Key Insights

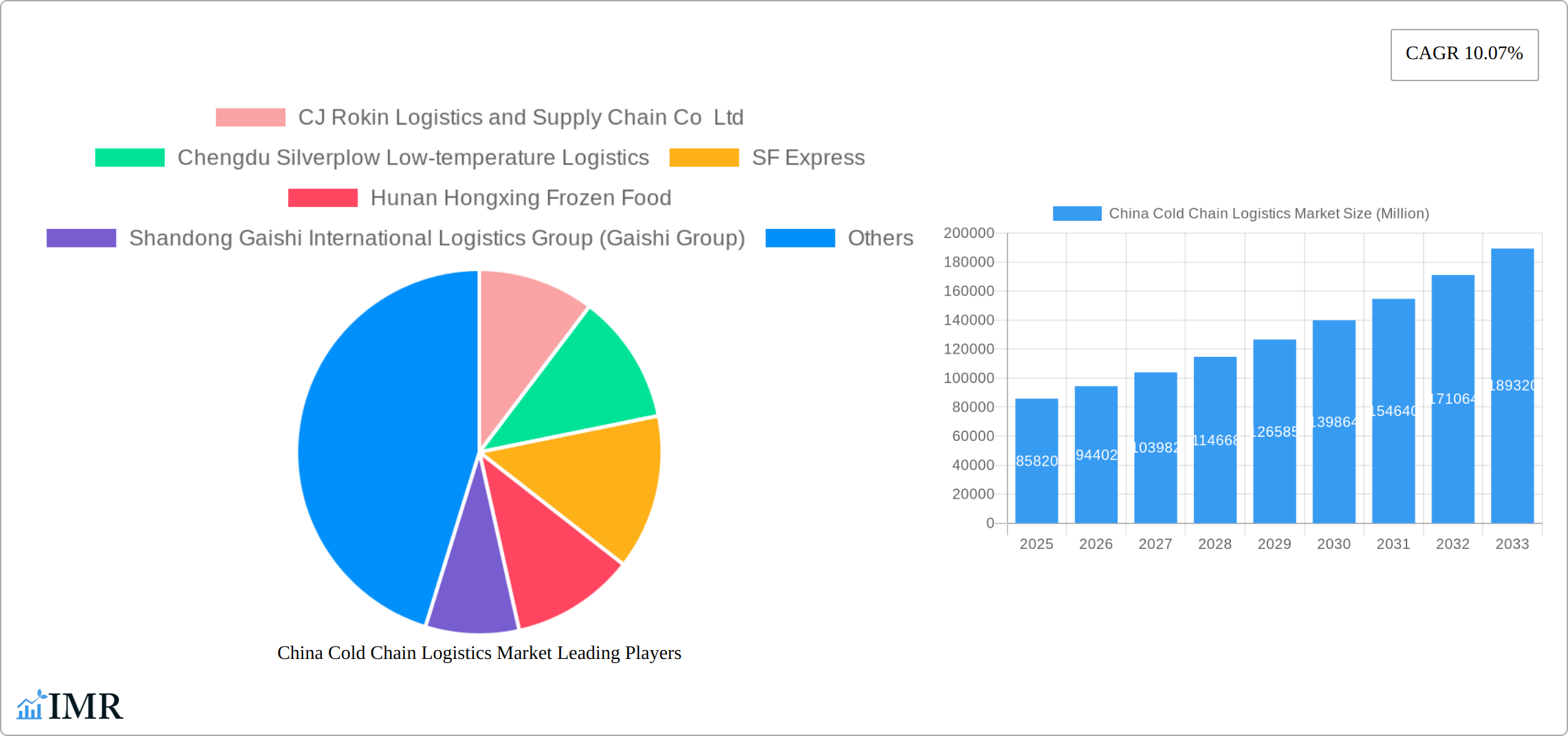

The China cold chain logistics market, valued at $85.82 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.07% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning e-commerce sector and rising consumer demand for fresh and processed foods, pharmaceuticals, and other temperature-sensitive goods are significantly boosting the need for efficient cold chain solutions. Secondly, increasing government initiatives promoting infrastructure development and technological advancements within the logistics sector are facilitating market expansion. The rise of sophisticated technologies such as IoT-enabled tracking and monitoring systems, and advanced refrigeration technologies are enhancing supply chain efficiency and minimizing product spoilage, further contributing to market growth. Finally, the diversification of cold chain services, encompassing storage, transportation, and value-added services like blast freezing and inventory management, caters to a wider range of customer needs, fueling market expansion across various application segments.

China Cold Chain Logistics Market Market Size (In Billion)

However, the market also faces certain challenges. The significant capital investment required for infrastructure development and the maintenance of stringent temperature control throughout the supply chain can be a barrier to entry for smaller players. Furthermore, the geographical diversity of China presents logistical complexities, particularly in reaching remote areas. Despite these constraints, the market's overall growth trajectory remains positive, fueled by a rising middle class with increased disposable income, an expanding cold chain infrastructure, and a growing preference for high-quality, perishable goods. Key players like CJ Rokin Logistics, SF Express, and Nichirei Logistics Group are strategically positioning themselves to capitalize on these opportunities, focusing on technological innovation and service diversification to maintain a competitive edge. The market segmentation, encompassing various services, temperature types, and applications, offers diverse avenues for growth and specialization within the sector.

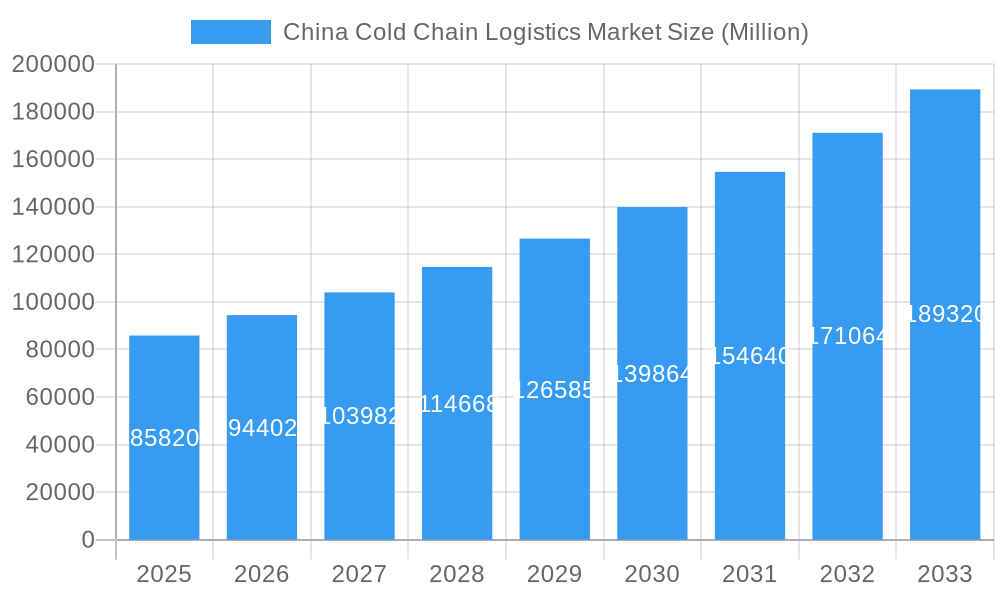

China Cold Chain Logistics Market Company Market Share

China Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China cold chain logistics market, encompassing market dynamics, growth trends, regional analysis, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and forecast period from 2025 to 2033. The market is segmented by services (storage, transportation, value-added services), temperature type (chilled, frozen), and application (horticulture, dairy, meats, fish, poultry, processed food, pharma, life sciences & chemicals, and others). This report is an essential resource for industry professionals, investors, and anyone seeking to understand the complexities and growth potential of this dynamic market. The market size is projected to reach xx Million units by 2033.

China Cold Chain Logistics Market Dynamics & Structure

This section delves into the intricate structure of the China cold chain logistics market, examining its concentration, technological advancements, regulatory landscape, competitive dynamics, and M&A activity. We analyze the market share held by key players, the impact of government regulations, and the emergence of innovative technologies. The analysis includes:

- Market Concentration: The market exhibits a [High/Medium/Low – choose one] level of concentration with the top 5 players holding an estimated xx% market share in 2025. This is largely due to [mention reasons for high/low concentration, e.g., scale economies, regulatory barriers, etc.].

- Technological Innovation: Technological advancements like IoT sensors, blockchain technology, and automated warehousing systems are transforming the industry, improving efficiency and reducing losses. However, challenges remain in terms of cost of implementation and integration with existing systems.

- Regulatory Framework: Government initiatives promoting food safety and cold chain infrastructure development significantly influence market growth. Specific regulations regarding temperature monitoring and transportation standards are creating both opportunities and challenges for companies.

- Competitive Product Substitutes: The primary substitutes are traditional transportation methods lacking temperature control, resulting in significant product spoilage. This emphasizes the growing need for advanced cold chain solutions.

- End-User Demographics: The rising middle class, increasing urbanization, and changing consumer preferences towards fresh and processed foods are driving demand for efficient cold chain logistics.

- M&A Trends: A growing number of mergers and acquisitions are occurring, with xx M&A deals recorded between [Year] and [Year], leading to increased consolidation within the market. This trend is expected to continue driven by [mention reasons for M&A activity].

China Cold Chain Logistics Market Growth Trends & Insights

This section presents a detailed analysis of market size evolution, adoption rates of new technologies, and shifting consumer behavior influencing the growth of the China cold chain logistics market. The market is experiencing significant growth driven by several factors, including:

The China cold chain logistics market has demonstrated robust expansion, driven by an increasing consumer appetite for fresh, frozen, and temperature-sensitive products. During the historical period (2019-2024), the market witnessed a Compound Annual Growth Rate (CAGR) of approximately 15.2%. This impressive growth is underpinned by a confluence of factors, including escalating disposable incomes, a rapidly urbanizing population, and a heightened awareness regarding food safety and quality. The penetration of advanced cold chain monitoring systems, particularly IoT-based solutions, has seen a significant uptick, reaching an estimated 35% in 2024. This technological adoption is crucial in minimizing product spoilage, ensuring regulatory compliance, and providing real-time visibility across the supply chain. Consumer behavior has shifted dramatically, with a greater demand for convenience and a willingness to pay a premium for reliably delivered perishable goods. E-commerce platforms, especially those specializing in groceries and pharmaceuticals, have become major catalysts, necessitating a more sophisticated and widespread cold chain network. This has spurred investments in refrigerated warehousing, specialized transportation fleets, and advanced inventory management systems. The market penetration for cold chain logistics services across key urban centers is already substantial, with projections indicating further growth in secondary and tertiary cities as the infrastructure expands. Technological disruptions, such as the implementation of AI for route optimization and demand forecasting, are further enhancing efficiency and reducing operational costs, thereby contributing to the market's upward trajectory. The evolving food safety regulations and growing export of high-value agricultural products also play a pivotal role in driving the demand for efficient and compliant cold chain solutions.

Dominant Regions, Countries, or Segments in China Cold Chain Logistics Market

This section identifies the leading regions, countries, or market segments driving market growth. The analysis considers factors such as economic policies, infrastructure development, and consumer demand across different segments:

- By Services: The transportation segment currently dominates the market, holding a 48% share in 2025, driven by the increasing demand for efficient and reliable delivery of temperature-sensitive goods across the vast geographical area of China. Value-added services, such as kitting, labeling, and reverse logistics, are experiencing rapid growth, with a projected CAGR of 18% during the forecast period, as businesses seek to optimize their supply chain operations beyond basic transportation.

- By Temperature Type: The frozen segment accounts for a larger share than the chilled segment due to the significant demand for frozen food products, particularly in the ready-to-eat and processed food categories. However, the chilled segment is expected to grow at a faster pace, driven by increasing consumer preference for fresh produce and dairy.

- By Application: Horticulture (fresh fruits and vegetables), dairy products, and meats, fish, and poultry are the major application segments, accounting for 65% of the total market in 2025. The pharmaceutical and life sciences segment is witnessing significant growth due to increasing demand for temperature-sensitive drugs and vaccines, with a projected CAGR of 20% over the next five years.

- The dominance of specific regions is closely tied to their economic development, population density, and existing cold chain infrastructure. Eastern coastal provinces such as Guangdong, Jiangsu, and Shandong are leading the market due to their robust manufacturing bases, high consumer spending power, and well-developed transportation networks. Inland regions are gradually catching up, with government initiatives focused on developing cold chain hubs and improving connectivity. The market share breakdown reveals that the food and beverage sector holds the largest portion, followed by pharmaceuticals. Projections indicate that while food and beverages will continue to be the primary driver, the pharmaceutical segment's rapid expansion will allow it to capture a more substantial share in the coming years. The increasing focus on domestic consumption and the "dual circulation" economic strategy further bolster the demand for efficient cold chain logistics across all application segments.

China Cold Chain Logistics Market Product Landscape

The China cold chain logistics market features a diverse range of products and services. These include sophisticated temperature-controlled containers, GPS tracking systems, advanced refrigeration technologies, and specialized warehousing facilities. Recent innovations focus on improving efficiency, reducing waste, and enhancing transparency across the entire supply chain. Companies are actively integrating IoT sensors and data analytics to monitor temperature, location, and other crucial parameters in real-time. This allows for proactive intervention and minimizes potential losses.

Key Drivers, Barriers & Challenges in China Cold Chain Logistics Market

Key Drivers: The key drivers of market growth include: increasing consumer demand for fresh and processed foods; government support for cold chain infrastructure development, including subsidies and policy incentives; rising disposable incomes, leading to higher consumption of premium and perishable goods; and technological advancements leading to improved efficiency, enhanced traceability, and cost reductions.

Key Challenges and Restraints: The market faces several challenges, including inadequate cold chain infrastructure in remote and underdeveloped areas, leading to significant product loss; high infrastructure development and maintenance costs; stringent and evolving regulatory compliance requirements for food and pharmaceuticals; and intense competition among a fragmented landscape of logistics providers. These challenges impact the overall efficiency, scalability, and profitability of the cold chain logistics industry. For example, inadequate last-mile delivery infrastructure in rural regions leads to increased spoilage, higher transportation costs, and longer delivery times, limiting market reach.

Emerging Opportunities in China Cold Chain Logistics Market

Emerging opportunities include the expansion of cold chain infrastructure into underserved rural areas, the integration of advanced technologies like AI and machine learning for better route optimization and inventory management, and the growth of e-commerce which fuels demand for last-mile cold chain delivery solutions. Furthermore, specialized cold chain solutions for niche products like pharmaceuticals and biologics present significant growth opportunities.

Growth Accelerators in the China Cold Chain Logistics Market Industry

Long-term growth will be fueled by continuous technological innovation, including the adoption of blockchain for enhanced traceability, AI for predictive analytics, and automation in warehousing. Strategic partnerships between logistics providers, producers, and e-commerce platforms will be crucial for building integrated and efficient supply chains. Expansion into new geographical markets, particularly in emerging inland cities, and the development of specialized cold chain solutions for niche products (e.g., high-end wines, gourmet ingredients) will also drive market expansion. Government support and policy initiatives, such as increased investments in cold chain infrastructure, standardization of cold chain practices, and streamlined regulatory frameworks, will further stimulate market growth. The increasing adoption of sustainable and environmentally friendly cold chain practices, such as the use of energy-efficient refrigeration technologies and optimized routing to reduce emissions, will also play a significant role in shaping future growth and meeting evolving corporate social responsibility goals.

Key Players Shaping the China Cold Chain Logistics Market Market

- CJ Rokin Logistics and Supply Chain Co Ltd

- Chengdu Silverplow Low-temperature Logistics

- SF Express

- Hunan Hongxing Frozen Food

- Shandong Gaishi International Logistics Group (Gaishi Group)

- China Merchants Americold (CMAC)

- Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China)

- Shanghai Speed Fresh Logistics Co Ltd

- Beijing Er Shang Group

- Nichirei Logistics Group Inc

- HNA Cold Chain

- Sinotrans Ltd

- Zhenjiang Hengwei Supply Chain Management Co Ltd

- Shanghai Jin Jiang International Industrial Investment Co Ltd

Notable Milestones in China Cold Chain Logistics Market Sector

- June 2023: JD Logistics announced an investment of $500 million to expand its cold chain network across 50 key cities in China, focusing on last-mile delivery capabilities.

- February 2023: SF Intra-city established a new dedicated cold chain division, aiming to provide specialized temperature-controlled solutions for the rapidly growing food delivery market.

- October 2022: The Chinese government released new guidelines promoting the development of smart cold chain logistics, encouraging the adoption of IoT and big data technologies.

- July 2022: Cainiao Network (Alibaba's logistics arm) launched a nationwide cold chain network for fresh produce, integrating with its extensive e-commerce platform.

- April 2022: COSCO Shipping Ports announced plans to invest in state-of-the-art cold chain facilities at key port locations to support the growing import and export of temperature-sensitive goods.

In-Depth China Cold Chain Logistics Market Market Outlook

The China cold chain logistics market is poised for substantial growth in the coming years, driven by the factors discussed above. The strategic focus should be on leveraging technological advancements, strengthening partnerships, and ensuring compliance with evolving regulatory frameworks. Companies that can effectively address the challenges of infrastructure development and maintain operational efficiency will be best positioned to capitalize on the significant market opportunities.

China Cold Chain Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

China Cold Chain Logistics Market Segmentation By Geography

- 1. China

China Cold Chain Logistics Market Regional Market Share

Geographic Coverage of China Cold Chain Logistics Market

China Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CJ Rokin Logistics and Supply Chain Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chengdu Silverplow Low-temperature Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hunan Hongxing Frozen Food

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shandong Gaishi International Logistics Group (Gaishi Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Merchants Americold (CMAC)**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Speed Fresh Logistics Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Er Shang Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nichirei Logistics Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HNA Cold Chain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sinotrans Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Zhenjiang Hengwei Supply Chain Management Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Shanghai Jin Jiang International Industrial Investment Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 CJ Rokin Logistics and Supply Chain Co Ltd

List of Figures

- Figure 1: China Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: China Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: China Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: China Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: China Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: China Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: China Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: China Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Cold Chain Logistics Market?

The projected CAGR is approximately 10.07%.

2. Which companies are prominent players in the China Cold Chain Logistics Market?

Key companies in the market include CJ Rokin Logistics and Supply Chain Co Ltd, Chengdu Silverplow Low-temperature Logistics, SF Express, Hunan Hongxing Frozen Food, Shandong Gaishi International Logistics Group (Gaishi Group), China Merchants Americold (CMAC)**List Not Exhaustive, Henan Fresh Easy Supply Chain Co Ltd (Xianyi Holding China), Shanghai Speed Fresh Logistics Co Ltd, Beijing Er Shang Group, Nichirei Logistics Group Inc, HNA Cold Chain, Sinotrans Ltd, Zhenjiang Hengwei Supply Chain Management Co Ltd, Shanghai Jin Jiang International Industrial Investment Co Ltd.

3. What are the main segments of the China Cold Chain Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.82 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing online users driving the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Regulatory Compliance Affecting the Market4.; High Competition in the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the China Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence