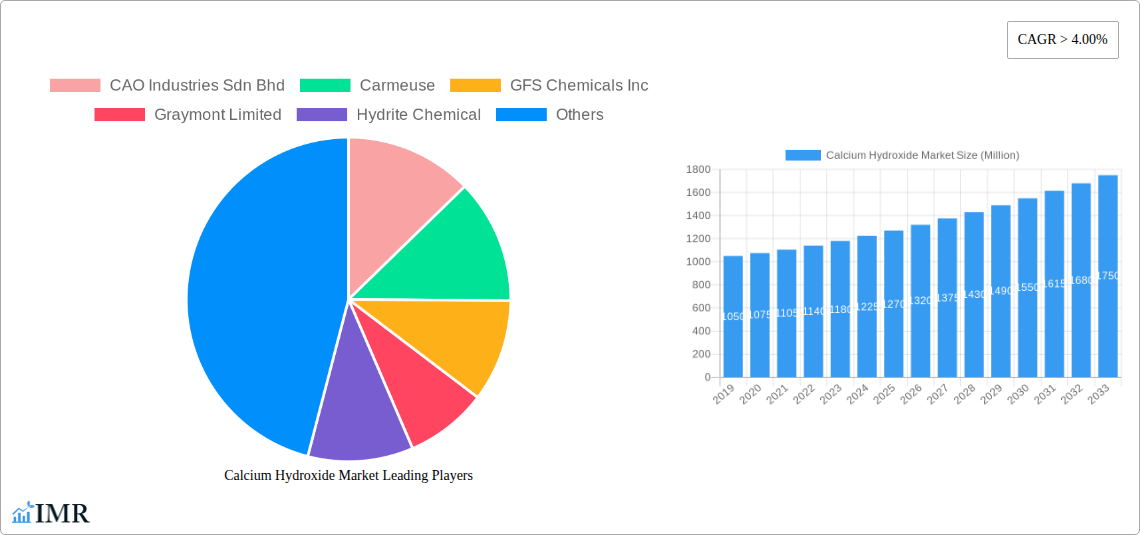

Calcium Hydroxide Market Company Market Share

Calcium Hydroxide Market: Unlocking Growth in Essential Industrial Applications (2019-2033)

This comprehensive report delivers an in-depth analysis of the global Calcium Hydroxide market, a vital compound underpinning critical industrial processes. Covering a detailed study period from 2019 to 2033, with a base and estimated year of 2025, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, emerging opportunities, and the strategic landscape shaped by leading industry players. With a focus on calcium hydroxide applications, lime hydrate market, slaked lime industry, and industrial lime uses, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving chemical manufacturing sector.

The report delves into the parent market of industrial chemicals and its child market, calcium hydroxide, meticulously examining the intricate interplay of factors influencing demand and supply. We present a forward-looking perspective, essential for strategic planning and investment decisions in this dynamic sector. All quantitative values are presented in Million units.

Calcium Hydroxide Market Dynamics & Structure

The calcium hydroxide market exhibits a moderate to highly concentrated structure, with a few key global players dominating production and supply. Technological innovation drivers primarily revolve around enhancing production efficiency, improving product purity for specialized applications like food and pharmaceuticals, and developing more sustainable manufacturing processes to minimize environmental impact. Regulatory frameworks play a crucial role, particularly in water treatment and environmental gas treatment sectors, dictating stringent quality standards and usage guidelines. Competitive product substitutes exist, such as caustic soda in certain pH adjustment applications, but calcium hydroxide often offers a more cost-effective and environmentally friendly alternative. End-user demographics are diverse, spanning established industrial sectors and emerging applications. Mergers & Acquisitions (M&A) trends are observed as companies seek to consolidate market share, expand product portfolios, and gain access to new geographic regions. For instance, strategic acquisitions in the industrial lime sector have aimed at vertical integration, securing raw material sources and enhancing distribution networks. Innovation barriers include high capital investment for new plant construction, the energy-intensive nature of lime production, and the need for specialized technical expertise.

- Market Concentration: Dominated by a mix of large multinational corporations and regional specialized producers.

- Technological Innovation: Focus on process optimization, energy efficiency, and product diversification.

- Regulatory Landscape: Strict adherence to environmental and health standards, especially in water and gas treatment.

- Competitive Landscape: Competition from alternative alkaline chemicals and integrated lime producers.

- End-User Sophistication: Increasing demand for high-purity calcium hydroxide in niche applications.

- M&A Activity: Driven by scale, market access, and diversification strategies.

Calcium Hydroxide Market Growth Trends & Insights

The calcium hydroxide market is projected to experience robust growth, driven by an increasing demand across its diverse end-user industries. The market size is anticipated to evolve significantly, with a projected Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033. Adoption rates in key sectors such as water treatment and environmental gas treatment are expected to remain high due to escalating environmental regulations and growing awareness of water quality. Technological disruptions, while not revolutionary, are gradually impacting production processes, leading to enhanced efficiency and reduced waste. Consumer behavior shifts are also playing a role; for example, the food and beverage industry's increasing preference for natural and safe additives favors calcium hydroxide over synthetic alternatives. The slaked lime market is witnessing a steady upward trajectory as infrastructure development and construction activities gain momentum globally. Furthermore, the pulp and paper industry's continued reliance on calcium hydroxide for chemical recovery processes underpins its stable demand. Emerging economies represent a significant growth avenue, as industrialization and urbanization drive demand for essential chemicals like calcium hydroxide. The market penetration of specialty grades of calcium hydroxide, tailored for specific applications, is also on the rise, indicating a maturing market ready to cater to specialized needs. The overall market evolution is characterized by a steady, demand-led expansion, with innovation focusing on incremental improvements rather than radical shifts.

Dominant Regions, Countries, or Segments in Calcium Hydroxide Market

The Water Treatment segment is a dominant force in the global calcium hydroxide market, driven by stringent regulations and the imperative for clean water resources worldwide. This segment accounts for an estimated xx% of the total market share in the base year 2025, with projected growth fueled by expanding populations, industrial wastewater treatment mandates, and the ongoing need for potable water purification. Key drivers include government initiatives for water infrastructure development, particularly in developing nations, and the increasing focus on removing impurities, heavy metals, and adjusting pH levels in both municipal and industrial water systems.

- Asia Pacific: This region is a powerhouse for calcium hydroxide demand, propelled by rapid industrialization, massive infrastructure projects, and a growing population. Countries like China and India are major consumers, with significant investments in both construction and environmental gas treatment applications. The region's burgeoning manufacturing sector also contributes to substantial demand in the pulp & paper and food & beverages industries. Economic policies promoting industrial growth and environmental protection initiatives are key accelerators.

- North America: Holds a significant share, primarily driven by advanced water and wastewater treatment facilities, stringent environmental regulations for industrial emissions, and a well-established construction sector. The US is a major market, with a mature construction industry and advanced environmental gas treatment technologies demanding high-purity calcium hydroxide.

- Europe: Exhibits strong demand driven by robust environmental policies, particularly in environmental gas treatment and water purification. The region's focus on sustainable practices and circular economy principles indirectly supports the demand for calcium hydroxide in various industrial recycling processes, including in the pulp & paper industry.

The growth potential in these regions is underpinned by ongoing infrastructure investments, stricter environmental compliance, and the increasing adoption of advanced manufacturing techniques.

Calcium Hydroxide Market Product Landscape

The calcium hydroxide product landscape is characterized by continuous refinement in purity and particle size distribution to cater to diverse applications. Innovations focus on producing highly pure grades of calcium hydroxide for the pharmaceutical and food & beverage industries, ensuring compliance with stringent quality standards. In the construction sector, advancements in admixtures incorporating calcium hydroxide aim to improve concrete performance, durability, and workability. For environmental gas treatment, refined products offer enhanced reactivity for efficient sulfur dioxide and other pollutant absorption. Performance metrics are increasingly scrutinized, with manufacturers emphasizing consistency, reactivity, and minimal impurities. Unique selling propositions often lie in the customized grades developed for specific industrial needs, such as ultra-fine powder for specialized chemical reactions or granular forms for ease of handling. Technological advancements are also directed towards optimizing the manufacturing process itself, leading to improved energy efficiency and a reduced environmental footprint for producers.

Key Drivers, Barriers & Challenges in Calcium Hydroxide Market

Key Drivers:

- Growing Demand for Clean Water: Escalating global population and industrialization necessitate advanced water and wastewater treatment solutions, a primary application for calcium hydroxide.

- Stringent Environmental Regulations: Mandates for flue gas desulfurization and industrial emissions control significantly boost demand in environmental gas treatment.

- Infrastructure Development: Robust growth in the construction sector, especially in emerging economies, drives demand for lime-based building materials and soil stabilization.

- Cost-Effectiveness: Calcium hydroxide offers an economically viable solution for pH adjustment and neutralization across various industrial processes.

- Food & Beverage Industry Expansion: Increasing use as a food additive, processing aid, and in sugar refining supports steady market growth.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of limestone, the primary raw material, can impact profitability.

- Energy-Intensive Production: The calcination process requires significant energy, leading to potential cost pressures and environmental concerns related to carbon emissions.

- Logistics and Transportation Costs: Calcium hydroxide is a bulky commodity, and transportation costs can be substantial, especially for long-distance deliveries.

- Competition from Alternatives: While cost-effective, calcium hydroxide faces competition from other alkaline chemicals in certain niche applications.

- Handling and Safety Concerns: Calcium hydroxide is alkaline and requires careful handling to mitigate potential health and safety risks.

Emerging Opportunities in Calcium Hydroxide Market

Emerging opportunities in the calcium hydroxide market are primarily centered around sustainable applications and specialized product development. The increasing global focus on waste management and recycling presents opportunities for calcium hydroxide in industrial waste stabilization and the treatment of hazardous materials. Innovative applications in agriculture for soil amendment and pH regulation are gaining traction, particularly in regions with acidic soil profiles. Furthermore, the development of nano-calcium hydroxide and its potential in advanced materials and biomedical applications represent a frontier for future growth. Untapped markets in regions undergoing rapid industrialization and urbanization, coupled with evolving consumer preferences for natural and environmentally friendly products, will further shape the market's trajectory.

Growth Accelerators in the Calcium Hydroxide Market Industry

The long-term growth of the calcium hydroxide market will be significantly accelerated by technological breakthroughs in production efficiency and product versatility. The development of more energy-efficient calcination methods and advanced purification techniques will not only reduce operational costs but also enhance the environmental profile of calcium hydroxide production. Strategic partnerships between raw material suppliers and end-users can ensure stable supply chains and foster the development of customized product solutions. Market expansion strategies targeting nascent industries and geographical regions with developing infrastructure will be crucial. Investments in research and development to explore novel applications, such as in advanced composite materials or as a catalyst in chemical synthesis, will also act as significant growth catalysts, pushing the boundaries of its current utility.

Key Players Shaping the Calcium Hydroxide Market Market

- CAO Industries Sdn Bhd

- Carmeuse

- GFS Chemicals Inc

- Graymont Limited

- Hydrite Chemical

- Innova Corporate

- Jost Chemical Co

- Lhoist

- Mississippi Lime Company

- United States Lime & Minerals Inc

Notable Milestones in Calcium Hydroxide Market Sector

- 2023: Introduction of advanced, energy-efficient kilns by leading manufacturers, reducing carbon footprints.

- 2023: Increased regulatory focus on industrial wastewater discharge standards, driving demand for specialized treatment chemicals like calcium hydroxide.

- 2022: Significant advancements in the production of ultra-high purity calcium hydroxide for pharmaceutical excipients.

- 2021: Growing adoption of calcium hydroxide in soil stabilization techniques for infrastructure projects in regions prone to seismic activity.

- 2020: Expansion of production capacities by major players to meet surging demand from the environmental gas treatment sector.

In-Depth Calcium Hydroxide Market Market Outlook

The future outlook for the calcium hydroxide market is exceptionally positive, driven by its indispensable role in essential industrial processes and its adaptability to evolving environmental and technological landscapes. Growth accelerators, including innovations in sustainable production and the exploration of novel applications, will pave the way for expanded market penetration. Strategic opportunities lie in catering to the burgeoning demand for clean water and robust environmental protection measures globally. The market's ability to provide cost-effective and reliable solutions positions it for sustained growth across diverse sectors, from basic industrial needs to high-tech applications, ensuring its continued significance in the global chemical industry.

Calcium Hydroxide Market Segmentation

-

1. End-user Industry

- 1.1. Water Treatment

- 1.2. Construction

- 1.3. Environmental Gas Treatment

- 1.4. Food & Beverages

- 1.5. Pulp & Paper

- 1.6. Other End-user Industries

Calcium Hydroxide Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Calcium Hydroxide Market Regional Market Share

Geographic Coverage of Calcium Hydroxide Market

Calcium Hydroxide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Investment in US Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Private Investment in US Construction Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Wastewater Treatment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Water Treatment

- 5.1.2. Construction

- 5.1.3. Environmental Gas Treatment

- 5.1.4. Food & Beverages

- 5.1.5. Pulp & Paper

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Water Treatment

- 6.1.2. Construction

- 6.1.3. Environmental Gas Treatment

- 6.1.4. Food & Beverages

- 6.1.5. Pulp & Paper

- 6.1.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Water Treatment

- 7.1.2. Construction

- 7.1.3. Environmental Gas Treatment

- 7.1.4. Food & Beverages

- 7.1.5. Pulp & Paper

- 7.1.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Water Treatment

- 8.1.2. Construction

- 8.1.3. Environmental Gas Treatment

- 8.1.4. Food & Beverages

- 8.1.5. Pulp & Paper

- 8.1.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. South America Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Water Treatment

- 9.1.2. Construction

- 9.1.3. Environmental Gas Treatment

- 9.1.4. Food & Beverages

- 9.1.5. Pulp & Paper

- 9.1.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Water Treatment

- 10.1.2. Construction

- 10.1.3. Environmental Gas Treatment

- 10.1.4. Food & Beverages

- 10.1.5. Pulp & Paper

- 10.1.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Saudi Arabia Calcium Hydroxide Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11.1.1. Water Treatment

- 11.1.2. Construction

- 11.1.3. Environmental Gas Treatment

- 11.1.4. Food & Beverages

- 11.1.5. Pulp & Paper

- 11.1.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by End-user Industry

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CAO Industries Sdn Bhd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Carmeuse

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GFS Chemicals Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Graymont Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hydrite Chemical

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innova Corporate

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Jost Chemical Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Lhoist

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mississippi Lime Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 United States Lime & Minerals Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 CAO Industries Sdn Bhd

List of Figures

- Figure 1: Global Calcium Hydroxide Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 5: Asia Pacific Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: South America Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 19: Middle East Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Saudi Arabia Calcium Hydroxide Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Saudi Arabia Calcium Hydroxide Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Saudi Arabia Calcium Hydroxide Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Saudi Arabia Calcium Hydroxide Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Calcium Hydroxide Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: India Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Japan Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Korea Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Canada Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Brazil Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Argentina Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Global Calcium Hydroxide Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Calcium Hydroxide Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: South Africa Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East Calcium Hydroxide Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Calcium Hydroxide Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Calcium Hydroxide Market?

Key companies in the market include CAO Industries Sdn Bhd, Carmeuse, GFS Chemicals Inc, Graymont Limited, Hydrite Chemical, Innova Corporate, Jost Chemical Co, Lhoist, Mississippi Lime Company, United States Lime & Minerals Inc *List Not Exhaustive.

3. What are the main segments of the Calcium Hydroxide Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Investment in US Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Wastewater Treatment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Private Investment in US Construction Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

The full report will cover recent developments in the market studied.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Calcium Hydroxide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Calcium Hydroxide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Calcium Hydroxide Market?

To stay informed about further developments, trends, and reports in the Calcium Hydroxide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence