Key Insights

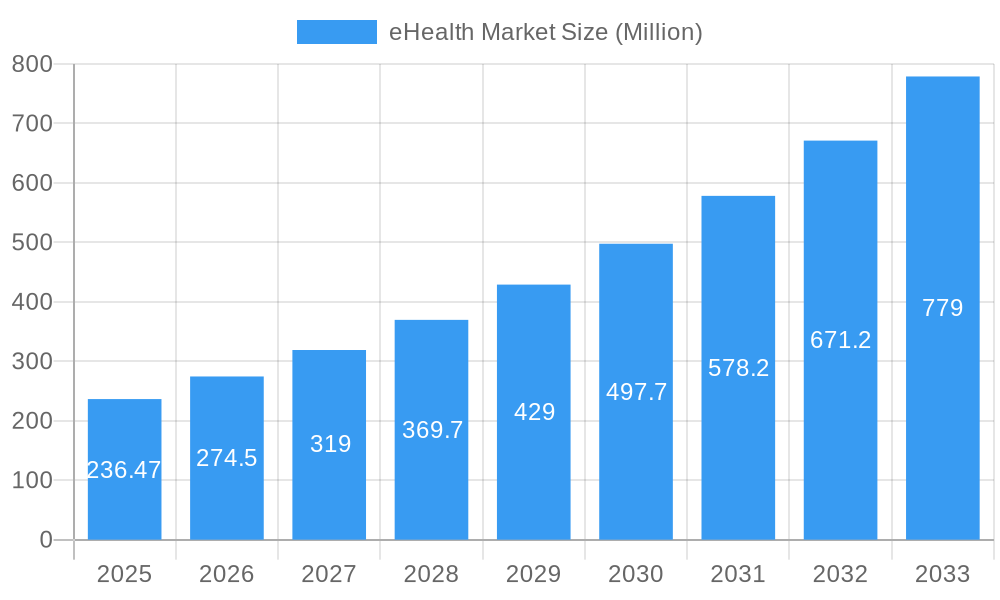

The global eHealth market is poised for substantial expansion, projected to reach an impressive \$236.47 million with a robust Compound Annual Growth Rate (CAGR) of 16.02%. This significant growth trajectory is underpinned by a confluence of powerful drivers, primarily the increasing adoption of Electronic Health Records (EHRs) and the burgeoning demand for telemedicine services. As healthcare systems globally grapple with the need for enhanced efficiency, improved patient outcomes, and greater accessibility, eHealth solutions are emerging as critical enablers. The shift towards value-based care models further incentivizes the implementation of advanced digital health technologies that can track, analyze, and optimize patient journeys. Moreover, a growing emphasis on preventative care and chronic disease management, facilitated by remote monitoring and diagnostic services, is fueling market expansion.

eHealth Market Market Size (In Million)

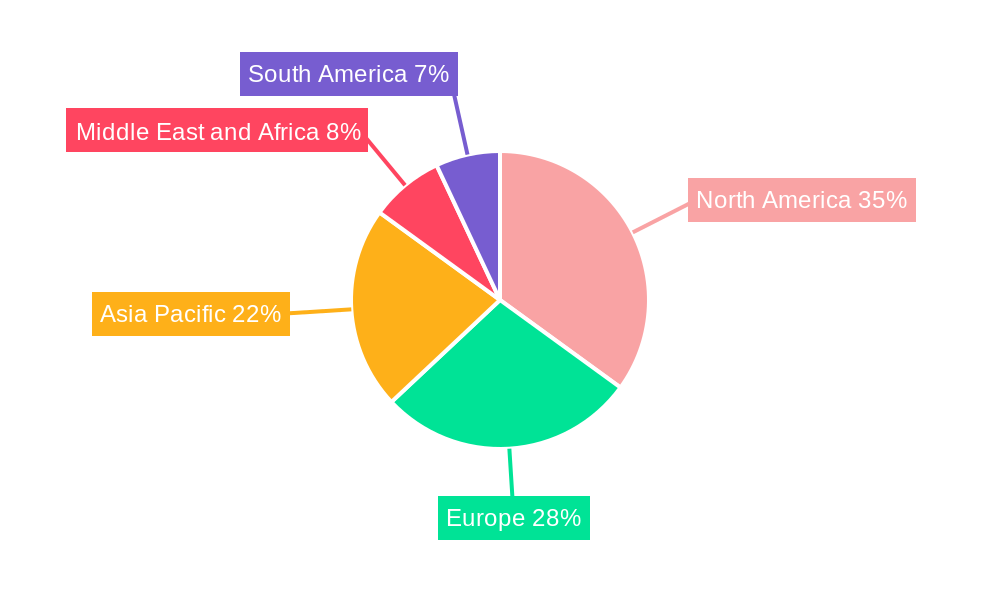

The eHealth market is characterized by a diverse range of components, with EHRs forming the bedrock of digital health infrastructure, followed closely by e-Prescribing systems and Clinical Decision Support Systems (CDSS). Telemedicine is rapidly gaining traction, offering a flexible and accessible approach to healthcare delivery, especially in remote or underserved areas. The service landscape is equally dynamic, with monitoring services experiencing significant growth due to the proliferation of wearable devices and the increasing need for continuous patient oversight. End-user adoption is broad, with hospitals leading the charge in implementing comprehensive eHealth solutions, closely followed by insurance companies seeking to streamline claims processing and improve cost-effectiveness. Regionally, North America is expected to maintain its dominant position, driven by early adoption of advanced technologies and supportive government initiatives. However, the Asia Pacific region is anticipated to witness the most rapid growth, fueled by increasing healthcare expenditure, a large patient population, and a growing digital infrastructure.

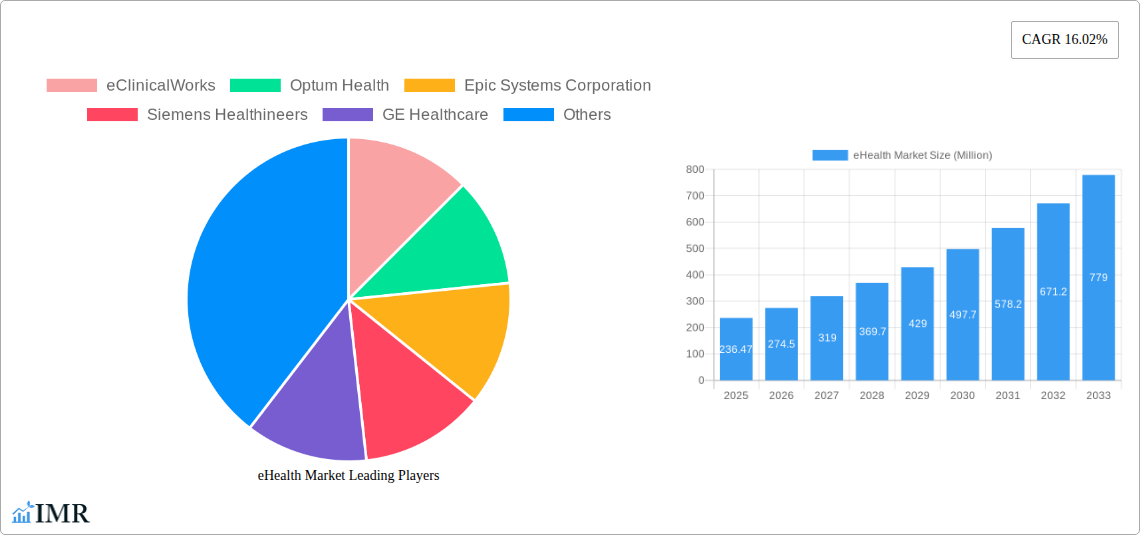

eHealth Market Company Market Share

eHealth Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a panoramic view of the global eHealth market, exploring its current dynamics, historical evolution, and projected trajectory through 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this research delves into the intricate interplay of technological advancements, regulatory landscapes, and evolving healthcare demands that are reshaping the digital health ecosystem. We examine key segments, including Electronic Health Records (EHRs), e-Prescribing, Clinical Decision Support Systems (CDSS), and Telemedicine, across various service types and end-user demographics.

This report is meticulously crafted to serve as an indispensable resource for industry stakeholders, including healthcare providers, technology developers, investors, policymakers, and market researchers. It offers actionable insights and quantitative data to inform strategic decision-making and capitalize on the burgeoning opportunities within the eHealth sector.

eHealth Market Market Dynamics & Structure

The eHealth market is characterized by a moderately consolidated structure, with leading players like Optum Health, Epic Systems Corporation, and Siemens Healthineers holding significant market shares. Technological innovation remains the primary driver, fueled by advancements in artificial intelligence (AI), cloud computing, and the Internet of Medical Things (IoMT). These innovations are critical for enhancing diagnostic accuracy, personalizing treatment plans, and improving patient outcomes. Regulatory frameworks, while sometimes presenting barriers, are also evolving to support the widespread adoption of digital health solutions, with a growing emphasis on data security and interoperability standards. Competitive product substitutes are emerging, particularly in niche areas of digital therapeutics and remote patient monitoring, forcing established players to continuously innovate. End-user demographics are shifting, with an increasing demand for patient-centric care, remote access to healthcare services, and personalized health management tools. Mergers and acquisitions (M&A) are prevalent, with companies consolidating to expand their service portfolios, gain market access, and acquire critical technologies. For instance, the acquisition of smaller AI-driven health tech startups by larger corporations is a recurring theme.

- Market Concentration: Moderate, with key players dominating specific segments.

- Technological Innovation Drivers: AI, cloud computing, IoMT, big data analytics.

- Regulatory Frameworks: Evolving to promote interoperability and data security (e.g., HIPAA, GDPR).

- Competitive Product Substitutes: Digital therapeutics, wearable health trackers, specialized remote monitoring platforms.

- End-User Demographics: Growing demand for convenience, personalization, and proactive health management.

- M&A Trends: Frequent consolidation to enhance capabilities and market reach.

eHealth Market Growth Trends & Insights

The global eHealth market is poised for substantial growth, driven by an increasing need for efficient, accessible, and personalized healthcare solutions. Throughout the historical period of 2019-2024, the market witnessed a steady upward trend, accelerated by the COVID-19 pandemic which highlighted the critical importance of digital health infrastructure. The base year of 2025 stands as a pivotal point, with the market projected to reach significant valuations, reflecting widespread adoption of electronic health records, robust growth in telemedicine services, and the increasing integration of clinical decision support systems within healthcare workflows. For instance, the adoption rate of EHR systems has surpassed 80% in developed nations, and this figure is expected to climb further across all regions by 2033.

The forecast period of 2025-2033 anticipates a compound annual growth rate (CAGR) of approximately 15-18%, a testament to the sustained momentum of digital transformation in healthcare. This growth will be further propelled by significant technological disruptions, including the widespread implementation of AI-powered diagnostic tools, advanced predictive analytics for disease management, and the seamless integration of wearable devices for continuous health monitoring. Consumer behavior is also a key influencer, with an increasing preference for virtual consultations, online health portals, and self-management of chronic conditions. The penetration of telemedicine services, which saw exponential growth during the pandemic, is expected to stabilize at a high level, becoming an integral part of routine healthcare delivery. Furthermore, the push towards value-based care models globally necessitates robust data analytics and interoperable systems, directly fueling eHealth market expansion. The increasing prevalence of chronic diseases and an aging global population further underscore the demand for scalable and accessible digital health solutions. The market penetration of e-prescribing systems is also projected to reach near-universal adoption in many developed countries by 2033, streamlining medication management and reducing errors.

Dominant Regions, Countries, or Segments in eHealth Market

The North American region consistently emerges as a dominant force in the global eHealth market, driven by a confluence of advanced technological infrastructure, favorable government initiatives, and a high prevalence of healthcare expenditure. The United States, in particular, spearheads this dominance due to its early adoption of Electronic Health Records (EHRs) and a mature telemedicine landscape. The segment of Electronic Health Records (EHRs) is the primary growth engine within the Component sector, demonstrating significant market share and a robust CAGR of over 12%. This is attributed to mandates for digital record-keeping and the recognized benefits of improved data accessibility and reduced medical errors.

Within the Type of Service, Monitoring Services are experiencing remarkable growth, fueled by the increasing adoption of remote patient monitoring (RPM) solutions for chronic disease management and post-operative care. This segment is expected to outpace other services in terms of growth rate, driven by technological advancements in wearable sensors and connected medical devices.

From an End User perspective, Hospitals represent the largest and most influential segment. Their substantial investments in integrated health IT systems, coupled with the imperative to enhance operational efficiency and patient care, make them key adopters of eHealth solutions. Insurance companies are also playing an increasingly vital role, incentivizing the adoption of digital health tools for cost containment and proactive health management.

- Dominant Region: North America (primarily the United States)

- Key Drivers: Strong technological infrastructure, significant healthcare investment, government support for digital health.

- Dominant Segment (Component): Electronic Health Records (EHRs)

- Market Share: Substantial, with high adoption rates and continuous upgrades.

- Growth Potential: Driven by interoperability mandates and data-driven decision-making.

- Dominant Segment (Type of Service): Monitoring Services

- Key Drivers: Rise of remote patient monitoring, chronic disease management, aging population.

- Growth Potential: Rapid expansion due to technological advancements in wearables and connectivity.

- Dominant Segment (End User): Hospitals

- Key Drivers: Need for operational efficiency, improved patient outcomes, integrated health IT systems.

- Market Share: Largest segment due to significant IT spending and adoption.

eHealth Market Product Landscape

The eHealth market's product landscape is dynamic and innovation-rich, characterized by cutting-edge solutions designed to streamline healthcare delivery and enhance patient engagement. Key product categories include sophisticated Electronic Health Records (EHRs) offering enhanced interoperability and user-friendly interfaces, advanced e-Prescribing platforms that reduce medication errors and improve patient adherence, and intelligent Clinical Decision Support Systems (CDSS) leveraging AI for diagnostics and treatment recommendations. Telemedicine platforms are increasingly offering integrated features like virtual waiting rooms, secure video conferencing, and remote diagnostic capabilities. The performance of these products is measured by their ability to improve patient outcomes, increase operational efficiency for healthcare providers, and enhance data security and privacy. Unique selling propositions often revolve around AI-driven analytics, seamless integration with existing hospital systems, and robust patient engagement tools.

Key Drivers, Barriers & Challenges in eHealth Market

Key Drivers:

The eHealth market is propelled by several significant drivers. Government initiatives and supportive policies worldwide are a major catalyst, promoting the adoption of digital health records and telemedicine. For example, India's National Health Authority's incentive scheme aims to boost digital health record creation. Technological advancements, particularly in AI, big data analytics, and cloud computing, are fundamental in developing more sophisticated and effective eHealth solutions. The increasing prevalence of chronic diseases and the growing demand for remote and personalized healthcare services are also key market shapers.

Barriers & Challenges:

Despite its growth, the eHealth market faces considerable barriers and challenges. High initial implementation costs for complex IT systems can be a significant hurdle, especially for smaller healthcare providers. Data security and privacy concerns remain paramount, with the risk of cyberattacks and data breaches creating user hesitancy. Regulatory hurdles and the lack of standardized interoperability between different health IT systems can impede seamless data exchange and integration, impacting overall efficiency. Resistance to change from healthcare professionals accustomed to traditional workflows also presents a challenge, requiring comprehensive training and change management strategies.

Emerging Opportunities in eHealth Market

Emerging opportunities within the eHealth market are ripe for exploration, driven by evolving patient needs and technological frontiers. The expansion of personalized medicine, empowered by genetic data and AI-driven insights, presents a significant avenue for growth. Furthermore, the burgeoning field of digital therapeutics (DTx), offering software-based interventions for specific medical conditions, is poised to revolutionize treatment paradigms. The increasing global focus on preventative healthcare and wellness management creates a demand for advanced wearable technology and AI-powered health coaching platforms. Untapped markets in developing economies, where access to traditional healthcare is limited, offer substantial potential for scalable eHealth solutions, particularly in remote patient monitoring and virtual consultations.

Growth Accelerators in the eHealth Market Industry

Several key catalysts are accelerating the long-term growth of the eHealth market. Continuous technological breakthroughs, especially in AI and machine learning for predictive analytics and diagnostics, are enhancing the capabilities and appeal of eHealth solutions. Strategic partnerships between technology providers, healthcare systems, and pharmaceutical companies are fostering innovation and expanding market reach, as seen with Health Services Management's partnership with Sound Physicians Telemedicine Services. The growing emphasis on value-based care models globally is driving the adoption of eHealth technologies that improve efficiency, patient outcomes, and cost-effectiveness. Furthermore, increasing patient demand for convenience, accessibility, and proactive health management is a powerful market expansion strategy that fuels sustained growth.

Key Players Shaping the eHealth Market Market

- eClinicalWorks

- Optum Health

- Epic Systems Corporation

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips NV

- CompuMed Inc

- Veradigm LLC

- athenahealth Inc

- Boston Scientific Corporation

- Oracle Cerner

Notable Milestones in eHealth Market Sector

- January 2023: India's National Health Authority launched an incentive scheme for healthcare providers and other stakeholders of the country's digital health ecosystem to promote the creation of digital health records. This initiative is expected to significantly boost EHR adoption and data digitization in India.

- January 2023: Health Services Management (HSM) partnered with Sound Physicians Telemedicine Services to provide enhanced care for residents in Texas, Indiana, and Florida. This collaboration underscores the growing trend of strategic partnerships to expand telemedicine reach and improve healthcare accessibility.

In-Depth eHealth Market Market Outlook

The eHealth market's outlook is exceptionally robust, driven by the persistent integration of innovative technologies and the increasing global demand for accessible, efficient, and personalized healthcare. Growth accelerators such as advancements in AI for diagnostics and personalized treatment plans, coupled with the expansion of remote patient monitoring capabilities through IoMT devices, will continue to fuel market expansion. Strategic collaborations and partnerships between technology giants and healthcare providers will further catalyze market penetration and service innovation. The evolving patient preference for digital-first healthcare experiences, including virtual consultations and self-management tools, presents significant opportunities for market players to develop user-centric solutions. The push towards value-based healthcare models globally necessitates data-driven insights and interoperable systems, which eHealth solutions are ideally positioned to provide, thereby ensuring a sustained and accelerated growth trajectory for the market in the coming years.

eHealth Market Segmentation

-

1. Component

- 1.1. Electronic Health Records

- 1.2. e-Prescribing

- 1.3. Clinical Decision Support Systems

- 1.4. Telemedicine

- 1.5. Other Components

-

2. Type of Service

- 2.1. Monitoring Service

- 2.2. Diagnosis Service

- 2.3. Therapeutic and Other Services

-

3. End User

- 3.1. Hospitals

- 3.2. Insurance Companies

- 3.3. Other End Users

eHealth Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

eHealth Market Regional Market Share

Geographic Coverage of eHealth Market

eHealth Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in IoT and Technological Innovations; Rising Preference Toward Mobile Technology and Internet; Rising Demand for Population Health Management

- 3.3. Market Restrains

- 3.3.1. Concerns over Data Security; Lack of Reimbursement Policies in the Emerging Markets; Lack of Proper Infrastructure for eHealth in Emerging Markets

- 3.4. Market Trends

- 3.4.1. e-Prescribing Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global eHealth Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Electronic Health Records

- 5.1.2. e-Prescribing

- 5.1.3. Clinical Decision Support Systems

- 5.1.4. Telemedicine

- 5.1.5. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Type of Service

- 5.2.1. Monitoring Service

- 5.2.2. Diagnosis Service

- 5.2.3. Therapeutic and Other Services

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Insurance Companies

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America eHealth Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Electronic Health Records

- 6.1.2. e-Prescribing

- 6.1.3. Clinical Decision Support Systems

- 6.1.4. Telemedicine

- 6.1.5. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Type of Service

- 6.2.1. Monitoring Service

- 6.2.2. Diagnosis Service

- 6.2.3. Therapeutic and Other Services

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Insurance Companies

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe eHealth Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Electronic Health Records

- 7.1.2. e-Prescribing

- 7.1.3. Clinical Decision Support Systems

- 7.1.4. Telemedicine

- 7.1.5. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Type of Service

- 7.2.1. Monitoring Service

- 7.2.2. Diagnosis Service

- 7.2.3. Therapeutic and Other Services

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Insurance Companies

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific eHealth Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Electronic Health Records

- 8.1.2. e-Prescribing

- 8.1.3. Clinical Decision Support Systems

- 8.1.4. Telemedicine

- 8.1.5. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Type of Service

- 8.2.1. Monitoring Service

- 8.2.2. Diagnosis Service

- 8.2.3. Therapeutic and Other Services

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Insurance Companies

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Middle East and Africa eHealth Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Electronic Health Records

- 9.1.2. e-Prescribing

- 9.1.3. Clinical Decision Support Systems

- 9.1.4. Telemedicine

- 9.1.5. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Type of Service

- 9.2.1. Monitoring Service

- 9.2.2. Diagnosis Service

- 9.2.3. Therapeutic and Other Services

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Insurance Companies

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. South America eHealth Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Electronic Health Records

- 10.1.2. e-Prescribing

- 10.1.3. Clinical Decision Support Systems

- 10.1.4. Telemedicine

- 10.1.5. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Type of Service

- 10.2.1. Monitoring Service

- 10.2.2. Diagnosis Service

- 10.2.3. Therapeutic and Other Services

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Insurance Companies

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 eClinicalWorks

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Optum Health

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Epic Systems Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Healthineers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GE Healthcare

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke Philips NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CompuMed Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veradigm LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 athenahealth Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boston Scientific Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Cerner

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 eClinicalWorks

List of Figures

- Figure 1: Global eHealth Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global eHealth Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America eHealth Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America eHealth Market Volume (K Unit), by Component 2025 & 2033

- Figure 5: North America eHealth Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America eHealth Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America eHealth Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 8: North America eHealth Market Volume (K Unit), by Type of Service 2025 & 2033

- Figure 9: North America eHealth Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 10: North America eHealth Market Volume Share (%), by Type of Service 2025 & 2033

- Figure 11: North America eHealth Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America eHealth Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America eHealth Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America eHealth Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America eHealth Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America eHealth Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America eHealth Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America eHealth Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe eHealth Market Revenue (Million), by Component 2025 & 2033

- Figure 20: Europe eHealth Market Volume (K Unit), by Component 2025 & 2033

- Figure 21: Europe eHealth Market Revenue Share (%), by Component 2025 & 2033

- Figure 22: Europe eHealth Market Volume Share (%), by Component 2025 & 2033

- Figure 23: Europe eHealth Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 24: Europe eHealth Market Volume (K Unit), by Type of Service 2025 & 2033

- Figure 25: Europe eHealth Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 26: Europe eHealth Market Volume Share (%), by Type of Service 2025 & 2033

- Figure 27: Europe eHealth Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe eHealth Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe eHealth Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe eHealth Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe eHealth Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe eHealth Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe eHealth Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe eHealth Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific eHealth Market Revenue (Million), by Component 2025 & 2033

- Figure 36: Asia Pacific eHealth Market Volume (K Unit), by Component 2025 & 2033

- Figure 37: Asia Pacific eHealth Market Revenue Share (%), by Component 2025 & 2033

- Figure 38: Asia Pacific eHealth Market Volume Share (%), by Component 2025 & 2033

- Figure 39: Asia Pacific eHealth Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 40: Asia Pacific eHealth Market Volume (K Unit), by Type of Service 2025 & 2033

- Figure 41: Asia Pacific eHealth Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 42: Asia Pacific eHealth Market Volume Share (%), by Type of Service 2025 & 2033

- Figure 43: Asia Pacific eHealth Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific eHealth Market Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific eHealth Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific eHealth Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific eHealth Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific eHealth Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific eHealth Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific eHealth Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa eHealth Market Revenue (Million), by Component 2025 & 2033

- Figure 52: Middle East and Africa eHealth Market Volume (K Unit), by Component 2025 & 2033

- Figure 53: Middle East and Africa eHealth Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Middle East and Africa eHealth Market Volume Share (%), by Component 2025 & 2033

- Figure 55: Middle East and Africa eHealth Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 56: Middle East and Africa eHealth Market Volume (K Unit), by Type of Service 2025 & 2033

- Figure 57: Middle East and Africa eHealth Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 58: Middle East and Africa eHealth Market Volume Share (%), by Type of Service 2025 & 2033

- Figure 59: Middle East and Africa eHealth Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa eHealth Market Volume (K Unit), by End User 2025 & 2033

- Figure 61: Middle East and Africa eHealth Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa eHealth Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa eHealth Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa eHealth Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa eHealth Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa eHealth Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America eHealth Market Revenue (Million), by Component 2025 & 2033

- Figure 68: South America eHealth Market Volume (K Unit), by Component 2025 & 2033

- Figure 69: South America eHealth Market Revenue Share (%), by Component 2025 & 2033

- Figure 70: South America eHealth Market Volume Share (%), by Component 2025 & 2033

- Figure 71: South America eHealth Market Revenue (Million), by Type of Service 2025 & 2033

- Figure 72: South America eHealth Market Volume (K Unit), by Type of Service 2025 & 2033

- Figure 73: South America eHealth Market Revenue Share (%), by Type of Service 2025 & 2033

- Figure 74: South America eHealth Market Volume Share (%), by Type of Service 2025 & 2033

- Figure 75: South America eHealth Market Revenue (Million), by End User 2025 & 2033

- Figure 76: South America eHealth Market Volume (K Unit), by End User 2025 & 2033

- Figure 77: South America eHealth Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America eHealth Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America eHealth Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America eHealth Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America eHealth Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America eHealth Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 3: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 4: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 5: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global eHealth Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global eHealth Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 11: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 12: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 13: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global eHealth Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global eHealth Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 24: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 25: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 26: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 27: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global eHealth Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global eHealth Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: United Kingdom eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Germany eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 44: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 45: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 46: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 47: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global eHealth Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global eHealth Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 64: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 65: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 66: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 67: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 69: Global eHealth Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global eHealth Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global eHealth Market Revenue Million Forecast, by Component 2020 & 2033

- Table 78: Global eHealth Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 79: Global eHealth Market Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 80: Global eHealth Market Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 81: Global eHealth Market Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global eHealth Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 83: Global eHealth Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global eHealth Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America eHealth Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America eHealth Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the eHealth Market?

The projected CAGR is approximately 16.02%.

2. Which companies are prominent players in the eHealth Market?

Key companies in the market include eClinicalWorks, Optum Health, Epic Systems Corporation, Siemens Healthineers, GE Healthcare, Koninklijke Philips NV, CompuMed Inc, Veradigm LLC, athenahealth Inc, Boston Scientific Corporation, Oracle Cerner.

3. What are the main segments of the eHealth Market?

The market segments include Component, Type of Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 236.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in IoT and Technological Innovations; Rising Preference Toward Mobile Technology and Internet; Rising Demand for Population Health Management.

6. What are the notable trends driving market growth?

e-Prescribing Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

Concerns over Data Security; Lack of Reimbursement Policies in the Emerging Markets; Lack of Proper Infrastructure for eHealth in Emerging Markets.

8. Can you provide examples of recent developments in the market?

January 2023: India's National Health Authority launched an incentive scheme for healthcare providers and other stakeholders of the country's digital health ecosystem to promote the creation of digital health records.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "eHealth Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the eHealth Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the eHealth Market?

To stay informed about further developments, trends, and reports in the eHealth Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence