Key Insights

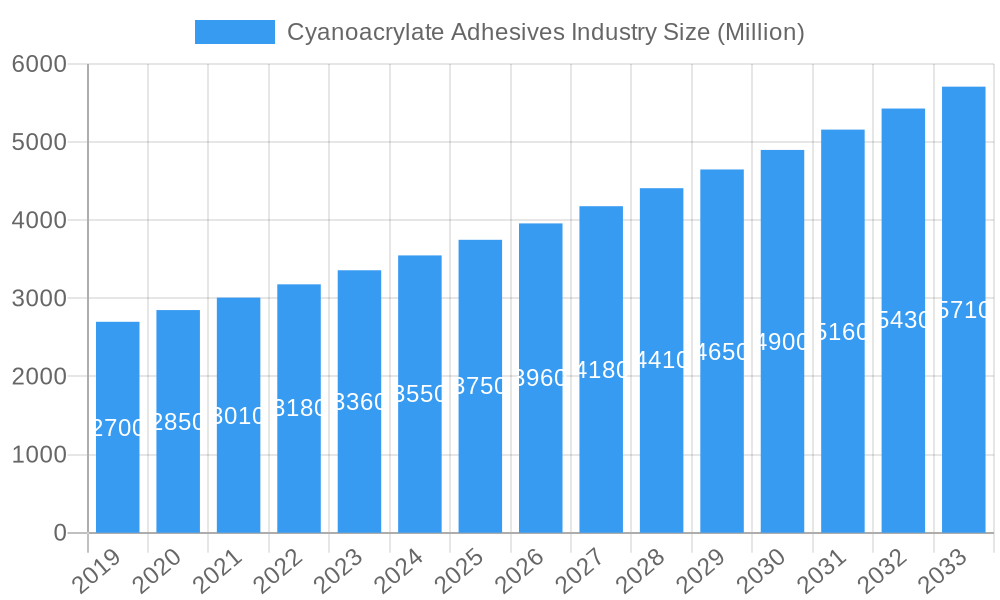

The global Cyanoacrylate Adhesives market is poised for robust expansion, projected to reach an estimated market size of $3,850 million in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) exceeding 6.00% throughout the study period, indicating sustained momentum and increasing demand. The market is propelled by significant drivers, including the escalating need for high-performance bonding solutions across diverse industries, the inherent advantages of cyanoacrylate adhesives such as rapid curing times, superior bond strength, and versatility in application. Furthermore, ongoing advancements in adhesive formulations, leading to enhanced durability, temperature resistance, and flexibility, are further fueling market penetration. The trend towards miniaturization in electronics and the growing adoption of advanced materials in automotive and aerospace manufacturing are key contributors to this upward trajectory.

Cyanoacrylate Adhesives Industry Market Size (In Billion)

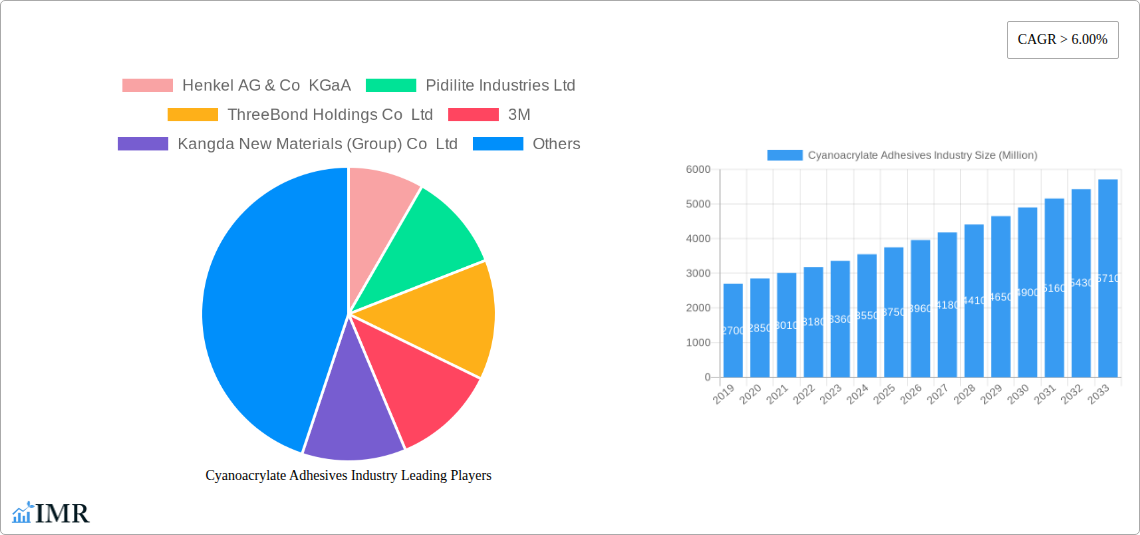

The market's segmentation reveals a dynamic landscape. The Aerospace and Automotive sectors are anticipated to be dominant end-user industries, driven by stringent requirements for lightweighting, structural integrity, and efficient assembly processes. The Building and Construction sector, while perhaps not as immediate as aerospace or automotive, is also a significant and growing segment, benefiting from the ease of application and rapid set times for repairs and assembly. The Healthcare industry, with its demand for medical-grade adhesives for device assembly and wound closure, presents a promising niche. In terms of technology, both Reactive and UV Cured Adhesives are expected to see considerable growth, with UV-cured variants offering precise application control and instant curing under UV light, ideal for high-volume manufacturing. Key players like Henkel AG & Co KGaA, Pidilite Industries Ltd, and 3M are at the forefront, actively innovating and expanding their product portfolios to capitalize on these opportunities.

Cyanoacrylate Adhesives Industry Company Market Share

Comprehensive Report on the Cyanoacrylate Adhesives Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This report offers an in-depth analysis of the global Cyanoacrylate Adhesives market, providing critical insights into its dynamics, growth trajectories, and future potential. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this study is an indispensable resource for stakeholders seeking to understand market concentration, technological advancements, regulatory landscapes, competitive pressures, and emerging opportunities. With a focus on quantitative data, including values in Million units, and qualitative analysis, this report equips industry professionals with actionable intelligence. It delves into the parent and child market structures, offering a granular understanding of market segmentation and driving forces across various end-user industries and technologies.

Cyanoacrylate Adhesives Industry Market Dynamics & Structure

The global Cyanoacrylate Adhesives market exhibits a moderate to high concentration, characterized by the presence of both established multinational corporations and emerging regional players. Technological innovation serves as a primary driver, with ongoing research focused on enhancing cure speeds, substrate adhesion, thermal resistance, and flexibility. Regulatory frameworks, particularly concerning environmental impact and safety standards, are increasingly influencing product development and market entry. Competitive product substitutes, such as epoxies and anaerobic adhesives, pose a constant challenge, necessitating continuous product differentiation and performance optimization. End-user demographics are shifting, with a growing demand from sectors like healthcare and electronics for specialized, high-performance cyanoacrylate formulations. Mergers and Acquisitions (M&A) are a significant trend, with companies strategically acquiring smaller entities to expand their product portfolios, geographic reach, and technological capabilities. For instance, the market has witnessed several strategic acquisitions aimed at consolidating market share and enhancing R&D prowess.

- Market Concentration: Dominated by a few key players but with increasing participation from specialized manufacturers.

- Technological Innovation: Focus on faster curing, improved bond strength, and resistance to environmental factors.

- Regulatory Impact: Growing emphasis on VOC compliance and eco-friendly formulations.

- Competitive Landscape: Intense competition from alternative adhesive technologies.

- End-User Demand: Driven by advancements in electronics, medical devices, and automotive assembly.

- M&A Activity: Strategic consolidations to gain market share and technological expertise.

Cyanoacrylate Adhesives Industry Growth Trends & Insights

The Cyanoacrylate Adhesives market is poised for robust expansion, projected to witness significant growth over the forecast period (2025–2033). This expansion is underpinned by an increasing adoption rate across diverse industries, driven by the inherent advantages of cyanoacrylate adhesives, including their rapid cure times, high bond strength, and versatility. Technological disruptions are continuously reshaping the market, with advancements in formulations addressing specific application needs, such as low-odor and low-blooming variants, and those offering enhanced flexibility and impact resistance. Consumer behavior shifts, particularly the demand for more efficient and durable assembly solutions in manufacturing and consumer goods, further fuel market penetration. The market size evolution is a direct reflection of these trends, with an anticipated Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This growth trajectory is supported by increasing investments in research and development aimed at overcoming existing limitations and expanding the application spectrum. The demand for these "super glues" is not confined to industrial applications; their ease of use and effectiveness in DIY applications also contribute to their widespread adoption, indicating a healthy market penetration across both professional and consumer segments. The underlying economic conditions, coupled with the continuous drive for miniaturization and lightweighting in various industries, will play a crucial role in sustaining this upward trend. The evolution of product performance, offering greater resistance to temperature fluctuations, moisture, and chemical exposure, will further solidify their position as a preferred bonding solution.

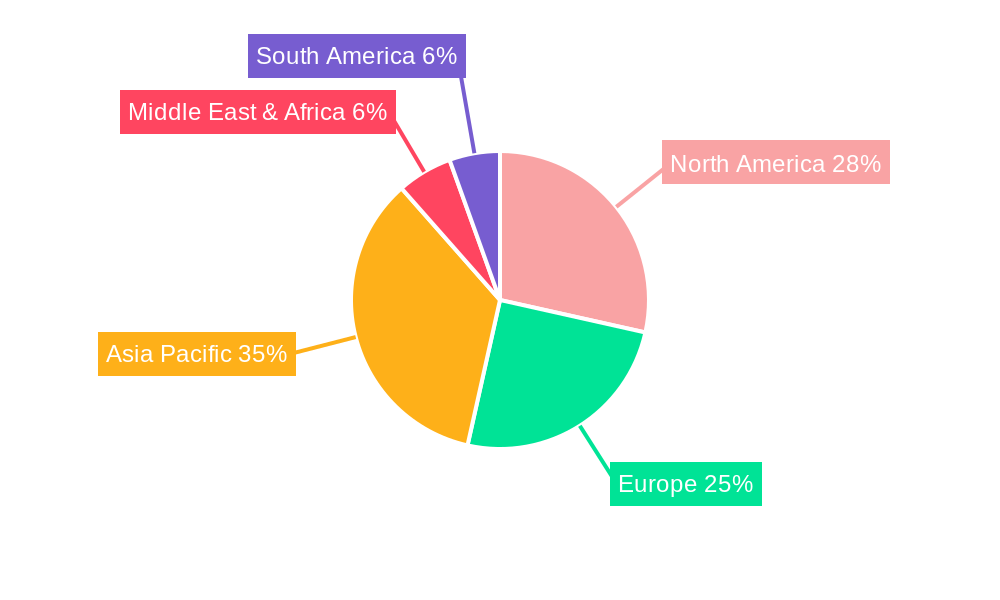

Dominant Regions, Countries, or Segments in Cyanoacrylate Adhesives Industry

The Automotive end-user industry stands out as a dominant segment driving growth in the global Cyanoacrylate Adhesives market. This dominance is attributed to several key factors that align perfectly with the capabilities of cyanoacrylate adhesives. The automotive sector’s relentless pursuit of lightweighting to improve fuel efficiency and reduce emissions necessitates the use of advanced bonding solutions to replace traditional mechanical fasteners. Cyanoacrylates, with their high tensile strength and rapid bonding capabilities, are ideally suited for assembling intricate components, interior trim, and even certain structural elements, contributing to a reduction in overall vehicle weight. Furthermore, the increasing complexity of automotive interiors and the growing trend towards sophisticated electronic components within vehicles create a substantial demand for adhesives that can reliably bond diverse materials, including plastics, rubbers, and metals, often in challenging geometries.

- Automotive Sector Dominance: Rapid assembly needs, lightweighting initiatives, and intricate component bonding drive demand.

- Market Share: Automotive segment is estimated to hold approximately 22% of the global market share by volume in 2025.

- Growth Potential: Projected to grow at a CAGR of 6.2% during the forecast period, outpacing other sectors.

- Technological Advancements: Development of specialized automotive-grade cyanoacrylates with enhanced temperature resistance and impact strength.

- Key Drivers: Increasing vehicle production, adoption of electric vehicles (EVs) with unique bonding requirements, and stringent quality standards.

- Geographic Influence: Asia-Pacific, with its burgeoning automotive manufacturing base, is a significant contributor to this segment's growth.

In terms of regions, Asia-Pacific is projected to be the leading market for cyanoacrylate adhesives, propelled by its robust manufacturing ecosystem and rapid industrialization. The region’s significant presence in electronics manufacturing, automotive production, and consumer goods production creates a vast and continually expanding demand for these versatile adhesives. Economic policies promoting industrial growth and investments in infrastructure further bolster this dominance. The growing disposable income in emerging economies within Asia-Pacific is also contributing to increased demand for consumer products that rely on cyanoacrylate adhesives for assembly.

Cyanoacrylate Adhesives Industry Product Landscape

The product landscape of the cyanoacrylate adhesives industry is characterized by continuous innovation aimed at expanding their application scope and enhancing performance. Manufacturers are actively developing formulations that offer improved resistance to extreme temperatures, moisture, and chemicals, making them suitable for more demanding environments. Specialty products now include low-odor, low-blooming adhesives for aesthetic applications, flexible formulations for bonding dissimilar materials prone to vibration, and high-viscosity options for gap-filling applications. These advancements are crucial for meeting the evolving needs of industries such as aerospace, medical device manufacturing, and electronics, where reliability and precision are paramount. The ongoing development of UV-curable cyanoacrylate variants further expands their utility, enabling faster production cycles and more precise application control.

Key Drivers, Barriers & Challenges in Cyanoacrylate Adhesives Industry

The Cyanoacrylate Adhesives industry is propelled by several key drivers. The inherent advantages of rapid curing, high bond strength, and versatility across various substrates make them indispensable in numerous manufacturing processes. The increasing demand for lightweighting in industries like automotive and aerospace directly translates into a higher adoption of adhesives over traditional fastening methods. Furthermore, the growing emphasis on miniaturization in electronics and medical devices necessitates the use of adhesives capable of precise bonding of small components. Technological advancements, leading to specialized formulations with enhanced properties such as flexibility, temperature resistance, and low-odor characteristics, are also significant growth accelerators.

However, the industry faces notable barriers and challenges. The relatively limited gap-filling capabilities of standard cyanoacrylates can be a constraint for certain applications. Susceptibility to degradation under prolonged exposure to moisture and certain chemicals can limit their use in harsh environments. The development of specialized, high-performance formulations often comes with higher costs, potentially limiting adoption in price-sensitive markets. Supply chain disruptions, particularly for raw materials, can impact production volumes and pricing. Moreover, stringent regulatory requirements related to environmental impact and worker safety necessitate continuous product reformulation and adherence to evolving standards. Competitive pressures from alternative adhesive technologies, such as epoxies, polyurethanes, and UV-curable adhesives, also demand ongoing innovation and cost-effectiveness.

Emerging Opportunities in Cyanoacrylate Adhesives Industry

Emerging opportunities in the Cyanoacrylate Adhesives industry lie in several key areas. The rapidly growing medical device sector presents a significant avenue, with a demand for biocompatible and sterilizable cyanoacrylate formulations for wound closure, device assembly, and surgical instruments. The expansion of the electric vehicle (EV) market creates new bonding challenges, particularly in battery pack assembly and the integration of complex electronic components, where high thermal conductivity and robust adhesion are critical. Advancements in 3D printing technology are also opening up possibilities for specialized cyanoacrylate-based resins for additive manufacturing applications. Furthermore, the development of "smart" adhesives with integrated functionalities, such as conductive or self-healing properties, represents a futuristic frontier for innovation and market differentiation. The growing consumer demand for durable and repairable products also fuels opportunities for high-performance, easy-to-use cyanoacrylate adhesives in the DIY and repair segments.

Growth Accelerators in the Cyanoacrylate Adhesives Industry Industry

The long-term growth of the Cyanoacrylate Adhesives industry is significantly accelerated by several critical factors. Continuous technological breakthroughs, leading to the development of novel formulations with superior performance characteristics, such as enhanced flexibility, increased temperature resistance, and improved adhesion to challenging substrates, are key. Strategic partnerships between adhesive manufacturers and end-user industries allow for co-development of tailored solutions that meet specific application requirements and production demands. Market expansion strategies, including entering untapped geographic regions and catering to newly emerging industrial sectors, are crucial for sustained growth. The increasing adoption of automated dispensing systems and robotic application technologies further enhances the efficiency and precision of cyanoacrylate adhesive usage, making them more attractive for high-volume manufacturing. Investment in research and development to address environmental concerns and develop more sustainable adhesive solutions will also be a major growth catalyst.

Key Players Shaping the Cyanoacrylate Adhesives Industry Market

- Henkel AG & Co KGaA

- Pidilite Industries Ltd

- ThreeBond Holdings Co Ltd

- 3M

- Kangda New Materials (Group) Co Ltd

- Hubei Huitian New Materials Co Ltd

- NANPAO RESINS CHEMICAL GROUP

- Illinois Tool Works Inc

- Arkema Group

- H B Fuller Company

- Soudal Holding N V

- Aica Kogyo Co Ltd

- Jowat SE

- Permabond LLC

- DELO Industrie Klebstoffe GmbH & Co KGaA

Notable Milestones in Cyanoacrylate Adhesives Industry Sector

- May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand, expanding its market reach and distribution network.

- February 2022: H.B. Fuller announced the acquisition of Fourny NV, a significant move to strengthen its Construction Adhesives business in the European market and broaden its product portfolio.

- January 2022: H.B. Fuller announced the acquisition of UK-based Apollo Chemicals, aiming to expand its footprint in the European market and enhance its specialty chemicals offering.

In-Depth Cyanoacrylate Adhesives Industry Market Outlook

The future outlook for the Cyanoacrylate Adhesives industry is exceptionally promising, driven by continuous innovation and expanding application frontiers. Growth accelerators such as the development of advanced formulations for the burgeoning medical device and electric vehicle sectors will significantly contribute to market expansion. Strategic partnerships and market expansion into emerging economies will unlock new revenue streams. The ongoing trend towards automation in manufacturing will further solidify the demand for high-speed, reliable bonding solutions like cyanoacrylates. The industry’s ability to adapt to environmental regulations and develop sustainable products will be crucial for long-term success. Anticipated advancements in areas like biocompatibility and thermal management will position cyanoacrylate adhesives as indispensable components in future technological advancements, ensuring sustained growth and market leadership. The total market value in 2025 is estimated at approximately USD 5,500 Million units, with a projected growth to over USD 8,500 Million units by 2033.

Cyanoacrylate Adhesives Industry Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Footwear and Leather

- 1.5. Healthcare

- 1.6. Woodworking and Joinery

- 1.7. Other End-user Industries

-

2. Technology

- 2.1. Reactive

- 2.2. UV Cured Adhesives

Cyanoacrylate Adhesives Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyanoacrylate Adhesives Industry Regional Market Share

Geographic Coverage of Cyanoacrylate Adhesives Industry

Cyanoacrylate Adhesives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Packaging Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic on Global Economy

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Footwear and Leather

- 5.1.5. Healthcare

- 5.1.6. Woodworking and Joinery

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Reactive

- 5.2.2. UV Cured Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Building and Construction

- 6.1.4. Footwear and Leather

- 6.1.5. Healthcare

- 6.1.6. Woodworking and Joinery

- 6.1.7. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Reactive

- 6.2.2. UV Cured Adhesives

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Building and Construction

- 7.1.4. Footwear and Leather

- 7.1.5. Healthcare

- 7.1.6. Woodworking and Joinery

- 7.1.7. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Reactive

- 7.2.2. UV Cured Adhesives

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Building and Construction

- 8.1.4. Footwear and Leather

- 8.1.5. Healthcare

- 8.1.6. Woodworking and Joinery

- 8.1.7. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Reactive

- 8.2.2. UV Cured Adhesives

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Building and Construction

- 9.1.4. Footwear and Leather

- 9.1.5. Healthcare

- 9.1.6. Woodworking and Joinery

- 9.1.7. Other End-user Industries

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Reactive

- 9.2.2. UV Cured Adhesives

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Cyanoacrylate Adhesives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Building and Construction

- 10.1.4. Footwear and Leather

- 10.1.5. Healthcare

- 10.1.6. Woodworking and Joinery

- 10.1.7. Other End-user Industries

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Reactive

- 10.2.2. UV Cured Adhesives

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pidilite Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ThreeBond Holdings Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kangda New Materials (Group) Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubei Huitian New Materials Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NANPAO RESINS CHEMICAL GROUP

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Illinois Tool Works Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arkema Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 H B Fuller Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Soudal Holding N V

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aica Kogyo Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jowat SE

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Permabond LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DELO Industrie Klebstoffe GmbH & Co KGaA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Cyanoacrylate Adhesives Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Cyanoacrylate Adhesives Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 3: North America Cyanoacrylate Adhesives Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America Cyanoacrylate Adhesives Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America Cyanoacrylate Adhesives Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Cyanoacrylate Adhesives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Cyanoacrylate Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cyanoacrylate Adhesives Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 9: South America Cyanoacrylate Adhesives Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 10: South America Cyanoacrylate Adhesives Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 11: South America Cyanoacrylate Adhesives Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: South America Cyanoacrylate Adhesives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Cyanoacrylate Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cyanoacrylate Adhesives Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 15: Europe Cyanoacrylate Adhesives Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Europe Cyanoacrylate Adhesives Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 17: Europe Cyanoacrylate Adhesives Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Cyanoacrylate Adhesives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Cyanoacrylate Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 21: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 22: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 23: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cyanoacrylate Adhesives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cyanoacrylate Adhesives Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 27: Asia Pacific Cyanoacrylate Adhesives Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: Asia Pacific Cyanoacrylate Adhesives Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Asia Pacific Cyanoacrylate Adhesives Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Pacific Cyanoacrylate Adhesives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Cyanoacrylate Adhesives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 5: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 6: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 11: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 12: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 17: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 29: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 30: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 38: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 39: Global Cyanoacrylate Adhesives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cyanoacrylate Adhesives Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyanoacrylate Adhesives Industry?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Cyanoacrylate Adhesives Industry?

Key companies in the market include Henkel AG & Co KGaA, Pidilite Industries Ltd, ThreeBond Holdings Co Ltd, 3M, Kangda New Materials (Group) Co Ltd, Hubei Huitian New Materials Co Ltd, NANPAO RESINS CHEMICAL GROUP, Illinois Tool Works Inc, Arkema Group, H B Fuller Company, Soudal Holding N V, Aica Kogyo Co Ltd, Jowat SE, Permabond LLC, DELO Industrie Klebstoffe GmbH & Co KGaA.

3. What are the main segments of the Cyanoacrylate Adhesives Industry?

The market segments include End User Industry, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Packaging Industry; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic on Global Economy.

8. Can you provide examples of recent developments in the market?

May 2022: ITW Performance Polymers announced a distribution partnership with PREMA SA in Poland for its Devcon brand.February 2022: H.B. Fuller announced the acquisition of Fourny NV to strengthen its Construction Adhesives business in Europe.January 2022: H.B. Fuller announced the acquisition of UK-based Apollo Chemicals to expand its foothold in the European market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyanoacrylate Adhesives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyanoacrylate Adhesives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyanoacrylate Adhesives Industry?

To stay informed about further developments, trends, and reports in the Cyanoacrylate Adhesives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence