Key Insights

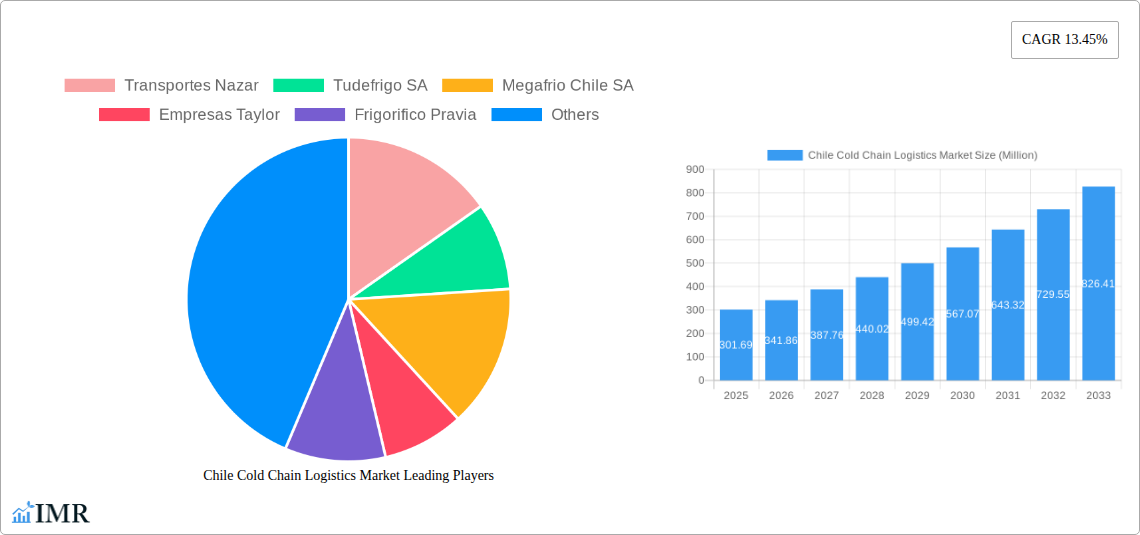

The Chilean cold chain logistics market, valued at $301.69 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.45% from 2025 to 2033. This growth is fueled by several key factors. The increasing demand for fresh produce, particularly fruits and vegetables, from both domestic and international markets, is a primary driver. Chile's strong agricultural sector, renowned for its high-quality exports, necessitates efficient cold chain solutions to maintain product quality and extend shelf life during transportation and storage. Furthermore, the burgeoning e-commerce sector, coupled with rising consumer preference for chilled and frozen foods, is significantly contributing to market expansion. The expansion of the pharmaceutical and life sciences industries in Chile also adds to the demand for reliable cold chain logistics, emphasizing temperature-sensitive drug delivery and storage. The market is segmented by service type (storage, transportation, value-added services like blast freezing and inventory management), temperature control (chilled, frozen, ambient), and end-user industry (horticulture, dairy, meat, fish and poultry, processed food, pharmaceuticals, and others). Key players such as Transportes Nazar, Tudefrigo SA, and Megafrio Chile SA are actively shaping the market landscape, with competition expected to intensify further. The market's success will depend on investments in advanced cold chain technologies, enhanced infrastructure, and effective regulatory frameworks that support sustainable practices.

Chile Cold Chain Logistics Market Market Size (In Million)

The competitive landscape involves a mix of established players and emerging companies, indicating opportunities for both expansion and consolidation. While the dominance of established firms suggests a mature market segment, continuous technological advancements and evolving consumer preferences create avenues for innovation and growth, fostering both organic expansion for incumbents and potential market entry for new players. Challenges exist; however, infrastructure limitations in certain regions might constrain market growth to a degree. Government initiatives to improve cold chain infrastructure, along with industry-wide adoption of best practices in temperature control and traceability, will be crucial in maximizing the market's growth trajectory. The consistent double-digit CAGR suggests a favorable outlook for investment and growth in this sector, making it an attractive proposition for both domestic and international stakeholders.

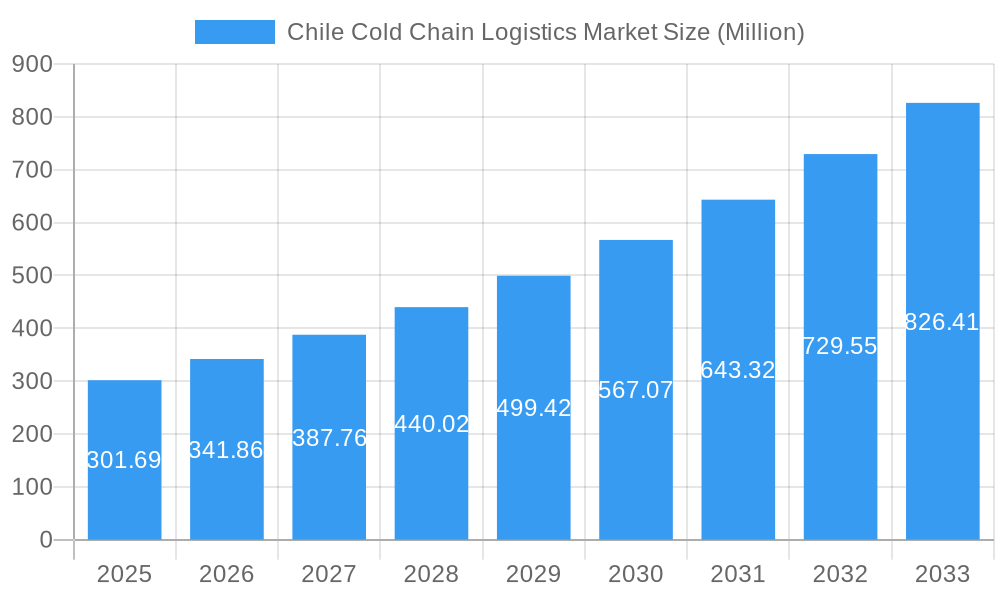

Chile Cold Chain Logistics Market Company Market Share

Chile Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Chile cold chain logistics market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry professionals, investors, and stakeholders seeking to understand the complexities and opportunities within this dynamic market. This analysis delves into the parent market of Logistics in Chile and the child market of Cold Chain Logistics, providing a granular view of this crucial sector. The market size is projected to reach xx Million by 2033.

Chile Cold Chain Logistics Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within Chile's cold chain logistics sector. We examine market concentration, identifying the share held by major players like Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, and Ceva Logistics, along with 63 other companies including Emergent Cold LatAm and TIBA Chile. The analysis also considers the impact of mergers and acquisitions (M&A) activity, estimating xx M&A deals during the study period.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, smaller regional players also contribute substantially.

- Technological Innovation: Adoption of technologies like IoT sensors, temperature monitoring systems, and advanced transportation management systems is driving efficiency and reducing losses. However, high initial investment costs pose a barrier for smaller companies.

- Regulatory Framework: Government regulations concerning food safety and pharmaceutical handling significantly impact the market, pushing for higher standards and compliance costs.

- Competitive Substitutes: Limited substitutes exist, strengthening the market's inherent growth potential. However, improved storage and transportation solutions outside of the cold chain could pose a long-term challenge.

- End-User Demographics: The growing population and increasing per capita consumption of perishable goods, especially in the growing middle class, fuel market expansion.

- M&A Trends: Consolidation is expected to continue, driven by the need for expanded reach and enhanced technological capabilities.

Chile Cold Chain Logistics Market Growth Trends & Insights

This section delves into the evolution of the Chilean cold chain logistics market, analyzing its size, adoption rates across various segments, and the impact of technological disruptions and consumer behavior shifts. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration for temperature-controlled storage in key segments like fresh produce and pharmaceuticals is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Chile Cold Chain Logistics Market

This section identifies the leading regions, countries, and segments within the Chilean cold chain logistics market driving market growth. The Metropolitan Region of Santiago is expected to maintain its dominance due to its high population density and robust economic activity.

- Service Segments: Transportation currently holds the largest market share, followed by storage and value-added services. The demand for value-added services like blast freezing and inventory management is growing rapidly.

- Temperature Segments: The frozen segment currently dominates due to the significant export of frozen seafood and fruits. However, the chilled segment is expected to experience faster growth.

- End-User Segments: Horticulture (fresh fruits and vegetables) is the largest end-user segment, followed by meat, fish, and poultry. The pharmaceutical and life sciences sectors exhibit high growth potential.

The high volume of agricultural exports and growing demand for temperature-sensitive products are key drivers for growth.

Chile Cold Chain Logistics Market Product Landscape

The product landscape is characterized by a mix of traditional and technologically advanced solutions. Innovations include the increasing use of GPS tracking, real-time temperature monitoring, and specialized refrigerated containers. These technologies enhance efficiency, minimize spoilage, and ensure product integrity throughout the supply chain. Unique selling propositions frequently center on advanced tracking capabilities, minimizing temperature deviations and ensuring regulatory compliance.

Key Drivers, Barriers & Challenges in Chile Cold Chain Logistics Market

Key Drivers:

- Increasing demand for perishable goods.

- Growing exports of agricultural products.

- Government initiatives to improve cold chain infrastructure.

- Technological advancements enhancing efficiency and reducing spoilage.

Key Barriers & Challenges:

- High infrastructure costs, especially in remote areas.

- Lack of skilled labor in certain segments.

- Regulatory complexities and compliance requirements.

- Competition from regional and international players. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% during the forecast period.

Emerging Opportunities in Chile Cold Chain Logistics Market

- Expansion into underserved regions.

- Growing demand for specialized cold chain solutions in niche markets (e.g., pharmaceuticals).

- Increased adoption of sustainable and environmentally friendly practices.

- Development of integrated cold chain solutions combining storage, transportation, and value-added services.

Growth Accelerators in the Chile Cold Chain Logistics Market Industry

Technological advancements, particularly in IoT, AI, and automation, are key growth accelerators. Strategic partnerships between logistics providers and technology companies are also driving innovation. Government investments in infrastructure and regulatory reforms are further bolstering market expansion.

Key Players Shaping the Chile Cold Chain Logistics Market Market

- Transportes Nazar

- Tudefrigo SA

- Megafrio Chile SA

- Empresas Taylor

- Frigorifico Pravia

- Friofort SA

- Frigorificos Puerto Montt

- Ceva Logistics

- 63 Other Companies

- Emergent Cold LatAm

- TIBA Chile

Notable Milestones in Chile Cold Chain Logistics Market Sector

- 2021 Q3: Megafrio Chile SA announces expansion of its cold storage facility in Santiago.

- 2022 Q1: New regulations on food safety are implemented, increasing compliance costs for logistics providers.

- 2023 Q2: Tudefrigo SA launches a new fleet of technologically advanced refrigerated trucks.

- (Further milestones can be added based on available data)

In-Depth Chile Cold Chain Logistics Market Market Outlook

The Chile cold chain logistics market is poised for robust growth, driven by increasing domestic consumption, expanding exports, and technological advancements. Strategic opportunities exist for companies that can leverage technology to enhance efficiency, improve traceability, and ensure product quality. Investments in infrastructure development and the implementation of sustainable practices will further contribute to market expansion.

Chile Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 3.3. Meat, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other End Users

Chile Cold Chain Logistics Market Segmentation By Geography

- 1. Chile

Chile Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Chile Cold Chain Logistics Market

Chile Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Fruit Exports

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges of First Mile Distribution in Chile

- 3.4. Market Trends

- 3.4.1. Growth Of E-commerce Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice Cream, Butter, etc.)

- 5.3.3. Meat, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tudefrigo SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megafrio Chile SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Empresas Taylor

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frigorifico Pravia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Friofort SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frigorificos Puerto Montt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceva Logistics**List Not Exhaustive 6 3 Other Companie

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emergent Cold LatAm

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TIBA Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Chile Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Chile Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Chile Cold Chain Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Chile Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Chile Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Cold Chain Logistics Market?

The projected CAGR is approximately 13.45%.

2. Which companies are prominent players in the Chile Cold Chain Logistics Market?

Key companies in the market include Transportes Nazar, Tudefrigo SA, Megafrio Chile SA, Empresas Taylor, Frigorifico Pravia, Friofort SA, Frigorificos Puerto Montt, Ceva Logistics**List Not Exhaustive 6 3 Other Companie, Emergent Cold LatAm, TIBA Chile.

3. What are the main segments of the Chile Cold Chain Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.69 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Fruit Exports.

6. What are the notable trends driving market growth?

Growth Of E-commerce Driving The Market.

7. Are there any restraints impacting market growth?

4.; Challenges of First Mile Distribution in Chile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Chile Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence